United States CAM Software Market: By Component (Solutions and Services); Deployment (On Premises and Cloud); Organization (Large and SME); Design (2D and 3D); Manufacturing Process (Milling, Turning, Cutting, Machining, Probing, and Additive Manufacturing); Integration (Standalone, Plug In, Dual Capacity); Industry (Aerospace & Defense, Shipbuilding, Automobile & Train, Machine Tool, Router Programming, Others)— Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2024–2032

- Last Updated: 28-May-2024 | | Report ID: AA1123673

Market Scenario

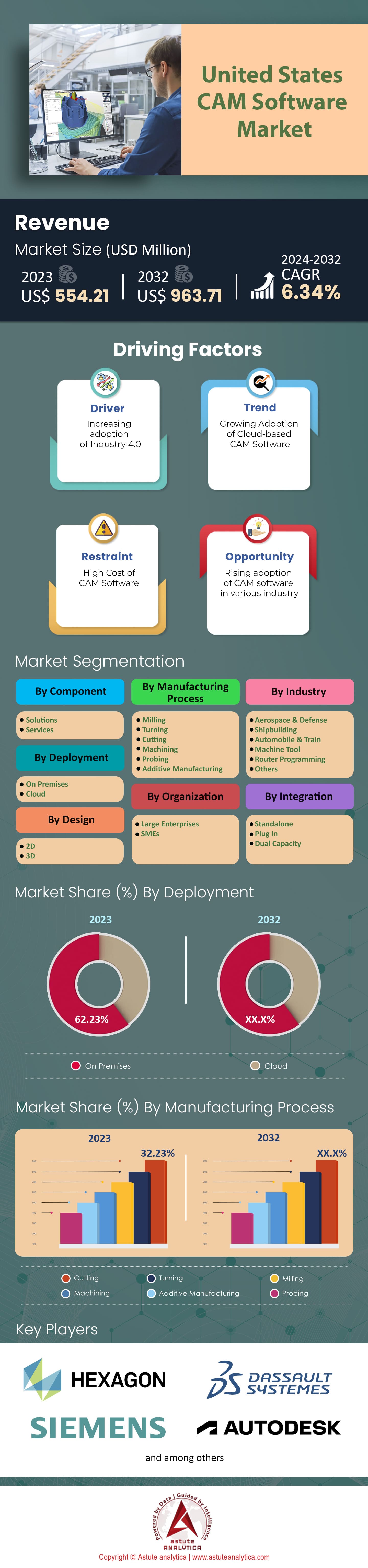

United States CAM Software Market was valued at US$ 554.21 million in 2023 and is projected to surpass the market size of US$ 963.71 million by 2032 at a CAGR of 6.34% during the forecast period 2024–2032.

The U.S. Computer-Aided Manufacturing (CAM) software market currently presents a dynamic landscape shaped by technological innovation and evolving industrial demands. As of the latest reports, this market is experiencing robust growth, driven by the increasing adoption of advanced manufacturing technologies across various sectors. Key end users include the aerospace and defense, automotive, healthcare, and consumer goods industries. These sectors are rapidly integrating CAM software to enhance precision, efficiency, and customization in manufacturing processes. The adoption pattern varies across industries, with aerospace and automotive sectors leading in the utilization of high-end, sophisticated CAM solutions. This is primarily due to their need for complex part designs and stringent quality standards. Meanwhile, the healthcare sector is increasingly adopting CAM software for customized medical devices and prosthetics, reflecting a more specialized application scope.

Looking towards the future, the U.S. CAM software market is poised for significant expansion. This growth is anticipated to be fueled by the integration of technologies like AI, machine learning, and the Internet of Things (IoT), which are expected to revolutionize manufacturing processes. The future market outlook suggests a trend towards increased customization and automation, catering to the growing demand for precision manufacturing and efficient production workflows. As industries increasingly strive for sustainability and cost-efficiency, CAM software developers are likely to introduce more energy-efficient and material-saving solutions. Additionally, the advent of Industry 4.0 is set to further augment market growth, as more companies embrace smart manufacturing practices. The potential integration of CAM software with additive manufacturing (3D printing) is another area that holds substantial promise, particularly in custom manufacturing and prototyping.

For developers and players in the US CAM software market, these trends offer a plethora of opportunities. There is a growing need for user-friendly, versatile CAM solutions that can cater to a range of industries and manufacturing requirements. Developers have the opportunity to innovate in areas such as cloud-based CAM solutions, which offer scalability and remote accessibility - a significant advantage in the current era of distributed manufacturing. Moreover, the ongoing shift towards digitalization and automation in manufacturing opens doors for CAM software integrated with advanced analytics and predictive maintenance capabilities. In terms of market potential, small and medium-sized enterprises (SMEs) emerge as a key segment. These businesses are increasingly adopting CAM solutions to remain competitive, offering a vast market for cost-effective and scalable CAM software. As industries continue to evolve, the U.S. CAM software market stands at the cusp of a transformative phase, offering significant growth potential and opportunities for innovation in the years to come.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Increasing Adoption of Advanced Manufacturing Technologies

The integration of CAM software in manufacturing processes is becoming more prevalent in the US CAM software market due to its ability to enhance efficiency, accuracy, and speed. A recent study revealed that over 60% of U.S. manufacturing companies are now utilizing some form of digital manufacturing technology, with CAM software being a significant component. This widespread adoption is further underscored by the fact that the U.S. manufacturing sector, contributing about 11% to the national GDP, is increasingly reliant on advanced technologies for staying competitive globally.

The push towards Industry 4.0 standards has been a substantial factor in this trend. With over 50% of U.S. manufacturers aiming to fully integrate Industry 4.0 technologies into their operations by 2025, CAM software becomes crucial for achieving this integration. The software’s ability to seamlessly connect with other digital tools and systems is pivotal in creating a fully digitized manufacturing environment. Moreover, the market has seen a 30% increase in investment in automation and digital manufacturing technologies, indicating a strong commitment to adopting CAM solutions. In addition, the demand for precision and customization in manufacturing has surged. Some of the findings show that over 70% of manufacturers in the US CAM software market are now facing demands for more complex and customized products, which necessitates the adoption of CAM software for precise and efficient production. This trend is particularly evident in industries like aerospace, automotive, and healthcare, where the precision requirement is paramount. The aerospace sector alone has seen a 40% increase in the utilization of CAM software over the past five years, reflecting its critical role in complex manufacturing processes.

Trend: Growing Integration of AI and Machine Learning

A prominent trend in the U.S. CAM software market is the integration of artificial intelligence (AI) and machine learning (ML) technologies. This integration is revolutionizing how manufacturing processes are planned, executed, and managed. As per recent data, around 45% of CAM software now incorporates some form of AI or ML algorithms, significantly enhancing the software’s capabilities in predictive analysis and process optimization. This trend is driven by the need for smarter, more efficient manufacturing operations that can adapt to changing conditions and optimize resource usage.

The integration of AI in CAM software allows for predictive maintenance, which can reduce machine downtime by up to 30%. This is a significant advantage for manufacturers aiming to maximize productivity and minimize operational disruptions. Additionally, AI-enabled CAM software can optimize tool paths and machine operations, leading to a reported 25% increase in overall manufacturing efficiency. This optimization not only enhances production rates but also reduces material wastage, contributing to more sustainable manufacturing practices in the CAM software market.

Furthermore, AI and ML technologies enable the handling of complex data sets, improving the accuracy of simulations and modeling within CAM systems. This capability is particularly beneficial in industries like automotive and aerospace, where precision and performance are critical. The automotive industry, for example, has seen a 20% improvement in prototype development times thanks to AI-integrated CAM software. The ability of these technologies to learn and improve over time also means that CAM software can continuously evolve, becoming more efficient and effective in handling diverse manufacturing challenges.

Restraint: High Cost and Complexity of Implementation

Despite the many advantages and positive trends, the U.S. CAM software market faces a significant restraint in the form of the high cost and complexity associated with its implementation. The initial investment required for integrating CAM software into manufacturing systems can be substantial. For small and medium-sized enterprises (SMEs), which make up over 98% of all U.S. manufacturing firms, the cost of advanced CAM systems can be prohibitive. Studies indicate that the average cost of deploying a comprehensive CAM solution can range from $20,000 to $100,000, depending on the scale and complexity of operations. In addition to the financial aspect, the implementation of CAM software often requires significant changes to existing workflows and processes. About 55% of manufacturers report facing challenges in integrating CAM software with their current systems, citing compatibility issues and the need for extensive training as major hurdles. The complexity of these systems also means that skilled personnel are required to operate and maintain them effectively. However, there is a notable skills gap in the industry, with over 60% of manufacturing companies struggling to find employees with the necessary technical expertise.

Moreover, the ongoing maintenance and updates of CAM software add to the total cost of ownership in the US CAM software market. Approximately 40% of CAM software users have indicated that the maintenance and upgrade costs are higher than initially anticipated, making it a continuous investment rather than a one-time expense. This aspect can be particularly challenging for smaller manufacturers who might not have the financial flexibility to accommodate these ongoing costs.

Segmental Analysis

By Component

The U.S. CAM software market, when analyzed by component, reveals a dominant position of the solution segment. In 2023, this segment held a commanding market share of 88.62%, underscoring its critical role in the industry. The solution segment is also projected to expand at the fastest CAGR of 6.52% during the forecast period. This substantial market share and growth rate can be attributed to several key factors. First, the increasing demand for precision and efficiency in manufacturing processes drives the need for advanced CAM solutions. These software solutions are integral in enabling manufacturers to design and produce complex parts with high accuracy, which is essential in industries like aerospace, automotive, and healthcare. Furthermore, the ongoing digital transformation in manufacturing, propelled by Industry 4.0 initiatives, further bolsters the demand for sophisticated CAM solutions that can integrate seamlessly with other digital systems.

The projected growth rate reflects the evolving needs of the manufacturing sector, where there is a continuous pursuit for innovative solutions to enhance productivity and reduce operational costs. The integration of emerging technologies such as AI and machine learning in CAM solutions is expected to further fuel their adoption in the CAM software market, making them an indispensable component in the modern manufacturing landscape. This trend suggests a sustained and growing reliance on CAM solutions, reinforcing their status as a cornerstone in the market.

By Design

Based on design in the U.S. CAM software market, 3D segment notably dominates, both in terms of value and market share. In 2023, this segment was valued at US$ 440.38 million and held a substantial 78.77% of the market share. Its prominence is not just a current phenomenon but also a predictive indicator of future trends, as it is projected to grow at a CAGR of 7.24% from 2024 to 2032, reaching an estimated value of US$ 826.21 million by 2032. The dominance of the 3D segment is primarily driven by the advanced capabilities it offers in comparison to 2D designs. 3D CAM software provides a more comprehensive and detailed approach to manufacturing design, allowing for the creation of complex and intricate parts with higher precision. This feature is particularly crucial in industries such as aerospace, automotive, and healthcare, where the demand for complex geometries and precision manufacturing is high.

The projected growth of the 3D segment is indicative of the evolving manufacturing industry's needs, where there is an increasing preference for sophisticated design solutions that enhance product quality and efficiency. The integration of new technologies like AI and machine learning in 3D CAM software further enhances its capabilities, making it an essential tool for modern manufacturing processes. This growth trajectory underscores the critical role of 3D CAM software in shaping the future of manufacturing in the U.S. market.

By Manufacturing Process

Based on the manufacturing process, the U.S. CAM software market is primarily sub-segmented into cutting, milling, turning, and others. In 2023, the cutting segment emerged as the market leader, accounting for the largest share of 32.23%. The segment is anticipated to continue its lead, projected to grow at the highest CAGR of 7.31% over the forecast period. The prominence of the cutting segment in the CAM software market is attributed to the widespread application and essential nature of cutting processes in manufacturing. Cutting operations are fundamental across various industries, including automotive, aerospace, and consumer electronics, where precision and efficiency are paramount. The need for high-precision cutting in these sectors, coupled with the increasing complexity of designs and materials, drives the demand for advanced CAM software solutions tailored for cutting processes.

This projected growth is also indicative of the ongoing technological advancements in manufacturing, where there is a continuous push for optimizing processes and enhancing production efficiency. The integration of cutting-edge technologies in CAM software, such as AI and advanced analytics, further augments the capabilities of cutting processes, aligning with the industry's evolving needs. The cutting segment's growth trajectory underscores its crucial role in modern manufacturing and its influence on the future direction of the U.S. CAM software market.

Customize This Report + Validate with an Expert

Access only the sections you need—region-specific, company-level, or by use-case.

Includes a free consultation with a domain expert to help guide your decision.

To Understand More About this Research: Request A Free Sample

By Industry

The U.S. CAM software market, when segmented by industry, highlights the substantial impact and growth within specific sectors, particularly in the automobile and trains segment. In 2023, this segment not only accounted for the highest market share at 30.23% but is also estimated to experience the most rapid growth, with a projected CAGR of 7.38%. This dominant position and anticipated growth can be attributed to the increasing complexity and precision requirements in the automobile and train manufacturing industries. As these sectors continuously innovate and introduce advanced vehicle designs and components, the demand for high-precision CAM software escalates. This software plays a pivotal role in streamlining production processes, from prototyping to final manufacturing, ensuring accuracy and efficiency.

The growth of the automobile and trains segment is also indicative of the broader trend towards automation and digitization in manufacturing. As these industries embrace Industry 4.0 principles, the integration of advanced CAM solutions becomes crucial. This trend is further driven by the push for electric vehicles and high-speed trains, which require more sophisticated manufacturing techniques, where CAM software’s precision and efficiency are invaluable.

Top Players in the US CAM Software Market

- Autodesk Inc.

- BobCAD-CAM, Inc.

- CAMBRIO (Sandvik AB)

- Camnetics, Inc.

- CNC Software, Inc. (Sandvik AB)

- Dassault Systèmes SE

- EZ-CAM

- GRZ Software LLC

- Hexagon AB

- MecSoft Corporation

- PTC

- Siemens AG

- SolidCAM Gmbh

- WiCAM GmbH

- ZWSOFT (ZWCAD Software Co., Ltd.)

- Other Prominent Players

Market Segmentation Overview:

By Component

- Solutions

- Services

By Deployment

- On Premises

- Cloud

By Organization

- Large Enterprises

- SMEs

By Design

- 2D

- 3D

By Manufacturing Process

- Milling

- Turning

- Cutting

- Machining

- Probing

- Additive Manufacturing

By Integration

- Standalone

- Plug In

- Dual Capacity

By Industry

- Aerospace & Defense

- Shipbuilding

- Automobile & Train

- Machine Tool

- Router Programming

- Others

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

.svg)