Gaming Peripheral Market: Devices (Input Device (Controller, Gamepads, Gaming Mice, Headsets, Joysticks, Keyboards, Steering Wheel, Web Camera, Others), Output Devices (AR/VR Headsets, Gaming Headsets, Head-mounted Display, Printer, Speakers, TFT and CRT Monitor, Others (Graphics Card, Digital Camera etc.)); Platform (Gaming Consoles, PC, (Desktop/Laptop)); Connectivity (Wired, Wireless (Bluetooth, Wi-Fi, Others); Distribution Channel (Online and Offline); End Users (Individual, Enterprises, Commercial (Game Parlors, Theme Parks/ Amusement Centers); Region—Industry Dynamics, Market Size, And Opportunity Forecast For 2025–2033

- Last Updated: Feb-2025 | | Report ID: AA0122130 | Delivery: 2 to 4 Hours

Market Scenario

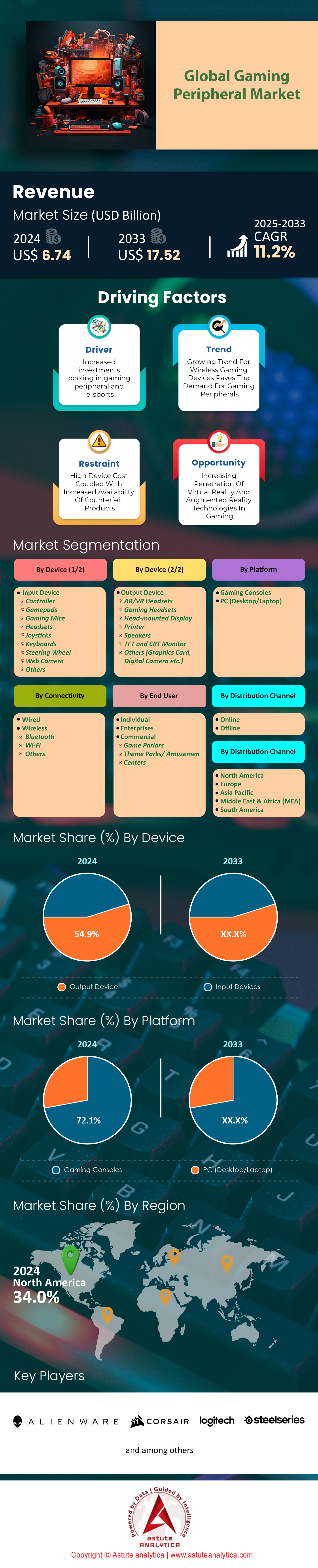

Gaming peripheral market was valued at US$ 6.74 billion in 2024 and is expected to see a revenue opportunity worth US$ 17.52 billion by 2033 at a CAGR of 11.2% from 2025-2033.

The gaming peripheral market is experiencing explosive growth, driven by the surging popularity of esports and the increasing integration of advanced technologies. This dynamic landscape is characterized by a diverse consumer base, ranging from professional gamers to casual enthusiasts, all seeking to enhance their gaming experience through cutting-edge peripherals. The market's expansion is fueled by the rise of competitive gaming, with major tournaments like The International Dota 2 Championship offering prize pools exceeding $40 million, attracting both players and viewers alike. This surge in competitive gaming has led to a demand for high-performance peripherals that offer precision, speed, and customization.

Key end users of gaming peripherals include professional esports athletes, content creators, and a growing number of casual gamers. The consumer base has expanded significantly, with the global gaming population reaching 3.2 billion players in 2024. This diverse user group is driving demand for a wide range of peripherals, from high-end mechanical keyboards and ultra-precise gaming mice to immersive VR headsets and customizable controllers. The market is also seeing a shift towards wireless technology, with advancements addressing previous concerns about latency and reliability. For instance, Logitech's LIGHTSPEED wireless technology now offers a 1ms report rate, rivaling wired peripherals in performance.

Recent developments in the gaming peripheral market include the integration of AI and machine learning capabilities, enhancing user experience through adaptive gameplay and personalized settings. Companies like Razer have introduced mice with AI-powered sensors that can predict and adapt to user movements, improving accuracy in fast-paced games. The market is also witnessing a trend towards sustainability, with manufacturers like Corsair launching peripherals made from recycled materials. Virtual reality is gaining traction, with VR headset shipments reaching 6.4 million units in 2023, indicating growing interest in immersive gaming experiences. Geographically, the demand is primarily driven by regions with strong gaming cultures, such as North America, Europe, and Asia-Pacific, with China alone boasting over 720 million gamers. These trends highlight the market's dynamic nature and its potential for continued innovation and growth.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Esports Explosion Fuels Demand for High-Performance Gaming Peripherals

The explosive growth of esports has become a primary driver in the gaming peripheral market, revolutionizing the industry and creating unprecedented demand for high-performance equipment. The global esports audience has skyrocketed, with viewership reaching 532 million in 2023, creating a massive market for specialized gaming gear. This surge in popularity has led to substantial investments in the sector, with esports organizations like Team Liquid securing partnerships worth over $25 million. The demand for top-tier peripherals is further amplified by the increasing prize pools in major tournaments, such as the Fortnite World Cup, which offered a staggering $30 million in 2023.

As competitive gaming continues to gain mainstream recognition, professional players and aspiring amateurs alike are seeking peripherals that can provide a competitive edge. This has led to a boom in the development of ultra-responsive gaming mice, low-latency mechanical keyboards, and high-fidelity headsets. For instance, the Razer Viper 8K Hz mouse, with its 8000Hz polling rate, exemplifies the push for millisecond-level precision in competitive gaming. The influence of esports has also extended to casual gamers, who are increasingly adopting professional-grade peripherals to emulate their favorite players, further driving market growth and innovation in the gaming peripheral sector.

Trend: Wireless Revolution: The Shift Towards Cord-Free Gaming Experiences

The gaming peripheral market is witnessing a significant trend towards wireless technology, as manufacturers overcome previous limitations to deliver cord-free experiences without compromising performance. This shift is driven by advancements in wireless protocols and battery technology, allowing for low-latency connections and extended playtime. Logitech's LIGHTSPEED wireless technology, for example, boasts a 1ms report rate, matching the responsiveness of wired peripherals. This breakthrough has led to a surge in demand for wireless gaming mice, keyboards, and headsets, with global shipments of wireless gaming peripherals exceeding 100 million units in 2023.

The appeal of wireless peripherals extends beyond just convenience, offering gamers greater freedom of movement and cleaner setups in the gaming peripheral market. High-profile esports tournaments, such as the League of Legends World Championship, have begun to feature wireless peripherals, further legitimizing their use in competitive settings. This trend is also fueled by improvements in battery life, with devices like the SteelSeries Arctis Nova Pro Wireless headset offering over 40 hours of continuous use. The integration of fast-charging technologies has further enhanced the appeal of wireless peripherals, with some mice capable of providing hours of gameplay from just a few minutes of charging. As wireless technology continues to evolve, it's reshaping the gaming peripheral landscape, offering users the perfect blend of performance and convenience.

Challenge: Cross-Platform Compatibility: Navigating the Fragmented Gaming Ecosystem

With the proliferation of gaming platforms, including PCs, consoles, mobile devices, and cloud gaming services, peripheral manufacturers are tasked with creating products that seamlessly work across multiple systems. This challenge in the gaming peripheral market is compounded by the fact that each platform may have its own unique interface standards and connectivity requirements. For instance, the PlayStation 5 DualSense controller, with its advanced haptic feedback, is designed specifically for the PS5 console, limiting its functionality on other platforms.

The complexity of cross-platform compatibility is further illustrated by the diverse range of connection types used across different devices. While USB-C is becoming more prevalent, many gaming peripherals still rely on USB-A, Bluetooth, or proprietary wireless technologies. This diversity can lead to confusion among consumers and potentially limit the gaming peripheral market reach of certain products. To address this challenge, some manufacturers are developing multi-platform peripherals, such as the Astro A50 wireless headset, which is compatible with both PC and console gaming. However, achieving full functionality across all platforms remains a significant hurdle. The rise of cloud gamingwhich attracted over 2 million users before its closure, has added another layer of complexity to the compatibility issue, requiring peripherals to adapt to new streaming technologies and input methods. As the gaming industry continues to evolve, solving the cross-platform compatibility challenge will be crucial for peripheral manufacturers to maintain relevance and appeal to a broad user base.

Segmental Analysis

By End Users

Individual consumers have emerged as the largest buyers in gaming peripheral market, accounting for over 51.2% of the market share. This dominance is reflected in the substantial global sales units, with individual consumers purchasing approximately 150 million gaming peripheral units annually. The driving force behind this dominance is multifaceted, stemming from the explosive growth of the gaming industry and the increasing accessibility of gaming platforms. The global gaming population has surged to 3 billion enthusiasts, creating a vast consumer base for gaming peripherals. On average, individual gamers spend $200 annually on gaming peripherals, contributing to the segment's robust sales figures.

The rise of esports and competitive gaming has further fueled the demand for high-performance peripherals among individual consumers. With 234 million esports enthusiasts worldwide, there's a growing need for specialized equipment that offers precision and comfort. The streaming phenomenon in the gaming peripheral market

has also played a significant role, with 8.3 million active streamers on Twitch alone, driving sales of high-quality audio and video peripherals. Additionally, the increasing disposable income in developed regions has enabled more individuals to invest in premium gaming peripherals, with the average age of gamers being 34 years old. The market has seen a 5% year-on-year growth rate in sales units, with mice accounting for 30% of individual consumer sales, translating to approximately 45 million units sold annually. This growth is further supported by the availability of a wide range of products at various price points, making gaming peripherals accessible to a broader audience and solidifying individual consumers' dominance in the market.

By Device

Output devices have established themselves as the largest segment of the gaming peripheral market, controlling over 55% of the market share. This dominance is primarily due to the critical role these devices play in delivering immersive gaming experiences. The output device category, which includes monitors, speakers, and VR headsets, has seen remarkable growth, with annual sales reaching 60 million units globally. The demand for high-resolution monitors has been particularly strong, with 70% of gamers preferring displays with refresh rates above 120Hz, driving the sales of advanced gaming monitors.

The growth of output devices is fueled by continuous technological advancements and the increasing demand for high-quality visual and audio experiences. For instance, the adoption of 4K and OLED display technologies has revolutionized gaming visuals, with 4K gaming monitor sales increasing by 400% in the past three years. The average price of gaming monitors stands at $300, reflecting the willingness of consumers to invest in superior display technology. Virtual Reality (VR) headsets have also seen a surge in popularity, with a 10% annual increase in adoption rates, as more gamers seek immersive experiences. High-fidelity audio systems, including surround sound speakers and noise-canceling headsets, have become essential for competitive gaming, with 85% of professional gamers using specialized audio equipment. The integration of AI and machine learning in audio devices, allowing for adaptive sound settings, has further enhanced their appeal. These factors, combined with the growing trend of creating dedicated gaming spaces in homes, have solidified the position of output devices as the dominant segment in the gaming peripheral market.

By Platform

Gaming consoles have maintained a commanding position in the gaming peripheral market, holding over 72.1% of the market share. This dominance is reflected in the impressive annual sales figures, with approximately 50 million gaming consoles sold worldwide each year. The most prominent gaming consoles, namely Sony's PlayStation, Microsoft's Xbox, and Nintendo's Switch, continue to drive the market forward. PlayStation leads the pack with 40% of console sales, translating to about 20 million units annually. Xbox follows with 23% market share, while Nintendo captures 27%, each selling millions of units per year.

The demand for gaming consoles is driven by several factors, including the continuous innovation in hardware capabilities and the availability of exclusive game titles. The latest generation consoles, such as the PlayStation 5 and Xbox Series X, have sold over 10 million units each within their first year of release. These consoles offer advanced features like ray tracing and 4K resolution gaming, appealing to consumers seeking cutting-edge gaming experiences. The average price of a gaming console is $400, indicating consumers' willingness to invest in high-quality gaming hardware. Online gaming services have also played a crucial role in driving console sales, with over 100 million active subscribers across various platforms. The primary consumer age group for consoles is 15-30 years, representing a significant portion of the gaming market. Additionally, the versatility of modern consoles, which often serve as entertainment hubs for streaming and media consumption, has broadened their appeal. With the console market growing at an annual rate of 8%, and the increasing integration of virtual reality and cloud gaming technologies, gaming consoles are poised to maintain their dominant position in the gaming peripheral market for the foreseeable future.

By Connectivity

Despite the rapid advancements in wireless technology, wired gaming peripherals continue to hold a dominant position in the market, capturing over 62.7% of the market share. This prevalence is evidenced by the annual sales of 70 million wired peripheral units globally. The enduring popularity of wired devices is primarily driven by their superior performance characteristics, which are crucial for both casual and competitive gamers. Wired peripherals, particularly mice and keyboards, offer unparalleled precision and responsiveness due to their direct connection, eliminating latency issues that can be critical in high-stakes gaming scenarios.

The dominance of wired peripherals is further reinforced by their reliability and lack of dependency on batteries, which is a significant advantage during extended gaming sessions. On average, wired gaming mice in the gaming peripheral market have a response time of 1ms compared to 8-16ms for wireless alternatives, a difference that can be crucial in competitive gaming. The affordability of wired peripherals also contributes to their widespread adoption, with the average price of a wired gaming mouse being $50, compared to $80 for wireless options. Among wired peripherals, keyboards are particularly popular, with mechanical keyboards accounting for 65% of all gaming keyboard sales, translating to approximately 20 million units annually. The durability of wired peripherals is another factor, with high-end wired mice often rated for over 50 million clicks, significantly outlasting their wireless counterparts. Additionally, the absence of interference issues that can plague wireless devices in crowded gaming environments, such as esports tournaments with thousands of devices in close proximity, further cements the position of wired peripherals as the preferred choice for serious gamers.

To Understand More About this Research: Request A Free Sample

Regional Analysis

North America has established itself as the largest gaming peripheral market, controlling over 34% of the global market share. This dominance is underpinned by the region's robust gaming culture, high disposable income, and early adoption of new technologies. The annual sales of gaming consoles in North America alone reach an impressive 30 million units, highlighting the region's significant contribution to the global gaming industry. The United States plays a pivotal role in this dominance, contributing over 80% of North America's market share, which translates to approximately 24 million console units sold annually in the country.

The United States' outsized influence in the gaming peripheral market can be attributed to several factors. Firstly, the country boasts a large and diverse gaming population, with 214 million active gamers, representing 65% of the adult population. This vast consumer base drives demand across all segments of gaming peripherals. Secondly, the U.S. is home to major gaming companies and developers, fostering a competitive environment that encourages innovation in gaming hardware. The average American gamer spends $250 annually on gaming peripherals, significantly higher than the global average. The country's strong economy and high disposable income levels enable consumers to invest in premium gaming equipment, with high-end gaming PCs and peripherals seeing a 15% year-over-year growth in sales. Additionally, the U.S. esports market, valued at $1.1 billion, drives demand for professional-grade peripherals among both competitive players and aspiring amateurs. The presence of 30,000 gaming centers and internet cafes across the country further contributes to the widespread adoption of gaming peripherals. Moreover, the U.S. benefits from a well-established retail and distribution network, with 65% of gaming peripheral sales occurring through online channels, ensuring easy accessibility for consumers. This combination of factors – a large gaming population, high consumer spending, a thriving esports scene, and efficient distribution channels – solidifies the United States' position as the driving force behind North America's leadership in the global gaming peripheral market.

Top Companies in the Gaming Peripheral Market:

- Alienware

- Anker Innovations Limited

- Cooler Master Technology, Inc.

- Corsair Components, Inc.

- Eastern Times Technology Co., Ltd. (Redragon)

- Gamdias

- Guillemot Corporation S.A

- HyperX

- Kingston Technology Company, Inc.

- Logitech International S.A

- Mad Catz

- Razer, Inc.

- GIGA-BYTE Technology Co., Ltd.

- Sades

- Sennheiser Electronic GmbH & Co. KG

- Sharkoon Technologies

- Shenzhen Rapoo Technology Co., Ltd.

- Sony Corporation

- SteelSeries

- Thermaltake Technology Co., Ltd.

- Turtle Beach Corporation

- Other Prominent Players

Segmental Overview

By Device

- Input Device

- Controller

- Gamepads

- Gaming Mice

- Headsets

- Joysticks

- Keyboards

- Steering Wheel

- Web Camera

- Others

- Output Device

- AR/VR Headsets

- Gaming Headsets

- Head-mounted Display

- Printer

- Speakers

- TFT and CRT Monitor

- Others (Graphics Card, Digital Camera, etc.)

- By Platform

- Gaming Consoles

- PC (Desktop/Laptop)

By Platform

- Gaming Consoles

- PC (Desktop/Laptop)

By Connectivity

- Wired

- Wireless

- Bluetooth

- Wi-Fi

- Others

By Distribution Channel

- Offline

- Online

By End-User

- Individual

- Enterprises

- Commercial

- Game Parlors

- Theme Parks/ Amusement Centers

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- Western Europe

- The UK

- Germany

- France

- Italy

- Spain

- Rest of Western Europe

- Eastern Europe

- Poland

- Russia

- Rest of Eastern Europe

- Western Europe

- Asia Pacific

- China

- India

- Japan

- Australia & New Zealand

- South Korea

- ASEAN

- Rest of Asia Pacific

- Middle East & Africa (MEA)

- UAE

- Saudi Arabia

- South Africa

- Rest of MEA

- South America

- Brazil

- Argentina

- Rest of South America

REPORT SCOPE

| Report Attribute | Details |

|---|---|

| Market Size Value in 2024 | US$ 6.74 Bn |

| Expected Revenue in 2033 | US$ 17.52 Bn |

| Historic Data | 2020-2023 |

| Base Year | 2024 |

| Forecast Period | 2025-2033 |

| Unit | Value (USD Bn) |

| CAGR | 11.2% |

| Segments covered | By Device, By Platform, By Connectivity, By Distribution Channel, By End-User, By Region |

| Key Companies | Alienware, Anker Innovations Limited, Cooler Master Technology, Inc., Corsair Components, Inc., Eastern Times Technology Co., Ltd. (Redragon), Gamdias, Guillemot Corporation S.A, HyperX, Kingston Technology Company, Inc., Logitech International S.A, Mad Catz, Razer, Inc., GIGA-BYTE Technology Co., Ltd., Sades, Sennheiser Electronic GmbH & Co. KG, Sony Corporation, Sharkoon Technologies, Shenzhen Rapoo Technology Co., Ltd., SteelSeries, Thermaltake Technology Co., Ltd., Turtle Beach Corporation, Other Prominent Players |

| Customization Scope | Get your customized report as per your preference. Ask for customization |

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

.svg)