Global Water Pipeline Leak Detection Systems Market: By Components (Instruments (Smart Ball, Smart Meters, Sensor Hoses, Noise Loggers, IR Cameras, MEMS Systems/ Sensors, Others), Software and Services (Training & Consultation, Maintenance & Installation, Contract/Outsourced Services); Technology (Acoustic Pressure, Vibration, GPR (Ground Penetrating Radar), Infra-Red, Others (Fiber Optic, Flow Rate, Tracer Gas, On-site); Pipe Location (On Ground and Under Ground); Pipe Type (Metallic Pipes (Ductile Iron Pipes, Stainless Steel Pipes, Aluminium Pipes, and Other Metal Pipes), Non-Metallic Pipes (Plastic Pipes, Glass Pipes, Concrete Pipes, Others); End Users (Industrial (Crude & Refined Petroleum, Water & Wastewater, Others ), Residential, Commercial, and Utilities); Region—Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2024–2032

- Last Updated: 13-Sep-2024 | | Report ID: AA0924918

Market Scenario

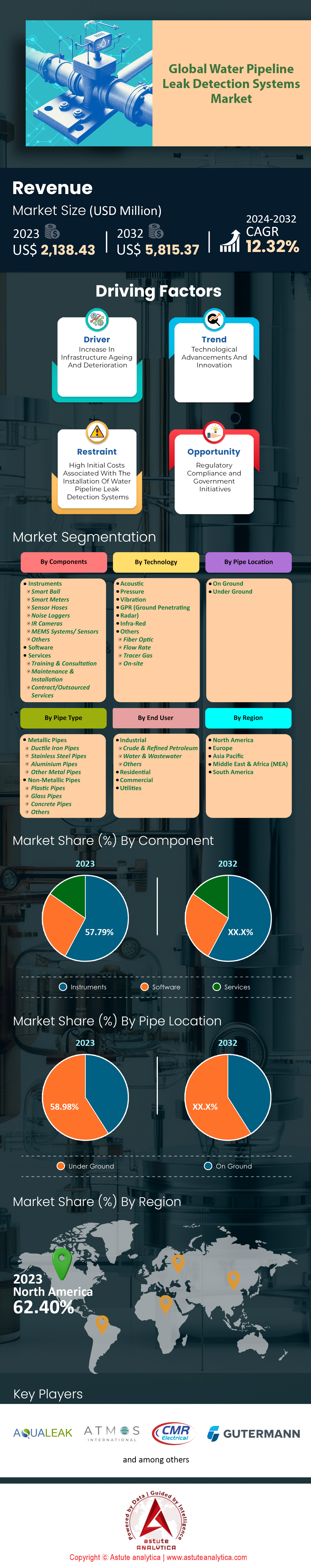

Global water pipeline leak detection systems market was valued at US$ 2,138.43 million in 2023 and is projected to hit the market valuation of US$ 5,815.37 million by 2032 at a CAGR of 12.32% during the forecast period 2024–2032.

Water pipeline leak detection systems are gaining demand owing to the deteriorating water infrastructure in most developing nations which leads to heavier water wastage. Unfortunately, the United States alone loses approximately 6 billion gallons of efficiently treated water every day due to leaks thereby creating a need for intervention. Other than that, global water consumption has increased three times within five decades and as a result, there is an increasing demand on water-use management systems. In a country that averages more than 200,000 water main breaks every year, such as the US, the need for reliable leak detection systems becomes even more apparent. Concern over the increasing water scarcity situation is also driving governments and organizations to adopt state-of-the-art leak detection methods, as for example over 20 billion has been allocated by India for water infrastructure enhancements.

Key manufacturers in the water pipeline leak detection systems market include entities such as Xylem, Inc., Badger Meter Inc., and Mueller Water Products Inc. Also, these companies are working towards bettering their market share through technological innovations and collaboration strategies. For instance, Xylem Inc. is implementing intelligent water management systems in about 40 nations. The target businesses include the urban centers and industries where water is precious. In China, the government wants to minimize water wastage in urban centers to below 10 liters per capita per day as a means of encouraging the use of this technology. Significant growth is being witnessed in the US market where it is expected that over 65% of cities and towns will invest in smart water technologies within the next couple of years.

Recent technologies accepted in the water pipeline leak detection systems market has been the incorporation of sensor and analytics technology. These innovations have decreased the average leak detection time from 30 days to 5 days in some smart city implementation. Global estimates reveal that the total mother market of smart water meters will hit 500 million by 2025. The market is also growing in depth as there are major investments in places such as the Middle East where water is in short supply. For instance, Saudi Arabia is funding more than 50 new water resource projects to repair leakage. As global warming leads to further deterioration of water resources, the need for efficient leak detection systems will remain steady and will spur innovation and competition in the sector.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Increasing demand for efficient water management to combat global water scarcity issues

The world's water crisis is getting worse as about 2 billion people do not have access to safe drinking water. In the future, there will be an increase in demand for water by 30% according to the UN due to population and urbanization growth. It is predicted that by 2025 more than one in two people will live in areas that are constrained by water supply, giving a boost to the water pipeline leak detection systems market growth. About 126 billion cubic meters of water is estimated to be lost every year by water utilities around the globe owing to leaking facilities and losses through impermeable structures. In the U.S water leaks waste more than 6 billion gallons of water every day. The World Bank observes that better management of water scarcity can result in rehabilitation of around 2 trillion cubic meters of water every year. The agricultural sector which uses 70% of the world’s water is under increasing demand to use water wisely. Water scarcity has put cities like Cape Town and São Paulo in danger of reaching nearly complete depletion of their water resources there water “Day Zero”. Demand is expected to exceed supply by 40% by 2030 unless there is a major shift in global water management practices.

It is important to note that effective water management is key to overcoming such issues and that technologies such as leak detection systems are significant. The global water pipeline leak detection systems market is expected to be worth around $3 billion by 2025 quite an interesting figure. For areas like MENA the last fifty years have seen water demand doubling again increasing pressure on the available supply. More and more smart water solutions are embraced by the utilities to make them more efficient and decrease water loss. Over 44 million smart water meters have been reported to have been installed globally with the purpose of conserving water. There has been massive underscoring by the governments and for example in the European Union 7.5 Billion dollars has been used to enhance Water Infrastructures. It is also estimated that proactive leak detection can help save up to 11 Trillion liters of water each year by 2035. As it is constructive to discuss its repercussions for water management those developments will become even more legitimate.

Trend: Integration of IoT technology for real-time monitoring and data-driven leak detection

The application of IoT technology in water management systems is aiding the utilities in leak detection and management as never before. As of 2023, there are 1.3 billion IoT devices being adopted across the globe for water management applications. The numbers, however, may grow as the market on IoT is expected to touch $1 trillion by 2030. An IoT leak detection system in the water pipeline leak detection systems market can detect practically leakages that are 3mm in diameter and allow faster response times. Over the years, water utilities have addressed the business information problems through the use of IoT and better directed a loss of non-revenue water of over 22 billion gallons annually. In 2024, there are more than 70,000 smart water grids in place across the globe optimizing water distribution system operations. The IoT platforms help utilities to look at more than 500 million data points every day and make decisions based on this information. The Internet of Things integration in water management has brought public savings covering its operational costs over $10 billion.

The incorporation of the IoT also facilitates the effort of predictive maintenance and helps to cut pipeline failures by 50% due to earlier detection of problems. In the US, the Environmental Protection Agency (EPA) specifically, has embraced IoT technology, calling it a key component in its water infrastructure improvement agenda. The rapid growth of IoT in the water pipeline leak detection systems market is responsible for the over 1200 smart city initiatives, most of which focus on efficient water management. With the help of IoT, utilities are able to track and control water consumption within the power grid and detect profiles of its usage and any abnormal behavior. Such trends have been attributed to the growth of cities and the ever-rising water requirements which in the future will increase the impact of IoT on the management of water. It is projected that by the year 2026, the global investment targeting water management systems that are facilitated by the IoT will be above 35 billion dollars as the world gears up to tap the benefits that technology offers in managing water shortages.

Challenge: Difficulty in detecting leaks in complex and aging pipeline infrastructures

More than half of the pipelines around the world are over 50 years, which makes it particularly difficult to find leaks caused by aging infrastructure. In the United States water pipeline leak detection systems market, there are about 240,000 water main breaks every year, which are mostly due to old and declining distribution systems. Because of all the related costs associated with replacing old pipelines, it is projected that over one trillion dollars will be spent on this operation over the next twenty years. In Europe, this percentage amounts to 23% where water leaks are responsible for reduction in available supply due to aging systems. More than 300,000 kilometers of water pipelines older than 40 years are a similar stuck in Japan. In terms of other countries and regions, 15,000 kilometers of total pipeline is replaced every day, but even this number is lowering the existing number of outstanding orders rather too slowly. In the United Kingdom, water leakages from leakages of infrastructure accounts for 3 billion liters daily. It is especially worse in developing countries on the lines of countries former Soviet Union where there are old systems but not enough money to build new ones.

In addition, how intricate the aging pipelines in the pipeline network can be contributes to how leak detection is carried out in the water pipeline leak detection systems market. Many older systems do not have telemetry and monitoring capabilities and thus can’t be amended for real time monitoring. The infusion of new technologies such as robotics and AI is on the rise with more than 1500 robotic systems made available in the world for inspection and maintenance of pipelines. However, such technologies have not been common yet, only five percent of the water utilities in the development of countries have utilized the same. The world pipeline inspection robots market is expected to hit $ 2.5 Billion by the year 2028. Addressing these challenges would entail great ingenuity investment and collaborative approach concerned bodies have with public and private institutions. As the networks age continually, the limits of leak detection and control will always be an operational challenge thereby requiring investment in the continued evolution of the technology and resources.

Segmental Analysis

By Component

The dominance of the instruments segment with 57.79% market share in the water pipeline leak detection systems market. The factors contributing to the continued growth of the instruments include the integration of IoT and AI which have improved the use of leak detecting instruments like Smart Ball, Smart Meters, and Sensor Hoses. Such devices ensure that loss or wastage of water, as well as costs of operation, are reduced considerably. For example, Smart Balls can run undisturbed over long spans of pipes to accurately locate even the slightest leaks while Smart Meters provide instantaneous reconnaissance of flow and pressure so that anomalies are not left unaddressed. This increased penetration of these technologies is evident in the burgeoning smart water management sector which is projected to reach $31 billion by 2027. Moreover, global water scarcity and growing concerns over efficient and effective water management have further propelled the quest for sophisticated leak detection systems prompting the markets and industries to heavily the development of leak detection technologies.

Furthermore, as a result of the rapid technological developments in the water pipeline leak detection systems market that are taking place and the investments accelerates the growth of the industry. MEMS Systems/sensors and IR camera are also gaining acceptance as they are able to gain access to the inner working systems for better diagnostics performed remotely in most cases, including within difficult to reach areas. It is as such no surprise that the adoption of MEMS technology is growing and forecasts indicate that by 2026, the global market for MEMS will be at $18 billion on account of the use of the smart structures. Further, the upgrading of noise loggers, which are estimated to cut detection time by 40%, illustrates the movement towards the availability of more efficient and cost effective solutions. In addition to the factors mentioned, new designs for water infrastructures due to the increasing need for water regulation in the emerging economies are likely lead to market growth. As the global pipeline will grow by 30,000 kilometers by 2030, the instruments segment is expected to assume a crucial role in improving leak detection and increasing revenues in the future.

By Technology

Acoustic technology is now considered the most effective method for water pipeline leak detection systems market as evidenced by its 49.34% market share in 2023. Its advantages in detection sensitivity and flexibility are unparalleled when compared with other methods such as vibration, pressure, Infrared Radiation (IR) and GPR. Although some methods only depend on sound detection as an indicator to a water leak, such as the zeal and GFR, Acoustic technology has the added advantage of identifying the smallest leaks which was defined before as the ‘capabilities of rhe sound capturing technique detects any escaping water through pressure’ Minimizing the cost and damages that could have been incurred if these small leakages were neglected. The sensors which are dispersed in a selected distance along the pipeline can sense extreme sound weak sound waves as a result of the flow of water through the pipeline. Due to its efficient approach, it can be used irrespective of the pipe material and the dimension of the pipe thus broadening the scope of detection. As Applicable Water Conservancy Plans in Appendix 15, more than 15, 000 kilometer of water pipes are being monitored worldwide due to the intrusion of geophones. This procedure doesn’t demonstrate any effectiveness in both urban and rural areas with the exception of some small patches here and there. Many studies have fulfilled on Ak acoustic detective replenishing the globe by over 3.5 million incidences of leaks detected through this means annually.

It has recently been confirmed that progress in acoustic technology of the water pipeline leak detection systems market has really come into the fore. Evolution of tools like Machine Learning for sound recognition systems and the application of wireless and Internet of Things (IoT) devices have helped improve such systems. With the use of over 200 IoT-based acoustic sensors in cities across the globe, it has become possible to prevent leaks rather than fixing them. The buyers of this technology include city water supply management bodies, industrial parks and agricultural enterprises which have lower water costs and losses as a result. In countries ranging in number from fifty, it has been noted that acoustic monitoring has helped water authorities save up to 20 million cubic meters every year to avoid undue losses. The requirement for such comprehensive data analysis capabilities, as well as predictive maintenance analytics, has made it extremely valuable for a number of stakeholders, focused on enhancing water management systems and securing the physical assets.

By Location

In terms of revenue share, the underground segment is leading the water pipeline leak detection systems market by accounting for more than 59% of total market revenue. The implementation in subterranean pipes is aimed primarily at the problems of leak detection and leak repair in situations where such works are done out of sight. Underground pipe networks are often spread over a long distance and lie within the subsurface earth of both urban and rural areas making it impossible to carry out a visual check on them. This makes it imperative to implement modern leak detection systems that will perform optimally, notwithstanding such restrictions. Acoustic sensors make up most of the technology deployed in such systems as they are capable to monitor escape of water through the pipes. In addition to these, technologies like fiber optic monitoring and electromagnetic monitoring are on the rise. These systems monitor temperature or electromagnetic current minute in construction to effectively identify any form of leakage. The stability of temperature and pressure in the underground environment also provides these technologies a better working platform hence imprecision is minimized. Not to mention the fact that these systems help to further decrease the capital expenditures associated with their deployment, it also reduces the risk level of disturbances to the surface.

These statistics also substantiate the efficiency and uptake of these systems in the water pipeline leak detection systems market. Recent research demonstrates the sensitivity of acoustic sensors able to leak as small as 1.5 L/min. On the other hand, Fiber optic systems can track a pipeline more than 50 km long and provide alerts in real time. Electromagnetic systems have been used an effective leak detection method for the buried pipes of up to three meter depth which surpasses the capability of conventional methods. The freshly evaluated global pipeline leak detection systems market amounts to over USD 2 billion in value. As for the US, here alone over 240,000 kilometers of buried water pipes are equipped with the latest detection means. Besides, cities incorporating these technologies have been able to cut non-revenue water annual losses by about 500 million cubic meters. Also, this is interesting in terms of costs because municipalities have avoided additional $400 million a year of costs due to making advances and preventing leakages. It was also noted that the incorporation of IoT in the water leak detection system improved the detection accuracy by 30% warranting why these systems are here to stay in modern water management systems.

By Pipe Type

Metal pipes are the most dominant material in water pipeline leak detection systems market as they account for more than 60.95% in market share owing to their ability to withstand high pressure which is very critical. For instance, ductile iron pipes which are made up of such metal can take pressure up to 350 psi making them suitable for water systems in cities. The acoustic properties present in metals made of steel and copper for instance help in the effectiveness of leak detection systems as these materials carry sound easily making it easy to pinpoint the location of the leak. It is necessary since water in the U.S. is discharged prudently, and technologically advanced water supply systems leak nearly 6 billion gallons of treated water in a day including underground leaks. The lifespan of the metal pipes is another consideration which includes some systems in Europe have worked for more than 100 years. Other properties that help in the effective management of piping systems under extreme conditions include class temperature, which assists in reducing the risk of pipe busting in very cold weather conditions copper metals possesses high thermal conductivity.

The preference for using metallic pipes in the water pipeline leak detection systems market is attributed to many reasons. In the US, for instance, there are more than 3 million miles of pipeline networks that comprise mainly metals. These technologies have also enhanced their position even more. It can be argued that even though the initial cost of the metallic pipes is higher than other alternatives the efficiency in the use of these pipes in the long run is apparent, in that they do not require to be changed so often as the non-metallic pipes. In addition, the ability of metals to be recycled makes them sustainable since steel is the most recycled material in the world, which reduces the amount of energy and other resources used for the production of new steel.

Customize This Report + Validate with an Expert

Access only the sections you need—region-specific, company-level, or by use-case.

Includes a free consultation with a domain expert to help guide your decision.

To Understand More About this Research: Request A Free Sample

Regional Analysis

The water pipeline leak detection systems market is being led by North America, which holds a considerable portion of over 62.40% market share, because of the regulatory framework & the development of infrastructural facilities. Its pipeline network is among the largest in the world, as the United States alone has more than 2.6 million miles of piping and requires stiff systems to monitor leakages as well as make sure that operations are effective and safe. The U.S. Environmental Protection Agency (EPA) states that approximately 6 billion gallons, which is treated water supplied by water utilities, is lost through leaks every day which encourages the need for detection systems. Also, the US Department of Energy has spent more than 100 million dollars on research and development of technologies aimed at improving pipeline safety which shows their determination to maintaining infrastructural security. Furthermore, North America’s led technological firms, Honeywell and Emerson, are some of the contributors to the market growth in the region by enhancing demand & assimilation of innovative technology.

In North America, the US establishes itself as a dominant player in the water pipeline leak detection systems market. As of 2000, the country’s water sector had more than 300,000 publicly owned water systems, all of which need protective devices to limit wastage of water. The American Water Works Association (AWWA) claims that the U. S. water industry requires $1 trillion worth of investment in the next 25 years simply to keep up with the existing infrastructure, which consists of modernization and installation of new systems, including advanced leakage control technologies. Also, several smart cities in the USA have come up with smart water management solutions, with over a 100 of such cities seeing further expenditure on leak detection technologies. The USGS also states that about 14 percent of water supply in the USA is non-revenue or lost due to leakage, which shows how essential to our society these systems are. This sensible approach also will help achieve the overall goals of sustainability expansion and support export growth of the leak detection devices market.

Apart from North America, Europe is the second largest water pipeline leak detection systems market and remains focused on technological integration and sustainability. Within the European framework, water loss reduction objectives are set high with countries like Germany and the Netherlands having some... where leak detection technologies are more advanced. The European Commission has more than 80 billion Euros for the missions azlik the infrastructure enhancement projects which incorporates the water management systems as its trend in the region toward environmental order. In the UK, water companies are given a target of 15% reduction of leakage by 2025, hence making the available market for demand for leak detection systems even broader. Further, Siemens and Schneider Electric are the hi-tech equipment manufacturers in Europe who are responsible for developing advanced technology for the industry. It is these reasons that well explain why Europe is position in terms of which the world has stood in the water pipeline leak detection system market and expanding recorded words on the technology acquisition and advancements.

Top Players in Water Pipeline Leak Detection Systems Market

- Aqualeak Detection Ltd.

- Atmos International Limited

- CMR Electrical

- Gutermann AG

- Hermann Sewerin GmbH

- Honeywell International Inc.

- Mueller Water Products Inc. (Echologics)

- Perma Pipes

- Pentair

- Siemens AG

- TTK S.A.S.

- Xylem Inc.

- Other Prominent Players

Market Segmentation Overview:

By Components

- Instruments

- Smart Ball

- Smart Meters

- Sensor Hoses

- Noise Loggers

- IR Cameras

- MEMS Systems/ Sensors

- Others

- Software

- Services

- Training & Consultation

- Maintenance & Installation

- Contract/Outsourced Services

By Technology

- Acoustic

- Pressure

- Vibration

- GPR (Ground Penetrating Radar)

- Infra-Red

- Others

- Fiber Optic

- Flow Rate

- Tracer Gas

- On-site

By Pipe Location

- On Ground

- Under Ground

By Pipe Type

- Metallic Pipes

- Ductile Iron Pipes

- Stainless Steel Pipes

- Aluminium Pipes

- Other Metal Pipes

- Non-Metallic Pipes

- Plastic Pipes

- Glass Pipes

- Concrete Pipes

- Others

By End User

- Industrial

- Crude & Refined Petroleum

- Water & Wastewater

- Others

- Residential

- Commercial

- Utilities

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- Western Europe

- U.K.

- Germany

- France

- Spain

- Italy

- Rest of Western Europe

- Eastern Europe

- Poland

- Russia

- Rest of Eastern Europe

- Western Europe

- Asia Pacific

- China

- India

- Japan

- Australia & New Zealand

- ASEAN

- Rest of Asia Pacific

- Middle East & Africa (MEA)

- UAE

- Saudi Arabia

- South Africa

- Rest of MEA

- South America

- Argentina

- Brazil

- Rest of South America

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

.svg)