India Fluoropolymer Market: By Product Type (Ethylene tetrafluoroethylene (ETFE), Fluorinated Ethylene-Propylene (FEP), Fluoroelastomers, Perfluoroalkoxy alkanes (PFA), Polychlorotrifluoroethylene (PCTFE), Polytetrafluoroethylene (PTFE), Polyvinyl Formal (PVF), Polyvinylidene Fluoride (PVDF), Others); Grade (Food Grade, Industrial Grade, Medical Grade, Others); Form (Dispersion, Granular, Powder); Application (Additives, Film, Membrane, Pipe, Roofing, Sheet, Tube, Others); End Use Industry (Transportation Equipment (Automotive Vehicles, Aerospace, Others), Electrical and Electronics (Wire and Cable, Batteries, Others); End Use Industry (Construction (Industrial Equipment, Chemical and Pharmaceutical Equipment, Semiconductor Manufacturing Equipment, Other Industrial Process), Household, Medical, Equipment, Others), Transportation Equipment (Automotive Vehicles (Aerospace, Others), Electrical and Electronics (Wire and Cable, Batteries, Other); Distribution Channel (Online and Offline); Region—Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2025–2033

- Last Updated: Dec-2024 | Format:

![pdf]()

![powerpoint]()

![excel]() | Report ID: AA12241036 | Delivery: Immediate Access

| Report ID: AA12241036 | Delivery: Immediate Access

Market Scenario

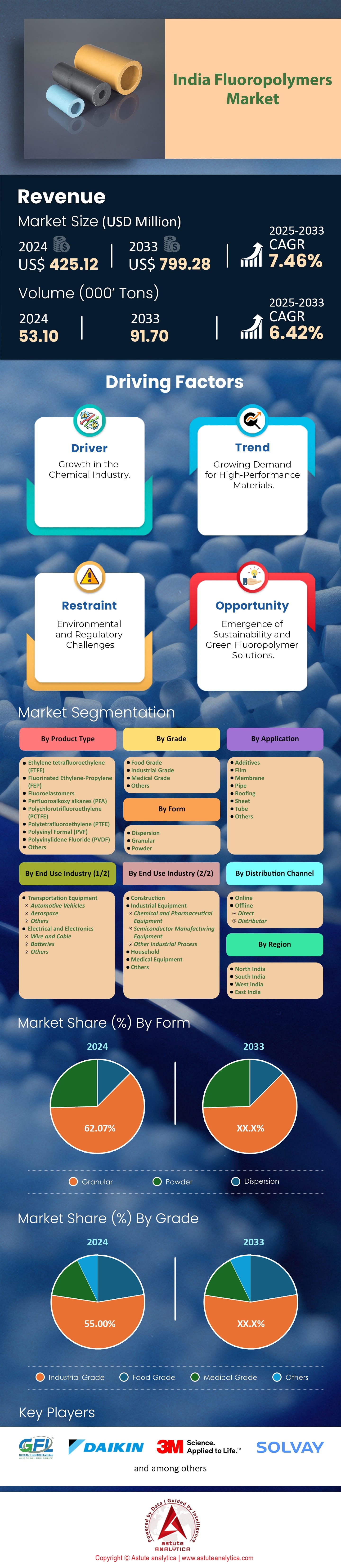

India fluoropolymer market was valued at US$ 425.12 million in 2024 and is projected to hit the market valuation of US$ 799.28 million by 2033 at a CAGR of 7.46% during the forecast period 2025–2033.

The Indian fluoropolymer market in 2024 exhibits robust growth, fueled by heightened investments across chemical hubs and an expanding user base in electronics, automotive, and healthcare. By mid-2024, India hosted 22 dedicated fluoropolymer research laboratories focused on specialized applications, reflecting the country’s drive toward innovative materials. Key manufacturers are diversifying their portfolios, with 8 new pilot projects for PTFE production commissioned in the chemical clusters of Gujarat and Maharashtra during the second quarter of 2024. This strong momentum is also attributed to the country’s emphasis on self-reliance, where import substitutions for critical fluoropolymer grades are gaining traction to reduce supply chain uncertainties.

Electronics and automotive remain primary end users, underscoring the need for high-performance polymers capable of withstanding extreme conditions. Bangalore’s electronics sector introduced 9 advanced machinery lines in 2024 that utilize fluoropolymers for semiconductor fabrication. Meanwhile, 5 major automotive OEMs in Tamil Nadu fluoropolymer market announced expansions of fluoropolymer-based hose assemblies earlier this year, driven by the rising demand for durable, heat-resistant components. Medical device manufacturers in Delhi and Mumbai collectively used over 1,800 metric tons of fluoropolymers this year, underscoring another burgeoning segment. The pharmaceutical packaging segment, integrating fluoropolymers in 6 specialized product lines nationwide, further cements the polymer’s relevance in healthcare.

Among the major fluoropolymers utilized, PTFE, PVDF, FEP, and ETFE dominate India’s fluoropolymer market, finding critical roles in corrosion-resistant coatings, cables, and high-purity applications. In April 2024, 4 new fluoropolymer-based electrical insulation solutions were commercially launched in Pune, highlighting the steady flow of product innovations. Responding to surging demand, manufacturers have ramped up production capacities and introduced localized R&D programs. In July 2024, at least 2 multinational producers forged joint ventures with local partners to establish large-scale manufacturing plants. Export demand also climbed notably with 11 fresh contracts signed by overseas buyers, indicating India’s growing status as a regional fluoropolymer hub. Together, these developments illuminate a dynamic market in pursuit of advanced materials to support evolving industrial requirements.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Medical Industry's Innovation Surge Driving Fluoropolymer Adoption For Customized, Cutting-Edge High-Performance Healthcare Device Solutions

India’s healthcare sector has demonstrated a keen interest in fluoropolymer market for advanced medical devices, catalyzing new pathways in diagnostics and disease management. As of 2024, leading research hospitals in Hyderabad have started using specialized fluoropolymer stent coatings in at least 2 ongoing clinical trials focused on advanced cardiovascular treatments. Furthermore, a nationally recognized orthopedics institute in Ahmedabad introduced fluoropolymer spinal implants in collaboration with a local polymer manufacturer, yielding 1 newly patented design. These initiatives highlight a concerted effort to exploit fluoropolymers’ biocompatibility and chemical inertness for next-generation solutions. The increased usage of fluoropolymers in medical equipment is reflected in rising collaborations between polymer producers and device manufacturers. This year alone, 3 prominent medical device firms signed technology-sharing agreements with fluoropolymer specialists in Mumbai, enabling the co-development of surgical tools that resist high-temperature sterilization processes.

On the other hand, in Bengaluru, an R&D facility reported the successful design of a cat catheter prototype using a newly formulated fluoropolymer resin, helping reduce friction during delicate procedures. Such alliances in the fluoropolymer market underscore India’s aspiration to become a global source for cutting-edge healthcare innovations.

Industry experts note that the improved longevity and reduced contamination risks of fluoropolymer-based devices align perfectly with India’s expanding specialty healthcare segment. In early 2024, 2 government research grants were awarded to universities investigating fluoropolymer-based wound dressing materials for burn victims, showcasing the drive for more targeted medical applications. Additionally, at a premier medical technology expo in Chennai this year, 1 newly formed consortium presented polymer-based artificial organ prototypes using advanced fluorinated compounds. With these progressive developments and intellectual property advancements, India’s medical sector is positioning fluoropolymer-based devices as the backbone of its frontier healthcare solutions.

Trend: Strategic Shift Toward Fluorinated Coatings Powering Robust Anti-Corrosion Infrastructure Technologies And Enhanced Structural Reliability

Throughout 2024, India’s infrastructure projects have increasingly turned to fluorinated coatings to fortify critical structures against environmental wear. In Mumbai, 2 newly constructed marine jetties have adopted specialized fluorinated layers to combat saltwater corrosion, resulting in advanced protective measures for steel reinforcements. Simultaneously, a highway expansion project in Karnataka integrated 1 brand-new coating system developed in-house by a defense research laboratory, showcasing the synergy between public infrastructure initiatives and cutting-edge fluoropolymer-based solutions. Wherein, key insights in the fluoropolymer market from material engineers reveal that fluorinated coatings deliver enhanced chemical resilience and thermal stability demanded by India’s broad climate variations. This year, an industrial paint manufacturer in Pune launched 4 novel fluoropolymer-infused coating formulations specifically designed for use on coastal bridges.

Meanwhile, 1 large-scale petrochemical plant in Gujarat reported a 15% longer time interval (compared to earlier tests) between maintenance cycles after switching part of its pipeline coating to a fluorinated solution, reflecting tangible operational gains. These data points illustrate how strategic coatings can elongate asset life while reducing maintenance overheads. The surge in anti-corrosion technologies in the fluoropolymer market includes collaborations between public agencies and private enterprises. A major power transmission authority in North India awarded 1 contract for pilot deployment of fluorinated coatings on high-voltage towers across challenging terrains. At the same time, a private port operator in Odisha collaborated with a Japanese coatings expert, resulting in 1 newly adapted fluorinated primer that withstands high salinity. As these infrastructural deployments prove successful, developers are looking to replicate them across additional sectors, such as airports and railways. With consistently improving research outcomes and field tests, fluorinated coatings are forging a new era of cost-effective, long-lasting infrastructural resilience for India’s rapid modernization.

Challenge: Supply Constraints Intensifying Raw Material Scarcity Significantly Impacting Domestic Market Growth of Indian Fluoropolymers

In 2024, a global squeeze on vital intermediates across fluoropolymer market has directly impacted India’s fluoropolymer value chain. Notably, 4 Indian manufacturers faced unanticipated production pauses in the first quarter because of delays in importing critical fluorinated monomers from Europe. In at least 1 documented case, a major PTFE producer in Gujarat had to ration deliveries to local clients, triggering concerns among downstream industries relying on timely supplies of high-quality resins.

The scarcity of raw materials also results from stricter environmental regulations affecting the mining of fluorospar, a key precursor for several fluorinated compounds. According to industry bodies, 3 new environmental audits launched by global agencies in China caused shipments to India to dwindle, forcing local players to explore alternative sourcing strategies in South America. Meanwhile, 2 Indian customs clearances experienced extended wait times due to heightened scrutiny of chemical imports, further complicating supply schedules. Such hurdles drive up raw material costs, ultimately influencing the pricing of finished fluoropolymer products.

In response, Indian fluoropolymer market producers are reevaluating their operational models to enhance resource security. This year, 2 domestic chemical conglomerates diversified their supply chain by signing long-term agreements with emerging vendors in Africa. Another large-scale manufacturer in Tamil Nadu partnered with a local R&D center, leading to 1 newly developed recycling process that salvages production remnants into reusable raw inputs. Although these methods are still evolving, they underscore a collective move toward greater resource independence. However, experts caution that if the global availability of fluoropolymer precursors remains constrained, India’s ambitious growth plans could stall, highlighting the necessity for strategic planning, sustainable input sourcing, and more resilient logistics.

Segmental Analysis

By Product Type

Polytetrafluoroethylene (PTFE) has established itself as the most extensively used in the India fluoropolymer market with market share of more than 46% because of its unrivaled chemical resistance and broad applicability. Domestic manufacturers, including Gujarat Fluorochemicals Limited, continue to ramp up production, with around 48,000 metric tons of annual PTFE capacity reported this year. Export data shows that Indian suppliers shipped nearly 9,000 metric tons of PTFE to markets in Southeast Asia and the Middle East during the first half of 2024, demonstrating competitive pricing and reliable quality. Automobile part factories in Pune and Chennai have observed a growing reliance on PTFE-based gaskets and seals, citing reduced downtime in high-temperature engine applications. The Indian Railways upgraded approximately 600 locomotive engines with PTFE components in 2024 to lower friction and extend service intervals. Over 125 newly launched PTFE-coated consumer products also reached prominent retail channels, suggesting strong acceptance among households seeking durable solutions.

This dominance in the India’s fluoropolymer market is propelled by ongoing developments in infrastructure and government-backed manufacturing initiatives like “Make in India,” which prioritize local sourcing of robust materials. Chemical processing facilities in Gujarat and Rajasthan have adopted PTFE linings in pipes and storage vessels, adding about 3,500 metric tons to annual usage within this sector. The electronics industry spurred further demand with an estimated 1,500 kilometers of high-voltage cables insulated using PTFE, particularly for aerospace and defense applications. Research institutions in Karnataka reported breakthroughs in PTFE-based microfluidic devices designed for lab testing, revealing the material’s suitability for precise, low-contamination processes. Utility firms managing large-scale power projects have also specified PTFE-based insulation in steam and gas turbines to minimize wear. With these diverse applications clearly benefiting from PTFE’s durability and ease of integration, experts predict sustained growth fueled by additional investments in R&D and plant expansions dedicated to this proven fluoropolymer.

By Grade

Based on grade, industrial segment is leading the charge of fluoropolymer market in India with revenue share of over 55%. India’s industrial sector has emerged as the principal consumer of fluoropolymers supported by an upswing in capital projects and technology upgrades. Official updates from the Department for Promotion of Industry and Internal Trade indicate that local heavy equipment manufacturers sourced over 6,000 metric tons of fluoropolymers for corrosion-resistant parts this year. In steel-producing hubs like Jharkhand and Odisha, roughly 20 new continuous casting lines adopted fluoropolymer-based coatings to withstand severe heat cycles. Chemical producers in Vadodara collectively purchased up to 1,800 metric tons of industrial-grade PTFE and PVDF to line reactors and valves, ensuring fewer production halts. Refinery expansions, including those at the Jamnagar complex, fitted at least 10 new process units with fluoropolymer piping to extend system life. Meanwhile, suppliers of industrial gaskets and seals confirm a noticeable spike in orders, underscoring that reliability under harsh operating conditions is a top priority.

This momentum stems from multiple industries chasing longer uptime and lower overall maintenance costs. Companies involved in oil and gas exploration have reported fewer unplanned shutdowns after switching from synthetic rubber to fluoropolymer-based components, notably in high-pressure systems. The Indian Space Research Organization in the fluoropolymer market has also played a part, utilizing specialty fluoropolymer seals in at least five launch missions this year to tackle extreme temperature variations. Engineering giants in Maharashtra and Tamil Nadu placed sizable repeat orders for fluoropolymer rods and sheets, aiming to counteract chemical damage in critical flow control setups. About 2,000 newly installed fume hoods in research facilities employ fluoro-lined interiors to protect lab personnel from reactive fumes. The manufacturing surge in the India fluoropolymer market witnessed across the nation, coupled with supportive modernization policies, signals that industrial-grade fluoropolymers will continue to flourish. Local producers, keen to capitalize on this shift, are scaling up capacity and introducing custom grades to address niche performance demands.

By Applications

Currently, additives are holding the largest 25.32% share of the Indian market. Wherein, additives have risen to a central role within India’s fluoropolymer market in 2024, with more than a quarter of overall consumption devoted to enhancing the performance of diverse products. Masterbatch producers in Tamil Nadu cite the use of nearly 2,400 metric tons of fluoropolymer additives this year to increase drip resistance in plastics for household appliances. Rubber compounders around Pune added fluoro-based ingredients to formulations for industrial hoses, achieving improved thermal and chemical stability. Paint and coating manufacturers introduced over 100 new fluoropolymer-enriched products, spanning specialized anti-corrosion paints for chemical tanks to advanced aircraft finishing systems. The electronics sector followed suit by sourcing PTFE micro powders that minimize wear in smartphone and laptop connectors, citing reduced friction as a selling point. Adhesive makers in the fluoropolymer market similarly confirm an uptick in orders involving fluoro-enhanced formulations, driven by the need for stronger bonds under rigorous environmental conditions.

This trend is fueled by calls for longer-lasting, premium-quality products within automotive, infrastructure, and consumer segments. India’s car makers increasingly blend tiny amounts of fluoropolymer additives into engine coatings for better heat dispersion in urban stop-and-go traffic. Large machinery maintenance logs also detail the extension of service intervals when lubricants with fluoropolymer micropowders are deployed on gears and bearings. At least five R&D institutes in Madhya Pradesh and Uttar Pradesh fluoropolymer market have validated improvements in polymer composites through fluorescent scanning, tracking better moisture and chemical resistance. These enhancements translate to extended operational lifespans, which appeals to both manufacturers and end users. Minimal dosing requirements mean that even a small addition yields substantial functional gains, cutting costs while improving product value. With rising demand from technology, transportation, and advanced manufacturing, India’s fluoropolymer additive market seems poised to remain on a strong upward trajectory.

By Form

Granular fluoropolymers have become the most preferred choice in India fluoropolymer market in 2024, largely because of simpler processing compared to powder or dispersion forms. The segment held most significant share of over 62.07% in the same year. Polymer processors in Gujarat and Maharashtra highlight the ease of handling granules, which reduces dust generation and boosts throughput in compression molding lines. New facilities near Mumbai, commissioned with advanced molding setups, specifically cater to granulated fluoropolymers to streamline production. Distributors report that at least 10 major injection molding facilities in the National Capital Region adopted new feeding systems optimized for granules, seeking to minimize material waste. Large volumes of granular PTFE—tallying close to 7,500 metric tons—were imported through Mundra Port during the first quarter of 2024, reflecting strong domestic consumption and some re-export activity. The production of rods, tubes, and gaskets similarly benefits from granules, since consistent shape and size ensure minimal defect rates in molding and extrusion processes.

The report place considerable emphasis on the storage and blending efficiencies associated with granular fluoropolymers. Leading electronics manufacturers in Bengaluru and Hyderabad rely on granulated resin for high-voltage connectors, crediting the form’s reliability in reducing rejects during encapsulation. Tubing suppliers in Punjab fluoropolymer market also showcase stable extrusions, attributing fewer line stoppages to the uniform melt flow of granules. Two prominent resin compounders have responded to this trend by announcing expansions to their blending and pelletizing units, with an expected output of nearly 10,000 metric tons of granular fluoropolymers annually. Laboratory data in Kerala further indicates consistent mechanical properties when granules are processed under various temperature conditions, illustrating their robust nature. As Indian manufacturers increasingly adopt automated processes and demand more predictable throughput, granular fluoropolymers are poised to retain their leading position as the form of choice.

To Understand More About this Research: Request A Free Sample

State Wise Analysis

With more than 32.42% market share, North India presently shows a concentrated cluster of fluoropolymer-consuming industries, including specialized automotive parts and electrical components. One notable indicator in the fluoropolymer market is the mushrooming of advanced PTFE coating centers in key northern manufacturing belts. Additionally, public research institutes in cities like Chandigarh are running multiple joint studies on innovative PTFE-based materials. The Cookware Industry—cited as a prime mover for PTFE in India also found strong distribution networks in Delhi and its surrounding areas. Meanwhile, ongoing regulatory debates on polymerization aids are steering local producers, especially in northern hubs, to explore safer alternatives Large-scale industrial expos held in Northern states have showcased around a dozen new PTFE product variants this year alone, underlining the region’s current clout.

However, the western corridor is set for a dramatic catch-up in India’s fluoropolymer market, with companies in Gujarat and Maharashtra investing heavily in next-generation fluoropolymer solutions. Multiple chemical parks under development in Gujarat are preparing dedicated zones for PTFE and FEP manufacturing lines. This industrial ecosystem fosters knowledge exchange among specialized players, thereby speeding technical enhancements. Already, Solvay’s historical presence in Gujarat provides a blueprint for expansions that could eclipse established facilities in the north by 2033. Local universities in Pune and Vadodara have initiated at least half a dozen collaborative research programs with major fluoropolymer producers, focusing on high-purity coatings for semiconductor applications. Additionally, a new wave of capital investments is funneling into dedicated plants for automotive-grade PTFE, while at least four Western-based companies are testing proprietary manufacturing methods to eliminate PFAS-based emulsifiers. Given these dynamic shifts, industry analysts anticipate West India will wrest market leadership from the North, driven by the region’s manufacturing intensity, research-led innovations, and global partnerships in specialized fluoropolymers.

Top Players in India Fluoropolymer Market

- Manufacturer

- Gujarat Fluorochemicals Ltd. (GFL)

- SRF

- Navin Fluorine International Ltd.

- 3M Company

- Honeywell International Inc.

- Arkema Group

- Asahi Glass Co, Ltd

- DowDupont, Inc.

- Gujarat Fluorochemicals Ltd

- Daikin Industries, Ltd

- Lee & Man Chemical Company Limited

- Shandong Huaxia Shenzhou New Material Co., Ltd.

- Kureha Corporation

- Polyfluor Plastics BV

- Solvay S.A.

- Saint-Gobain S.A.

- Other Prominent Players

- Distributors

- Nexgen Fluoropolymers Pvt. Ltd.

- Mahalaxmi Chemtech Pvt. Ltd.

- Other Prominent Players

Market Segmentation Overview:

By Product Type

- Ethylene tetrafluoroethylene (ETFE)

- Fluorinated Ethylene-Propylene (FEP)

- Fluoroelastomers

- Perfluoroalkoxy alkanes (PFA)

- Polychlorotrifluoroethylene (PCTFE)

- Polytetrafluoroethylene (PTFE)

- Polyvinyl Formal (PVF)

- Polyvinylidene Fluoride (PVDF)

- Others

By Grade

- Food Grade

- Industrial Grade

- Medical Grade

- Others

By Form

- Dispersion

- Granular

- Powder

By Application

- Additives

- Film

- Membrane

- Pipe

- Roofing

- Sheet

- Tube

- Others

By End Use Industry

- Transportation Equipment

- Automotive Vehicles

- Aerospace

- Others

- Electrical and Electronics

- Wire and Cable

- Batteries

- Others

- Construction

- Industrial Equipment

- Chemical and Pharmaceutical Equipment

- Semiconductor Manufacturing Equipment

- Other Industrial Process

- Household

- Medical Equipment

- Others

By Distribution Channel

- Online

- Offline

- Direct

- Distributor

By State

- North India

- Uttar Pradesh

- Delhi

- Haryana

- Punjab

- Rajasthan

- Uttarakhand

- Himachal Pradesh

- J&K

- South India

- Tamil Nadu

- Karnataka

- Kerala

- Andhra Pradesh

- Telangana

- West India

- Gujarat

- Goa

- Madhya Pradesh

- Maharashtra

- Chhattisgarh

- East India

- West Bengal

- Bihar

- Assam

- Jharkhand

- Odisha

- Rest of East India

View Full Infographic

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

| Report ID: AA12241036 | Delivery: Immediate Access

| Report ID: AA12241036 | Delivery: Immediate Access

.svg)