U.S. Liquid Biopsy Market: By Technology (Multi Gene Parallel Analysis (NGS) and Single Gene Analysis (PCR Microarrays)), Product (Blood Sample Based and Others); Biomarker (Circulating Nucleic Acids, CTC, Exosomes/Microvesicles, Circulating Proteins)— Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2024–2032

- Last Updated: 07-May-2024 | | Report ID: AA0823577

Market Scenario

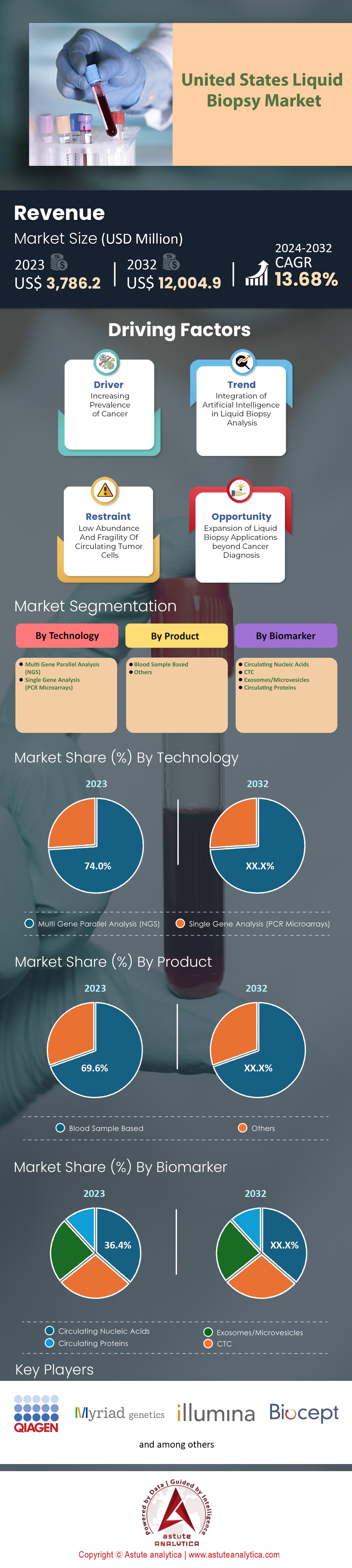

U.S. liquid biopsy market was valued at US$ 3,786.2 million in 2023 and is projected to surpass a market valuation of US$ 12,004.9 million by 2032 at a CAGR of 13.68% during the forecast period 2024–2032.

In recent times, the U.S. liquid biopsy market has thrived due to technological breakthroughs and a rise in cancer and chronic diseases prevalence that have increased interest and applications. By 2023, the U.S. market became highly competitive with both established companies and startups struggling for space. In 2022, Guardant Health was leading having taken up a significant share of the market but there are other big players too. Traditional tissue biopsies which are still responsible for about 70% of all biopsies done in the United States remain liquid biopsies’ main competitor nevertheless they now constitute only 30%. This transformation is because they can detect multiple biomarkers simultaneously without being invasive; are quicker to yield results thus allowing for timely interventions while providing more information on tumor heterogeneity.

Astute Analytica’s research found that liquid biopsy technology has been adopted rapidly by surgeons, pathologists, oncologists who were identified as key users in the liquid biopsy market . A survey conducted recently showed that among respondents over half (55%) said that within next year they would like or plan on using liquid biopsies more often than before. The number of patients wanting less painful diagnostic methods such as these has also gone up by around 30% in just one year according to estimates made from patient inquiries received at various facilities across different states. Government regulations alongside policy making processes too played their part towards shaping this particular sector since FDA had given its approval on twelve tests meant to detect different types cancers through blood samples taken from patients’ bodies which indicate an increasing confidence level with regards applying new technologies into everyday healthcare practice. Moreover, additional $215 million poured into Precision Medicine Initiative by US government led to increased investments thereby boosting growth even further.

The future appears bright for liquid biopsy markets where it is projected that once these become widely recognized within clinical circles then we should expect an increment ranging between twenty percent (20%) up-to fifty percent (50%) per annum; this is likely due to more numbers being requested mainly because they have now proven themselves as being quite reliable even though cheaper alternatives are available too but still expensive when compared against their counterparts.

To Get more Insights, Request A Free Sample

Market Dynamics

Trend: Integration of Artificial Intelligence in Liquid Biopsy Analysis

With the development of liquid biopsy technology, there is an increase in data that needs to be interpreted correctly and quickly. AI can help analyze large and complex datasets with its advanced machine learning and deep learning capabilities which may be difficult for traditional data analysis methods to handle. Among the many factors that have contributed to this growth of liquid biopsy as a field, one stands out above all others: integration with artificial intelligence (AI). Over the last five years alone, annualized growth rates for applications employing AI in liquid biopsy analysis have averaged approximately 28%.

More users within the U.S. liquid biopsy market are adopting this approach because it has been proven to dramatically accelerate data processing speeds. In 2022 researchers at the University of California demonstrated that an algorithm powered by artificial intelligence could evaluate results from such tests within half an hour rather than several hours required using conventional means. Furthermore, accuracy rates also improve when computers are used instead of humans. For instance, a study published in Cancer Research two years later found that while algorithms achieved 95% accuracy identifying certain cancer mutations through analyzing test samples taken via blood draw – compared with just 85% achieved through traditional means – they were also able to discover patterns or correlations which might otherwise elude human analysts. Indeed, MIT researchers working with these systems last year discovered heretofore unseen links between biomarkers present within patients' blood workups obtained via needle sticks during routine checkups and aggressiveness levels exhibited by different forms of malignancies throughout their bodies. Insights like these could greatly enhance early-stage detection efforts aimed at curbing cancer's lethal potential.

Restrain: High Cost of Liquid Biopsy Test

Challenges exist despite AI’s potential in liquid biopsy analysis. One significant barrier that restrains the liquid biopsy market is its high cost. In 2022, the average price of a liquid biopsy test was around $2,800—almost four times as much as a traditional tissue biopsy test. This has deterred many patients and healthcare providers from adopting liquid biopsies.

This elevated expense is mainly due to costly technology used for liquid biopsies like next-generation sequencing (NGS) and digital PCR). Moreover, integration with AI further increases costs because it needs powerful computers and sophisticated algorithms. Besides these points lack of widespread reimbursement for such tests makes matters worse still; only some limited range of them were covered by Medicare as at 2023 while private insurance coverage varies greatly thus only bigger hospitals with greater resources have adopted this service due to their ability to take care of high costs involved.

Still another issue is validity of AI algorithms used in the liquid biopsy market. Although there has been some success shown by AI in detecting cancers through blood samples but it requires more tests to validate these claims so that they can be utilized widely during diagnosis processes therefore rigorous clinical studies are required according A survey conducted by American Association Clinical Oncology in 2022 which found out that 61% oncologists were concerned about lack validation of AI algorithms used in detection cancer cells through blood samples.

Opportunity: Expansion of Liquid Biopsy Applications beyond Cancer Diagnosis

Mostly, liquid biopsies have been used for the detection of cancer, its monitoring and treatment planning. Nevertheless, according to some recent research, they might be applicable to other illnesses such as cardiovascular diseases, neurodegenerative disorders and infectious diseases among others too. A number of studies in the liquid biopsy market have shown that biomarkers related with various non-cancerous conditions can be detected through use of liquid biopsy. For example, a study which was published by Journal of American College Cardiology 2022 showed that specific RNA markers linked with heart failure could be accurately detected using this method; also, another research published in Nature Medicine 2021 indicated that amyloid-beta – a protein associated with Alzheimer’s disease could be identified by means of this test. Additionally, the Covid-19 pandemic has brought out potential possibilities for diagnosis of infectious diseases using liquid biopsies; during one such investigation carried out at university Washington in 2022, it was demonstrated that viral RNA can be recognized from blood samples obtained through patients suffering from covid nineteen thereby providing an alternative diagnostic tool for traditional nasal swab tests.

Liquid biopsies could expand their application from only diagnosing cancer thus significantly increasing market potential. If its applications are diversified then this will help in boosting growth further. Therefore, more streams for revenue generation may open up within companies dealing with these tests while at the same time potentially changing how wide range diseases are diagnosed and managed.

Segmental Analysis

By Technology

In the liquid biopsy market, technology is categorized into Multi Gene Parallel Analysis (Next Generation Sequencing, NGS) and Single Gene Analysis (PCR Microarrays). The market has been dominated by Multi Gene Parallel Analysis which is mainly done via NGS and accounted for over 74% of the market revenue in 2023. According to the projections this trend will continue at a CAGR of 13.97% during next few years. The reason behind its dominance is that NGS can analyze several genes at once thereby giving a holistic picture of genetic mutations with just one test. Such feature makes it highly applicable for tumor detection & characterization as well as treatment response monitoring & identification of resistance mutations. Moreover, targeted therapies development and personalized treatment plans’ creation have also greatly relied on NGS.

However, single gene analysis still remains significant technology within liquid biopsies market especially when carried out through PCR Microarrays despite being largely overshadowed by NGS. In certain clinical settings where detection specific gene alterations are key, these arrays are preferred over any other method such as cost or time effectiveness compared to Next Generation Sequencing which may be more suitable for routine examinations aimed at continuous control purposes.

By Product

Based on product classification, the U.S. liquid biopsy market is mainly split into two categories of blood sample based and other types such as urine or cerebrospinal fluid. In 2023, more than 69% of its revenues were made from using blood samples as a medium for liquid biopsy. Also, it has been estimated that this particular segment would grow with strong CAGR i.e., 14.10% during next few year period.

Liquid biopsies are changing the game in cancer diagnosis and monitoring by providing a less invasive alternative to traditional tissue biopsies. This breakthrough is built on one key idea: a simple blood draw. Blood is advantageous because it is easy to obtain; unlike surgical procedures required for tissue biopsies which can be highly invasive to patients’ bodies. The increased ease not only makes patients more comfortable but also allows for sampling to take place more often. It is necessary when keeping track of how fast or slow cancer spreads throughout someone’s body. It also helps doctors can make better choices regarding treatments they use against different types of cancers found inside them. Tissue biopsies can miss variations present in different regions of the tumor but a liquid biopsy captures this heterogeneity, providing valuable insights for personalized treatment plans.

Frequent blood draws in the liquid biopsy market enable continuous monitoring of cancer progression overtime. However, tissue biopsies cannot be done repeatedly due to their invasiveness thus making it impossible to monitor all changes happening continuously over time through them like what could have been achieved using liquid biopsies supported by simple blood draws. This allow ongoing analysis till desired results are obtained depending on patient’s condition vis-a-vis type or stage of his/her cancer being investigated. In addition to convenience factor mentioned above regarding accessibly.

By Biomarker Segment

The U.S. liquid biopsy market’s biomarker segment consists of exosomes/microvesicles, circulating proteins, circulating tumor cells (CTCs), and circulating nucleic acids. Circulating nucleic acids is the largest segment in this market, accounting for more than 36.40% of its revenue in 2023 and is expected to grow at a CAGR of 13.93% during the forecast period.

Circulating nucleic acids refer to cell-free DNA (cfDNA) as well as cell-free RNA (cfRNA), both of which have proved useful as cancer biomarkers for diagnosis, prognosis assessment and monitoring purposes. These biomarkers can reveal information about the genetic composition of tumors and identify mutations associated with drug resistance among other applications hence they are now integral parts of precision oncology used for individualized treatment strategies. Liquid biopsies based on CTCs are increasingly being adopted because they help identify aggressive subtypes of tumors; evaluate prognosis; predict response rates to different treatments etcetera. So far studies have been carried out into creating liquid biopsy tests for various types of cancer that are CTC-based thus increasing their market potential even further but still more research is needed in this area too.

The other two promising areas within liquid biopsy market include exosomes/microvesicles and circulating proteins respectively. Exosomes represent vesicles derived from cells which contain RNA molecules alongside DNA molecules plus proteins thereby offering a broader perspective on the tumor microenvironment while on the other hand tumour specific antigens found within some circulating proteins can be used not only to detect but also monitor early stages or progression levels of cancers among other things like indicating extent severity etcetera so these should also gain importance over time with increased understanding through research development along clinical lines too where necessary has already started happening hereabouts.

Customize This Report + Validate with an Expert

Access only the sections you need—region-specific, company-level, or by use-case.

Includes a free consultation with a domain expert to help guide your decision.

To Understand More About this Research: Request A Free Sample

Top Players in the U.S. Liquid Biopsy Market

- Biocept, Inc.

- Illumina, Inc.

- Myriad Genetics, Inc.

- QIAGEN

- Thermo Fisher Scientific, Inc.

- Guardant Health

- F. Hoffmann-La Roche Ltd

- ANGLE plc

- BIODESIX

- NeoGenomics Laboratories, Inc.

- Other major players

Market Segmentation Overview:

By Technology

- Multi Gene Parallel Analysis (NGS)

- Single Gene Analysis (PCR Microarrays)

By Product

- Blood Sample Based

- Others

By Biomarker

- Circulating Nucleic Acids

- CTC

- Exosomes/Microvesicles

- Circulating Proteins

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

.svg)