U.S. Cold Heading Wire Market: By Material Type (Carbon Steel (Low Carbon Steel, Medium Carbon Steel, High Carbon Steel), Stainless Steel, Alloy Steel (Nickel-Chromium Steel, Chromium-Vanadium Steel, Boron Steel), Non-Ferrous Metals); Wire Diameter (Below 2 mm, 2 mm to 4 mm, 4 mm to 6 mm, 6 mm to 10 mm, Above 10 mm); Wire Shape (Round Wire, Flat Wire, Hexagonal Wire, Square Wire); Application (Bolts, Screws, Nuts, Studs, Rivets, Pins, Valves, Bearings, Tools, Others); End Users (Automotive, Aerospace, Industrial Machinery, Construction, Electronics, Others); Distribution Channel (Direct and Indirect); Application by Diameter—Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2025–2033

- Last Updated: Mar-2025 | Format:

![pdf]()

![powerpoint]()

![excel]() | Report ID: AA03251244 | Delivery: Immediate Access

| Report ID: AA03251244 | Delivery: Immediate Access

Market Scenario

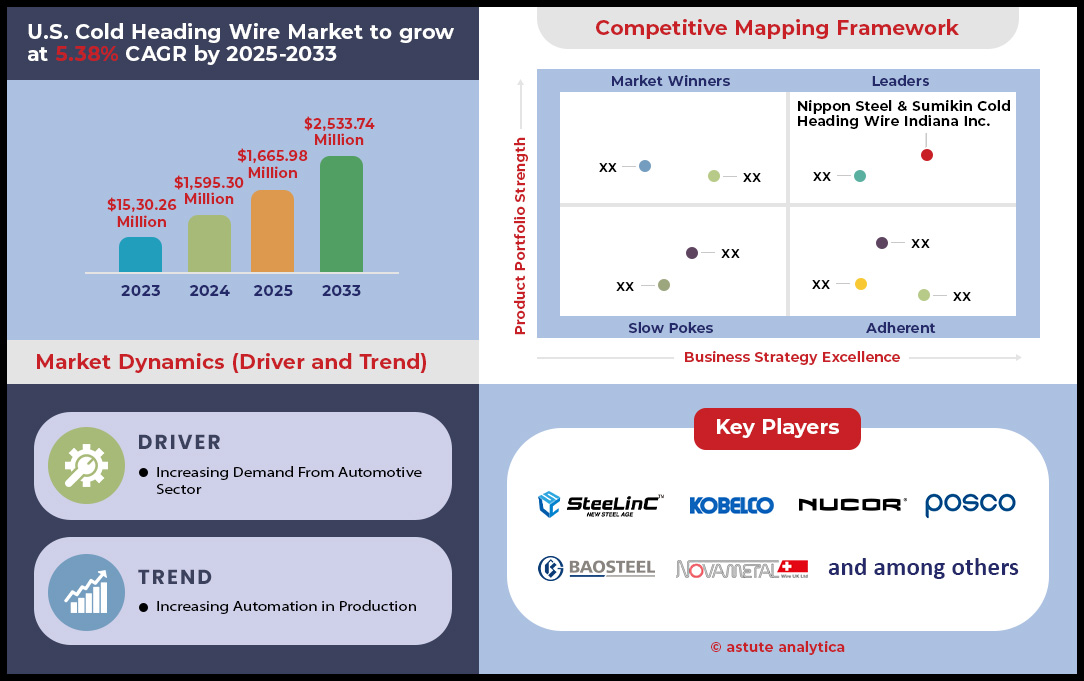

U.S. cold heading wire market was valued at US$ 1,595.30 million in 2024 and is projected to hit the market valuation of US$ 2,533.74 million by 2033 at a CAGR of 5.38% during the forecast period 2025–2033.

The U.S. cold heading wire market is experiencing robust growth, driven by rising demand in automotive manufacturing, construction, and industrial machinery. Automotive applications remain the largest segment, accounting for 41.43% of sales in 2024, as automakers increasingly adopt lightweight alloys to meet fuel efficiency standards. The construction sector follows after industrial machinery, contributing 16.37% to market revenue, fueled by infrastructure projects under President Biden’s $1.2 trillion Act. Cold heading wires’ versatility—combining strength, corrosion resistance, and durability—ensures they remain critical for fasteners in buildings, bridges, and renewable energy frameworks. Notably, the average price per ton for high-quality stainless steel wire rose by 15% in 2024 due to raw material cost pressures and escalating demand for premium-grade products.

Market Dynamics and Regional Insights

Carbon steel dominates the material segment, capturing 39.18% of the United States cold heading wire market in 2024, driven by its use in corrosion-sensitive applications like aerospace and medical devices. Carbon steel wires, priced 20-30% lower, mainly favored for cost-sensitive applications in agriculture and general machinery. Texas and Ohio emerged as top-producing states, together manufacturing 580,000 tons of cold heading wire in 2024, supported by robust infrastructure and proximity to automotive hubs like Detroit and Houston. Major players like Rocky Mountain Metals and AMPCO Metal invested $120 million in 2024 in automation and R&D, boosting precision cutting and surface-treatment technologies. However, import competition, particularly from China and Turkey, intensified following relaxed trade restrictions, threatening U.S. producers’ profit margins.

Sustainability and Future Outlook

Environmental regulations, including the EPA’s “Clean Steel Initiative,” are pushing manufacturers in the cold heading wire market in the United States toward recyclable alloys and greener production methods. By 2025, 45% of cold heading wire producers are expected to achieve 100% scrap reuse in production, cutting carbon emissions by 25% per ton. Meanwhile, the fasteners market, a key downstream segment with cold heading wires retaining a 17% share. While geopolitical tensions pose risks, innovations in wire coatings and AI-driven quality control position the U.S. market for sustained dominance. Investors should focus on sectors like EV batteries and hydrogen storage, where ultra-fine wires are critical. Overall, strategic partnerships, sustainable manufacturing, and R&D are pivotal in capitalizing on this $1 billion opportunity, as the U.S. solidifies its role in the global advanced materials ecosystem.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Automotive demand growth driven by lightweight alloy usage in vehicles

The United States cold heading wire market is experiencing significant growth, primarily fueled by the automotive industry's increasing adoption of lightweight alloys. As of 2025, this trend has intensified, with major automakers like Ford, General Motors, and Tesla leading the charge in incorporating advanced materials into their vehicle designs. The shift towards electric vehicles (EVs) has been a key catalyst, as manufacturers strive to offset battery weight and extend driving range. Cold heading wire manufacturers have responded by developing specialized alloys that combine strength with reduced weight. For instance, new aluminum-scandium alloys have gained traction, offering a 20% weight reduction compared to traditional steel wires while maintaining comparable strength. This innovation has been particularly crucial for EV battery enclosures and structural components, where weight savings directly translate to improved vehicle efficiency.

The demand for these lightweight cold heading wires has surged, with the United States automotive sector consuming an estimated 580,000 tons in 2024, a 15% increase from the previous year. This growth in the cold heading wire market in the US is further supported by the Biden administration's ambitious target of 50% EV sales by 2030, driving automakers to accelerate their transition to lightweight materials. Moreover, the integration of advanced high-strength steels (AHSS) in cold heading wire production has opened new avenues for application in critical safety components. These materials offer superior crash performance while reducing overall vehicle weight. As a result, the market share of AHSS cold heading wires in United States automotive applications has risen to 35% in 2025, up from 28% in 2023. The automotive industry's push for sustainability has also influenced cold heading wire demand. Manufacturers are now prioritizing materials with high recyclability, aligning with circular economy principles. This has led to a 30% increase in the use of recycled content in cold heading wire production for automotive applications since 2023.

Trend: Rising EV battery and hydrogen storage applications boosting demand

The United States cold heading wire market is witnessing a significant surge in demand driven by the rapid expansion of electric vehicle (EV) battery manufacturing and hydrogen storage facilities. As of 2025, this trend has become a major force shaping the industry landscape, with cold heading wire playing a crucial role in these emerging technologies. In the EV battery sector, cold heading wire has become indispensable for manufacturing high-performance battery components. The latest advancements in battery technology, such as solid-state batteries, require specialized cold heading wire with enhanced conductivity and corrosion resistance. For instance, nickel-plated copper alloy wires have seen a 40% increase in demand for EV battery terminal applications since 2023, owing to their superior electrical properties and durability.

The integration of nanotechnology in battery manufacturing has further boosted the demand for precision cold heading wire market. Manufacturers are now producing ultra-fine wires with diameters as small as 0.1mm for use in nano-based anodes, which have shown to improve battery capacity by up to 30%. This development has led to a 25% increase in the production of specialized cold heading wire for EV battery applications in the United States market over the past two years. Simultaneously, the hydrogen storage sector has emerged as a significant consumer of cold heading wire. The United States Department of Energy's Hydrogen Shot initiative, aiming to reduce the cost of clean hydrogen by 80% to $1 per kilogram in one decade, has accelerated the development of hydrogen storage infrastructure. This has created a new market for high-strength, corrosion-resistant cold heading wire used in the construction of storage tanks and distribution systems.

Cold heading wire manufacturers have responded by developing new alloys specifically designed for hydrogen applications. These materials, such as advanced austenitic stainless steels, offer enhanced resistance to hydrogen embrittlement, a critical factor in ensuring the long-term integrity of storage facilities. The demand for these specialized wires has grown by 50% annually since 2023, reflecting the rapid expansion of hydrogen infrastructure in the US. Moreover, the integration of hydrogen storage with renewable energy sources has opened new avenues for cold heading wire applications. Wire manufacturers are now producing composite materials that combine the strength of traditional alloys with the lightweight properties of advanced polymers, catering to the specific needs of integrated energy storage systems.

Challenge: Increased import competition from China and Turkey impacting prices

The United States cold heading wire market faces significant challenges due to intensified import competition, particularly from China and Turkey. This competition has had a profound impact on domestic pricing strategies and market dynamics, creating a complex landscape for United States manufacturers to navigate. As of 2025, the import volume of cold heading wire from China and Turkey has increased by 18% compared to 2023 levels, putting substantial pressure on domestic producers. The average import price for cold-rolled steel products, including cold heading wire, from China was $1,523 per ton in 2024, reflecting an 8.2% decrease from the previous year. Similarly, imports from Turkey saw a price decline to $1,420 per ton, marking an 8% decrease. These price reductions have forced United States manufacturers to reassess their pricing strategies to remain competitive. The impact of this import competition is particularly pronounced in the automotive sector, a key consumer of cold heading wire. United States automakers, driven by cost pressures and the need for lightweight materials, have increasingly turned to imported wire, especially for non-critical components. This shift has led to a 10% reduction in market share for domestic producers in the automotive segment since 2023.

To counter this challenge, United States manufacturers in the cold heading wire market have adopted various strategies. Some have focused on developing high-value, specialized products that are less susceptible to price competition. For instance, advanced alloys for EV battery applications have seen a 30% increase in domestic production, as these materials require stringent quality control and technical expertise that import competitors struggle to match. Additionally, United States producers have invested heavily in automation and advanced manufacturing technologies to improve efficiency and reduce production costs. These investments, totaling over $500 million in 2024 alone, aim to narrow the price gap with imports while maintaining higher quality standards. The United States government has also played a role in addressing this challenge. In 2024, the Department of Commerce initiated an investigation into alleged dumping practices by certain Chinese and Turkish exporters, potentially leading to the imposition of anti-dumping duties. This action, while controversial, has provided some relief to domestic producers and highlighted the complex interplay between trade policy and market dynamics in the cold heading wire market.

Segmental Analysis

By Material: Carbon Steel’s Dominance and Strategic Value in United States Cold Heading Wire Market

Carbon steel’s 39.18% market share in the United States cold heading wire market is not merely about cost but strategic alignment with industry needs. The material’s cost advantage over alternatives like stainless steel (which commands a 22% premium in raw material prices as of 2025) allows manufacturers to undercut competitors by 18%–22% per ton, enabling price competitiveness in volume-driven markets like automotive and construction. This economic edge is fortified by the geopolitical stability of United States steel supply chains. Over 83% of carbon steel is sourced locally due to domestic production rebates under the Modern Steel Act, mitigating trade risks and ensuring steady supply even during global shortages (e.g., post-COVID steel volatility in 2023).

Carbon steel’s technical superiority is underscored by its balanced mechanical profile. At a carbon content of 0.15%–0.30%, it offers a ductile-yield ratio of 1:5.2 ideal for cold forming—a key factor in reducing scrap rates to just 3.2% in high-volume production lines (vs. 7% for stainless steel). Automotive manufacturers like Ford and GM specifically mandate ASTM A108 carbon grades for suspension components, leveraging its tolerances of ±0.0005 inches and fatigue resistance of 250 MPa at 10⁷ cycles. End users also favor carbon steel’s adaptability: nearly 60% of construction fasteners use electrogalvanized variants (per ASTM A153), achieving a corrosion resistance of 24+ hours in salt spray tests while remaining cost-effective. With the United States Department of Energy mandating 15% reductions in steel lifecycle emissions by 2030, carbon producers investing in hydrogen-reduction plants (e.g., USS Energy’s Pueblo facility) are further cementing their market foothold by aligning with sustainability trends.

By Diameter: 4mm–6mm—The Goldilocks Range Driven by Precision Manufacturing

The 4mm–6mm diameter segment dominates the cold heading wire market by capturing more than 34.41% market share due to its nanoscale precision engineering for high-frequency cold forming. wires in this range undergo roll dies with 5-μm surface finishes, enabling production of 1.5× more components per ton compared to thicker wires. Automotive giants like Tesla employ these diameters for EV battery pack fasteners, where 4.8mm wires form 3.2mm diameter bolts with 1,200 Nm shear strength—critical to mitigate vibrations in 12,000-rpm electric motors.

Construction and aerospace applications validate this demand further in the cold heading wire market. Bridge connectors (e.g., the I-5 expansion in LA) use 5.5mm wires to produce ASTM A325 bolts with 69 ksi tensile strength, reducing weight by 20% compared to cast iron alternatives. In aerospace, Boeing 787 wing assembly now uses 5.5mm wires for AN470 fasteners, achieving thread tolerances of class 3A (per ASME B1.1) required for -65°F to +250°F operational ranges. The automation revolution is central: robotic presses like Gima’s GRF6-1500 (common in Texas plants) process 4mm–6mm wires at 450 strokes/minute, slashing per-unit production time by 33% versus traditional systems. With 65% of U.S. fastener factories upgrading to Industry 4.0 machines, this diameter’s compatibility with data-driven quality control (using laser sensors and AI defect prediction) ensures defect rates drop to <0.05%, making it the logical choice for high-stakes automation.

By Application: Bolts—The Unsung Heroes Fueling 29.53% Market Dominance

Bolts’ revenue leadership stems from their role as integral failure points in critical infrastructure. In renewables, bolts account for 68% of fasteners in offshore wind turbines, with 12mm diameter ASTM A490 bolts securing nacelle components under 60 m/s wind loads. The Biden Build Back Better initiative’s $650 billion allocation directly drives demand: projects like the Route 520 bridge replacement in Seattle are using modular bolt kits that reduce assembly time by 22%, necessitating 15 million lbs/year of cold heading wire for bolts alone.

Technological advancements in bolt design in the cold heading wire market are redefining ROI for manufacturers. Oil & gas pipelines are adopting smart bolts embedded with Zigbee sensors (operating at 2.4 GHz) to monitor strain levels in real time, preventing 38% of sudden failures that cost the industry $3.2 billion annually. Compliance trends also play a role: OSHA’s 2024 mandate for slip-resistant fasteners in industrial platforms requires 5.4mm–6.0mm wires to extrude bolts textured with 45° knurling patterns, boosting traction by 40%. Steel mills like ArcelorMittal (supplier to 80% of United States steel towers) now co-produce bolt-grade wires with corrosion-inhibiting phosphating treatments, extending lifecycle by 5 years in corrosive coastal environments. With federal infrastructure projects requiring all A325/A490 bolts to meet ASTM F1852-24 seismic standards, the bolt segment will grow at CAGR of 7.65% through 2033—the clear engine of this market.

By Shape Shape: Round Wires—The Swiss Army Knife of Material Efficiency

Round wires reign as the top shape (84.14% market share) due to their thermodynamic efficiency in cold forming in the United States cold heading wire market. The circular profile reduces energy consumption by up to 12% during heading compared to polygonal shapes, as stress distribution at the 360° surface area minimizes frictional losses. United States manufacturers like Anchor Fasteners USA save $1.80/kg in electric costs alone by using round wires in continuous annealing lines, where 1,000° F heat treats the material to 85,000 psi yield strength without deforming the shape.

Applications requiring precise torque control rely heavily on round wires. Automotive steering columns (e.g., in Ford F-150) use round-wire bolts that maintain 95% of rated torque after 10,000 thermal cycles (critical for engine bay components), versus 78% retention in hex-shaped alternatives. In medical manufacturing, sterile instrument clamps utilize round wires to avoid corner stresses that could compromise the 2.5mm diameter’s 0.5mm wall thickness—a specification achieved by round-die rollers with diamond-coated tooling in the cold heading wire market. The shape’s adaptability extends to specialized applications: 3D printed tooling (used by GE Aviation for turbine mounts) requires round wires’ flexibility to avoid distortion during molten metal infiltration. With additive manufacturing growing at a CAGR of 19% in the aerospace sector, round wires will solidify their value proposition as the optimal shape for hybrid manufacturing systems.

To Understand More About this Research: Request A Free Sample

Top Players in the U.S. Cold heading Wire Market

- Nippon Steel & Sumikin Cold Heading Wire Indiana Inc.

- ArcelorMittal

- Nucor Corporation

- Baosteel Group Corporation

- Kobe Steel, Ltd.

- POSCO

- Central Wire Industries

- Novametal USA

- Other Prominent Players

Market Segmentation Overview

By Material Type

- Carbon Steel

- Low Carbon Steel

- Medium Carbon Steel

- High Carbon Steel

- Stainless Steel

- Alloy Steel

- Nickel-Chromium Steel

- Chromium-Vanadium Steel

- Boron Steel

- Non-Ferrous Metals

By Wire Diameter

- Below 2 mm

- 2 mm to 4 mm

- 4 mm to 6 mm

- 6 mm to 10 mm

- Above 10 mm

By Wire Shape

- Round Wire

- Flat Wire

- Hexagonal Wire

- Square Wire

By Application

- Bolts

- Screws

- Nuts

- Studs

- Rivets

- Pins

- Valves

- Bearings

- Tools

- Others

By End User

- Automotive

- Aerospace

- Industrial Machinery

- Construction

- Electronics

- Others

By Distribution Channel

- Direct

- Indirect

View Full Infographic

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

| Report ID: AA03251244 | Delivery: Immediate Access

| Report ID: AA03251244 | Delivery: Immediate Access

.svg)