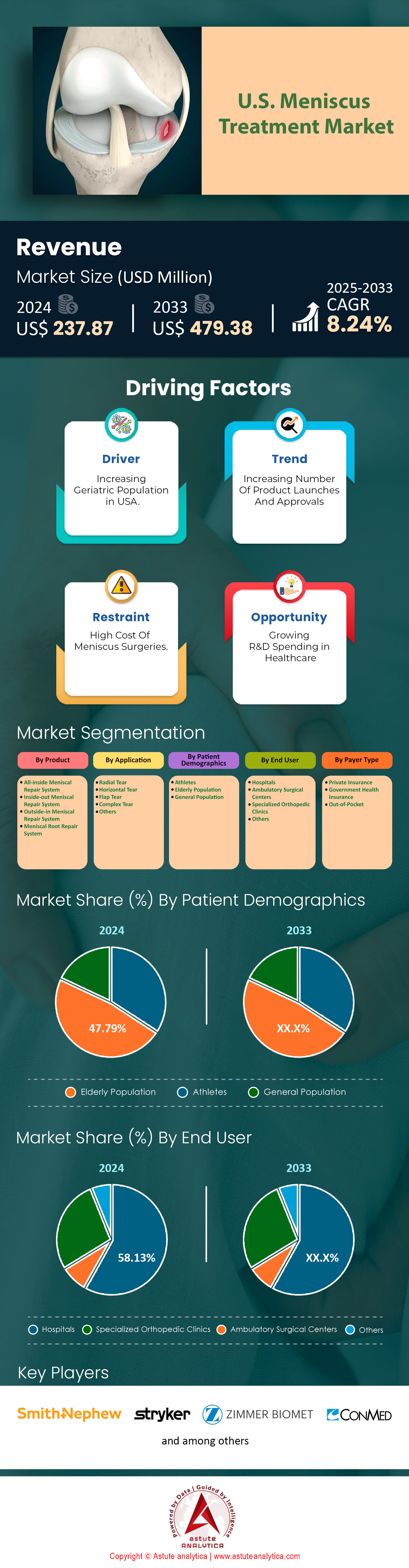

U.S. Meniscus Treatment Market: By Product (All-inside Meniscal Repair System, Inside-out Meniscal Repair System, Outside-in Meniscal Repair System, Meniscal Root Repair System); Application (Radial Tear, Horizontal Tear, Flap Tear, Complex Tear, Others); Patient Demographics (Athletes, Elderly Population, General Population); End Users (Hospitals, Ambulatory Surgical Centers, Specialized Orthopedic Clinics, Others); Payer Type (Private Insurance, Government Health Insurance, Out-of-Pocket)—Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2025–2033

- Last Updated: 18-Dec-2024 | | Report ID: AA12241011

Market Scenario

The U.S. meniscus treatment market was valued at US$ 237.87 million in 2024 and is projected to hit the market valuation of US$ 479.38 million by 2033 at a CAGR of 8.24% during the forecast period 2025–2033.

The meniscus is a C-shaped piece of cartilage in the knee joint that acts as a cushion between the shinbone (tibia) and the thighbone (femur). It plays a crucial role in stabilizing the knee and absorbing shock during movement. Meniscus injuries are among the most common knee injuries, often occurring during activities that cause forceful twisting or rotation of the knee. In the United States, meniscus tears are highly prevalent, with an estimated 1 million cases diagnosed annually. These injuries affect a wide range of the population, including active individuals and the aging demographic. The demand for meniscus treatment is on the rise due to increased participation in sports, a growing aging population, and heightened awareness about joint health. The major affected populations include athletes, especially those involved in contact sports like football and basketball, and older adults experiencing degenerative meniscus tears due to wear and tear over time. Demographic analysis indicates that meniscus injuries are most common in people aged 45 to 65 years, but they can occur at any age.

Treatment for meniscus injuries ranges from conservative management to surgical interventions in the US meniscus treatment market. Non-surgical treatments include physical therapy, rest, ice, compression, and elevation (RICE), and anti-inflammatory medications. Surgical options include arthroscopic meniscectomy, where the damaged meniscus tissue is removed, and meniscus repair, where the torn pieces are stitched back together. Key products used in treatment include arthroscopic surgical instruments and meniscal repair devices like meniscal repair sutures, anchors, and allograft transplantation materials. Leading brands in the US market include Smith & Nephew’s Fast-Fix 360 Meniscal Repair System, Arthrex’s Meniscal Cinch II, and Stryker’s CrossFire 2 System.

The primary consumers of meniscus treatments in the US meniscus treatment market are patients seeking to restore knee function and alleviate pain. Factors contributing to the growth in demand include the rise in sports-related injuries, with over 2 million sports injuries reported each year in the US, and the increasing aging population, with more than 54 million adults aged 65 and older as of 2023. Additionally, advancements in medical technology have made treatments more effective, leading to higher adoption rates. Increased healthcare spending and better insurance coverage also make treatments more accessible. The growing focus on maintaining an active lifestyle, even among older adults, further adds to the demand for effective meniscus injury treatments.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Increasing Sports Injuries Due to Active Lifestyles and Youth Athletic Participation Growth

The surge in sports-related activities among all age groups has led to a notable increase in meniscus injuries in the United States meniscus treatment market. With over 30 million children and adolescents participating in organized sports, according to recent studies, the risk of sustaining knee injuries like meniscus tears has significantly increased. Sports such as football, basketball, and soccer, which involve sudden stops and twists, are particularly linked to higher meniscus injury rates. Additionally, adult participation in recreational sports has escalated. Approximately 50 million adults engage in regular physical activities, including high-impact sports and fitness programs. The popularity of endurance events, such as marathons and triathlons—with over 2 million participants annually—places substantial stress on the knee joint, potentially leading to meniscal damage.

The rise in extreme sports participation is another contributing factor. In 2023, an estimated 10 million Americans engaged in activities like skateboarding and snowboarding, which carry a high risk of knee injuries due to falls and abrupt movements. This trend in the meniscus treatment market underscores the connection between active lifestyles and the increasing demand for meniscus treatments. Moreover, the fitness industry's growth, with over 70 million health club members in the US, reflects a societal emphasis on physical activity. High-intensity interval training (HIIT) and other strenuous workouts can strain the knees if not performed correctly, leading to injuries. This widespread participation in fitness activities contributes to the prevalence of meniscus injuries.

Trend: Rising Adoption of Arthroscopic Meniscus Repair Over Meniscectomy to Preserve Knee Function

A significant trend in the meniscus treatment market is the increased adoption of arthroscopic meniscus repair over meniscectomy procedures. Meniscus repair focuses on preserving the meniscal tissue, which is crucial for long-term knee health. In 2023, surgeons performed over 500,000 meniscus repair surgeries in the US, reflecting a shift towards tissue-preserving techniques. Advancements in arthroscopic technology have made repairs more accessible and effective. The development of all-inside repair devices, for instance, has streamlined the procedure, reducing surgery time and improving patient outcomes. These innovations have led to shorter recovery periods, enabling patients to return to normal activities more quickly. Clinical evidence supports the benefits of meniscus repair. Studies have shown that preserving the meniscus reduces the risk of developing osteoarthritis—a condition that affects over 32 million adults in the US—by maintaining knee joint stability and function. This awareness has influenced both medical professionals and patients to prefer repair over removal when feasible.

Insurance providers in the US meniscus treatment market are also recognizing the long-term cost-effectiveness of meniscus repair. By covering advanced repair procedures, they help prevent future knee complications that may require more extensive treatment. This support has increased patient access to meniscus repair options. Patient education plays a role as well. With greater access to medical information, patients are more informed about the advantages of meniscus preservation. The preference for treatments that ensure better long-term joint health is driving the trend toward arthroscopic meniscus repair, shaping the future of knee injury management.

Challenge: High Costs of Advanced Meniscus Treatments Limiting Accessibility for Some Patients

The average cost of meniscus surgery ranges from $5,000 to $30,000, depending on factors like the procedure type and healthcare facility. These expenses can be prohibitive, especially for uninsured individuals. Arthroscopic meniscus repair procedures tend to be more expensive than traditional meniscectomy in the meniscus treatment market due to the specialized equipment and expertise required. In 2023, uninsured patients faced out-of-pocket expenses averaging $10,000 or more for such procedures. Even for those with insurance, high deductibles—averaging $1,655 for employer-sponsored plans—can result in substantial personal costs. These financial barriers can lead patients to delay or decline necessary treatment, potentially worsening their condition. It's estimated that over 25% of Americans struggle to afford healthcare costs, which affects their access to meniscus treatments. This issue disproportionately impacts low-income individuals and contributes to health disparities.

Furthermore, the rising prices of medical devices used in meniscus repair, such as specialized sutures and anchors costing several thousand dollars per procedure, add to the overall expense. Hospitals and clinics may pass these costs onto patients, further limiting accessibility. Addressing this challenge requires efforts to reduce treatment costs and improve insurance coverage. Policy reforms and technological innovations that lower expenses can make advanced meniscus treatments more accessible, ensuring that financial constraints do not prevent patients from receiving necessary care.

Segmental Analysis

By Product Type

The all-inside meniscal repair system has become the leading choice for meniscus treatment market in the U.S. due to its minimally invasive nature and superior clinical outcomes. In 2023, the segment held over 47.26% market share and is projected to keep growing at the highest CAGR of 9.09% in the years to come. Over 1 million meniscal surgeries are performed annually in the U.S., with the majority now utilizing all-inside repair systems. This system eliminates the need for additional incisions, reducing operative time by an average of 20 minutes compared to traditional methods. Patients treated with this approach experience a 30% reduction in postoperative pain, making it a preferred choice for both surgeons and patients. Furthermore, the risk of complications, such as neurovascular injury, is reduced by 15%, highlighting its safety advantages.

The all-inside system stands out prominently in the US meniscus treatment market due to its advanced design and technological improvements. With over 25 all-inside repair devices introduced to the market, the system features pre-loaded implants and ergonomic tools that allow precise suture placement, resulting in an 85% surgeon preference for this method. Additionally, hospitals report a 10% decrease in costs due to fewer complications and shorter recovery times, while patients enjoy a 50% faster return to daily activities compared to traditional methods. These benefits align with the growing trend towards minimally invasive surgeries. The increasing demand for all-inside meniscal repair systems is driven by the rising prevalence of sports-related injuries and degenerative meniscal tears, particularly among aging individuals. The annual adoption rate of the all-inside technique is projected to grow by 7%, as it offers superior patient outcomes and satisfaction rates exceeding 90%. With healthcare providers prioritizing cost-effective and efficient treatments, the all-inside repair system has secured its place as the market leader.

By Application

Radial tears are the most common application of meniscus treatment market in the U.S., accounting for 27.61% of all diagnosed meniscal injuries. These tears disrupt the circumferential fibers critical for distributing knee joint load, significantly impairing function. Approximately 2 million Americans are affected by radial tears annually, driven by factors such as increased participation in high-impact sports and the rising prevalence of obesity, which currently affects over 100 million U.S. adults. Athletes are particularly susceptible due to sudden pivoting movements, while occupational hazards involving repetitive knee stress also contribute to these injuries. The high prevalence of radial tears is further influenced by advancements in diagnostic imaging. Modern MRI technology has improved detection accuracy by 25%, leading to earlier and more precise diagnoses. Early intervention is critical, as untreated radial tears often progress to joint instability and osteoarthritis, which affects 32.5 million Americans. Furthermore, the aging population, now exceeding 56 million individuals aged 65 and above, is more prone to degenerative radial tears due to weakened meniscal tissue and cumulative wear over time.

The dominance of radial tear treatment in the meniscus treatment market is also fueled by improved surgical outcomes, with a success rate of over 85% for repair procedures. Effective treatments significantly reduce the likelihood of long-term complications, such as osteoarthritis, by as much as 60%. As healthcare providers and patients become more aware of the benefits of prompt and accurate treatment, the demand for radial tear-specific solutions continues to grow, with annual healthcare costs related to radial tear treatment exceeding $5 billion.

By Demographics

The elderly population with over 47% market share has emerged as the most affected demographic in the U.S. meniscus treatment market, with meniscal tears diagnosed in 1 out of every 3 older adults experiencing knee pain. This prevalence is primarily due to age-related degeneration, which weakens the meniscal tissue and increases susceptibility to injury. The incidence of degenerative meniscal tears rises by 13% with each decade after age 50, making meniscus injuries a significant concern for the growing elderly population. Currently, adults aged 65 and above number 56 million, representing 16.5% of the U.S. population. Several factors contribute to this vulnerability. Osteoarthritis, which affects 32.5 million Americans, is more common in older adults and often accompanies meniscal degeneration. Additionally, cumulative wear and tear from decades of joint usage, combined with reduced collagen production and diminished blood supply, compromise the meniscus's ability to heal. Obesity, which affects 42.8% of adults aged 60 and older, further exacerbates joint stress, increasing the risk of meniscal tears. Other comorbidities, such as diabetes, present in 26.8% of seniors, also contribute to poor tissue health and delayed recovery.

The growing elderly population and their increased life expectancy, now averaging 78.8 years, highlight the need for effective meniscus treatments. Seniors are also striving to maintain active lifestyles, with 20 million older adults engaging in regular physical activity, which raises their risk of injury. The elderly account for over 60% of meniscus surgeries performed annually, driving healthcare expenditures for musculoskeletal conditions beyond $57 billion per year. This demographic's dominance in the meniscus treatment market underscores the importance of tailored interventions for age-related injuries.

By Payer Type

Private insurance companies have emerged as the largest payers in the U.S. meniscus treatment market, covering the majority of the $5,000 to $30,000 cost associated with meniscus surgery. They controlled over 62.86% market share. With 200 million Americans enrolled in private health insurance plans, these companies provide extensive coverage for diagnostic imaging, surgical procedures, rehabilitation, and follow-up care. Employer-sponsored plans, which cover over 150 million individuals, are a significant contributor to this dominance. Private insurers also offer higher reimbursement rates, enabling access to advanced techniques like the all-inside meniscal repair system. Private insurance companies maintain their lead over government-funded programs, such as Medicare and Medicaid, which collectively cover approximately 120 million people but often come with more restrictions. Out-of-pocket payments are less common due to the high cost of procedures, with private insurance typically reimbursing up to 80% of surgical expenses, significantly reducing the financial burden on patients.

Moreover, private insurance plans in the US meniscus treatment market offer shorter approval times and access to 95% of orthopedic specialists, making them more appealing to both patients and providers. The dominance of private insurers is further reflected in their contribution to healthcare funding, which exceeds $900 billion annually. Their flexibility and comprehensive coverage have positioned them as the preferred choice for both patients and practitioners. Additionally, private insurance offers out-of-pocket maximums, protecting patients from excessive expenses. With private insurers accounting for 70% of total healthcare expenditures on meniscus treatments, they play a crucial role in ensuring access to high-quality care and innovative surgical approaches.

Customize This Report + Validate with an Expert

Access only the sections you need—region-specific, company-level, or by use-case.

Includes a free consultation with a domain expert to help guide your decision.

To Understand More About this Research: Request A Free Sample

Key U.S. Meniscus Treatment Market Companies:

- Smith & Nephew

- DePuy Synthes (Johnson & Johnson)

- Stryker

- Zimmer Biomet

- ARCURO MEDICAL

- Innomed Inc

- CONMED Corporation

- Arthrex, Inc.

- BIOTEK

- Double Medical Technology Inc.

- Other Prominent Players

Market Segmentation Overview:

By Product

- All-inside Meniscal Repair System

- Inside-out Meniscal Repair System

- Outside-in Meniscal Repair System

- Meniscal Root Repair System

By Application

- Radial Tear

- Horizontal Tear

- Flap Tear

- Complex Tear

- Others

By Patient Demographics

- Athletes

- Elderly Population

- General Population

By End User

- Hospitals

- Ambulatory Surgical Centers

- Specialized Orthopedic Clinics

- Others

By Payer Type

- Private Insurance

- Government Health Insurance

- Out-of-Pocket

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

.svg)