Japan Gaming Peripherals Market: By Input Devices (Controllers, Keyboards, Mice, Gamepads, Joystick, Touchpads, Others), Output Devices (Monitors, Speakers, Headsets/Headphones, Gaming Glasses, Others); Connectivity (Wired Peripherals and Wireless Peripherals (Bluetooth, Radio Frequency, Others)); Gaming Platform (PC (Desktop/Laptop), Video Game Console, Smartphone); End Users (Individuals and Gaming Centers and Arcades); Distriubution Channel (Online (E-Marketplace, Brand Websites), Offline (Hypermarket/Supermarket and Specialty Stores)—Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2025–2033

- Last Updated: Feb-2025 | Format:

![pdf]()

![powerpoint]()

![excel]() | Report ID: AA02251210 | Delivery: Immediate Access

| Report ID: AA02251210 | Delivery: Immediate Access

Market Scenario

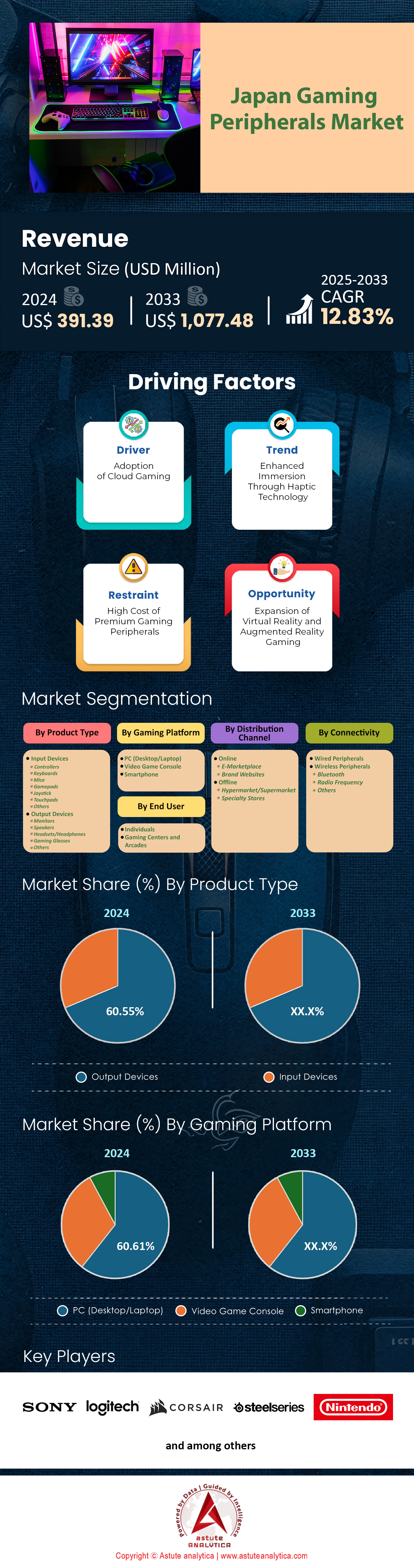

Japan gaming peripherals market was valued at US$ 391.39 million in 2024 and is projected to hit the market valuation of US$ 1,077.48 million by 2033 at a CAGR of 12.83% during the forecast period 2025–2033.

The demand for gaming peripherals in Japan is well-established and continues to thrive in 2024, propelled by technological innovations, cultural factors, and the escalating popularity of esports and streaming. Given Japan’s robust gaming culture and high standard of living, consumers exhibit a strong preference for top-quality, cutting-edge products that enhance their gaming experiences. The country’s gaming peripherals market is underscoring a sizable appetite for accessories like keyboards, headsets, controllers, and mice. Furthermore, the surge of professional gaming and the widespread adoption of consoles equipped with built-in USB interfaces have expanded the need for specialized peripherals. An additional driver for this growing demand is the emergence of advanced PCs featuring high-quality graphics and gesture-based gaming capabilities, as gamers strive to optimize their play with the finest equipment on the market.

The impact of esports and streaming on Japan’s gaming peripheral demand is profound, with the esports market itself having grown dramatically from US$ 139 million in 2024 to US$ 390 million in 2033. This surge reflects the broader trend of competitive gamers requiring high-performance peripherals to maintain a competitive edge in tournaments. Indeed, gaming keyboards command a significant portion of this market, accounting for roughly 40% of the total share, illustrating the importance of precision and customization in modern gameplay. At the same time, the prominence of streaming platforms has broadened peripheral demand beyond traditional devices: contemporary content creators need advanced microphones, webcams, and other specialized equipment, while the meteoric rise of VTubing—using digital avatars—has introduced additional niche requirements. Another notable trend is the growing preference for wireless gaming peripherals, fueled by the convenience and freedom of movement they offer. Furthermore, mobile gaming accessories have become increasingly popular, with Japanese players typically investing an average of 6.7 hours per week in mobile games. Meanwhile, the nation’s aging population, with approximately 29% of citizens over 65, highlights the necessity for ergonomic designs and user-friendly features in peripheral manufacturing.

Looking ahead, manufacturers in the Japan gaming peripherals market are expected to produce even more specialized peripherals that cater to the unique demands of esports athletes, casual gamers, and content creators alike. Coupled with Japan’s reputation for technological innovation, the future of gaming peripherals remains bright, with ongoing developments in game streaming, virtual reality, and mixed reality poised to elevate the market further by the end of 2024.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Rising popularity of esports and competitive gaming fuels demand for high-performance gaming peripherals

The esports industry in Japan has experienced exponential growth. This remarkable expansion has significantly impacted the country's gaming peripherals market, as competitive gamers increasingly seek top-tier equipment to gain a decisive edge in tournaments. The escalating demand for specialized peripherals has prompted ongoing innovation, including the development of mechanical keyboards with customizable switches and mice featuring adjustable weights. In 2024, Japan hosted 274 major esports tournaments, drawing over 1.2 million attendees and fueling remarkable interest in professional-grade gaming accessories. Further amplifying this momentum, escalating prize pools—topped by a $500,000 prize at one of Japan’s largest competitions in 2024—have incentivized both casual and professional gamers to invest in high-performance peripherals that can deliver superior speed, accuracy, and overall gameplay.

Streaming platforms have also driven heightened demand for gaming peripherals market, as content creators require premium-quality gear to engage audiences effectively. In 2024, Japan reported 15 million active streamers, each averaging 6.7 hours of streaming per week, creating a robust market for specialized streaming devices such as high-fidelity microphones and webcams. An additional driver of growth is the burgeoning VTubing scene—unique virtual-avatar-based streaming—with 8,000 active VTubers nationwide in 2024. These digital entertainers often need specialized motion-capture and audio equipment, significantly expanding peripheral demand. The proliferation of gaming cafés and dedicated esports training centers, now numbering 450 establishments throughout Japan, has led to large-scale purchases of high-end gaming devices. Collectively, these factors have firmly cemented esports and competitive gaming as pivotal drivers of Japan’s gaming peripherals market.

Trend: Integration of advanced technologies in gaming peripherals enhances user experience and performance

The integration of advanced technologies in gaming peripherals has evolved into a key trend within the Japanese gaming peripherals market, as manufacturers continuously push the envelope to deliver superior performance and a more immersive experience. Among the most notable innovations is the incorporation of high-precision optical sensors in gaming mice, with top models now offering an impressive range of up to 32,000 DPI for exceptional accuracy. This degree of precision is fundamental for competitive gaming scenarios where split-second decisions determine match outcomes. Similarly, the rise of customizable RGB lighting—providing up to 16.8 million color options—has redefined personalization standards, empowering gamers to adapt their setups to both practical and aesthetic preferences.

Additional technological milestones include the integration of haptic feedback systems in high-end gaming controllers, featuring motors capable of delivering up to 1,000 distinct vibration patterns, thereby generating a more nuanced and realistic tactile experience. This immersive feedback is particularly popular in simulation games, where authenticity is paramount. Meanwhile, low-latency wireless technologies in the Japan gaming peripherals market have revolutionized the landscape by enabling wireless mice and keyboards to achieve 1ms response times, negating the performance disparities that once favored wired devices. Consequently, wireless peripherals have soared in demand, accounting for 60% of all gaming peripheral sales in Japan in 2024. Another essential breakthrough is the adoption of AI-driven audio software, which enables gaming headsets to process and enhance audio in real-time, producing capabilities such as 3D sound positioning with up to 360-degree accuracy. All these innovations collectively underscore a steadfast commitment to elevating user experience and performance, effectively shaping the future of Japan’s gaming peripherals market.

Challenge: Market saturation and increased competition among manufacturers drive innovation and price wars

Japan’s gaming peripherals market has become highly saturated, with a growing number of brands vigorously competing for consumer attention. Throughout 2024, this intensified environment saw the entry of 15 new gaming peripheral brands, bringing the total active manufacturers to over 50, which has splintered the market and heightened the quest for differentiation. As a result, even the top five brands collectively command just 45% of the market, leaving plenty of space for emerging players to carve out their own followings. Such fierce competition encourages companies to release product lines at a rapid clip, pushing them to enhance feature sets and experiment with pricing models that can attract and retain loyal customers.

In an effort to stay relevant, manufacturers are now releasing an average of eight new product models per year, narrowing the lifecycle of each peripheral to as little as 18 months before it risks obsolescence. Heavy investments in research and development—totaling $150 million across the gaming peripherals market in 2024—have yielded noteworthy advancements, including modular designs that let users tailor peripherals to their needs and biometric sensors that monitor vital signs during extended gameplay. However, these ambitious R&D efforts and increased competition have also ignited price wars, driving the cost of mid-range gaming peripherals to drop by around 20% in the last two years. While these lower prices benefit consumers, they also compress profit margins, compelling manufacturers to optimize production processes and search for more efficient strategies. Ultimately, this relentless competition fosters swift innovation but also introduces financial pressures that force companies to adapt swiftly to capture and maintain market share in Japan’s dynamic gaming peripherals landscape.

Segmental Analysis

By Product Type

Output devices, such as monitors, speakers, and headsets, dominate the Japan gaming peripherals market, accounting for over 60% of the market share. This dominance is driven by the increasing demand for immersive gaming experiences, which rely heavily on high-quality visual and auditory output. Monitors with high refresh rates, such as 240Hz, and low response times, often below 1ms, are particularly popular among gamers seeking competitive advantages. Headsets with surround sound capabilities and noise cancellation are also in high demand, as they enhance the auditory experience, crucial for games that rely on sound cues. The average price of a high-end gaming monitor in Japan is around $500, while premium gaming headsets can cost upwards of $300, reflecting the willingness of consumers to invest in quality output devices.

The popularity of output devices in the Japan gaming peripherals market is further fueled by the rise of esports and streaming culture in Japan. Esports tournaments often require high-performance monitors and headsets to ensure fair competition and optimal performance. Streamers, who are a growing segment in Japan, also invest heavily in output devices to provide high-quality content to their viewers. The average lifespan of a gaming monitor is around 5 years, while headsets typically last for 3 years, indicating a steady replacement cycle that sustains market demand. Additionally, the integration of advanced technologies like OLED and HDR in monitors, and 7.1 surround sound in headsets, has further driven the adoption of these devices. The average annual growth rate for output devices in Japan is projected to be around 8%, reflecting sustained consumer interest and technological advancements.

By Connectivity

Wired peripherals, including keyboards, mouse, and controllers, hold a dominant position in the Japan gaming peripherals market, with over 60.59% market share. This dominance is primarily driven by the reliability and lower latency offered by wired connections, which are crucial for competitive gaming. Wired keyboards and mice often have response times as low as 0.001ms, compared to wireless devices that can experience delays of up to 10ms. This makes wired peripherals the preferred choice for professional gamers and esports enthusiasts who cannot afford any lag during gameplay. The average price of a wired gaming keyboard in Japan is around $150, while a wired gaming mouse typically costs $100, reflecting the premium placed on performance.

Another factor driving the popularity of wired peripherals in the Japan gaming peripherals market is their durability and lower maintenance requirements. Wired devices do not require batteries, which eliminates the need for frequent charging or replacement, a common issue with wireless peripherals. The average lifespan of a wired gaming keyboard is around 7 years, compared to 4 years for a wireless one, making wired devices a more cost-effective long-term investment. Additionally, wired peripherals are often more affordable upfront, with entry-level wired gaming mice available for as low as $50, compared to $80 for their wireless counterparts. The average annual growth rate for wired peripherals in Japan is projected to be around 7.5%, indicating continued consumer preference for these devices despite the growing popularity of wireless alternatives.

By Gaming Platform

PC gaming is the most prominent gaming platform in Japan, capturing over 60% of the market share. This dominance is driven by the versatility and customization options that PCs offer, allowing gamers in the gaming peripherals market to upgrade hardware components like GPUs, CPUs, and RAM to enhance performance. The average cost of a high-end gaming PC in Japan is around $2,000, with GPUs alone costing upwards of $800. This investment is justified by the superior performance PCs offer, with frame rates often exceeding 144fps in modern games, compared to the 60fps cap on many consoles. The ability to run games at higher resolutions, such as 4K, and support for advanced features like ray tracing, further solidifies the PC's position as the preferred gaming platform.

The demand for PC gaming in Japan gaming peripherals market is also fueled by the growing popularity of esports and multiplayer online games, which are often optimized for PC. Games like "League of Legends" and "Counter-Strike: Global Offensive" have large player bases in Japan, driving the need for high-performance PCs. Key gaming peripherals used in PC gaming include mechanical keyboards, gaming mice, and monitors with high refresh rates. The average price of a mechanical gaming keyboard in Japan is around $200, while a high-performance gaming mouse costs approximately $150. The average annual growth rate for PC gaming in Japan is projected to be around 9%, reflecting the sustained demand for high-performance gaming hardware and peripherals.

By End Users

Gaming centers and arcades consume over 66% of the gaming peripherals market in Japan, driven by the country's rich arcade culture and the social aspect of gaming. These venues often feature high-end gaming setups, including custom-built PCs, high-refresh-rate monitors, and specialized controllers, to attract customers. The average cost of setting up a single gaming station in a Japanese arcade is around $3,000, with peripherals accounting for a significant portion of this cost. Gaming centers also invest in durable peripherals designed for heavy use, with keyboards and mice often rated for over 50 million keystrokes and clicks, respectively. This ensures longevity and reduces maintenance costs, making them a cost-effective choice for businesses.

The dominance of gaming centers and arcades in the Japan gaming peripherals market is further reinforced by the social experience they offer, which is highly valued in Japanese culture. Unlike individual gaming setups, arcades provide a communal space where players can compete and interact with others, enhancing the overall gaming experience. The average footfall in a popular gaming center in Japan is around 500 visitors per day, with peak hours seeing up to 200 concurrent users. This high usage rate drives the demand for robust and high-performance peripherals, such as joysticks and racing wheels, which are often used in arcade games. The average annual growth rate for gaming centers and arcades in Japan is projected to be around 6.5%, reflecting the continued popularity of these venues and their significant contribution to the market.

Top Players in the Japan Gaming Peripherals Market

- Logitech International S.A.

- Razer Inc.

- Corsair Gaming

- SteelSeries

- HyperX

- Microsoft

- Cooler Master

- Nintendo

- Sony Corporation

- 8BitDo

- BenQ

- Hori

- Thrustmaster

- CH Products

- Other Prominent Players

Market Segmentation Overview:

By Product Type

- Input Devices

- Controllers

- Keyboards

- Mice

- Gamepads

- Joystick

- Touchpads

- Others

- Output Devices

- Monitors

- Speakers

- Headsets/Headphones

- Gaming Glasses

- Others

By Connectivity

- Wired Peripherals

- Wireless Peripherals

- Bluetooth

- Radio Frequency

- Others

By Gaming Platform

- PC (Desktop/Laptop)

- Video Game Console

- Smartphone

By End User

- Individuals

- Gaming Centers and Arcades

By Distribution Channel

- Online

- E-Marketplace

- Brand Websites

- Offline

- Hypermarket/Supermarket

- Specialty Stores

View Full Infographic

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

| Report ID: AA02251210 | Delivery: Immediate Access

| Report ID: AA02251210 | Delivery: Immediate Access

.svg)