Cold Chain Logistics Market: By Technology (Vapor Compression, Blast Freezing, Evaporative Cooling, Programmable Logic Controller, Cryogenic Systems, Other Technologies); Temperature Type (Chilled, Frozen); Solution (Cold Chain Warehouse/storage, Cold Chain Transport, Automated Material Handling); Industry (Food and Beverages - Fruit and Vegetable, Meat and Seafood, Dairy and Frozen Dessert, Bakery and Confectionery, Ready-to-eat Meal, Chemical, Pharmaceuticals, Medical, Others); Region–Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2025–2033

- Last Updated: 12-Nov-2025 | | Report ID: AA1023644

Market Scenario

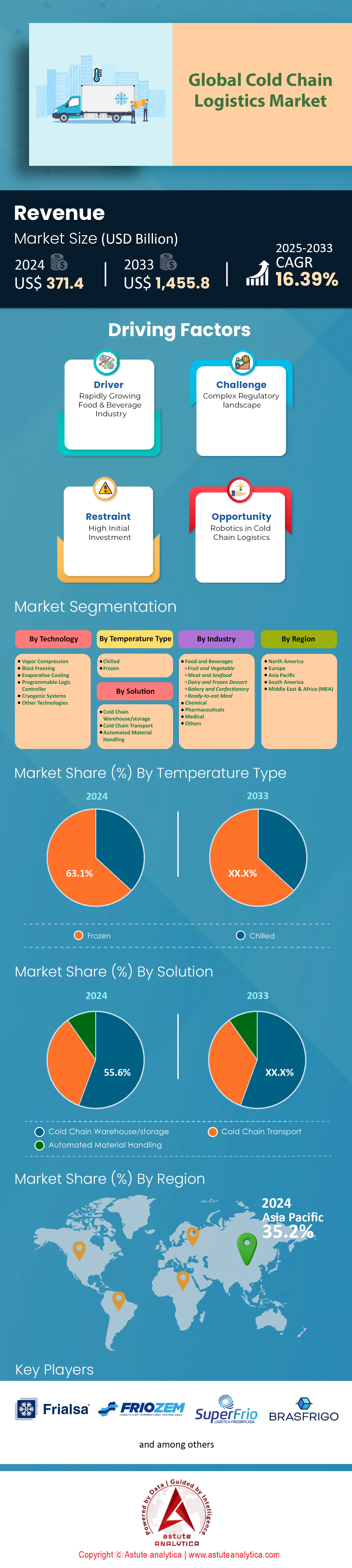

Cold chain logistics market was valued at US$ 371.4 billion in 2024 and is projected to hit a market size of US$ 1,455.8 billion by 2033 at a CAGR of 16.39% during the forecast period 2025–2033.

Key Findings Shaping the Cold Chain Logistics Market

- Based on technology, evaporative cooling technology contributed to a significant portion of more than 28% to the global market dominance.

- By temperature type, the global market is dominated by the frozen temperature need by commanding an impressive 63%.

- Based on solution, the global cold chain logistics market is majorly driven by cold chain warehouse/storage solution. This segment is the market's powerhouse, contributing a whopping 55.6% to the overall market revenue.

- By industry, the food and beverage industry emerged as the leader in the global market by holding a substantial 59.6% of the market share.

- Asia Pacific is the key contributor to the global market as it control over 35% market share.

An innovation surge is fundamentally reshaping the cold chain logistics market. The pharmaceutical sector is at the epicenter, with the U.S. FDA approving 50 new molecular entities in 2024. Significantly, 18 of these were new biologic entities that demand exacting temperature control. This boom in sensitive products is creating tangible shipping growth, demonstrated by a 16% year-over-year tonnage increase in outbound pharma air cargo from North America in early 2025. Specialized infrastructure is already handling this increased volume, with Vienna Airport's Pharma Handling Center processing 4,238 tons of these goods in 2024.

A parallel demand driver is the consumer revolution in grocery purchasing. By mid-2025, an estimated 81 million U.S. households will purchase groceries online, while the number of individual American online shoppers is set to reach 148.4 million. This widespread adoption is generating immense revenue, with U.S. online grocery sales hitting a record US$ 12.5 billion in September 2025. The global emergence of quick commerce, used by 600 million people in 2024, is further intensifying the need for a responsive and robust cold chain logistics market capable of handling hyper-local, on-demand delivery of perishables.

In response, the industry is witnessing unprecedented investment and strategic maneuvering. Infrastructure is rapidly expanding, with 2.2 million square feet of new speculative cold storage space scheduled for completion in the U.S. in 2025. The competitive landscape is heating up, evidenced by 18 acquisitions within the sector in 2024 and significant funding rounds, such as Coldcart's US$ 6,546,893 seed investment. Major players are making bold moves; DHL Group is injecting €2 billion into its healthcare logistics capabilities, and FedEx launched a new Life Science Center in Mumbai in 2024. Fleets are also modernizing, with 7,506 new energy refrigerated trucks sold in China in just eight months of 2024.

To Get more Insights, Request A Free Sample

Untapped Niches Present New Cold Chain Logistics Market Opportunities

- The "pet humanization" trend is creating a substantial opportunity in the fresh and frozen pet food category: Major brands like Royal Canin and General Mills launched new fresh pet food lines in 2024, signaling a market shift. This segment's growth necessitates a dedicated cold chain from manufacturing to retail. Investments are already flowing, with Big Country Raw planning a CAD 8.9 million production boost and Petsource by Scoular completing a US$ 75 million facility expansion in 2024. This niche demands precise temperature management to maintain the integrity and safety of premium, perishable pet nutrition products.

- The nascent cultivated meat industry represents a future cornerstone of the cold chain logistics market: As companies like Ivy Farm target a 2025 launch for cultivated Wagyu beef, the need for a sophisticated, end-to-end cold supply chain becomes critical. This includes cryogenic storage at production sites and refrigerated transport to distribution centers and consumers. While regulatory hurdles exist—Florida and Alabama banned the sale of cultivated meat in 2024—the industry is advancing. The complexity of transporting these novel products presents a first-mover advantage for logistics firms that develop expertise in this area.

Key Demand Drivers

Global Seafood Trade Intensifies Demand for Specialized Cold Chain Logistics Market

The surging international trade in high-value seafood is dramatically increasing demand within the market. Global aquaculture production recently reached an unprecedented 130.9 million tons, now surpassing capture fisheries as the primary source of aquatic animals. A massive volume of fish production, forecasted to exceed 190 million tons in 2024, with aquaculture contributing over 100 million tons, must be transported globally. A significant and growing portion of this trade depends on specialized refrigerated transport to ensure product quality and freshness across vast shipping lanes.

The need for new infrastructure to support this volume is driving massive investments in the cold chain logistics market. In 2024, a total of 4.4 million TEU of new container ship capacity was contracted, pushing the global order book to a record 8.3 million TEU by the end of the year. Of the new capacity ordered, 286 container vessels representing 3.3 million TEU were added in 2024 alone. Accelerated deliveries are already underway, with a record 2.5 million TEU of capacity delivered in the first ten months of 2024. Furthermore, an additional 0.5 million TEU is slated for delivery before year's end. Projections anticipate a peak of 2.2 million TEU will be delivered in the single year of 2027, with an average of 1.9 million TEU delivered annually between 2025 and 2028. Port infrastructure is also being enhanced, as demonstrated by DP World's opening of a new 110,000 sq ft temperature-controlled warehouse in Navi Mumbai in May 2025, providing 11,000 pallet positions for cold storage.

Precision Logistics For Clinical Trials Drives Ultra-Cold Chain Logistics Market Growth

The proliferation of advanced clinical trials for biologics and cell and gene therapies is a powerful, high-value catalyst for the cold chain logistics market. In 2024, the FDA's Center for Drug Evaluation and Research (CDER) logged 1,855 new Investigational New Drug (IND) receipts for drugs and non-biosimilar biologics. An astonishing 14,870 active INDs were reported in 2024, signaling an enormous pipeline of products requiring specialized clinical trial logistics. A substantial number of these complex therapies are temperature-sensitive; in 2024, there were over 2,500 active INDs for cell and gene therapies specifically. The FDA’s approval of 8 novel cell and gene therapies during 2023 and 2024 further underscores the market shift.

The demanding nature of this research boom necessitates ultra-precise, temperature-controlled logistics. The rise of decentralized trials is increasing demand for direct-to-patient services, a segment where cold chain logistics market capabilities captured 70.42% of the logistics market share in 2024. Providers are rapidly expanding their specialized infrastructure to keep pace, exemplified by Yourway’s opening of a new flagship GMP Depot in Dublin in June 2024. Investment in technology is equally critical, with Thermo Fisher Scientific launching an IoT-connected cryogenic freezer line in 2025. The scale of late-stage research is massive; Phase III trials accounted for the largest share of logistics demand in 2024, a phase involving thousands of participants. In total, 631 new trials for cell and gene therapies were initiated in 2023 alone, and the American Society of Gene and Cell Therapy noted that 76 gene therapy trials were initiated in the second quarter of 2024.

Segmental Analysis

Evaporative Cooling Technology A Cost-Effective and Efficient Market Choice

Evaporative cooling technology’s significant contribution of over 28% to the global market is justified by its remarkable operational efficiency and substantial cost savings. This technology offers a compelling alternative to traditional refrigeration, with running costs that can be as low as US$ 0.10 per hour. The installation cost is up to 50% lower than comparable refrigerated air conditioning, presenting a significant initial investment advantage. For businesses in the cold chain logistics market, a payback period of under two years makes this technology an attractive long-term asset. The system's efficiency is further highlighted by its ability to provide up to 40 kW of cooling power for every 1 kWh of electricity consumed, a ratio far superior to conventional methods.

- Maintenance for these systems is notably affordable, with annual costs typically ranging between US$ 100 and US$ 200.

- The technology is capable of reducing air temperatures by as much as 15 degrees Celsius, crucial for maintaining product integrity.

- Industrial units can achieve an Energy Efficiency Ratio (EER) of up to 40, which is approximately 10 times higher than traditional cooling systems.

Furthermore, the energy savings can reach as high as 90% compared to mechanical refrigeration, a critical factor for energy-intensive storage facilities. Water consumption is also optimized, with some advanced systems using just 1 cubic meter of water to produce a 695 kW cooling capacity. The reduced complexity, with fewer components like compressors, not only lowers the initial outlay but also minimizes potential points of failure, enhancing reliability. These combined economic and performance benefits firmly establish evaporative cooling's dominant position within the cold chain logistics market, offering a powerful solution for temperature control.

Frozen Temperature Needs Fueling Widespread Market Ascendancy

The frozen temperature segment's commanding 63% share of the global cold chain logistics market is propelled by relentless consumer demand and the expansion of frozen product lines across the globe. In 2024, the average shopper increased their purchasing frequency to 50 trips per year, spending nearly US$ 700 annually on frozen goods. This consistent purchasing behavior is a direct driver for the extensive infrastructure required. The demand is not uniform; specific categories are showing exceptional growth, with unit sales for processed chicken rising by 9.6% and frozen fruit sales increasing by 8.8% in the first half of 2024 alone. The innovation in this space is rapid, with kid-friendly frozen meals now generating more than US$ 248 million in annual sales.

- Online grocery orders that include frozen foods see a 25% average increase in basket size.

- The global consumption of seafood for human use is projected to reach 182 million tons by 2032, a significant portion of which is frozen.

- Households with additional freezer space, a trend that grew significantly, create a larger capacity for consumers to store frozen products.

The sheer volume of products moving through the supply chain, such as the projected 5.8 million metric tons of shrimp by 2025, necessitates robust frozen logistics capabilities. The foodservice industry further amplifies this need, with frozen breakfast sandwiches alone becoming a US$ 2.3 billion category. As dietary habits evolve, the cold chain logistics market is continuously adapting to handle an ever-expanding variety and volume of frozen goods, cementing the dominance of this temperature requirement. The global frozen bakery products market is also substantial, projected to be worth US$ 46.53 billion in 2025, further fueling demand.

Cold Chain Warehousing The Indispensable Backbone of The Market

Cold chain warehousing and storage solutions are the powerhouse of the cold chain logistics market, contributing a massive 55.6% to market revenue due to their fundamental role in preserving product integrity. The scale of development underscores this dominance, with 2.2 million square feet of new speculative cold storage space expected to be completed in 2025. These modern facilities are substantial, typically ranging from 200,000 to 400,000 square feet, designed to meet broad demand. The investment required is significant, as construction costs can range from US$ 130 to US$ 350 per square foot, two to three times more than standard dry warehouses. This investment is necessary to replace aging infrastructure, with a considerable portion of existing inventory predating 1960.

- A new 90,000-square-foot automated facility in India has a capacity for 10,000 pallets.

- Over 80% of food retailers now depend on public cold storage to manage inventory efficiently.

- The demand for public refrigerated warehouses has surged, driven by third-party logistics (3PL) services.

The operational complexity and capital intensity create high barriers to entry, ensuring that established players in the cold chain logistics market maintain a strong foothold. Projections show that between five and seven million square feet of new cold storage inventory will be added annually over the next five years to meet escalating demand. Even smaller specialized facilities, such as a 65,000-square-foot pharmaceutical storage unit, represent critical nodes in the network. The continuous need for more modern, efficient, and strategically located storage solidifies the warehouse segment's foundational role. This is essential for the cold chain logistics market to function effectively.

Customize This Report + Validate with an Expert

Access only the sections you need—region-specific, company-level, or by use-case.

Includes a free consultation with a domain expert to help guide your decision.

Food and Beverage Sector The Unwavering Engine of Market Growth

The food and beverage industry's leadership, holding a substantial 59.6% market share, is a direct result of the massive global volumes of perishable goods that depend on temperature-controlled supply chains. In 2024, global exports of fresh fruits and vegetables alone reached 148 million tons. An effective cold chain logistics market is not just a convenience but a necessity; it has the potential to prevent the loss of 620 million tons of food annually. The spoilage of food is a significant issue, contributing to 8-10% of global greenhouse gas emissions, a problem that this industry directly addresses. The scale of individual product movements is immense, with countries like Morocco now exporting 767,000 tons of fresh tomatoes each year.

- Global dairy consumption is rising, fueling a logistics sector valued at approximately US$ 80 billion in 2025.

- South Africa’s citrus exports hit a record 3 million tons in 2025, all requiring refrigeration.

- China's fresh produce exports surged to 13.4 million tons in 2024.

These vast quantities of perishable goods, from fresh produce to dairy and seafood, are the lifeblood of the global food supply. The reliance on temperature control is absolute to ensure these products reach consumers safely and with high quality. The sheer volume and critical nature of food transport and storage mean that the food and beverage sector will continue to be the primary driver of the cold chain logistics market. Without these specialized services, the global trade of essential food items would be impossible, confirming its dominant and non-negotiable position.

To Understand More About this Research: Request A Free Sample

Regional Analysis

Asia Pacific Infrastructure Boom Cements Its Market Dominance

The Asia Pacific region commands the cold chain logistics market with a share of over 35%. This leadership is fueled by massive infrastructure development and rising domestic consumption. In India, the Pradhan Mantri Kisan Sampada Yojana scheme has sanctioned 41 mega food parks and 376 cold chain projects as of early 2024. China is also rapidly expanding, with its refrigerated truck ownership reaching an estimated 430,000 units in 2024. The country’s cold storage capacity is projected to reach 240 million cubic meters by 2025, supported by the construction of 65 new national cold chain logistics bases.

Further investments across the region underscore its dominance in the cold chain logistics market. Vietnam’s agricultural exports, heavily reliant on cold chain integrity, reached a value of US$ 53 billion in 2024. To support such trade, the country's government has planned for an investment of up to US$ 1.5 billion in its national seaport system through 2025. In Indonesia, the government allocated US$ 25.5 billion for infrastructure projects in its 2024 state budget, which includes logistics enhancements. Meanwhile, Japan’s food self-sufficiency rate on a calorie basis was recorded at 38% in fiscal 2023, driving demand for imports requiring cold chain. Singapore’s Changi Airport handled 1.76 million tons of air freight in 2023, a significant portion being pharmaceuticals and perishables. Finally, the Philippines' Board of Investments approved 36 new cold storage projects in the first ten months of 2024.

North America’s Modernization Responds to Surging Consumer Demand

North America’s cold chain logistics market is defined by modernization and high consumer demand. The U.S. had 3.7 million square feet of speculative cold storage under construction in the second quarter of 2024. The Port of Savannah handled 449,000 TEUs of refrigerated cargo in fiscal year 2023, a new record for the facility. Investment in new capacity continues, with a single project in Houston adding 303,500 square feet of convertible freezer space in 2024. Further inland, the Port of Corpus Christi moved a record 2.2 million tons of refrigerated goods in 2023. In Canada, online food and beverage sales are projected to reach US$ 5.1 billion in 2024. The country’s food manufacturing sales reached CAD 12.3 billion in a single month of 2024. Mexico’s agricultural exports to the U.S. amounted to US$ 42.1 billion in the first ten months of 2023, much of it temperature-sensitive. The U.S. also imported over 4 billion pounds of avocados in the 2022/2023 season, all requiring refrigeration.

Europe’s Strategic Ports and Production Drive Cold Chain Volume

Europe's mature cold chain logistics market thrives on its powerful production hubs and efficient port infrastructure. The Port of Rotterdam, a critical gateway, handled 1.2 million TEUs in reefer cargo in 2023. The Netherlands remains a floral powerhouse, exporting an estimated €8 billion worth of flowers and plants in 2023, a trade entirely dependent on cold chain. Spain’s fruit and vegetable exports reached a volume of 12 million tons in 2023. France’s e-commerce market includes 42.5 million online shoppers as of 2024, driving demand for refrigerated grocery delivery. Germany’s pharmaceutical production value was recorded at €57.7 billion in 2023, with exports forming a substantial part. Amsterdam’s Schiphol Airport handled 1.4 million tons of cargo in 2023, with its pharma and perishable segments being key. In the UK, a single new cold storage facility with 230,000 square feet of space was approved for construction in 2024.

Top 5 Strategic Investments and Acquisitions Reshape The Competitive Landscape of the Cold Chain Logistics Market

- Americold Realty Trust Acquires Safeway’s Distribution Center (January 2024): Americold acquired a 1.2 million-square-foot facility in Maryland from Albertsons for US$ 248.5 million to expand its temperature-controlled network.

- Lineage Logistics Acquires Cold Storage Company Kloosterboer (January 2024): Lineage completed its acquisition of Kloosterboer Group, which operates 11 facilities in the Netherlands, France, and Germany, significantly expanding its European footprint.

- RLS Logistics Expands through Acquisition of Premier Refrigerated Warehouse (April 2024): RLS acquired the Texas-based company, adding a 200,000-square-foot facility to its growing network of cold storage solutions in the U.S.

- Emergent Cold Latin America Acquires Frigorifico Modelo (May 2024): The company expanded its presence in Uruguay by acquiring Frigorifico Modelo S.A., a key player with a multi-temperature facility in Montevideo.

- Magnavale Secures Funding for New Cold Store in England (June 2024): The UK-based provider secured an eight-figure funding package to develop a 101,000-pallet automated cold store in Easton, Lincolnshire.

Top Players in the Global Cold Chain Logistics Market

- Frialsa Frigorificos SA

- Comfrio Solucoes Logisticas

- Friozem Armazens Frigorificos Ltda

- Superfrio Armazens Gerais Ltda

- Americold Logistics

- Brasfrigo

- Arfrio Armazens Gerais Frigorificos

- Ransa Comercial SA

- Localfrio

- Qualianz

- Burris Logistics

- Other Prominent Players

Market Segmentation Overview:

By Technology

- Vapor Compression

- Blast Freezing

- Evaporative Cooling

- Programmable Logic Controller

- Cryogenic Systems

- Other Technologies

By Temperature Type

- Chilled

- Frozen

By Solution

- Cold Chain Warehouse/storage

- Cold Chain Transport

- Automated Material Handling

By Industry

- Food and Beverages

- Fruit and Vegetable

- Meat and Seafood

- Dairy and Frozen Dessert

- Bakery and Confectionery

- Ready-to-eat Meal

- Chemical

- Pharmaceuticals

- Medical

- Others

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- Western Europe

- The UK

- Germany

- France

- Italy

- Spain

- Rest of Western Europe

- Eastern Europe

- Poland

- Russia

- Rest of Eastern Europe

- Western Europe

- Asia Pacific

- China

- India

- Japan

- Australia & New Zealand

- South Korea

- ASEAN

- Rest of Asia Pacific

- Middle East & Africa (MEA)

- Saudi Arabia

- South Africa

- UAE

- Rest of MEA

- South America

- Argentina

- Brazil

- Rest of South America

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

.svg)