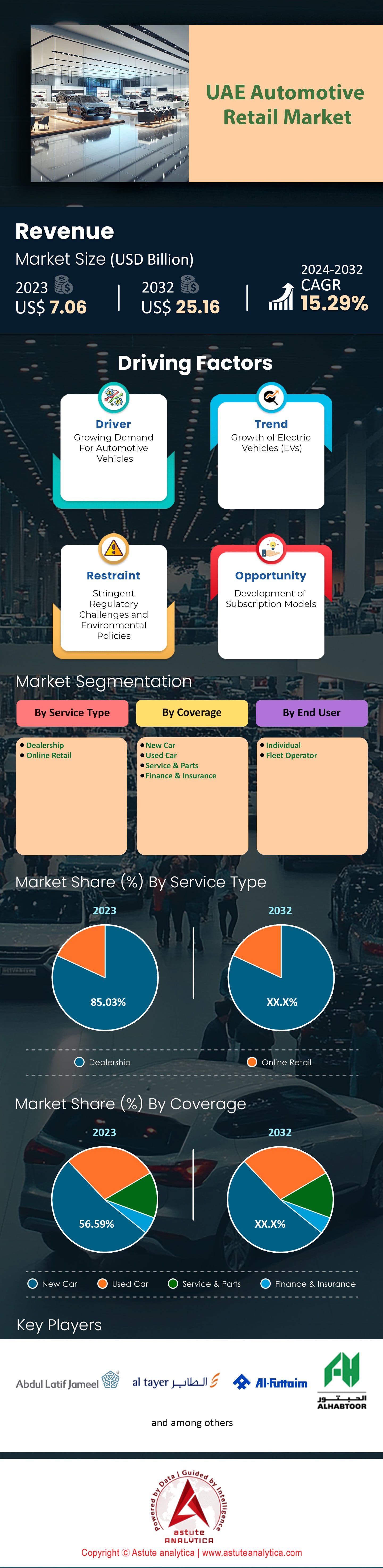

UAE Automotive Retail Market: By Service Type (Dealership and Online Retail); Coverage (New Car, Used Car, Service & Parts, Finance & Insurance); End Users (Individual and Fleet Operator)—Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2024–2032

- Last Updated: Nov-2024 | Format:

![pdf]()

![powerpoint]()

![excel]() | Report ID: AA1124972 | Delivery: 2 to 4 Hours

| Report ID: AA1124972 | Delivery: 2 to 4 Hours

Market Scenario

UAE automotive retail market was valued at US$ 7.06 billion in 2023 and is projected to hit the market valuation of US$ 25.16 billion by 2032 at a CAGR of 15.29% during the forecast period 2024–2032.

The United Arab Emirates is witnessing a remarkable surge in its automotive retail industry, reinforcing its status as one of the leading markets in the Middle East. Annual retail sales have soared to approximately 277,525 units, showcasing a robust consumer demand that significantly contributes around $7.07 billion to the national economy each year. This growth is fueled by the UAE's strategic position as a trade hub, which facilitates the import of a wide variety of vehicles. Post-pandemic economic recovery has played a pivotal role in boosting consumer confidence, leading to increased spending in the automotive sector. The UAE boasts one of the highest vehicle ownership rates globally, with over 540 cars per 1,000 people. This high ownership rate is a testament to the country's affluent lifestyle and the strong purchasing power of its residents.

Luxury vehicles and SUVs are in high demand across the UAE automotive retail market, driven by affluent consumers seeking premium automobiles. Brands like Mercedes-Benz, BMW, and Lexus collectively sell over 80,000 units annually in the UAE. Additionally, the electric vehicle (EV) market is gaining momentum, with sales reaching 10,000 units in 2023. This shift towards EVs is supported by government initiatives promoting sustainable transportation, including a $2 billion investment in EV infrastructure and the development of over 1,000 charging stations nationwide. The automotive industry in the UAE is also embracing digitalization, with online sales platforms facilitating over 30,000 transactions in 2023. This trend towards digital sales is complemented by marketing strategies that focus on personalized customer experiences and comprehensive after-sales services, enhancing brand loyalty.

The UAE's favorable tax environment, characterized by zero income tax and a stable VAT rate of 5%, makes vehicle ownership more accessible and appealing, giving a boost the automotive retail market. This economic backdrop, combined with high disposable incomes averaging $45,000 annually, empowers consumers to invest in both luxury and everyday vehicles.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: High Resident Disposable Income Levels Boosting Automobile Purchases

The UAE is renowned for its high standard of living, underpinned by substantial disposable income among residents. In 2023, the average annual household disposable income reached approximately $45,000 (World Bank, 2023), one of the highest in the region. This financial capacity translates directly into increased spending power in the automotive retail market. The luxury car segment accounts for sales of over 80,000 units annually (Arabian Automobiles Company, 2023), indicating a strong market for premium vehicles. Expatriates, constituting about 88% of the population, contribute significantly to automobile purchases (UAE Statistics Center, 2023). Over 200,000 expatriates earn more than $100,000 annually (Gulf Business, 2023), enabling investment in personal vehicles for convenience and status. The tax-friendly environment, with zero income tax, saves individuals an average of $10,000 annually, allowing allocation toward big-ticket items like automobiles in the automotive retail market.

Car ownership is considered essential due to the climate and lifestyle, with ownership rates surpassing 540 cars per 1,000 people (World Health Organization, 2023). Attractive auto financing options are widespread, with over 70% of car purchases financed through loans (Emirates NBD Bank, 2023). The average auto loan amount has increased to $30,000 (UAE Central Bank, 2023), reflecting confidence in taking on debt for vehicle purchases.

Trend: Electric Vehicles' Popularity Amid Sustainability Initiatives

The UAE's commitment to environmental sustainability is evident in the rising popularity of electric vehicles (EVs). EV sales reached 8,000 units in 2023. The government aims for 30% of vehicles to be electric by 2030 (UAE Energy Strategy 2050). Over 1,000 EV charging stations have been installed nationwide (Abu Dhabi Department of Energy, 2023), including fast-charging stations delivering 150 kW (Tesla UAE, 2023). Incentives in the automotive retail market such as free parking, toll exemptions, and registration fee waivers save EV owners up to $2,700 annually (Gulf News, 2023). Zero customs duties reduce purchase prices by approximately $5,000 (UAE Federal Customs Authority, 2023). Consumer interest is high, with over 70% of residents considering an EV purchase (YouGov UAE, 2023). Over 50 different EV models are available, including Tesla's Model 3 and Audi's e-tron, which sold over 3,000 units collectively (Emirates Electric Mobility, 2023).

Challenge: Competitive Pressures from Neighboring Markets

The UAE automotive retail market faces challenges due to competitive pressures from neighboring countries impacting automobile imports. Imports constitute over 80% of vehicles sold in the UAE (UAE Ministry of Economy, 2023). Saudi Arabia's investment of $1 billion in local automotive manufacturing aims to produce 150,000 vehicles annually by 2025 (Saudi Ministry of Industry, 2023). This development may divert regional demand away from UAE imports. Differences in import tariffs affect vehicle pricing. The UAE imposes a 5% customs duty on imported vehicles (UAE Federal Customs Authority, 2023), while Bahrain offers duty exemptions, making cars cheaper by an average of $2,000 (Bahrain EDB, 2023). Currency fluctuations play a role; the UAE dirham's strength led to an average vehicle price increase of $1,500 compared to Oman (Oman Automobile Association, 2023).

Logistical costs are also a factor. Shipping a vehicle to Kuwait costs $500 less than to the UAE (Maersk Line, 2023). Trade agreements among GCC countries sometimes favor member states, reducing the UAE's competitive edge. These pressures necessitate strategic responses, such as diversifying import sources and enhancing value-added services.

Segmental Analysis

By Service Type

The dealership segment is currently leading the UAE automotive retail market with over 85% market share due to a combination of cultural preferences, regulatory frameworks, and economic factors that favor traditional dealerships over online retail. Over 235,450 new vehicles were sold through dealerships in 2023, highlighting their dominant position. One key factor contributing to the superiority of dealerships over online retail is the consumer's desire for a personalized and tangible buying experience. The UAE boasts over 500 authorized dealerships spread across the country, providing accessible locations for consumers to view and test-drive vehicles. In a market where luxury vehicles are highly sought after—evidenced by over 50,000 luxury cars sold in 2023—the ability to physically experience a car before purchase is paramount. Additionally, dealerships offer comprehensive after-sales services, with more than 200,000 vehicles enrolled in maintenance and service programs in 2023, enhancing customer loyalty and satisfaction.

Regulatory factors also play a significant role in the growth of the UAE automotive retail market. The UAE government enforces stringent regulations on vehicle imports and sales, ensuring that authorized dealerships remain the primary channel for new vehicle distribution. In 2023, the government invested over US$ 500 million in infrastructure supporting automotive dealerships, reinforcing their market position. Moreover, dealerships provide financing options, with the automotive financing market in the UAE valued at over US$ 10 billion in 2023, making vehicle ownership more accessible to consumers. The combination of consumer trust, government support, and comprehensive services solidifies the dominance of dealerships in the UAE automotive retail market.

By Coverage

The new cars segment leads the UAE automotive retail market as a result of strong consumer demand driven by economic prosperity, status considerations, and a preference for the latest automotive technology. In 2023, annual sales of new cars in the UAE surpassed 277,000 units. This far surpasses the revenues generated from used cars, spare parts, and financial services. Higher revenue generation in the new car segment is attributed to the higher average transaction values. The average price of a new car sold in the UAE is around US$ 40,000 in 2023, while used cars average US$ 15,000. The luxury car market is particularly influential, with over 60,000 luxury vehicles sold in 2023. Consumers are inclined to purchase new vehicles to enjoy the latest features, safety technologies, and to reflect their social status—an important cultural aspect in the UAE. The market's growth is further driven by favorable economic conditions; the UAE's GDP is projected to reach US$ 450 billion in 2023, with a per capita income of approximately US$ 43,000.

Looking to the future, the new car automotive retail market is expected to continue its upward trajectory. Projections estimate annual new car sales could surpass 350,000 units by 2025. Factors such as population growth, which reached 10.5 million in 2023, and increasing urbanization support this growth. Additionally, government initiatives promoting electric and hybrid vehicles are gaining traction, with over 5,000 electric vehicles sold in 2023, signaling a shift towards sustainable transportation and opening new avenues for market expansion.

By End Users

In the vibrant landscape of the UAE's automotive retail market, individual consumers stand as the undisputed champions with over 81.84% market share, fueling the engine of demand with their high personal incomes and cultural inclinations. With a remarkable 277,000 new vehicles purchased in 2023, these buyers far outpace fleet operators, who acquired a modest 50,000 vehicles. This trend is powered by the UAE's impressive per capita income of US$ 43,000, which positions a significant portion of the population to indulge in personal vehicle ownership, including high-end luxury models that reflect their success and status. Cars here are not just modes of transport; they are symbols of prestige and personal achievement.

The allure of owning a personal vehicle is further buoyed by enticing financial landscapes in the automotive retail market. The automotive loan market offers accessible financing options that make purchasing a car more feasible for individuals. Complementing this financial accessibility is the UAE’s expansive road network, boasting over 5,000 kilometers of well-maintained highways, and fuel prices that average just US$ 0.65 per liter. Together, these factors create a compelling case for car ownership, reinforcing its practicality in daily life and underscoring its role as a central component of the UAE lifestyle.

Meanwhile, fleet operators face a challenging terrain, with market saturation and the high costs of operation stymieing their growth. The shift in consumer preferences towards ride-sharing, alongside stringent regulatory measures aimed at reducing traffic congestion and enhancing environmental sustainability, has further impeded their expansion. This resulted in fleet operators reducing their new purchases by 5,000 units in 2023 compared to the previous year. As individual buyers continue to dominate the market, driven by economic prosperity and cultural values, this segment is poised to maintain its leadership, steering the UAE automotive market into the future.

To Understand More About this Research: Request A Free Sample

Top Players in UAE Automotive Retail Market

- Al Futtaim Motors

- Al Habtoor Motors

- Al Tayer Group

- Abdul Latif Jameel IPR Company Limited

- Dynatrade Auto Service

- Al Ghandi Auto

- Other Prominent Players

Market Segmentation Overview:

By Service Type

- Dealership

- Online Retail

By Coverage

- New Car

- Used Car

- Service & Parts

- Finance & Insurance

By End User

- Individual

- Fleet Operator

View Full Infographic

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

| Report ID: AA1124972 | Delivery: 2 to 4 Hours

| Report ID: AA1124972 | Delivery: 2 to 4 Hours

.svg)