Brazil Frozen Food Market Analysis: By Product Type (Fruits (Seasonal and Regular), Vegetables (Peas, Corn, Potatoes, Others), Dairy Products (Milk, Butter, Cheese, Others), Meat & Poultry (Red Meat, Pork Meat, Poultry Meat), Seafood, Bakery Products (Bread, Pizza Crust, Cakes & Pastries, Others), Soups, Ready Meals (Dumplings, Rice based, Italian (Pastas), Indian, Korean, Chinese, Others), Others); Distribution Channel ( Retail (Online, Supermarket/ Hypermarket, Convenience Stores/ Standalone Stores); Enterprise Sale (B2B) (HoReCa (Hotel, Restaurants, Café) – Food Service, Travel (Railway/ Airline/ Others), Educational Institutes, Food Processing Industry)— Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2024–2032

- Last Updated: Mar-2024 | Format:

![pdf]()

![powerpoint]()

![excel]() | Report ID: AA0923625 | Delivery: 2 to 4 Hours

| Report ID: AA0923625 | Delivery: 2 to 4 Hours

Market Scenario

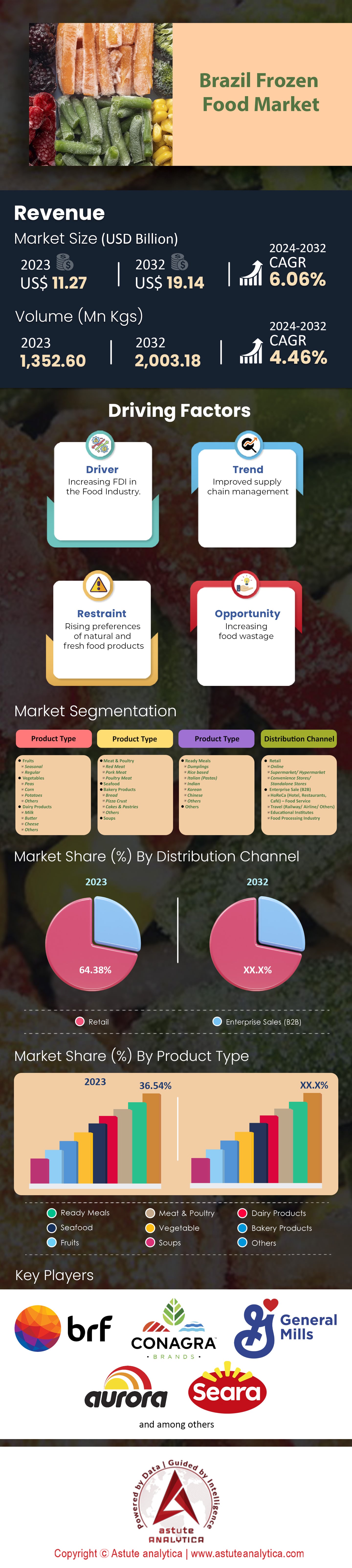

Brazil Frozen Food Market was valued at US$ 11.27 billion in 2023 and is projected to surpass the market valuation of US$ 19.14 billion by 2032 at a CAGR of 6.06% during the forecast period 2024–2032.

The Brazil frozen food market has experienced significant growth over the past few years, reflecting both global and regional trends. Increasing urbanization, changing consumer preferences, and expanding retail channels are some of the key driving forces behind the expansion of this market in Brazil. This growth is impressive when we consider that the global average during this period was slightly lower. Brazil's burgeoning middle class, which comprises around 47% of its population of over 214 million, has been a significant consumer of frozen products. This demographic's rising disposable income has contributed immensely to the demand for convenience foods, which includes frozen products.

The consumption patterns also provide insight into the Brazil frozen food market's character. For instance, frozen meat products held a market share of about 21% in Brazil in 2022. Poultry, particularly chicken, was a dominant segment, accounting for nearly 22% of the total frozen meat products. In contrast, frozen vegetables and fruits saw growth at a CAGR of 4.95 and 4.18% in 2022 respectively and collectively accounted for about 13% of the market share. The increasing health awareness among Brazilians, paired with the desire for quick and easy meal preparations, are driving these numbers up.

On the other hand, supermarkets and hypermarkets dominate as the primary sales channels. In fact, the retail sales are making up roughly 64.38% of frozen food sales in Brazil in 2022. Local grocery stores and online channels, while having smaller shares, are growing steadily due to the convenience they offer, especially in the wake of the COVID-19 pandemic. E-commerce, which constituted about 8% of frozen food sales in 2020, saw a surge to 11% in 2022, showing a growing comfort and reliance on online shopping among Brazilian consumers.

However, Brazil frozen food market is not without its challenges. Brazil's infrastructure, particularly in terms of cold storage and transportation, can be a limiting factor. While the country has made strides in improving its logistical capabilities, gaps still exist in ensuring that frozen products maintain their quality from manufacturing hubs to remote areas.

To Get more Insights, Request A Free Sample

Market Dynamics

The Ascension of the Middle Class: A Prime Driver for Brazil's Frozen Food Market

Brazil's frozen food market is primarily driven by the remarkable rise of its middle-class population. As of 2022, Brazil's middle class has seen considerable growth, comprising approximately 47% of its 214 million population. But what makes this demographic so impactful to the frozen food sector? The financial potential. With rising incomes, the middle class in Brazil has increased purchasing power. In 2022 alone, the middle-class segment had an estimated combined disposable income that reached close to $400 billion. This figure indicates a 4.5% growth rate from the previous year, which is noteworthy given the global economic challenges that year. This rise in disposable income translates to an elevated propensity to spend on convenient, varied, and sometimes premium products, such as those found in the frozen food section. Furthermore, data indicates that 62% of the Brazilian middle class reside in urban areas. Urban lifestyles often come with time constraints due to longer working hours and commutes. This has led to a significant 7% annual rise in the demand for convenience foods within these urban centers from 2019 to 2022. Given that frozen foods fit the bill of convenience seamlessly, it's no surprise that this category has become a favorite. In fact, sales of frozen dinners and ready meals saw a jump of 8.5% in 2021 compared to the previous year, a direct correlation with this urban middle-class lifestyle.

Yet, the rise of the middle class doesn't just shape purchasing habits; it also molds preferences in the Brazil frozen food market. There's a noticeable shift towards seeking healthier options within the frozen food aisle. A survey in 2021 highlighted that 53% of the middle-class consumers in Brazil prefer frozen foods that are organic, low in preservatives, or have clear health benefits. This means there's not just an increased quantity of consumption, but also a qualitative demand shift in the frozen food market driven primarily by this demographic.

E-Commerce Boom: A Trend Reshaping Brazil's Frozen Food Landscape

The digital revolution is global, and Brazil is no exception. The nation has witnessed a surge in e-commerce activities in recent years, and this has begun to significantly influence the frozen food market. While traditionally, supermarkets and hypermarkets dominated the frozen food sales channel with about 68% in 2022, the story has started to evolve. In 2020, e-commerce constituted roughly 8% of Brazil's frozen food sales. But by 2022, this number had shot up to 11%, translating to a growth rate of 37.5% in just two years. When we dissect these numbers further, the potential of this trend becomes even clearer. Brazil boasts an impressive 150 million internet users, with 93 million of them being active e-commerce consumers. The nation saw a 23% increase in first-time online shoppers in 2021, reflecting the rapidly expanding digital market base.

The frozen food segment within e-commerce is particularly thriving due to two primary reasons: the pandemic-induced shift to online shopping and the advancements in cold storage logistics for online retail. The latter has played a pivotal role, with investments in cold storage for e-commerce growing by an impressive 15% in 2021. What's more intriguing is the predictive data. Forecasts suggest that by 2030, e-commerce is likely to account for close to 18% of the frozen food sales in Brazil. The trend indicates a blend of technology adoption, logistical improvements, and behavioral shifts, making e-commerce a formidable force in the frozen food market's future in Brazil.

Navigating the Cold Chain Conundrum: Brazil's Logistical Challenge

A critical restraint hindering the full potential of Brazil's frozen food market lies in its logistics, specifically within the realm of cold chain infrastructure. Brazil, with its vast geographical expanse, presents both an opportunity and a challenge for businesses in the frozen food sector. The sheer size of the country demands an intricate and efficient cold chain network to ensure that products reach consumers in optimal condition. In 2021, studies indicated that Brazil faced a shortage of approximately 30% in required cold storage capacity. This gap, both in terms of storage and transportation, can lead to significant product wastage. It's estimated that almost 5% of frozen food products face quality degradation or total loss due to cold chain inefficiencies.

Moreover, the investments in cold chain logistics grew by just 4.3% in 2020, which, while positive, is not commensurate with the rapid growth of the frozen food market itself, which saw a CAGR of around 5.7% between 2018 and 2022. The disparity between market growth and infrastructure development is evident. The interior regions of Brazil also present a greater challenge. In 2022, it was estimated that transporting frozen goods to these remote areas cost 15% more than to urban centers, mainly due to inadequate infrastructure and longer transportation routes.

Segmental Analysis

By Product Type

Brazil's frozen food market is diverse with various segments indicating unique growth trajectories. At the forefront of this market stands the "Ready Meals" segment. This category's dominance is evident from its substantial market share, which reached an impressive 36.54% in 2023 and valued at $3.9 billion in the same year. With a forecasted CAGR of 7.12%, the ready meals segment is poised to nearly double its value, potentially reaching a whopping US$ 7 billion by 2032. This prodigious growth can be attributed to the sheer convenience these meals offer. As urban lifestyles in Brazil intensify and time becomes a luxury, many find solace in the immediacy of ready meals. Their prolonged shelf-life, which ensures product quality over extended periods, only amplifies their appeal.

Behind ready meals segment, the meat and poultry category are dominating the Brazil frozen food market. Brazil's fondness for these products is reflected in its consumption patterns. An astounding 78.23 kgs of meat and poultry were consumed per capita in 2021, underscoring the country's penchant for these foods. This significant consumption rate, coupled with innovations and product launches, ensures that the Meat and Poultry segment remains a vital component of Brazil's market.

Together, these two segments encapsulate the dynamic nature of Brazil's frozen food industry, shaped by evolving consumer preferences and practical demands.

By Distribution Channel

Based on distribution channel in Brazil's frozen food market, retail segment emerges as a leader with 64% revenue share. However, the enterprise sale segment is anticipated to grow at an impressive CAGR of 6.51% between 2024 and 2032. This segment's surge is closely linked to the travel sector, especially railways and airlines. As these industries continue to serve frozen ready-to-eat meals to passengers, the demand within the enterprise sales channel for frozen foods sees an upward swing. It's a testament to the symbiotic relationship between travel's resurgence post-pandemic and the convenience of frozen meal solutions.

Concurrently, the 'Retail' segment, too, is demonstrating robust growth, with a projected rate of 5.8%. The tactile experience retail provides, allowing consumers to assess, compare, and choose between various product offerings, stands as a significant advantage. In a frozen food market like Brazil, where the discernment of quality, hygiene, and taste is paramount for frozen food items, the retail segment's importance cannot be overstated.

The 'Online' channel, while having a smaller share in 2023, representing 13% of total food sales, showcases the profound shift in consumer purchasing patterns. Influenced primarily by the COVID-19 pandemic, online shopping for frozen foods witnessed a paradigm shift. Movement restrictions and altered lifestyles during the pandemic catalyzed this shift. Interestingly, the momentum gained by the online segment during the crisis is not merely a temporary spike. Data suggests that the demand for frozen foods online is set to endure well beyond the pandemic's immediate impacts.

To Understand More About this Research: Request A Free Sample

Top Players in Brazil Frozen Food Market

- Ajinomoto Co., Inc.

- Associated British Foods PLC

- Aurora

- BRF

- CJ Foods

- ConAgra Brands, Inc.

- General Mills Inc.

- Grupo Bimbo

- JBS

- Kellogg Company

- Mccain Foods Limited

- Nestle SA

- NH Foods Ltd.

- Nichirei Corporation

- Nippon Suisan Kaisha Ltd

- Swift/Seara Group

- The Kraft Heinz Company

- Tyson Foods, Inc.

- Unilever

- Other Prominent Players

Market Segmentation Overview:

By Product Type

- Fruits

- Seasonal

- Regular

- Vegetables

- Peas

- Corn

- Potatoes

- Others

- Dairy Products

- Milk

- Butter

- Cheese

- Others

- Meat & Poultry

- Red Meat

- Pork Meat

- Poultry Meat

- Seafood

- Bakery Products

- Bread

- Pizza Crust

- Cakes & Pastries

- Others

- Soups

- Ready Meals

- Dumplings

- Rice based

- Italian (Pastas)

- Indian

- Korean

- Chinese

- Others

- Others

By Distribution Channel

- Retail

- Online

- Supermarket/ Hypermarket

- Convenience Stores/ Standalone Stores

- Enterprise Sale (B2B)

- HoReCa (Hotel, Restaurants, Café) – Food Service

- Travel (Railway/ Airline/ Others)

- Educational Institutes

- Food Processing Industry

View Full Infographic

REPORT SCOPE

| Report Attribute | Details |

|---|---|

| Market Size Value in 2023 | US$ 11.27 Bn |

| Expected Revenue in 2032 | US$ 19.14 Bn |

| Historic Data | 2019-2022 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Unit | Value (USD Bn) |

| CAGR | 6.06% |

| Segments covered | By Product Type, By Distribution Channel |

| Key Companies | Ajinomoto Co., Inc., Associated British Foods PLC, Aurora, BRF, CJ Foods, ConAgra Brands, Inc., General Mills Inc., Grupo Bimbo, JBS, Kellogg Company, Mccain Foods Limited, Nestle SA, NH Foods Ltd., Nichirei Corporation, Nippon Suisan Kaisha Ltd, Swift/Seara Group, The Kraft Heinz Company, Tyson Foods, Inc., Unilever, Other Prominent Players |

| Customization Scope | Get your customized report as per your preference. Ask for customization |

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

| Report ID: AA0923625 | Delivery: 2 to 4 Hours

| Report ID: AA0923625 | Delivery: 2 to 4 Hours

.svg)