Hemophilia Treatment Market: By Type (Hemophilia A, Hemophilia B, Hemophilia C, and Others); Product (Recombinant coagulation factor concentrates , Plasma-derived coagulation factor concentrates, Desmopressin, Antifibrinolytic agents, Gene therapy products, and Others); Patients (Pediatric (0 to 4 yrs, 5 to 13 yrs, and 14 to18 yrs) and Adult (19 to 44 yrs and 45+ yrs); Form (Powders, Liquids & Gels, Tablets & Capsules, and Others)); Treatment Type (On-Demand Treatment, Prophylactic Treatment, and Immune Tolerance Induction (ITI) Therapy); Route of Administration (Intravenous and Subcutaneous); End User (Hospitals, Specialty Clinics, Home Care Settings, and Hemophilia Treatment Centers (HTCs)) and Distribution Channel (Hospital Pharmacies, Retail Pharmacies, and Online Pharmacies); Region—Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2025–2033

- Last Updated: Jan-2025 | Format:

![pdf]()

![powerpoint]()

![excel]() | Report ID: AA01251135 | Delivery: Immediate Access

| Report ID: AA01251135 | Delivery: Immediate Access

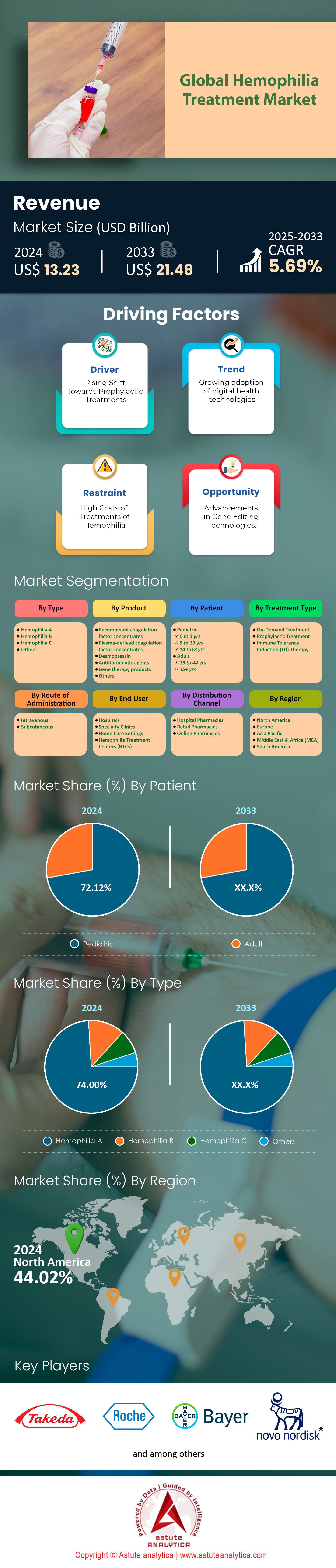

The global hemophilia treatment market, valued at approximately USD 13.23 billion in 2024, is poised for significant growth, with projections indicating a surge to USD 21.48 billion by 2033. This notable expansion represents a compound annual growth rate (CAGR) of 5.69% from 2025 to 2033, underscoring a rising demand for advanced therapies and innovative solutions in managing hemophilia.

Key drivers of this growth include an increasing emphasis on prophylactic treatments, which are fostering the adoption of novel therapeutic options. For example, advancements in gene therapies and recombinant clotting factors are transforming patient care by reducing the frequency of treatments and improving quality of life. Furthermore, heightened investments in research and development are accelerating the discovery of cutting-edge treatments. Global R&D spending has reached unprecedented levels, exceeding USD 1.7 trillion, with approximately 10 countries accounting for 80% of this expenditure, as reported by UNESCO.

The impact of these efforts is evident in the broader pharmaceutical landscape. According to the IQVIA report, clinical development productivity saw a significant improvement in 2023, with the composite success rate rising to 10.8%, the highest recorded since 2018. This progress was reflected in the launch of 69 novel active substances (NASs) globally, marking an increase of six from the previous year. A key example of these advancements is the launch of valoctocogene roxaparvovec (Roctavian) for Hemophilia A, the first gene therapy of its kind in 2023. Roctavian demonstrated a significant reduction in mean annualized bleeding rate (ABR), with 0.5 bleeds per year for spontaneous bleeds and 0.6 bleeds per year for joint bleeds, compared to the standard of care (SOC). Additionally, another breakthrough therapy, efanesoctocog alfa (Altuviiio), a factor VIII replacement for Hemophilia A, was also introduced in 2023. These developments underscore the continuous innovation in hemophilia treatment, driven by advancements in drug discovery and clinical success rates.

Furthermore, a key factor propelling the growth of the hemophilia market is the rapid progress in gene editing technologies, which are transforming treatment paradigms by addressing the underlying genetic causes of the condition. Breakthrough tools such as CRISPR-Cas9 and base editing are enabling highly precise genetic modifications, leading to significantly improved therapeutic outcomes. These advancements hold the promise of delivering long-term or even permanent solutions for hemophilia patients.

To Get more Insights, Request A Free Sample

Hemophilia Epidemiology

The global epidemiology of hemophilia has shown a steady increase in the number of identified patients over the years. According to the World Federation of Hemophilia (WFH) report, the number of identified hemophilia cases has risen from 195,263 in 2019 to 218,804 in 2023, reflecting a growing awareness, improving diagnostic capabilities, and rising demand for treatment.

By sex, hemophilia predominantly affects males. Approximately, 90% of hemophilia A cases occurs in males Vs 4% in females and 6% in unknown. Similarly, ~88% of hemophilia B cases occur in males Vs 6% in females and 6% in unknown.

By severity, in 2023- 69,000 individuals globally had severe hemophilia, while ~43,653 individuals had mild severity. This underscores the ongoing public health challenge posed by hemophilia.

A case study published in the American Journal in 2019 further detailed the prevalence of hemophilia in males. The study found that among every 100,000 males, there are 17.1 cases of hemophilia A and 3.8 cases of hemophilia B, i.e., encompassing cases of all severity. At birth, the prevalence is notably higher, with 24.6 cases per 100,000 males for all severities of hemophilia A and 5.0 for all severities of hemophilia B. For individuals born with hemophilia, life expectancy and quality of life (QoL) are significantly impacted, with reductions of 64% in upper-middle-income countries, 77% in middle-income countries, and up to 93% in low-income countries. This stark disparity in life expectancy underscores the urgent need for improved healthcare access and treatment options globally.

Market Dynamics

Driver: Growing Investments in R&D for Innovative Therapies

Expanding investments in research and development (R&D) for innovative therapies are playing a pivotal role in driving growth in the hemophilia treatment market, enabling the development of advanced solutions to address unmet medical needs. Increased financial support through investments and grants is significantly fueling progress. For example, in March 2022, the Indiana University School of Medicine secured USD 12 million in funding from the National Heart, Lung, and Blood Institute to advance hemophilia therapies. Such initiatives underscore a strong commitment to enhancing treatment outcomes through innovation.

R&D efforts are increasingly focusing on groundbreaking approaches such as gene therapy and monoclonal antibodies, which hold transformative potential. A notable milestone occurred in April 2020 when the FDA approved Sevenfact (coagulation factor VIIa [recombinant]-jncw), a genetically engineered product for managing bleeding episodes in adolescents and adults. This approval highlights the tangible impact of R&D in delivering next-generation treatments that are shaping the future of hemophilia care.

Pharmaceutical R&D investment has grown exponentially over the past few decades. For instance, PhRMA member companies invested $83 billion in research and development (R&D) in 2019, the highest level of investment on record, according to the 2020 PhRMA member annual survey. The impact of sustained R&D investment is evident in the surge of drug approvals. Between 2010 and 2019, the average number of new drugs approved annually in the U.S. nearly doubled, reaching 38 per year. This rapid progress can be seen in the approval of gene therapies for Hemophilia in early 2024. Roctavian for hemophilia A received approval from both FDA and EMA, while Hemgenix for hemophilia B, gained approval from the FDA, EMA, and Health Canada and Beqvez for hemophilia B by Health Canada. As these treatments continue to reshape the landscape of hemophilia care, they highlight the critical role of sustained innovation and investment in transforming patient outcomes and creating life-changing therapies.

Restraint: High Costs of Treatments of Hemophilia

The high cost of advanced hemophilia treatments presents a major challenge to the market, limiting patient accessibility and hindering broader adoption. In the U.S., for example, hemophilia treatment costs can average $270,000 annually per patient, as noted in a 2015 Express Scripts report, placing these drugs among the most expensive in the healthcare industry. Despite the availability of 28 hemophilia therapies, prices have consistently risen, driven by the complexity of biologic drug development, such as recombinant clotting factors and gene therapies, which entail significant R&D, manufacturing, and regulatory compliance costs.

Dr. Stacy E. Croteau of Dana-Farber/Boston Children’s Cancer and Blood Disorders Center highlights that, therapies for Hemophilia A and B, including traditional factor replacements and newer options like emicizumab, can cost between $300,000 and $500,000 annually for adults. A 2018 pharmaceutical trend report revealed that antihemophilic factor spending increased by 62% within a year and tripled for Medicare. High costs are exemplified by products like Advate, a third-generation recombinant factor for Hemophilia A, which costs approximately $20,630 per prescription, and long-acting products like Eloctate, which are priced similarly. These expenses are exacerbated by limited insurance coverage and inconsistencies in access to financial assistance programs, further burdening patients. Globally, these high treatment costs are stalling market growth, particularly in emerging economies with underdeveloped healthcare infrastructures. Regions such as Asia-Pacific and Africa face significant challenges in affording cutting-edge therapies like gene therapy and long-acting recombinant factors, resulting in unequal access to life-saving treatments. Even in developed markets, high out-of-pocket costs remain a barrier for patients, especially in private healthcare systems where insurance may not fully cover treatment expenses.

Opportunity: Advancements in Gene Editing Technologies

Advancements in gene editing technologies are reshaping the hemophilia treatment landscape by introducing innovative, long-term solutions that extend beyond traditional factor replacement therapies. Cutting-edge approaches like gene therapy and CRISPR-based gene editing directly address the genetic deficiencies underlying hemophilia, representing a paradigm shift in disease management. Gene therapy has emerged as a game-changer for both hemophilia A and B, enabling sustained endogenous production of clotting factors through a one-time vector injection. According to the European Association for Haemophilia and Allied Disorders (EAHAD), 11 clinical trials are currently in progress, involving over 300 patients (202 for hemophilia A and 135 for hemophilia B) as of June 2024. These therapies aim to elevate factor VIII or IX levels above 1% of normal, significantly reducing bleeding risks and eliminating the need for frequent infusions. The success of these trials is driving significant investments and accelerating market growth, reinforcing the transformative potential of gene therapy.

Recent FDA approvals further underscore this progress. In April 2024, fidanacogene elaparvovec became the second gene therapy approved for hemophilia B, following etranacogene dezaparvovec-drlb in 2022. These therapies, developed through collaborations between academic and biotech firms, such as Penn Medicine, highlight the rapid strides in commercialization and innovation within the hemophilia market. Further, BioMarin’s Roctavian, approved in Europe for hemophilia A, and fidanacogene elaparvovec exemplify how these therapies eliminate the burden of lifelong prophylactic treatments, dramatically enhancing patient quality of life and adherence. These innovations are not only transforming treatment options but are also driving adoption among healthcare providers and patients, fueling the global demand for advanced hemophilia therapies.

Segmental Analysis

Type Insights

The hemophilia treatment market is categorized by type into Hemophilia A, Hemophilia B, Hemophilia C, and Others, with Hemophilia A leading the market, accounting for 74% of the market share in 2024. This dominance is attributed to its higher prevalence, caused by a deficiency in factor VIII, and the continuous development of innovative treatments. Targeted therapies like emicizumab (Hemlibra) have significantly improved treatment outcomes, especially for patients with inhibitors, contributing to the growth of this segment. Hemophilia A's substantial market share is also bolstered by a large patient population and the demand for advanced therapeutic options, especially in regions with well-established healthcare systems, such as Japan.

Additionally, Hemophilia A leads the market, driven by its high prevalence and advancements in targeted therapies that improve outcomes and reduce treatment burdens, accelerating patient and provider adoption.

Meanwhile, Hemophilia B is caused by a deficiency in factor IX. Though less common, this segment is experiencing growing traction, driven by the introduction of new therapies that improve patient management and quality of life. This upward trend reflects the broader efforts in addressing unmet needs across the hemophilia spectrum. Further Hemophilia C, a rarer form caused by factor XI deficiency, holds a smaller market share due to its lower prevalence and limited availability of targeted treatment options.

Product Insights

Among all products of the hemophilia treatment market, the recombinant coagulation factor concentrates segment dominates the global hemophilia treatment market in 2024, holding almost half of the market share. This leadership is driven by the proven safety and efficacy of synthetic alternatives to plasma-derived products. Therapies such as Advate and Kogenate minimize the risk of blood-borne infections while providing effective, long-term management of bleeding episodes, making them the preferred choice for patients with hemophilia A and B. The segment has further gained traction from innovations like extended half-life products, which significantly reduce the frequency of infusions and enhance patient convenience.

However, the gene therapy segment is emerging as the fastest-growing category, with a remarkable CAGR of 13.9%. This growth is fueled by its potential to deliver long-term or even permanent solutions for hemophilia patients. These advancements not only reduce the burden of lifelong treatments but also cater to the growing demand for transformative, curative options. The rapid expansion of this segment underscores the potential of gene therapy to revolutionize hemophilia care, offering more effective and less intrusive solutions for patients worldwide.

Patient Insights

The pediatric patients segment led the hemophilia treatment market in 2023, capturing more than half of the market share, with the 14-18 age group representing the largest portion. This dominance is driven by the critical need for continuous treatment during key growth phases, as this age group experiences frequent bleeding episodes, necessitating consistent clotting factor infusions. Innovations in long-acting clotting factors and gene therapies have enhanced treatment outcomes by reducing infusion frequency and improving patient quality of life. Additionally, strong government support and advancements in healthcare infrastructure continue to drive demand for pediatric-focused therapies, such as emicizumab (Hemlibra), specifically designed for children.

Further, the adult patient segment is experiencing the fastest growth, with a projected CAGR of 6.89%. The rising number of aging hemophilia patients necessitates more specialized and long-term care due to complications such as joint damage. The adoption of advanced treatment options, including extended half-life clotting factors and gene therapies, is improving disease management, enhancing patient quality of life, and driving market expansion within the adult segment.

Treatment Insights

The global hemophilia treatment market is segmented into on-demand treatment, prophylactic treatment, and Immune Tolerance Induction (ITI) therapy, each playing a distinct role in disease management. On-demand treatment currently leads the market, valued at USD 6,358.8 million, primarily due to its critical role in managing acute bleeding episodes. This approach remains essential for patients with mild to moderate hemophilia, relying on clotting factors concentrate to control spontaneous or injury-related bleeds effectively.

Prophylactic treatment however is poised for the highest growth rate, driven by innovations in long-acting clotting factors and breakthrough therapies like emicizumab (Hemlibra). With reduced infusion frequency and enhanced patient outcomes, prophylaxis is becoming the preferred strategy for severe hemophilia cases. The increasing adoption of proactive treatment approaches and continuous advancements in therapy options are expected to propel this segment’s expansion in the coming years.

Route of Administration Insights

Based on route of administration, the hemophilia market is divided into intravenous administration and subcutaneous administration. In 2024, intravenous (IV) administration dominates the hemophilia treatment market with a 74.89% share, driven by its effectiveness in delivering clotting factors concentrates like Adynovate and Kogenate. IV infusion remains the standard for both acute and prophylactic treatment, ensuring rapid absorption. However, venous access challenges persist, especially for pediatric and elderly patients.

Meanwhile, subcutaneous administration holds a 25.11% share and is the fastest-growing segment, fueled by the adoption of non-factor therapies like Hemlibra. Offering a less invasive, self-administered option with flexible dosing, subcutaneous treatments improve patient adherence and convenience, particularly for those with inhibitors.

End User Insights

In the hemophilia treatment market, hospitals represent the leading end-user segment, with a market value of USD 6,529.8 million in 2024. Their dominance is attributed to their ability to handle severe and emergency cases, supported by advanced medical infrastructure, specialized diagnostic tools, and access to surgical and critical care services. Hospitals play a vital role in administering complex therapies like gene therapy and factor replacement treatments, while also serving as primary centers for clinical trials focused on innovative hemophilia treatments. Hospitals remain the preferred choice for patients requiring multidisciplinary care, as they provide access to hematologists, specialized nursing staff, and comprehensive treatment facilities in a single setting.

Additionally, this segment is expected to witness the highest CAGR, fueled by the increasing adoption of advanced treatment options such as extended half-life clotting factors and gene therapies. Growing investments in healthcare infrastructure, coupled with rising awareness of hemophilia management, are further strengthening the hospital segment’s market position and accelerating its expansion.

Distribution Channel Insights

In 2024, hospital pharmacies dominate the hemophilia treatment market offering specialized therapies like gene treatments and extended half-life clotting factors under expert supervision. Their role in emergency care and personalized treatment sustains their market leadership.

The online pharmacy segment is experiencing rapid growth, fueled by the increasing adoption of digital health platforms, telemedicine services, and the growing demand for convenience in healthcare access. Patients now can order medications from the comfort of their homes, reducing the need for in-person visits and making healthcare more accessible. Companies like Walgreens are at the forefront of this trend, offering streamlined online pharmacy services that include home delivery, automatic refills, and telehealth consultations. This digital shift is enhancing patient experience and driving market expansion in the online pharmacy space.

To Understand More About this Research: Request A Free Sample

Regional Insights

Among all the regions, North America leads the hemophilia treatment market, accounting for approximately 44% of the share, driven by its advanced healthcare infrastructure, high R&D investments, and widespread access to cutting-edge therapies like gene treatments and extended half-life clotting factors. The presence of major players such as Pfizer, BioMarin, and Takeda, along with strong insurance coverage and patient awareness, reinforces its dominance. Europe follows with a 30.15% market share, supported by well-developed healthcare systems, government-backed initiatives, and early adoption of innovative treatments. Leading countries like Germany, the UK, and France benefit from strong R&D efforts and advocacy from organizations like the European Hemophilia Consortium, though disparities exist between Western and Eastern Europe.

Meanwhile, the Asia-Pacific region is experiencing the fastest growth, driven by a rising hemophilia prevalence, expanding healthcare investments, and government initiatives such as Japan’s Revitalization Strategy. Key markets like Japan, China, and India are increasingly adopting advanced therapies, with growing awareness and improved access in both urban and rural areas fueling future market expansion.

Recent Developments

- In October 2024, Pfizer Inc. announced that the U.S. FDA has approved HYMPAVZI (marstacimab-hncq) for routine prophylaxis to prevent or reduce bleeding episodes in adults and pediatric patients 12 years and older with hemophilia A or B without inhibitors. HYMPAVZI is the first anti-TFPI treatment approved in the U.S. for hemophilia A or B and is the first hemophilia drug to be administered via a pre-filled auto-injector pen, offering a convenient once-weekly subcutaneous dosing schedule with minimal preparation.

- In June 2023, CSL Behring has announced that the first patient in the U.S. has received FDA-approved HEMGENIX (etranacogene dezaparvovec-drlb; gene therapy) for hemophilia B treatment. Clinical trials demonstrated that 94% of patients (51 out of 54) experienced a reduction or elimination of the need for prophylactic treatment, marking a significant shift from traditional therapies and potentially transforming the treatment landscape for hemophilia B patients.

- In April 2024, Pfizer Inc. received FDA approval for BEQVEZ (fidanacogene elaparvovec-dzkt) as a treatment for adults with moderate to severe hemophilia B. The approval covers patients currently on factor IX (FIX) prophylaxis therapy and those with a history of life-threatening bleeding episodes.

- In December 2024, Novo Nordisk received FDA approval for Alhemo (concizumab-mtci), a once-daily subcutaneous prophylactic treatment for hemophilia A or B with inhibitors in patients aged 12 and older. As the first subcutaneous therapy for this condition, Alhemo offers a more convenient alternative to traditional IV infusions. Delivered via a prefilled, premixed pen with a thin 32-gauge needle, it reinforces Novo Nordisk’s longstanding commitment to rare bleeding disorders.

Key Players in Haemophilia Treatment Market

- Bayer AG

- Biogen Inc.

- BioMarin Pharmaceutical Inc

- Takeda Pharmaceuticals

- CSL Behring LLC

- F. Hoffmann-La Roche AG

- Ferring B.V.

- Genentech, Inc. (Roche Holding AG)

- Grifols, S.A

- Kedrion S.p.A

- Medexus Pharmaceuticals Inc.

- Novo Nordisk A/S

- Octapharma AG

- Pfizer Inc.

- Sanofi SA

- Swedish Orphan Biovitrum AB

- Takeda Pharmaceuticals

- Other Prominent Players

Segments Covered in The Report

By Type

- Hemophilia A

- Hemophilia B

- Hemophilia C

- Others

By Product

- Recombinant coagulation factor concentrates

- Plasma-derived coagulation factor concentrates

- Desmopressin

- Antifibrinolytic agents

- Gene therapy products

- Others

By Patient

- Pediatric

- 0 to 4 yrs

- 5 to 13 yrs

- 14 to18 yrs

- Adult

- 19 to 44 yrs

- 45+ yrs

By Treatment Type

- On-Demand Treatment

- Prophylactic Treatment

- Immune Tolerance Induction (ITI) Therapy

By Route of Administration

- Intravenous

- Subcutaneous

By End user

- Hospitals

- Specialty Clinics

- Home Care Settings

- Hemophilia Treatment Centers (HTCs)

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

By Region

- North America

- The USA

- Canada

- Mexico

- Europe

- Western Europe

- The UK

- Germany

- France

- Italy

- Spain

- Rest of Western Europe

- Eastern Europe

- Poland

- Russia

- Rest of Eastern Europe

- Western Europe

- Asia Pacific

- China

- India

- Japan

- Australia & New Zealand

- South Korea

- ASEAN

- Cambodia

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of MEA

- South America

- Argentina

- Brazil

- Rest of South America

View Full Infographic

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

| Report ID: AA01251135 | Delivery: Immediate Access

| Report ID: AA01251135 | Delivery: Immediate Access

.svg)