U.S. Flooring Market: By Material (Wood (Hardwood, Softwood, Engineered Wood), Vinyl (Vinyl Tiles, Vinyl Sheets, Luxury Vinyl Flooring), Carpet, Laminate, Ceramic, Others); Application (Kitchen, Living Room, Bathroom/Washroom, Auditoriums, Warehouses, Workshops, Sport Complex, Institutes, Other Applications); End Users (Domestic Flooring and Commercial Flooring (Corporate Buildings, Healthcare, Education, Retail & E-Commerce, Government, Food & Beverage, Oil & Gas, and Others); Sales Channel (Online and Offline (Hardware Stores, Flagship Stores, Specialty Stores, Others)— Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2024–2032

- Last Updated: Mar-2024 | Format:

![pdf]()

![powerpoint]()

![excel]() | Report ID: AA0923614 | Delivery: 2 to 4 Hours

| Report ID: AA0923614 | Delivery: 2 to 4 Hours

Market Scenario

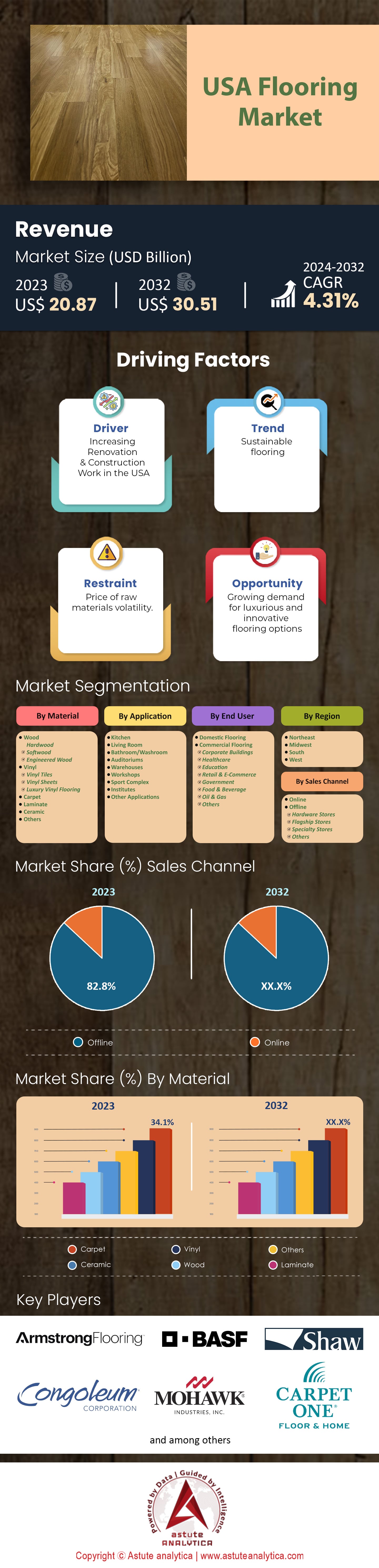

United States Flooring Market was valued at US$ 20.87 billion in 2023 and is projected to attain a market valuation of US$ 30.51 billion by 2032 at a CAGR of 4.31% during the forecast period 2024–2032.

The U.S. flooring market has evolved dramatically over recent years, presenting an intricate tapestry of trends, opportunities, and challenges. Historically, the American consumer's affinity for home renovation and the consistent surge in residential and commercial construction projects have been underpinning the market's robustness. To put this in perspective, construction spending in the US has been steadily climbing. In 2022, the expenditure on construction activities had surpassed $1.8 trillion, with a significant portion earmarked for flooring. As a testament to this, the average American homeowner, eager to embellish their living spaces with aesthetic and durable floors, spends roughly between $6 and $10 per square foot on flooring installation, although the precise figure can vary widely based on the type of material used and the intricacies of the project.

Several factors have been steering this market towards its upward trajectory. Notably, the rise in real estate activities, coupled with increasing consumer purchasing power and a strong predilection for luxury and aesthetic appeal, is driving demand in the USA flooring market. This is further supported by growing emphasis on eco-friendly revolution. There's a growing demand for sustainable and eco-friendly flooring solutions like bamboo, cork, and linoleum. This green wave is more than just a transient trend; it’s a movement dictating the strategic directions of many industry players. Further, technological advancements have birthed innovative flooring solutions, which are not only durable but also more cost-effective and easier to maintain. Luxury vinyl tiles (LVT) and waterproof core flooring, for instance, are winning consumers over for their resilience, versatility, and ease of installation.

Apart from the green revolution the USA flooring market is also witnessing a marked shift towards personalized and custom flooring solutions. Consumers are not merely seeking floors; they want unique floor solutions that reflect their personal style, and are willing to spend a premium for such customization. Then there's the digital wave. The e-commerce boom, bolstered by the pandemic, has accentuated the online sales of flooring products. This is largely due to the convenience of online shopping and the vast array of options available at the click of a button. It's a lucrative avenue that’s luring many traditional retailers to augment their digital footprint.

Amidst all these opportunities, competition in the USA flooring market is fierce. Established players and emerging enterprises are all vying for a piece of this lucrative pie. Their strategies are many-sided. Product differentiation remains a foundation. Be it through introducing novel designs, leveraging advanced technology to enhance durability, or pioneering eco-friendly solutions, brands are incessantly innovating to stand out. Pricing, too, is a critical battlefield. While some players are aiming to capture the luxury segment by offering premium products, others are targeting the mass market with cost-effective solutions.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Eco-friendly and Sustainable Flooring Solutions

The surge in environmental consciousness among consumers is dramatically reshaping the USA flooring market. A recent uptick in demand for sustainable and eco-friendly flooring solutions can be attributed to a broader global emphasis on sustainable living. To illustrate this shift, a study revealed that the global green building materials market, of which eco-friendly flooring is a significant component, was valued at $377.0 billion in 2022, with North America being a dominant player. This indicates a growing inclination towards materials that have minimal environmental footprints.

Bamboo, for instance, has gained immense popularity, with its market size in the U.S. growing substantially. It's not just its rapid renewability that appeals to consumers; bamboo floors also offer durability comparable to hardwood floors. Prices, hovering around $5 to $8 per square foot for bamboo flooring, mirror those of conventional hardwood, making it an attractive alternative. Cork is another material in vogue. Between its natural insulating properties, comfort underfoot, and eco-friendliness, cork flooring has witnessed an annual growth rate of around 4% in recent years. Moreover, reclaimed wood, previously seen as just a stylistic choice, is now being embraced for its sustainable appeal. With hardwood flooring costs ranging from $5 to $10 per square foot and up, reclaimed wood provides an alternative that combines aesthetic, history, and sustainability, often at a fraction of the price of new hardwood. Manufacturers and retailers in the USA flooring market are capitalizing on this trend, offering a plethora of green flooring solutions catering to the ever-growing eco-conscious consumer base.

Restraint: Fluctuating Raw Material Prices

A significant challenge that the USA flooring market grapples with is the fluctuation in raw material prices. Flooring materials, whether it's hardwood, carpet, or even certain eco-friendly alternatives, are subject to global commodity price dynamics. Over the past few years, the price volatility of essential raw materials has impacted the production costs of flooring solutions. Taking hardwood as an example: The U.S. heavily depends on imports for specific exotic wood types. A study showed that in a span of five years leading to 2022, lumber prices fluctuated between $250 per thousand board feet to highs of over $1,500 in 2022. Such unpredictability directly impacts the cost structure of hardwood flooring manufacturers, occasionally resulting in price hikes passed on to consumers.

Similarly, for carpet flooring, which occupies a substantial market share in the U.S., the prices of key raw materials such as nylon and polyester have been inconsistent. Since these polymers are derivatives of crude oil, any disturbance in oil prices reverberates through the carpet manufacturing cost structure. Such volatility often acts as a deterrent for consumers and investors alike, causing hesitancy in adopting specific flooring types and making long-term market predictions challenging for industry stakeholders.

Trend: Rise of Luxury Vinyl Tile (LVT) and Waterproof Core Flooring

The U.S. flooring market has seen a distinct shift towards Luxury Vinyl Tile (LVT) and its innovative sibling, waterproof core flooring. LVT, a luxury variant of vinyl tile, replicates the appearance of natural materials like wood or stone while offering the durability of vinyl. Its market share has been on a steady incline, registering a compound annual growth rate (CAGR) of approximately 12.9% in the years to come. This explosive growth can be attributed to LVT's price point, which generally ranges from $3 to $7 per square foot, making it an affordable alternative to pricier hardwood or stone options.

Waterproof core flooring, often referred to as WPC or SPC (Stone Plastic Composite), has also been turning heads. This category, essentially an advanced version of LVT, is not only 100% waterproof but also offers enhanced durability. Sales of WPC flooring in the U.S. exceeded 500 million square feet in 2019, a number that reflects its increasing acceptance among homeowners and commercial entities alike. A significant factor in this trend's momentum is the consumer's desire for aesthetically pleasing floors that are also functional and long-lasting. With LVT and waterproof core flooring fitting this bill perfectly and at a competitive price point, their dominance in the U.S. flooring market trend is evident and expected to sustain for the foreseeable future.

Segmental Analysis

By Material:

By material, the carpet segment accounted for over 34.1% of the USA flooring market. This dominant position can be attributed to the comfort, warmth, and stylistic flexibility carpets offer. The wide range of textures, colors, and patterns available caters to diverse consumer preferences, making it a preferred choice for many households and commercial spaces. It is estimated that the annual carpet sales hover around the multi-billion-dollar mark, highlighting its significant hold on the market.

On the other hand, the vinyl segment, while not occupying the lion's share like its carpet counterpart, has exhibited impressive dynamism. With the highest compound annual growth rate (CAGR) of 5.24%, the vinyl flooring segment is on a trajectory that's hard to overlook. Its rising popularity can be traced back to its durability, water resistance, and cost-effectiveness. By 2025, if this growth persists, vinyl's market share could witness a substantial leap, significantly bridging the gap with leading segments.

By Application

Based on application, the living room segment emerges as the undisputed leader in the USA flooring market. This segment's dominance is rooted in the living room's pivotal role in homes – it's often the centerpiece, the area where families converge, guests are entertained, and most indoor activities take place. The numbers speak volumes of its prominence: the living room flooring segment is not only leading the current market scenario but is also projected to maintain its stronghold, growing at a staggering CAGR of 25.3%. To translate this growth rate into monetary terms, considering the average spending on flooring ranges between $6 and $10 per square foot, a 25.3% annual growth in the living room segment can translate to billions of dollars in sales over the next few years. This growth is fueled by the constant desire of homeowners to refresh and reinvent their living spaces, making it an attractive, modern, and comfortable environment. Trends such as open-floor plans and integrated living spaces further amplify the focus on living room flooring, reinforcing its dominant position in the application-based segmental analysis of the USA flooring market.

By End User

In the US flooring market, the commercial segment, comprising offices, retail spaces, hospitality industry, and other business establishments, holds the majority stake with a commanding 52.3%. This dominance suggests an enormous expenditure, considering the vast expanse of commercial spaces across the U.S. For instance, with commercial real estate in the U.S. encompassing over 50 billion square feet and the average expenditure on flooring lying between $6 to $10 per square foot, the implied commercial segment spending runs into several billions of dollars annually. As per our study, the commercial real estate contributed over 2.3 trillion to the US GDP in 2022.

However, trends in market dynamics suggest that this dominance might witness some competition. The domestic segment of the USA flooring market, encompassing residential properties, has been showing signs of rapid growth. With a projected compound annual growth rate (CAGR) of 4.54% during the forecast period, the domestic sector might soon inch closer to the commercial segment in terms of market share.

To Understand More About this Research: Request A Free Sample

By Sales Channel

By sales channel, the US flooring market, offline sales segment – encompassing brick-and-mortar retail stores, direct sales, and distributors – firmly grasps the lead with an 82.7% market share. This means, of the total flooring market's estimated value of hundreds of billions, a whopping 82.7% is funneled through physical outlets. The reasons can range from the tactile nature of flooring products, where consumers prefer a touch-and-feel experience, to the expert in-store guidance that often aids decision-making.

Yet, in this digital age, the online sales segment is making its presence felt. Though currently trailing its offline counterpart, online sales are projected to grow at a CAGR of 6.4%. This surge can be attributed to the convenience of digital platforms, the plethora of choices available, and often competitive pricing. This growth rate implies a potential shift of several billions of dollars in sales value towards online channels in the upcoming years. This reflects the broader trend of e-commerce proliferation and suggests that flooring market stakeholders must increasingly focus on enhancing their digital footprint to tap into this growing segment.

Top Players in U.S. Flooring Market

- Armstrong Flooring, Inc.

- BASF SE

- Carpet One Floor & Home

- Congoleum Corporation

- Dixie Group, Inc.

- Forbo Holding AG

- Interface, Inc.

- Mannington Mills Inc.

- Mohawk Industries, Inc.

- Shaw Industries Group, Inc.

- Tarkett Group

- Other prominent players

Market Segmentation Overview:

By Material

- Wood

- Hardwood

- Softwood

- Engineered Wood

- Vinyl

- Vinyl Tiles

- Vinyl Sheets

- Luxury Vinyl Flooring

- Carpet

- Laminate

- Ceramic

- Others

By Application

- Kitchen

- Living Room

- Bathroom/Washroom

- Auditoriums

- Warehouses

- Workshops

- Sport Complex

- Institutes

- Other Applications

By End User

- Domestic Flooring

- Commercial Flooring

- Corporate Buildings

- Healthcare

- Education

- Retail & E-Commerce

- Government

- Food & Beverage

- Oil & Gas

- Others

By Sales Channel

- Online

- Offline

- Hardware Stores

- Flagship Stores

- Specialty Stores

- Others

By Northeast

- New Jersey

- New York

- Pennsylvania

- Massachusetts

- Rest of Northeast

By Midwest

- Illinois

- Michigan

- Indiana

- Ohio

- Rest of Midwest

By South

- Texas

- North Carolina

- Georgia

- Florida

- Rest of South

By West

- California

- Arizona

- Colorado

- Washington

- Rest West

View Full Infographic

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

| Report ID: AA0923614 | Delivery: 2 to 4 Hours

| Report ID: AA0923614 | Delivery: 2 to 4 Hours

.svg)