Global Fluoropolymers Market: By Type (Ethylene Tetrafluoroethylene (ETFE), Fluorinated Ethylene-Propylene (FEP), Fluoroelastomers, and others); Form (Dispersion, Granular, and Powder); Application (Additives, Film, Membrane, and Others); End User Industry (Transportation Equipment, Electrical and Electronics, and Others); Region—Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2024–2032

- Last Updated: Sep-2024 | Format:

![pdf]()

![powerpoint]()

![excel]() | Report ID: AA0222139 | Delivery: 2 to 4 Hours

| Report ID: AA0222139 | Delivery: 2 to 4 Hours

Market Scenario

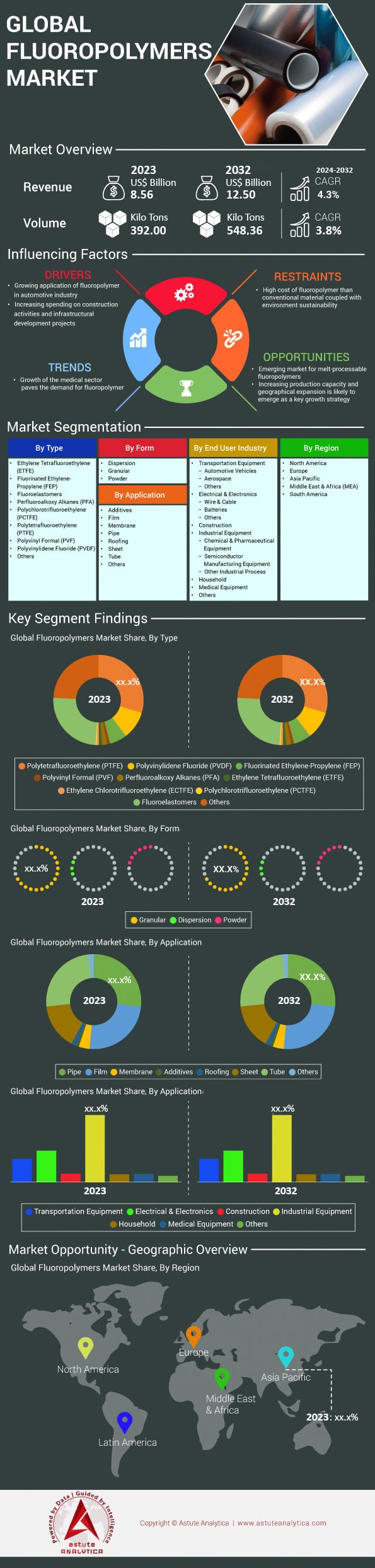

Global fluoropolymers market is estimated to witness a rise in revenue from US$ 8.56 billion in 2023 to US$ 12.50 billion by 2032 at a CAGR of 4.3% during the forecast period 2024-2032.

The demand for fluoropolymers is increasing at a steady pace owing to their special characteristics such as strong resistance to chemicals, heat, and electricity, which makes them useful in a number of industries. In particular, it is estimated that there are more than 40,000 fluoropolymer materials used as insulation for wiring and cables around the world every year. This increase results from increasing uses in automotive, electronics, healthcare and other industries. In the automotive industry, at least 70% of the vehicles produced in the world use fluoropolymers in one component or another to improve vehicle efficiency and durability. Moreover, the Asia-Pacific region is likely to account the majority of the market share and will earn good revenues owing to rising demand of quality medical, automotive and electronics products ever from its significant manufacturing centers of China and India. The HVAC industry spends in excess of 15000 tons of fluoropolymer materials every year illustrating its necessity given efficiency of the system.

Different fluoropolymers market utilize fluoropolymers such as automotive, electronics, healthcare and construction. The electronics industry benefits from the cavity-filled dielectric properties of fluoropolymers which are essential in the making of semiconductors and there are about 50 million semiconductor devices made each year with these materials. In healthcare, these materials are used in more than 30 million devices each year due to their biocompatibility and inertness to steam sterilization. The construction services sector did not shy away to harness fluoropolymer paints and coatings, over 20,000 buildings in different countries have similar paintings due to their ability to withstand harsh external environmental conditions. The market is fitted with the number of strategic partnerships between manufacturers and end users in order to help increase their production capacities so as to service the growing market, over 100 partnerships are active as for last year. In addition, there are rapid changes in technology whereby over 500 patents pertaining to innovative formulations of high performance fluoropolymers for 5G have been filed in the last two years.

The development in the fluoropolymers market in the recent past includes high-performance variants like PTFE, FEP and PFA which occupy roughly 75% of the market. These materials are being increasingly adapted for newer uses such as in lithium-ion batteries and photovoltaic systems where more than 200 million square meters of solar panels are shielded by fluoropolymers. The coatings segment has been responsible for the majority of sales as it provides advantages such as high chemical and corrosion resistance essential in industrial applications with above 10,000 industrial plants employing such coatings. The market is also transforming with developers’ adjustments embracing environmental issues with research being conducted in an attempt to reduce the distributional effects of fluoropolymers amidst many studies, over 50, on sustainability. However, as the market keeps on reshaping itself, the continuous stress on eco-friendly measures and innovative enhanced fluoropolymer applications are expected to support an even wider need and further diversification on fluoropolymers usage on several markets.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Increasing Demand from End-Use Sectors Like Automotive, Aerospace, and Electronics

The fluoropolymers market is on the rise owing to the demand coming from several end-use industries particularly automotive, aerospace, and electronics. The automobile industry produced over 90 million cars globally in the year 2023 while fluoropolymers helped in improving fuel economy and emission. Safety of its use has contributed to the US$838 billion aerospace sector employing fluoropolymers as thermal protection materials and fuel-efficient light weight parts. Now, the global electronics market reached $3 trillion, fueled by advanced semiconductors and consumer electronics where fluoropolymers are used for insulation and protection, with high durability. In addition, in year the 20222 electric vehicle (EV) market sold 10 million units notably achieving into new EV markets & importantly efficient and effective ionized fluoropolymers for battery cases, internal parts & harnesses. The rapid expansion of these industries emphasizes the critical importance of fluoropolymers in the future of technology.

Besides the size of the fluoropolymers market and the production statistics, the demand for new 42000 aircraft in the aviation industry over the next twenty years shows the strategic importance of fluoropolymers. This requires materials such as fluoropolymers which assist in making quality designs. Their use is also apparent in the electronics sector, where the semiconductor industry raked in $600b in revenue for the year 2023 with fluoropolymers making sure that microchip fabrication processes are intact. In addition, the technology shift toward hybrid and electric vehicles in the automotive industry has propelled the usage of fluoropolymer materials in batteries to unprecedented levels. The increasing quest for smaller and smaller consumer electronics means that even better materials shall be required, and thus accelerating the demand for fluoropolymers. These and other factors shift the polymers including fluoropolymers to wide uses as their design needs continue to increase over time making them important in modern industrial systems.

Trend: Electrical and Electronics Sector Overtaking Industrial Manufacturing as Leading Market

The fluoropolymers market has experienced unprecedented growth as a result of the dominance of the electrical and electronics manufacturing domains over the conventional industrial construction applications. The fluoropolymers market by applications in electronics was valued at $3.5 billion in the year 2023 due to the growth in smartphones, tablets and wearable devices. The unconditional need for the extra performance materials in relation to device wear and tear allude to this fact. Also, production of printed circuits boards cross 60 billion units and, fluoropolymers perform vital roles in providing electrical insulation and limiting the signal attenuation. The increasingly expanding market for Internet of Things with the already sited 50 billion connected devices highlights the trend for materials that are tough and reliable such as fluoropolymers. These developments evoke a change in focus as far as the consumption patterns of fluoropolymers are concerned as electronics manufacturing continues to be the driving force.

The advancement in the shift towards the electronics sector is seen in the annual semiconductor industry production of more than 1 trillion chips which calls for high quality materials at maximum levels of performance. Also, with 1.5 billion subscriptions worldwide for 5G technology, adoptions of such components will push the limits of frequency and power which will create further demand for fluoropolymer applications. In the same way, the global LED market which is estimated at $100 billion is also supported to be utilizing fluoropolymers due to their ability to offer heat and optical clarity. Additionally, the PV market managed to install 200g, watts of solar capacity in 2023 with quality materials needed to ensure its effectiveness and durability. These figures point towards the direction of the ever rising potential that the electronics industry presents upon the fluoropolymers market, bringing out a change that is a characteristic of convergence in a more forward motion.

Challenge: High Production Costs and Complex Manufacturing Processes Limiting Market Expansion

Despite the promising demand across various sectors, it faces huge hurdles as a result of high manufacturing costs and technical elaborations which are not easy to achieve. The capital outlay required to establish a fluoro polymer production plant is around USD 100 million showing that it is a very capital intensive business. For instance, the cost of raw materials for fluorspar which is a utility in the production process solids up to USD 400 a tonne. The complexity of production by use of polymerization also involves the use of specific machines and skilled human labor which makes it non scalable to most young companies or aspiring new entrants. Production is also particularly energy intensive, with facilities consuming on the order of 500,000 MWh of energy per annum, which adds to the operational expenses of the business. Consequently, there are factors which inhibit entry and development in the market and growth of the sector.

In addition to this, the manufacturing process is further complicated by rigid rules and regulations in the fluoropolymers market, which can incur over $10 million in compliance costs for large scale manufacturers. Due to the requirement of such advanced quality control systems which Voltas claims cost at least $5 million, this is yet another added expense. Furthermore, the industry suffers from a lack of trained technician with a deficit of 10,000 technicians worldwide which limits the growth of production. Another concern that industries have to deal with in the production process is the aspect of the environment where waste management is accounted for at $3 million per plant. All such complexities call for expansion of investments in research and development such that it is estimated that $50 million is provided each year by the top companies for process developments.

Segmental Analysis

By Type

Polytetrafluoroethylene (PTFE) stands as a market leader in the fluoropolymers market with market share of over 29.6% owing to its unique properties and diverse applications across various sectors. Due to its outstanding chemical resistance, high temperature strength valued at 260 °C, and low friction, PTFE has become the most critical application including automotive, electronic and aerospace. PTFE demand is particularly high in the automotive industry because this thermoplastic is incorporated into fuel pipes, brake systems and gaskets. In addition, the electronics industry is also concerned with PTFE use for insulation and high speed communication without significance interferences where approximately 30 kilometers of PTFE insulated wires are fabricated annually. In addition, PTFE finds applications in surgical implants and grafts, over 5000 medical aids and devices are manufactured every year using PTFE. Its passive nature qualifies it more to be used in the chemical hostile environments and empowers the apparatus of manufacturing chemical resistant coatings of over a million liters every year.

Geographically, demand for PTFE is highly concentrated in North America and Europe fluoropolymers market, where roughly 3000 companies operating across different sectors consume PTFE in their production processes. The explosive growth of industrialization and urbanization in the Asia-Pacific region makes this area a new stronghold, China alone using about 500 thousand metric tons of PTFE per year, which is a huge market. According to the research, the valuation of the PTFE market exceeds USD 6 billion and is developing at a constant rate on account of active product-related innovations and increase in the uses of the products. R&D costs are a daunting task for the leaders of the hemisphere, or more than $ 200 million a year for 10 to 20 years spent on improving the characteristics of PTFE and bringing its abilities to new heights in different market domains. The uniqueness and flexibility of the polyfluoroethylene polymer and further innovation ensures it relative position on the top of polymers over other fluoropolymers, thus being key in several present and future industries.

By Form

The fluoropolymers market is witnessing a shift towards the powder segment, attributed to its superior properties that cater to a broad range of industrial applications. Notably, the global consumption of fluoropolymer powders in the manufacturing sector has seen a significant increase, with industries utilizing 5,000 metric tons annually in electrical and electronic components alone. This demand is further reinforced by the material's ability to withstand temperatures exceeding 260°C, making it indispensable in high-stress environments. The transportation sector, particularly in the production of vehicles, sees a usage of approximately 3,200 metric tons, highlighting its critical role in enhancing vehicle efficiency and reducing maintenance costs. Moreover, the industrial equipment sector has embraced fluoropolymer powders due to their chemical resistance, employing around 2,800 metric tons annually to ensure equipment longevity and reliability. These figures collectively underscore the pivotal role of the powder segment in steering the market dynamics.

Beyond these applications, the reduced friction levels associated with powder fluoropolymers are instrumental in enhancing machinery performance, leading to an estimated 30% increase in operational efficiency across various industries. The insulation capabilities of these powders in the fluoropolymers market, with dielectric strengths reaching up to 60 kV/mm, are particularly beneficial for electrical applications, ensuring safety and performance in critical components. Additionally, the global industrial sector has reported a 20% reduction in energy consumption due to the adoption of these materials, translating to significant cost savings and environmental benefits. In aerospace, the growing use of fluoropolymer powders is evidenced by the 1,500 metric tons utilized annually to improve aircraft performance and safety. As industries continue to prioritize efficiency and sustainability, the growth trajectory of the fluoropolymer powder segment is poised to maintain its upward momentum, reinforcing its dominance in the market landscape.

By Application

The fluoropolymers market, particularly the pipe segment, showcases significant dominance with 26.7% market share attributed to its widespread application across various industries. Due to their chemical stability, fluoropolymer pipes have found widespread use in industries which involve polymer fumigating compounds such as the pharmaceutical sector which alone has an estimated 2 million kilometers of piping systems in place across the globe. The construction and building industries are used annually chronicled over 1.5 million kilometers of these pipes strengthening the safety in the operations. In petrochemicals, the companies say that they use fluoropolymer pipes in over 80% of their solvent recovery and management systems, which indicates how much they depend on the materials. This nature of fluoropolymer can further withstand up to a temperature o ranging -200 – 260 degrees with the proper operations, thus making them essential at the extreme. Furthermore, it is estimated that the total global output of fluoropolymers also exists in the vicinity of 340,000 mt which goes in satisfying the construction needs. The water treatment industry too has adopted these pipes and more than 5000 major facilities operating around the World have been using them for a large number of years.

The strong expansion of the pipe segment in the fluoropolymers market is also driven by their use in the food processing industry, where the requirements for cleanliness and chemical resistance are critical. Tobacco companies have installed these pipes in over 10 000 food processing plants for product safety. Company manufactures the pipes for semiconductor business which are used in 70% of the manufacturing processes where on precision and contamination exclusion are required. This expansion is reinforced further by the allocated amounts into R&D where big corporations spend over half a billion dollars each year to develop new technologies and improve existing fluoropolymer technologies. Nevertheless, infrastructure projects in the developing states are estimated to increase global consumption of these bottles and medical plastic pipes per year by 5 million kilometers over the next five years. With all these factors contributing to the growth of industries, even after globalization resurfaced, there was continuity in the application of fluoropolymer pipes which explains the undoubted performance of such pipes and their strategic position on the global stage.

By End Users

Over 53.0% revenue share of the fluoropolymers market continues to come from industrial equipment owing to the its necessity in durable and extreme applications. Equipment manufacturing has no alternative than to incorporate fluoropolymers, like PTFE and FEP, in structures that are exposed to high temperature and strong chemicals. For the year 2023, the total estimated global industrial market demand was roughly 200,000 metric tons, signifying heavy usage in such domains. The chemical processing industry, as the end user, accounts for almost all fluoropolymer usage in over 15,000 chemical factories across the globe, particularly in regards to corrosion resistant linings and seals. As the global chemical industry is worth over $5 trillion, it’s clear that chemists have to use fluoropolymers for protection and extending the life of the equipment. Asia Pacific is the largest regional market for fluoropolymers as a region has no less than 200 million tons of chemicals produced every year in china which needs massive equipment. The fluoropolymers market helps the other sectors in a lot of ways. The other significant market is the global heat exchanger market of about $17 billion which also makes a large use of the fluoropolymers because of their thermal stability.

There are a number of determinants which influence the fluoropolymers market in industrial equipment. As there are an estimated 1.4 billion vehicles in the world, the transportation sector also uses the fluoropolymers for fuel systems and emission control devices owing to its light and tough characteristic. Moreover, the electrical and electronics market valued at more than US$ 5 trillion, fluoropolymers are also utilized for insulation and protection for wiring and components. And with the construction industry’s global infrastructure projects estimated at about $10 trillion, Fluoropolymers are also employed in coatings and sealants for their weather protection properties. The food processing industry, which deals with 1.3 billion tons of food every year, has easy processing of fluoropolymer coated food due to its oil and fat resistant. In line with the industrial machinery market that is set to grow to $800 billion by 2025, fluoropolymer demand will surge. The interest of the European industrial sector in adopting fluoropolymers that is around $2 trillion worth in economic output is undiminished in order to be able to fulfill more ICS regulatory requirements of efficiency and safety. Due to the ever-increasing quest of industries to improve their productivity and lower their maintenance expenses, the use of fluoropolymers in the industrial machinery is bound to be core to the business.

To Understand More About this Research: Request A Free Sample

Regional Analysis

The Asia-Pacific region is positively a stronghold in the fluoropolymers market because of its growing industrial expansion. In the automotive category alone, fluoropolymers find their applications in use in more than over 10 million vehicles every year, which increases the demand for such structures in the region. In this dominant industry of production, Asia-Pacific alone consumes the fluoropolymer in manufacture of over 6 billion devices and can be customized in different ways every year. The construction sector is also active in this aspect with any infrastructural task adding more than 20,000 new buildings with materials comprising fluoropolymers annually. Supported by a large number of more than 500 fluoropolymer factories that are all operating, the region is also quite advanced in its manufacturing sector. Against such a background there is also very large annual expenditure on infrastructure amounting to about $1 trillion and therefore more demand of such structures in the region. These combined helps explain the reason why Asia Pacific has remained as the strongest region for the fluoropolymers market.

In North America, the fluoropolymers market finds strength in its advanced technological applications and industrial prowess. The region has over 200 major research institutes that seek to develop more applications for the use of fluoropolymers, especially in the aerospace and defense industries. For example, every year within the aerospace industry, aircrafts are produced where fluoropolymers are used in more than 1000 between these aircrafts manufactured each year. Furthermore, the medical field an active sector in the consumption of fluoropolymers for devices and implants publishes over 50 million medical operations performed every year that involve these materials. The processing of materials on the other hand a significant user has more than 100 units that deal with piping systems directly which use fluoropolymer materials for their anti-corrosion properties. Ranked with $500 billion worth of industry output t every year clearly shows that the region is the center of the segments. In addition, the market is guaranteed to reveal new developments and the efficiency of the supply chain as there are more than 150 core participants in the market.

The fluoropolymers market within Europe is focused on high-performance applications and takes into consideration environmental issues. The automotive sector, which constitutes a major segment, produces more than 15 million cars every year, substantial percentage of which contains fluoropolymer parts to improve fuel efficiency. In renewable energy, particularly in wind turbines, over five thousand fluoropolymers are used in yearly operations. The region is termed industrialized largely due to the presence of more than 300 chemical plants in which a lot of fluoropolymers are used to bolster Europe’s industrial base. In addition, the over 10 billion medication units produced each year by the pharmaceutical industry depends on fluoropolymers to provide packaging which is much safer. Investment of about $700 billion yearly on R&D on a variety of spheres shows the level of determination of Europe to place more uses on fluoropolymer than currently available. With such commitment to innovation coupled with thorough and robust regulatory mechanisms driving the use of advanced materials, Europe stands to retain relevant market share in this particular segment of the global market.

Top Companies in Global Predictive Maintenance Market:

- 3M

- Arkema Group

- Asahi Glass Co, Ltd.

- Daikin Industries, Ltd.

- Dongyue Group

- Dow Dupont, Inc.

- Ensinger Inc.

- Gujarat Fluorochemicals Ltd.

- Halopolymer, OJSC

- Honeywell International Inc.

- Hubei Everflon Polymer CO., Ltd.

- Itaflon Srl

- Jiangsu Meilan Chemical Co., Ltd.

- Juhua Group Corporation

- Kureha Corporation

- L. Gore & Associates, Inc.

- Lee & Man Chemical Company Limited

- Polyfluor Plastics bv

- Saint-Gobain S.A.

- Shandong Hengyi New Material Technology Co., Ltd.

- Shanghai Huayi 3F New Materials Co., Ltd.

- Solvay S.A.

- The Chemours Chenguang Fluoromaterials (Shanghai) Co., Ltd.

- The Chemours Company

- Zeus Industrial Products, Inc.

- Other Prominent Players

Market Segmentation Overview:

By Type:

- Ethylene tetrafluoroethylene (ETFE)

- Fluorinated Ethylene-Propylene (FEP)

- Fluoroelastomers

- Perfluoroalkoxy alkanes (PFA)

- Polychlorotrifluoroethylene (PCTFE)

- Polytetrafluoroethylene (PTFE)

- Polyvinyl Formal (PVF)

- Polyvinylidene Fluoride (PVDF)

- Others

By Form:

- Dispersion

- Granular

- Powder

By Application:

- Additives

- Film

- Membrane

- Pipe

- Roofing

- Sheet

- Tube

- Others

By End-user:

- Transportation Equipment

- Automotive Vehicles

- Aerospace

- Others

- Electrical and Electronics

- Wire and Cable

- Batteries

- Others

- Construction

- Industrial Equipment

- Chemical and Pharmaceutical Equipment

- Semiconductor Manufacturing Equipment

- Other Industrial Process

- Household

- Construction

- Medical Equipment

- Others

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- Western Europe

- The UK

- Germany

- France

- Italy

- Spain

- Rest of Western Europe

- Eastern Europe

- Poland

- Russia

- Rest of Eastern Europe

- Western Europe

- Asia Pacific

- China

- India

- Japan

- Australia & New Zealand

- ASEAN

- Rest of Asia Pacific

- Middle East & Africa (MEA)

- UAE

- Saudi Arabia

- South Africa

- Rest of MEA

- South America

- Argentina

- Brazil

- Rest of South America

View Full Infographic

REPORT SCOPE

| Report Attribute | Details |

|---|---|

| Market Size Value in 2022 | US$ 8.56 Bn |

| Expected Revenue in 2031 | US$ 12.50 Bn |

| Historic Data | 2019-2022 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Unit | Value (USD Bn) |

| CAGR | 4.3% |

| Segments covered | By Type, Form, Application, End-user, By Region |

| Key Companies | 3M, Arkema Group, Asahi Glass Co, Ltd., Daikin Industries, Ltd., Dongyue Group, Dow Dupont, Inc., Ensinger Inc., Gujarat Fluorochemicals Ltd., Halopolymer, OJSC, Honeywell International Inc., Hubei Everflon Polymer CO., Ltd., Itaflon Srl, Jiangsu Meilan Chemical Co., Ltd., Juhua Group Corporation, Kureha Corporation, L. Gore & Associates, Inc., Lee & Man Chemical Company Limited, Polyfluor Plastics bv, Saint-Gobain S.A., Shandong Hengyi New Material Technology Co., Ltd., Shanghai Huayi 3F New Materials Co., Ltd., Solvay S.A., The Chemours Chenguang Fluoromaterials (Shanghai) Co., Ltd., The Chemours Company , Zeus Industrial Products, Inc., Other Prominent Players |

| Customization Scope | Get your customized report as per your preference. Ask for customization |

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

| Report ID: AA0222139 | Delivery: 2 to 4 Hours

| Report ID: AA0222139 | Delivery: 2 to 4 Hours

.svg)