Wave and Tidal Energy Market: By Type (Wave Energy, Tidal Energy); Technology (Wave Energy, Tidal Energy); Application (Power Generation, Desalination); and Region— Market Size, Industry Dynamics, Opportunity Analysis And Forecast For 2025–2033

- Last Updated: 05-Nov-2025 | | Report ID: AA0423393

Market Snapshot

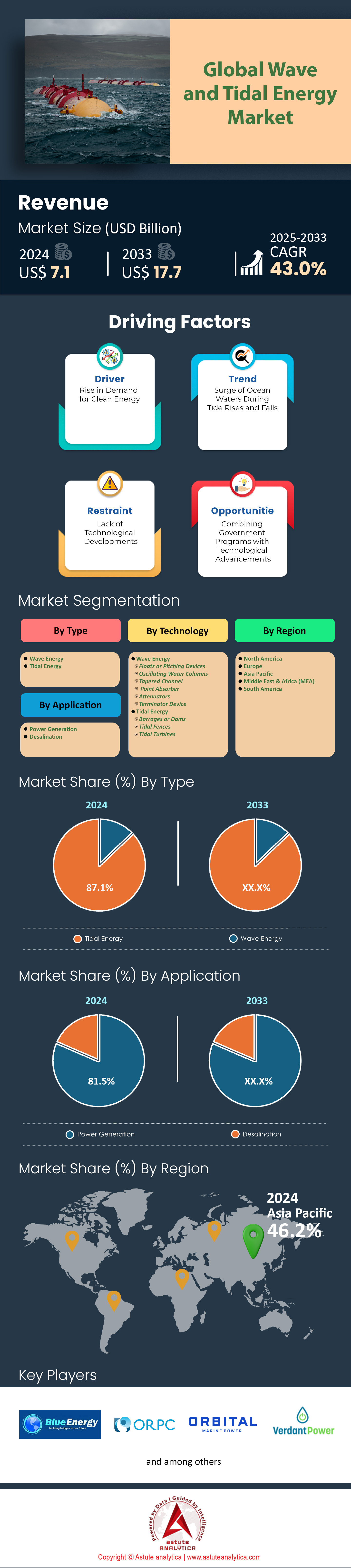

Wave and tidal energy market was valued at US$ 7.1 billion in 2024 and is projected to generate a revenue of US$ 17.7 billion by 2033 at a CAGR of 43.0% during the forecast period 2025-2033.

Key Findings

- Based on type, The tidal energy segment is expected to continue holding over 87% market share and is poised to grow at the highest CAGR of 43.3% during the forecast period.

- Based on technology, tidal energy technology is to remain the dominant with over 87% market share.

- Based on application, power generation is accounting for 81.50% market share.

- Europe takes led in the global market and is poised to continue with over 46.20% market share.

- Global wave and tidal energy market is set to grow at an exponential CAGR of 43.01%.

A powerful appetite for predictable, grid-scale renewable energy is accelerating the wave and tidal energy market. In Europe, a publicly funded project pipeline of 165 MW is taking shape, composed of 15 distinct ocean energy farms. Governments are the primary drivers of this demand, with the United States Department of Energy committing US$ 141 million in 2024 alone. A further funding opportunity of up to US$ 112.5 million was announced to support as many as 17 projects. National energy strategies are also creating concrete demand, with the UK contracting for 83 MW of tidal capacity in Scotland and 38 MW in Wales.

Private capital is decisively following public investment, signaling strong commercial demand across the wave and tidal energy market. Since 2023, European ocean energy companies have attracted €60 million in publicly announced private investments. Technology developers like CorPower Ocean are proving bankable, securing €18.2 million in February 2025 and an additional US$ 33 million in late 2024. This investor confidence is bolstered by tangible commercial progress. For instance, Orbital Marine Power reported an estimated revenue of US$ 7.6 million in 2024, proving the technology can generate returns. The total US public support over the last five years has now reached an impressive US$ 591 million.

Ultimately, utility and grid operator needs are solidifying the wave and tidal energy market's future. The UK's 2024 renewable energy auction secured tidal stream projects at a strike price of £172/MWh, creating a guaranteed offtake market. Successful projects like MeyGen, now operating at a full 6 MW capacity, demonstrate the reliability utilities require. Looking ahead, the European Union's ambition for 88 GW of offshore renewable capacity creates a massive future market for marine power. The immediate supply to meet a portion of that demand is already visible in Europe’s 152 MW tidal stream project pipeline. The EU's Horizon Europe program is also set to provide €8 million in 2025 for two projects.

To Get more Insights, Request A Free Sample

Vast Blue Economy Integration Unlocks New Profitable Wave and Tidal Frontiers

- Hybrid Project Synergies: A significant opportunity is emerging from the co-location of wave and tidal energy projects with offshore wind farms and aquaculture sites. Hybrid models offer shared infrastructure, reducing capital expenditure and operational costs. For example, integrating marine energy devices within a wind farm's footprint can provide more consistent power output, smoothing intermittency for the grid. Furthermore, powering offshore aquaculture operations with local wave or tidal energy reduces reliance on diesel generators. Such integration lowers both carbon footprints and operating expenses, creating a compelling business case for cross-sector collaboration in the wave and tidal energy market.

- Powering Off-Grid Industries: Demand for clean, reliable power in remote maritime industries presents a major growth vector. Wave and tidal energy are ideal for powering subsea observation systems, offshore charging stations for autonomous vessels, and remote desalination plants. These niche applications provide a premium market where marine renewables are not competing with grid-scale electricity but are enabling technologies for the blue economy. Companies that can provide scalable, modular power solutions tailored for specific industrial needs will capture high-value contracts and establish a strong foothold in this underserved market segment.

Remote Community Electrification Drives a New Wave of Decentralized Energy Demand

A pressing need for energy independence in remote and island communities is shaping a distinct demand segment within the wave and tidal energy market. These locations often rely on expensive and polluting diesel imports for power generation. In response, governments are funding targeted initiatives. For instance, Canada’s Ocean Renewable Energy Group (OREG) is advancing a 2025 project to power a remote British Columbia community, requiring 3 customized turbines. Similarly, the European Union's Clean Energy for EU Islands Secretariat supported 11 island energy transition projects in early 2024. The U.S. Department of Energy, through its Water Power Technologies Office, is also funding the development of 4 modular wave energy systems in 2025 specifically for remote coastal stakeholders.

The nature of this demand centers on small-scale, resilient power systems in the wave and tidal energy market. In 2024, Indonesia announced plans for 8 new tidal energy installations to power isolated fishing villages. A 2025 study identified 15 potential sites in the Philippines suitable for sub-1MW wave energy converters for community microgrids. Scotland’s Wave Energy Scotland (WES) program funded 3 projects in 2024 focused on developing devices for off-grid applications. Verdant Power's RITE project in New York, operational in 2024, provided power for 9 homes, serving as a key demonstrator. A new Australian government grant in 2025 will support 5 off-grid marine energy pilot projects. Finally, a 2024 report highlighted that 22 remote communities in Chile have the potential to be fully powered by local wave resources.

Offshore Industrial Power Needs Create a High-Value Niche Market Application

The burgeoning blue economy is creating a robust, high-value demand for localized ocean power across the wave and tidal energy market. Industries operating offshore require persistent, clean energy sources to move away from fossil fuels. A key driver is the offshore aquaculture sector. A 2025 Norwegian initiative will equip 3 large salmon farms with integrated wave energy devices to power automated feeding systems. Similarly, a 2024 project in Scotland saw the installation of 2 tidal-powered systems for monitoring water quality at a mussel farm. The market for powering unmanned underwater vehicles (UUVs) is also growing; a 2025 defense contract in the U.S. calls for 6 tidal-powered subsea docking stations for autonomous patrols.

The scope of industrial demand extends to critical data collection and resource extraction. The Global Ocean Observing System has plans in 2025 to deploy 12 new data buoys in the Atlantic, powered by small-scale wave energy converters. In 2024, an oil and gas consortium in Brazil invested in a pilot project using 1 wave energy device to power subsea injection equipment. The scientific community is another key stakeholder; the University of Washington deployed 4 specialized tidal-powered sensors in Puget Sound in 2024. A Japanese project in 2025 aims to power 2 offshore hydrogen production platforms with tidal turbines. Finally, a 2024 tender was issued for 7 wave-powered desalination units for a remote mining operation in Western Australia, showcasing diverse industrial pull for the wave and tidal energy market.

Segmental Analysis

Tidal Energy's Predictable Power Fuels Unmatched Market Growth

The tidal energy segment is set to maintain its commanding position in the wave and tidal energy market. It currently holds over 87% of the market share. Its remarkable growth is due to the predictable nature of tides, which are governed by lunar and solar gravitational pulls. Unlike wind or solar, tidal patterns can be forecasted with incredible accuracy for years to come. Consequently, a consistent energy supply is ensured. The world's largest installation, South Korea's Sihwa Lake Tidal Power Station, has a powerful 254 MW capacity. Similarly, the La Rance facility in France, operational since 1966 with a 240 MW capacity, demonstrates the long-term viability of tidal projects. The total global potential for tidal energy is estimated to be a substantial 1,000 GW.

- The MeyGen project in Scotland, the world's largest planned tidal stream array, aims for a final capacity of 398 MW.

- Water is over 800 times denser than air, allowing tidal turbines to generate significant power with slower rotation speeds.

- Over 500 patents for wave and tidal technologies have been filed in the last five years, indicating rapid innovation.

The predictable, cyclic nature of tidal power provides four distinct power periods each day. Such consistency makes the market particularly appealing for ensuring grid stability. It also reduces the need for large-scale energy storage solutions. Furthermore, the long lifespan of tidal infrastructure, with some barrages able to operate for over 120 years, enhances its economic appeal. As the wave and tidal energy market matures, the proven reliability of tidal technology continues to attract investment and drive large-scale project development.

Advanced Tidal Technologies Propel a New Era of Ocean Power

Within the wave and tidal energy market, tidal energy technology will remain dominant with a share exceeding 87%. The most prominent technologies are tidal barrages and tidal stream generators. Tidal barrages are essentially dams that use water height differences to drive turbines. In contrast, tidal stream generators are like underwater wind turbines, harnessing the kinetic energy of moving water. Their dominance over wave technology stems from higher predictability. Furthermore, they are in a more advanced stage of development. Wave energy is more variable, and its technology faces challenges in surviving harsh ocean conditions and efficiently capturing energy.

- The planned Morlais project in the UK aims to facilitate the installation of up to 240 MW of tidal stream capacity.

- Tidal turbines are designed for robustness, with some pile-mounted devices suited for water depths up to 40 meters.

- Globally, 59 startups are focused on developing tidal energy generation systems, attracting significant investment.

The operational success of large-scale projects provides a long-term performance record that wave energy currently lacks. Tidal technology's scalability allows for installations ranging from single devices to massive arrays. The global technically harvestable tidal energy resource is estimated at 1 terawatt. The wave energy sector, however, is still largely in a demonstration phase. The established expertise in the tidal sector creates a favorable investment climate within the market. Ongoing development in the wave and tidal energy market is therefore heavily skewed towards refining and deploying these proven tidal systems.

Customize This Report + Validate with an Expert

Access only the sections you need—region-specific, company-level, or by use-case.

Includes a free consultation with a domain expert to help guide your decision.

Power Generation The Core Application Driving Market Momentum

Power generation firmly leads the wave and tidal energy market, accounting for an 81.50% market share. The fundamental purpose of these technologies is converting marine energy into electricity for the grid. For instance, tidal power plants like the Sihwa Lake facility generate a massive amount of electricity. Its annual capacity of 552.7 GWh is enough to power a city of 500,000 people. Electricity is generated when water movement spins a turbine connected to a generator. The power is then transmitted to shore through underwater cables for grid integration.

- The La Rance tidal plant in France has an annual generation capacity of 540 GWh, powering approximately 130,000 homes.

- The 552.7 GWh generated by the Sihwa plant displaces the need for 862,000 barrels of oil annually.

- The first commercial-scale tidal stream generator, SeaGen, had a capacity of 1.2 MW and could generate power 18 to 20 hours a day.

The high energy density of water allows a significant amount of clean energy to be produced from a relatively small footprint. A direct contribution to national energy security and decarbonization goals is a primary driver for investment in the wave and tidal energy market. As nations strive to meet climate targets, the reliable power from tidal projects presents a compelling solution. The continuous operation of these facilities ensures they are a cornerstone of the renewable energy transition. As a result, power generation's role in the expanding market is solidified.

To Understand More About this Research: Request A Free Sample

Regional Analysis

Europe’s Project Maturity and Strong Infrastructure Solidify Its Market Dominance

Europe commands the global wave and tidal energy market with a formidable 46.20% share, driven by its advanced project pipeline and robust testing infrastructure. The European Marine Energy Centre (EMEC) in Scotland facilitated testing for 12 marine energy clients throughout 2024. France is significantly expanding its capacity, with the FloWatt tidal project in Normandy set to install 7 turbines, each with a 2.5 MW capacity, beginning in 2025. In the Netherlands, the Oosterschelde Tidal Power Plant, comprising 5 turbines, is targeted to generate 3.2 GWh of electricity in 2024. Furthermore, the UK awarded contracts for 6 new tidal stream projects in its 2024 renewable energy auction.

The continent’s commitment in the wave and tidal energy market is also reflected in its collaborative R&D and specific project milestones. Portugal’s Aguçadoura wave farm site is being repowered, with plans for 3 new high-efficiency devices by 2025. Spain’s BiMEP test site hosted 2 full-scale wave energy converter prototypes for performance validation in early 2024. The UK government's latest funding round allocated grants to 4 UK-based tidal technology developers in Q1 2024. In Ireland, 1 full-scale tidal turbine was deployed for grid-connected testing near Strangford Lough. Finally, Sweden's Minesto commissioned its second 1.2 MW 'Dragon 12' tidal kite in the Faroe Islands in February 2024.

Asia Pacific’s Strategic Government Initiatives Signal an Impending Market Surge

The Asia Pacific region is rapidly accelerating its marine energy ambitions through strategic government-led projects in the wave and tidal energy market. China is at the forefront, with its LHD tidal energy project in Zhejiang province adding 2 new 600 kW turbines in 2024. South Korea’s Sihwa Lake Tidal Power Plant, the world's largest, is scheduled for a major component upgrade across its 10 turbines starting in 2025. India's Ministry of New and Renewable Energy approved the development of a 5 MW demonstration tidal project in the Gulf of Kutch in early 2024. Australia is also advancing, with Carnegie Clean Energy initiating site work for its 2 MW North Fremantle wave energy project. Indonesia’s government has identified 5 priority locations for its first utility-scale tidal stream farms, with feasibility studies completed in 2024. Japan has also installed 1 new 500kW tidal device for testing off the Goto Islands.

North America’s Federal Funding and Test Site Development Cultivate Growth

North America’s wave and tidal energy market is characterized by strong federal support and the development of world-class testing infrastructure. The U.S. Department of Energy awarded US$ 6 million in January 2025 to 3 companies for testing at the PacWave South wave energy test site in Oregon. In Canada, Sustainable Marine is proceeding with the next phase of its project in the Bay of Fundy, planning to install 4 new floating tidal platforms by the end of 2025. The U.S. also identified 2 potential sites in Washington's Puget Sound for a new 10 MW tidal array in a 2024 assessment. Mexico's Cemie-Oceano research center deployed 1 new prototype wave energy device for evaluation in 2024. The U.S. National Renewable Energy Laboratory (NREL) began construction on 3 new test berths for marine energy devices in 2024.

Strategic Capital Injections and Key Acquisitions Shape the Competitive Landscape of Wave and Tidal Energy Market

- CorPower Ocean Secures Major EU Funding (Feb 2025): The Swedish developer secured an investment package of €18.2 million from the European Innovation Council (EIC) Accelerator to support its commercial-scale manufacturing.

- Orbital Marine Power Raises Significant Capital (Feb 2024): The Scottish tidal turbine firm raised £4 million from existing investors to support the delivery of its technology in new global projects.

- HydroQuest Completes Funding Round (Jan 2024): The French tidal energy company secured €12 million in a new funding round to accelerate the deployment of its turbines at the FloWatt pilot farm.

- Minesto Initiates Rights Issue for Expansion (May 2024): The Swedish tidal developer launched a rights issue to raise approximately SEK 120.5 million (US$ 11.5 million) to scale up production of its 'Dragon' class kites.

- Mocean Energy Secures New Investment (Apr 2024): The Scottish wave energy company raised £2.7 million in its latest funding round to advance the design of its Blue Star wave energy converter.

- SIMEC Atlantis Sells Stake in Uskmouth Project (Mar 2024): SIMEC Atlantis Energy sold its majority stake in the Uskmouth Power Station site to focus capital and resources on its core tidal energy portfolio, including the MeyGen project.

- Eco Wave Power Secures Spanish Port Deal (Mar 2024): The company signed an agreement with Port Adriano, Spain, for a new wave energy project, marking a significant commercial expansion and investment in a new European wave and tidal energy market.

- AMOG Consulting Acquired by ABL Group (Feb 2024): ABL Group acquired Australian engineering firm AMOG Consulting, which has expertise in wave energy projects, to strengthen its offshore renewable energy services.

- Bombora Wave Power Receives Welsh Government Funding (Jan 2024): The wave energy developer received a £1.2 million grant from the Welsh government to support the next development phase of its mWave technology.

- Wave Swell Energy Secures Private Equity Investment (Apr 2024): The Australian wave energy developer secured a significant, undisclosed investment from a private equity firm to advance its UniWave200 technology towards commercial projects.

List of Key Companies Profiled:

- Applied Technologies Company, Ltd.

- Aquagen Technologies

- BioPower Systems Pty. Ltd.

- Blue Energy Canada Inc.

- Carnegie Clean Energy Ltd.

- Corpower Ocean AB

- Eco Wave Power AB

- Nova Innovation Ltd.

- Ocean Power Technologies Inc.

- Ocean Renewable Power Company, LLC

- Orbital Marine Power

- Pelamis Wave Power

- SIMEC Atlantis Energy Ltd

- Tidal Lagoon Plc

- Verdant Power, Inc.

- Other Prominent Players

Market Segmentation Overview

By Type:

- Wave Energy

- Tidal Energy

By Technology:

- Wave Energy

- Floats or Pitching Devices

- Oscillating Water Columns

- Tapered Channel

- Point Absorber

- Attenuators

- Terminator Device

- Tidal Energy

- Barrages or Dams

- Tidal Fences

- Tidal Turbines

By Application:

- Power Generation

- Desalination

By Region:

- North America

- The U.S.

- Canada

- Mexico

- Europe

- Western Europe

- The UK

- Germany

- France

- Italy

- Spain

- Rest of Western Europe

- Eastern Europe

- Poland

- Russia

- Rest of Eastern Europe

- Western Europe

- Asia Pacific

- China

- India

- Japan

- Australia & New Zealand

- South Korea

- ASEAN

- Rest of Asia Pacific

- Middle East & Africa (MEA)

- Saudi Arabia

- South Africa

- UAE

- Rest of MEA

- South America

- Argentina

- Brazil

- Rest of South America

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

.svg)