Scaffold Technology Market to Attain Revenue of US$ 5,570.75 Million By 2033

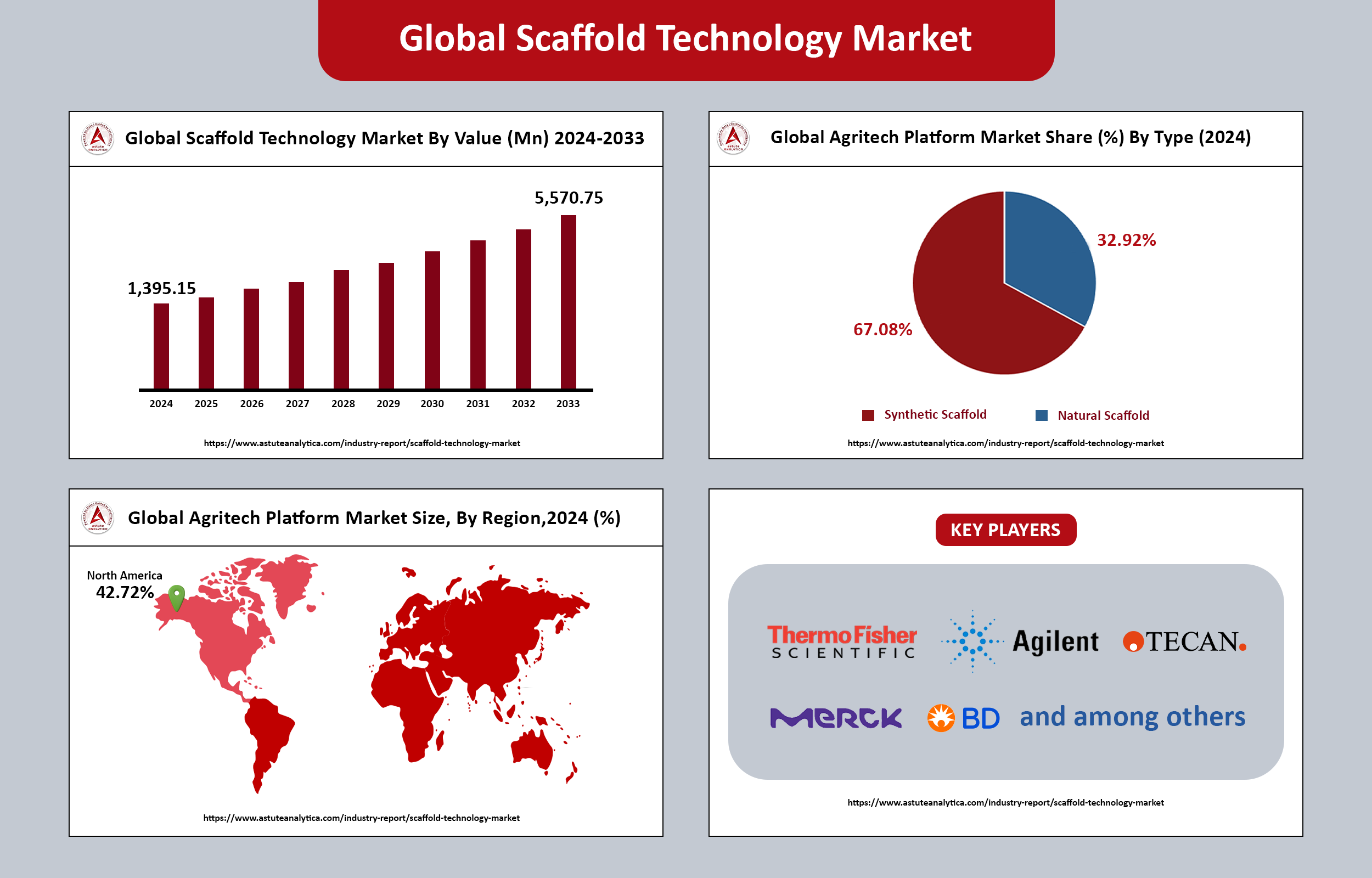

The global scaffold technology market revenue surpassed US$ 1,395.15 million in 2024 and is predicted to attain around US$ 5,570.75 million by 2033, growing at a CAGR of 16.63% during the forecast period from 2025 to 2033.

The global scaffold technology market is witnessing substantial growth, largely driven by the increasing demand for regenerative medicine. This heightened demand is primarily a response to the rising prevalence of chronic diseases and the aging population, both of which necessitate the development of advanced treatment modalities. For instance, chronic conditions such as diabetes, which affects over 422 million people worldwide, and cardiovascular diseases, impacting approximately 17.9 million individuals, are significant contributors to the growing need for innovative medical solutions.

Within regenerative medicine, scaffold technologies play a crucial role in tissue engineering. Over the past five years, there has been a remarkable 30% increase in research investment in this field, underscoring the sector’s potential to transform healthcare practices. The close relationship between scaffold technologies and regenerative medicine is evident, as more than 60% of regenerative medicine applications rely on these scaffolds. This interdependence highlights the importance of continued innovation and investment in scaffold technology to address the pressing challenges posed by chronic diseases and the demands of an aging demographic.

Scaffold Technology Market Key Takeaways

- The scaffold technology market is projected to exceed USD 5,570.75 million by 2033, with a compound annual growth rate (CAGR) of 16.63% during the forecast period from 2025 to 2033.

- In terms of type, the hydrogel scaffold segment is expected to maintain its leadership position, commanding a robust market share of over 34.28% in 2024. This dominance can be due to the unique properties of hydrogels, including their exceptional water retention, biocompatibility, and structures that closely resemble the natural extracellular matrix.

- When examining the market based on material type, synthetic scaffolds continue to dominate, holding an impressive 67.08% share of the global scaffold technology market. Their success is largely due to the precise control that manufacturers can exert over various factors, such as chemical composition, mechanical integrity, and degradation profiles.

- In terms of application, regenerative medicine stands out as a significant contributor, accounting for 38.05% of the scaffold technology market revenue. This is driven by the essential role that scaffolds play in tissue engineering and stem cell therapies.

- Regarding cell culture types, the 2-D cell culture method holds a commanding 64.19% share of the scaffold technology market. This dominance is rooted in its long-standing reputation as the gold standard for biological research and drug development.

North America to Remain the Largest Region, With 42.72% of Revenue Share

North America continues to dominate the global scaffold technology market, accounting for over 42.72% of the total market share as of 2024. This region is recognized as the most influential player in driving advancements within the industry. One of the primary factors contributing to this leadership is the advanced healthcare infrastructure prevalent in North America. This infrastructure not only supports but also encourages the rapid adoption of innovative medical solutions, allowing for significant progress in scaffold technology.

In particular, the United States stands out, boasting a market size that exceeds USD 1 billion. This impressive figure is indicative of the high level of research and development (R&D) activity taking place within the country, which constitutes approximately 40% of global investments in scaffold technology. Such substantial funding is crucial as it facilitates consistent breakthroughs in various areas, including biomaterials, 3D printing techniques, and tissue engineering strategies.

Moreover, specific applications in fields such as orthopedics and dental implants account for about 40% of the region’s total usage of scaffold technology. This focused approach highlights the commitment to tackling critical issues such as musculoskeletal disorders, bone regeneration, and the development of robust dental restorations.

Access a free sample copy or review the report summary :

Market Overview

Scaffold technology refers to two significant areas: the temporary structures used in construction and the biomaterials utilized in medical applications to support cell growth and facilitate tissue regeneration. This dual focus highlights the versatility and importance of scaffolds across various fields.

One of the key drivers of scaffold technology is the increasing research and development (R&D) efforts aimed at understanding biological processes. Researchers are increasingly substituting traditional animal trials with studies conducted in real-time biological environments. This shift is motivated by a desire to address both regulatory and ethical issues associated with animal testing, paving the way for more humane and effective research methodologies.

As scaffold applications expand, scientists can gain a deeper insight into how specific treatments affect the human body. Since synthetic scaffolds can closely mimic the natural biological environment, they are increasingly preferred over animal trials. This preference is rooted in the need for more accurate and relevant data that can translate better to human physiology.

Market Growth Factors

Driver

Advancements in Regenerative Medicine and Tissue Engineering: Recent advancements in regenerative medicine and tissue engineering techniques have significantly enhanced scaffold technology, leading to innovative solutions for repairing and regenerating damaged tissues.

Increasing Demand for 3D Cellular Models: The growing interest in 3D cellular models has been driven by the need for more accurate representations of in vivo conditions in biological studies. The increasing demand for personalized medicine has fueled interest in 3D cellular models that can be derived from patient-specific cells.

Restraint

High Production Costs and Regulatory Compliance Requirements: The production costs associated with scaffold technology pose significant challenges to its widespread adoption and utilization in various industries, particularly biomedical applications. The combination of high production costs and regulatory hurdles can create barriers to entry for smaller companies or startups, limiting competition and innovation in the market.

Safety Risks with Scaffold Installation and Operation: The primary concern with scaffolds is ensuring their structural integrity during installation and use. If a scaffold is not properly designed, fabricated, or maintained, it may fail under load, posing significant risks to workers and patients. Regular inspections and adherence to safety standards are critical to mitigate this risk.

Top Trends

Increased Use of Electrospun Nanofiber Scaffolds: The adoption of electrospun nanofiber scaffolds in tissue engineering has significantly increased due to their unique properties and advantages. This resemblance allows for enhanced cell attachment, proliferation, and differentiation, making nanofiber scaffolds particularly effective for various tissue engineering applications.

Expansion of Scaffold Technology Applications in Drug Discovery: The realm of scaffold technology is experiencing a transformative expansion in its applications within drug discovery. Scaffolds, which serve as molecular frameworks, are increasingly utilized to facilitate the identification and development of new therapeutic agents.

Recent Developments

- In February 2025, Atreon Orthopedics, LLC, an innovative company based in Columbus specializing in tissue healing and regenerative technologies, announced the 510(k) clearance from the Food and Drug Administration (FDA) for its BioCharge® Autobiologic Matrix. Notably, the BioCharge implant is the first-ever fully resorbable synthetic scaffold, engineered to accelerate tendon healing via a significantly simplified surgical technique.

- In February 2025, Levee Medical secured a $10 million Series B financing round aimed at enhancing outcomes for prostate cancer surgery patients. This funding will support the development of the Voro urologic scaffold, an absorbable device designed to mitigate post-prostatectomy urinary incontinence. Additionally, the funds will facilitate ongoing clinical studies, including an upcoming U.S. pivotal trial and current ARID studies.

- In November 2024, R3 Vascular announced that the FDA granted the company investigational device exemption (IDE) approval to commence its ELITE-BTK pivotal trial. This trial focuses on the next-generation Magnitude drug-eluting bioresorbable scaffold for treating below-the-knee (BTK) peripheral arterial disease (PAD).

Global Scaffold Technology Market Major Players:

- 3D Biotek LLC

- Agilent Technologies Inc. (Biotek)

- Becton, Dickinson, and Company

- Bico Group

- BioVison Incorporated

- Corning Incorporated

- Merck KGaA (Sigma aldrich)

- Promo Cell GmbH

- Reprocell Incorporation

- Synthecon Incorporated

- Tecan Trading AG

- Thermo Fisher Scientific Inc.

- Other Prominent Players

Key Segmentation:

By Material Type

- Natural Scaffold

- Polysaccharides

- Chitosan

- Collagen

- Fibrin

- Synthetic Scaffold

By Type

- Macro-Porous Scaffolds

- Micro-Porous Scaffolds

- Nano-Porous Scaffolds

- Solid Scaffolds

- Matrigel Scaffolds

- Hydrogel Scaffold

- Wound Healing

- 3D Bioprinting

- Immunomodulation

By Cell Culture Type

- 2-D Cell Culture

- 3-D Cell Culture

By Structure

- Porous

- Non-Porous

By Application

- Cancer Cell Research

- Stem Cell Research

- Drug Discovery

- Regenerative Medicine

By End User

- Hospitals & Clinics

- Biotechnology & Pharmaceutical Companies

- Contract Research Laboratories

- Academic Institutes

By Geography

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa (MEA)