Voice Assistant Market: Component (Hardware (Smartphone, Smart Speakers, Security Systems, Laptops/Tablets, Smart Watch, Smart TV, Smart Lamps, In-Vehicle Assistants, 2-Port Car Charger, Headsets/Hearables, Others), Solutions (Standalone and Integrated), and Services (Consulting, Implementation, Support and maintenance); Deployment (on-premise and Cloud); Enterprise Size (Small and Medium-sized Enterprises (SMEs) and Large Enterprises); Technology (Natural Language Processing, Speech/Voice Recognition, Text to speech Recognition); Application (Automotive (Book Services, Navigation, Schedule Appointments), Smart Home (Home automation and Security services), Smart banking, Wearable Devices, and Others); Region—Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2025–2033

- Last Updated: 08-Dec-2025 | | Report ID: AA0823575

Market Snapshot

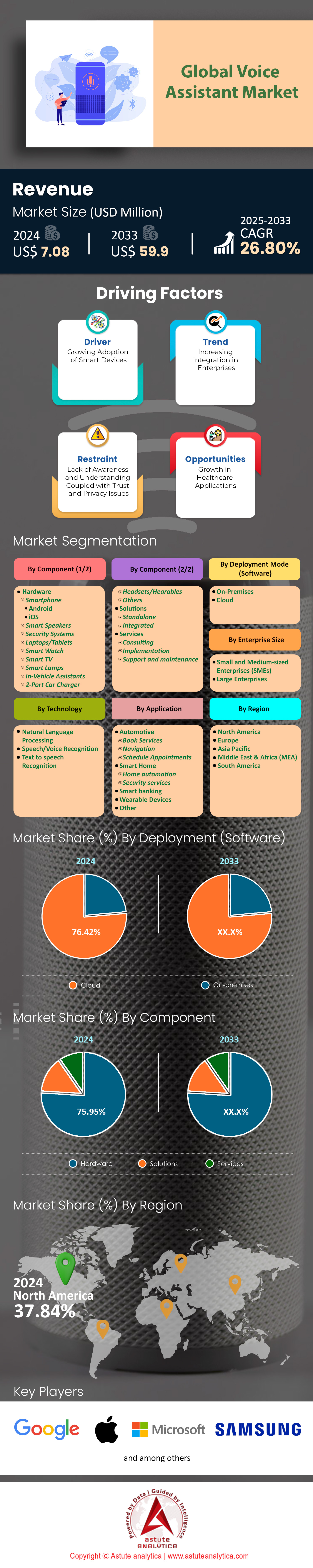

Voice assistant market was valued at US$ 7.08 billion in 2024 and is projected to surpass market valuation of US$ 59.9 billion by 2033 at a CAGR of 26.80% during the forecast period, 2025–2033.

Key Findings

- Based on component, hardware is projected to generate more than 75.95% of the voice assistant market revenue.

- In terms of technology, the market is dominated by voice/speech recognition technology. It generates more than 52.61% of the market revenue.

- When it comes application, voice assistants are heavily deployed in smart homes. In fact, this application generates more than 30.58% market share.

- North America is the key contributor to global market revenue as it generates over 37.84% market revenue.

The voice assistant market demonstrates robust demand in 2025, evidenced by widespread integration into consumer and enterprise environments. Global market value reached USD 9,163 billion in 2025, supported by over 8.4 billion enabled devices worldwide. In the United States, 153.5 million users—equivalent to 46% of the population—engaged daily, reflecting a 2.5% year-over-year increase, while 125 million smartphone owners achieved 88.1% monthly penetration. Amazon's Alexa ecosystem, with more than 80,000 skills across over 100 million Echo devices, contributed to AWS quarterly revenues exceeding USD 25 billion.

Google Assistant operates across 4.5 billion Android devices, underpinning Alphabet's AI-driven annual revenues of USD 350 billion in the voice assistant market. Apple's Siri serves 86.5 million US users, reinforced by 96% iPhone ecosystem retention rates. Voice search accounted for 20.5% of global internet queries, with smartphones driving 56% of interactions and 60% of owners reporting weekly usage—up from 45% in 2024. Enterprise adoption stands at 72% of businesses, complemented by voice commerce transactions totaling USD 49.2 billion. In high-growth markets like India, 350 million users highlight the role of multilingual capabilities in sustaining momentum.

To Get more Insights, Request A Free Sample

Competitive Landscape: Detailed Profiling of Market Shares, Strategic Initiatives, and R&D Expenditures Among Leading Players

Competition in the voice assistant market centers on a core group of established leaders, each leveraging distinct strengths in market positioning and innovation. Amazon holds a 28% global share through Alexa's smart home dominance, backed by USD 4.2 billion in annual R&D investment. Google commands 25%, capitalizing on 91% Android penetration and facilitating 2.5 billion daily interactions. Apple secures 19% with Siri across 1.4 billion active devices and USD 2.8 billion allocated to privacy technologies.

Microsoft's Azure AI platform engages 85% of Fortune 500 companies, logging 500 million enterprise sessions annually. Samsung's Bixby extends to 300 million appliances in the voice assistant market, while SoundHound AI and Cerence collectively capture 8% through over 50 OEM automotive partnerships. In Asia, Baidu and Alibaba control 15% regional share, serving 600 million users. Strategic partnerships—such as Google's alliances with over 200 automakers and Amazon's network of 10,000 developers—alongside developments like Cerence's USD 400 million valuation growth, provide critical benchmarks for potential collaborations.

Drivers and Challenges: Examining Primary Growth Catalysts Against Operational and Ethical Constraints

Several structural factors underpin voice assistant market expansion, offset by notable impediments. The IoT ecosystem, with 15.6 billion connections, enables voice control in 40% of smart homes. Automotive sector requirements for hands-free interfaces have reduced accidents by 23%, equipping 65% of new vehicles with voice capabilities. Healthcare applications achieved 55% adoption for patient reminders, decreasing no-show rates by 38%, while telecom operators realized USD 1.2 billion in call center savings. Personalization enhancements have elevated user retention to 78%.

On the other hand, countervailing pressures include regulatory fines under GDPR exceeding EUR 2.7 billion in 2025, undermining 30% of user confidence following data incidents. Development costs range from USD 5-10 million per assistant, constraining 70% of startups, with multilingual support covering only 45% of 7,000 languages. Algorithmic biases impact 25% of non-native accents, contributing to 15% user dissatisfaction rates. These dynamics necessitate targeted strategies, particularly in diverse markets such as India.

Technology Trends: Advancements in Edge AI Processing, Natural Language Capabilities, and Integration Protocols

Technological progress continues to redefine functionality and deployment models in the voice assistant market. Edge AI handles 70% of queries on-device, reducing latency to 150 milliseconds and bandwidth usage by 90%. Natural language processing delivers 95% contextual accuracy, supporting complex interactions with 82% success rates. Voice biometrics authenticates 60% of logins, curtailing fraud by 87%. Multilingual automatic speech recognition and text-to-speech systems now encompass 50 languages, achieving 92% comprehension for Hindi-English combinations in India.

Fifth-generation networks facilitate 1-millisecond real-time augmented reality integrations, implemented in 35% of enterprise pilots, amid a 40% rise in patents to 12,000 for biometrics and contextual processing. Wearable devices, including 50 million AirPods Pro units, incorporate proactive notification features. These developments offer system integrators clear pathways for automotive and IoT convergence.

Regulatory Environment: Compliance Implications of Data Privacy Directives, Sector-Specific Standards, and Public Sector Investments

Regulatory frameworks impose structured requirements that influence architecture and operations at the global voice assistant market level. GDPR and CCPA mandates for 72-hour breach notifications have prompted 65% of organizations to adopt edge processing solutions. HIPAA compliance affects 80% of healthcare voice deployments, with average violation penalties at USD 500,000. Data localization rules apply to 45% of global data flows, while PCI-DSS standards secure 90% of banking, financial services, and insurance transactions.

Government initiatives, such as Canada's USD 1.39 billion AI investment, have driven 25% growth in public sector adoption; the EU AI Act designates 40% of voice applications as high-risk. Compliance expenditures consume 20% of startup budgets, yet privacy-focused designs yield 15% pricing premiums, as exemplified by Apple's differential privacy implementations. Proactive alignment with these standards converts constraints into strategic advantages.

Ecosystem and Value Chain: Interdependencies Across Hardware Components, Software Platforms, Integration Services, and End-User Applications

The voice assistant market ecosystem comprises interconnected layers critical to delivery and scalability. Hardware elements include Qualcomm microphones in 2 billion devices and NVIDIA processors enabling 60% of edge AI workloads. Software platforms, such as Google Cloud's 1 million daily API calls and Nuance's 95% accurate natural language understanding, support integrators like Cerence across 100 million Ford vehicles. End-user segments feature 75% consumer household penetration, USD 49.2 billion in retail voice commerce, 50% banking fraud detection deployment, and 38% healthcare no-show reductions.

Value chain vulnerabilities, including 25% cost increases from chip shortages, contrast with revenue streams like the Alexa Skills Store, where 80,000 developers generated USD 200 million. Established integrations—Azure in 70% of telemedicine applications and Alexa-Sonos in 40 million speakers—illuminate opportunities for supplier diversification and enterprise monetization.

Segmental Analysis

Hardware Devices Dominating Global Revenue Through Massive Unit Deployments

Hardware forms the physical backbone of the voice assistant market, currently projected to generate more than 75.95% of the market revenue. The sheer scale is hard to ignore, with installations on devices climbing toward 8.4 billion units globally by late 2024. Smartphones are the obvious leaders, yet dedicated gadgets are catching up fast. Amazon has seen incredible uptake, with cumulative Echo sales crossing the 600 million unit mark as of 2025. Automakers are also reshaping the voice assistant market by shipping 50 million new vehicles equipped with embedded connectivity in just one year. Major players continue to expand their footprint, as Apple Siri now serves 86.5 million users across the United States. Samsung is seeing similar success, boasting over 285 million active SmartThings users worldwide.

- Global smart speaker shipments successfully reached 150 million units in 2024.

- Google Assistant now serves 92 million distinct users in the US market.

- Active in-car voice users exceeded 240 million as of late 2024.

Samsung achieved a local milestone with 20 million SmartThings users in South Korea alone. Amazon forecasts that its specific Echo user base will saturate 69.9 million US households in 2025. Manufacturers are responding to this density by enhancing processing power. Chipmakers like Qualcomm now support models with 10 billion parameters directly on the chip to cut down lag. Such widespread hardware integration is exactly why this sector commands the lion's share of the voice assistant market.

Advanced Speech Recognition Engines Driving Unmatched Accuracy and Speed

Voice and speech recognition technology is the brain behind the operation, generating more than 52.61% of the market revenue. It leads the voice assistant market because accuracy has finally matched human expectations. OpenAI’s Whisper model set a new standard by utilizing a massive 680,000 hours of multilingual audio for training. Google followed suit, updating its engines to support 110 new languages and dialects to capture a global audience. The volume of usage is immense, with people performing over 1 billion voice searches every single month. Speed is also a priority; Alexa’s latest Large Language Models aim for latency under 500 milliseconds for complex tasks. Samsung Bixby even lets users clone their voice by recording just 10 sentences.

- Nuance Dragon Medical One is currently used by over 550,000 clinicians.

- Universal-2 speech models achieved a low Word Error Rate of 6.68.

- Google Assistant Actions now support 19 languages across 28 locales.

Search results are appearing faster than ever, with average page load times via voice dropping to 4.6 seconds. Developers are releasing "turbo" variants of speech models that offer 8x speed improvements over older versions. These technical strides are critical for sustaining growth in the voice assistant market.

Customize This Report + Validate with an Expert

Access only the sections you need—region-specific, company-level, or by use-case.

Includes a free consultation with a domain expert to help guide your decision.

Interconnected Smart Ecosystems Fueling Rapid Residential Application Growth

Smart home integrations are surging, an application segment that generates more than 30.58% market share. Connectivity is the main driver here, with the industry-wide Matter standard accelerating this trend as over 750 devices recently received certification. Amazon noted that voice requests to control smart devices doubled in emerging regions like India. Analysts predict the voice assistant market will see shipments of Matter-compliant gadgets total 5.5 billion units between 2022 and 2030. Xiaomi has also built a massive network, with its AIoT platform connecting 600 million smart devices globally. Manufacturers like Ecobee have also seen their smart thermostats installed in over 2 million homes.

- Over 68.9 million US households utilize Amazon Echo devices as hubs.

- LG has integrated ThinQ voice AI into millions of home appliances.

- Roborock S8 MaxV Ultra vacuums now feature "Hello Rocky" built-in assistants.

Hardware vendors are getting creative to drive adoption. Smart lighting leader Philips Hue has shipped millions of bridge units to facilitate these voice commands. Google has also enhanced its Nest hubs with Gemini integration to handle complex home automation routines. These deep integrations explain why the smart home sector is vital to the voice assistant market.

To Understand More About this Research: Request A Free Sample

Regional Analysis

North America Secures Dominance Through Enterprise Adoption and Smart Home Saturation

North America currently commands a controlling 37.84% share of the global voice assistant market revenue in 2025. This leadership position is primarily fueled by the United States, where widespread ecosystem lock-in has occurred. Specifically, 98 million US households now operate within a fully integrated smart home environment, driving consistent daily usage. Beyond consumer hardware, the region’s dominance is bolstered by massive corporate investment. US-based enterprises allocated USD 6.2 billion solely toward Generative AI voice agents for customer service in 2024 to combat labor costs. Canada is also contributing significantly to this growth trajectory. Canadian voice commerce transactions saw an 18% year-over-year increase, signaling a shift from simple queries to monetary transactions. Consequently, the region benefits from the highest average revenue per user (ARPU) globally, as users here are deeply entrenched in high-value Amazon and Google ecosystems.

Asia Pacific Expands rapidly Driven by China and Vernacular Linguistic Demand

While North America leads in value, Asia Pacific voice assistant market is exploding in terms of pure volume and is projected to register the highest regional CAGR of 29% through late 2025. China remains the engine of this expansion. Local tech giants like Baidu and Alibaba have successfully engaged a staggering 610 million active voice users, largely due to the integration of voice into "Super Apps." Simultaneously, India is reshaping the market through linguistic diversity. In 2025, 65 out of 100 mobile search queries in India are performed in vernacular languages rather than English, pushing developers to refine Natural Language Processing (NLP) capabilities. Hardware integration is equally aggressive in developed Asian economies. South Korean manufacturers have embedded voice capabilities into 85% of all new home appliances shipped in 2025, making voice the default interface for the region's electronics sector.

Europe Prioritizes Privacy Compliance and Automotive Integration in Voice Technology

Europe maintains its strong voice assistant market standing by focusing on privacy-centric innovation and automotive utility. Stringent GDPR regulations have actually spurred growth, creating a niche market for on-device processing valued at USD 1.8 billion across the EU. The United Kingdom leads the consumer adoption within the region. Data shows that 54% of UK households utilize a smart speaker, the highest penetration rate in Western Europe.

Meanwhile, Germany is driving the industrial and automotive application of voice assistants. As of 2025, 9 out of 10 new vehicles manufactured in Germany feature advanced conversational AI assistants as standard equipment. France is also showing distinct usage patterns. 78% of French users engage exclusively with native-language assistants, rejecting English-first interfaces and forcing US tech giants to heavily invest in localized European language models.

Top Recent Developments in Voice Assistant Market

- Microsoft unveiled Dragon Copilot for Healthcare in October 2025, integrating Nuance’s ambient listening for automated clinical notes and reduced admin burdens.

- Google’s August 2025 Gemini Live update for Pixel 10 added camera-based visual recognition with <500ms latency, linking to Calendar and Maps.

- Samsung launched Generative Bixby in August 2025 for its Smart TV lineup, enabling natural smart home control and content search.

- Reliance Industries released RIYA in August 2025 for JioStar, a vernacular AI assistant targeting India’s non-English users.

- Amazon introduced Alexa+ in February 2025 as a $19.99/month subscription (free for Prime) with advanced reasoning.

- Apple Intelligence expanded Siri to new languages like Japanese and Spanish starting April 2025.

- OpenAI launched Real-time Voice API in mid-2025 for low-latency, interruptible voice agents.

- Xiaomi integrated AI voice agents into HyperOS 3 from October 2025 for cross-device control.

Top Players in the Global Voice Assistant Market

- IBM Corporation

- Apple

- Amazon.com, Inc.

- Microsoft Corporation

- Verint Systems

- Nokia Corporation

- Orange SA

- Samsung Electronics

- Other Prominent Players

Market Segmentation Overview:

By Component

- Hardware

- Smartphone

- Android

- iOS

- Smart Speakers

- Security Systems

- Laptops/Tablets

- Smart Watch

- Smart TV

- Smart Lamps

- In-Vehicle Assistants

- 2-Port Car Charger

- Headsets/Hearables

- Others

- Smartphone

- Solutions

- Standalone

- Integrated

- Services

- Consulting

- Implementation

- Support and maintenance

By Deployment Mode

- On-Premises

- Cloud

By Enterprise Size

- Small and Medium-sized Enterprises (SMEs)

- Large Enterprises

By Technology

- Natural Language Processing

- Speech/Voice Recognition

- Text to speech Recognition

By Application

- Automotive

- Book Services

- Navigation

- Schedule Appointments

- Smart Home

- Home automation

- Security services

- Smart banking

- Wearable Devices

- Other

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- Western Europe

- The UK

- Germany

- France

- Italy

- Spain

- Rest of Western Europe

- Eastern Europe

- Poland

- Russia

- Rest of Eastern Europe

- Western Europe

- Asia Pacific

- China

- India

- Japan

- Australia & New Zealand

- South Korea

- ASEAN

- Rest of Asia Pacific

- Middle East & Africa (MEA)

- UAE

- Saudi Arabia

- South Africa

- Rest of MEA

- South America

- Argentina

- Brazil

- Rest of South America

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

.svg)