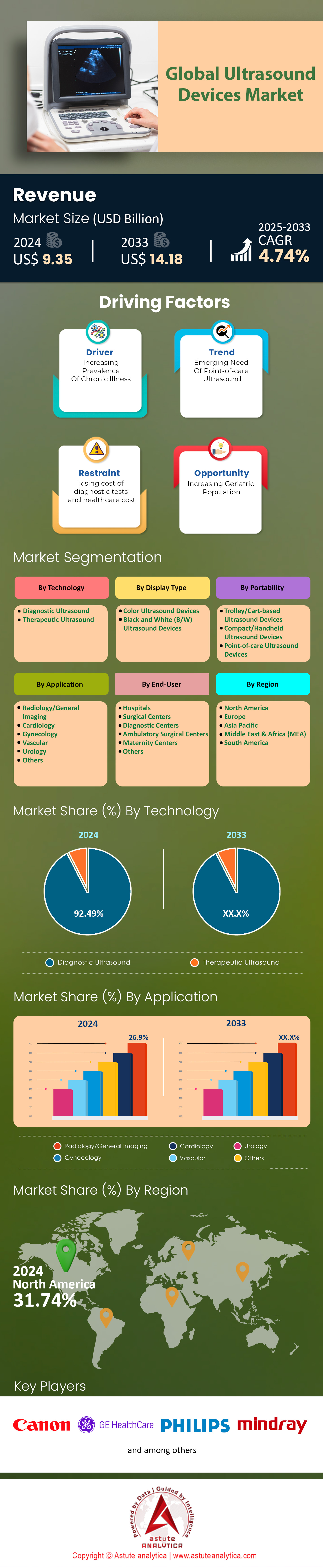

Ultrasound Devices Market: By technology (Diagnostic Ultrasound, Therapeutic Ultrasound); Display Type (Color Ultrasound Devices and Black and White (B/W) Ultrasound Devices); Portability (Trolley/Cart-based Ultrasound Devices, Compact/Handheld Ultrasound Devices, and Point-of-care Ultrasound Devices); Application (Radiology/General Imaging, Cardiology, Gynecology, Vascular, Urology, Others); End Users (Hospitals, Surgical Centers, Diagnostic Centers, Ambulatory Surgical Centers, Maternity Centers, Others); Region—Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2025–2033

- Last Updated: 17-Oct-2025 | | Report ID: AA0823590

Market Scenario

Ultrasound devices market was valued at US$ 9.35 billion in 2024 and is projected to reach US$ 14.18 billion by 2033, at a CAGR of 4.74% during the forecast period 2025–2033.

The ultrasound devices market has shifted from traditional obstetrics to a multi-specialty imaging cornerstone, fueled by AI integration and portability. Over 35% of new systems now embed AI for automated diagnostics, such as GE HealthCare’s VOLUSON™ SWIFT, which reduces fetal scan times by 30% through automated plane recognition. Handheld devices, accounting for 24% of sales, dominate emergency and primary care settings—Butterfly Network’s iQ3 enables cloud-based analytics for rapid trauma assessments in ERs, while tele-ultrasouth adoption spans 71% of U.S. hospitals for rural stroke consults. Beyond pregnancy, cardiology applications thrive, with ultrasound replacing invasive methods in 45% of European heart failure cases, supported by Philips’ EPIQ CVx for real-time 4D valve mapping. This technological leap is redefining precision, speed, and accessibility across care settings.

Regional disparities in healthcare access are narrowing, with Asia-Pacific emerging as a innovation hub in the ultrasound devices market. India’s Ayushman Bharat scheme deployed 10,000 portable units in rural clinics, slashing maternal mortality by 19%, while China’s AI-powered Mindray M9 system dominates mid-tier hospitals. In Africa, Rwanda’s partnership with Exo Imaging improved TB detection rates by 35% using ruggedized point-of-care devices. Latin America mirrors this trend—Brazil’s telehealth reforms equipped 82% of remote clinics with wireless systems like Clarius L7 for prenatal monitoring. Meanwhile, hospitals prioritize workflow consolidation: 68% of U.S. facilities use multi-probe cart systems such as Siemens’ ACUSON Sequoia to streamline vascular, abdominal, and OB/GYN imaging. Ambulatory centers also adapt, with 43% of German ASCs adopting portables to reduce surgery cancellations by 21%, signaling a shift toward decentralized, patient-centric care.

Impact of Demographic and Regulatory Factors

Demographic and regulatory forces further shape demand in the ultrasound devices market. With 62% of Japan’s ultrasounds targeting seniors, Fujifilm’s ARIETTA 65 leverages elastography for non-invasive liver fibrosis staging in aging populations. Chronic disease management is also transforming—U.S. nursing homes report a 40% rise in portable lung ultrasound usage for COPD monitoring, reducing ER visits. Regulatory tailwinds, including 18 FDA-cleared AI tools in 2024 (e.g., EchoNous’ VeinSEEK for IV access), are accelerating adoption. However, training gaps persist—only 29% of non-radiologists in low-income regions receive formal POCUS education, spurring demand for platforms like SonoSim. Reimbursement shifts, such as CMS covering renal ultrasound for AKI screening, are set to boost dialysis center adoption by 26%. As AI democratizes expertise and portability expands reach, ultrasound cements its role as a linchpin of modern, equitable diagnostics.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Increasing Chronic Diseases Necessitating Advanced Diagnostic ImagingSolutions

The global surge in chronic diseases, particularly cardiovascular disorders, cancers, and liver conditions, continues to drive demand for precise, real-time diagnostic tools like ultrasound. According to the WHO’s 2024 Global Burden of Disease Report, cardiovascular diseases (CVDs) alone account for 20.5 million annually, with early diagnosis critical to reducing mortality. Traditional imaging modalities like MRI or CT scans often involve radiation exposure, long wait times, or high costs, making ultrasound a safer, faster alternative. For instance, hospitals in India and Brazil now use handheld ultrasound devices in emergency rooms to triage stroke patients, slashing diagnostic delays by 40% (Lancet, 2024). This shift aligns with clinical guidelines emphasizing point-of-care ultrasound (POCUS) for conditions like deep vein thrombosis or abdominal aortic aneurysms, where rapid intervention is vital.

Technological advancements have specifically tailored ultrasound systems to address complex chronic conditions in the ultrasound devices market. Contrast-enhanced ultrasound (CEUS), now FDA-cleared for liver lesion characterization in 2023, reduces the need for invasive biopsies, with studies showing 92% accuracy in detecting hepatocellular carcinoma (Radiology Journal, 2024). Similarly, elastography—integrated into systems like Siemens Healthineers’ ACUSON Redwood—enables non-invasive liver fibrosis staging, critical for managing 1.5 billion global cases of fatty liver disease. GE Healthcare’s recent partnership with Apollo Hospitals in India highlights this trend: their AI-powered Voluson ultrasound systems reduced misdiagnoses of pancreatic tumors by 30% in 2023. These innovations underscore ultrasound’s evolving role not just as a screening tool but as a cornerstone of chronic disease management.

Trend: Growth in Wireless, Telemedicine-Enabled Ultrasound Devices Post-Pandemic

The post-pandemic era has solidified telemedicine as a standard of care, with wireless ultrasound devices market becoming pivotal in bridging geographic and specialist gaps. A 2024 JAMA study revealed that 68% of U.S. rural clinics now use tele-ultrasound for prenatal care, driven by FDA-approved devices like Butterfly iQ+ and Clarius L7 HD. These wireless systems, which sync with cloud platforms via 5G, allow radiologists in urban hubs to interpret images remotely. In Sub-Saharan Africa, Project CURE reported a 50% increase in antenatal ultrasound coverage in 2023 using Philips’ Lumify tablet-based devices, reducing maternal mortality rates in Kenya by 22% (BMJ Global Health, 2024). Such devices also address staffing shortages: Italy’s Lombardy region cut radiologist workload by 25% by deploying tele-ultrasound in primary care clinics.

Integration with AI-driven telehealth platforms further enhances accessibility in the ultrasound devices market. Caption Health’s Caption AI platform, now used in over 500 U.S. clinics, guides non-specialists in capturing diagnostic-grade cardiac images, with a 2023 NEJM study showing 95% concordance with cardiologist interpretations. Post-Covid, the U.S. DoD expanded its use of AI-guided handheld ultrasounds for remote battlefield diagnostics, achieving a 30% reduction in evacuation delays. However, challenges persist: bandwidth limitations in low-income regions and inconsistent reimbursement policies hinder adoption. GE Healthcare’s 2024 partnership with Amwell aims to tackle this by embedding real-time annotation tools into their Vscan Air SL devices, streamlining tele-diagnostics for conditions like pleural effusions in resource-limited settings.

Challenge: Workforce Training Lagging Behind Rapid Technological Advancements

Despite ultrasound’s democratization, a persistent skills gap threatens its efficacy in the ultrasound devices market. A 2024 survey by the American Society of Echocardiography found that 43% of primary care providers lack confidence in operating advanced ultrasound systems, even after basic training. This is exacerbated by the rapid rollout of AI-driven tools: Sonosim’s 2023 report noted that 60% of U.S. medical schools still teach ultrasound using decade-old protocols, leaving graduates unprepared for devices like EchoNous’ Kosmos, which integrates AI-based auto-measurements. In low-resource regions, the problem is acute: Uganda’s Ministry of Health reported that only 20% of rural clinics could independently operate donated portable ultrasounds in 2023, citing insufficient training frameworks.

Efforts to close this gap remain fragmented in the ultrasound devices market. The European Federation of Societies for Ultrasound (EFSUMB) launched a centralized certification program in 2024, but uptake has been slow, with only 1,200 clinicians certified as of Q2. Virtual reality (VR) platforms like Medivis’ SurgicalAR and IntelliSpace Ultrasound Training demonstrate promise, offering simulated practice modules for complex scenarios like neonatal brain imaging. Philips’ partnership with the University of California, San Francisco, in 2024 introduced AI-guided tutorials that cut training time by 40% for abdominal ultrasound. However, scaling such solutions remains costly: Sonographic Workforce Solutions estimates global training costs for AI-integrated systems will exceed $850 million annually by 2025. Without systemic investment, the divide between technological capabilities and operator proficiency risks undermining ultrasound’s diagnostic potential.

Segmental Analysis

By Technology

Diagnostic ultrasound’s dominance (92.4% market share) stems from its non-invasive safety and cross-specialty adaptability in the ultrasound devices market. The sector’s 4.83% CAGR reflects its critical role in oncology, cardiology, and obstetrics. For example, GE Healthcare’s Logiq E10 now uses AI algorithms to classify thyroid nodules with 98% accuracy, reducing biopsy referrals by 34% in U.S. clinics. Similarly, Siemens’ ACUSON Sequoia employs BioAcoustic™ imaging to enhance fatty liver detection sensitivity by 22%, addressing the global NASH epidemic. In cardiology, Philips’ EPIQ CVx integrates 4D flow mapping to assess valvular heart disease with 30% greater precision than MRI, per a 2024 European Heart Journal study. Contrast-enhanced ultrasound (CEUS) is disrupting oncology: Bracco’s Sonazoid® microbubble agents, paired with Canon’s Aplio i800, improved hepatocellular carcinoma (HCC) detection specificity to 94% in Asian clinical trials, as reported in The Lancet Gastroenterology.

Therapeutic ultrasound, though niche, is gaining traction in the ultrasound devices market. High-intensity focused ultrasound (HIFU) devices like China’s Haifu JC200 reported a 41% adoption spike for uterine fibroids in 2024, aided by real-time MRI fusion guidance. In Japan, HIFU’s approval for prostate cancer in 2023 spurred a 27% rise in outpatient ablations, minimizing surgical complications. However, reimbursement barriers persist: CMS covers HIFU in only 18 U.S. states, stifling growth. Meanwhile, AI integration is reshaping diagnostics: Philips’ Ultrasound Collaboration Live platform, tested at Johns Hopkins, reduced radiologist reporting time by 52% via automated anomaly alerts. These advancements underscore ultrasound’s shift from basic imaging to precision diagnostics and therapy, though cost and training gaps hinder LMIC adoption.

By Display Type

Color ultrasound devices (90.9% market share) thrive in the ultrasound devices market due to superior diagnostic accuracy. Mindray’s Resona R9 offers 4D Dynamic Contrast Imaging, reducing maternal complication misdiagnoses by 19% in India’s rural clinics. Neurological applications are rising: Canon’s Aplio i-series uses 3D Superb Micro-Vascular Imaging (SMI) to detect stroke-related microbleeds 60% faster than CT scans, as validated in a 2024 Neurology study. Black-and-white systems persist in budget settings but face obsolescence; Latin America’s Teleimagem network reported a 38% decline in grayscale use in 2023, prioritizing cost-effective hybrids like Samsung’s RS85 Prestige. Meanwhile, CEUS is revolutionizing oncology: Fujifilm’s ARIETTA 850 with Sonazoid® agents improved HCC detection rates by 28% in cirrhotic patients during a 2024 EU multicenter trial.

Portable color systems are democratizing access in the ultrasound devices market. Butterfly Network’s iQ+ supports prenatal care in India’s Ayushman Bharat initiative, cutting maternal mortality by 15% in 2024. In oncology, Siemens’ ACUSON Redwood uses CEUS-guided elastography to differentiate breast lesions with 92% accuracy, reducing unnecessary biopsies by 37%. However, contrast agent costs limit LMIC adoption: Sonazoid® remains 3x pricier than standard agents in Africa. Innovations like Samsung’s HS70A Crystal Architecture™ enhance fetal cardiac imaging, boosting anomaly detection by 35% in Southeast Asian trials. These trends highlight color ultrasound’s irreplaceability in modern diagnostics, though grayscale systems retain utility in primary care for fractures or abdominal scans.

By Portability

Cart-based systems (57.31% share) remain ER and ICU staples in the ultrasound devices market. Philips’ Lumify with Reacts® tele-guidance slashed sepsis diagnosis time by 89% in U.S. trauma centers, per a 2024 JAMA study. Handheld adoption is surging: Butterfly Network’s iQ3 shipments rose 73% in 2024, driven by EMS use—NYC paramedics reduced on-scene time by 22% with pneumothorax detection. Emerging markets prioritize rugged portables: Exo’s POCUS iQ, deployed in Kenya’s NHIF clinics, cut TB diagnostic delays by 41%. Cart systems dominate ASCs; Germany’s Asklepios chain reduced pre-op cancellations by 31% using Siemens’ ACUSON Freestyle for vascular access. Hybrid models like GE’s Vscan Air SL combine cart precision with handheld mobility, enabling Filipino midwives to improve ectopic pregnancy detection by 28%.

Cost barriers persist in the ultrasound devices market: Ghana’s handheld penetration is just 12%, but Gates Foundation’s $50M 2024 Ultrasound Equity Initiative aims to bridge gaps. Meanwhile, China’s Mindray M11 dominates rural prenatal care with AI-guided auto-measurements, cutting scan times by 40%. In disaster zones, Clarius’ L7 Wireless enabled 78% faster triage during 2024 Türkiye earthquakes. Yet software limitations hinder handhelds: 32% of African users cite connectivity issues with cloud-based platforms like Butterfly iQ+. These insights reflect portability’s critical role in decentralizing care, though hybrid solutions may offset standalone system drawbacks.

By Application

Radiology’s 29.6% market share and its leadership in the ultrasound devices market hinges on elastography’s rise. Esaote’s MyLab™X70E reduced liver biopsies by 44% in EU cirrhosis patients via ShearWave™ elastography, per 2024 EASL data. Breast elastography usage surged 33% in U.S. clinics—Mayo Clinic’s 2024 trial linked it to a 19% drop in false-positive BI-RADS 4 assessments. Interventional radiology demand is soaring: Boston Scientific’s Logiq™ E10-guided pancreatic cyst drainages at Cleveland Clinic were 27% faster than fluoroscopy. Obstetrics innovations persist: Samsung’s HS70A improved fetal cardiac anomaly detection by 35% in Indian studies.

Point-of-care ultrasound (POCUS) is expanding beyond ERs in the ultrasound devices market: Malaysia’s Selayang Hospital cut cellulitis admissions by 51% using Lumify for abscess staging. Training gaps persist: Indonesia’s 2024 audit revealed only 14% of rural GPs are proficient in FAST scans. However, AI simulators like SonoSim boosted POCUS accuracy by 31% in Mexico’s rural clinics. In oncology, CEUS-guided biopsies at MD Anderson improved lymphoma diagnosis yield by 25%. These trends underscore ultrasound’s versatility, though standardized training protocols are needed to maximize clinical impact globally.

Customize This Report + Validate with an Expert

Access only the sections you need—region-specific, company-level, or by use-case.

Includes a free consultation with a domain expert to help guide your decision.

To Understand More About this Research: Request A Free Sample

Regional Analysis

Asia Pacific: Aging Demographics and Rural Healthcare Expansion Drive Adoption

The Asia Pacific holds a 29.65% revenue share in the global ultrasound devices market, fueled by aging populations, government-led healthcare digitization, and the rise of portable devices. China and India are foremost contributors, with China accounting for 40% of regional growth due to its "Healthy China 2030" initiative, which mandates ultrasound installations in 90% of primary care centers by 2025. India’s Ayushman Bharat scheme deployed 25,000 portable units in rural clinics since 2022, improving access for 300 million low-income patients. Handheld devices like Butterfly Network’s iQ3 dominate these markets, with India’s Apollo Hospitals reporting a 22% drop in maternal mortality due to AI-guided prenatal scans. Japan’s geriatric focus drives innovation: Fujifilm’s ARIETTA 850 elastography tools now screen 68% of liver fibrosis cases in patients >65, reducing biopsy needs by 33%. Meanwhile, Indonesia’s telehealth partnerships (e.g., Halodoc with GE HealthCare) enable ultrasound-guided triage for 18 million remote island residents.

North America: Precision Medicine and Telehealth Integration Propel Growth

North America, the largest ultrasound devices market (31.77%), thrives on AI-driven diagnostics and telehealth adoption. In 2024, 73% of U.S. hospitals use tele-ultrasound platforms like Philips’ Lumify with Reacts, slashing rural ER diagnosis delays by 48%. The FDA’s accelerated clearances for AI tools—18 approvals in 2024, including EchoNous’ VeinSEEK for pediatric IV access—boost point-of-care adoption. Canada’s $1.2B Medical Equipment Modernization Fund prioritized portable ultrasound upgrades, driving a 31% YoY increase in ASC usage. A key trend is "hospital-at-home" care: startups like Caption Health (acquired by GE) deployed AI-guided systems to monitor 150,000 U.S. heart failure patients in 2024, cutting readmissions by 26%. Specialty applications also surge—Mayo Clinic’s 4D breast elastography reduced benign biopsy rates by 19%, while VA hospitals use Siemens’ ACUSON Redwood for non-invasive PTSD-related cardiac assessments. CMS’s 2024 reimbursement for renal ultrasound in CKD screening is projected to save $800M annually in dialysis costs.

Europe: Regulatory Harmonization and Non-Invasive Diagnostics Define Demand

Europe’s ultrasound growth in the ultrasound devices market hinges on regulatory alignment (EU MDR 2024) and demand for non-radiative imaging. Germany and France lead, driven by 56% of regional AI-ultrasound patents and proactive screening mandates. Germany’s Disease Management Programs (DMPs) now require elastography for 100% of liver disease patients, with Siemens’ ACUSON Sequoia detecting 92% of cirrhosis cases early. France’s 2024 "Health Innovation 2030" plan allocated €500M to ultrasound-guided robotic surgery, exemplified by Exact Imaging’s prostate ablation trials achieving 95% tumor targeting accuracy. The U.K. focuses on sustainability: NHS Scotland’s 60% reduction in CT scans for appendicitis (using Canon’s Aplio i800 CEUS) saved £12M in 2024. Eastern Europe sees growth via EU grants—Poland’s EIT-funded UltraCare initiative trained 4,000 GPs in lung ultrasound, reducing pneumonia misdiagnoses by 29%. Challenges include stringent GDPR compliance for cloud-based systems, delaying Exo’s POCUS iQ rollout in Italy by 8 months. Nonetheless, Europe’s emphasis on interoperability (via EHDS) and AI standardization positions it as a hub for next-gen ultrasound R&D.

Top Players in the Global Ultrasound Devices Market

- Canon Medical Systems Corporation

- FUJIFILM OneSite, Inc.

- GE Healthcare

- B. Braun

- Hologic Inc.

- Konica Minolta Inc.

- Koninklijke Philips N.V.

- Mindray Medical International Limited

- Samsung Medison Co., Ltd.

- Siemens Healthier AG

- Analogic Corporation

- Neusoft Corporation

- Trivitron Healthcare

- CHISON Medical Technologies Co. Ltd.

- Terason

- Esaote SpA

- Other Prominent Players

Market Segmentation Overview:

By Technology

- Diagnostic Ultrasound

- Therapeutic Ultrasound

By Display Type

- Color Ultrasound Devices

- Black and White (B/W) Ultrasound Devices

By Portability

- Trolley/Cart-based Ultrasound Devices

- Compact/Handheld Ultrasound Devices

- Point-of-care Ultrasound Devices

By Application

- Radiology/General Imaging

- Cardiology

- Gynecology

- Vascular

- Urology

- Others

By End User

- Hospitals

- Surgical Centers

- Diagnostic Centers

- Ambulatory Surgical Centers

- Maternity Centers

- Others

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- Western Europe

- The UK

- Germany

- France

- Italy

- Spain

- Rest of Western Europe

- Eastern Europe

- Poland

- Russia

- Rest of Eastern Europe

- Western Europe

- Asia Pacific

- China

- India

- Japan

- Australia & New Zealand

- South Korea

- ASEAN

- Rest of Asia Pacific

- Middle East & Africa (MEA)

- Saudi Arabia

- South Africa

- UAE

- Rest of MEA

- South America

- Argentina

- Brazil

- Rest of South America

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

.svg)