Israel Electric Vehicle Market: By Type (Battery electric vehicle (BEV), Fuel cell electric vehicle (FCEV), Plug-in hybrid electric vehicle (PHEV), Hybrid electric vehicle (HEV), Autonomous Electric Vehicles); Vehicle Type (Passenger Cars (Small, Medium, and Large), SUVs (Small, Medium, Large), Light Commercial Vehicles (Pick-Up Trucks and Vans), Others); Charger (Fast and Normal); Power Output (Less than 100 KW, 100-250 KW, Above 250 KW); Sales Channel (Aftermarket and OEM)— Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2024–2032

- Last Updated: May-2024 | Format:

![pdf]()

![powerpoint]()

![excel]() | Report ID: AA0524829 | Delivery: 2 to 4 Hours

| Report ID: AA0524829 | Delivery: 2 to 4 Hours

Market Scenario

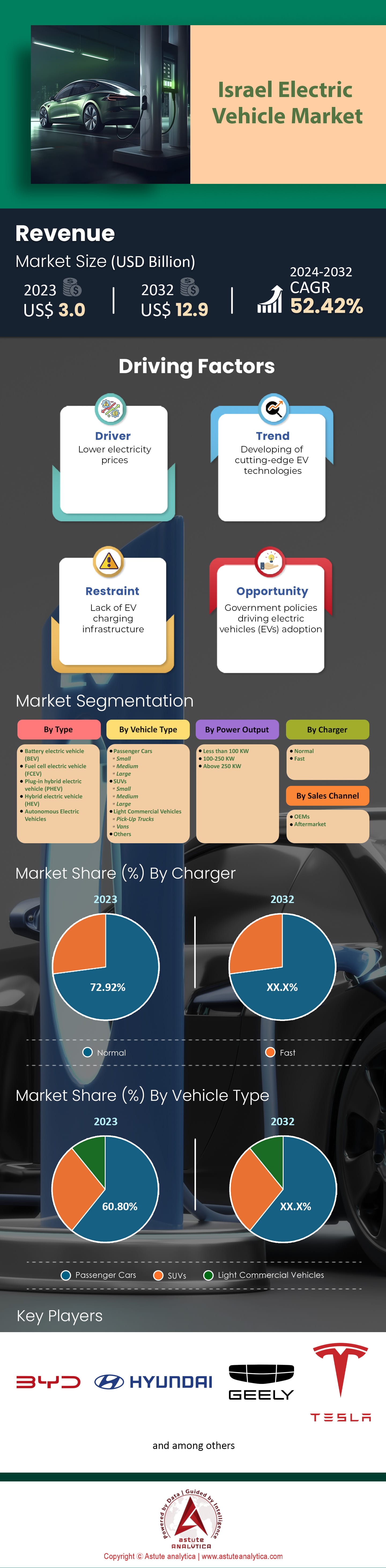

Israel Electric Vehicle Market was valued at US$ 3.0 billion in 2023 and is projected to hit the market valuation of US$ 12.9 billion by 2032 at a CAGR of 52.42% during the forecast period 2024–2032.

EV demand has increased by 40% and this type of car accounts for about one-fourth of all new cars sold. This is mainly due to the dominance of Chinese brands in the Israeli market for electric vehicles; these include gasoline engine versions as well, and account for nearly 19% of all new vehicle sales. The country’s economy has been adversely affected by such wars, resulting in a decline in vehicle deliveries by about 16.9% compared to last year. This was the lowest level of vehicles delivered for January and February since at least ten years ago following economic slowdown as well as war.

By 2030, it is anticipated that Israel electric vehicle market will witness a significant rise in electric vehicle (EV) penetration rate, which may exceed one-third of the nation’s total number of cars. The transition will likely put some stress on the national grid, accounting for about 6% depth-to-plate ratio fusion power generation development rate (Watts). The number of electric vehicles is projected to rise from the current 70,000 to approximately 1.3 million by 2030, with the long-term vision of electrifying all 6 million vehicles on Israeli roads by 2050. In spite of an expected increase in taxes on electric vehicles; however, growth projections for EVs remain strong. From now till 2024 tax rates applied to EVs are expected rise from present standard 20% or so up until 35% although their market share among new vehicle sales jumped up to about 24% having notable 40% surge at once.

To Get more Insights, Request A Free Sample

Market Dynamics

Charging Infrastructure and Government Regulation

The Israeli’s government and private enterprises have been very proactive in supporting the electric vehicle market. Electric vehicle drivers are looking for the high-capacity charging outlets, and thus, there is a movement to install these at homes especially among those who can afford it. In addition to that, the government has acted through legislations in relation to pricing of charging within public network which ensures service level agreements (SLAs), adherence to system standards as well as cyber security. Likewise, companies like GingerG have introduced fast EV charging stations in strategic places leading to installation of more than two hundred and fifty chargers. It is important for an HEV or PHEV adoption that we need to develop charging infrastructure. By April 2024, Israel had 4000 charging stations. This infrastructure supports the growing number of electric vehicles on the road.

Global and Local EV Trends in Israel

In 2023, the global sales of electric vehicles reached nearly 14 million units, with China, Europe and America being the major electric vehicle market. This trend continued in the first quarter of 2024 when sales hit a mark about 25% higher than during the same period last year. By 2030, Israeli government expects EV uptake to rise significantly such that almost one-third of its cars will be electric. However, international trade and supply chains for EVs have been interrupted by military conflicts. In particular, global trade has declined by 1.3% due to detours around Africa by ships because of the Red Sea crisis leading to extra freight costs as well as delivery delays for automakers such as Geely or Tesla. These incidents have emphasized strategic autonomy needed in supply chains.

Resilience of the Automotive Sector and Government Regulation Pose a Challenge

In 2024, Moody’s Israel sovereign rating was downgraded for the first time ever as a result of economic contraction and yet the electric car leasing sector has been able to boom in the Israel electric vehicle market. It is because the taxation framework enacted by the government in 2019 has encouraged distancing from fossil fuels. The business environment in Israel including that of EVs will be largely shaped by ongoing regional clashes and their impact on global oil prices. This calls for government input to allow for EV transition with incentives causing an upswing in production and adoption rates as well.

Nevertheless, there is a financial hurdle both consumers and manufacturers have to overcome due to the plan of raising purchase tax for EVs from 10% to 20% in 2023 and further to 35% from 2024 onwards. This move by lawmakers may hamper demand for such vehicles making it difficult for companies involved to sell their cars at competitive prices.

Segmental Analysis

By Type

Israel’s electric vehicle market has been dominated by hybrid-electric vehicles (HEVs), which commanded a market share of over 76.56%. Despite a slight decline in sales of HEVs in Q2 2023 when compared to previous years, plug-in hybrid electric vehicles (PHEVs) can be said to have a bright future. PHEV market, which is likely to boom, will have a forecasted unit sales reaching 10,170 vehicles by 2024. Some of the reasons behind this rise are as follows. The Israeli government on sustainability and innovation has resulted in increased demand for PHEVs from consumers who seek environmental benefits combined with potential cost savings. Israel’s promotion of electric and hybrid cars through incentives and policies over the years has significantly contributed to the trend. However, luxurious EVs are no longer subsidized as much as before and other perks were also recently reduced.

The range of PHEV models available in the country’s electric vehicle market allows more consumers to access them hence increasing its market base. This is consistent with national efforts by Israel towards cutting dependence on imported petroleum and move to cleaner sources of energy. Besides, Israel’s strong economy and high living standards make it possible for consumers to pay the upfront costs associated with PHEVs. Finally, Government commitment relates directly to worldwide attempts aimed at mitigating climate change effects that are worsened by carbon emission as far as green transport sector is concerned.

By Charger

Normal chargers dominate the Israel's electric vehicle market, capturing a dominant share of over 72.92%. As of April 2024, there are approximately 4,000 charging stations across the country’s districts with the Central District leading with 297 stations. Tel Aviv comes second in this list with 231 stations while other places such as Northern, Southern, Haifa and Jerusalem have significant numbers too. Most of them are normal chargers which take up more than 80%. Like most electric vehicle owners around the globe, a similar trend can be seen with Israeli owners preferring home-charging. Such a choice is influenced by factors like location (urban versus rural), dwelling types and income levels that determine the availability of home charging. However, cities such as Tel Aviv where apartment living is common, there may be no place to charge at home thus pushing residents to use public stations.

Public charging network, however, is experiencing a notable increase. Within just one year of 2023 alone this inventory reported a figure that increased remarkably above 40% alongside 55% growth in fast charging equipment. This situation mirrors the worldwide pattern where private chargers dominating include all sorts of home-based workplaces and reserved compared to public ones by ten times.

In 2018, Israel viewed infrastructure gap as an obstacle for EV adoption thus it took action, added fuel to the overall electric vehicle market growth. The government announced that there were plans to establish about 2,560 all over the country new recharge points. Under this ambitious program, another 60 fast-charging points were constructed on major highways while within city centers 2,500 were positioned for slow charging among them. “Fast” chargers designed to effect between 60% and 80% battery charge in less than half an hour while slower charged allowed cars plugged overnight by servicing two at once on each unit from NESS ZIONA city- goin such directions towards BEN GURION Airport or TEL AVIV. This crucial infrastructure development addressed a major barrier to electric vehicle penetration in Israel, paving the way for a more sustainable transportation future.

By Power Output

Most existing charging points in Israel electric vehicle market provide slow-charging options, for instance; those with less than 100KW account for more than 45.54% of the market share. This is an indication that it is possible to charge vehicles overnight or when they are going to remain parked for a while. By 2023, there were about 4,000 charging stations in Israel of which majority 3,400 were AC stations categorized under <100 KW. Israel's future charging arrangements have also undergone significant transitions. For instance, in 2023, the country introduced a fast charger with an output power of 360 KW. This implies that the current technology will result in very short recharge times where some models can achieve a range increase of up to 100km within five minutes or even less. Though only few car models allow such high charging rates today; this breakthrough paves way towards better efficient chargers. To address this deficiency in rapid-charge capability, Israel made significant pronouncements in October 2023 aimed at expanding its infrastructure through various initiatives and schemes.

The Energy and Infrastructure Ministry has ambitious plans of setting up over 700 new stations, out of which approximately 357 shall be focused on fast-charging while another 350 would cater for ultra-fast charging requirements. These sites have been strategically located along major highways and city centers throughout the nation so as to ensure easy accessibility by EV owners.

The project in the Israel electric vehicle market was backed by around 6.5 million euros (approximately 27.5 million Israeli shekels). In the next two years, this initiative will bring together 52 firms involved in building process spending approximately €6m ($80m). Financial aid further incentivizes government’s effort to promote establishment of fast-charging network here. As much as it requires almost 60,000 shekels to build a quick charger with state’s grant support that goes above one lakh shekel can be used as subsidy per ultra-fast charger. In so doing, the country is able to align itself for a future in which fast and ultra-fast charging becomes the norm in its EV landscape.

By Sales Chanel

Israeli electric vehicle market landscape is highly dominated by original equipment manufacturers (OEMs) who hold a mammoth 93.85% market share. This has been the result of the Israeli government efforts to spur the EV market, including such incentives as reduced purchase taxes and other financial benefits that have made it attractive for potential EV buyers. Furthermore, Israel’s access to natural gas makes electricity prices lower than fuel prices leading to a major disconnect on cost front – an alluring combination for budget-conscious consumers. The commitment of the authorities towards a cleaner environment is reinforced by their pledge to eliminate petrol- and diesel-powered vehicles from the market by 2030.

There is also an advantage in being a first mover in this electric vehicle market. For instance, car manufacturers that were among first entrants into Israel and whose products reflected local preferences have managed to become strong established brands. These internationally recognized companies benefit from close ties with key automakers and extensive distribution channels run by large importers in their respective countries. Nevertheless, Tesla also faces difficulties in Israel due to lack of marketing and sales support systems that are well developed. Also, transition of Israelis, generally they are very open-minded people ready to embrace new technologies into using electric cars is simplified through adoption of electric vehicles which these countrymen do at early stages. As long as electrical vehicles’ prices remain competitive against gasoline choices; this will be essential in making OEMs still remain dominant over cleaner transport options.

Moreover, strong technological and automotive presence places Israeli businesses at the forefront of electric vehicle innovation globally. There is also a booming start-up community while sustainability principles are highly regarded which has led Israel being referred as one of world leaders in development related innovations within EV space. Thus, global automotive players choose Israel as their target investment spot owing to government assistance provided here and skilled workforce available thereon for graduates leaving institutions like Jerusalem College of Technology or Technion-Israel Institute of Technology’s Haifa campus located near Kiryat Motzkin or elsewhere. Besides, there is the active competition for the electric vehicle market in Israel. Various new entrants including Chinese EV companies are entering the market. Meanwhile, due to their relatively young age and either high or low model line diversity among different brands, sales concentration here is on a small number of well-known OEMs. Additionally, manufacturers’ dominant position in this sector is supported by pricing strategies such as providing substantial discounts to leasing companies.

To Understand More About this Research: Request A Free Sample

Major Players in Israel Electric Vehicle Market

Market Segmentation Overview:

Market Segmentation Overview:

By Type

- Battery electric vehicle (BEV)

- Fuel cell electric vehicle (FCEV)

- Plug-in hybrid electric vehicle (PHEV)

- Hybrid electric vehicle (HEV)

- Autonomous Electric Vehicles

By Vehicle Type

- Passenger Cars

- Small

- Medium

- Large

- SUVs

- Small

- Medium

- Large

- Light Commercial Vehicles

- Pick-Up Trucks

- Vans

By Charger

- Normal

- Fast

By Power Output

- Less than 100 KW

- 100-250 KW

- Above 250 KW

By Sales Channel

- OEMs

- Aftermarket

View Full Infographic

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

| Report ID: AA0524829 | Delivery: 2 to 4 Hours

| Report ID: AA0524829 | Delivery: 2 to 4 Hours

.svg)