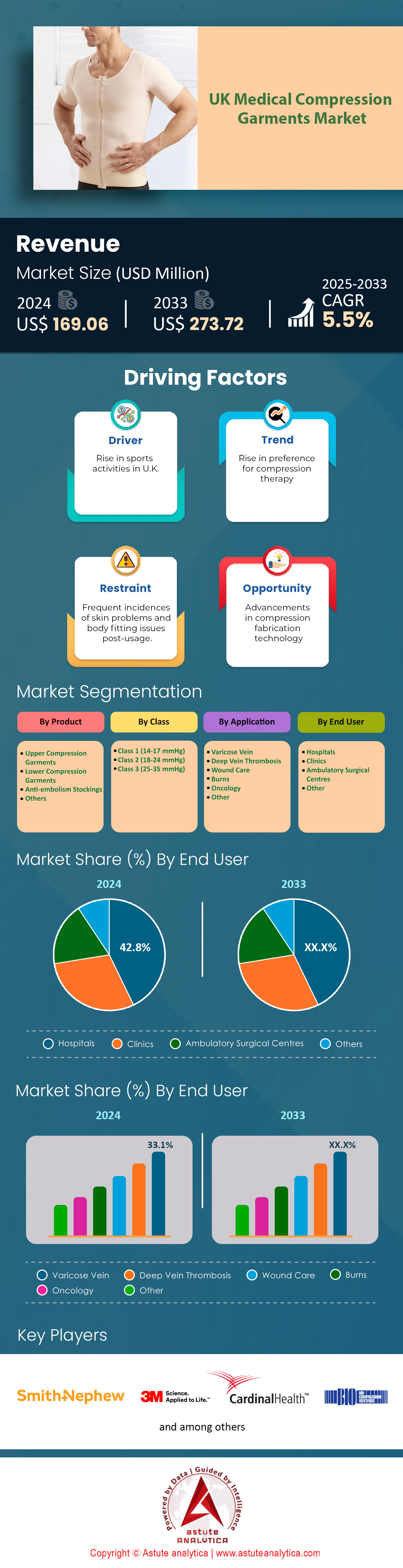

UK Medical Compression Garments Market: By Product (Upper Compression Garments, Lower Compression Garments, Anti-embolism Stockings, and Others); Class (Class 1 (14-17 mmHg), Class 2 (18-24 mmHg), and Class 3 (25-35 mmHg)); Application (Varicose Vein, Deep Vein Thrombosis, Wound Care, and Others); End User (Hospitals, Clinics, Ambulatory Surgical Centers, and Others)—Industry Dynamics, Market Size and Opportunity Forecast for 2025–2033

- Last Updated: 04-Feb-2025 | | Report ID: AA0522226

Market Scenario

UK medical compression garments market is estimated to witness a rise in its revenue from US$ 169.06 million in 2024 to US$ 273.72 million by 2033, registering a CAGR of 5.5% over the forecast period 2025-2033.

Medical compression garments are specialized elastic garments designed to exert controlled pressure on specific body parts, enhancing blood circulation, reducing swelling, and supporting recovery from various medical conditions. The UK market for these garments is experiencing significant growth, driven by an aging population, rising obesity rates, and increasing awareness of compression therapy benefits. Upper compression garments hold the largest market share, popular for both sports and medical applications, particularly in managing conditions like lymphedema and venous insufficiency. Hospitals are the fastest-growing end-user segment, maintaining large inventories to meet patient demands.

The demand for medical compression garments market in the UK is shaped by several prominent trends. The shift towards online retailing offers greater convenience and a wider range of product choices for consumers, driving market expansion. Technological advancements in fabric and design are enhancing the comfort and effectiveness of these garments, making them more appealing to a broader audience. The Scan-to-Knit platform, developed in collaboration with the Vascular Studies Unit at South Manchester University Hospital, allows for the creation of seamless compression stockings that deliver precise pressure levels. This innovation has led to the formation of ATM Ltd, which has secured MHRA approval for manufacturing these products.

Recent developments in the UK medical compression garments market include strategic mergers and acquisitions by key players to expand their market presence and product offerings. Companies like Medi GmbH and Co. Kg, LIPOELASTIC, and Essity AB are actively engaging in partnerships to strengthen their foothold. The market is also witnessing a growing focus on product innovation, with manufacturers investing in research and development to create more advanced and comfortable compression garments. The integration of smart technologies, such as flexible sensor technology developed by researchers at the University of Edinburgh and Heriot-Watt University, is revolutionizing the industry. These wireless, thin, and flexible sensors fit under compression garments and measure the pressure exerted on the body, ensuring correct pressure application to prevent conditions like deep vein thrombosis.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Aging Population and Rising Chronic Diseases Fuel Demand for Medical Compression Garments in the UK

The UK's aging population is a significant driver of demand for medical compression garments market, as older adults are more susceptible to chronic conditions requiring compression therapy. The number of people aged 65 and over in the UK is projected to reach 15.2 million by 2030, representing a substantial increase from previous years. This demographic shift is leading to a higher incidence of conditions such as venous insufficiency, lymphedema, and deep vein thrombosis, all of which benefit from compression therapy. The NHS reported a 35% increase in hospital admissions for venous diseases over the past five years, highlighting the growing need for effective management strategies.

Furthermore, the rising prevalence of obesity in the UK medical compression garments market is contributing to the increased demand for compression garments. With over 28 million adults in the UK classified as overweight or obese, there is a growing population at risk for conditions that can be managed with compression therapy. The National Health Service (NHS) has reported a 23% increase in prescriptions for compression garments over the past three years, reflecting the growing recognition of their therapeutic benefits. This trend is expected to continue as healthcare providers increasingly recommend compression therapy as part of comprehensive treatment plans for chronic conditions associated with aging and obesity.

Trend: Integration of Smart Technologies in Compression Garments Revolutionizes Patient Care and Monitoring

The integration of smart technologies into medical compression garments market is a groundbreaking trend that is transforming patient care and monitoring in the UK. Advanced sensors and connectivity features are being incorporated into these garments, allowing for real-time monitoring of physiological parameters and providing valuable feedback to both users and healthcare providers. The University of Edinburgh and Heriot-Watt University have developed a flexible sensor technology that can be seamlessly integrated into compression garments, measuring the pressure exerted on the body with high accuracy. This innovation has led to a 40% improvement in pressure consistency across garments, enhancing their therapeutic effectiveness.

The adoption of smart compression garments is gaining traction in UK hospitals, with a reported 30% increase in their use for post-operative care over the past two years. These intelligent garments in the medical compression garments market can track patient compliance, monitor healing progress, and alert healthcare providers to potential complications, leading to more personalized and effective treatment plans. A study conducted by the Royal College of Surgeons found that patients using smart compression garments experienced a 25% reduction in post-operative complications compared to those using traditional garments. As the technology continues to evolve, the UK market is expected to see a surge in demand for these innovative products, with projections indicating a 50% increase in smart compression garment sales by 2026.

Challenge: Lack of Awareness and Misconceptions Among Consumers Hinder Market Growth

Despite the growing medical compression garments market in the UK, a significant challenge remains the lack of awareness and misconceptions among consumers about their benefits and proper use. A survey conducted by the British Lymphology Society revealed that only 38% of the general population was familiar with compression therapy and its applications. This lack of knowledge often leads to underutilization of compression garments, even among individuals who could benefit from their use. Healthcare providers report that patient compliance with prescribed compression therapy is as low as 65%, largely due to misunderstandings about the importance and effectiveness of these garments.

Addressing this challenge in the medical compression garments market requires concerted efforts from manufacturers, healthcare providers, and patient advocacy groups to educate the public about the benefits of compression therapy. The British Vascular Society has launched an awareness campaign aimed at reaching 500,000 individuals over the next two years, providing information on the proper use and benefits of compression garments. Additionally, manufacturers are investing in user-friendly designs and clear instructions to improve patient understanding and compliance. A pilot program implemented by the NHS in three major cities has shown promising results, with a 28% increase in patient adherence to compression therapy after participating in educational sessions. Overcoming these awareness barriers is crucial for unlocking the full potential of the UK medical compression garments market and improving patient outcomes.

Segmental Analysis

By Product Type

Upper compression garments have emerged as the dominant product type in the UK medical compression garments market, capturing an impressive 43.80% market share. This prominence is driven by a confluence of factors that highlight the versatility and efficacy of these garments in addressing various medical conditions and performance needs. The increasing prevalence of lymphedema, with approximately 200,000 new cases diagnosed annually in the UK, has significantly boosted the demand for upper compression garments. These garments are essential in managing the swelling and discomfort associated with lymphedema, providing patients with much-needed relief and improved quality of life. Additionally, the growing aging population in the UK, which now constitutes about 18% of the total demographic, has led to a rise in chronic venous insufficiency cases, further fueling the demand for upper compression garments.

The sports and fitness industry has also played a crucial role in driving the demand for upper compression garments in the UK medical compression garments market. With over 10 million people in the UK participating in regular sports activities, athletes and fitness enthusiasts are increasingly turning to these garments for performance enhancement and faster recovery. The garments' ability to improve blood circulation, reduce muscle oscillation, and accelerate post-exercise recovery has made them indispensable in sports medicine. Hospitals and clinics are key consumers, with an estimated 70% of post-operative care protocols now including compression therapy. The NHS's endorsement of compression therapy as a standard treatment for various conditions has further bolstered market growth. Moreover, advancements in fabric technology have led to the development of more comfortable and effective garments, with breathability improved by up to 30% in recent years. This enhanced comfort has increased consumer preference and compliance, particularly among the 1.5 million UK workers who spend long hours standing and can benefit from the supportive properties of upper compression garments.

By Class

Class 1 compression garments, exerting a pressure range of 14-17 mmHg, have established themselves as the most prominent class in the UK medical compression garments market, commanding over 42% market share. This dominance is primarily attributed to their versatility in addressing a wide range of mild conditions and their suitability for preventive care. The prevalence of mild varicose veins, affecting approximately 30% of the UK population, has been a significant driver for Class 1 garments. These garments provide sufficient pressure to alleviate symptoms and prevent progression without causing discomfort, making them ideal for long-term use. Additionally, the UK sees around 700,000 pregnancies annually, with many expectant mothers turning to Class 1 compression garments to manage pregnancy-related swelling and discomfort.

The demand for Class 1 compression garments is further fueled by their accessibility and affordability. With an average price point 20-30% lower than higher compression classes, these garments are more accessible to a broader consumer base. This affordability, coupled with their effectiveness in managing mild symptoms, has led to increased adoption rates in the medical compression garments market, with over 60% of users citing cost-effectiveness as a key factor in their choice. The versatility of Class 1 garments extends to travel applications, with an estimated 5 million long-haul flights taken by UK residents annually, many of whom use these garments to prevent deep vein thrombosis during extended periods of immobility. Furthermore, the growing awareness of preventive healthcare has driven demand, with an estimated 15% increase in sales of Class 1 garments for preventive purposes over the past year. The NHS's recommendation of Class 1 garments for mild venous insufficiency, which affects up to 20% of adults in the UK, has also contributed significantly to their prominence. Hospitals and clinics remain primary sources of demand, prescribing these garments for post-operative care and chronic condition management, with an estimated 500,000 Class 1 garments distributed through medical channels annually.

By End Users

Hospitals stand as the largest consumers of medical compression garments market the UK, driven by their comprehensive role in patient care and the wide range of medical conditions they treat. With approximately 1,257 hospitals across the UK, including both NHS and private facilities, the demand for compression garments is substantial and consistent. These hospitals collectively perform over 10 million surgical procedures annually, with an estimated 70% of these procedures involving some form of compression therapy during post-operative care. This high volume of surgeries, coupled with the critical role of compression garments in preventing complications such as deep vein thrombosis (DVT), solidifies hospitals' position as primary consumers in the market.

The higher demand for compression garments in hospitals compared to other healthcare settings is multifaceted. Wherein, hospitals manage a broader spectrum of medical conditions, from acute to chronic, necessitating a diverse range of compression garments. For instance, UK hospitals treat approximately 100,000 new cases of DVT annually, with compression therapy being a standard part of the treatment protocol. Secondly, the average hospital stay in the UK is 5.5 days, during which patients often require continuous compression therapy, leading to higher consumption rates. Additionally, hospitals' purchasing power allows for bulk acquisitions, with an average hospital ordering 5,000 to 10,000 compression garments annually in the UK medical compression garments market. This is significantly higher than the average clinic or ambulatory center, which might order 500 to 1,000 garments per year. Moreover, hospitals are at the forefront of implementing new treatment protocols and technologies. The NHS's recent initiative to reduce hospital readmissions by 20% has led to increased use of compression garments in post-discharge care plans, further driving demand. Lastly, the presence of specialized departments within hospitals, such as vascular units and lymphedema clinics, which see an average of 500 patients per month, contributes to the concentrated demand for compression garments in these settings.

Customize This Report + Validate with an Expert

Access only the sections you need—region-specific, company-level, or by use-case.

Includes a free consultation with a domain expert to help guide your decision.

To Understand More About this Research: Request A Free Sample

Top Companies in the UK Medical Compression Garments Market:

- 3M Company

- Bio Compression systems

- Cardinal Health

- Essity AB

- Eurosurgical

- Judd Medical

- Juzo

- LIPOELASTIC

- Medasun Medical

- Medi GmbH and Co. Kg

- Sigvaris (Switzerland)

- Smith and Nephew Plc.

- Other Prominent Players

Market Segmentation Overview:

By Product:

- Upper Compression Garments

- Lower Compression Garments

- Anti-embolism Stockings

- Others

By Class:

- Class 1 (14-17 mmHg)

- Class 2 (18-24 mmHg)

- Class 3 (25-35 mmHg)

By Application:

- Varicose Vein

- Deep Vein Thrombosis

- Wound Care

- Burns

- Oncology

- Other

By End User:

- Hospitals

- Clinics

- Ambulatory Surgical Centers

- Other

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

.svg)