Vietnam OTC Consumer Health Products Market: By Type (Wound Care Products, Dermatological Products, Contraceptives, Vitamins & Dietary Supplements, Ophthalmology Products, Gastrointestinal Products, Others); Distribution Channel (Online and Offline (Pharmacies and Convenience Store))— Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2024–2032

- Last Updated: Apr-2024 | Format:

![pdf]()

![powerpoint]()

![excel]() | Report ID: AA0424807 | Delivery: 2 to 4 Hours

| Report ID: AA0424807 | Delivery: 2 to 4 Hours

Market Scenario

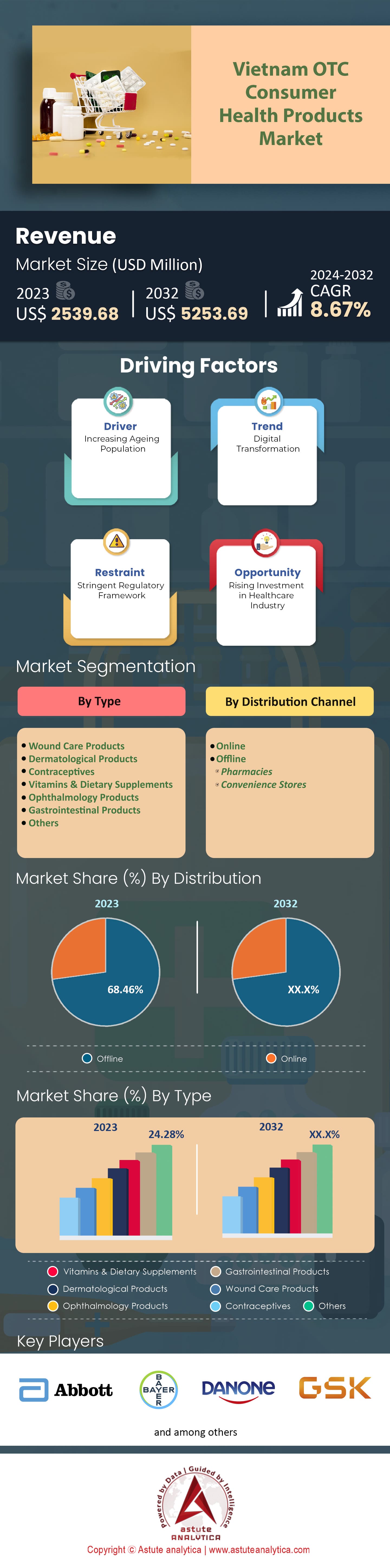

Vietnam OTC Consumer Health Products Market was valued at US$ 2,539.68 million in 2023 and is projected to hit the market valuation of US$ 5,253.69 million by 2032 at a CAGR of 8.67% during the forecast period 2024–2032.

Consumer health products are in high demand across Vietnam, and it's easy to understand why. There are a number of factors at play here that have all come together to create an environment where people want over-the-counter (OTC) medicine more than ever. The government has been actively promoting natural ingredients as well as traditional medicine, so it makes sense that consumers would be more prone to purchasing these types of products in the Vietnam OTC consumer health products market. After the pandemic came to an end many people realized that their health was now the most important thing in their lives, and they should do whatever they can to take care of themselves so they don't get sick again. This could mean addressing common illnesses early with OTC products.

Vietnam is also a country with a rapidly growing aging population, and this is significant because chronic health conditions require ongoing medication when consumers are older. Taking this into account alongside the fact the nation's expanding middle class is leading to higher salaries for everyone means there will be a higher demand for OTC medicines soon enough.

Looking ahead, Vietnam's future in the OTC consumer health products market appears very promising. It’s just a matter of time before their middle-class doubles by 2022 and then consumption across all sectors will increase dramatically. As of right now, convenience seems to be the biggest selling point for OTC medicines since people prefer being able to self-medicate rather than trying to go through prescriptions or doctor visits. The only downside is around 65% of Vietnam's OTC and Pharma products are foreign imports as opposed to domestic alternatives.

The Vietnamese Ministry of Health has issued an official list of approved OTC medications that companies like Bayer must follow exactly if they want any chance at making sales here. Herbal remedies have gained popularity in Vietnam recently too due to the fact everyone wants natural healthcare solutions now. With such strong demand from customers alongside support from both companies and governments, there’s no telling how far this market can grow given enough time.

To Get more Insights, Request A Free Sample

Market Dynamics

Trend: Rising Demand for Natural and Organic Products

Vietnam's OTC consumer health products market is changing. People are becoming more and more interested in natural and organic products, which has led to a shift from traditional alternatives. According to Astute Analytica, 88% of Vietnamese consumers say they are willing to pay extra for items that contain natural ingredients. This survey also found that 78% actively look for the word "organic" on labels when shopping for their health-related essentials. The same study discovered that this trend is especially apparent in dietary supplement sales, where herbal and plant-based options are starting to take over. In recent years, gac fruit, ginger, and turmeric have all seen increased use as ingredients in supplements that help improve digestion, immunity, or joint health.

This newfound preference for all things organic isn't specific to just supplements though. Shoppers are also beginning to hunt down these kinds of choices in personal care, baby products, and functional foods as well. It seems like it's becoming an all-around lifestyle change. The Vietnam Chamber of Commerce and Industry (VCCI) published a report back in 2023 stating that the country's organic food market is expected to grow by 30% each year. Sales should reach $1.8 billion by 2025 if everything goes according to plan and those numbers don't seem too far fetched at this point. Not only do we see farmers' markets popping up left and right now but we're also seeing an increase in online platforms dedicated solely to the sale of such items in the Vietnam OTC consumer health products market.

The COVID-19 pandemic has also contributed a great deal toward this change in mentality. With people wanting nothing more than a way out of this mess, it’s no wonder they’re looking towards anything labeled “immune boosting". Because of the increased emphasis on preventive healthcare since COVID-19 hit us gatekeepers have done alright thus far according to surveys ran by Vietnam Union of Science and Technology Associations (VUSTA). They revealed that 62% of Vietnamese consumers have increased their natural health product intake since the start of the pandemic.

Driver: Growing Middle Class and Increased Health Awareness

The rise in demand for natural and organic products is being boosted by multiple factors, including higher disposable incomes, greater awareness of health and wellness, and concerns about the safety and quality of conventional goods. Euromonitor International states that Vietnam is likely to have 44 million middle class consumers by 2022, up from 33 million in 2016 in the OTC consumer health products market. The government’s efforts to promote healthy lifestyles through campaigns such as “5K” (Khẩu trang, Khử khuẩn, Khoảng cách, Không tụ tập, Khai báo y tế - Masks, Disinfection, Distance, No gatherings, Health declaration) has further encouraged interest in preventative health measures among Vietnamese people.

Social media and digital platforms have also had a big impact on the surge in demand for natural and organic health products. In Vietnam (particularly with millennial’s) online sources are increasingly being relied upon for health information and product recommendations. Social media influencers, health bloggers and online communities have become powerful channels for promoting the benefits of natural/organic products. A study conducted by the Vietnam E-commerce Association (VECOM) found that consumer sales in the country’s e-commerce market had a YoY increase of around 35%, with sales rising fastest within health/beauty products category during this time period. This transformation has made smaller niche brands’ market share increase as they compete against established players.

Challenge: Evolving Regulatory Framework and Quality Control Issues

The natural OTC consumer health products market is booming in Vietnam, causing a headache for regulators and consumers alike. The country’s framework for health supplements and functional foods is still being developed, leading to inconsistencies in product classification, labeling requirements and quality control standards. This regulatory uncertainty has allowed some unscrupulous manufacturers to make misleading claims or sell products made with substandard ingredients, which has eroded consumer trust. In 2019 the Vietnam Food Administration (VFA) issued warnings against more than 50 health supplements found to contain undeclared or banned substances.

To tackle these issues leading companies in Vietnam’s consumer health market have been investing heavily in research and development, quality control, and consumer education. For instance Traphaco has opened a research centre focused on developing science-backed natural health products that use locally sourced ingredients. It also partners with farmers to ensure a reliable supply of high-quality raw materials and runs strict testing protocols to ensure product safety and efficacy. Larger firms like Herbalife and Amway are working with regulators to encourage more consistent standards across the OTC consumer health products market as well as educating Vietnamese consumers about the benefits of natural and organic products.

Those firms that can navigate the current regulatory landscape, build consumer trust through transparency and quality control, while also innovating with organic ingredients will be best placed to tap into this rising demand, according to analysts at Fitch Solutions. The country’s rich biodiversity offers huge potential for new formulas based on traditional medicine practices that could make Vietnam a regional hub for natural and organic health innovation.

Segmental Analysis

Vitamins and Dietary Supplements Segment Dominates the Vietnam OTC consumer health products market

Vitamins and dietary supplements hold the highest share of 22.46% in the Vietnam OTC consumer health products market as of 2023. The segment's domination comes from people being self-health-conscious and growing their health consciousness, making it easy for them to look after themselves. With this reason, consumers are now more conscious about their health and are looking for natural ways to prevent illness while staying overall healthy themselves, which causes a massive demand boost in vitamins and dietary supplements. People are learning that nutraceuticals are beneficial through word-of-mouth conversation, education levels increasing, and advertising campaigns.

Between the years 2023 and 2032, the dietary supplements segment of the OTC consumer health products market is projected to grow at an approximate CAGR of 9.22%. This is a significant indicator that people in this country want these products more than ever. In addition to this, there has been an increased usage of imported vitamin and dietary supplement products because consumers tend to trust these brands more than domestic ones. As a result of this trend, functional foods are gaining popularity in Vietnam as well. The abundance of options allows consumers to select what they like best when it comes to soft gel and capsule forms.

Offline Distribution Channel Leads, while Online Segment Exhibits Fastest Growth

The offline segment of distribution channels in the Vietnam OTC consumer health products market holds 68.46% as of 2023. The growth can be due to the increase in prescribed dietary supplements for treatment from medical professionals. The supplements are used for an array of issues like gastrointestinal disorders, immunity-related problems, bone health, folic acid deficiencies, heart health, and age-related macular degeneration. In-person sales at pharmacies and healthcare professional offices offer trust and personal interaction that benefits vitamins and dietary supplement OTC sales.

On the other hand, the online segment is growing with the fastest CAGR of 9.93% in the Vietnam OTC consumer health products market. As internet users increase so does access to numerous brands; fast-paced lifestyles create a demand for 24/7 availability, convenience of shopping and wide range of products offered by online distribution channels. E-commerce expansion has made it easier for consumers to buy supplements online, contributing to rapid growth in this area. As digital platforms become more popular among consumers' health and wellness needs, experts expect significant growth on the online side soon enough.

To Understand More About this Research: Request A Free Sample

Top Players in Vietnam OTC Consumer Health Products Market

- Abbott Laboratories

- Bayer AG

- Danone

- GSK plc

- Johnson and Johnson

- Pfizer Inc.

- Reckitt Benckiser Group PLC

- Sanofi SA

- Taisho Pharmaceutical Holdings Co., Ltd.

- The Procter & Gamble Company

- Other Prominent Players

Recent Developments in Vietnam OTC Consumer Health Products Market

- In March 2024, Zuellig Pharma, a leading healthcare services provider in Asia, and Karo Healthcare, a global consumer healthcare company, announced the strengthening of their partnership across key markets in the region. The expanded collaboration aims to leverage Zuellig Pharma's extensive distribution network and market expertise to bring Karo Healthcare's innovative consumer health products to more consumers across Asia.

- In September 2022, LEO Pharma, a global leader in medical dermatology, entered into a strategic partnership with DKSH, a leading market expansion services provider, to deliver innovative products and solutions to people in Asia suffering from skin conditions and thrombosis. The partnership will focus on expanding access to LEO Pharma's comprehensive portfolio of treatments for conditions such as psoriasis, eczema, and deep vein thrombosis, leveraging DKSH's well-established healthcare distribution network and commercial expertise in the region.

Market Segmentation Overview:

By Type

- Wound Care Products

- Dermatological Products

- Contraceptives

- Vitamins & Dietary Supplements

- Ophthalmology Products

- Gastrointestinal Products

- Others

By Distribution Channel

- Online

- Offline

- Pharmacies

- Convenience Stores

View Full Infographic

REPORT SCOPE

| Report Attribute | Details |

|---|---|

| Market Size Value in 2023 | US$ 2,539.68 Mn |

| Expected Revenue in 2032 | US$ 5,253.69 Mn |

| Historic Data | 2019-2022 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Unit | Value (USD Mn) |

| CAGR | 8.67% |

| Segments covered | By Type, By Distribution Channel |

| Key Companies | Abbott Laboratories, Bayer AG, Danone, GSK plc, Johnson and Johnson, Pfizer Inc., Reckitt Benckiser Group PLC, Sanofi SA, Taisho Pharmaceutical Holdings Co., Ltd., The Procter & Gamble Company, Other Prominent Players |

| Customization Scope | Get your customized report as per your preference. Ask for customization |

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

| Report ID: AA0424807 | Delivery: 2 to 4 Hours

| Report ID: AA0424807 | Delivery: 2 to 4 Hours

.svg)