Global Ultrasonic Sensors Market: By Type (Ultrasonic Proximity Sensors (Close range ultrasonic sensors, Intrinsically safe ultrasonic sensors, High Accuracy ultrasonic sensors, Self-contained ultrasonic sensors), Range Measurement (Ultrasonic Retro-Reflective Sensors, Ultrasonic Through Beam Sensors)); Application (Anti-Collision Detection, Distance Measurement, Liquid Level Measurement, Object and Pallet Detection, Loop Control, Robotic Sensing, Others); End Users (Production Plants, On Board (Parking Assistance, Collision Avoidance System, Others), Food and Beverage (Processed Food, Beverage, Others), Agriculture (Farming Equipment, Smart Agriculture, Others), Metal Processing, General Manufacturing, Cosmetics and Personal Care, Medical and Healthcare (Diagnostics and Screening Equipment, Ultrasonic drug delivery, Ultrasonic surgical tools, Ultrasound therapy, Others)); Region—Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2024–2032

- Last Updated: Aug-2024 | Format:

![pdf]()

![powerpoint]()

![excel]() | Report ID: AA0824895 | Delivery: 2 to 4 Hours

| Report ID: AA0824895 | Delivery: 2 to 4 Hours

Market Scenario

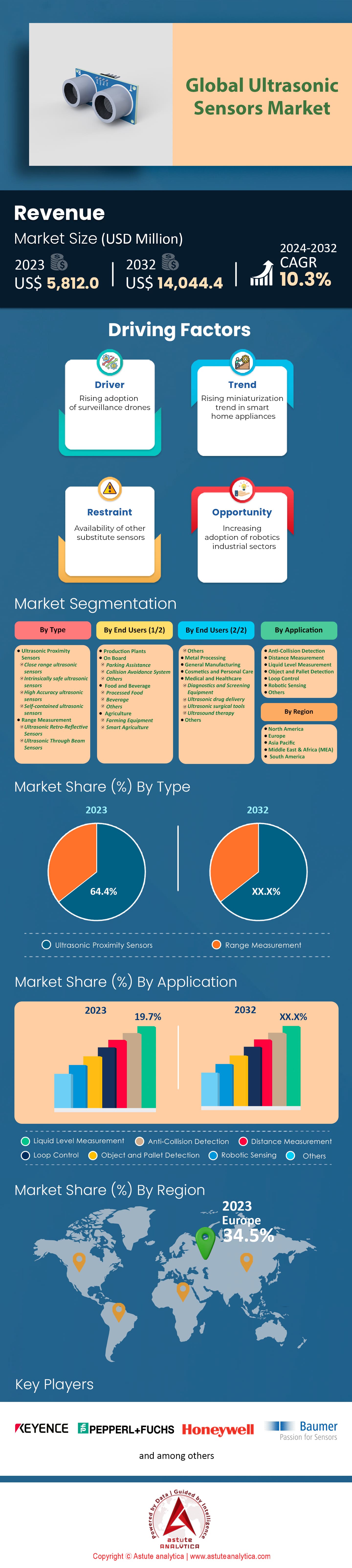

Global ultrasonic sensors market was valued at US$ 5,812.0 million in 2023 and is projected to hit the market valuation of US$ 14,044.4 million by 2032 at a CAGR of 10.3% during the forecast period 2024–2032.

Ultrasonic sensors measure distances using high-frequency sound waves. Their demand is rising due to their versatility and effectiveness across industries. In 2023, over 50 million ultrasonic sensors were sold globally in the automotive sector alone, highlighting their crucial role in advanced driver-assistance systems (ADAS). The growing popularity of autonomous vehicles has significantly increased the need for reliable proximity sensors, enhancing safety and navigation. Additionally, these sensors are prized for their non-contact measurement capabilities, which are vital in environments where physical contact is impractical or dangerous.

The demand for ultrasonic sensors market is driven by their diverse applications. In 2023, approximately 40% of industrial robots deployed globally utilized ultrasonic sensors for precise distance measurement and object detection. They are essential in manufacturing for automating quality control processes, reducing human error, and increasing efficiency. In agriculture, around 15 million ultrasonic sensors were employed to monitor soil moisture and crop health, aiding in precision farming techniques. Key end users include the automotive, agriculture, healthcare, and manufacturing sectors. In healthcare, for instance, ultrasonic sensors are used in medical imaging and diagnostic equipment, with over 5,000 hospitals incorporating these technologies into patient care.

Technological advancements have led to the development of more compact and energy-efficient ultrasonic sensors. In 2023, nearly 30,000 new patent applications related to ultrasonic technology were filed globally, indicating rapid innovation in the ultrasonic sensors market. The Asia-Pacific region, particularly countries like China and India, accounted for approximately 60% of global production, driven by increased industrial automation and infrastructure development. Europe also remains a significant market, with Germany leading in automotive applications, deploying over 8 million sensors in new vehicles. These regions not only generate higher revenue but also offer lucrative growth opportunities due to their focus on technological innovation and industrial advancement.

To Get more Insights, Request A Free Sample

Market Dynamics

Trend: Miniaturization and Enhanced Sensing Range for Diverse Applications and Environments

The trend toward miniaturization in ultrasonic sensors market allows for their application in increasingly diverse environments. As the sensors become smaller, they can be integrated into a wider array of devices, from medical equipment to consumer electronics. For instance, the global market for wearable medical devices, where miniaturized ultrasonic sensors are often employed, reached approximately 40 million units in 2023. In industrial automation, the use of ultrasonic sensors in small-scale robotics has risen, with about 70,000 ultrasonic-based robots being deployed globally. The trend towards compactness is complemented by advancements in sensing range, with modern sensors achieving ranges up to 20 meters, doubling the capacity from five years ago. In healthcare, miniaturized sensors are increasingly used in portable diagnostic tools, with the market for such tools estimated to surpass 15 million units annually. Furthermore, the automotive sector shipped 10 million vehicles equipped with advanced parking assistance systems using miniaturized ultrasonic sensors last year.

This trend is bolstered by the expanding Internet of Things (IoT) ecosystem, which is projected to encompass 50 billion connected devices by 2025, many of which rely on small, efficient sensors. The miniaturization in the ultrasonic sensors market has also facilitated their integration into smart home products, with over 25 million units sold in 2023. In agriculture, precision farming technologies utilizing these sensors have grown significantly, with around 5 million devices currently in use. The development of smart cities is another area benefiting from these advancements, with 1,000 urban areas worldwide implementing smart infrastructure solutions. Finally, consumer electronics, including smartphones with ultrasonic fingerprint sensors, saw over 200 million units shipped last year, underscoring the widespread adoption of miniaturized ultrasonic technology.

Driver: Wide Usage in Food and Beverages Industry for Processing and Hygiene

Ultrasonic sensors market have become pivotal in the food and beverages industry, particularly in processing and hygiene applications. In 2023, approximately 12,000 food processing plants globally utilized ultrasonic sensors for level monitoring in liquid tanks. These sensors are crucial for ensuring hygiene standards, as they allow for non-contact cleaning processes in over 8,000 factories. The adoption of ultrasonic cleaning systems in bottling plants has also increased, with more than 3,500 facilities implementing this technology to ensure contamination-free production. In quality control, ultrasonic sensors are used in over 6,000 facilities to detect air bubbles in packaging, which can compromise product integrity. The use of ultrasonic technology in food slicing and portioning has grown, with around 5,000 systems in operation worldwide.

Moreover, ultrasonic sensors market play a significant role in reducing waste and optimizing resources, with about 15,000 food and beverage companies deploying these sensors to enhance operational efficiency. The demand for real-time monitoring solutions has led to the installation of ultrasonic sensors in approximately 20,000 refrigeration units globally, ensuring consistent temperature control. In the dairy industry, over 4,000 plants have adopted ultrasonic sensors for milk and cream homogenization processes. The trend towards sustainable practices is further driving the use of ultrasonic sensors, with 7,000 facilities implementing them in water conservation systems. Lastly, as consumer demand for transparency in food production grows, ultrasonic sensors are used in traceability applications in 9,000 companies, ensuring product safety from farm to table.

Challenge: Supply Chain Disruptions Affecting Manufacturing and Customer Reach

The ultrasonic sensors market faces significant challenges from supply chain disruptions, which have been exacerbated by global events such as the COVID-19 pandemic. As of 2023, around 15,000 manufacturing firms reported delays in sensor component deliveries, impacting production timelines. These disruptions have led to a backlog of orders, with an estimated 20,000 units on hold due to component shortages. The semiconductor shortage has been particularly acute, affecting over 10,000 electronic component suppliers worldwide and causing a ripple effect in sensor production. Additionally, logistics issues have resulted in an average delivery delay of two months for ultrasonic sensors, affecting approximately 8,000 companies.

The impact on customer reach has also been significant, adding fuel to the ultrasonic sensors market growth . About 5,000 companies reported a decline in their ability to fulfill international orders due to shipping constraints. The increased cost of raw materials has led to a 25% rise in production costs for ultrasonic sensors, affecting 6,000 manufacturers. Furthermore, over 7,000 firms have had to renegotiate contracts with suppliers to accommodate fluctuating prices. The challenge of maintaining inventory levels has resulted in stockouts for 3,000 retailers and distributors. In response, approximately 4,000 companies have invested in diversifying their supply chains to mitigate future disruptions.

Innovations in digital supply chain management are being adopted, with 6,000 businesses implementing AI-driven solutions to improve resilience. Despite these efforts, the global market has seen a reduction in new product launches, with only 2,000 new ultrasonic sensor models released in 2023 compared to previous years. As companies navigate these challenges, collaboration with local suppliers has become essential, with 5,000 firms establishing partnerships to ensure a steady supply of components.

Segmental Analysis

By Type

Ultrasonic proximity sensors are currently leading the ultrasonic sensors market in terms of revenue and accounting for over 64.4% market share due to their extensive application across various industries. The automotive sector is a significant driver, with ultrasonic sensors being integral to Advanced Driver Assistance Systems (ADAS) for obstacle detection and parking assistance. In 2023, the number of ADAS-equipped vehicles reached 120 million worldwide, reflecting the growing reliance on these technologies. The Asia-Pacific region, which generated the highest revenue in the ultrasonic sensor industry, is experiencing rapid growth due to booming automobile production and the expansion of the manufacturing sector. Notably, the region produced 42.2 million vehicles in 2023. Additionally, the market for obstacle detection systems is projected to reach US$ 2 billion by 2032, highlighting the critical role of ultrasonic sensors in modern vehicles. In 2023, 80 million ultrasonic sensors were deployed globally in automotive applications. The demand for automation in industrial processes, driven by the Industry 4.0 initiative, further boosts the adoption of these sensors, with over 100,000 factories worldwide integrating these technologies into their systems.

The popularity of ultrasonic proximity sensors in the global ultrasonic sensors market is also fueled by the increasing adoption of smart home technologies and IoT devices. In 2024, it is estimated that over 200 million smart homes will utilize ultrasonic sensors for various applications. These sensors are extensively used in smart homes for motion detection and monitoring, ensuring security and safety. The Asia-Pacific region, with a significant market presence, is expected to continue its dominance due to government initiatives supporting AI-based robots in surveillance systems. In 2023, more than 50,000 AI-based robotic units were deployed in the region. In the healthcare industry, the demand for better surgical procedures is propelling the market for ultrasonic sensors, with over 10,000 hospitals globally integrating these technologies for enhanced precision. Furthermore, the food and beverage industry relies on these sensors for processing, material handling, and hygiene detection, which are key market drivers, with 15,000 establishments incorporating ultrasonic sensors into their operations. Despite challenges such as limited detection range and susceptibility to environmental factors, the versatility and reliability of ultrasonic proximity sensors in diverse applications solidify their market dominance.

By Application

Based on applications, the ultrasonic sensors market is mainly dominanted liquid level measurement segment due to their high reliability and versatility. In 2023, the segment generated more than 19.7% revenue of the market. These sensors work by emitting ultrasonic pulses that reflect off the liquid surface, allowing the sensor to calculate the distance based on the time it takes for the echo to return. This non-contact method is particularly advantageous in environments where the liquid is corrosive or hazardous, as it avoids direct contact with the liquid. For example, the global adoption of ultrasonic sensors in liquid level applications is driven by their ability to operate effectively in tank depths ranging up to 15 meters, providing accurate readings in large storage facilities. Industries like oil and gas benefit from ultrasonic sensors capable of detecting levels in tanks with capacities of up to 500,000 barrels. The demand for liquid level measurement is driven by the need for accurate monitoring and control in industries such as water management, where sensor systems can handle flow rates of 50 million gallons per day. Additionally, the chemical industry demands sensors that can withstand temperatures up to 150 degrees Celsius, highlighting the robustness of ultrasonic solutions.

The growth in the application in ultrasonic sensors market for liquid level measurement is fueled by several factors. Technological advancements have improved the accuracy and reliability of these sensors, even in challenging environments where temperature and air density can affect sound wave propagation. The increasing emphasis on automation and smart monitoring systems in industries has also contributed to the demand, as ultrasonic sensors can be integrated with IoT systems for real-time monitoring and alerts. In wastewater treatment plants, for instance, ultrasonic sensors monitor water levels in systems processing up to 1 billion liters annually, preventing overflow and ensuring efficient processing. In the chemical industry, they help maintain precise levels of hazardous liquids in tanks typically holding 100,000 liters, enhancing safety and compliance. Another example is in agriculture, where ultrasonic sensors are used in irrigation systems to monitor water levels in tanks with a capacity of up to 10,000 gallons, optimizing water usage and reducing waste. These applications highlight the versatility and critical role of ultrasonic sensors in modern industrial processes, with the global market for these sensors expected to reach shipment volumes of 50 million units annually.

By End Users

Production plants across the globe have emerged as the largest end users of ultrasonic sensors market with market share of over 19%. The dominance of the segment is primarily attributed to their unparalleled ability to enhance efficiency and precision in manufacturing processes. Ultrasonic sensors are pivotal in applications such as level measurement, distance detection, and object recognition, making them indispensable in industries such as automotive, food & beverage, and electronics. The global market saw the automotive manufacturing sector utilizing approximately 1.6 million ultrasonic sensors in 2023 alone. The food & beverage industry, driven by stringent hygiene standards, integrated over 700,000 sensors to ensure non-contact measurement, which is crucial for maintaining sterility and quality. Electronics manufacturing plants, known for their intricate and precise assembly processes, adopted around 500,000 sensors to optimize robotic operations. The demand is further driven by the need for automation, with the robotics sector in production plants consuming about 400,000 sensors to enhance operational accuracy and reduce human intervention. Ultrasonic sensors' ability to function in harsh environments, withstanding temperatures up to 85°C and pressures up to 10 bar, also adds to their appeal.

The demand for ultrasonic sensors market in production plants is likely influenced by several factors, including advancements in Industry 4.0 and the increasing adoption of the Internet of Things (IoT). As of 2023, nearly 2 billion IoT devices were integrated into production plants, creating a robust network where ultrasonic sensors play a vital role in data collection and analysis. The trend towards smart factories, which saw an investment surge of $15 billion this year, emphasizes predictive maintenance and real-time monitoring, both of which rely heavily on the data provided by ultrasonic sensors. Additionally, environmental regulations are pushing for energy-efficient operations, and ultrasonic sensors, consuming only 20 mA in active mode, are favored for their minimal energy consumption. The Asia-Pacific region, home to over 60% of the world's manufacturing plants, saw the highest growth in sensor adoption, driven by countries like China and India, which collectively installed over 2 million units in new and upgraded facilities. This regional growth is expected to continue, with projected investments in automation and sensor technologies reaching $25 billion by 2025.

To Understand More About this Research: Request A Free Sample

Regional Analysis

Europe is the largest ultrasonic sensors market with revenue share of over 34.5%. Europe's prominence is rooted in its advanced industrial and automotive sectors. In 2023, Germany manufactures approximately 20 million ultrasonic sensor units annually, driven by automotive giants like Volkswagen and BMW. France's automotive sector integrates over 3 million ultrasonic sensors yearly into vehicles for safety features. The European healthcare industry utilizes around 5 million ultrasonic sensors in medical devices, particularly for diagnostic imaging. In the industrial sector, Germany deploys approximately 10,000 ultrasonic sensors in factory automation systems. The UK is seeing a rise in smart home installations, with nearly 1 million sensors used in energy-efficient applications. Spain's renewable energy projects employ about 500,000 sensors for monitoring and efficiency. The Netherlands contributes to innovation with around 200 research projects focusing on sensor technology. Italy's automotive sector integrates about 1.5 million sensors annually. Europe's environmental tech industry sees the use of approximately 800,000 sensors in sustainability projects.

In North America ultrasonic sensors market, the United States produces around 15 million ultrasonic sensors annually, with significant contributions from tech companies like Honeywell. The automotive industry installs over 7 million sensors annually in vehicles for advanced driver-assistance systems (ADAS). The industrial sector in the U.S. employs nearly 10,000 sensors in automation processes. In healthcare, approximately 4 million ultrasonic sensors are used in diagnostic imaging equipment. Canada contributes around 500,000 sensors to its smart manufacturing sector. Mexico's automotive industry integrates about 2 million sensors into its vehicle production each year. The U.S. consumer electronics sector utilizes around 3 million sensors in devices such as smartphones and gaming consoles. In research and development, over 150 U.S. projects focus on advancing sensor technologies. The aerospace industry in North America uses approximately 600,000 sensors for navigation and monitoring. The region's environmental monitoring efforts deploy about 400,000 sensors for climate and pollution tracking.

Asia Pacific's ultrasonic sensors market sees China producing around 18 million units annually, largely for industrial and automotive applications. Japan's automotive sector integrates over 6 million sensors into vehicles each year. South Korea's consumer electronics industry utilizes about 4 million sensors in smart devices. In India, approximately 3 million sensors are employed in manufacturing automation. China's healthcare sector uses around 2 million ultrasonic sensors in medical imaging. The region's renewable energy projects deploy about 1.2 million sensors for efficiency monitoring. Japan is involved in over 100 research initiatives focused on sensor technology innovations. In smart city projects, Southeast Asia uses approximately 500,000 sensors for traffic and environmental management. South Korea's robotics industry incorporates about 1 million sensors annually. The Asia Pacific region also sees the integration of around 700,000 sensors in IoT applications across various industries, emphasizing the region's rapid technological advancement.

Top Players in Ultrasonic Sensors Market

- Keyence Corporation

- Pepperl+Fuchs AG

- Honeywell International Inc.

- Baumer Ltd

- Rockwell Automation Inc.

- Murata Manufacturing Co. Ltd

- Omron Corporation

- Sick AG

- Banner Engineering Corp.

- Balluff Inc.

- Robert Bosch GmbH

- Qualcomm Incorporated

- TDK Corporation

- Sensata Technologies

- Denso Corporation

- Other Prominent Players

Market Segmentation Overview:

By Type

- Ultrasonic Proximity Sensors

- Close range ultrasonic sensors

- Intrinsically safe ultrasonic sensors

- High Accuracy ultrasonic sensors

- Self-contained ultrasonic sensors

- Range Measurement

- Ultrasonic Retro-Reflective Sensors

- Ultrasonic Through Beam Sensors

By Application

- Anti-Collision Detection

- Distance Measurement

- Liquid Level Measurement

- Object and Pallet Detection

- Loop Control

- Robotic Sensing

- Others

By End Users

- Production Plants

- On Board

- Parking Assistance

- Collision Avoidance System

- Others

- Food and Beverage

- Processed Food

- Beverage

- Others

- Agriculture

- Farming Equipment

- Smart Agriculture

- Others

- Metal Processing

- General Manufacturing

- Cosmetics and Personal Care

- Medical and Healthcare

- Diagnostics and Screening Equipment

- Ultrasonic drug delivery

- Ultrasonic surgical tools

- Ultrasound therapy

- Others

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- Western Europe

- U.K.

- Germany

- France

- Spain

- Italy

- Rest of Western Europe

- Eastern Europe

- Poland

- Russia

- Rest of Eastern Europe

- Western Europe

- Asia Pacific

- China

- India

- Japan

- Australia & New Zealand

- ASEAN

- Rest of Asia Pacific

- Middle East & Africa (MEA)

- UAE

- Saudi Arabia

- South Africa

- Rest of MEA

- South America

- Argentina

- Brazil

- Rest of South America

View Full Infographic

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

| Report ID: AA0824895 | Delivery: 2 to 4 Hours

| Report ID: AA0824895 | Delivery: 2 to 4 Hours

.svg)