Global Data Center Market: By Component (Solution and Services); Type (Co-location, Hyperscale, Edge, and Other); Enterprise Size (Small and Medium-Sized Enterprises (SMEs), Large Enterprises); Industry (Banking, Financial Services & Insurance (BFSI), Information and Communication Technology, Government Agencies, Energy & Utilities, Healthcare, and Other); Region—Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2025–2033

- Last Updated: Dec-2024 | Format:

![pdf]()

![powerpoint]()

![excel]() | Report ID: AA0424804 | Delivery: 2 to 4 Hours

| Report ID: AA0424804 | Delivery: 2 to 4 Hours

Market Dynamics

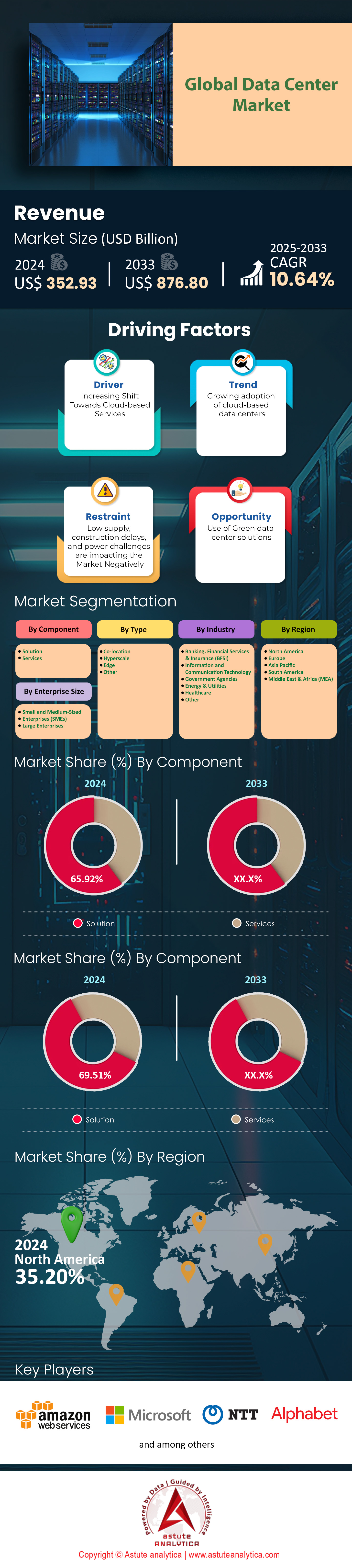

Data center market was valued at US$ 352.93 billion in 2024 and is projected to hit the market valuation of US$ 876.80 billion by 2033 at a CAGR of 10.64% during the forecast period 2025–2033.

The expansion of the data center economy can be attributed to the growing popularity of cloud offerings, online AI compute workloads, and the enterprise-wide emphasis on digital transformation. This expansion is corroborated by the present data center market which is noted to have an estimated power capacity of over 30 gigawatts (GW), a figure that encompasses both co-located and hyperscale storage facilities. This trend is especially evident at a global level, where the data center industry is established to be consuming over 536 terawatt-hours (TWh) of energy by the 2024 calendar year accounting to about 2% of the total energy usage of the entire world. According to estimates available, this number will likely surpass 857 TWh when compounding growth of 19.5% is observed through 2028.

The data center market is evolving due to AI and high-end computing, which are predicted to account for the majority of the industry’s growth liquidity. AI workloads will account for about a-third of global data center electricity usage in 2030, as they’re expected to expand at a remarkable CAGR of 44.7% from a modest share today. AI-ready data centers are set to constitute approximately 70% of the total demand, which could peak at an astonishing 171 to 219 GW by 2030. Infrastructure amortization looks massive too, as this new additional IT load should, by 2030, entail up to $250 – $300 billion estimate. The United States leads this upward trend, as data centers forecasted to expand their share of total electricity consumption domestically to 9% by 2030, a 55% leap from 4% consumed in 2023.

It has become apparent that sustainability and energy efficiency are of great importance for data centers. As of 2024, data centers consumed around 3% of the electricity and accounts for around 2% of carbon emissions, which is almost the same as the aviation industry. To combat these issues, the industry is advocating for a faster transition to renewable sources and better cooling mechanisms. According to statistics, more than 50% of all data centers intend to use solar energy to meet their energy needs, and more than 25% will have added wind energy solutions. Furthermore, considerable attention in the data center market is now being given to new solutions in cooling technologies, for example, liquid cooling for efficient management of higher density computing.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Rapid Increase in Data Center Demand

The demand for data center market is increasing as an effect of greater demand for technologies and applications that are data-intensive. In 2023, the US still comprises a large portion of the global data center landscape and is estimated at roughly 35% of the world’s market share. The tooling up trends for the data centers in the U.S. are continuing as they have recorded figures approaching 70 billion kilowatt-hours (kWh) in regards to annual consumption with new needs for compute and storage being the main driver. Due to the need of minimizing data latency, edge computing has quickly become a key factor in this development as it seeks to lessen the data latency. With the growth shown in 5G technology and the large scale of expected IoT devices — over 30 billion devices by 2025 — this edges the global edge computing market to $15.7 billion by 2025. Also, the spending on cloud IT infrastructure is increasing, reaching over $80 billion worldwide in 2022, with expectations that this figure will rise to over $100 billion by 2025.

There’s an increasing interest in data center REITs (Real Estate Investment Trusts) among investors as these investment vehicles are considered to provide a good exposure to this growing data center market. Digital Realty Trust (DLR), one of the top tier data center REITs, has experienced stellar growth with huge appreciation in its market valuation over the last ten years. In particular, the India data center industry, which is anticipated to grow at a CAGR above 8% from 2023 to 2028, has a lot of room for development. Additionally, the sector has also been adopting automation and artificial intelligence (AI) to streamline their operations, improve their energy efficiency, and foster innovation.

Challenge 1: Highly Competitive Market with Established Players

The competition in the data center market is fierce with many well-known companies having a large portion of the market. For example, a large share of the data center market is held by the top 10 providers in the US, who collectively account for over 50% of the market, leaving little room for new players. This much market control calls for major differentiation on the part of the participants who want to enter this segment. For instance, by offering services targeted at the unserved regions, or introducing high end computing services or providing services for specific industries. Competing on prices alone is dangerous since it severely eats off margins and questions the long term sustainability of the industry.

Moreover, the acquisition of data centers in hubs such as Northern Virginia, with vacancy rates below 5%, is proving to be difficult due to real estate limitations. Furthermore, power and tighter environmental standards only add to the issue by making development of new data centers costly and the market introduction of such centers impractical. New technologically advanced data centers require an enormous investment not only in the land but also in effective construction and efficient machinery. These set of expenses prevent smaller businesses from possibly competing against larger ones that are already in the market.

The data center market landscape is evolving with the emergence of hyperscale cloud providers such as Amazon Web Services (AWS), Microsoft Azure, and Google Cloud. These companies are continuously expanding the emergence of hyperscale data centers or using their bargaining position which puts stress on the existing data center operators. In order to remain competitive, these operators have no option but to adapt by ensuring they provide additional services, increasing available connectivity options, and providing solutions curated for the specific customer.

Challenge 2: Significantly High Power Consumption Puts More Stress on Capital Expenditure

Data center market has also been seen to consume large amounts of energy to power servers offer efficient cooling. In 2023, it is estimated that the energy consumption of data centers is pegged 240 to 340TWh which translates to about 0.87 billion kwh per capita. In the US data centers are seen to consume around 70 billion kwh a year which is 2.0% out of the total recorded energy consumption in the country over a single year. In contrast, data centers industry as a whole consumed 1,100 TWh or approximately 1% of the world's total power consumption according to Global Electricity Review 2020. Today, data centers have a high power usage level for an ample reasons including continuous server operation, which is accompanied by the use of cooling systems which aim to reduce the heat emitted by the devices. Although IT devices have benefitted from new technology in terms of energy efficiency, the use of AI applications and data driven workloads has the potential to empede and undermine this technological advancement due to their high computational efficiency. As an example, teaching an AI model that is large requires a similar amount of power that would be consumed by hundreds of houses in a single year.

In order to tackle these issues, a number of operators of data center market are shifting towards the use of renewable power and energy efficient technologies. Such companies as Google or Microsoft are striving for carbon neutrality and are looking into alternative means of cooling, such as liquid and free cooling. On the other hand, meeting the enormous energy needs while producing clean energy is still a challenge that will require major capital and team-up with energy suppliers.

Segmental Analysis

By Component

By component, solutions segment captured more than 65% revenue share of the data center market. Due to the widespread use of IoT devices, enterprise level data storage moved to the cloud, and Artificial Intelligence technology became mainstream. As a result, the amount of data created has skyrocketed. In 2023, the number of Internet of Things (IoT) devices alone will total more than 29 billion worldwide, further complicating global data consumption patterns. It requires new, high-performance data center solutions that can accommodate and process large quantities of information. Expanding infrastructure capability of data center market to facilitate data generation has resulted into major technology companies spending extensively. To improve its cloud services, for example, Microsoft has said it plans to build between 50 and 100 new data centers every year. In addition, the data center industry's energy consumption has become a central issue: facilities represented around 1% of the world's electricity consumption in 2023. This has led to a movement toward green energy solutions and a shift away from traditional energy sources.

According to IBM's Cost of a Data Breach Report, the average cost of a data breach reached a staggering $4.45 million, making cybersecurity a critical issue. Therefore, companies in the data center market are looking into adopting reliable security measures in their data centers. In addition, AI is helping to optimize data center infrastructure as AI-based cooling systems save energy by almost 40%. The use of low latency 5G networks, that are expected to have over 1.5 billion connections by the end of the year, will also stimulate the need for cutting edge data center solutions to deal with the additional data loads.

By Type

The hyperscale segment continues to hold a significant share in the data center market with revenue share of 35.14% in 2023. Operated by cloud services such as Amazon, Microsoft, Google, Meta, Apple, Alibaba, and Tencent, the hyperscale data center are crucial in expanding and supporting the global cloud platform. The number of centers has crossed the mark of 700 around the globe. With the data demands increasing more and more in the market, such large expansion was important so that they could be catered to. Now looking towards the modular data centers which are now being accepted into the market as building blocks. These building blocks help the larger global players to target the data center market instantly and help reduce the outflow of costs as well. Construction speed aims to be increased with the help of these centers. Modula is making strides in the market and is seeing growth as well due to the global need for efficiency and flexibility. Ideal customer locations in population marks for greater service and when changes are required, the capacity boosts are quick to provide enhancements.

Technological advancements and location have made cities such as Mumbai, Singapore, Amsterdam, and Dublin, known as the ‘four tech cities’, emerge as leading regions for hyperscale activity in the data center market. As these regions have been estimated to host a boom in hyperscale data centers. It’s expected that Mumbai will turn into a data hub by doubling its data center capacity within the time span of 2 years. On the other hand, the great Indian digital revolution will also play a major role in this growth. Furthermore, environmental issues have prompted hyperscale investors to invest in clean energy to operate their buildings and strive for carbon targets, giving a boost to the dominance of hyperscale data center segment.

By Enterprise Size

Large enterprises are the primary consumers of data center market, making up over 69% of the global market and driving significant growth in 2023. These organizations leverage digital technologies like cloud computing, big data analytics, and IoT to enhance operations, necessitating robust support systems for efficiency. The sheer volume of data generated has skyrocketed, with global data creation projected to reach over 180 zettabytes by 2025, up from 79 zettabytes in 2021.

Building and managing in-house data centers remains expensive and complex, prompting businesses to increasingly rely on third-party providers offering scalable, secure, and efficient solutions. In 2023, it's estimated that over 50% of enterprise workloads are now running in the cloud, highlighting a significant shift from traditional infrastructure. Enterprises seek agility and cost savings, leading to rapid migration of workloads to cloud environments provided by services like AWS, Azure, and Google Cloud. Moreover, large enterprises in the data center market are adopting multi-cloud strategies, utilizing an average of two public clouds and three private clouds to optimize performance and reduce risk. Approximately 92% of enterprises have implemented a multi-cloud approach in 2023. Investment in cloud services continues to rise, with enterprise spending increasing by 35% year-over-year in the first quarter of 2023. This upward trend is expected to persist, as companies plan to further elevate their cloud budgets to support ongoing digital transformation initiatives.

By Industry

The ICT industry (information and communication technology) has the potential to play a big role in the data center market. It's projected to hold a revenue share of 33.49%. The most significant end-users of data centers infrastructure are internet, software, and hardware companies in the ICT sector. With digital technologies such as IoT, AI, 5G networks and cloud computing growing faster than ever before, these companies need increasingly more processing power and storage capacity. So much so that they’re driving rapid expansion in construction and leasing activity all over. Today, global internet traffic has grown in size by 20 times since 2010 thanks to streaming services like video streaming, social media sites, and mobile applications. These large ICT companies rely on data centers to store and process this massive influx of data. But out of all the different digital technologies I listed earlier, cloud computing is the main driver behind their demand for more storage capacity. They're migrating workloads away from on-premises infrastructure towards cloud platforms operated by Amazon, Microsoft, Google etc... This is most evident when you see the first quarter year-over-year growth of the global cloud IT infrastructure market at 35%.

Telecom operators around the world data center market are also investing significant sums into creating more data centers to support 5G network rollout. In order for it be successful there needs to be dense computing infrastructure at low-latency applications like remote surgery or autonomous vehicles would never work. As blockchain innovation continues along with machine learning and virtual/augmented reality we are seeing new ways that require specialized data center infrastructure come about every day. Bitcoin mining consumes quite a bit of power just due to its nature alone. Its estimated electricity consumption in 2022 is expected to hit as high as 110 TWh which would be nearly a 20-fold increase since 2016.

When it comes to building and operating data centers it’s really hard for smaller firms to compete with those larger firms that have the backing of the ICT industry. They are able to do it with greater speed and efficiency as well as invest more heavily into renewable energy sources and other sustainable technologies to be able to follow regulations better. Because of this, they’re also now the largest consumer and operator within the global data center market which is changing everything about it.

To Understand More About this Research: Request A Free Sample

Regional Analysis

Compared to the rest of the regions, North America with over 35% market share, on the other hand, remains key to the global data center market. Conversely, however, limitations on supply as a result of power shortages in key areas and the lack of land options are pushing growth in secondary and emerging regions like Yorkville, Illinois, and Fort Worth, Texas. The industry is transitioning from the expansion of power subs to the installation of data centers close to the power source. In terms of sustainability, major expansions are taking place, but first and foremost, AWS, Google, Meta, and Apple were the most advanced in the use of green energy meeting their needs by 100%. In addition, technological innovations are moving to the front as the market for higher- density computing continues to demand increased progress in liquid cooling technologies. Of great significance, work with AI is projected to triple the workload of hyperscale data centers within six years. Efforts across the sector to reach data center neutrality by 2030 underline the commitment to sustainable development in the face of growing digital requirements.

The global data center market is transforming, and mobile evolution together with the growing trend towards digitalization acts as the catalyst for this transformation. In the Asia Pacific (APAC) region, the market is the fastest growing, and is poised to become the global epicenter of the data center business within a decade. This development is caused by the increased use of cloud services, big data, IoT and AI ports. For example, in 2023, APAC saw 3.1b users, roughly about 72% of the populations supported internet connectivity. In the region, the number of cellular IoT connections rose to 3.4 billion in late 2023, and this number is predicted to reach near 4 billion by the end of 2024. Also increasing the demand for edge data centers are expanding 5G networks which allow ultra-fast connectivity to these technologies and ensure ultra-reliable wiring.

Much like the global market, the APAC data center market is facing the brunt of high interest rates and renewable energy shortages but nevertheless, it still manages to entice large scale investors. There definitely seems to be a rapid increase in the demand for AI alongside a shift in strategy towards businesses sharing data center facilities in an aim to save costs. There seems to be a clear trend of operators expanding globally as they’d rather look for new opportunities in India and Indonesia than face the overpopulation and power shortages of Singapore or Hong Kong. Latin America too has seen a 38% growth in the power sector during the start of 2024 which hints at global expansion.

Major Players in the Global Data Center Market

- Amazon Inc.

- Dell Technologies

- Digital Realty

- Equinix, Inc.

- Google LLC

- Hewlett Packard Enterprise Development LP

- IBM Corporation

- Microsoft Corporation

- N+ONE Data Centers

- NTT DATA, Inc.

- Oracle Corporation

- SAP SE

- Other Prominent Players

Market Segmentation Overview:

By Component

- Solution

- Services

By Type

- Co-location

- Hyperscale

- Edge

- Other

By Enterprise Size

- Small and Medium-Sized Enterprises (SMEs)

- Large Enterprises

By Industry

- Banking, Financial Services & Insurance (BFSI)

- Information and Communication Technology

- Government Agencies

- Energy & Utilities

- Healthcare

- Other

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- Western Europe

- The UK

- Germany

- France

- Italy

- Spain

- Rest of Western Europe

- Eastern Europe

- Poland

- Russia

- Rest of Eastern Europe

- Western Europe

- Asia Pacific

- China

- India

- Japan

- Australia & New Zealand

- South Korea

- ASEAN

- Rest of Asia Pacific

- Middle East & Africa (MEA)

- Saudi Arabia

- South Africa

- UAE

- Rest of MEA

- South America

- Argentina

- Brazil

- Rest of South America

View Full Infographic

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

| Report ID: AA0424804 | Delivery: 2 to 4 Hours

| Report ID: AA0424804 | Delivery: 2 to 4 Hours

.svg)