U.S. Sulfentrazone-Based Herbicides Market: By Form (Liquid and Solid); Functionality (Pre-Emergence Herbicide and Post Emergence Herbicide); Application (Agricultural Crop (Corn, Soyabean, Tobacco, Sugarcane, Pulses, Sunflower, Peas, Cereal, Others), Turf (Seeded, Sodded, Sprigged), Ornamentals (Trees (Shrubs and Others), Fruits and Vegetables (Tomatoes, Potatoes, Others), Others); End Users (Farmers, Agricultural Producers, Turf Managers, Landscapers, Others); Distribution Channel (Online and Offline (Direct and Distributor)–Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2025–2033

- Last Updated: Mar-2025 | Format:

![pdf]()

![powerpoint]()

![excel]() | Report ID: AA03251227 | Delivery: Immediate Access

| Report ID: AA03251227 | Delivery: Immediate Access

Market Scenario

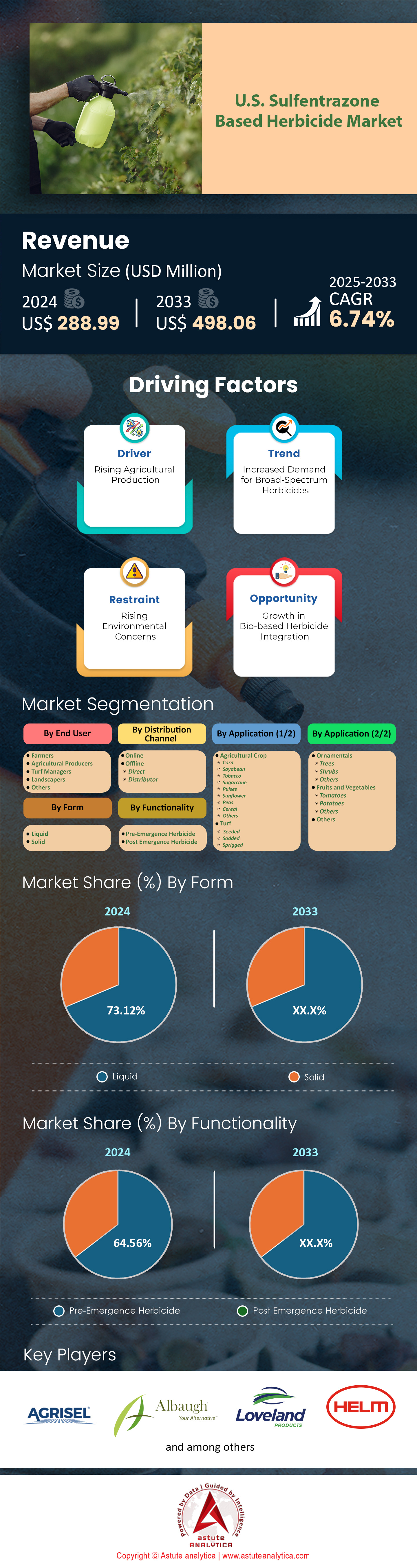

U.S. Sulfentrazone-based herbicides market was valued at US$ 288.99 million in 2024 and is projected to hit the market valuation of US$ 498.06 million by 2033 at a CAGR of 6.74% during the forecast period 2025–2033.

The demand for sulfentrazone-based herbicides in the US is surging, driven by the need for effective weed control in agriculture and turf management. In 2024, over 15 million acres of soybean fields in the Midwest have been treated with sulfentrazone-based products, showcasing its widespread adoption. The most prominent forms of these herbicides include pre-emergent and post-emergent formulations, with the pre-emergent segment dominating due to its ability to prevent weed germination early in the crop cycle. Key applications include soybean, cotton, and sugarcane cultivation, with soybeans accounting for the largest share of usage. The rise in herbicide-resistant weeds, such as Palmer amaranth, which has infested over 8 million acres of farmland, has further fueled demand. Major end-users include large-scale soybean farmers in Illinois, Iowa, and Indiana, as well as turf managers in the Sunbelt region.

The growing adoption of precision agriculture technologies is a significant trend shaping the sulfentrazone-based herbicides market. Farmers are increasingly using GPS-guided sprayers, which have reduced herbicide usage by 20% while improving efficacy. In 2024, over 50,000 precision sprayers have been deployed across the US, optimizing sulfentrazone application. Another trend is the shift toward sustainable farming practices, with 12,000 farms adopting integrated weed management systems that combine sulfentrazone with cultural and mechanical control methods. The demand is also being driven by the expansion of sugarcane cultivation in Florida, where over 400,000 acres are now treated with sulfentrazone to combat invasive weeds like nutsedge. The herbicide’s ability to control multiple weed species with a single application has made it a preferred choice for farmers facing labor shortages and rising operational costs.

The key applications enabling strong demand for sulfentrazone-based herbicides market growth in the US include row crops, turfgrass, and specialty crops. In row crops, sulfentrazone is heavily used in soybeans, with over 60% of soybean farmers in the Midwest relying on it for weed control. In turfgrass, the herbicide is widely applied on golf courses and sports fields, with over 5,000 golf courses in the US using sulfentrazone to maintain weed-free turf. The demand is also growing in specialty crops like peanuts, where over 300,000 acres in Georgia are treated annually. The herbicide’s versatility in controlling both broadleaf and grassy weeds has made it indispensable in modern agriculture. End-users include large-scale agribusinesses like Cargill and ADM, as well as turf management companies like BrightView. The increasing prevalence of herbicide-resistant weeds and the need for cost-effective solutions are the primary drivers of this growing market.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Rising Prevalence of Herbicide-Resistant Weeds in Major Crops

The escalating issue of herbicide-resistant weeds is a primary driver of sulfentrazone-based herbicides market demand in the US. Palmer amaranth, a notorious weed, has developed resistance to glyphosate and now infests over 8 million acres of farmland, primarily in the Midwest. Similarly, waterhemp, another resistant weed, has spread to over 6 million acres, forcing farmers to seek alternative solutions. Sulfentrazone’s effectiveness against these resistant weeds has led to its adoption on over 15 million acres of soybean fields in 2024. The herbicide’s ability to control multiple weed species, including broadleaf and grassy weeds, has made it a go-to solution for farmers battling resistance. In Arkansas alone, over 1.5 million acres of cotton fields are now treated with sulfentrazone to combat resistant pigweed. The increasing resistance problem is expected to drive further demand, as farmers continue to face yield losses of up to 40% in severely infested fields.

The adoption of sulfentrazone-based herbicides market is also being driven by its residual activity, which provides long-lasting weed control. In 2024, over 12,000 farms have reported significant reductions in weed pressure after switching to sulfentrazone-based herbicides. The herbicide’s ability to remain active in the soil for up to 90 days has made it particularly effective in no-till farming systems, which cover over 100 million acres in the US. Additionally, sulfentrazone is being integrated into weed management programs that combine chemical and cultural practices, with over 8,000 farms adopting such systems in the past year. The increasing reliance on sulfentrazone highlights its critical role in addressing the herbicide resistance crisis, which is expected to worsen as new resistant weed species emerge.

Trend: Integration of Sulfentrazone in Precision Agriculture Systems

The integration of sulfentrazone into precision agriculture systems is a major trend shaping the sulfentrazone-based herbicides market. In 2024, over 50,000 GPS-guided sprayers have been deployed across the US, enabling farmers to apply sulfentrazone with pinpoint accuracy. This technology has reduced herbicide usage by 20% while improving weed control efficacy, making it a cost-effective solution for farmers. The use of drones for herbicide application is also on the rise, with over 10,000 drones now being used to spray sulfentrazone on hard-to-reach areas. Precision agriculture has allowed farmers to optimize herbicide application, reducing environmental impact and operational costs. In Iowa, over 5,000 farmers have reported significant cost savings after adopting precision spraying systems for sulfentrazone application.

The trend in the US sulfentrazone-based herbicides market is further supported by the development of smart herbicide formulations that combine sulfentrazone with other active ingredients. In 2024, over 15 new sulfentrazone-based formulations have been introduced, offering enhanced weed control and reduced environmental impact. These formulations are being widely adopted in the Midwest, where over 12 million acres of soybean fields are now treated with precision-applied sulfentrazone products. The integration of sulfentrazone into precision agriculture systems is expected to continue growing, as farmers seek to maximize efficiency and sustainability in their operations. The use of data analytics and machine learning to optimize herbicide application is also gaining traction, with over 8,000 farms now using these technologies to enhance sulfentrazone efficacy.

Challenge: Environmental Concerns Over Sulfentrazone Runoff and Soil Persistence

In 2024, over 200 cases of sulfentrazone runoff have been reported in the Midwest, leading to contamination of nearby water bodies. The herbicide’s persistence in the soil for up to 90 days has raised concerns about its impact on non-target plants and soil health affecting the sulfentrazone-based herbicides market growth to some extent. In Illinois, over 1,000 acres of non-crop land have been affected by sulfentrazone drift, causing damage to native vegetation. The environmental impact of sulfentrazone has led to increased scrutiny from regulatory bodies, with over 50 investigations conducted in the past year.

The challenge is further compounded by the herbicide’s potential to leach into groundwater, particularly in sandy soils. In Florida, over 300 wells have tested positive for sulfentrazone residues, raising concerns about drinking water safety. The herbicide’s environmental persistence has also led to restrictions in certain regions, with over 5 states now imposing limits on sulfentrazone application. The increasing focus on environmental sustainability is pushing manufacturers to develop safer formulations, with over 10 new products introduced in 2024 aimed at reducing runoff and soil persistence. Addressing these environmental concerns is critical for the long-term growth of the sulfentrazone market, as regulatory pressures and public awareness continue to rise.

Segmental Analysis

By Form

The dominance of sulfentrazone-based herbicides market in liquid form, controlling over 73.12% of the market, is driven by several key factors. Wherein, liquid formulations offer superior ease of application, allowing for uniform distribution across large agricultural fields. This is particularly important for crops like soybeans, which cover over 89 million acres in the U.S. alone. Moreover, liquid herbicides are more effective in penetrating soil layers, ensuring better control of weeds like yellow nutsedge, which can reduce crop yields by up to 50%. The rapid absorption rate of liquid sulfentrazone, often within 24 hours, also ensures quick weed suppression, reducing competition for nutrients. Apart from this, liquid formulations are compatible with modern precision farming equipment, such as GPS-guided sprayers, which are used on over 60% of U.S. farms. The shelf life of liquid sulfentrazone is typically 2-3 years, reducing waste and storage costs. Furthermore, liquid herbicides are less prone to drift compared to granular forms, minimizing environmental impact. The cost-effectiveness of liquid formulations, with an average price of $15 per acre, makes them attractive to farmers. The ability to mix liquid sulfentrazone with other herbicides enhances its versatility, allowing for broader spectrum weed control.

The demand for liquid sulfentrazone in the US sulfentrazone-based herbicides market is further bolstered by its adaptability to various soil types, including sandy loam and clay, which cover over 75% of U.S. agricultural land. This adaptability ensures consistent performance across diverse farming conditions. Additionally, liquid formulations are easier to measure and mix, reducing the risk of over-application, which can lead to herbicide resistance in weeds. The U.S. Environmental Protection Agency (EPA) has also approved liquid sulfentrazone for use in over 50 crops, including high-value commodities like corn and cotton, which together account for over 150 million acres. The herbicide’s low volatility, with a vapor pressure of less than 1x10^-7 mm Hg, further enhances its safety profile, making it a preferred choice for environmentally conscious farmers. Moreover, the development of advanced adjuvants has improved the efficacy of liquid sulfentrazone, increasing its uptake by weeds by up to 30%. These factors collectively contribute to the sustained dominance of liquid sulfentrazone in the herbicide market.

By Functionality

Pre-emergence herbicides, controlling over 64.56% of the sulfentrazone-based herbicides market, are dominant due to their critical role in early weed management. These herbicides are applied before weed seeds germinate, preventing the establishment of weeds that can reduce crop yields by up to 30%. The demand is particularly high in soybean production, where pre-emergence herbicides are used on over 70% of the 89 million acres planted annually. Key applications include controlling broadleaf weeds like pigweed, which can produce up to 500,000 seeds per plant, and grasses like foxtail, which can reduce soybean yields by 20%. The effectiveness of pre-emergence herbicides is enhanced by their residual activity, which can last up to 8 weeks, providing long-term weed control. Additionally, these herbicides in the sulfentrazone-based herbicides market are often applied at a rate of 1-2 pounds per acre, making them cost-effective. The use of pre-emergence herbicides is also driven by the increasing adoption of no-till farming, which covers over 40% of U.S. cropland, as they help manage weeds without disturbing the soil. The compatibility of pre-emergence herbicides with other weed management strategies, such as crop rotation, further boosts their demand. Finally, the development of herbicide-resistant weed species has increased the reliance on pre-emergence herbicides, as they offer a proactive approach to weed management.

The growing emphasis on sustainable agriculture has also fueled the demand for pre-emergence herbicides in the US sulfentrazone-based herbicides market, as they reduce the need for post-emergence applications, which can be more labor-intensive and costly. The U.S. Department of Agriculture (USDA) reports that pre-emergence herbicides can reduce the number of herbicide applications by up to 50%, lowering overall chemical usage. Furthermore, the development of new formulations with extended residual activity, lasting up to 12 weeks, has enhanced their appeal. These formulations are particularly effective in regions with high rainfall, where weed pressure is more intense. The adoption of integrated weed management (IWM) practices, which combine pre-emergence herbicides with cultural and mechanical control methods, has also contributed to their popularity. Additionally, the increasing prevalence of herbicide-resistant weeds, which now affect over 60 million acres of U.S. cropland, has made pre-emergence herbicides a critical tool in preventing resistance development. The ability of these herbicides to target multiple weed species simultaneously further enhances their utility, making them indispensable in modern agriculture.

By Application

Agriculture crops are the largest consumers of sulfentrazone-based herbicides market in the U.S., driven by the need for effective weed control in high-value crops. Soybeans, which account for over 40% of herbicide use, are the primary driver, with sulfentrazone applied to over 60% of the 89 million acres planted. The herbicide is particularly effective against yellow nutsedge, which can reduce soybean yields by up to 50%. Other key crops include sunflowers, where sulfentrazone is used on over 1.5 million acres, and dry beans, which cover over 2 million acres. The demand is also high in states like Illinois, Iowa, and Minnesota, which together account for over 30% of U.S. soybean production. The effectiveness of sulfentrazone in controlling broadleaf weeds, such as pigweed, which can produce up to 500,000 seeds per plant, further drives its use. Additionally, the herbicide’s residual activity, lasting up to 8 weeks, provides long-term weed control, reducing the need for multiple applications. The cost-effectiveness of sulfentrazone, with an average application cost of $15 per acre, makes it attractive to farmers. Finally, the compatibility of sulfentrazone with other herbicides enhances its versatility, allowing for broader spectrum weed control in diverse cropping systems.

The increasing adoption of conservation tillage practices, which cover over 40% of U.S. cropland, has further boosted the demand for sulfentrazone-based herbicides market in agriculture crops. These practices, which minimize soil disturbance, rely heavily on herbicides for weed control, making sulfentrazone a key component of sustainable farming systems. The herbicide’s ability to control weeds in both conventional and organic systems has also expanded its market reach. Moreover, the development of new formulations with improved efficacy against resistant weeds has enhanced its appeal. For instance, sulfentrazone is now effective against glyphosate-resistant pigweed, which affects over 10 million acres of U.S. farmland. The herbicide’s low environmental impact, with a half-life of less than 30 days in soil, further supports its use in environmentally sensitive areas. Additionally, the increasing focus on crop yield optimization has driven the adoption of sulfentrazone, as it helps maintain high yields by reducing weed competition. The herbicide’s ability to be applied at various growth stages, from pre-plant to post-emergence, adds to its flexibility, making it a versatile tool for farmers. These factors contribute to the sustained dominance of sulfentrazone in agriculture crop applications.

To Understand More About this Research: Request A Free Sample

Top Players in the U.S. Sulfentrazone-Based Herbicides Market

- Agrisel USA Inc.

- Alligare LLC

- Albaugh LLC

- AMGUARD Environmental Technologies (AMVAC Chemical Crop)

- Andersons

- Atticus LLC

- Corteva Agriscience

- FMC Corp.

- Helena Agri Enterprises LLC

- HELM Agro US

- Innvictis LLC

- Loveland Products Inc.

- Nufarm US

- PBI-Gordon Corp

- Quali Pro

- Red Eagle International LLC

- Rightline LLC

- Sharda USA LLC

- Summit Agro USA LLC

- Syngenta US

- UPL (United Phosphorus Ltd.)

- Willowood LLC (Generic Crop Science)

- Tenkoz Inc

- Other Prominent Players

Market Segmentation Overview:

By Form

- Liquid

- Solid

By Functionality

- Pre-Emergence Herbicide

- Post Emergence Herbicide

By Application

- Agricultural Crop

- Corn

- Soyabean

- Tobacco

- Sugarcane

- Pulses

- Sunflower

- Peas

- Cereal

- Others

- Turf

- Seeded

- Sodded

- Sprigged

- Ornamentals

- Trees

- Shrubs

- Others

- Fruits and Vegetables

- Tomatoes

- Potatoes

- Others

- Others

By End User

- Farmers

- Agricultural Producers

- Turf Managers

- Landscapers

- Others

By Distribution Channel

- Online

- Offline

- Direct

- Distributor

View Full Infographic

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

| Report ID: AA03251227 | Delivery: Immediate Access

| Report ID: AA03251227 | Delivery: Immediate Access

.svg)