Wet Strength Resin Market: By Resin Type (Formaldehyde-based resin, Polyamine-polyamide-epichlorohydrin, Glyoxal-polyacrylamide); Applications (Banknote Paper, Tissue, Paperboard, and Others)— Market Size, Industry Dynamics, Opportunity Analysis and Forecast, for 2025–2033

- Last Updated: 29-Aug-2025 | | Report ID: AA0123345

Market Scenario

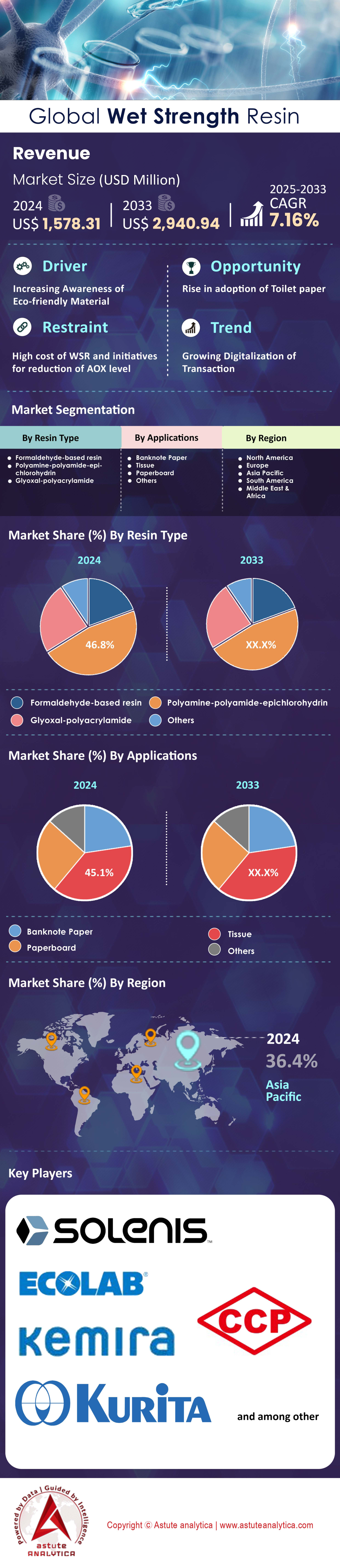

Wet strength resin market was valued at US$ 1,578.31 million in 2024 and is projected to hit the market valuation of US$ 2,940.94 million by 2033 at a CAGR of 7.16% during the forecast period 2025–2033.

Key Findings in Wet Strength Resin Market

- Based on resin type, Polyamine-polyamide-epichlorohydrin is projected to continue dominating the market by capturing more than 46.79% market share.

Based on application, wet strength resin is heavily used for production of tissue paper by accounting for over 45.07% market share. - Asia Pacific is dominant region in the market as it capture over 37.30% market share

- Wet strength resin market is projected to surpass valuation of US$ 2,940.94 million by 2033

The wet strength resin market is on a strong upward trajectory, supported by growing consumption in packaging, tissue, and specialty paper applications. Increasing substitution of plastic with fiber-based packaging, coupled with higher demand for hygiene paper products, has positioned wet strength resins as an indispensable additive for the paper industry.

The wet strength resin market is experiencing rising demand primarily from the packaging sector, where applications such as tissue papers, coffee filters, food service disposables, and e-commerce packaging boards rely on these resins to ensure durability under moist conditions, driving consistent procurement by converters and paper producers. Beyond packaging, industrial activities within the broader paper and wood product resin ecosystem also shape market growth, as evidenced by India’s MDF production reaching 2.8 million cubic meters in 2024 and Brazil’s plywood exports totaling 0.75 million cubic meters, both heavily reliant on formaldehyde-based resins, highlighting the embedded role of resin formulations in board, panel, and paper laminate applications. In parallel, innovation in resin formulations is propelling adoption, with advancements such as the incorporation of 0.20 wt% graphene oxide (GO) into urea formaldehyde resin, which significantly reduces emissions, paving the way for more sustainable wet strength resin variants aligned with tightening global environmental standards.

To Get more Insights, Request A Free Sample

How World is Responding to the Key Market Trends

- Asia-Pacific in the Lead: China invested $1.2 billion in low-emission resin R&D in 2024, signaling long-term commitment to sustainable and high-performance resin technologies. India and other Asian producers are expanding paperboard capacity, translating into sustained wet strength resin consumption.

- Price Differentials Driving Procurement: Raw material and resin prices remain a decisive factor in supply planning. In June 2025, UF resin prices stood at $407/MT in the USA, $250/MT in China, $361/MT in Germany, $375/MT in Saudi Arabia, and $422/MT in Japan. These regional differences force wet strength resin suppliers to adjust sourcing and pricing strategies to maintain competitiveness.

- Cross-Regional Supply Dynamics: Imports of epoxy resins into the US from key Asian markets have averaged 100 ktpa since 2020, reflecting a broader trend of cross-border resin flows. This dynamic has implications for wet strength resin markets as well, where raw material availability and logistics directly impact supply-demand balance.

Future Outlook

The forthcoming growth phase in the wet strength resin market will be substantially influenced by escalating tissue and hygiene paper consumption in emerging economies, propelled by rising urbanization and improved living standards driving higher per capita usage. Concurrently, regulatory frameworks in Europe and North America increasingly incentivize a shift from plastics to sustainable paper-based packaging, augmenting demand for wet strength resins which enhance moisture resistance and durability. For context, urea-formaldehyde resin prices—an important raw material segment—have shown significant volatility, with the USA price falling from $688/MT in December 2023 to $407/MT by June 2025, and China exhibiting a similar downward trend from $627/MT in late 2023 to $250/MT in mid-2025, reflecting supply-demand fluctuations and feedstock cost variations.

Meanwhile, product innovation remains a key enabler, exemplified by advances such as incorporating just 0.20 wt% graphene oxide into urea-formaldehyde resin, which has experimentally demonstrated an 81.5% reduction in formaldehyde emissions, driving demand for greener wet strength resin formulations amid stricter environmental regulations globally. Amid this growth, ongoing raw material price volatility, as driven by feedstock availability and geopolitical factors, will compel resin producers and converters to adopt agile procurement strategies and robust supply chains to sustain profitability while meeting evolving market and sustainability requirements.

Unlocking Future Growth in the Dynamic Wet Strength Resin Market

Significant opportunities are emerging for players within the market, driven by product innovation tied to sustainability and consumer convenience. Forward-thinking companies can capitalize on these trends to secure a competitive advantage and drive substantial growth. The market is evolving beyond traditional applications, creating new revenue streams.

- A major opportunity lies in the expanding demand for temporary wet strength resins (TWSRs). These are crucial for products designed for disintegration, such as flushable wipes and repulpable packaging. The global production of flushable wipes is projected to surpass 35 billion units by 2025, creating a massive, specialized demand channel for advanced TWSR formulations that ensure both performance and environmental compliance.

- Another lucrative avenue is the development of recycling-friendly wet strength resins. Conventional resins often hinder the paper recycling process. New-generation debonding-on-demand resins, which break down under specific conditions, are gaining traction. Advanced resins launched in 2024 can improve paper fiber recovery rates by over 12% in recycling mills, directly addressing a critical pain point for the circular economy and offering a strong value proposition.

Circular Economy Mandates Are Redefining the Wet Strength Resin Market

Demand in the wet strength resin market is increasingly shaped by the principles of a circular economy. A strong push toward enhanced paper recyclability is creating new requirements for resin formulations. Improperly treated paper containing conventional wet strength resin currently costs European recycling mills an additional 95 Euros per ton to process due to contamination issues. In response, advanced debonding agents developed in 2024 can shorten repulping times by an average of 25 minutes, boosting operational efficiency. Research into enzymatic debonding solutions for these resins attracted investments totaling 45 million Euros in 2024. The impact of these innovations is tangible, with new technologies reducing the water required for repulping treated board by 700 liters per ton.

These developments are driven by both corporate sustainability goals and tightening regulations. Major consumer brands in the have set a target to use packaging with a recycled content of 500 grams per square meter by 2025. To meet such goals, new recycling-friendly resins reduce repulping energy consumption by 8 kilowatt-hours per ton. A single large pulp mill can now recover an additional 15,000 tons of high-quality fiber annually using these advanced resins. New environmental regulations slated for 2025 will limit non-repulpable material to just 20 kilograms per ton of collected paper waste. Consequently, demand for greener alternatives like glyoxal-based resins is surging, with an expected increase of 2,500 tons in Europe in 2024 alone, while over 300 paper mills globally are projected to have upgraded their sorting and repulping systems by 2025 to handle these materials.

Specialty Packaging and Advanced Filtration Are Driving High-Performance Resin Demand

The requirement for high-performance materials in specialized applications is a powerful demand driver for the wet strength resin market. Global demand for liquid packaging board (LPB), a primary end-use, is forecast to increase by a substantial 1.8 million tons in 2024. Aseptic cartons for long-life products require sophisticated resins capable of withstanding processing temperatures of 140 degrees Celsius without delamination. Material efficiency is also key; next-generation gable top cartons for dairy products will feature a 3-gram reduction in resin per unit in 2025. Performance is measured by stringent metrics, with new resin formulations for LPB now achieving a low Cobb water absorption value of 18 grams per square meter. Even niche consumer markets, such as specialty coffee filters, will demand 4,000 tons of high-purity wet strength resin in 2025.

Beyond packaging, advanced industrial filtration media represents another critical growth area. High-efficiency automotive air filters now depend on resins that help capture airborne particles as small as 0.3 microns. The burgeoning market for electric vehicle battery separator papers, a niche but vital application of the wet strength resin market, is expected to grow by 60 million square meters in 2024. New resin innovations have improved the wet burst strength of industrial filter media by 15 kilopascals, enhancing durability. Demand from the healthcare sector is also rising, with production of sterile medical-grade packaging papers set to increase by 22,000 tons in 2024. These applications are subject to strict safety standards, with migration limits for specific resin components in food contact paper being tightened to 50 micrograms per kilogram in 2025.

Segmental Analysis

PAE Resins Lead the Market with Unmatched Performance and Compliance

Polyamine-polyamide-epichlorohydrin (PAE) resins are set to continue their market leadership, holding a commanding 46.79% share. This dominance stems from their high efficiency, allowing them to impart significant wet strength to paper at low addition levels. A key factor is their compatibility with modern neutral-alkaline papermaking processes, which have become the industry standard over older, acidic methods. The robust, permanent covalent bonds they form with cellulose fibers ensure products like paper towels maintain their integrity when saturated. Manufacturers in the wet strength resin market favor PAE resins as they help improve operational efficiency. Advanced fourth-generation (G4) PAE resins have been developed to contain significantly reduced levels of harmful by-products, with some achieving 1,3-DCP and 3-MCPD levels below 10 parts per billion, satisfying stringent food-contact regulations. This focus on safety and performance solidifies their top position. Furthermore, these resins can make paper more than 3 times stronger when wet compared to untreated paper.

The wet strength resin market continues to evolve toward sustainability, a trend that PAE technology is well-positioned to meet. The development of high-solids PAE resins is a significant step, as their reduced water content effectively cuts down the need for 1 in every 7 shipments, lowering transportation costs and associated emissions. This aligns with the industry-wide push for greener manufacturing solutions.

- Major chemical companies have recently invested over $50 million in research and development for bio-based PAE resin alternatives.

- The price of epichlorohydrin, a crucial raw material, experienced a significant fluctuation of over $300 per metric ton in the last fiscal quarter, impacting production costs.

- The adaptability of PAE resins makes them suitable for use with recycled pulp, supporting the production of over 60 million tons of recycled paper and board annually in Europe alone.

Customize This Report + Validate with an Expert

Access only the sections you need—region-specific, company-level, or by use-case.

Includes a free consultation with a domain expert to help guide your decision.

Surging Hygiene Consciousness Propels Tissue Paper's Resin Demand in the Wet Strength Resin Market

The tissue paper sector's commanding use of wet strength resin, representing over 45.07% of the market, is directly fueled by powerful consumer trends. A global surge in hygiene awareness has solidified the role of paper towels, napkins, and facial tissues as household staples. This demand is amplified by rising disposable incomes and rapid urbanization, especially in developing regions. For these products, strength when wet is not a feature but a necessity, making resin application indispensable for manufacturers to meet baseline quality expectations. The average annual per capita consumption of tissue in developed regions like North America now exceeds 25 kilograms, showcasing the segment's maturity and high-volume demand. The ongoing expansion of production capacity, such as the expected addition of over 2 million tons in China by the end of 2025, further cements this dominance.

The resilience of the wet strength resin market is intrinsically linked to the health of the tissue industry. The recovery of the "away-from-home" market, including hotels and restaurants, to near pre-2020 levels has further bolstered consumption. Innovations in specialty tissue products also open new avenues for advanced resin applications.

- Recent investments in high-speed tissue manufacturing lines across Southeast Asia, which require fast-curing and efficient resins, have totaled more than $500 million in the past 18 months.

- Regulatory shifts away from single-use plastics could see over 1 billion plastic food containers replaced by resin-treated paper alternatives in Europe annually.

- The production of premium, multi-ply tissue products, which often use higher concentrations of wet strength additives for better performance, has seen consistent growth.

To Understand More About this Research: Request A Free Sample

Regional Analysis

Asia Pacific’s Unmatched Production Engine Dominates Global Resin Supply

The Asia Pacific region solidifies its leadership in the wet strength resin market through its immense manufacturing scale and escalating domestic consumption. In 2024, China commissioned a new Polyamide-epichlorohydrin (PAE) resin plant in Jiangsu province, adding a significant 35,000 tons of annual production capacity. Meanwhile, India’s demand for paperboard used in liquid packaging is set to surge by an additional 80,000 tons in 2025, driving substantial resin consumption. Regulatory shifts also play a role; Indonesia tightened its formaldehyde emission standards for wood panels to a stringent 0.5 mg/L in 2024, pushing demand toward premium, low-emission resin formulations. Vietnam’s booming export market expects to ship an additional 110,000 tons of paper packaging to Europe in 2024, all requiring high-quality wet strength treatment.

Further cementing the region’s dominance in the global wet strength resin market, South Korea filed 18 new patents related to advanced glyoxal-based wet strength agents in 2024, showcasing strong innovation. Japan’s government is backing future growth by allocating ¥2.5 billion in 2025 for research into cellulose nanofiber composites that utilize specialized wet strength binders. China’s raw material self-sufficiency also grew, with domestic production of the key precursor epichlorohydrin increasing by 200,000 tons in 2024. A major investment in Thailand saw $60 million allocated for a new production line for high-performance tea bag filter paper. In India, the Bureau of Indian Standards (BIS) updated regulations for food contact paper in 2024, lowering specific migration limits by 8 mg/dm². Lastly, the number of sustainably certified paper mills across Southeast Asia is projected to surpass 1,500 by 2025.

North Americas Market Is Driven by Regulatory Compliance and Innovation

North America’s mature wet strength resin market, which accounts for a notable market share, is defined by stringent regulations and high-value applications. In 2024, the U.S. Environmental Protection Agency’s comprehensive TSCA review resulted in new workplace handling protocols for specific byproducts of PAE resin synthesis. Responding to consumer demand, over 950 food service companies in the U.S. committed to eliminating PFAS coatings by 2025, which directly increases demand for resin-treated paper barrier solutions. Canada is fostering innovation with a CAD 7 million research grant awarded in 2025 to develop advanced lignin-based wet strength polymers. In 2024, the U.S. Food and Drug Administration approved 5 new wet strength additives for direct food contact applications, opening new commercial avenues. A $150 million investment was made to modernize a pulp mill in the U.S. South to produce 90,000 tons of specialty packaging board.

Europes Circular Economy Focus Is Reshaping Regional Resin Demand

Europe’s demand for the wet strength resin market is intrinsically linked to its aggressive sustainability targets. A new French law, effective 2025, banning plastic packaging for 30 types of produce is expected to create new demand for 200,000 tons of paper-based alternatives. In Germany, the BfR updated its food contact regulations in 2024, setting a new specific migration limit for epichlorohydrin at 0.01 mg/kg. A leading Italian tissue manufacturer invested €95 million to add production capacity for 70,000 tons of hygienic paper products. The EU’s Horizon Europe program recently funded a €18 million project to develop fully biodegradable wet strength polymers from biomass. Sweden’s forestry industry is investing €250 million in a new bio-product mill designed to produce 120,000 tons of sustainable packaging materials annually, a project starting in 2025.

Strategic Investments and Acquisitions Are Reshaping the Competitive Landscape in Wet Strength Resin Market

- Solenis Finalizes Acquisition of Diversey (2024): Expanding its portfolio in cleaning and hygiene, which has synergies with paper manufacturing clients, Solenis completed its acquisition of Diversey Holdings, Ltd. for approximately $4.6 billion.

- Cascades Announces Major Investment in Bear Island Mill (2024): Cascades confirmed a total investment of $515 million to convert its Bear Island newsprint mill in Virginia to produce 100% recycled containerboard, impacting regional resin demand.

- Stora Enso Divests Paper Mill to Schwarz Produktion (2024): Stora Enso completed the divestment of its Maxau paper production site in Germany to Schwarz Produktion, shifting assets within the European paper industry.

- WestRock to be Acquired by Smurfit Kappa (2024): Smurfit Kappa and WestRock agreed to merge, creating a global packaging leader with combined revenues of approximately $34 billion, set to influence global procurement of paper chemicals in the wet strength resin market.

- Ahlstrom Invests in New Glass Fiber Tissue Line (2024): Ahlstrom announced a €58 million investment in a new glass fiber tissue line in a North American plant, a specialty application requiring high-performance binders.

- Kemira Expands Bleaching Chemical Capacity in Brazil (2024): Kemira invested to expand sodium chlorate capacity in Brazil by 40,000 tons, a chemical essential for pulp bleaching, supporting the raw material base for specialty papers.

- Sappi Receives Funding for Mill Decarbonization (2024): Sappi’s Gratkorn Mill in Austria received significant funding from the EU Innovation Fund for a project aimed at decarbonizing pulp and paper production, which includes process upgrades.

- Georgia-Pacific Invests in Green Bay Mill Expansion (2024): Georgia-Pacific announced a $550 million investment into its Green Bay, Wisconsin, facility to expand its capacity for producing bath tissue and paper towels.

- Mondi Finalizes Acquisition of Hinton Pulp Mill (2024): Mondi completed its acquisition of the Hinton pulp mill in Alberta, Canada from West Fraser for $5 million, securing its access to high-quality pulp for its packaging products.

Top Companies in the Wet Strength Resin Market

- Buckman

- Chang Chun Group

- CHT Group

- Delamine

- Ecolab

- Kemira

- Korfez Kimya

- Kothari Group Of Industries

- Kurita

- Melaminska Kemija

- Seiko PMC Corporation

- Solenis

- Other Prominent Players

Market Segmental Overview

By Resin Type

- Formaldehyde-based resin

- Polyamine-polyamide-epichlorohydrin

- Glyoxal-polyacrylamide

By Applications

- Banknote Paper

- Tissue

- Paperboard

- Others

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- Western Europe

- The UK

- Germany

- France

- Italy

- Spain

- Rest of Western Europe

- Eastern Europe

- Poland

- Russia

- Rest of Eastern Europe

- Western Europe

- Asia Pacific

- China

- India

- Japan

- Australia & New Zealand

- South Korea

- ASEAN

- Rest of Asia Pacific

- Middle East & Africa (MEA)

- Saudi Arabia

- South Africa

- UAE

- Rest of MEA

- South America

- Argentina

- Brazil

- Rest of South America

REPORT SCOPE

| Report Attribute | Details |

|---|---|

| Market Size Value in 2024 | US$ 1,578.31 Million |

| Expected Revenue in 2033 | US$ 2,940.94 Million |

| Historic Data | 2020-2023 |

| Base Year | 2024 |

| Forecast Period | 2025-2033 |

| Unit | Value (USD Mn) |

| CAGR | 7.16% |

| Segments covered | By Resin Type, By Applications, By Region |

| Key Companies | Buckman, Chang Chun Group, CHT Group, Delamine, Ecolab, Kemira, Korfez Kimya, Kothari Group Of Industries, Kurita, Melaminska Kemija, Seiko PMC Corporation, Solenis, Other Prominent Players |

| Customization Scope | Get your customized report as per your preference. Ask for customization |

FREQUENTLY ASKED QUESTIONS

The global wet strength resin market was valued at US$ 1,578.31 million in 2024 and is projected to reach US$ 2,940.94 million by 2033, growing at a CAGR of 7.16%.

Tissue paper production accounts for over 45.07% of demand, driven by rising global hygiene awareness and growth in premium multi-ply tissue consumption.

Tissue paper production accounts for over 45.07% of demand, driven by rising global hygiene awareness and growth in premium multi-ply tissue consumption.

Asia Pacific captures 37.30% share, supported by expanding paperboard capacity in China and India, as well as rapid urbanization and consumer demand.

Leading companies include Solenis, Kemira, Buckman, Ecolab, Kurita, Seiko PMC, CHT Group, and Chang Chun Group.

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

.svg)