UAE Electric Vehicle Market: By Type (Battery electric vehicle (BEV), Fuel cell electric vehicle (FCEV), Plug-in hybrid electric vehicle (PHEV), Hybrid electric vehicle (HEV), Autonomous Electric Vehicles); Vehicle Type (Passenger Cars (Small, Medium, and Large), SUVs (Small, Medium, Large), Light Commercial Vehicles (Pick-Up Trucks and Vans), Others); Charger (Fast and Normal); Power Output (Less than 100 KW, 100-250 KW, Above 250 KW); Sales Channel (Aftermarket and OEM)— Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2024–2032

- Last Updated: Apr-2024 | Format:

![pdf]()

![powerpoint]()

![excel]() | Report ID: AA0424824 | Delivery: 2 to 4 Hours

| Report ID: AA0424824 | Delivery: 2 to 4 Hours

Market Scenario

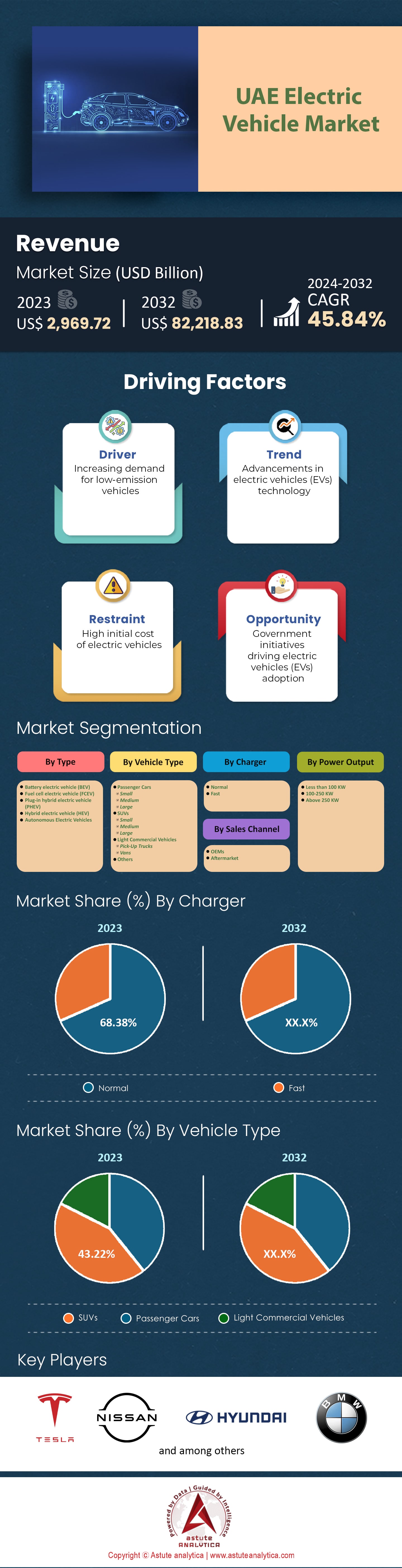

UAE Electric Vehicle Market was valued at US$ 2,969.72 million in 2023 and is projected to hit the market valuation of USD 82,218.83 million by 2032 at a CAGR of 45.84% during the forecast period 2024–2032.

The UAE is making a strong effort toward electric vehicles (EVs). The government has set a target of 42,000 EVs on the road by 2030 and already converted one-fifth of its government agency cars to electric. This commitment can be seen in the country’s recognition among the top 10 worldwide for electric mobility readiness.

In order to promote the adoption of EVs, UAE has invested heavily into charging infrastructure. The number of EV charging stations has grown by 60% over the past three years, reaching a total of 800 stations. It is expected that this growth will continue as Abu Dhabi alone plans for 70,000 charging points by 2030. Authorities and private companies are also working together to improve charging technology so as to reduce charging times. In addition, there is an increasing demand among consumers in UAE for EVs; research shows that about 30% residents consider buying an electric car being driven by their aspiration towards “green” transportation means. Currently passenger vehicles dominate sales accounting for around 95% market share while rental companies have shifted largely towards them too.

Apart from government initiatives various macroeconomic factors are driving growth within UAE’s Electric vehicle market such as concerns over future energy security coupled with climate change mitigation efforts which make this type of transport more appealing; rising prices of conventional fuels combined with need for saving power also contribute greatly towards demand for these vehicles among Emiratis; moreover sustainable travel options become highly sought after due booming tourism industry thus creating another significant driver behind increased sales volume within Dubai up until year end 2030 when said city would still retain its status as leader nationwide followed closely by other regions like Sharjah where there exist few but well scattered charging points mainly along highways.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Increasing Affordability and Cost-Effectiveness

A chief driver of the UAE electric vehicle market is the expanding affordability and cost-effectiveness of electric vehicles (EVs). In recent years, it has become significantly cheaper to buy and run an EV, putting them in reach for more people. The UAE now ranks as the fourth cheapest country in the world for charging an electric vehicle, with consumers potentially saving 88% on fuel costs by switching to electricity. This lower cost is a key factor boosting demand for such cars. What’s happened to prices over the past five years has been nothing short of transformative — in terms of making electric vehicles more widely accessible, the falling price tags have been game-changers. For instance, at current petrol and electricity rates in Dubai, a Tesla Model 3 could be bought and driven for $0.34 per km. This brings them much closer to matching traditional petrol-powered models on price. Indeed, running an electric car is now 40% cheaper than operating a similar-sized petrol vehicle in the UAE.

Government subsidies and incentives have also played their part in driving down costs for buyers in the UAE electric vehicle market. Free parking spaces and toll gate exemptions are offered to EV owners across the country, among other benefits. In Dubai authorities even waived charging tariffs at public stations until the end of 2023. These incentives combined with inherent savings from cheaper-to-run EVs increasingly make battery-powered cars attractive options for consumers in this country. Falling battery costs have helped bring down overall purchase prices too — batteries remain one of the most expensive components within an electric vehicle’s powertrain but they have gotten much cheaper over time thanks largely due economies of scale achieved as a result mass production coupled with advances made regarding cell chemistry which improved energy density significantly thus reducing volume required thereby lowering material consumption leading ultimately towards decreased unit cost . From 2010 through last year alone average battery pack prices declined an impressive 89%.

Trend: Strong Focus on Expanding Charging Infrastructure

EV charging infrastructure in the UAE electric vehicle market is booming with an estimated 800 stations by 2023, a 60% rise in three years. This is fueled by government support in boosting electric vehicle uptake, led by Dubai’s deployment of over 300 stations through DEWA. The country has both private and public charging facilities, including those at malls, hotels and even homes.

The UAE’s goals are ambitious; it aims to have 42,000 EVs on its roads (government fleet) by 2030 and convert one-fifth of official vehicles into electric. These include schemes such as Dubai’s Green Charger program which offers free use until 2023 and Abu Dhabi’s free parking/toll exemptions for EV owners. Private enterprise is also active in this space; for instance, leading developers like Majid Al Futtaim are installing chargers while utilities providers DEWA and ADNOC are working together to expand the network across the UAE electric vehicle market.

Technology also plays a vital part – solar-powered charging stations were first trialed by DEWA in 2020 among other initiatives being explored such as faster charging solutions being researched through partnerships like those at SRTIP. There is much cause for optimism; with continuing commitment from governments coupled with increasing involvement from businesses plus a predicted demand of up to 70K points alone within Abu Dhabi emirate by 2030 where more than half world’s population resides according UN estimates– there could hardly be better positioning anywhere else globally than here within this region now known too well not only for having strong roots but also being endowed naturally richly blessed indeed strategically located area that has all it takes towards becoming an international market leader not just manufacturing but equally supplying various products associated with clean energy transportation systems including electric powered motor vehicles.

Challenge: Developing Dealer and Maintenance Networks

Developing a strong dealer and maintenance network is the biggest challenge to the growth of UAE’s electric vehicle market. Currently, there are 800 charging stations which will be increased to 70,000 by 2030 in order to support a targeted 30% EVs of all vehicles on the road. However, this is still not enough as there is no readily available sales and service options for cars. Only about 10% of car dealerships sell electric cars, thus limiting people’s access to them and their knowledge about it. This lack of exposure has been intensified with shortages in trained salespeople who can answer questions related to these types of vehicles; which also acts as a deterrent for buyers since they would like an individual that knows what he/she is talking about when it comes down to purchasing decisions [45% cite this]. Moreover, potential buyers are concerned with the restricted numbers qualified mechanics within this field [52% worry].

The service network for electric vehicles needs significant improvement in UAE electric vehicle market. At present, only 15% repair shops have technicians trained on how to handle such automobiles; hence an average wait time period would be around seven days before getting an appointment compared two days waiting period for regular cars services. This means that the few repair shops that cater for EVs take longer than usual because they don’t have enough personnel who are skilled in fixing them or even handling their unique problems like battery replacement among others.

In addition, limited availability extends beyond service provision itself in the electric vehicle market; consider these facts: $5000-$50k worth of diagnostic equipment is required by small scale repairs which limits its use due high-cost factor associated with it. Even diagnosis alone becomes expensive if you want your own dedicated center nearby – just one out every five owners has got such facility within reasonable reach i.e., less than 20km radius. Furthermore, there aren’t many models from different brands either so choices are limited here too. In fact, as at now only 500 have been trained yet government hopes train 5k technicians within next five years.

Astute Analytica believes that about $200 million needs to be injected into the dealerships. It is estimated that a well-developed network could increase adoption rates by 25% over the next five years.

Segmental Analysis

By Type

The UAE, which has the largest share of battery electric vehicles (BEVs) at 65.46%, is in the lead for electric vehicle development. The city’s Electric vehicle market is projected to grow 75% by 2025, with BEVs going from 7,331 in 2023 to 12,852. Aiming for a fully electric taxi fleet by 2027 and an autonomous all-electric taxi fleet of up to 4,000 by 2030 are among some of the ambitious plans driving this growth forward. Dubai recognizes range anxiety as an issue and is building out its charging infrastructure accordingly; countrywide there will be a national ultra-fast charging corridor and more than 70k charging points in place across UAE communities by the end of this decade alone. While within Dubai alone, over thousand public stations should be operational before it ends on top what they already have now number wise.

By Vehicle Type

Concerns about the environment and practicality have fueled the United Arab Emirates’ passion for SUVs, which has spilled over into the electric vehicle (EV) sector. With 43.22% market share, SUVs are dominating the electric vehicle market more than any other type of car. These vehicles are perfect for large families as they boast spacious interiors and ample cargo capacity, which makes them compatible with buyers looking for customizable EVs — 33% compared to 20% of whom wanting pre-configured options. This concentration on usefulness reflects well on UAE family-oriented culture too; besides being symbols of wealth (50% more likely among wealthy people), SUVs are also associated with status in life generally — an inclination that suits rich people who prefer established brands such as Mercedes-Benz over specialty makers like Tesla while buying these kinds of vehicles since they’re most likely to serve their needs best.

The government of the United Arab Emirates actively encourages citizens to buy electric cars through various incentives such as free parking slots and reduced registration fees among others, giving a boost the growth of the electric vehicle market. Such measures serve two purposes: first making environmentally friendly cars attractive by offsetting higher initial costs against petrol-driven counterparts; secondly, discouraging use private cars altogether. The benefits of electric SUVs such as instant torque, smooth acceleration and quiet ride have attracted many drivers in the country. The government is also committed to building charging stations throughout the nation with over 70k points planned by 2030.

By Charger Type

The UAE is hurriedly developing its EV charging system to match the rapid adoption of electric cars. Wherein, 68.38% share of electric vehicle market was taken by normal charger segment in 2023. There are more than 620 charging stations now, with an aim of having 1,000 by 2025 and 10,000 by 2030 – led by Dubai’s DEWA (Dubai Electricity and Water Authority). Over 300 Green Chargers across Dubai can simultaneously service over 600 electric vehicles. It is expected that this impressive infrastructure will grow even further with projections reaching as high as 2,000 stations by 2025.

Normal AC chargers are everywhere across the UAE electric vehicle market, while a few strategically placed DC fast chargers allow for quick top-ups. In Dubai alone, there are over dozen Green Charger stations that have fast-charging capabilities, which can fully charge an EV within just half an hour. Distribution of these stations prioritizes major cities and highways – it has been done so on purpose because Dubai and Abu Dhabi have the highest density of charging points meaning this placement caters both daily commutes as well long journeys too sometimes. Therefore, not only most people want them to be located along their route but also, they need them most often throughout day or night depending upon their energy levels.

40% of respondents planned to buy an electric or hybrid vehicle within the next two years revealed a survey conducted recently. This is indicating just how much demand there really is for such things like new cars that run off electricity instead petrol.

By Power Output

The electrical vehicle (EV) charging system in the UAE electric vehicle market is dominated by less than 100 KW chargers, which made up more than 51.1% of market share in 2023. Such chargers, with power output typically below 100 kW, are cheaper and easier to install than DC fast chargers –– making them ideal for home or workplace use where cars can be left for longer periods. An overnight charge at a typical Level 2 AC charger can add significantly to an electric vehicle’s range. A 7-kW charger will give it an extra 25-30 miles (40-48 km) per hour; while a more powerful 22 kW supply will provide another 90 miles (145 km).

Dubai and Abu Dhabi have been leading the way in terms of EV adoption — and they follow this trend perfectly. In Dubai, DEWA has more than 300 level two charging stations ranging from outputs of 11 kW to 22 kW, while Abu Dhabi has about 250 stations using mainly less than a maximum of level two chargers at around the same power rating as those seen in Dubai (22kW). These slow chargers fit most people's needs in the UAE electric vehicle market because they are designed for overnight charging when electricity is cheapest — backed up by government incentives like free parking and toll exemptions on certain highways that make it attractive to put them in homes or businesses.

Level two AC chargers are much less impactful on the electricity grid compared with direct current fast-chargers because their lower power output means they use fewer resources. This makes them more environmentally friendly and sustainable options for greater distribution across cities such as Dubai or Abu Dhabi. The wide availability has been crucial in supporting growth within this segment which tends cater heavily towards daily drivers who commute into cities each day from suburbs where there may not have been any other option than plugging their car into a wall socket every night.

The country's dedication towards providing an easily accessible charging infrastructure is shown through the National Electric Vehicles Policy, giving a boost to the expansion of electric vehicle market. It sets clear guidelines for level two AC chargers ensuring compatibility with all models sold nationwide. The predominance of these types aligns with global trends while also making it easier and convenient for people who want charge their cars up outside their own houses but still need some place close by that isn't too far away either.

To Understand More About this Research: Request A Free Sample

Key Players in the Saudi Arabia Electric Vehicle Market

- BMW AG

- BYD Company Ltd

- M GLORY HOLDING L.L.C.

- MG Motor

- Tesla

- Toyota Motor Corporation

- Emirates Global Motor Electric

- Volkswagen AG

- Other Prominent Players

Market Segmentation Overview:

By Type

- Battery electric vehicle (BEV)

- Fuel cell electric vehicle (FCEV)

- Plug-in hybrid electric vehicle (PHEV)

- Hybrid electric vehicle (HEV)

- Autonomous Electric Vehicles

By Vehicle Type

- Passenger Cars

- Small

- Medium

- Large

- SUVs

- Small

- Medium

- Large

- Light Commercial Vehicles

- Pick-Up Trucks

- Vans

By Charger

- Normal

- Fast

By Power Output

- Less than 100 KW

- 100-250 KW

- Above 250 KW

By Sales Channel

- OEMs

- Aftermarket

View Full Infographic

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

| Report ID: AA0424824 | Delivery: 2 to 4 Hours

| Report ID: AA0424824 | Delivery: 2 to 4 Hours

.svg)