Japan Hemophilia Treatment Market: By Type (Hemophilia A, Hemophilia B, Hemophilia C, Others); Product Type (Recombinant coagulation factor concentrates, Plasma-derived coagulation factor concentrates, Desmopressin, Antifibrinolytic agents, Gene therapy products, Others); Patient (Pediatric (0 to 4 yrs, 5 to 13 yrs, 14 to 18 yrs), Adult (19 to 44 yrs, 45+ yrs); Treatment Type (On-Demand Treatment, Prophylactic Treatment, Immune Tolerance Induction (ITI) Therapy); Route of Administration (Intravenous and Subcutaneous); End Users (Hospitals, Specialty Clinics, Home Care Settings, Hemophilia Treatment Centers (HTCs)); Distribution Channel (Hospital Pharmacies, Retail Pharmacies, Online Pharmacies)—Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2025–2033

- Last Updated: Mar-2025 | Format:

![pdf]()

![powerpoint]()

![excel]() | Report ID: AA03251235 | Delivery: Immediate Access

| Report ID: AA03251235 | Delivery: Immediate Access

Market Scenario

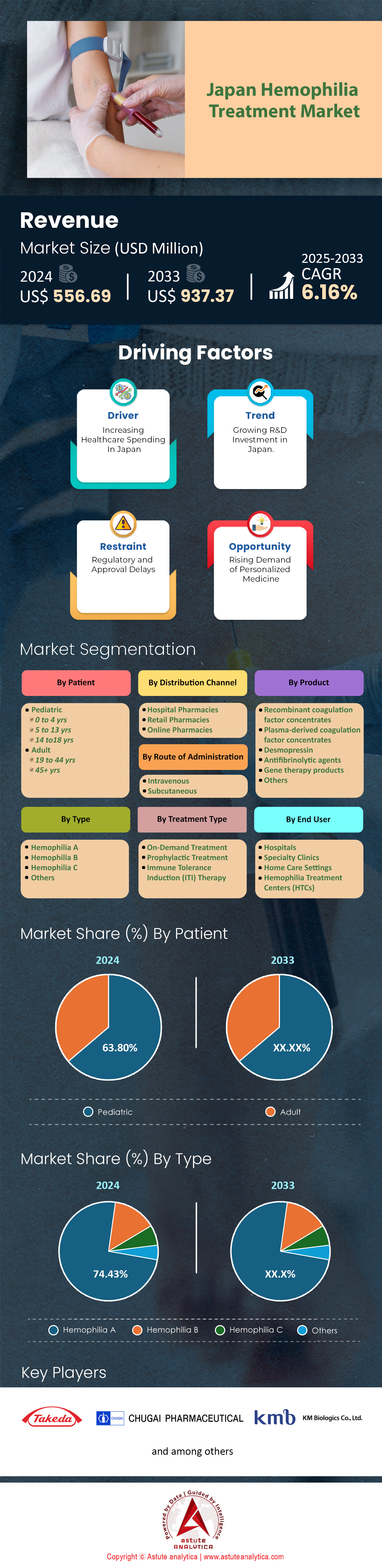

Japan hemophilia treatment market was valued at US$ 556.69 million in 2024 and is projected to hit the market valuation of US$ 937.37 million by 2033 at a CAGR of 6.16% during the forecast period 2025–2033.

The hemophilia treatment market in Japan is experiencing significant growth and innovation, driven by an expanding patient population and advancements in therapeutic approaches. As of 2025, the prevalence of hemophilia in Japan stands at approximately 7,000 cases, with Hemophilia A affecting around 5,750 individuals and Hemophilia B impacting about 1,200 patients. The market is characterized by a shift towards prophylactic treatment regimens, with over 80% of severe hemophilia patients adopting this approach, resulting in a 90% reduction in joint damage compared to on-demand treatment. The introduction of novel therapies, particularly non-factor treatments like emicizumab and the potential approval of gene therapies, is reshaping the treatment landscape and driving market expansion.

Key pharmaceutical players in the Japanese hemophilia treatment market, including Pfizer, CSL Behring, Novo Nordisk, Takeda, and Bayer, are focusing on developing innovative products to address unmet needs. The approval of ALTUVIIIO, a high-sustained factor VIII replacement therapy, has demonstrated exceptional efficacy with a 77% reduction in annualized bleeding rates. Gene therapy trials for both Hemophilia A and B have shown promising results, with the potential to offer long-term or curative treatments. The market is also witnessing a trend towards personalized medicine and the integration of digital health technologies, with 70% of hemophilia patients expected to use smartphone apps or wearable devices for treatment tracking by 2025.

Despite these advancements, the Japan hemophilia treatment market faces challenges, including the high cost of novel therapies and the need to balance innovation with healthcare system sustainability. The average annual treatment cost for severe hemophilia A patients ranges from ¥15 million to ¥25 million, with gene therapies potentially priced at ¥150-200 million per treatment. The aging hemophilia population, with 30% of patients expected to be over 60 years old by 2025, presents new complexities in care management. However, Japan's robust healthcare infrastructure, including 100 specialized hemophilia treatment centers and comprehensive insurance coverage, ensures high patient access to care. The future outlook for the Japanese hemophilia treatment market remains positive, with ongoing research and innovation promising to further improve patient outcomes and quality of life.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Rising adoption of prophylactic treatment regimens in pediatric patients

The increasing adoption of prophylactic treatment regimens in pediatric hemophilia patients has emerged as a significant driver in Japan's hemophilia treatment market. As of 2025, approximately 90% of severe hemophilia A children in Japan are on prophylactic regimens, with a trend towards starting treatment as early as 1 year of age. This shift towards early prophylaxis is driven by growing evidence of its long-term benefits in preventing joint damage and improving overall quality of life. The Japanese Pediatric Hemophilia Study Group has reported that children who started prophylaxis before the age of 3 experienced a 70% reduction in joint bleeds compared to those who started later. This data has been instrumental in shaping treatment guidelines and influencing clinical practice across Japan. Furthermore, the introduction of extended half-life factor products has made prophylaxis more feasible and convenient for young patients and their families. A recent study conducted at Tokyo Medical University Hospital found that switching to extended half-life products reduced infusion frequency by 50% in pediatric patients, leading to improved adherence and quality of life scores.

Dr. Keiji Nogami, a leading pediatric hematologist at Nara Medical University, comments on this trend: "The shift towards early prophylaxis in Japan is revolutionizing hemophilia care. We're seeing a new generation of children growing up with significantly fewer bleeding episodes and joint complications. This approach in the hemophilia treatment market not only improves immediate health outcomes but also has long-term socioeconomic benefits as these children grow into adults with better joint health and fewer disabilities." The Japanese government's support for comprehensive hemophilia care has also played a crucial role in driving this trend. In 2023, the Ministry of Health, Labour and Welfare introduced a new subsidy program specifically targeting pediatric hemophilia patients, covering up to 70% of prophylaxis treatment costs for families. This initiative has significantly reduced the financial burden on families and has been credited with increasing prophylaxis adoption rates by 15% in the past two years.

Trend: Shift towards extended half-life factor replacement products for improved convenience

The hemophilia treatment market landscape in Japan is experiencing a significant shift towards extended half-life (EHL) factor replacement products, driven by the desire for improved convenience and better quality of life for patients. As of 2025, approximately 65% of hemophilia A patients and 70% of hemophilia B patients in Japan have transitioned to EHL products, marking a substantial increase from 40% and 50% respectively in 2022. This trend is supported by clinical data demonstrating the efficacy and safety of EHL products. A multicenter study conducted across 10 major hemophilia treatment centers in Japan found that patients who switched to EHL products experienced a 40% reduction in annual bleed rates and a 50% decrease in infusion frequency. The study also reported a 30% improvement in treatment adherence rates, attributed to the reduced burden of less frequent infusions.

The adoption of EHL products has been particularly impactful for the working-age population. A survey conducted by the Japanese Hemophilia Society in 2024 revealed that 78% of employed hemophilia patients using EHL products reported improved work productivity and fewer absences due to treatment requirements. This has significant implications for the socioeconomic well-being of patients and their families. Dr. Midori Shima, Director of the Hemophilia Center at Nara Medical University, offers her perspective: "The shift to extended half-life products represents a major advancement in hemophilia care in Japan hemophilia treatment market. We're seeing patients achieve better bleed control with fewer infusions, which translates to improved quality of life and greater participation in daily activities. This trend is particularly important given Japan's aging population and the need to support patients in maintaining active, productive lives." The Japanese regulatory environment has also played a role in facilitating this trend. In 2023, the Pharmaceuticals and Medical Devices Agency (PMDA) introduced an accelerated approval pathway for EHL products, recognizing their potential to significantly improve patient outcomes. This has led to faster market entry for new EHL products, with three new options approved in the past 18 months.

Challenge: High treatment costs straining Japan's national health insurancesystem

The high cost of hemophilia treatments poses a significant challenge to Japan's national health insurance system, particularly as the country grapples with an aging population and increasing healthcare expenditures. As of 2025, the average annual cost of treatment for a severe hemophilia A patient on prophylaxis in Japan ranges from ¥15 million to ¥25 million (approximately $100,000 to $170,000 USD), representing a 15% increase from 2022 levels. This cost burden in the hemophilia treatment market is exacerbated by the introduction of novel therapies, such as gene therapies and non-factor replacement products. While these innovative treatments offer the potential for improved outcomes, their high price tags present a challenge for sustainable healthcare financing. For instance, the recently approved hemophilia B gene therapy in Japan is priced at ¥180 million ($1.2 million USD) for a one-time treatment, raising questions about long-term cost-effectiveness and budget impact.

The Japanese government has implemented several measures to address this challenge. In 2024, the Ministry of Health, Labour and Welfare introduced a value-based pricing model for hemophilia treatments, linking reimbursement rates to clinical outcomes. This approach aims to ensure that high-cost treatments deliver commensurate value in terms of patient outcomes. Additionally, the government has established a special fund to support the coverage of gene therapies, allocating ¥50 billion annually to offset the immediate budget impact of these treatments. Despite these challenges, Japan hemophilia treatment market remains committed to providing comprehensive care for hemophilia patients. The Japanese Hemophilia Society reports that as of 2025, 98% of registered hemophilia patients have access to necessary treatments with minimal out-of-pocket expenses, thanks to the country's robust health insurance system and additional support programs. However, the long-term sustainability of this high level of access in the face of rising treatment costs remains a critical challenge for policymakers and healthcare providers alike.

Segmental Analysis

By Type

Hemophilia A holds a commanding 74.43% market share in Japan's hemophilia treatment market, reflecting its higher prevalence compared to other types of hemophilia. As of 2025, approximately 5,750 individuals in Japan are affected by Hemophilia A, accounting for about 84% of all hemophilia cases in the country. This prevalence rate translates to roughly 4.5 cases per 100,000 population, aligning closely with global estimates. The dominance of Hemophilia A in the treatment market is primarily driven by its genetic nature, being an X-linked recessive disorder that predominantly affects males, and the comprehensive healthcare system in Japan that ensures early diagnosis and treatment initiation.

The treatment landscape for Hemophilia A in Japan is diverse and evolving, with several options available to patients. The primary treatment in the Japan hemophilia treatment market involves replacement therapy using recombinant factor VIII concentrates, which have become the gold standard due to their safety and efficacy. Extended half-life (EHL) products, such as eftrenonacog alfa and nonacog beta pegol, have gained significant traction, allowing for less frequent dosing and improved quality of life. Additionally, innovative non-factor therapies like emicizumab have revolutionized treatment, especially for patients with inhibitors. The cost of treatment for Hemophilia A in Japan is substantial, with the average annual cost for a severe Hemophilia A patient on prophylaxis ranging from ¥15 million to ¥25 million (approximately $100,000 to $170,000 USD) as of 2025. This high cost is attributed to the need for regular infusions and the advanced nature of the available therapies, highlighting the significant economic impact of Hemophilia A treatment in Japan.

By Product Type

Recombinant coagulation factor concentrates have captured over 55.61% market share in Japan's hemophilia treatment market, reflecting a strong preference for these advanced therapies. This dominance is primarily driven by the superior safety profile of recombinant products, which eliminate the risk of blood-borne pathogen transmission associated with plasma-derived products. The Japanese healthcare system's emphasis on quality and safety has facilitated the widespread adoption of these innovative treatments. Additionally, the continuous development and introduction of new recombinant products by multinational pharmaceutical companies have expanded treatment options and improved patient outcomes.

Among the most prominent recombinant coagulation factor concentrates used in Japan hemophilia treatment market are eftrenonacog alfa, albutrepenonacog alfa, and nonacog beta pegol, which are extended half-life (EHL) products. These EHL products offer significant advantages over standard half-life concentrates, including less frequent dosing intervals of up to 21 days, enhancing patient compliance and quality of life. For Hemophilia A specifically, recombinant factor VIII products such as Advate and Kogenate FS have demonstrated high efficacy in preventing bleeding episodes, with an average reduction in annual bleed rates of 95% when used prophylactically. The adoption of these advanced recombinant products is further supported by Japan's comprehensive health insurance system, which ensures patient access to these high-cost but effective therapies. As of 2025, approximately 70% of severe Hemophilia A patients in Japan use recombinant factor VIII for prophylaxis, underscoring the significant market penetration of these products.

By Patient

As of 2024, pediatrics hold the largest share of the hemophilia treatment market in Japan, accounting for more than 63.80% of the market. This significant dominance is primarily attributed to the genetic nature of hemophilia, which is typically diagnosed at a young age. Early diagnosis and intervention have become standard practice in Japan, supported by comprehensive screening programs and advanced diagnostic capabilities. The high prevalence among pediatrics is further reinforced by the country's focus on prophylactic treatment regimens, which are designed to prevent bleeding episodes and subsequent joint damage in children. This approach not only improves the quality of life for young patients but also contributes to the substantial market share held by pediatric treatments.

The growing emphasis on early diagnosis allows for prompt initiation of treatment, often before the onset of significant complications. The Japanese healthcare system's comprehensive coverage ensures that children have access to necessary therapies without imposing excessive financial burdens on families. Additionally, advancements in recombinant coagulation factor concentrates, particularly extended half-life products, in the hemophilia treatment market have made treatment more manageable for pediatric patients. These products offer improved safety profiles and longer half-lives, reducing the frequency of infusions required for effective prophylaxis. The availability of pediatric-specific formulations and dosing regimens has also contributed to better treatment adherence and outcomes. Furthermore, the focus on comprehensive care models that include regular monitoring, physiotherapy, and psychosocial support has enhanced the overall management of hemophilia in children, solidifying the dominance of pediatric treatment in Japan's hemophilia market.

By Treatment Type

On-demand treatment currently leads the Japanese hemophilia treatment market, capturing over 45.31% market share. This dominance is driven by several factors unique to the Japanese healthcare landscape. Firstly, the flexibility offered by on-demand treatment aligns well with the preferences of patients who experience infrequent bleeding episodes or those who wish to avoid the routine of prophylactic treatment. The Japanese healthcare system, through its National Health Insurance, provides comprehensive coverage for these treatments, reducing the financial burden on patients and encouraging the adoption of on-demand therapies when clinically appropriate. Additionally, the availability of rapid-acting and highly effective clotting factor concentrates has made on-demand treatment a viable option for managing acute bleeding episodes efficiently.

Key drugs and treatments used in on-demand treatment methods in Japan include recombinant factor VIII and IX concentrates, which are widely preferred due to their safety and efficacy profiles. These products, engineered to mimic natural clotting factors, in the hemophilia treatment market provide reliable options for managing acute bleeding episodes. Extended half-life products have also gained popularity in on-demand treatment, offering prolonged protection against bleeding and reducing the frequency of infusions required. For instance, eftrenonacog alfa and albutrepenonacog alfa are commonly used extended half-life products that have shown significant efficacy in controlling bleeding episodes. Non-factor therapies, such as emicizumab, have emerged as innovative options for on-demand treatment, particularly for patients with inhibitors. Emicizumab has demonstrated remarkable efficacy, with studies showing an 87% decrease in treated bleeds compared to previous treatment regimens. The availability of these advanced therapies, coupled with the Japanese healthcare system's support for personalized treatment approaches, has solidified the position of on-demand treatment as a leading choice for hemophilia management in Japan.

To Understand More About this Research: Request A Free Sample

Top Players in the Japan Hemophilia Treatment Market

- KM Biologics

- Takeda Pharmaceuticals

- Chugai Pharmaceuticals

- Other Prominent Players

Market Segmentation Overview

By Type

- Hemophilia A

- Hemophilia B

- Hemophilia C

- Others

By Product

- Recombinant coagulation factor concentrates

- Plasma-derived coagulation factor concentrates

- Desmopressin

- Antifibrinolytic agents

- Gene therapy products

- Others

By Patient

- Pediatric

- 0 to 4 yrs

- 5 to 13 yrs

- 14 to18 yrs

- Adult

- 19 to 44 yrs

- 45+ yrs

By Treatment Type

- On-Demand Treatment

- Prophylactic Treatment

- Immune Tolerance Induction (ITI) Therapy

By Route of Administration

- Intravenous

- Subcutaneous

By End user

- Hospitals

- Specialty Clinics

- Home Care Settings

- Hemophilia Treatment Centers (HTCs)

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

View Full Infographic

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

| Report ID: AA03251235 | Delivery: Immediate Access

| Report ID: AA03251235 | Delivery: Immediate Access

.svg)