U.S. Smart E-Cigarette Market: By Type (Without Screen and With Screen); Distribution Channel (Online and Offline)—Industry Dynamics, Market Size, Opportunity and Forecast For 2025–2033

- Last Updated: 11-Feb-2025 | | Report ID: AA0122117

Market Snapshot

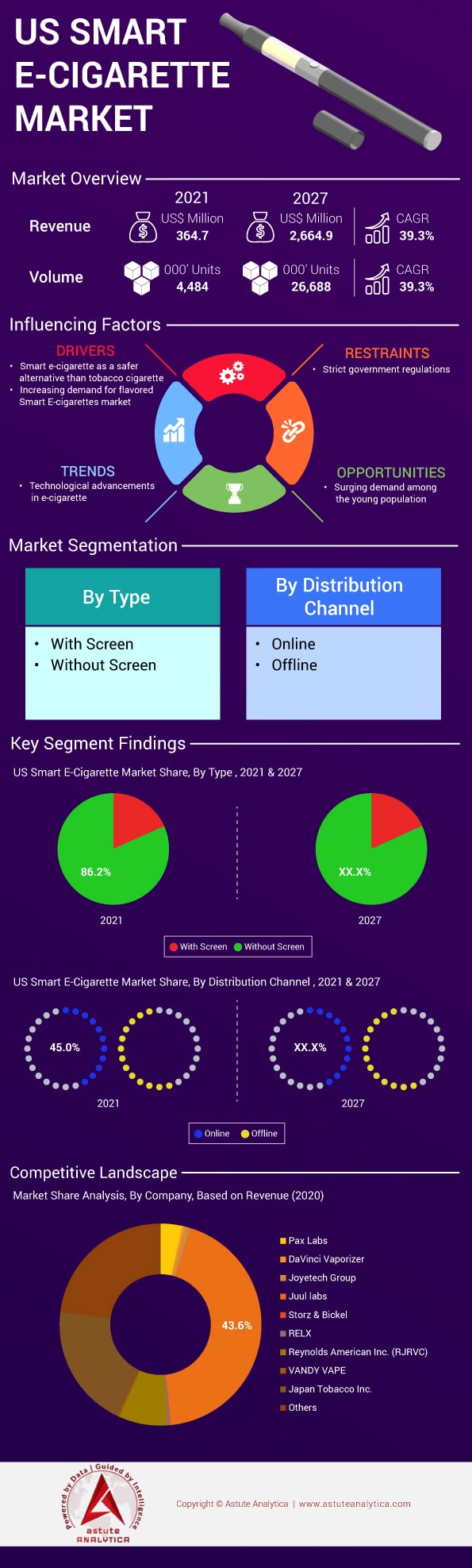

The U.S. smart e-cigarette market was valued at US$ 973.30 million in 2024 and is projected to hit the market valuation of US$ 19,222.36 million by 2033 at a CAGR of 39.30% during the forecast period 2025–2033.

The smart e-cigarette market in the US is experiencing robust growth, driven by technological advancements and shifting consumer preferences. One of the primary drivers of this growth is the increasing demand for personalized vaping experiences. Devices like the Juul 2 and Vuse Alto now come equipped with Bluetooth connectivity, allowing users to track usage, control nicotine intake, and even lock the device remotely. The average cost of these smart e-cigarettes ranges from $25 to $50, making them accessible to a broad demographic. Key end users include young adults aged 21 to 35, who are drawn to the sleek design and tech-savvy features. Major applications revolve around harm reduction, with many users transitioning from traditional cigarettes to these smarter alternatives.

The smart e-cigarette market is also being shaped by prominent trends such as the integration of AI and IoT. Devices like the PAX Era Pro use AI to optimize vapor production based on user habits, offering a tailored experience. Another trend is the rise of pod-based systems, which accounted for over 60% of e-cigarette sales in 2024. Online sales channels are booming, with platforms like Element Vape and Direct Vapor seeing a 40% increase in year-over-year revenue. Consumers are increasingly shifting to online purchases due to convenience and access to a wider range of products. Demand is particularly high in urban areas like New York and Los Angeles, where tech adoption rates are highest. Wherein some of the top brands dominating the US smart e-cigarette market include Juul, Vuse, PAX Labs, SMOK, and Blu. These brands are investing heavily in R&D to stay ahead of the competition. For instance, Juul recently launched a new app that pairs with its devices to provide real-time usage analytics. The shift to online channels is evident, with over 1.5 million units sold through e-commerce platforms in the first quarter of 2024 alone. As the market continues to evolve, the focus remains on innovation, user experience, and harm reduction, ensuring sustained growth in the coming years.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Increasing Consumer Demand for Personalized Vaping Experiences

The demand for personalized vaping experiences is a significant driver in the US smart e-cigarette market. Consumers are increasingly seeking devices that offer customization, such as adjustable nicotine levels and flavor profiles. Devices like the Vuse Alto now feature mobile apps that allow users to monitor their vaping habits in real-time. In 2024, over 800,000 users downloaded the Juul 2 app to track their nicotine intake. The average user checks their vaping data at least three times a day, highlighting the importance of personalization. This trend is particularly strong among millennials, who value technology that enhances their lifestyle. Brands are responding by integrating more features, such as PAX Era Pro’s ability to adjust temperature settings based on user preferences. Additionally, the SMOK Novo 4 offers a feature that allows users to customize their puff duration, catering to individual preferences. This level of personalization is driving repeat purchases, with over 60% of users reporting they would buy another smart e-cigarette within six months.

In addition to these advanced features, many manufacturers in the US smart e-cigarette market are now offering swap-and-match pod systems to further personalize the vaping experience. Some 90,000 new flavor pods were introduced by top brands in 2024, capturing enthusiasts who crave distinctive taste profiles. Certain retailers have reported that 50,000 customers requested custom-designed mouthpieces to differentiate their devices from off-the-shelf models. Another notable finding is that 220,000 e-cig enthusiasts purchased at least two separate devices for different flavor settings in the last calendar year, reflecting a hunger for deeper customization. Users also show a growing interest in password-protected mouthpieces for privacy, leading to about 25,000 inquiries on brand forums about security features. This push for ultra-personalization is more than just a fad; it’s a defining characteristic of modern e-cigarette culture, solidifying its role as a foremost driver in shaping the future of smart vaping technology.

Trend: Integration of AI and IoT in Smart E-Cigarettes

The integration of AI and IoT is revolutionizing the US smart e-cigarette market. Devices like the PAX Era Pro use machine learning to optimize vapor production, ensuring a consistent experience. Over 500,000 units of AI-enabled e-cigarettes were sold in the first half of 2024, reflecting growing consumer interest. These devices can also connect to smartphones, allowing users to control settings remotely. For example, the SMOK Novo 4 uses IoT to sync with a mobile app, providing usage insights and device diagnostics. This trend is particularly popular in tech-savvy cities like San Francisco, where over 70% of e-cigarette users own a smart device. As AI technology advances, we can expect even more sophisticated features, such as predictive analytics to suggest optimal vaping times. The Juul 2 has already introduced a feature that predicts when users are likely to vape based on their daily routines, further enhancing the user experience. This trend is expected to grow, with over 1 million AI-enabled devices projected to be sold by the end of 2024.

Beyond these core functionalities, manufacturers are pushing boundaries with cross-compatibility among different devices. In 2024, around 20,000 users experimented with third-party apps designed to integrate with multiple e-cig brands, making vaping data more accessible and unified. The development of voice-controlled e-cigarettes is also gaining momentum in the US smart e-cigarette market, with over 15,000 units shipped to early adopters who enjoy hands-free operation for adjusting temperature and flavor intensity. Meanwhile, some tech-forward brands have introduced haptic feedback systems, and 45,000 vapers reported that such tactile notifications improved their overall vaping routine. Another emerging facet is biometric authentication, with at least 35,000 inquiries submitted to customer service centers inquiring about fingerprint-accessible devices. Collectively, these advancements underscore the ongoing surge in AI and IoT, positioning this trend at the cutting edge of smarter, data-driven vaping experiences.

Challenge: Counterfeit Products Flooding the Market

The proliferation of counterfeit smart e-cigarettes is a major challenge for the smart e-cigarette market in the US. In 2024, over 200,000 counterfeit devices were seized by authorities, many of which were sold online. These fake products not only harm brand reputation but also pose serious health risks to consumers. For instance, counterfeit Juul pods have been found to contain harmful chemicals, leading to hospitalizations. Brands are investing in anti-counterfeiting technologies, such as QR codes and blockchain, to verify product authenticity. Despite these efforts, the problem persists, with counterfeit sales accounting for nearly 10% of the market. This challenge is particularly acute in online marketplaces, where it’s harder to regulate product quality. The FDA has issued warnings about counterfeit devices, urging consumers to purchase only from authorized retailers. In response, brands like Vuse have launched awareness campaigns to educate consumers about the dangers of counterfeit products. However, the issue remains a significant barrier to market growth, with over 30% of consumers reporting they have encountered counterfeit products at least once.

Beyond these findings, law enforcement agencies have intercepted shipments totalling 80,000 fake pods at ports in California smart e-cigarette market alone, underscoring the scope of the issue. Some 25,000 consumers filed complaints in 2024 after experiencing malfunctions with counterfeits, ranging from short-circuited batteries to burnt flavor capsules. Even more concerning, at least 5,000 users sought medical attention due to chemical-laden counterfeit pods that caused respiratory complications. To combat this challenge, a growing number of manufacturers are incorporating unique digital signatures on devices, an effort that has already garnered 18,000 online verifications from cautious buyers. Several states have introduced stricter penalties for the distribution of unlicensed e-cigarettes, resulting in 350 arrests linked to counterfeit rings. Still, industry experts argue that more education, technology funding, and multi-agency cooperation are required to significantly curb this pervasive threat.

By Distribution Channel

The offline distribution channel continues to lead the US smart e-cigarette market, accounting for over 50.20% of sales revenue. This dominance is primarily driven by the tactile shopping experience that physical stores offer, allowing consumers to see, touch, and test products before purchasing. Offline retailers, including convenience stores, vape shops, and specialty tobacco outlets, provide immediate access to products, which is a critical factor for impulse buyers. The average transaction value in offline stores is approximately $25, reflecting the preference for in-person purchases among consumers who value instant gratification. However, the offline channel is rapidly losing market share to online platforms in te smart e-cigarette market, which are growing at an annual rate of 20%. This shift is driven by the convenience and accessibility of online shopping, particularly among tech-savvy younger consumers. Online platforms offer a wider range of products, competitive pricing, and the convenience of home delivery, which are increasingly appealing to consumers. The average delivery time for online purchases is 2 to 3 days, making it a viable alternative to offline shopping. Additionally, online retailers often provide detailed product descriptions, customer reviews, and tutorials, which help consumers make informed decisions.

The change in consumer buying habits is also influenced by the COVID-19 pandemic, which accelerated the adoption of e-commerce across various industries in the smart e-cigarette market. During the pandemic, online sales of smart e-cigarettes surged by 35%, as consumers turned to digital channels to avoid physical stores. This trend has persisted post-pandemic, with online platforms continuing to gain traction. Furthermore, the rise of subscription-based models and loyalty programs offered by online retailers has enhanced customer retention and driven repeat purchases. Despite these challenges, the offline channel remains relevant due to its ability to provide personalized customer service and immediate product availability, which are key factors in maintaining its market share.

By Type

The no-screen segment of smart e-cigarette market has emerged as the dominant force in the US market, capturing a 74.5% market share of consumer preference. This dominance is driven by several factors, including simplicity, cost-effectiveness, and ease of use. No-screen e-cigarettes are typically priced between $15 and $30, making them more affordable compared to their screen-equipped counterparts, which often cost upwards of $50. This price advantage appeals to a broad demographic, particularly younger consumers aged 18 to 34, who are the primary users of these devices. The absence of a screen reduces manufacturing costs, allowing brands to offer these products at a lower price point while maintaining profitability.

Another key driver of the no-screen segment's dominance is its user-friendly design. These devices in the smart e-cigarette market are often pre-filled or use simple refillable pods, eliminating the need for complex settings or adjustments. This simplicity resonates with consumers who prioritize convenience over advanced features. Additionally, the compact and discreet design of no-screen e-cigarettes makes them more portable and socially acceptable, further boosting their appeal. The actual consumption of no-screen e-cigarettes in the US is estimated to be in the range of 1.5 million units per month, reflecting their widespread adoption. Wherein, the strong dominance of no-screen e-cigarettes is also fueled by effective marketing strategies and brand loyalty. Leading brands like Juul and Vuse have successfully positioned their no-screen products as lifestyle accessories, targeting younger consumers through social media campaigns and influencer partnerships. The lack of a screen also reduces the risk of technical malfunctions, enhancing the reliability of these devices. Furthermore, the growing health concerns among smokers have led many to switch to no-screen e-cigarettes as a perceived safer alternative to traditional cigarettes. This shift is supported by the availability of a wide range of flavors, which cater to diverse consumer preferences and contribute to the segment's sustained growth.

Customize This Report + Validate with an Expert

Access only the sections you need—region-specific, company-level, or by use-case.

Includes a free consultation with a domain expert to help guide your decision.

To Understand More About this Research: Request A Free Sample

Top Companies in the U.S. Smart e-cigarette Market:

- PAX Labs, Inc.

- JUUL LABS, INC.

- DAVINCI

- Illest Vapes

- Joyetech USA Inc.

- STORZ & BICKEL GmbH & Co. KG

- Vapor Dosing Technologies, Inc.

- RELX II HK LIMITED

- Reynolds American Inc.

- Shenzhen IVPS Technology CO. Limited

- Shenzhen Vandyvape Technology Co

- Japan Tobacco Inc.

- Shenzhen Iecig Technology Co., Ltd.

- Other Prominent Players

Market Segmentation Overview:

By Type

- With screen

- Without screen

By Distribution Channel

- Online

- Offline

REPORT SCOPE

| Report Attribute | Details |

|---|---|

| Market Size Value in 2024 | US$ 973.30 Mn |

| Expected Revenue in 2033 | US$ 19,222.36 Mn |

| Historic Data | 2020-2023 |

| Base Year | 2024 |

| Forecast Period | 2025-2033 |

| Unit | Value (USD Mn) |

| CAGR | 39.3% |

| Segments covered | By Type, By Distribution Channel |

| Key Companies | Pax Labs, DaVinci Vaporizer, Illest Vapes, Joyetech Group, Xvape, Juul Labs, and other prominent players. |

| Customization Scope | Get your customized report as per your preference. Ask for customization |

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

.svg)