India Data Center Market: By hardware (Servers (Blade servers, Rack servers, Tower servers, Micro servers), Storage Systems (Storage Area Network (SAN), Network-Attached Storage (NAS), Direct-Attached Storage (DAS), Cloud storage), Power and Cooling Systems (Power Supply, Uninterruptible Power Supply (UPS) systems, Generators, Power distribution units (PDUs), Cooling Solutions, Air conditioning units, Liquid Cooling Systems, Advanced Cooling Technologies), Racks and Enclosures (Open frame racks, Enclosed Racks, Customized Enclosures); End Users (IT and Telecom, Banking, Financial Services, and Insurance (BFSI), Healthcare, Government, Manufacturing, and Others); Region—Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2025–2033

- Last Updated: 22-Sep-2025 | | Report ID: AA0724871

Market Scenario

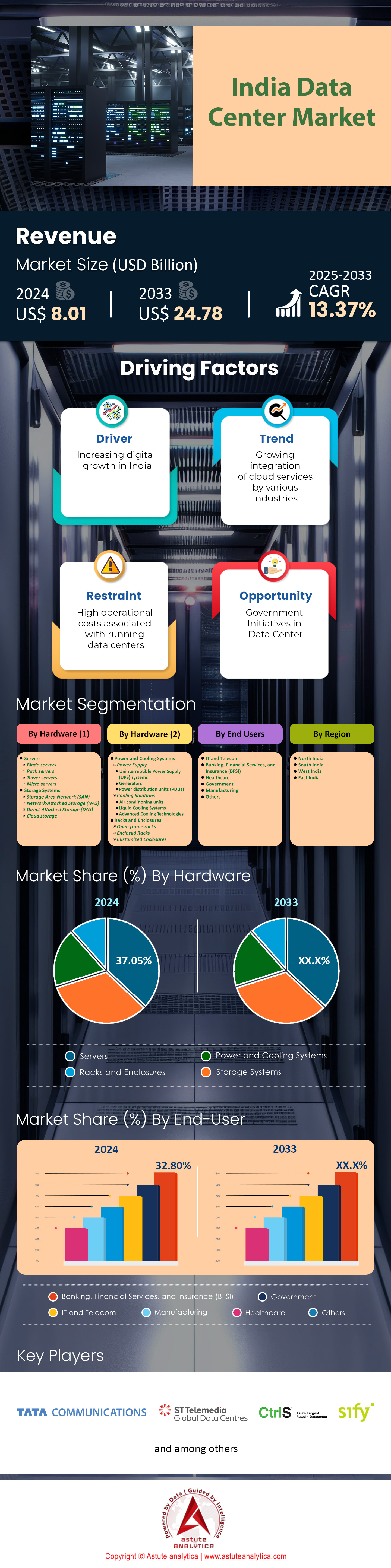

India data center market was valued at US$ 8.01 billion in 2024 and is projected to hit the market valuation of US$ 24.78 billion by 2033 at a CAGR of 13.37% during the forecast period 2025–2033.

Key Findings Shaping the Market

- Based on hardware, servers accounted for more than 37.05% of the total revenue in the India market

- Based on end users, Banking Financial Services and Insurance (BFSI) sector is the biggest end users with over 32.80% market share.

- West India capture over 44% market share.

- India data center market is expected to grow at CAGR of 13.37% to reach valuation of US$ 24.78 billion by 2033.

India’s data center market is surging to unprecedented heights, driven by powerful forces of AI and cloud adoption. In 2024 alone, the market absorbed a massive 407 MW of IT capacity, with an aggressive forecast projecting an additional 600 MW surge in 2025, fueling one of Asia’s fastest-growing digital infrastructures. Transactions in the first half of 2024 alone accounted for around 200 MW of IT capacity, while the second half saw an additional absorption of 122 MW. Such robust activity signals a deeply rooted need for digital infrastructure among enterprises and hyperscalers.

The primary catalyst for a significant portion of upcoming demand in the India data center market is Artificial Intelligence. Cloud Service Providers have already pre-committed an astounding 800 MW of future capacity exclusively for AI workloads. The dedicated AI demand is anticipated to be between 650-800 MW from 2024 to 2026. The immense power requirement of these technologies is a key consideration, as training a single high-end AI model can consume 30 MW. This demand translates directly into physical space, with the sector projected to require 10 million sq ft of real estate by 2026.

Supporting this explosive growth are powerful government initiatives and strategic investments. The government's USD 1.16 Billion investment in AI development and the allocation of INR 10,300 crore to the IndiaAI Mission create a fertile ground for innovation and infrastructure needs. Furthermore, Amazon Web Services (AWS) is investing $12.7 billion to expand its presence, while Google's development of a 381,000 sq ft facility in Navi Mumbai, set for a 2025 completion, underscores the scale of hyperscaler commitment to the region.

Discovering India's Premier Data Centers and Key Industry Titans

The digital infrastructure landscape in India is expanding at a remarkable pace, raising questions about its scale and key operators. When considering how many data center in India exist, as of 2025, the nation is home to approximately 121 active colocation data centers. This number is rapidly growing as numerous new projects are under construction to meet the country's surging digital consumption, cloud adoption, and AI processing needs. The India data center market is not just growing in number but also in sophistication, with facilities being developed to global hyperscale standards.

A diverse and competitive field of data center companies in India is driving this expansion. The top data center companies in India include a mix of global giants and strong domestic players. Leaders like STT Global Data Centres India, with a 400 MW capacity across 30 projects, and CtrlS Data Centers, managing 250 MW over 20 projects, are significant forces. Other major operators include NTT Communications (268 MW), Nxtra Data by Airtel (over 200 MW), and Yotta Data Services (434 MW), each making substantial investments to scale their operations and capture market share.

Identifying the single largest data center in India data center market often points to Yotta's NM1 facility in Panvel, Navi Mumbai. Recognized as one of the world's largest Tier IV data centers, it was designed with an ultimate capacity of 7,200 racks and 50 MW of IT power. The title of the biggest data center in India is a dynamic one, as companies like AdaniConneX and Google are developing massive hyperscale campuses. Google's planned 1 GW campus in Visakhapatnam, for instance, signals the monumental scale of future developments that will continue to redefine the upper limits of data center size and capacity in the nation.

To Get more Insights, Request A Free Sample

Unlocking Future Growth in India’s Evolving Data Center Market Landscape

- The Green Transition to Sustainable Digital Infrastructure

There is a monumental shift towards sustainability, creating a demand for green data centers. Opportunities abound in developing facilities powered by renewable energy, with a growing number of operators signing long-term Power Purchase Agreements (PPAs) for solar and wind energy. In 2024, data centers accounted for over 1.5 GW of renewable energy contracts. Investment through green bonds for financing sustainable data center projects is also gaining traction, with more than $500 million in green financing raised in 2024 for Indian digital infrastructure projects. Companies achieving low Power Usage Effectiveness (PUE) ratings below 1.4 command a premium, opening a market for energy-efficient technologies and operational expertise. - The Rise of High-Density and Liquid Cooling Solutions

The AI revolution necessitates a move towards high-density racks that current air-cooling technologies cannot efficiently manage. A significant opportunity in the India data center market lies in deploying advanced liquid cooling solutions, including direct-to-chip and immersion cooling. The demand for these technologies is projected to surge, with related infrastructure spending expected to exceed $200 million by 2025. Data centers capable of supporting rack densities above 30 kW are becoming essential. Developing expertise and offering solutions in a "cooling-as-a-service" model presents a lucrative new revenue stream for specialized providers.

Top 2 Core Drivers Defining Market Demand

Digital Public Infrastructure and 5G Create Unprecedented Data Velocity and Volume

India's world-class Digital Public Infrastructure (DPI) and the rapid rollout of 5G are generating data at a colossal scale, fundamentally reshaping demand in the India data center market. The Unified Payments Interface (UPI) is a primary driver, with monthly transactions regularly exceeding 14 billion in 2024. Projections show UPI is on track to process over 2 billion transactions per day by 2028. Concurrently, the number of 5G subscribers in India surpassed 150 million in early 2025. Each 5G user is expected to consume over 40 gigabytes of data monthly by the end of 2025.

These platforms create a continuous, high-velocity stream of data requiring real-time processing and secure storage. The Aadhaar system processed over 80 million authentication requests daily in 2024, while the DigiLocker platform now serves over 250 million registered users. The number of active FASTag devices for electronic toll collection exceeded 85 million in 2024, generating millions of daily transaction records. Furthermore, the number of connected IoT devices in India is forecasted to reach 5 billion by the end of 2025, creating a massive new wave of data from sensors and smart devices that require localized processing power.

OTT Media and Online Gaming Boom Drives Low-Latency Infrastructure Demand

The explosive growth of digital entertainment, specifically Over-The-Top (OTT) media and online gaming, is carving out a distinct and critical demand segment within the India data center market. The number of active online gamers in India is projected to exceed 650 million by 2025. In parallel, the country's paid OTT subscriber base crossed 120 million in early 2025, with a significant portion subscribing to multiple services. The average daily time spent on OTT platforms surpassed 90 minutes per user in 2024, driving immense data consumption. The total number of hours of regional OTT content produced in 2024 grew by over 1,500 hours.

The India data center market is intensely sensitive to latency, creating a non-negotiable requirement for edge data centers and robust Content Delivery Networks (CDNs). India’s esports audience size is forecasted to grow to over 50 million viewers by 2025, an activity where milliseconds of delay can impact outcomes. Consequently, investments in edge computing infrastructure are rising, with over 30 new edge locations planned for 2025. The number of cloud gaming users also saw a substantial increase, reaching over 15 million in 2024. Data consumption for video streaming alone accounted for over 12 exabytes of data in 2024, mandating high-performance infrastructure to ensure a seamless user experience.

Segmental Analysis

BFSI Sector's Dominance Quantified by Transactions and Spending

The BFSI sector's leadership position in the India data center market with over 32.80% is vividly illustrated by its staggering digital transaction volumes. In fiscal year 2025, the Unified Payments Interface (UPI) alone processed over 11,761 crore transactions valued at ₹180.24 lakh crore, all of which require robust data center processing and storage. The total volume of all digital transactions surged by 34.8% in the same period, reaching a total value of Rs 2,862 lakh crore, highlighting the immense data load generated by the financial sector. This growth in digital payments is a primary driver for the sector's 18% share in data center user demand.

- The BFSI sector's market capitalization has surged over 50 times in two decades, from Rs 1.8 trillion in 2005 to Rs 91 trillion in 2025.

- Digital payments in India are projected to have over 130 billion transactions by the end of 2025.

- The total IT spending in India is projected to reach US$ 138.9 billion in 2024, with the BFSI sector being a major contributor to data center systems spending.

The financial industry's commitment to digital transformation extends beyond transaction processing to significant investments in IT infrastructure. Data localization regulations compel BFSI firms in the India data center market to store sensitive financial data within India, further fueling the demand for domestic data center capacity. This regulatory push, combined with the sector's continuous innovation in areas like online banking, AI-driven analytics, and fraud detection, ensures its sustained, high-volume consumption of data center resources. The market for AI in the BFSI industry was valued at USD 20 billion in 2022 and is forecasted to grow, indicating future needs for high-density, powerful data centers.

Customize This Report + Validate with an Expert

Access only the sections you need—region-specific, company-level, or by use-case.

Includes a free consultation with a domain expert to help guide your decision.

Server Hardware Dominance Measured in Racks and Investments

The server segment's significant 37.05% revenue share in the India data center market is a direct result of massive capital deployment and the physical build-out of digital capacity. To meet escalating demand, the planned capex for data centers is expected to surpass Rs 5 lakh crore in the next five years, a substantial portion of which is dedicated to server procurement. The demand for high-performance computing to handle AI workloads is pushing average rack densities from a previous average of 8-10 KW/rack towards 30 KW/rack, requiring more advanced and powerful servers. This hardware revolution is reshaping facility design as operators pivot to support racks that could exceed 100 kW.

- Hyperscalers like Google, AWS, and Microsoft are expected to drive 80% of the market growth between 2024 and 2027, focusing heavily on server infrastructure.

- To support new AI hardware, facilities are being upgraded for higher floor loads, increasing from legacy standards to between 2,200-2,500 kg/m2 .

- "Make-in-India" initiatives are gaining traction, with companies like Netweb Technologies launching advanced servers powered by AMD EPYC processors to boost local manufacturing.

The sheer scale of investment in the India data center market underscores the server's central role. Between 2019 and 2024, the industry attracted investment commitments of approximately $60 billion, with a significant amount allocated to hardware. Global technology giants are increasingly adopting an "own-and-operate" model, allowing for greater control over their server infrastructure. For instance, Google is developing a 381,000 sq ft, 8-story data center in Navi Mumbai, set for completion by 2025, which will be filled with server racks to power its cloud services.

To Understand More About this Research: Request A Free Sample

Mapping India's Regional Data Center Investment and Operations Hubs

Maharashtra: The Unrivaled Leader

The state of Maharashtra, with Mumbai as its anchor, is the undisputed data center capital of India. It commands the largest share of the India data center market, holding over 50% of the country's total data center stock in 2024. This dominance is built on Mumbai's exceptional connectivity, including numerous submarine cable landing stations that provide high-speed international bandwidth, and its status as India's financial hub. In 2024, Mumbai alone accounted for 53% of the total data center absorption in the country and is expected to receive approximately 35% of all upcoming power capacity. The city and its surrounding regions, like Pune, continue to attract massive investments and the highest number of data center facilities, with 61 located in the state.

Tamil Nadu: The Southern Connectivity Giant

Tamil Nadu, with Chennai at its core, has solidified its position as the second most popular India data center market, holding an 18% share of the nation's data center capacity. Chennai's strategic advantage lies in its extensive network of undersea cables, second only to Mumbai, offering robust connectivity to East Asia. The state is a preferred destination for hyperscalers and colocation providers, attracting significant investment commitments. As of 2024, Tamil Nadu has 29 data centers and is poised for substantial growth, with projections indicating it will receive a major portion of the 795 MW of new capacity expected in India by 2027.

Telangana and Karnataka: The Tech-Driven Hubs

Telangana, particularly its capital Hyderabad, is a rapidly emerging tech hub attracting significant data center investment in the India data center market. The state's proactive government policies, offering incentives like power subsidies and fast-tracked clearances, have made it highly attractive. Both Telangana and the neighboring state of Karnataka, home to India's Silicon Valley, Bengaluru, each host 24 data centers. These states benefit from a deeply entrenched IT ecosystem, with a large presence of major tech companies and a skilled workforce. In 2024, Hyderabad saw a 14% share of national absorption, and both it and Bengaluru are witnessing major land acquisitions for future data center development.

Uttar Pradesh and Delhi-NCR: The Northern Powerhouse

The National Capital Region (NCR), encompassing Delhi, Noida, and Gurgaon, serves as the primary data center hub for North India. Uttar Pradesh, particularly Noida, is a significant part of this cluster, with 21 data centers located in the state. The region benefits from its large consumer base and proximity to numerous industrial and commercial hubs. The installed IT capacity in the NCR is projected to grow from 61 MW in 2023 to 260 MW by 2026, driven by strong demand from cloud service providers and the rise of edge data centers.

Top Players in India Data Center Market

- Tata Communications Ltd

- STT GDC INDIA Pvt Ltd

- Datacenters Ltd

- Sify Technologies

- Netmagic Solutions Pvt Ltd

- Web Werks India Pvt Ltd

- ESDS Software Solutions Ltd

- NxtGen Datacenter and Cloud Technologies Pvt Ltd

- GPX India Pvt Ltd

- Yotta Data Services Pvt. Ltd

Market Segmentation Overview:

By Hardware

- Servers

- Blade servers

- Rack servers

- Tower servers

- Micro servers

- Storage Systems

- Storage Area Network (SAN)

- Network-Attached Storage (NAS)

- Direct-Attached Storage (DAS)

- Cloud storage

- Power and Cooling Systems

- Power Supply

- Uninterruptible Power Supply (UPS) systems

- Generators

- Power distribution units (PDUs)

- Cooling Solutions

- Air conditioning units

- Liquid Cooling Systems

- Advanced Cooling Technologies

- Power Supply

- Racks and Enclosures

- Open frame racks

- Enclosed Racks

- Customized Enclosures

By End Users

- IT and Telecom

- Banking, Financial Services, and Insurance (BFSI)

- Healthcare

- Government

- Manufacturing

- Others

By Region

- North India

- South India

- West India

- East India

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

.svg)