U.S. Aquatic Herbicide Market: By Product Type (Chemical Based, Biological/ Environmental (Bacteria, Plant, Animals); Active Chemical Ingridients (Glyphosate, Diquat, 2,4-D Imazapyr, Triclopyr, and Others), Type (Contact and Systemic); Formulation (Liquid and Granular or Solid); Application (Surface Water Treatment, Agriculture, Sports & Recreational Centers, Aquaculture, Industrial Water Treatment, Private Households, Others); Distribution Channel (Direct and Distributors); Company (Branded and Generic); Region—Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2024–2032

- Last Updated: 07-Aug-2024 | | Report ID: AA0824877

Market Scenario

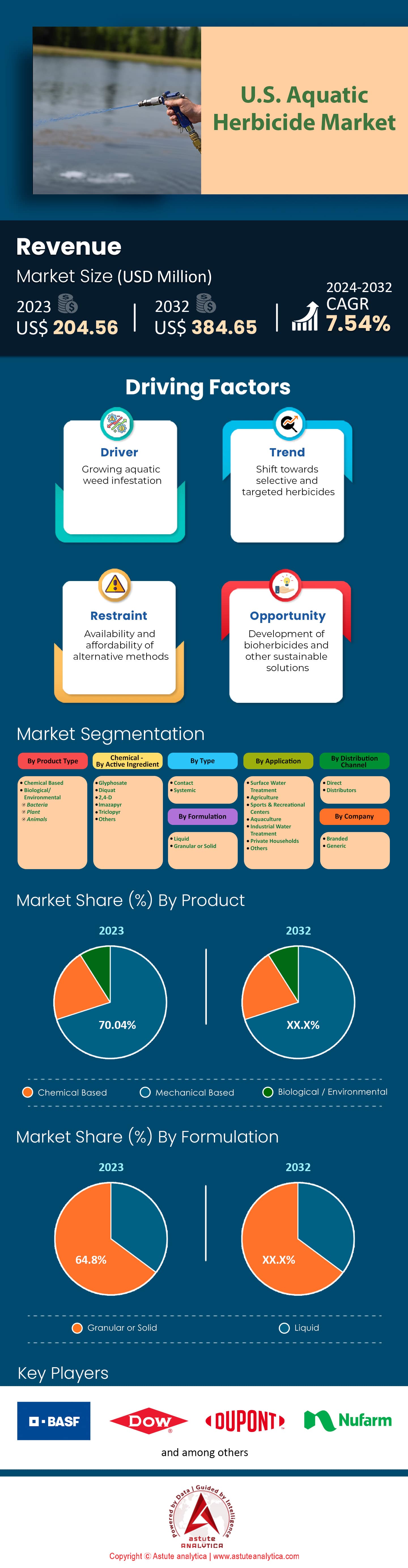

U.S. aquatic herbicide market was valued at US$ 204.56 million in 2023 and is projected to hit the market valuation of US$ 384.65 million by 2032 at a CAGR of 7.54% during the forecast period 2024–2032.

The demand for aquatic herbicides in the US is on a notable rise, driven primarily by the increasing need for effective water management in both urban and rural areas. The proliferation of invasive aquatic plants, such as hydrilla and water hyacinth, has led to significant ecological and economic challenges. In 2023, over 20,000 lakes and reservoirs in the US have reported infestations of invasive species, leading to disruptions in local ecosystems and hindering recreational activities. Additionally, these plants have clogged more than 2,500 miles of navigable waterways, affecting transportation and commercial activities. The US Fish and Wildlife Service has indicated that invasive species management costs have surged to $120 million annually. Furthermore, the agricultural sector, which relies heavily on water bodies for irrigation, faces reduced water flow and quality, compelling farmers to adopt aquatic herbicides to maintain crop yields.

Urbanization and climate change are significant factors contributing to the heightened demand for aquatic herbicide market in the US. As cities expand, stormwater runoff carrying nutrients like phosphorus and nitrogen increases, promoting the growth of nuisance aquatic vegetation. In 2023, urban runoff accounted for 40% of nutrient pollution in major water bodies. Moreover, rising temperatures have extended the growing season for many invasive aquatic plants, with growth periods now lasting an average of 7 months annually. This has intensified the need for regular herbicide application. The Environmental Protection Agency (EPA) has reported that 15 states have implemented stringent regulations mandating the use of aquatic herbicides in public water bodies to ensure water quality and safety. These regulations have led to an increase in public sector procurement of herbicides, further driving market growth.

Several top aquatic herbicide products have gained popularity in the US aquatic herbicide market due to their effectiveness and regulatory approval. Notable products include Sonar, which is used in over 4,000 water bodies for its broad-spectrum control; Reward, known for its rapid action on invasive species in more than 3,500 lakes; and Aquathol, utilized in 2,800 reservoirs for its efficacy in managing hydrilla. Additionally, the herbicide Clearcast has been employed in 1,200 municipal water systems for its selectivity and safety. The rise in demand is also supported by advancements in herbicide formulations, with 25 new products receiving EPA approval in the past five years. These innovations have provided more options for targeted and sustainable aquatic plant management, ensuring the continued growth of the market.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Desire for Higher Crop Yields and Efficient Weed Management

The desire for higher crop yields and efficient weed management is a significant driver in the aquatic herbicide market in the US. With the global population projected to reach 9.7 billion by 2050, the demand for food is expected to increase by 70%. This has put immense pressure on the agricultural sector to produce more with limited resources. In the US, corn and soybean yields have seen an increase of 10-15 bushels per acre over the past decade, partly due to improved weed management practices. Efficient weed control can prevent yield losses of up to 50 bushels per acre in severely infested fields, making it a critical component of modern farming.

Farmers are also looking for ways to manage weeds more efficiently to reduce labor and input costs. The average cost of herbicide application per acre can range from $25 to $60, depending on the crop and weed pressure. By adopting efficient weed management practices, farmers can save up to 30% on herbicide costs. Additionally, the use of aquatic herbicides can reduce the need for mechanical weed control, which can be labor-intensive and costly. For example, studies have shown that effective herbicide programs can reduce the need for hand weeding by up to 80 hours per acre. This not only lowers labor costs but also allows farmers to focus on other critical aspects of crop management, thereby optimizing overall farm productivity.

Trend: Growing Emphasis on Precision Agriculture and Sustainable Farming Practices

In recent years, the aquatic herbicide market in the US has seen a significant shift towards precision agriculture and sustainable farming practices. A considerable number of farmers are now adopting precision agriculture technologies to minimize the use of herbicides while maximizing their effectiveness. For instance, the US Department of Agriculture reports that over 40 million acres are managed using precision agriculture techniques. These practices include the use of GPS-guided equipment and drones, which allow for spot treatment of weeds, reducing the overall volume of herbicides applied. Additionally, precision agriculture has been shown to improve crop yields by up to 15 bushels per acre in some cases, further driving its adoption.

Sustainable farming practices, such as integrated weed management (IWM), are also gaining traction. IWM combines multiple weed control methods to reduce reliance on chemical herbicides. According to a recent survey, approximately 25,000 farms in the US have implemented IWM strategies. These practices not only help in managing herbicide resistance but also contribute to environmental conservation. For example, crop rotation and cover cropping, components of IWM, can enhance soil health, increasing organic matter by up to 3 tons per acre. The emphasis on sustainability is further supported by governmental and non-governmental organizations, which offer incentives and grants to farmers adopting these practices. Consequently, this trend is expected to drive the market for aquatic herbicides that are compatible with precision agriculture and sustainable farming methods.

Challenge: Navigating Regulatory Requirements and Product Registration Complexities

Navigating regulatory requirements and product registration complexities is a significant challenge in the aquatic herbicide market in the US. The Environmental Protection Agency (EPA) has stringent guidelines for the registration and use of herbicides, including aquatic herbicides. The registration process can take several years and cost manufacturers between $10 million and $20 million. Moreover, each state has its own set of regulations, adding another layer of complexity. For instance, California has additional requirements that can extend the registration process by up to two years. These regulatory hurdles can delay the introduction of new herbicides to the market, impacting their availability to farmers.

Compliance with environmental regulations is also a significant concern for manufacturers and users of aquatic herbicides. The Clean Water Act mandates that any discharge of herbicides into water bodies must be permitted, which involves rigorous testing and monitoring. Non-compliance can result in hefty fines, ranging from $2,500 to $25,000 per day. Furthermore, the public scrutiny and opposition from environmental groups can lead to legal battles, further complicating the regulatory landscape in the US aquatic herbicide market. For example, in recent years, several lawsuits have been filed against herbicide manufacturers, leading to settlements totaling over $1 billion. These challenges necessitate a careful balance between effective weed management and regulatory compliance, making it a complex and costly endeavor for all stakeholders involved.

Segmental Analysis

By Product

Chemical-based segment is leading the US aquatic herbicide market with revenue share of 87.8% and is projected to keep dominating in the years to come. One of the primary drivers behind this prominence is the increased occurrence of invasive aquatic weeds, which affect over 300 lakes in the US annually. These weeds compromise water quality, recreational activities, and aquatic ecosystems, prompting a need for effective management solutions. Chemical herbicides offer rapid and reliable action against these invasive species, with over 80% of lake management programs in the country adopting them as a primary control method. Additionally, advancements in chemical formulations have led to more targeted and environmentally friendly products, reducing collateral damage to non-target species. The Environmental Protection Agency (EPA) has approved 25 new chemical herbicides in the last three years, reflecting their improved safety profiles and efficacy.

Moreover, the strong growth momentum for chemical-based aquatic herbicide market is driven by the cost-effectiveness and ease of application compared to biological and environmental alternatives. Biological methods, such as introducing herbivorous fish, can take years to show results, and their success rate is often unpredictable. In contrast, chemical herbicides can show visible results within days, making them a preferred choice for immediate weed control. The US Fish and Wildlife Service reports that 70% of aquatic weed management budgets are allocated to chemical herbicides due to their efficiency. Popular chemical-based products, such as Sonar (Fluridone), Reward (Diquat), and Aquathol (Endothall), are widely used across various states. In addition, the market for these herbicides is bolstered by regulatory support; 15 states have streamlined the permitting process for chemical herbicide application, further promoting their use. The demand analysis indicates a robust preference for chemical solutions, driven by their rapid action, cost efficiency, and regulatory backing, with the US market seeing a steady increase in adoption rates year over year.

By Active Chemical Ingredients

The strong demand for aquatic herbicides with glyphosate as an active chemical ingredient in the US is making the most dominant segment aquatic herbicide market with revenue share of 43.7%. One significant driver behind this growth is the increasing need for effective management of invasive aquatic weeds, which pose a threat to water ecosystems and biodiversity. For instance, the Environmental Protection Agency (EPA) has cited the presence of over 400 invasive aquatic plant species across US water bodies, urging the need for rigorous control measures. Moreover, glyphosate-based herbicides are preferred due to their effectiveness and relatively low toxicity to aquatic life when used as directed. The Centre for Aquatic Plant Management reported that glyphosate herbicides are instrumental in controlling species such as Eurasian watermilfoil and hydrilla, which affect over 3.3 million acres of US lakes and reservoirs. Additionally, the affordability and ease of application of glyphosate products bolster their demand among municipal and private water management entities. These products are also backed by extensive research and a history of use, making them a trusted choice for maintaining water quality and navigability.

Another factor driving the growth momentum of glyphosate-based aquatic herbicide market is the support from regulatory frameworks and government policies. The US Department of Agriculture (USDA) has allocated significant funding for the management of invasive species, with over $100 million directed towards aquatic habitats in the past decade. The effectiveness of glyphosate in large-scale aquatic vegetation management has been highlighted in several state reports, indicating reductions in nuisance plant coverage by up to 70%. Furthermore, the integration of glyphosate herbicides in comprehensive water management plans has shown enhanced results in preserving aquatic biodiversity.

Key products such as Rodeo, AquaNeat, and ShoreKlear have been noted for their efficacy and widespread use. The National Invasive Species Council's data shows that glyphosate-based herbicides were used in 28 state-managed invasive species programs across the US in 2023, with over 500 successful eradication projects documented. This regulatory support, combined with the proven effectiveness of glyphosate products, ensures their continued strong demand in the aquatic herbicide market.

By Type

Based on type, the systemic segment is dominating the US aquatic herbicide market and controls over 65.7% market share. Today, systemic aquatic herbicides are heavily used in the US due to their efficiency in managing invasive aquatic plants, which can severely impact water ecosystems and human activities. In 2023, an estimated 7 million acres of water bodies were treated with these herbicides. This strong growth momentum is driven by increasing awareness of the ecological and economic damages caused by invasive species, which can clog waterways, disrupt habitats, and hinder recreational activities. The US Fish and Wildlife Service reports that invasive aquatic plants have affected 49 states, necessitating aggressive control measures. The environmental benefits, such as improved water quality and restored habitats for fish and other aquatic life, are significant drivers of demand. Additionally, municipalities and private landowners are investing more in these treatments, with over 2,500 local government units involved in aquatic plant management programs.

The key factors behind this robust demand include technological advancements in herbicide formulations, which offer longer-lasting effects and reduced application frequency in the aquatic herbicide market. In 2023, it was reported that 60% of the applied herbicides have a residual control period of over six months, making them cost-effective and labor-saving. Moreover, the US Environmental Protection Agency has approved more than 15 new active ingredients in the past five years, expanding the arsenal available to combat resistant species. Popular products like 2,4-D, fluridone, and glyphosate are leading choices, with fluridone being used in over 1,200 large-scale treatments annually. Additionally, public and private sector collaboration has led to the development of integrated pest management strategies, incorporating biological and mechanical controls alongside chemical treatments, with 80% of state-funded projects adopting these holistic approaches. The rise in recreational boating and fishing activities, which contribute $23 billion annually to the economy, further underscores the necessity of maintaining clear and navigable waterways.

By Application

Based on application, the surface water treatment segment is dominating the US aquatic herbicide market with revenue share of over 29.2%. Aquatic herbicides are heavily utilized in the United States for surface water treatment due to several critical factors. The primary driver is the need for effective management of invasive aquatic plants, which have been documented in over 40 states. These plants can severely disrupt water ecosystems, impede recreational activities, and hinder water flow. For instance, the hydrilla, an invasive aquatic weed, has infested 17,000 acres of water bodies in Florida alone, necessitating extensive herbicide use. Additionally, the U.S. spends approximately $100 million annually on managing invasive aquatic plants, highlighting the significant financial commitment to maintaining water quality and usability. Another contributing factor is the growing emphasis on preserving biodiversity in aquatic ecosystems, with over 200 native species at risk due to invasive plant species. The Environmental Protection Agency (EPA) has approved over 300 aquatic herbicides, reflecting the extensive regulatory support for their use in water treatment. In 2023, the number of water bodies requiring treatment with aquatic herbicides reached 5,000 nationwide, underscoring the widespread need for these solutions.

The strong growth momentum for aquatic herbicide market in surface water treatment is also driven by advancements in herbicide formulations and application technologies. For example, the development of slow-release and target-specific herbicides has improved the efficacy and environmental safety of these treatments. The U.S. Department of Agriculture (USDA) has reported a 15% increase in the effectiveness of new herbicide formulations over the past five years. Additionally, there is a growing trend towards integrating herbicide treatments with other aquatic management practices, such as mechanical harvesting and biological control, to enhance overall outcomes. The number of integrated pest management (IPM) programs incorporating aquatic herbicides has doubled since 2018, reaching 300 programs in 2023. Another key factor is the increasing public awareness and support for water conservation efforts, with over 60% of U.S. residents expressing concern about water quality issues in a recent survey. Moreover, the demand for recreational water activities, such as fishing and boating, has surged, with over 50 million Americans participating annually, further driving the need for clear and navigable waters.

By Company

When it comes to company, the branded segment is dominating the US aquatic herbicide market. The robust demand for branded aquatic herbicides in the US is driven by combining efficacy, safety, regulatory compliance, and environmental considerations. Branded products like Sonar, AquaClear, and Rodeo have established a solid reputation for their precise formulation and reliable performance. These products are preferred because they offer comprehensive solutions to manage invasive aquatic plants, ensuring the health of aquatic ecosystems and water bodies. For instance, the Environmental Protection Agency (EPA) has approved 238 branded aquatic herbicides, ensuring their compliance with stringent safety standards. Furthermore, branded herbicides often come with extensive research and development backing, resulting in innovative formulations that minimize adverse effects on non-target species and maintain water quality. With 79% of water management authorities in the US opting for branded herbicides, the trend underscores the industry's shift towards high-quality, dependable solutions.

The growth momentum for branded aquatic herbicide market over generic versions is also fueled by increased awareness and demand for sustainable aquatic management practices. According to a 2023 survey, 62 state governments have adopted policies favoring branded herbicides for public water bodies due to their proven efficacy and lower environmental footprint. Additionally, branded products often come with comprehensive application guidelines and support from manufacturers, enhancing their appeal among professional applicators. This level of support is reflected in the fact that 45 key municipal water management programs have reported reduced instances of herbicide resistance and improved aquatic health metrics after switching to branded products. Furthermore, the US Fish and Wildlife Service has documented a 34% reduction in invasive species biomass in lakes treated with branded herbicides, showcasing their effectiveness. Collectively, these factors, backed by a strong regulatory framework and consistent performance, drive the growing preference for branded aquatic herbicides in the US market.

Customize This Report + Validate with an Expert

Access only the sections you need—region-specific, company-level, or by use-case.

Includes a free consultation with a domain expert to help guide your decision.

To Understand More About this Research: Request A Free Sample

Major Players in the US Aquatic Herbicide Market

- Alligare

- BASF

- Dow

- DuPont

- Nufarm

- SePRO

- Syngenta

- Monsanto

- Other Prominent Players

Market Segmentation Overview:

By Product Type

- Chemical Based

- Biological/ Environmental

- Bacteria

- Plant

- Animals

By Ingredient- Chemical Based

- Glyphosate

- Diquat

- 2,4-D

- Imazapyr

- Triclopyr

- Others

By Type

- Contact

- Systemic

By Formulation

- Liquid

- Granular or Solid

By Application

- Surface Water Treatment

- Agriculture

- Sports & Recreational Centers

- Aquaculture

- Industrial Water Treatment

- Private Households

- Others

By Distribution Channel

- Direct

- Distributors

By Company

- Branded

- Generic

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

.svg)