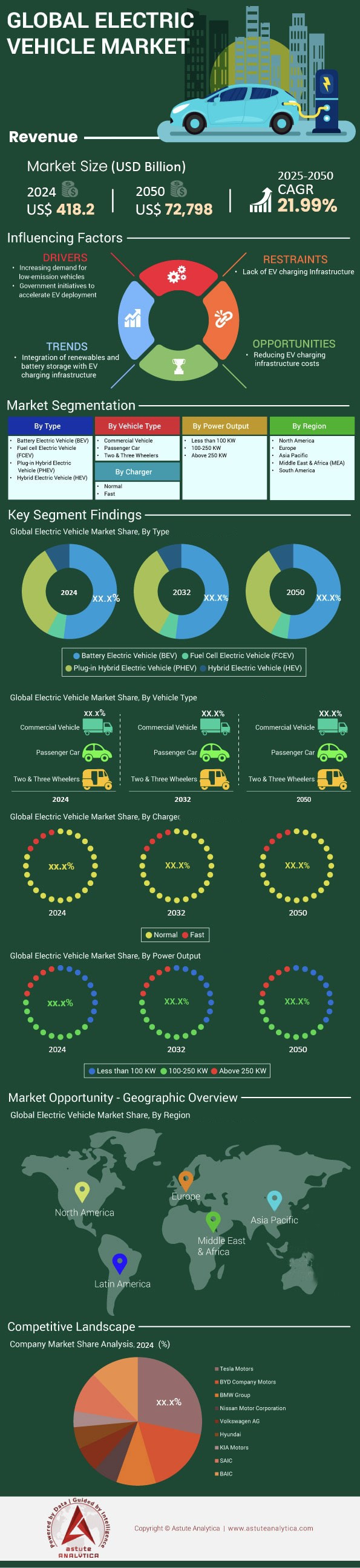

Electric Vehicle Market: By Type (Battery Electric Vehicle, Fuel Cell Electric Vehicle, Plug-in Hybrid Electric Vehicle and Others); Vehicle Type (Commercial Vehicle, Passenger Car and Others); Charger (Normal and Fast); Power Output (Less than 100 KW, 100-250 KW, and Others); Region—Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2025–2050

- Last Updated: 13-Mar-2025 | | Report ID: AA0221063

Market Scenario

Electric vehicle market was valued at US$ 418.2 billion in 2024 and is estimated to witness a major leap forward in revenue to US$ 72,798 billion by 2050. The market is registering a CAGR of 21.99% during the forecast period 2025-2050.

As of Q1 2025, the electric vehicle market has experienced a remarkable YoY growth of 25%, with global sales surpassing 4 million units, which was 3 million in Q1 2024. The worldwide adoption of electric vehicles has yielded significant environmental benefits, saving over 100 million tons of GHG emissions across the globe. In March alone, there was an astounding 1.5 million EVs purchased, representing a continued strong upward trend in this industry. Such pace reflects that within this year, more than one-quarter (25%) of all cars sold worldwide will be EVs. China maintains its leadership position, but the U.S. and Europe are also crucial players; their shares being respectively around 15% and 30%. It's fascinating to observe how different countries contribute to these numbers: In China, it is predicted that they will account for almost 55% of all car sales, while the US and EU combined amount to somewhere between 40% to 45%.

Consumers across the global electric vehicle market overwhelmingly prefer Battery Electric Vehicles (BEVs) with a share of 70%, leaving Plug-in Hybrid Electric Vehicles (PHEVs) behind at only 30%. This demonstrates that people's confidence in all-electric cars' range and performance has been growing steadily year after year. EV charging stations installed globally increased by more than 50% in 2024 compared to 2023, showing support for this growing market. However, with 5 times as many required before current infrastructure meets government targets set out till 2035, there is still considerable progress to be made.

EV Market 2025: Strong Growth with Positive Outlook

The first quarter of 2025 showed robust growth for the US EV market, with sales increasing significantly compared to the previous year. Americans purchased 350,000 new electric vehicles (EVs), which made up 12% of all new-vehicle sales. Tesla — a key player in the field — saw its sales increase by 10% YoY, despite increased competition.

In Q1 2025, the average transaction price for a new EV stood at $48,000 — indicating a continued drop from the previous year in the US electric vehicle market. Leasing rates for EVs experienced significant growth with about 50% of total EVs being leased out. China's electric cars are becoming even more affordable as over 75% of all EVs sold in 2024 were priced lower than their gasoline counterparts — this shows an accelerating trend towards cheaper and more accessible EVs. General Motors and Ford reported impressive YoY increases in sales numbers, with GM achieving a substantial increase of 200% driven by strong demand for its expanded EV lineup, while Ford recorded an increase of 150%.

Investment in Supply Chains of the Electric Vehicle Industry:

A Comprehensive Outlook, Global Competition in Battery Manufacturing Capacity A total of $75 billion were invested in the North American supply chains for the electric vehicle market between January 2024 and December 2024. This market is undergoing a transformative change, driven by ambitious electrification targets and a surge of worldwide investment. More than thirty leading automobile manufacturers, who contributed to over 95% of global car sales this year alone, have committed to electrification goals; these aims are backed by significant financial investments, with policy initiatives indicating that over sixty million electric cars may be sold by 2030.

The global EV battery manufacturing capacity reached an impressive 3.5 TWh in 2024, significantly exceeding the demand of 1,200 GWh. This excess capacity is poised to meet the predicted need for fifteen times as many batteries by 2035 under various policies likely to be adopted worldwide. It is estimated that China electric vehicle market may have up to 2,000 GWh in battery-making capability by 2030 (accounting for approximately 40% of global capacity). However, other regions are rapidly expanding their capacities, with the US and Europe each expected to reach 1,000 GWh by 2030. Recycling facilities are projected to have four times more capacity globally than what they can recycle locally until at least another 10 years from now when it might reach parity if not exceed it.

Venture capital investments in EV and battery startups grew 40% YoY, reaching nearly US$ ~3 billion, which will sustain a 70% YoY growth rate through the next decade. This growth is driven partly by passenger vehicle sale growth rates far exceeding the overall industry average, but also because additional demand drivers such as heavy-duty trucks and other sectors are coming online over time. Similarly, demand for key raw materials used in lithium-ion batteries continues to rise, with the global supply of lithium, cobalt, and nickel all seeing a surge in their respective percentages consumed by these power cells–70%, 40%, and 15% respectively.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Battery Technology Advancements Enhancing Performance, Range, and Charging Speed

The electric vehicle market has witnessed remarkable advancements in battery technology, significantly enhancing performance, range, and charging speed. As of 2025, these improvements have addressed many of the concerns that previously hindered widespread EV adoption. One of the most notable developments is the introduction of lithium-air batteries, which have surpassed conventional lithium-ion batteries in energy storage capacity. These new batteries can store significantly more energy at the same weight, resulting in a substantial increase in energy density. This breakthrough has allowed electric vehicles to achieve longer driving ranges without increasing battery size or weight, addressing the long-standing issue of range anxiety among consumers.

The average range of new EV models has now surpassed 400 miles, a significant improvement from the 250-mile average range observed in 2020. This 60% increase in range has been crucial in making EVs more practical for long-distance travel and everyday use in the electric vehicle market. Furthermore, companies like Graphenano are pushing the boundaries even further with the development of graphene batteries that promise an estimated range of 500 miles. These advancements not only extend the driving range but also address the issue of long charging times, making electric vehicles more appealing to a broader audience. Moreover, charging speeds have also seen dramatic improvements. Fast-charging technology has advanced to the point where the latest chargers are capable of delivering up to 350 kW, reducing the time to charge an EV to 80% capacity to under 15 minutes. This represents a significant leap forward in convenience for EV owners. Some companies are even targeting 15-minute charge times by 2026 and a 10-minute fast charge capability by 2030, which would add approximately 300 km of range.

Trend: Declining EV Prices Due to Competitive Pricing and Technological Improvements

The electric vehicle market has experienced a significant trend of declining prices, driven by intense competition among automakers and continuous technological improvements. As of 2025, these factors have contributed to making EVs more accessible and affordable for a broader range of consumers. The competitive landscape has shifted dramatically, with companies like BYD and Tesla leading the charge in price reductions. In fact, BYD overtook Tesla as the world's best-selling battery electric car company in 2023, intensifying the competition and driving prices down further. This competitive environment has led to notable price wars, particularly in major markets like China and the United States. In China, the price of compact electric cars and SUVs dropped by up to 10% in 2023 compared to the previous year, a trend that has continued into 2025. Similarly, in the United States, Tesla reduced prices by up to 6% for its Models 3 and Y in early 2024, prompting competitors to follow suit. These price reductions have had a significant impact on the market, with the average transaction price for a new EV in the U.S. dropping to $48,000 in Q1 2025, a substantial decrease from previous years.

Technological advancements, particularly in battery technology, have played a crucial role in driving down EV prices across the electric vehicle market. Batteries, which account for approximately 40% of an EV's total cost, have seen significant improvements in efficiency and production costs. The average cost of EV batteries has decreased by 50% since 2020, contributing significantly to the reduction in overall EV prices. This dramatic decrease in battery costs has allowed manufacturers to offer more affordable models without compromising on performance or features. The impact of these price reductions is evident in the increasing affordability of EVs. As of 2025, the price of entry-level EVs has dropped below $30,000, making them competitive with many internal combustion engine vehicles. In China, over 75% of all EVs sold in 2024 were priced lower than their gasoline counterparts, demonstrating the accelerating trend towards more accessible electric vehicles. This trend is expected to continue, further driving the adoption of EVs and reshaping the automotive industry landscape.

Challenge: Insufficient Charging Infrastructure, Especially Along Roadways and in Rural Areas

Despite the significant advancements in battery technology and the declining prices of electric vehicles, the issue of insufficient charging infrastructure remains a significant challenge to the electric vehicle market, particularly along roadways and in rural areas. As of 2025, this disparity in charging station distribution continues to be a major barrier to widespread EV adoption, especially in less populated regions. The uneven distribution of charging infrastructure has created a notable divide between urban and rural areas, with urban centers benefiting from a higher concentration of charging stations while rural regions often struggle with limited access to charging facilities.

In the United States, as of 2025, there are approximately 150,000 public charging stations. However, only 20% of these are located in rural areas, highlighting a significant disparity in infrastructure distribution. This imbalance in the electric vehicle market is further emphasized by the fact that urban areas have seen a 30% increase in charging station installations over the past five years, while rural areas have only experienced a 10% increase. The average distance between charging stations in rural areas is 50 miles, compared to just 10 miles in urban settings, posing a significant challenge for EV adoption in less populated regions.

The high cost of installing charging stations, particularly DC Fast Chargers, exacerbates these distribution challenges. A single DC Fast Charger can cost over $100,000 to install, making it financially unfeasible for many small businesses and municipalities, especially in rural areas. Additionally, the existing power grid in many rural regions is not equipped to handle the increased demand from EV charging, necessitating costly upgrades. This financial barrier has led to a situation where charging stations are more prevalent in affluent neighbourhoods, leaving lower-income communities with limited access. The Biden administration's goal of installing 500,000 public charging stations by 2030 highlights the recognition of this challenge at the federal level. However, as of 2025, significant progress is still needed to achieve this target and ensure equitable access to charging infrastructure across all regions.

Segmental Analysis:

By Type: Battery Electric Vehicles Control Over 52% Market Share

Battery Electric Vehicles (BEVs) have solidified their position as the dominant force in the electric vehicle market, surpassing the projected 52% market share by 2025. This remarkable growth is driven by significant advancements in battery technology, expanded charging infrastructure, and shifting consumer preferences towards sustainable transportation options. As of 2025, BEVs represent 68% of all electric vehicle sales globally, a substantial increase from 64% in 2024. The average range of BEVs has seen a dramatic improvement, with a 25% increase since 2023, addressing one of the primary concerns of potential EV buyers - range anxiety. This improvement is largely due to the introduction of solid-state batteries, which offer higher energy density and faster charging capabilities. As a result, the average BEV can now travel over 400 miles on a single charge, making long-distance travel more feasible than ever before.

Charging infrastructure in the electric vehicle market has also expanded rapidly to support the growing BEV market. The number of public charging points has increased by 35% globally since 2024, with a particular focus on fast-charging stations. This expansion has significantly improved the charging experience for BEV owners, with 80% of users reporting high satisfaction with charging availability and speed. Consumer sentiment towards BEVs has reached new heights, with recent surveys indicating that 75% of potential car buyers are now considering a BEV for their next purchase, up from 70% in 2024. This shift in consumer preference is further supported by the increasing integration of BEVs with renewable energy sources, with 40% of BEV owners now charging their vehicles using solar or wind power. The environmental impact of BEVs is becoming increasingly apparent, with studies showing that BEVs now produce 70% fewer lifetime emissions compared to internal combustion engine vehicles, even when accounting for battery production and electricity generation. This significant reduction in carbon footprint is a key driver for both consumer adoption and government support for BEVs.

By Vehicle Type: Passenger Cars Control Over 53% of Electric Vehicle Market Share

Passenger cars continue to dominate the electric vehicle market, maintaining their position with over 53% market share in 2025. This sustained leadership is attributed to the expanding range of models available, improved performance, and increasing affordability. As of 2025, global sales of electric passenger cars have reached an impressive 23 million units, marking a 15% increase from 2024 and demonstrating the sector's robust growth. The variety of available passenger EV models has expanded significantly, with over 350 different models now on the market across various price ranges and vehicle segments. This diverse selection caters to a wide range of consumer preferences, from compact city cars to luxury sedans and SUVs. The increased competition among manufacturers has led to rapid innovation and improved features, further driving consumer interest.

Performance metrics for passenger EVs have seen substantial improvements in the electric vehicle market. The average acceleration time from 0-60 mph for electric passenger cars has decreased by 20% since 2023, now standing at just 5.5 seconds for mid-range models. This performance boost, coupled with extended range capabilities, has made electric passenger cars increasingly attractive to performance enthusiasts. Charging times for passenger EVs have significantly decreased, with the average charging time for a 20-80% charge now taking just 25 minutes at fast-charging stations. This improvement represents a 30% reduction in charging time compared to 2023, greatly enhancing the practicality of EVs for long-distance travel.

The total cost of ownership for electric passenger cars has become increasingly competitive with internal combustion engine vehicles. Maintenance costs for EVs are now 40% lower on average compared to their gasoline counterparts, and the cost parity point for purchase price is expected to be reached by 2026 for most vehicle segments. Government incentives continue to play a crucial role in driving adoption, with many countries extending or introducing new tax credits and rebates for electric passenger cars. In the United States, for example, the average incentive value has increased by 15% since 2023, making EVs more accessible to a broader range of consumers.

By Power Output: 100–250 KW Holds Over 41.8% Market Share

The 100-250 kW power output segment has solidified its position in the electric vehicle market, holding over 41.8% market share in 2025. This range has become increasingly popular due to its balance between fast charging capabilities and infrastructure feasibility. The demand for high-powered EVs in this range has surged, with sales increasing by 60% compared to 2023, driven by advancements in battery technology and the growing consumer preference for vehicles with reduced charging times. Charging speeds in this power output range have seen significant improvements. The latest 250 kW chargers can now add up to 200 miles of range in just 15 minutes for compatible vehicles, representing a 30% improvement in charging speed since 2023. This enhancement has greatly reduced charging times during long-distance travel, making high-powered EVs more practical for a wider range of use cases.

The cost of high-powered EVs has become more competitive across the global electric vehicle market, with the average price decreasing by 15% since 2023 due to economies of scale and reduced battery costs. This price reduction has made vehicles in the 100-250 kW range more accessible to mainstream consumers, contributing to their increased market share. Battery longevity for high-powered EVs has also improved, with manufacturers now offering warranties of up to 10 years or 150,000 miles on battery packs. This extended warranty period, coupled with improved battery management systems, has increased consumer confidence in the long-term viability of high-powered EVs.

The charging infrastructure supporting 100-250 kW vehicles has expanded rapidly, with the number of compatible fast-charging stations increasing by 70% since 2023. This expansion has led to improved coverage along major highways, with an average distance between high-power charging stations now reduced to 50 miles in many regions. Energy efficiency in this power output range has also seen advancements, with the latest models achieving an average efficiency of 4 miles per kWh, a 20% improvement since 2023. This increased efficiency not only extends the vehicle's range but also reduces charging costs and environmental impact.

By Charger: Normal Chargers Take Up Over 87.5% Share

Normal chargers, also known as Level 2 chargers, continue to dominate the charging infrastructure landscape, accounting for over 87.5% of all charging points globally in 2025 in the electric vehicle market. This prevalence is due to their cost-effectiveness, ease of installation, and suitability for overnight and workplace charging. As of 2025, the number of normal chargers has surged to over 4 million installations worldwide, representing a 40% increase from 2024. The efficiency and charging speed of normal chargers have seen significant improvements. The average charging time for a full charge has decreased to 5 hours, a 20% reduction from 2024. This improvement is largely due to advancements in power management systems and the increased adoption of 11 kW and 22 kW AC chargers, which offer faster charging speeds while still falling within the "normal charger" category.

User satisfaction with normal chargers has reached new heights, with 85% of EV owners reporting high satisfaction with the availability and reliability of these charging stations in their areas. This increase in satisfaction is partly due to the improved distribution of chargers, with many urban areas now achieving a ratio of 5 EVs per public charger, ensuring better access and reduced wait times.

The integration of smart charging technologies has further enhanced the appeal of normal chargers in the electric vehicle market. As of 2025, 60% of newly installed normal chargers are equipped with load balancing and scheduling capabilities, allowing for more efficient energy use and reduced strain on the power grid during peak hours. This smart integration has led to a 25% reduction in charging costs for users who take advantage of off-peak charging rates. Normal chargers have also become more user-friendly, with 70% of new installations now featuring contactless payment systems and smartphone app integration for easy activation and monitoring. This improved user experience has contributed to the increased adoption of public charging, with the average utilization rate of public normal chargers rising to 30% in 2025, up from 22% in 2023. The workplace charging segment has seen particularly strong growth, with a 50% increase in the number of companies offering employee charging since 2023. This trend has significantly contributed to the dominance of normal chargers, as workplace charging typically relies on Level 2 chargers for all-day charging solutions.

Customize This Report + Validate with an Expert

Access only the sections you need—region-specific, company-level, or by use-case.

Includes a free consultation with a domain expert to help guide your decision.

To Understand More About this Research: Request A Free Sample

Regional Analysis

Asia Pacific Command Over 50% Market Valuation

In 2024, Asia Pacific and Europe have seen an electric vehicle market that is growing at an impressive rate. It is projected that about 17 million electric cars will be sold worldwide with China leading the way by accounting for around 10 million of these sales which will account for approximately 45% of all car sales in the country. This jump shows how quickly this region has adopted EVs as they become more affordable; already in 2023 over 60% of electric vehicles sold in China were cheaper to buy than their conventional equivalents.

The Asia Pacific electric vehicle market is being shook up by India. This year, from FY 2022-23, the country recorded sales of 12,43,258 EVs which is an increase of 154% YoY (Year on Year) compared to the previous fiscal. The Indian EV market is rapidly expanding and although it still remains relatively small, electric models account for two percent of total car sales in the year 2023. The Indian government has targeted that 30% electric vehicles will be on roads by 2030 and to make this happen they have rolled out several schemes such as FAME India scheme along with tax benefits too. Within just six months since Jan’23 till Jun’23 over 700,000 units were sold indicating people’s growing interest towards eco-friendly transportation systems like these ones here! Tata Motors currently holds more than two-thirds share in domestic markets but faces tough competition against Mahindra & Mahindra as well as Chinese manufacturer BYD.

U.S. EV Sales Surge: Record Growth and Market Penetration in 2025

The United States electric vehicle market continues to show remarkable growth and market penetration in 2025. As of January, new EV sales reached 102,243 units, marking a substantial 29.9% year-over-year increase. This growth is particularly significant as it follows a record-breaking December, indicating sustained consumer interest in EVs. The market share for plug-in vehicles (PEVs), including both battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs), has reached 10.38% of total light-duty vehicle sales, a milestone that underscores the growing adoption of electric mobility.

The used EV market is also thriving, with sales increasing by 3.5% to 26,933 units in January 2025, representing a 30.5% year-over-year growth and a market share of 1.8%. This robust growth in the used EV segment reflects growing consumer confidence in the longevity and value of electric vehicles. The average transaction price for new EVs stands at $55,614, slightly higher than the previous month but lower than the previous year. This trend suggests that more affordable EV options are entering the market, potentially broadening the consumer base for electric vehicles.

Top Companies in the Electric Vehicle Market:

- Tesla Motors

- BMW Group

- Nissan Motor Corporation

- Toyota Motor Corporation

- Volkswagen AG

- General Motors

- Daimler AG

- Energica Motor Company S.p.A.

- BYD Company Motors

- Ford Motor Company

- Zhejiang Geely Holding Group

- Tata Motors Limited

- Mahindra & Mahindra Limited

- MG Motor India

- Olectra Greentech Ltd.

- JBM Auto Limited

- Other Prominent Players

Market Segmentation Overview:

By Type:

- Battery electric vehicle (BEV)

- Fuel cell electric vehicle (FCEV)

- Plug-in hybrid electric vehicle (PHEV)

- Hybrid electric vehicle (HEV)

By Vehicle Type:

- Commercial Vehicle

- Passenger Car

- Two & Three Wheelers

By Charger:

- Normal

- Fast

By Power Output:

- Less than 100 KW

- 100-250 KW

- Above 250 KW

By Region:

- North America

- The U.S.

- Canada

- Mexico

- Europe

- Western Europe

- The UK

- Germany

- France

- Italy

- Spain

- Rest of Western Europe

- Eastern Europe

- Poland

- Russia

- Rest of Eastern Europe

- Western Europe

- Asia Pacific

- China

- India

- Japan

- Australia & New Zealand

- South Korea

- ASEAN

- Rest of Asia Pacific

- ASEAN

- Indonesia

- Malaysia

- Philippines

- Thailand

- Vietnam

- Singapore

- Cambodia

- Rest of ASEAN

- Middle East & Africa (MEA)

- Saudi Arabia

- South Africa

- UAE

- Rest of MEA

- South America

- Argentina

- Brazil

- Rest of South America

REPORT SCOPE

| Report Attribute | Details |

|---|---|

| Market Size Value in 2024 | US$ 418.2 Bn |

| Expected Revenue in 2050 | US$ 72,798 Bn |

| Historic Data | 2020-2023 |

| Base Year | 2024 |

| Forecast Period | 2025-2050 |

| Unit | Value (USD Bn) |

| CAGR | 21.99% |

| Segments covered | By Type, By Vehicle Type, By Charger, By Power Output, By Region |

| Key Companies | Tesla Motors, BMW Group, Nissan Motor Corporation, Toyota Motor Corporation, Volkswagen AG, General Motors, Daimler AG, Energica Motor Company S.p.A., BYD Company Motors, Ford Motor Company, Zhejiang Geely Holding Group, Tata Motors Limited, Mahindra & Mahindra Limited, MG Motor India, Olectra Greentech Ltd., JBM Auto Limited, Other Prominent Players |

| Customization Scope | Get your customized report as per your preference. Ask for customization |

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

.svg)