Saudi Arabia Electric Vehicle Market: By Type (Battery electric vehicle (BEV), Fuel cell electric vehicle (FCEV), Plug-in hybrid electric vehicle (PHEV), Hybrid electric vehicle (HEV), Autonomous Electric Vehicles); Vehicle Type (Passenger Cars (Small, Medium, and Large), SUVs (Small, Medium, Large), Light Commercial Vehicles (Pick-Up Trucks and Vans), Others); Charger (Fast and Normal); Power Output (Less than 100 KW, 100-250 KW, Above 250 KW); Sales Channel (Aftermarket and OEM)— Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2024–2032

- Last Updated: Apr-2024 | Format:

![pdf]() | Report ID: AA0424823 | Delivery: 2 to 4 Hours

| Report ID: AA0424823 | Delivery: 2 to 4 Hours

Market Scenario

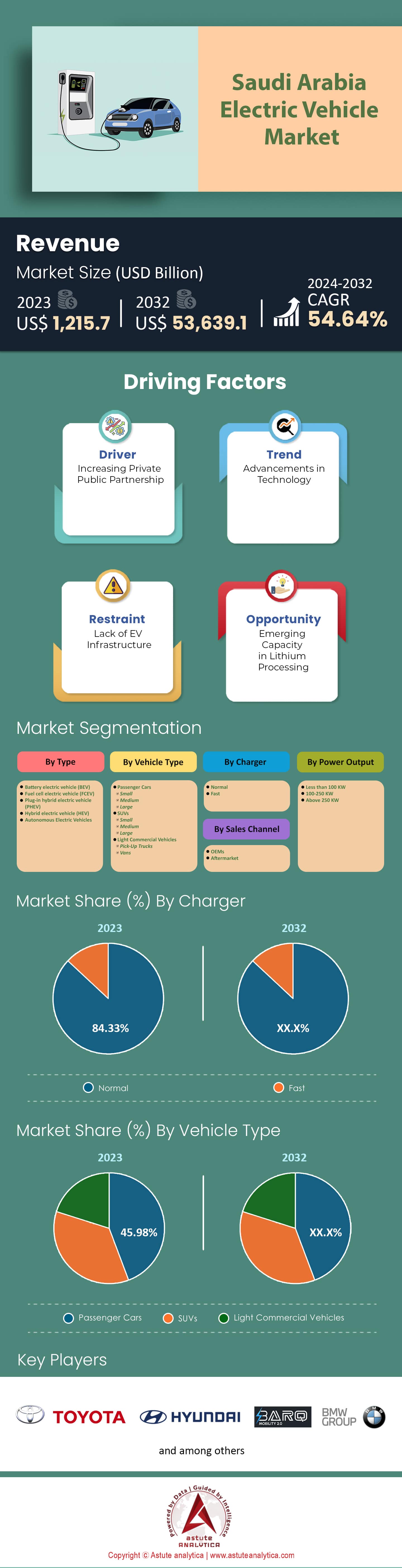

Saudi Arabia Electric Vehicle Market was valued at USD 1,215.7 million in 2023 and is projected to hit the market valuation of USD 53,639.1 million by 2032 at a CAGR of 54.64% during the forecast period 2024–2032.

By 2030, at least 30% of all cars in Riyadh should be electric vehicles, according to the Saudi Arabian government’s new policy. This goal shows their commitment towards sustainability within transportation systems. In order for this to happen, sales of electric vehicles have been increasing which is driving up the overall market demand for them. The need for charging stations has also been recognized by the Saudi Government who plans on installing over 10 thousand EV chargers throughout the nation before year end 2029; with 2803 operational as at now (2024) situated mainly at corporate and residential areas within the kingdom’s electric vehicle market. Companies like Electromin are helping speed up this process by installing 100 charging points in multiple phases but more partnerships are needed if there is going to be a well-distributed robust network that can serve everyone equally.

The Saudis want people to buy more EVs through incentives such as tax exemptions or deductions on incomes earned from working with these types of cars; they also offer loans at lower interest rates compared to other types of consumer financing products; they further provide subsidies which can be used either towards manufacturing cost reduction or customer discounts during purchase period only applicable when dealing with an authorized dealer appointed by manufacturer duly licensed under relevant regulation enacted time being force...etc all designed encourage uptake across board regardless affordability level among potential buyers especially during initial stages when prices still high.National Industrial Development Center (NIDC) is pushing for even more EV production through inviting between three and four original equipment manufacturers (OEMs) into setting up their plants locally; additionally, various mining companies have begun exploration activities meant tap battery metals required powering these next generation cleaner energy vehicles.

In Saudi Arabia, a recent study showed that consumers are positive about electric vehicles (EVs). The survey covered over 500 potential car buyers who expressed a strong intention to shift from traditional internal combustion engine vehicles (ICEVs) to electric ones within the next 24 months. In other words, this means that more and more people are thinking of buying an EV in Saudi Arabia electric vehicle market, which may result into significant growth for this industry. Besides these general findings, the researchers also looked into specific aspects concerning charging facilities: where should stations be located; how long can customers wait; should employers offer it at work parking lots; what payment methods are acceptable etcetera? The information collected here will greatly contribute towards creating more convenient charging networks for users.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Government Takes the Wheel: Investing in a Sustainable Future

The electric vehicle market in Saudi Arabia is growing incredibly quickly, with the country speeding towards an electrically powered future. This dream comes from a mixture of government programs, economic and environmental aims, and strategic attempts to dominate regional electric vehicle markets. The Saudi Arabian government is certainly not dragging their feet on this issue; they plan to invest $50 billion into EV production in the next ten years alone. Their commitment becomes even more apparent when it is understood that this means 30% of all new cars sold should be electric by 2030–seems like wishful thinking but who knows what could happen? However, Riyadh (the capital) has set its sights higher than anyone else: by that same year 30% of the city’s streets will be lined with these types of automobiles.

These objectives are not just empty promises either – tangible steps are being taken towards achieving them too! For instance; SEVCIDI wants 50,000 EV charging stations installed nationwide by 2025 which seems like quite an overreaction considering only few people own such vehicles currently but maybe they know something we don’t.

Environmental and Economic Benefits: A Green Ride Towards Vision 2030

The reason for the move towards EVs is not just about technology, but it’s more of achieving the environmental and economic objectives stated in Saudi Vision 2030. The rapid deployment in Electric Vehicle market can significantly cut down on emissions whereby every 1% penetration of EVs is projected to reduce emissions by 0.5%. This suits well with programs such as “Green Riyadh” which seeks to lower the city’s carbon footprint through different sustainable actions. There are also good prospects for economic gains; EVs could help check the increasing demand for electricity that comes with population and economic expansions. Robust growth in e-commerce as well as transport & logistics will additionally drive-up numbers of zero-emission commercial vehicles needed. Moreover, being ranked number one among MENA countries’ electric vehicle markets (which is expected to reach $9,42bn by 2029), Saudi Arabia should take lead in regional shift towards sustainability.

Trend: Rise in Homegrown Electric Vehicle Brands

Saudi Arabia’s hopes to electrify the transport sector are not limited to being a big EV adopter. When Ceer Motors rolls out in 2022 as Saudi Arabia’s first homegrown electric vehicle brand, it will have made a big step towards becoming an EV manufacturer of note. The partnership with manufacturing behemoth Foxconn and backing from the Public Investment Fund (PIF) of Saudi Arabia is indicative of strategic intent on the part of the kingdom – PIF’s financial heft combined with Foxconn’s electronics manufacturing prowess aims for $150m in foreign investment. This plan is aligned with Saudi Vision 2030, which seeks economic diversification through job creation driven by technology.

A domestic electric vehicle market would help reduce reliance on oil revenues for Saudi Arabia. However, there are still some challenges ahead; building up successful brands calls for significant investments in R&D, factories, supply chains and skilled workers among other things. Partnership with established players like Foxconn is necessary to speed up learning processes as well as access new technologies that may be out of reach otherwise. It also requires creating an enabling environment around this new sector such as government initiatives like installing 50k charging points by 2025 or aiming for 30% sales of EVs by 2030 both locally produced and imported ones included in addition competitive pricing strategies should be adopted coupled with quality improvement efforts plus unique features incorporation into these vehicles if at all they are going compete favorably against already established global brands.

However difficult it may seem; still this move represents nothing less than audacity itself where we see Ceer Motors positioned right next amid other companies racing towards success within electric vehicle market worldwide. A thriving national industry producing its own lineups could easily turn around fortunes not only regionally but internationally too considering steady growth rates experienced currently across all segments associated directly or indirectly with this booming alternative energy source.

Challenges and Opportunities: A Road Map for Success

The future of Saudi Arabia electric vehicle market is bright but there are obstacles. These include the absence of a comprehensive charging system and the ease of use associated with petrol-powered cars which are cheap in Saudi Arabia due to low fuel costs. On the other hand, this void should be filled if the government stays true to its word about incentives and infrastructure. According to Arthur D. Little consultancy, Saudi Arabia may become a more vibrant EV market than developed countries such as Australia or Singapore could ever hope to be – thus indicating immense potential for exponential growth in that industry within this nation alone. With more backing from authorities; alliances forged strategically; heightened environmental consciousness among buyers – all signs point towards Saudi Arabia becoming an unstoppable force behind the electric vehicle revolution.

Segmental Analysis

By Type

While Saudi Arabia is setting ambitious targets for electric vehicle (EV) adoption, hybrid models currently hold the fort with over 71% market share in Saudi electric vehicle market. The main problem of pure EVs in Saudi Arabia is the lack of charging stations. Thus, consumers are left with hybrid electric vehicles that can switch between an electric and a petrol engine. The total number of registered electric cars in the country stands at 23,170. Efforts have been made to increase the charging infrastructure with a current pilot project and a goal of 50,000 stations by 2025.

In terms of marketability among Saudi buyer’s hybrid technology provides a middle ground option. In order for them to be competitive with their gasoline counterparts which are further aided by cheap fuel prices across Saudi Arabia today; Electric cars must offer more incentives than other kinds do. Consequently, this new type combines two sources namely electricity and petrol produced during operation itself while driving along streets or highways so that it provides advantages of battery-powered vehicles without any problems related to limited range coverage anxiety solely powered from batteries only when charged overnight at home or work place which could be far away from destination points known Toyota as worldwide top seller having already sold over eleven million hybrid units till date proves its reliability being practical too.

By Vehicle Type

More than 45% of Saudi Arabia’s electric vehicle market revenue comes from passenger cars such as sedans, SUVs and hatchbacks. This shows that people like these types of vehicles a lot therefore it is only natural for them to extend their preference into the EV space. The growth rate in this area will be fueled by an increase in the number of sedans alone which are predicted to exceed 517,000 units by 2027 and thus creating huge room for adoption. A study done recently revealed that in Hail City; one thing mattered most when it came to switching over to an electric car – what somebody else thought about it. As more users start giving feedback on their experiences with driving electric vehicles, other people become interested in trying them out too because they see this as the best way forward so demand goes up leading us into believing there’s a bright future ahead for passenger electric cars.

Saudi government has not been left behind as far as promoting use of EVs is concerned especially when talking about passenger vehicles. Through partnerships with international brands in the electric vehicle market who have agreed to share their knowledge on manufacturing processes required while setting up factories within its borders, the market is projected to witness a strong growth momentum.

What’s more? They are also injecting large sums of money through PIF and signing agreements with key players. This will enable speedy development of all aspects surrounding production from design phase up until assembly line stage for distribution both locally as well internationally. In addition, there exists collaboration between UK which seeks facilitate exchange ideas related smart grids infrastructure alongside technological advancements associated with electric cars since without robust power network charging stations would not be possible at various locations across cities. Hence, making adoption difficult or non-existent altogether. SASO (Saudi Standards, Metrology Quality Organization) plays a critical role here too because it ensures that minimum requirements are met prior deployment happens. Also, it gives out certifications required whenever needed thus reinforcing ecosystem further for successful implementation.

By Charger

Saudi Arabia is taking giant strides towards establishing a wide-ranging network of normal electric vehicle (EV) chargers throughout the country’s electric vehicle market. Correspondingly, the regular charger segment has been contributing more than 83.33% market share of Saudi Arabia electric vehicles market. This bold move is in line with the kingdom’s target of having 30% of Riyadh’s cars being electric by 2030 which is intended to fast track EV adoption and meet environmental objectives outlined in Vision 2030 and Saudi Green Initiative.

This pattern can be seen among key players within Saudi Arabian EV charging industry. Electromin, one biggest networks boasting over 700 stations mainly deals with normal charging while ChargeNow together with E.ON who are large networks planning expansions concentrate on standard charging solutions in the Saudi Arabia electric vehicle market. Limited demand for high-speed chargers from customers also reflects itself on online trends where searches for “fast chargers” give fewer results than those for “mobile chargers” on major e-commerce platforms probably because First of all, it could be that Saudi Arabia’s standard voltage of 230V is suitable for normal charging but not fast charging which may require additional equipment. Secondly, Energy Sustainable Solutions offers mostly normal chargers while fastest onboard chargers speed available in popular EV models such as Renault Zoe or Hyundai Ioniq suggest an overnight or workplace charge routine based around normal speeds.

Additionally, fast charging might not thrive well in Saudi Arabian scorching climate due to battery health issues associated with high temperatures. This worry forms part Normal Charging Standards under Saudi Standard. Metrology and Quality Organization (SASO) EV Charging Regulations suggests that concerns over heat compromises were taken into account when designing them.

By Power Output

For the moment, Saudi Arabia is constructing its EV charging network but prioritizing accessibility over ultra-fast charging (100 kW and above). This reflects early stages of EV adoption seen elsewhere. However, in the Saudi Arabia electric vehicle market, less than 100 KW power output chargers are dominating. Electromin, a leading charger provider, offers various options - but not many are ultra-fast. In the same vein, chargers less than 100 kW take precedence during the initial rollout. Even in developed EV markets like Korea slow chargers account for nearly 90% despite high charging power per EV ratio.

Rather than expensive ultra-fast stations, Saudi Arabia plans to enable long-distance travel through a ubiquitous network boosting growth of the electric vehicle market. The first phase of the national rollout employs chargers capped at 43 kW; certified manufacturer Wallbox mainly offers AC solutions under 100 kW. There's no mandate for ultra-fast charging to meet the 30% EV target in Riyadh by 2030 either. Even pilot projects focus on "fast-charger" stations without mentioning power levels above 100 kW. Looking globally, major European EV markets have yet to reach the recommended 1 kW charging power per EV ratio - some even lack basic infrastructure altogether. This underscores a need for robust slower-charging networks at an early stage; it's no different in Saudi Arabia where service providers offer both AC and DC options but mostly fall within 50-100 kW range with DC fast charging below that mark as well. The standard AC being deployed also falls below this level.

Ultra-fast charging deployment presents challenges in the electric vehicle market given Saudi Arabia's hot climate regionally too; budget-friendly local manufacturing hints towards preference for affordable sub-100 kW solutions hereabouts. Average public charging power per EV worldwide hovers around 2.4 kW - decidedly short of 100 kW threshold which is further from reality vis-a-vis Europe (1.2kW). A geographically comprehensive network lays groundwork for EV adoption in Saudi Arabia; however, with a future role in mind, it presently aligns accessibility and cost-effectiveness with global trends.

To Understand More About this Research: Request A Free Sample

Key Players in the Saudi Arabia Electric Vehicle Market

- BMW AG

- BYD Company Ltd.

- Ceer Motors

- Lucid Group, Inc.

- MG Motor

- The Hyundai Motor Company

- Toyota Motor Corporation

- Volkswagen AG

- Other Prominent Players

Market Segmentation Overview:

By Type

- Battery electric vehicle (BEV)

- Fuel cell electric vehicle (FCEV)

- Plug-in hybrid electric vehicle (PHEV)

- Hybrid electric vehicle (HEV)

- Autonomous Electric Vehicles

By Vehicle Type

- Passenger Cars

- Small

- Medium

- Large

- SUVs

- Small

- Medium

- Large

- Light Commercial Vehicles

- Pick-Up Trucks

- Vans

By Charger

- Normal

- Fast

By Power Output

- Less than 100 KW

- 100-250 KW

- Above 250 KW

By Sales Channel

- OEMs

- Aftermarket

View Full Infographic

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST | Report ID: AA0424823 | Delivery: 2 to 4 Hours

| Report ID: AA0424823 | Delivery: 2 to 4 Hours

.svg)