Tugboat Charter Services Market: By Vessel Type (Harbor (ship-assist) Tugs, Terminal Tugs, Coastal (Sea-going) Tugs, River Tugs and Others); Power (<2000 bhp, 2001-4000 bhp, 4001-6`000 bhp and Others); End Users (Shipping Companies, Port Operators and Others); and Region—Industry Dynamics, Market Size and Opportunity Forecast for 2024–2032

- Last Updated: 05-Nov-2024 | | Report ID: AA0322176

Market Scenario

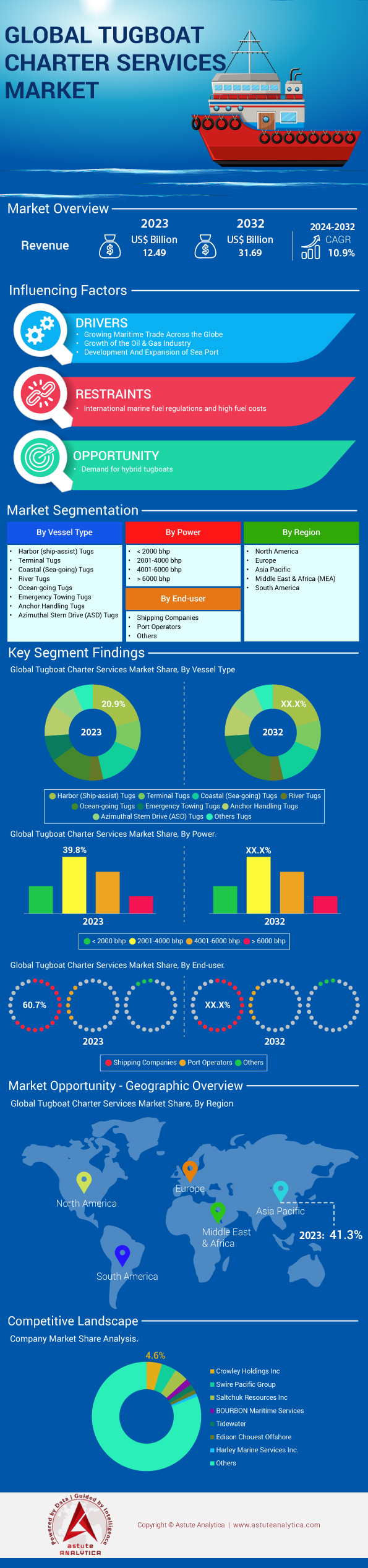

Tugboat charter services market is estimated to witness a rise in its revenue from US$ 12.49 billion in 2023 to US$ 31.69 billion by 2032 at a CAGR of 10.9% over the forecast period 2024-2032.

Tugboat charter services involve renting tugboats for maritime operations such as towing, maneuvering, and escorting larger vessels in ports, harbors, and offshore areas. The demand for these services is rising due to increasing global maritime trade, port infrastructure expansion, and the growth of offshore energy projects. In 2023, global maritime trade volumes are reaching unprecedented levels, necessitating enhanced tugboat services to manage the safe navigation of massive vessels like Ultra Large Container Ships (ULCS) and Very Large Crude Carriers (VLCCs). The construction of new ports and the expansion of existing ones, such as the recent development of Port of Tangier Med II in Morocco, underscore the growth of the tugboat charter services market. Additionally, the offshore wind industry is booming, with over 35 gigawatts of capacity installed worldwide, requiring specialized tugboat services for installation and maintenance.

Vessels heavily used in tugboat charter services market include advanced tugboats equipped with Azimuth Stern Drive (ASD) and Voith Schneider Propeller (VSP) systems, offering superior maneuverability and control. As of 2023, there are over 5,000 ASD tugboats in operation globally. Key end users are port authorities, shipping companies, offshore oil and gas operators, and renewable energy firms engaged in offshore wind projects. The most prominent engine powers in these tugboats range from 3,000 to 7,000 horsepower, enabling them to handle the increasing size of commercial vessels. High-powered tugboats with bollard pulls exceeding 80 tons are increasingly in demand, with more than 200 such vessels operating worldwide. Innovations like the introduction of the world's first autonomous commercial tugboat in Japan highlight the technological advancements in the industry.

Some of the major factors enabling strong growth momentum of the tugboat charter services market include globalization driving increased seaborne commerce, which accounts for over 80% of global trade by volume. Significant investments in port and harbor developments are also propelling the market, with projects like the $10 billion Gwadar Port expansion in Pakistan. Technological advancements are leading to more efficient and environmentally friendly tugboats; for instance, over 100 hybrid and electric tugboats are now in service globally. Stringent environmental regulations, such as the IMO 2020 sulfur cap limiting fuel sulfur content to 0.5%, are pushing operators to adopt cleaner technologies. On a micro level, the integration of digital technologies in fleet management is enhancing operational efficiency, with maritime IoT solutions projected to reach a market value of $15 billion by 2023. The rise of LNG-powered tugboats is another trend, with at least 10 such vessels launched in the past year, reducing emissions significantly.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Surge in Global Maritime Trade Increasing Demand for Tugboat Assistance

The global maritime trade in 2023 has witnessed a significant upswing, substantially impacting the tugboat charter services market. World seaborne trade volumes have surpassed 12 billion tons, marking an increase driven by the rebound of global economies and heightened consumer demand. Container shipping has particularly surged, with global container throughput exceeding 850 million TEUs (twenty-foot equivalent units), a 4% rise from the previous year. The deployment of mega-ships, such as those with capacities over 24,000 TEUs like the "Ever Ace," necessitates more powerful and specialized tugboats for maneuvering and docking procedures. This escalation in vessel size has directly amplified the demand for robust tugboat assistance in major ports worldwide.

Emerging tugboat charter services market have significantly contributed to this surge, with Asia accounting for approximately 60% of global port container traffic. Ports like Shanghai and Singapore have reported a 5% increase in vessel calls, handling over 40,000 ship movements annually. The expansion of port infrastructure, exemplified by the Tuas Megaport in Singapore, projected to handle 65 million TEUs upon completion, underscores the need for enhanced tugboat services. Moreover, the rise in LNG shipments, which reached 400 million tons in 2023, requires specialized tugboats equipped for handling hazardous cargos safely. The increase in crude oil shipments to 2.1 billion tons also elevates the need for escort and towing services. Collectively, these factors have propelled the tugboat charter market, with industry revenues expected to grow by 6% annually over the next five years.

Trend: Adoption of Hybrid and Electric Tugboats for Environmental Compliance

The tugboat charter services market is experiencing a transformative shift towards hybrid and electric propulsion systems, driven by stringent environmental regulations and the pursuit of operational efficiency. The International Maritime Organization (IMO) aims for a 40% reduction in CO2 emissions by 2030, compelling operators to invest in greener technologies. Currently, over 150 hybrid tugboats are operational worldwide, a 25% increase from 2022. Notably, the Port of Auckland introduced "Sparky," the world's first full-sized electric tugboat with a 70-ton bollard pull, contributing to its goal of being zero-emission by 2040. This trend is further evidenced by the Port of Rotterdam adopting five new hybrid tugboats, reducing fuel consumption by 20%.

Port authorities across the tugboat charter services market are incentivizing this adoption through green port fees and preferential docking for eco-friendly vessels. In the United States, the Clean Ports Program allocated $250 million in 2023 for upgrading harbor equipment, including tugboats, to reduce emissions. Additionally, advancements in battery technology have enhanced the viability of electric tugboats, with energy storage capacities increasing by 15% and costs decreasing by 10%. The global market for hybrid and electric tugboats is projected to grow at a CAGR of 12% from 2023 to 2032. This momentum reflects a broader industry commitment to sustainability, with over 50% of new tugboat orders featuring hybrid or electric propulsion.

Challenge: High Operational Costs from Fuel Prices and Maintenance Expenses

Today, tugboat operators are contending with escalating operational costs fueled by surging energy prices and increasing maintenance expenses. Marine fuel prices in the tugboat charter services market have risen sharply, with very low sulfur fuel oil (VLSFO) averaging $650 per metric ton, a 15% increase from the previous year. Fuel constitutes up to 40% of a tugboat's operational costs, and this spike has strained profit margins, leading some operators to implement fuel surcharges or reduce services. For instance, a standard tugboat consuming 2,500 liters of fuel daily now faces an additional $1,000 in daily operating costs compared to 2022.

Maintenance expenses have also climbed due to inflation and supply chain disruptions. The cost of spare parts has increased by 12%, while labor costs have risen by 8% owing to a shortage of skilled marine engineers. Compliance with new environmental regulations requires significant investment in the tugboat charter services market; installing exhaust gas cleaning systems can cost upwards of $1 million per vessel. Moreover, insurance premiums for maritime vessels have increased by 5% due to heightened risks and claims in the industry. These factors collectively challenge operators, particularly smaller companies, threatening the viability of their operations and necessitating strategic adjustments to sustain profitability.

Segmental Analysis

By Vessel Type

Harbor (ship-assist) tugs have solidified their position as the most prominent vessels in the tugboat charter services market as of 2023. It captured more than 20.9% revenue share of the market thanks to exponential growth in global maritime trade, which has significantly increased port traffic worldwide. According to the United Nations Conference on Trade and Development (UNCTAD), international seaborne trade volumes have surpassed 12 billion tons annually. With over 50,000 merchant ships operating globally, the demand for efficient port operations has never been higher. The expansion in the size of vessels, such as mega-container ships capable of carrying over 24,000 TEUs (Twenty-foot Equivalent Units), necessitates the use of powerful harbor tugs for maneuvering within constrained harbor spaces. The Ever Ace, one of the largest container ships launched recently, measures approximately 400 meters in length and requires ship-assist tugs for safe docking and undocking procedures. Additionally, the Port of Shanghai, the world's busiest container port, handled over 47 million TEUs in 2022, highlighting the scale of operations dependent on harbor tugs.

Key primary end users of harbor tugs in the tugboat charter services market include port authorities, terminal operators, and shipping companies that rely on these vessels for safe and efficient harbor operations. Factors influencing the demand for harbor tugs encompass the modernization and expansion of port infrastructure, stricter maritime safety regulations, and the growing emphasis on environmental sustainability. There are over 4,000 active seaports worldwide, many undergoing upgrades to accommodate larger vessels and increased traffic volumes. The global fleet of harbor tugs is estimated to consist of around 18,000 vessels, with new orders being placed to meet rising demand. Technological advancements have led to the introduction of hybrid and electric harbor tugs, with over 100 such vessels currently in operation, contributing to reduced emissions in port areas. The International Maritime Organization (IMO) has implemented regulations, such as the IMO 2020 Sulphur Cap, prompting operators to invest in cleaner and more efficient harbor tugs. The average bollard pull of modern harbor tugs has increased to over 80 tons to handle larger ships effectively. In 2023, the global tugboat market value is estimated at $11 billion, with harbor tugs accounting for a substantial share due to their critical role in port operations.

By Power

Based on power, the tugboat charter services market is notably led by vessels with a power output of 2001–4000 bhp with more than 39.7% market share as these tugboats offer an optimal balance between power and efficiency, making them versatile for a variety of maritime operations. They are powerful enough to handle medium to large vessels yet maintain fuel efficiency important for cost-effective operations. These tugboats are predominantly used in harbor towing, coastal towing, and ship escort services. Types of tugboats in this power range often include the Azimuth Stern Drive (ASD) and Voith Schneider Propeller (VSP) tugboats, both renowned for their superior maneuverability and handling capabilities essential in confined port environments.

Primary end-users of these vessels across the global tugboat charter services market are port authorities, shipping companies, and offshore service providers who require reliable and efficient tug services for docking, undocking, and navigation assistance of large ships. The demand for 2001–4000 bhp tugboats is influenced by the increasing size of commercial ships, necessitating more powerful tugs for safe maneuvering. Additionally, the growth in global maritime trade has led to busier ports, thereby increasing the need for more efficient and capable tug assistance. Technological advancements have also played a role; modern tugboats within this power range are equipped with advanced navigation and propulsion systems, enhancing their operational effectiveness. Environmental regulations pushing for reduced emissions have further driven demand, as newer tugboats are designed to be more environmentally friendly while providing the necessary power output.

By End Users

Shipping companies are currently at the forefront of the global tugboat charter services market with over 60.7% market share thanks to their extensive need for vessel maneuvering and docking assistance. The sheer volume of goods transported by sea has surged in recent years, with the global seaborne trade reaching approximately 12 billion tons in 2023. This massive movement of cargo necessitates efficient port operations, where tugboats play a critical role. Shipping companies require tugboat services for berthing and unberthing operations, escorting vessels through congested or difficult waterways, and ensuring the safety of large cargo ships that cannot navigate port confines independently. Furthermore, the increasing size of modern vessels, some exceeding 400 meters in length, amplifies the demand for powerful tugboat assistance.

Another driving factor behind the dominance of shipping companies in the tugboat charter services market is the expansion of international trade routes and the development of new ports and terminals. In 2023, over 90,000 commercial ships traversed global waters, highlighting the immense scale of maritime activity. Shipping companies are investing in chartering tugboats to enhance operational efficiency and reduce turnaround times at ports. The reliance on tugboats is also linked to stringent safety regulations imposed by maritime authorities, requiring vessels to utilize tug assistance in specific scenarios. Additionally, the growth of specialized shipping sectors, such as LNG transport, which saw shipments exceeding 380 million tons in 2023, underscores the need for tugboats equipped to handle specialized tasks.

Customize This Report + Validate with an Expert

Access only the sections you need—region-specific, company-level, or by use-case.

Includes a free consultation with a domain expert to help guide your decision.

To Understand More About this Research: Request A Free Sample

Regional Analysis

The Asia Pacific region stands at the pinnacle of the global tugboat charter services market, primarily due to its bustling maritime trade activities and the presence of some of the world's largest and busiest ports. In 2023, the region controlled more than 40.6% revenue share of the market. Wherein, countries like China, Singapore, South Korea, and Japan are significant contributors to this dominance. For instance, China's port of Shanghai handled over 43 million TEUs (twenty-foot equivalent units) in 2023, solidifying its position as the busiest container port globally. The high volume of imports and exports in these countries necessitates an extensive fleet of tugboats to manage the dense traffic and ensure the smooth operation of port activities.

The strong growth momentum in the region is driven by industrial expansion, advancing infrastructure projects, and increasing investments in port development. In 2023, Asia Pacific's maritime trade volume surpassed 5.8 billion tons, reflecting its critical role in global shipping and tugboat charter services market. The demand for tugboat charter services correlates with this trade volume, as more vessels require assistance in navigation, berthing, and compliance with stringent safety protocols. Additionally, the emergence of new trade agreements and the Belt and Road Initiative have spurred maritime activities, further augmenting the need for tugboat services.

The region's growth potential remains substantial, with countries like Vietnam and Malaysia emerging as lucrative markets due to their strategic locations and growing port capacities. Vietnam's ports, for example, handled over 700 million tons of cargo in 2023, indicating significant market opportunities. Local players such as PSA Marine in Singapore and Keppel Smit Towage are actively enhancing their fleets and services to meet rising demands. The adoption of advanced tugboat technologies, including hybrid propulsion systems and enhanced navigational tools, positions these companies favorably in catering to modern maritime requirements.

Europe, as the second-largest market, also plays a vital role in the global tugboat charter services market landscape. Countries like the Netherlands, with its port of Rotterdam handling over 15 million TEUs in 2023, and Germany, with significant port activities in Hamburg, contribute to the strong demand for tugboat services. The region focuses on sustainable and efficient port operations, leading to investments in advanced tugboat fleets. European maritime trade, involving over 4 billion tons of cargo in 2023, underscores the significance of tugboat services in facilitating commerce and maintaining the robustness of global supply chains.

Top Companies in Global Tugboat Charter Services Market:

- AMSBACH MARINE (S) PTE LTD.

- BOURBON Maritime Services

- Cheoy Lee Shipyards Ltd.

- Crowley Holdings Inc

- Damen Shipyards Group NV

- DSB OFFSHORE LTD

- Eastern Shipbuilding Group Inc

- Edison Chouest Offshore

- Fr. Fassmer GmbH & Co. KG

- Harley Marine Services Inc.

- Harmony Marine Shipbrokers

- Moran Towing Corporation

- Saltchuk Resources Inc

- SEACOR Marine

- Star Global Agency Pte Ltd.

- Swire Pacific Group

- Tidewater

- Other Prominent Players

Market Segmentation Overview:

By Vessel Type:

- Harbor (ship-assist) Tugs

- Terminal Tugs

- Coastal (Sea-going) Tugs

- River Tugs

- Ocean-going Tugs

- Emergency Towing Tugs

- Anchor Handling Tugs

- Azimuthal Stern Drive (ASD) Tugs

By Power:

- < 2000 bhp

- 2001-4000 bhp

- 4001-6000 bhp

- > 6000 bhp

By End-user:

- Shipping Companies

- Port Operators

- Others

By Region:

- North America

- The U.S.

- Canada

- Mexico

- Europe

- The UK

- Germany

- France

- Italy

- Spain

- Poland

- Russia

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Australia & New Zealand

- ASEAN

- Singapore

- Rest of Asia Pacific

- Middle East & Africa (MEA)

- UAE

- Saudi Arabia

- South Africa

- Rest of MEA

- South America

- Argentina

- Brazil

- Rest of South America

REPORT SCOPE

| Report Attribute | Details |

|---|---|

| Market Size Value in 2023 | US$ 12.49 Bn |

| Expected Revenue in 2032 | US$ 31.69 Bn |

| Historic Data | 2019-2022 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Unit | Value (USD Bn) |

| CAGR | 10.9% |

| Segments covered | By Vessel Type, Power, End-user, and Region |

| Key Companies | AMSBACH MARINE (S) PTE LTD., BOURBON Maritime Services, Cheoy Lee Shipyards Ltd., Crowley Holdings Inc, Damen Shipyards Group NV, DSB OFFSHORE LTD, Eastern Shipbuilding Group Inc, Edison Chouest Offshore, Fr. Fassmer GmbH & Co. KG, Harley Marine Services Inc., Harmony Marine Shipbrokers, Moran Towing Corporation, Saltchuk Resources Inc, SEACOR Marine, Star Global Agency Pte Ltd., Swire Pacific Group, Tidewater, Other Prominent Players |

| Customization Scope | Get your customized report as per your preference. Ask for customization |

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

.svg)