India Cold Chain Logistics Market: By Technology (Vapor Compression, Blast Freezing, Evaporative Cooling, Programmable Logic Controller, Cryogenic Systems, Other Technologies); Temperature Technology (Chilled and Frozen); Solution (Cold Chain Warehouse/storage, Cold Chain Transport, Automated Temperature Type Handling); Industry (Food and Beverages (Fruit and Vegetable, Meat and Seafood, Dairy and Frozen Dessert, Bakery and Confectionery, Ready-to-eat Meal), Chemical, Pharmaceuticals, Medical, Others); Region— Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2024–2032

- Last Updated: 12-Nov-2024 | | Report ID: AA1124974

Market Scenario

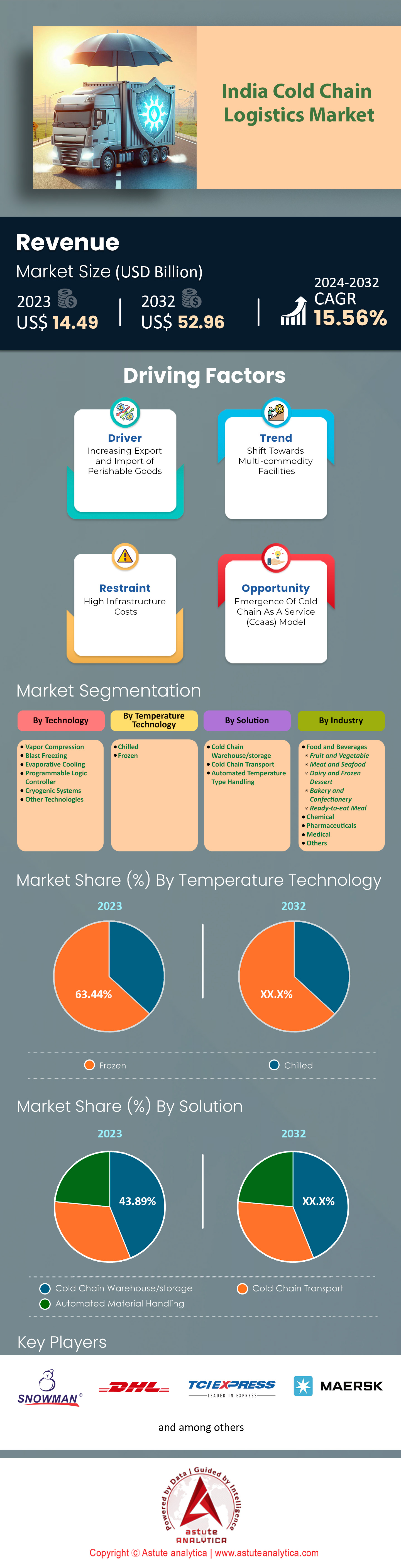

India cold chain logistics market was valued at US$ 14.49 billion in 2023 and is projected to hit the market valuation of US$ 52.96 billion by 2032 at a CAGR of 15.56% during the forecast period 2024–2032.

Cold chain logistics market in India is witnessing a remarkable boom, driven by rising demand across sectors like food and beverage, pharmaceuticals, and agriculture. This growth is underpinned by consumer awareness, government initiatives, and technological advancements. Despite a cold storage capacity of approximately 39.36 million metric tons as of December 2023, growing at CAGR 15%, the sector grapples with challenges like inadequate infrastructure and high energy costs. Over 90% of the market remains fragmented, leading to service inefficiencies.

The Food and Beverage (F&B) industry in India cold chain logistics market heavily depends on robust cold chain logistics to preserve the quality of perishables, including fruits, vegetables, dairy, meat, and seafood. As the world's largest producer of milk and the second-largest producer of fruits and vegetables, India faces significant post-harvest losses, estimated at 40% of total production. The cold chain market in F&B is expanding due to consumer demand for fresh produce, driven by organized retail and e-commerce growth. The segment is set to grow over CAGR of 20% until 2025, highlighting the importance of quality and distribution networks. Technology, including IoT, blockchain, and AI, plays a crucial role in enhancing cold chain efficiency and transparency, positioning the sector for continued expansion.

Despite significant growth, India's cold chain logistics market faces a critical infrastructure gap, particularly in rural and semi-urban areas, where modern storage facilities and refrigerated transport are scarce. The current capacity struggles to meet F&B industry demands, exacerbating post-harvest losses. High setup and maintenance costs deter SMEs from entering the market. However, government support through various schemes aims to bridge these gaps, stabilizing prices and boosting food security. As the industry evolves, integrating advanced logistics systems promises to enhance operations, benefiting the F&B sector by reducing wastage and improving product quality. With strategic investments and technological integration, India's cold chain logistics sector is poised to transform the landscape of food preservation and distribution.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Rising demand for perishable goods necessitating expanded cold chain logistics infrastructure in India

The rising demand for perishable goods in India cold chain logistics market necessitates an expansion of cold chain logistics infrastructure. India produces over 300 million metric tons of fruits and vegetables annually, making it one of the largest producers globally. However, inadequate cold storage facilities lead to post-harvest losses of around 16 million metric tons of fruits and vegetables each year. The dairy industry, producing over 200 million metric tons of milk annually, requires substantial cold storage and transportation to maintain quality and safety.

The seafood sector contributes significantly, with an annual production exceeding 13 million metric tons, necessitating efficient cold chain logistics for both domestic consumption and exports. Meat production also stands substantial at over 8 million metric tons annually, further highlighting the need for robust cold storage solutions. The frozen food market is witnessing rapid growth, valued at over US$ 1,200 million, driven by increasing consumer preference for convenience foods.

To meet this burgeoning demand, the number of cold storage facilities in India cold chain logistics market has grown to over 8,200 units with a combined capacity exceeding 37 million metric tons. Despite this growth, there remains a capacity shortfall of more than 10 million metric tons to adequately serve the market. The government has recognized this gap and has allocated over INR 7,000 crore towards developing additional cold chain infrastructure. Additionally, the refrigerated transport fleet consists of over 10,000 vehicles, which is still insufficient to cover India's vast geography.

Major logistics companies are investing heavily to expand their cold chain capabilities. For instance, Snowman Logistics has increased its capacity to over 100,000 pallet positions. The processed food industry, valued at over US$ 400 billion, continues to demand enhanced cold chain services. E-commerce platforms like BigBasket, Zepto, and Swigy Instamart and Blinkit process over 150,000 orders of perishable goods daily, emphasizing the critical need for robust cold chain logistics to sustain market growth and reduce wastage.

Trend: Adoption of advanced technologies enhancing efficiency in cold chain logistics operations

The adoption of advanced technologies is enhancing efficiency in cold chain logistics market operations across India. Automation in warehouses is becoming prevalent, with over 500 cold storage facilities integrating Automated Storage and Retrieval Systems (AS/RS) to improve efficiency and reduce human error. The implementation of Internet of Things (IoT) devices has enabled real-time monitoring in over 2,000 refrigerated trucks, ensuring temperature compliance during transit.

Blockchain technology is being piloted by companies to enhance traceability, impacting over 1 million transactions annually in the cold chain sector. Artificial Intelligence (AI) and Machine Learning (ML) algorithms are optimizing route planning for refrigerated transport, reducing delivery times and fuel consumption across several hundred logistics routes. Predictive analytics assist over 200 companies in India cold chain logistics market in demand forecasting, minimizing inventory losses and enhancing supply chain responsiveness. Energy-efficient refrigeration systems using natural refrigerants have been installed in over 1,000 cold storage units, reducing energy consumption significantly. Solar-powered cold storage units have been deployed in rural areas, with over 100 units operational, aiding farmers in preserving produce and reducing spoilage. The adoption of Warehouse Management Systems (WMS) has increased, with over 700 warehouses utilizing advanced software for inventory management.

E-commerce giants like Amazon India are investing in temperature-controlled delivery systems, adding over 500 refrigerated delivery vans to their fleet. Mobile applications facilitate better coordination among stakeholders, with over 10,000 users leveraging these platforms for logistics management. These technological advancements collectively drive efficiency, reduce costs, and enhance the reliability of cold chain logistics in India.

Challenge: Insufficient infrastructure leading to gaps in the cold chain logistics network

Insufficient infrastructure is leading to gaps in the cold chain logistics market network in India. Despite having over 8,200 cold storage facilities, the total capacity of approximately 39.37 million metric tons is inadequate to meet the country's requirement of over 50 million metric tons for perishable goods storage. This deficit contributes to substantial post-harvest losses valued at over INR 92,000 crore annually, particularly affecting the agriculture sector. Approximately 30% of agricultural produce spoils before reaching consumers due to inadequate cold chain infrastructure. Rural areas are most affected, with over 70% of farmers lacking access to nearby cold storage facilities. The refrigerated transport sector operates around 10,000 vehicles, which is insufficient for India's vast geography, leading to uneven distribution and accessibility issues for perishable goods.

Investments in cold chain infrastructure have been lagging, with the private sector contributing less than INR 4,000 crore over the past decade to the India’s cold chain logistics market. While the government has allocated over INR 7,000 crore, it is still insufficient to bridge the infrastructure gap completely. The seafood industry alone incurs losses exceeding INR 6,000 crore annually due to inadequate cold storage, affecting livelihoods of over 14 million people dependent on fisheries.

Pharmaceutical losses due to cold chain disruptions amount to over INR 2,500 crore yearly, impacting the distribution of critical medicines and vaccines. Lack of last-mile connectivity is a persistent issue, with over 100,000 villages lacking access to reliable cold chain logistics. Energy shortages and unreliable power supply further hinder cold storage operations, particularly in rural regions. Addressing these infrastructural challenges is imperative to enhance the efficiency and reach of India's cold chain logistics network.

Segmental Analysis

By Technology

Based on technology, vapor compression technology is leading the India’s cold chain logistics market by capturing more than 35.42% market share thanks it being heavily employed due to its efficiency in maintaining precise temperature conditions essential for preserving perishable goods. India produces over 300 million metric tons of fruits and vegetables annually, making it one of the largest producers globally. To reduce post-harvest losses, which amount to over 15 million metric tons each year, the adoption of effective refrigeration technologies like vapor compression is crucial. The technology's ability to maintain temperatures ranging from -30°C to 15°C caters to a wide array of products, including dairy, meat, and pharmaceuticals.

The demand for vapor compression technology is driven by the significant growth of the food processing and pharmaceutical industries. The Indian food processing market is valued at over US$ 400 billion, necessitating advanced cold chain solutions to ensure food safety and extend shelf life. The pharmaceutical sector, valued at around US$ 42 billion, relies on cold chain logistics market for the distribution of temperature-sensitive vaccines and biologics. During the COVID-19 pandemic, India administered over 1.3 billion vaccine doses, highlighting the critical need for reliable cold storage solutions utilizing vapor compression systems.

Key factors behind the dominance of vapor compression technology include government support, technological advancements, and cost-effectiveness. The government has allocated over INR 6,000 crore for the development of cold chain infrastructure, encouraging the use of efficient technologies. India has more than 8,200 cold storage facilities with a combined capacity exceeding 37 million metric tons, most of which employ vapor compression systems. Major logistics companies like Snowman Logistics operate over 300 refrigerated vehicles equipped with vapor compression technology. The scalability of these systems allows for customization to meet various industry requirements, reinforcing their dominance in the market.

By Temperature Technology

Frozen temperature technology is at the forefront of India's rapidly changing cold chain logistics market with over 63% revenue share. This is due to the increasing demand for frozen food products and the need to preserve perishable items for longer durations. The frozen food market in India is projected to surpass valuation of US$ 19.20 billion by 2030 and is experiencing significant growth. With an annual seafood production exceeding 10 million metric tons, much of which is exported, maintaining ultra-low temperatures during storage and transit is essential. The meat industry, producing over 8 million metric tons annually, also relies heavily on frozen temperature logistics to ensure quality and safety.

The higher demand for frozen temperature logistics over chilled technology stems from shifting consumer preferences towards convenience foods and ready-to-eat meals. The consumption of frozen vegetables and snacks in India cold chain logistics market has surpassed 1 million metric tons annually. Additionally, the pharmaceutical industry requires frozen temperature logistics for certain vaccines and biological products. The deployment of over 2,000 ultra-low temperature freezers during the COVID-19 vaccination drive underscores this necessity. Retail expansion, with over 10,000 supermarkets now stocking frozen products, further boosts the demand for frozen logistics solutions.

Astute Analytica’s market analysis indicates that advancements in freezing technology, increased investment, and government initiatives drive the dominance of frozen temperature logistics. The government has sanctioned over INR 5,000 crore for projects focusing on frozen storage facilities. Companies like Dev Bhumi Cold Chain have expanded their infrastructure, adding over 100,000 metric tons of frozen storage capacity. The fleet of refrigerated vehicles capable of maintaining frozen temperatures has grown by more than 3,000 units to support nationwide distribution. Energy-efficient technologies like individual quick freezing (IQF) have reduced operational costs, making frozen storage more economically viable and further solidifying its market position.

By Solutions

Cold chain warehouse and storage solutions are currently leading India's cold chain logistics market by accounting for nearly 44% market share. The dominance is attributed to the pressing need to reduce food wastage and support the growing pharmaceutical sector. India's current cold storage capacity stands at over 39.37 million metric tons. Uttar Pradesh boasts the highest capacity with more than 12 million metric tons, followed by West Bengal with over 6 million metric tons, primarily due to their significant agricultural outputs. Other states like Punjab and Gujarat also contribute substantially, each with capacities exceeding 2 million metric tons.

The dominance of the cold chain warehouse segment in the cold chain logistics market is propelled by the agricultural industry's requirements. Annually, India faces post-harvest losses of over 15 million metric tons of fruits and vegetables. The establishment of over 8,200 cold storage facilities nationwide has been instrumental in mitigating these losses. The government has invested over INR 7,000 crore in developing cold storage infrastructure, recognizing its vital role in food security. The growth of e-commerce and organized retail, with companies like BigBasket and Zepto, Blinkit, and Swiggy Instamart processing over 150,000 orders daily for perishable goods, further amplifies the need for advanced cold storage solutions.

Technological advancements and increased private sector participation have reinforced the segment's leadership. Major cold storage providers like Snowman Logistics have expanded their capacity to over 100,000 pallet positions. The pharmaceutical industry's reliance on cold storage, especially during the distribution of over 1.3 billion COVID-19 vaccine doses, has also contributed to the demand. Improved warehouse management systems and energy-efficient refrigeration technologies have enhanced operational efficiency, making cold chain warehouses a cornerstone of India's cold chain logistics market.

By Industry

Almost 48.08% of the cold chain logistics market demand in India arises from the food and beverage industry due to its vast size and the perishable nature of its products. The industry is valued at over US$ 400 billion, representing one of the largest markets globally. India is the world's largest producer of milk, with an annual output exceeding 200 million metric tons, and a leading producer of fruits and vegetables, with over 300 million metric tons harvested each year. The need to maintain the quality and extend the shelf life of these perishable goods drives the demand for efficient cold chain logistics.

The food and beverage industry's centrality in the cold chain logistics market is further emphasized by the growth of the processed food sector, expected to reach US$ 500 billion by 2025. The consumption of frozen and convenience foods has increased, with frozen food sales surpassing 1 million metric tons annually. India exports more than 5 million metric tons of agricultural produce, requiring reliable cold storage and transportation to retain competitiveness in international markets. The meat and poultry industry, producing over 8 million metric tons annually, also depends heavily on cold chain logistics to meet both domestic and export demands.

The expansion of modern retail outlets, now numbering over 10,000, and online grocery platforms serving over 200 cities, has increased the availability of perishable products, necessitating robust cold chain infrastructure. Government initiatives like the Pradhan Mantri Kisan SAMPADA Yojana have allocated over INR 6,000 crore towards developing the food processing industry and related cold chain facilities. Additionally, significant investments by multinational corporations, totaling over US$ 10 billion in recent years, have fueled advancements in cold storage technologies and logistics. These factors collectively position the food and beverage industry at the center of India's cold chain logistics market.

Customize This Report + Validate with an Expert

Access only the sections you need—region-specific, company-level, or by use-case.

Includes a free consultation with a domain expert to help guide your decision.

To Understand More About this Research: Request A Free Sample

State Analysis

Over 40% of India's cold chain logistics market and storage capacity is concentrated in the Northern region due to a combination of high agricultural productivity, strategic location near major markets, and supportive government policies. States like Uttar Pradesh, Punjab, Haryana, and Himachal Pradesh are leading agricultural producers. Uttar Pradesh, for instance, is the largest producer of potatoes in India, harvesting over 16 million metric tons annually, which necessitates extensive cold storage facilities to prevent spoilage. The state alone has a cold storage capacity exceeding 14 million metric tons as of 2023. Punjab and Haryana collectively produce over 25 million metric tons of food grains each year, along with significant quantities of fruits and vegetables requiring temperature-controlled storage.

The strategic proximity of the Northern region to large consumption markets amplifies the concentration of cold chain facilities in India cold chain logistics market. The Delhi-National Capital Region (NCR), with a population exceeding 33 million people, creates immense demand for fresh and frozen products. This metropolitan area acts as a central hub for distribution across North India. For example, Snowman Logistics operates a cold storage facility in Delhi with a capacity of over 30,000 pallets, facilitating efficient supply to retailers and food service providers. Amul, India's largest dairy cooperative, manages multiple cold storage units in Haryana and Uttar Pradesh, collectively handling over 10 million liters of milk per day to meet regional dairy demands.

Government initiatives have significantly contributed to the development of cold chain infrastructure in the North cold chain logistics market. Under the Pradhan Mantri Kisan SAMPADA Yojana, over INR 2,000 crore has been allocated specifically for cold chain projects in Northern states. The Mega Food Park scheme led to the establishment of the Sukhjit Mega Food Park in Punjab, spanning 55 acres and providing modern cold storage facilities with a capacity of 100,000 metric tons. In Rajasthan, the International Centre for Innovative Agriculture, covering 100 hectares, includes state-of-the-art cold storage units capable of storing 50,000 metric tons of produce. Additionally, the Northern region benefits from over 5,000 kilometers of national highways, enhancing logistics efficiency. Companies like Dev Bhumi Cold Chain Limited in Himachal Pradesh handle over 100,000 metric tons of apples annually, reflecting the area's focus on horticulture and the need for robust cold storage solutions.

Top Players in India Cold Chain Logistics Market

- A.P. Møller – Mærsk

- CEVA Logistics

- Cold Care Group B.V.

- Coldman Logistics Pvt. Ltd.

- Coldrush Logistics Pvt. Ltd.

- ColdStar Logistics Pvt. Ltd.

- Crystal Group

- DHL Group

- Gubba Cold Storage Pvt. Ltd.

- Kool-Ex Cold Chain Limited

- Snowman Logistics Limited

- TCIEXPRESS LIMITED

- Other Prominent Players

Market Segmentation Overview:

By Technology

- Vapor Compression

- Blast Freezing

- Evaporative Cooling

- Programmable Logic Controller

- Cryogenic Systems

- Other Technologies

By Temperature Technology

- Chilled

- Frozen

By Solution

- Cold Chain Warehouse/storage

- Cold Chain Transport

- Automated Temperature Type Handling

By Industry

- Food and Beverages

- Fruit and Vegetable

- Meat and Seafood

- Dairy and Frozen Dessert

- Bakery and Confectionery

- Ready-to-eat Meal

- Chemical

- Pharmaceuticals

- Medical

- Others

By State

- North India

- Uttar Pradesh

- Delhi

- Haryana

- Punjab

- Rajasthan

- Himachal Pradesh

- Uttarakhand

- J&K

- South India

- Tamil Nadu

- Karnataka

- Kerala

- Andhra Pradesh

- Telangana

- West India

- Gujarat

- Goa

- Madhya Pradesh

- Maharashtra

- Chhattisgarh

- East India

- West Bengal

- Bihar

- Assam

- Jharkhand

- Odisha

- Rest of East India

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

.svg)