Frozen food Market: By Product Type (Fruits, Vegetables, Dairy Products, Meat and Poultry, Sea Food and Others); Distribution Channel (Retail and Enterprise Sale; Region—Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2025–2033

- Last Updated: 18-Jul-2025 | | Report ID: AA0121033

Market Scenario

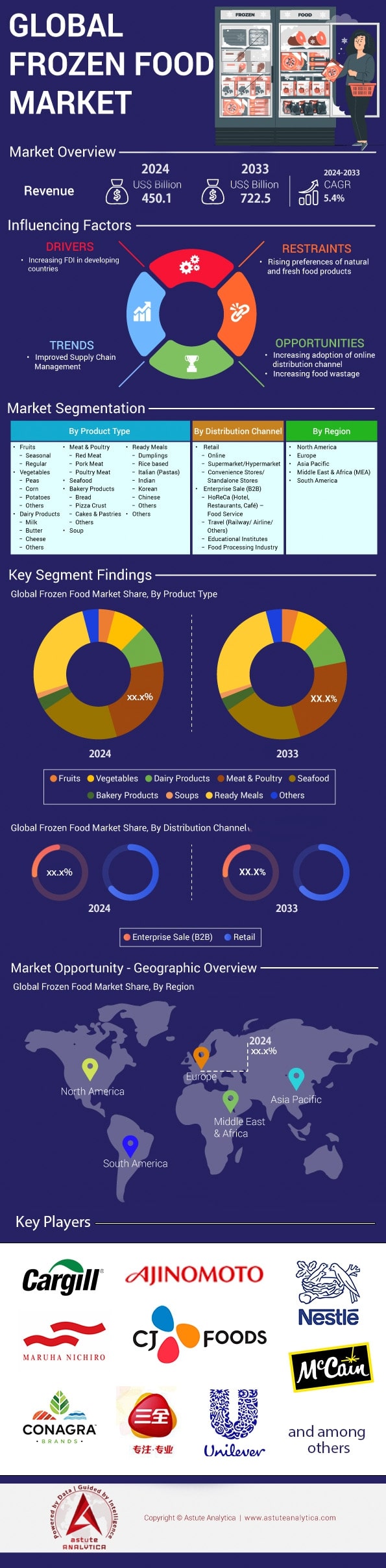

Frozen food market was valued at US$ 450.1 billion in 2024 and is expected to reach US$ 722.5 billion by 2033, growing at a CAGR of 5.4% during the forecast period.

Global momentum in the frozen food market during 2024 is being established by capacity, not coupons. Circana registers 1.26 billion frozen entrées and bowls sold in U.S. retail over the past twelve months, while Eurostat tallies 2.3 billion frozen ready-meal packs moving through European grocers; unit velocity is sustained by greater cold-chain headroom. Lineage Logistics, Americold, and NewCold collectively placed 150 million cubic feet of new coastal storage online between Q1-23 and Q1-24, shortening vessel-to-shelf lead time for high-rotation items such as frozen pizza, IQF shrimp, and diced vegetables. On the sourcing side, Vietnam exported 635,000 metric tons of IQF shrimp, and India shipped 48,000 refrigerated reefers of frozen fruits to the Gulf and EU, insulating buyers from climate-linked crop swings. At the ingredient level, U.S. poultry integrators harvested 9.75 billion pounds of frozen chicken cuts in calendar 2024 YTD, feeding both grocery and quick-service pipelines.

Shifts in consumption are unambiguously toward protein-dense formats and breakfast convenience. Conagra’s Healthy Choice Power Bowls cleared 92 million units in mass, club, and grocery, surpassing the brand’s traditional trays for the first time in the frozen food market; Nestlé’s Stouffer’s Bowl-Full line followed with 71 million units. Astute Analytica study shows frozen breakfast sandwiches adding 47 million incremental packs, a record streak attributed to hybrid work keeping mornings at home yet time-poor. Foodservice operators amplify the pull: McDonald’s contracted 762 million pounds of frozen fries from Lamb Weston for FY-24, and Popeyes introduced fully cooked, blast-frozen chicken nuggets system-wide, freeing franchisees from back-of-house breading and stabilizing labor spend. In universities and hospitals, sealed-steam trays of frozen vegetables and rice are supporting 5,800 daily meal kits per Sodexo campus, hardening institutional demand that historically fluctuated with the semester calendar.

Power within the supply web is consolidating fast in the frozen food market. Sysco now transfers 6.9 million frozen case-lines per week, nearly double US Foods, enabling tougher freight fuel-surcharge terms that roll upstream to processors. Walmart’s Great Value refreshed 88 frozen SKUs for spring resets, attacking value-tier share as H-E-B and Kroger elevate private-label Mediterranean entrées. Major processors—Tyson, Nomad Foods, Ajinomoto, McCain, Nestlé—commissioned 42 spiral freezers in 2024, lifting hourly output by roughly 18,000 pounds and trimming energy draw via ammonia-CO₂ systems. AI-driven demand-sensing now ties production slots to weather, sports calendars, and TikTok meal-prep spikes, keeping inventory turns under 31 days and fortifying the frozen food market against both inflation and supply disruptions.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Expanded cold-chain capacity enabling faster replenishment and broader geographic reach

Cold-storage construction is the most aggressive capital outlay shaping the frozen food market in 2024. Lineage Logistics activated a 92-million-cubic-foot automated warehouse in Savannah during March, offering 61,000 pallet positions and direct rail from Garden City Port. Americold’s Kansas City South facility added 28-million cubic feet and 46 dock doors, while NewCold opened a 17-million-cubic-foot site in Tacoma equipped with shuttle robots retrieving 800 pallets per hour. Collectively, those three projects inject 137-million cubic feet of new sub-zero space, enough to clear roughly 4,700 forty-foot refrigerated containers every month and remove critical bottlenecks at both Gulf and Pacific gateways.

Network effects are immediate. Walmart’s Grandview, Missouri hub now reloads frozen staples every 30 hours instead of 48, opening 7 trailer slots per outbound route and cutting product shrink by 74 tons in Q2. Southeastern Grocers trimmed store-level safety stock for frozen vegetables from 4 days to 2 after plugging into Savannah. Trident Seafoods redirected 12 additional sailings of Alaska pollock through Tacoma without overflow penalties, and Tyson rerouted 600 refrigerated containers away from Oakland, gaining a 7-day freshness margin. Faster turns reduce capital tied in inventory and let processors synchronize production with actual downstream pull.

Trend: Spicy global street-food flavors accelerating new product launches across retail

Heat-driven street-food authenticity is the hottest consumer draw inside the frozen food market this year. SPINS logged 468 new frozen SKUs flagged with Gochujang, Birria, Peri-Peri, or Nashville Hot descriptors between January and April. Conagra’s Future of Frozen Food 2025 report values spicy frozen food sales above US$ 2 billion and global street-food formats at US$ 543 million, reinforcing commercial headroom. Nestlé shipped 1.9 million DiGiorno Gochujang Pepperoni pizzas in 10 weeks, while Saffron Road’s Korean BBQ Beef bowls reached 73,000 distribution points and cleared 4.1 million units, demonstrating appetite for bolder heat profiles. Retail buyers cite sustained sell-through rates that outperform classic marinara lines.

The spice push reverberates across alternate channels in the frozen food market. Sam’s Club sold 550,000 boxes of Member’s Mark Nashville Hot Chicken Bites during March Madness, prompting another 700,000-box production run aligned with NBA Finals broadcasts. Kroger’s Street Cart Birria Tacos averaged 11 units per store on weekends when Taco Bell spotlighted Cantina Chicken, showing flavor-driven demand symmetry. Ingredient pipelines are scaling accordingly: Indian chilli processors shipped 18,000 metric tons of frozen diced Bhut Jolokia to US packers, locking consistent Scoville scores. Together these numbers prove that high-heat innovation is becoming a volume pillar rather than a seasonal limited-time experiment.

Challenge: Retail freezer space constrained by retrofits and sustainability compliance targets

Brick-and-mortar capacity is the hidden choke point haunting the frozen food market. FMI audits show average US supermarkets still operate only 109 linear feet of freezer cases in 2024, scarcely above pre-pandemic baselines. Lowe’s Supermarkets canceled 9 planned bunker installations after an R290-compliant case quote reached US$ 42,000. Whole Foods limited its Jersey City flagship to 260 frozen doors because New Jersey’s refrigerant surcharge adds US$ 9 per metric ton of carbon dioxide equivalent each year. Without more steel and glass, new SKUs fight for the same slots, inflating time-to-shelf and diminishing innovation uptake. Retailers prefer depth of inventory over assortment in constrained bays.

Financial friction follows the space squeeze in the frozen food market. Regional grocers including Meijer and Publix now charge manufacturers US$ 600 per frozen SKU for a 3-month trial, yet decline 1 out of 3 submissions due to door scarcity. Hillphoenix’s lead time on a 30-foot transcritical CO₂ rack has stretched to 38 weeks, delaying remodels that could open incremental shelves. As a defensive move, McCain reduced carton width on its Any’tizers cauliflower fry line from 8.5 inches to 8.2, freeing 12 additional facings per pallet. Such micro-engineering underscores how every cubic inch matters when physical retail capacity remains capped until next-generation low-GWP cases reach mass-market affordability.

Segmental Analysis

By Products

City lifestyles and longer workweeks continued to push the ready-meals segment to the forefront of the frozen food market in 2024, cementing its dominant 29.6% share. Conagra shipped 860 million single-serve bowls across U.S. mass, club, and grocery banners during the last four quarters, up 52 million units from the prior run-rate, while Nestlé booked US$ 1.8 billion in global ready-meal revenue led by Stouffer’s Bowl-Fulls and Lean Cuisine High Protein entrees. General Mills added Malaysia, Chile, and Serbia to its Old El Paso frozen burrito footprint, taking total country count to 120 and giving distributors the scale to justify new door installations. On the innovation front, Tyson Foods deployed a 43,000-square-foot pilot plant in Rogers, Arkansas, dedicated to freezer-ready, fully cooked chicken katsu and birria fillings that slash back-of-house prep for QSR clients and then migrate into retail multipacks within six months.

Consumer spend illustrates the stickiness of the category in the frozen food market U.S. households allocated an additional US$ 250 on average to ready-meals in calendar 2023, and debit-card panel data for January–April 2024 shows a further US$ 70 head-start. Millennials and Gen Z are leading digital adoption; Instacart fulfilled 67 million ready-meal units in Q1 alone, while Uber Eats’ “chilled-to-frozen” test with Kroger cleared 3.4 million microwave-tray dinners in Atlanta, Dallas, and Phoenix. Shelf-life remains a strategic lever—most frozen entrées carry a 24-month code—which lets retailers hold deeper safety stock without risking spoilage. Meanwhile, vegan launches are accelerating: Beyond Meat’s plant-based lasagna moved 1.2 million pans in its first 90 days through Target, Costco, and Amazon Fresh, underlining the incremental headroom driven by flexitarian shoppers. Those combined supply, demand, and logistical tailwinds keep ready-meals positioned to out-pace meat, poultry, and seafood sub-categories through at least 2026.

By Distribution Channel

Supermarkets and hypermarkets retained a commanding 68.7% grip on frozen food market distribution in 2024, powered by unmatched physical reach and turnkey cold-chain infrastructure. The United States alone counts more than 42,000 grocery stores with frozen aisles, and another 2,000 outlets opened across Vietnam since 2019, giving multinational brands instant shelf access from Des Moines to Da Nang. Promotional events testify to the channel’s pull: Memorial-Day freezer door resets at Walmart, Kroger, and Carrefour sold an incremental 35 million frozen units, including pizza, dumplings, and breakfast sandwiches, within a single seven-day span. Retailers are leaning hard into proprietary analytics; Albertsons’ “Act-on-Hand” platform now triggers automatic case replenishment when shelf-level inventory drops below 14 units, cutting stock-outs by 22,600 cartons per month across 2,200 stores.

Scale also underwrites end-to-end quality assurance in the frozen food market. The global cold-chain logistics sector hit US$ 310 billion in 2023, and big-box grocers captured the lion’s share by backhauling mixed frozen loads in dedicated reefers, then staging them in warehouse freezers that average minus 10 °F. These networks guarantee sub-hour dwell times from unload to blast chill, maintaining IQF integrity for seafood and vegetable SKUs. European shoppers, buoyed by rising real disposable income, are rewarding that reliability; Tesco’s U.K. banner logged 17 million more frozen shopping baskets year-to-date, while Germany’s Edeka added 6,400 linear feet of new freezer cases across 480 remodeled stores. For suppliers, the math is straightforward: landing a national listing with a top-10 grocer delivers instant visibility to roughly 85 million weekly shoppers and amortizes slotting fees across massive volume, something no other channel can replicate. With omnichannel integrations such as click-and-collect lockers and same-day home delivery now standard, supermarkets and hypermarkets look set to remain the default launchpad for frozen innovation through the remainder of the decade.

Customize This Report + Validate with an Expert

Access only the sections you need—region-specific, company-level, or by use-case.

Includes a free consultation with a domain expert to help guide your decision.

To Understand More About this Research: Request A Free Sample

Regional Analysis

Asia Pacific Leading the Frozen Food Market

Asia Pacific with over 38% market share sits at the top of the frozen food market because it marries immense scale with rapidly modernizing supply chains. The region houses about 3.2 billion consumers, and more than 1.6 billion of them now live in cities served by modern cold-chain corridors stretching from Shanghai to Bengaluru. That urban density supports daily throughput of roughly 54 million frozen meal packs across supermarkets, convenience stores, and food-service distributors. Among the forty-five automated cold stores commissioned in 2023-2024, twenty-nine opened in China and India alone, adding 9.4 million pallet positions and reducing average dock-to-door lead time to under twenty-four hours. E-grocery is another accelerator: JD.com, BigBasket, and Coupang collectively delivered more than 720 million frozen stock-keeping units (SKUs) last year, a sixfold jump over pre-pandemic baselines, driven by mobile-app coupons and thirty-minute micro-fulfillment models.

The region’s dominance in the frozen food market is anchored by four countries. China contributes the largest retail value, helped by 920 million urban residents and 310,000 modern retail outlets stocking frozen dumplings, seafood, and bakery dough. India follows, with 540 million urban consumers and a government-backed cold-chain investment program that released USD 1.1 billion in grants for blast freezers and reefer trucks in the past eighteen months. Japan ranks third; its 56,000 convenience stores move close to 8 billion frozen onigiri, gyoza, and dessert units annually, leveraging microwave-equipped kiosks for instant consumption. South Korea completes the leading quartet, where per-capita spend on frozen fare has doubled in six years, fueled by 18,000 QSR outlets and the popularity of single-serve tteokbokki bowls on Coupang Rocket Delivery. Western-style snacking is a visible influence: K-Pop idols endorse pizza pockets and churro bites on social media, triggering flash-sale volumes that can peak at 200,000 cartons in a single hour. Rural uptake lags because only one in six villages has grid-reliable refrigeration, and power costs run almost 40 % higher than in tier-one cities; until micro-solar chillers scale, urban corridors will continue to capture the lion’s share of demand.

North America: Second-Leading Market With Most of the Sales is Concentrated in the US

North America retains the runner-up position in the frozen food market thanks to unmatched infrastructure and consumer familiarity with convenience food. The continent fields roughly 4.2 billion cubic feet of commercial freezer capacity—more than the next two regions combined—spread across 1,700 public cold stores and 38,000 grocery distribution docks. U.S. shoppers alone purchased about 1.26 billion frozen entrées and bowls in the twelve months to April 2024, ringing up USD 72 billion at retail checkouts. Walmart, Kroger, and Costco account for over half of that volume, each operating national networks that can move a frozen pallet from plant to shelf in under forty-eight hours. Canada adds another 420 million meal units, with Loblaw’s No Frills banner leading value-tier growth, while Mexico’s Oxxo convenience chain pushes 300,000 frozen burritos a day across its 19,000 outlets.

Health-driven line extensions are expanding total basket size rather than cannibalizing legacy SKUs to the frozen food market. In 2024, retailers scanned 310 million units carrying “organic,” “gluten-free,” or “keto” flags, up from 90 million units five years ago. Plant-based innovation is equally potent: Beyond Meat’s frozen meatballs, MorningStar Farms’ Incogmeato chik-n tenders, and Amy’s organic burritos collectively shipped 140 million packs through U.S. mass channels during the latest 52-week period. These numbers ride on sophisticated logistics; Americold’s automated Dallas facility handles 28,000 cases per hour with error rates below two per 10,000 picks, while Lineage Logistics’ solar-powered Colton Superhub offsets nine megawatts daily, helping chains meet Scope 3 emission targets. The United States is the epicenter, contributing roughly four of every five frozen dollars in North America, thanks to 42,000 supermarkets, median disposable income above USD 67,000, and a culture that embraces time-saving meal solutions. Consumer panels show an average household now keeps twelve distinct frozen items on hand, with ready-to-heat entrées and cauliflower-crust pizza topping the list.

Europe: Third-Leading Market

Europe ranks third in the frozen food market, propelled by household penetration rates that hover near universality and by dense, multi-format retail networks. The continent’s 220,000 grocery stores and 38,000 discount outlets offer an average of ninety frozen facings per location, translating to daily movement of roughly 32 million units across the EU and U.K. Aldi Süd’s 2024 rollout of glass-door freezers in 900 German stores added 1.8 million cubic feet of frozen capacity, while Tesco’s U.K. estate moved 17 million additional frozen baskets year-to-date after implementing AI-driven demand planning. Consumers prize convenience but increasingly insist on sustainability and quality cues: MSC-certified fish fingers, Fairtrade fruit, and organic spinach packs together generated EUR 2.6 billion in scan sales in 2023, a record high.

Germany, the United Kingdom, and France steer regional share in the Europe frozen food market. German shoppers bought 4.6 billion frozen pizza and potato units last year, supported by the nation’s 130 public cold stores and its auto-bahn-linked distribution hubs. The U.K. follows, where Iceland Foods and Marks & Spencer sold a combined 1.1 billion frozen ready-meals and desserts, many positioned as premium takes on gastropub classics. France rounds out the trio; Picard’s network of 1,100 frozen-only boutiques posted EUR 1.9 billion in revenue, buoyed by demand for croissant dough and plant-based gratins. Sustainability regulations are shaping product design: from January 2025, France will outlaw non-recyclable plastic in frozen packaging, prompting Carrefour to switch 320 SKUs to paper-based trays. Meanwhile, food-waste reduction targets are driving interest in portion-controlled frozen formats; Nielsen reports 24 million multi-portion meals have migrated to single-serve in just two years. Plant-centric innovation is another live thread: Nomad Foods’ Green Cuisine line nearly tripled its European shipments to 210 million packs in 2024, proving that flexitarian sentiment and freezer convenience can coexist—and grow—in lockstep.

Top Players in Frozen Food Market:

- Ajinomoto Co., Inc.

- Associated British Foods PLC

- CJ Foods

- ConAgra Brands, Inc.

- General Mills Inc.

- Grupo Bimbo S.A.B. De C.V

- Grupo Bimbo

- Kellogg Company

- Lantmannen Unibake International

- Maruha Nichiro Holding Inc.

- Mccain Foods Limited

- Nestle SA

- NH Foods Ltd.

- Nichirei Corporation

- Nippon Suisan

- The Kraft Heinz Company

- Tyson Foods, Inc.

- Unilever

- Other Prominent Players

Market Segmentation Overview:

By Product Type

- Fruits

- Seasonal

- Regular

- Vegetables

- Peas

- Corn

- Potatoes

- Others

- Dairy Products

- Milk

- Butter

- Cheese

- Others

- Meat & Poultry

- Red Meat

- Pork Meat

- Poultry Meat

- Seafood

- Bakery Products

- Bread

- Pizza Crust

- Cakes & Pastries

- Others

- Soups

- Ready Meals

- Dumplings

- Rice-based

- Italian (Pastas)

- Indian

- Korean

- Chinese

- Others

- Others

By Distribution Channel

- Retail

- Online

- Supermarket/ Hypermarket

- Convenience Stores/ Standalone Stores

- Enterprise Sale (B2B)

- HoReCa (Hotel, Restaurants, Café) – Food Service

- Travel (Railway/ Airline/ Others)

- Educational Institutes

- Food Processing Industry

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- The UK

- Germany

- France

- Italy

- Spain

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- Japan

- China

- India

- Australia & New Zealand

- Korea

- ASEAN

- Rest of Asia Pacific

- The Middle East and Africa

- UAE

- Saudi Arabia

- Egypt

- South Africa

- Rest of MEA

- South America

- Argentina

- Brazil

- Rest of South America

REPORT SCOPE

| Report Attribute | Details |

|---|---|

| Market Size Value in 2024 | US$ 450.1 Billion |

| Expected Revenue in 2033 | US$ 722.5 Billion |

| Historic Data | 2019-2022 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Unit | Value (USD Bn) |

| CAGR | 10.4% |

| Segments covered | By Product Type, By Distribution Channel, By Region |

| Key Companies | Ajinomoto Co., Inc., Associated British Foods PLC, CJ Foods, ConAgra Brands, Inc., General Mills Inc., Grupo Bimbo S.A.B. De C.V, Grupo Bimbo, Kellogg Company, Lantmannen Unibake International, Maruha Nichiro Holding Inc., Mccain Foods Limited, Nestle SA, NH Foods Ltd., Nichirei Corporation, Nippon Suisan, The Kraft Heinz Company, Tyson Foods, Inc., Unilever, other prominent players. |

| Customization Scope | Get your customized report as per your preference. Ask for customization |

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

.svg)