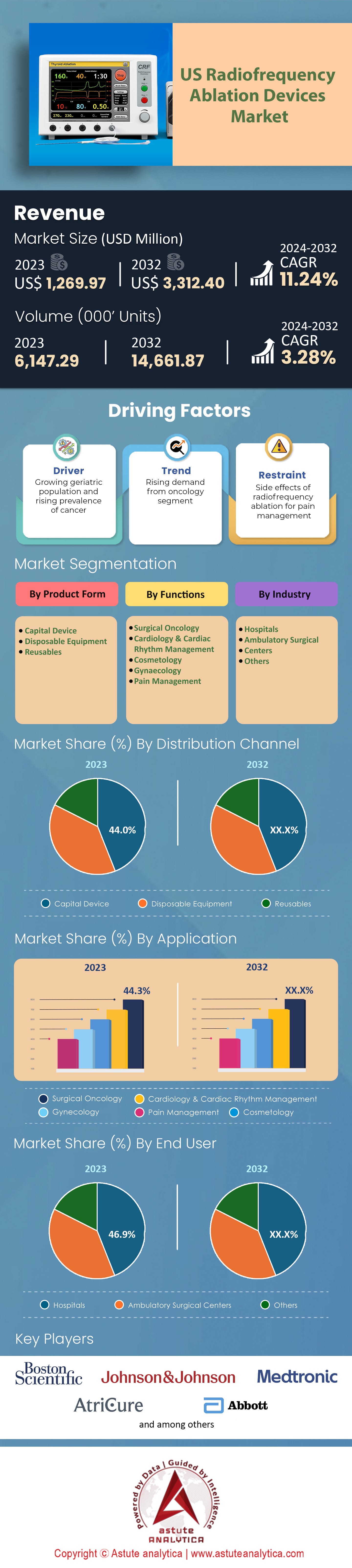

United States Radiofrequency Ablation Devices Market: By Device Type (Capital Device, Disposable Equipment, Reusables); Application (Surgical Oncology, Cardiology & Cardiac Rhythm Management, Cosmetology, Gynecology, Pain Management); End Users (Hospitals, Ambulatory Surgical Centers, and Others); Region—Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2024–2032

- Last Updated: 13-Mar-2024 | | Report ID: AA1023659

Market Scenario

United States Radiofrequency Ablation Devices Market was valued at US$ 1,296.97 million in 2023 and is projected to attain a market size of US$ 3,312.40 million by 2032 at a CAGR of 11.24% during the forecast period 2024–2032.

The U.S. radiofrequency ablation devices market is a burgeoning segment in the medical devices sector, with significant potential for growth and innovation. This growth is primarily propelled by the increasing incidence of chronic conditions, chronic pain, and the advantages RFA offers over alternative treatments. Wherein, the cardiology emerges as a second dominant segment within this market after surgical oncology. The prevalence of atrial fibrillation and other arrhythmias has steered the demand for RFA devices, given their role in treatments. Notably, the RFA adoption rate for cardiac applications is robust, with over 38% of the market share attributable to this segment alone. Cancer treatment, especially for inoperable tumors like those in the liver, represents significant application of RFA. By 2022 an estimated 35% of RFA procedures were employed for oncological purposes, offering a minimally invasive solution where surgical interventions might not be feasible.

The application of RFA devices for chronic pain management is steadily gaining traction in the US radiofrequency ablation devices market. Wherein, conditions such as osteoarthritis and chronic back pain have seen increased RFA usage. Given that nearly 20% of U.S. adults suffer from chronic pain, the potential for RFA devices in this sector is substantial. Additionally, cosmetic applications, including procedures like skin tightening, are emerging as potential growth areas, accounting for about 9% of the market share. The appeal here lies in RFA's non-invasive nature, with patients often preferring it over surgical options. Apart from growth and demand, the U.S. radiofrequency ablation devices market's is shaped by various players, with Medtronic, Boston Scientific, and Johnson & Johnson being the primary competitors. Their investment in R&D has fostered technological advancements such as 3D mapping systems and innovative catheter designs, enhancing the precision and safety of RFA procedures.

However, the US radiofrequency ablation devices market is facing one prominent challenge is the high recurrence rate of some ailments post-RFA treatment, especially in cardiac conditions. For instance, atrial fibrillation has a recurrence rate of about 20% within a year of the RFA procedure. Despite this, the safety profile remains commendable, often surpassing surgical alternatives. The market also benefits from favorable reimbursement scenarios. A majority of insurance providers, recognizing the long-term benefits of RFA treatments, have incorporated them into their coverage plans. This integration facilitates the procedure's accessibility to a broader patient base.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Increasing Prevalence of Chronic Diseases

A principal driver of the radiofrequency ablation devices market in the U.S. is the escalating prevalence of chronic diseases, especially those necessitating non-invasive or minimally invasive treatments. As the nation's population ages, the incidence of such conditions increases. According to the Centers for Disease Control and Prevention (CDC), by 2022, about 60% of American adults had a chronic disease, and 40% had two or more. This is significant, as chronic conditions often demand prolonged, repetitive treatments, where RFA devices play a crucial role due to their minimally invasive nature.

Atrial fibrillation (AFib) exemplifies this trend in the US radiofrequency ablation devices market. AFib, a common type of cardiac arrhythmia, affected approximately 6.1 million people in the U.S. as of 2022 and the number is projected to surpass 12.1 million by 2030. Traditional treatments, often characterized by extended hospital stays and recovery periods, are gradually being overshadowed by RFA procedures. With a shorter recovery span and reduced hospitalization costs, RFA procedures for AFib patients lead to an estimated annual savings of $2,500 per patient for the healthcare system. Furthermore, the American Cancer Society projects that nearly 1.9 million new cancer cases would be diagnosed in 2022. Among these, liver cancer stands out, with the U.S. seeing an average annual percent change of 2.3% in liver cancer cases from 2017-2022. For many of these patients, RFA emerges as a preferred choice, especially when tumors are deemed inoperable.

Trend: Technological Advancements and Personalization

Technological innovation remains at the forefront of the radiofrequency ablation devices market trend. The rapid pace of R&D investments has led to a surge in sophisticated devices that ensure precision, safety, and better patient outcomes. The U.S. radiofrequency ablatio devices market, in particular, witnesses substantial investments in medical device technologies, with a growth rate of 6% annually, resulting in an estimated $34 billion spent on med-tech R&D in 2021. A notable development is the integration of 3D mapping systems with RFA devices. This technology permits a three-dimensional visualization of the area under treatment, ensuring pinpoint accuracy. By 2022, hospitals utilizing 3D mapping in conjunction with RFA saw a 15% reduction in procedure time, translating to better efficiency and patient throughput.

Moreover, the trend towards personalized medical treatments is spurring the development of adaptive RFA devices. These devices can adjust their ablation parameters based on real-time feedback, tailoring the treatment to individual patient needs. A study in 2022 showed that personalized RFA treatments could reduce the recurrence rate of atrial fibrillation by approximately 8% compared to standard procedures in the US radiofrequency ablation devices market. Additionally, the miniaturization of RFA devices, making them portable and user-friendly, is a burgeoning trend. With the global portable medical devices market projected to reach $132 billion by 2031, the demand for compact RFA devices is set to surge. This is particularly advantageous for outpatient settings and clinics, facilitating on-the-spot treatments without the need for extensive infrastructure.

Restrain: High Costs and Training Challenges

Inherent costliness, complexity of use, and the substantial investment required in training and equipment is one of the primary restraints impacting the broader adoption of radiofrequency ablation devices market across the U.S. The upfront cost of an RFA system ranges significantly depending on its complexity, but many advanced systems can cost upwards of $100,000. In addition to this, the recurring costs associated with disposables, such as electrodes and cannulas, can add another $1,500 to $2,500 per procedure. For many clinics, especially those in underserved regions, this presents a substantial financial hurdle.

Moreover, the complexity of using RFA devices cannot be overlooked. A survey conducted in 2022 indicated that approximately 40% of healthcare professionals found the operation of advanced RFA systems moderately challenging. This learning curve directly correlates with the necessity for extensive training. Training is another major cost driver. The average cost of comprehensive training programs for RFA ranges between $5,000 and $10,000 per professional. For a mid-sized clinic with ten professionals requiring training, this translates to a substantial $50,000 to $100,000 investment.

Thus, while the efficacy and benefits of RFA are well-established, the combined challenges of initial investment, recurring costs, and training expenses can make its adoption daunting for many healthcare systems.

Segmental Analysis

By Device Type

By 2032, capital devices are poised to dominate the US radiofrequency ablation devices market, capturing an impressive revenue share of over 44%. This commanding presence is a testament to their intrinsic value and efficacy in various medical fields such as oncology, cardiology, and cosmetology. Their burgeoning demand can also be attributed to the benefits they offer, including fast alleviation and a remarkable success rate in treating conditions like atrial fibrillation.

Contrastingly, while the market share for disposable equipment may not overshadow that of capital devices, its forecasted growth trajectory is robust. Disposable equipment emerges as the fastest-growing segment in the US radiofrequency ablation devices market, registering the highest CAGR of 11.42%. Such rapid growth can be credited to the rising demand for efficient and hygienic medical solutions, ensuring patient safety and streamlining operations. Moreover, as the medical industry continually seeks to balance between cost-efficiency and optimal care, the momentum for disposable equipment is expected to surge.

By Application

The US radiofrequency ablation devices market, when segmented by application, is led by the surgical oncology segment. By 2032, this segment is forecasted to capture an impressive revenue share exceeding 45%, establishing its dominance in the market landscape. Such dominance can be attributed to the high incidence of cancer in the US. With a staggering 1.9 million new cancer cases and 609,360 cancer-related deaths reported in 2022, the pressing need for effective treatments is palpable. Radiofrequency ablation, with its precision and efficiency, serves as a promising solution in surgical oncology, driving its demand.

Furthermore, the surgical oncology segment isn't just leading in terms of market share but also in its growth rate. With an anticipated CAGR of 11.54%, it is set to be the fastest-growing segment in the coming years thanks to rapid technological advancements, increased purchasing power, and robust government support for high-quality healthcare.

By End Users

Based on end users, the US radiofrequency ablation devices market is led by hospitals. By the end of 2032, hospitals are projected to account for a substantial revenue share, exceeding 46%, which can be attributed to the intricate nature of ablation treatments and the high prevalence of specialized staff and equipment available in hospitals, ensuring safer and more effective procedures. Specifically, for patients with concomitant conditions and the elderly, inpatient treatments in hospitals become imperative as they often aren't candidates for outpatient operations. The trend suggests that not only are hospitals maintaining their leadership role in the market, but they are also set to achieve the fastest growth with an anticipated CAGR of 11.70% on account strong demand and need for experienced operators for ablation treatments, which are more commonly found in hospital settings.

On the other hand, Ambulatory Surgical Centers (ASCs), another significant segment, accounted for 35.2% of the market share in 2023. However, projections indicate a slight decline to 35.45% by 2031. These centers, although efficient for certain outpatient procedures, may not always have the specialized staff needed for more complex ablation treatments, explaining the modest dip.

Customize This Report + Validate with an Expert

Access only the sections you need—region-specific, company-level, or by use-case.

Includes a free consultation with a domain expert to help guide your decision.

To Understand More About this Research: Request A Free Sample

Top Players in the US Radiofrequency Ablation Devices Market

- AngioDynamics

- Arthrex

- AtriCure

- Baylis Medical

- Boston Scientific Corporation

- Bramsys Indústria e ComércioLtda

- C. R. Bard

- Cosman Medical, Inc.

- ENDO-FLEX GmbH

- Epimed International

- Halyard Health

- Hologic

- Inomed Medizintechnik GmbH

- Johnson & Johnson

- Medtronic

- SFM Medical Devices GmbH

- Smith & Nephew

- St. Jude Medical

- Stryker

- Sutter Medizintechnik GmbH

- Other Prominent Players

Market Segmentation Overview:

By Device Type

- Capital Device

- RF Energy Generators

- Circumferential Ablation Catheters

- RFA Balloon Catheter

- RFA Focal Catheters

- RFA Endoscopic Catheters

- Irrigated Tip RFA Catheters

- Electrode Catheters

- Conventional RFA Catheters

- Others

- Disposable Equipment

- Cannulas

- RFA Needles

- Reusables

- Probes

- Electrodes

By Application

- Surgical Oncology

- Adrenal Gland Cancer

- Breast Cancer

- Bone Cancer

- Kidney Cancer

- Liver Cancer

- Lung Cancer

- Pancreas Cancer

- Thyroid Cancer

- Others

- Cardiology & Cardiac Rhythm Management

- Atrial Fibrillation

- Cardiac Arrhythmia

- Others

- Cosmetology

- Gynaecology

- Uterine Fibroids

- Others

- Pain Management

- Neck Pain

- Shoulder Pain

- Upper & Lower Back Pain

- Knee Pain

- Facial Pain

- Others

By End User

- Hospitals

- Ambulatory Surgical Centers

- Others

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

.svg)