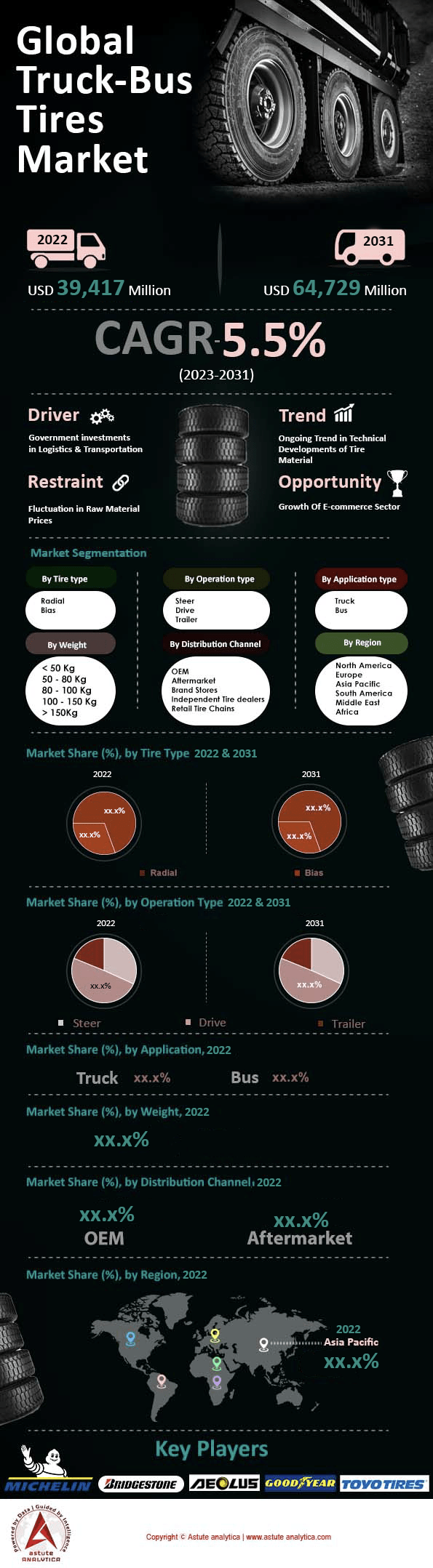

Global Truck and Bus Tires Market: By Tire Type- Radial and Bias; By Operation Type (Steer, Drive and Trailer); Applications (Truck and Bus); Weight (< 50 Kg, 50–80 Kg, 80–100 Kg, 100–150 Kg and > 150Kg); Distribution Channel (OEM and Aftermarket); and Region—Industry Dynamics, Market Size and Opportunity Forecast Until 2031

- Last Updated: 20-Mar-2023 | | Report ID: AA0422202

Market Scenario

The global truck and bus tires market is expected to witness a significant increase in revenue, with an estimated rise from US$ 39,417 Mn in 2022 to US$ 64,729 Mn by 2031. This represents a CAGR of 5.5% during the forecast period of 2023-2031. In terms of volume, the market is expected to register a CAGR of 5.2% over the same period.

The truck and bus tires market has seen significant growth over the past few years, and this growth is expected to continue over the forecast period. One of the major factors contributing to this growth is government investment in logistics and transportation. In many countries, the government is investing in infrastructure projects such as highways and bridges to improve transportation and logistics. For instance, the Indian government has invested $1.4 billion in its "Bharatmala" project, which aims to build highways and other road infrastructure to improve the country's logistics and transportation capabilities. Similarly, the Chinese government's "One Belt One Road" initiative is also expected to drive demand for truck and bus tires.

Another factor contributing to the growth of the truck and bus tires market is the entry of commercial vehicle manufacturers into the market. With the increasing demand for commercial vehicles, major manufacturers are focusing on expanding their market share in the global truck and bus tires market. For instance, in 2020, Bridgestone announced its plans to invest $120 million to expand its truck and bus tire production capacity in Japan, reflecting the growth potential of this market.

Furthermore, the rapid pace of e-commerce and growing industrial sector is leading to an increased demand for logistics, which in turn is driving the growth of the truck and bus tires market. According to a report by the International Transport Forum, the volume of goods transported by road in OECD countries is expected to grow by 50% by 2050.

However, the fluctuation in raw material prices is a challenging factor for tire manufacturers, as they heavily rely on materials such as synthetic rubber, natural rubber, and crude oil. The price of natural rubber, for instance, has been fluctuating due to various factors such as weather conditions, demand-supply dynamics, and government policies. This has a direct impact on the cost of manufacturing tires, which could potentially affect the growth of the market.

Regulations/Standard of Truck & Bus Tire Market

UK Construction and Use Regulations 24 and 27: These regulations allow tires that are identified on the sidewall as "regroovable" to be legally regrooved, whether they are new or retreaded. However, it is a legal requirement that the regrooving must follow the pattern specified by the manufacturer.

UN ECE Regulation 109: This regulation ensures that retreaded tires meet the same standard for structural integrity under endurance testing as new tires. Additionally, retreaded tires must bear the UN ECE type approval mark and the word "RETREAD" on at least one sidewall. The regulation also requires certain sidewall markings on a retreaded tire.

FMSCA and DOT tire regulations code section 393.75 (c): This regulation specifies that tires must have a tread groove pattern depth of at least 2/32 of an inch when measured in a major tread groove. It also includes a provision that measurements cannot be taken "where tie bars, humps, or fillets are located." However, DOT steer tire regulations require a minimum depth of at least 4/32 of an inch. Failure to comply with these regulations may result in the driver being cited.

To Get more Insights, Request A Free Sample

Market Dynamics

Drivers:

Growing Demand for Commercial Vehicles

The demand for commercial vehicles is a major driver for the global Truck and Bus Tires Market. The logistics and transportation industry has witnessed significant growth in recent years, driven by the rise of e-commerce and increasing globalization. This growth has led to a surge in demand for commercial vehicles, which in turn has boosted the demand for Truck and Bus Tires. The expanding industrial sector and infrastructure development are also contributing to the growth of the market.

Government Investments in Infrastructure

Governments in various countries are investing heavily in infrastructure development, including highways, bridges, and ports. These investments are driving the demand for commercial vehicles, which in turn is boosting the demand for Truck and Bus Tires. For example, the Indian government's ambitious infrastructure development plan, Bharatmala, aims to improve the country's road network, which will lead to an increase in demand for commercial vehicles and Truck and Bus Tires.

Restraint:

Fluctuating Raw Material Prices

The global Truck and Bus Tires Market is highly dependent on raw materials such as synthetic rubber, natural rubber, and crude oil. Fluctuations in the prices of these raw materials can significantly impact the production and pricing of Truck and Bus Tires, which can restrain the growth of the market. This creates a challenge for manufacturers, who need to balance production costs while keeping prices competitive.

Trend:

Increasing Adoption of Radial Tires

The trend towards radial tires is one of the significant developments in the global Truck and Bus Tires Market. Radial tires have several advantages over bias tires, such as better fuel efficiency, longer lifespan, and better handling. The rising demand for medium-sized trucks is also driving the growth of the radial tire segment. In addition, technological advancements in tire manufacturing, such as the use of high-strength steel belts and advanced rubber compounds, are further driving the adoption of radial tires.

Focus on Sustainability

The growing focus on sustainability is a trend in the global Truck and Bus Tires Market. Many tire manufacturers are developing sustainable solutions, such as eco-friendly tires, to reduce their environmental impact. For example, Bridgestone has developed a technology that uses natural rubber derived from guayule plants, which reduces the dependence on traditional sources of rubber. Additionally, retreaded tires are becoming increasingly popular, as they reduce the waste generated by discarded tires and are also cost-effective.

Segmental Analysis of Global Truck and Bus Tires Market

By Tire Type

Based on tire type, the radial segment is estimated to have the highest market share and highest CAGR in the global Truck and Bus Tires Market during forecast period owing to the rise in demand for medium-sized trucks.

Radial tires have been gaining popularity in the global Truck and Bus Tires Market due to their superior performance over bias tires. Radial tires dissipate heat better, offer better fuel efficiency, and provide better handling, making them ideal for medium-sized trucks. The increase in the demand for medium-sized trucks globally is expected to contribute significantly to the growth of the radial tire segment in the market. Additionally, radial tires have a longer lifespan compared to bias tires, which further drives their demand in the market.

By Operation Type

The drive segment has contributed the major share in the global Truck and Bus Tires Market in 2022, driven by the rising adoption of Truck and Bus Tires in this segment. Drive tires are designed to provide better traction and grip on the road surface, making them ideal for use in vehicles that require high torque. The trailer segment is expected to project the highest CAGR in the global Truck and Bus Tires Market during the forecast period, driven by the growing demand for trailers in the logistics and transportation industry.

By Application

The truck segment has contributed the major share in the global Truck and Bus Tires Market in 2022, driven by the increasing demand for commercial vehicles globally. The growth of the e-commerce sector and logistics industry has also contributed significantly to the demand for Truck and Bus Tires in this segment. The bus segment is projected to grow at the highest CAGR during the forecast period, driven by the increasing demand for public transportation in urban areas and the growing adoption of electric buses.

By Weight

The 50-80 Kg segment dominated the major share in the global Truck and Bus Tires Market in 2022, driven by the rising demand for these tires for buses and the growing demand for multi-axle vehicles in the market. These tires are designed to provide better grip and handling on the road, making them ideal for use in buses and multi-axle vehicles.

The 80-100 Kg segment is expected to project the highest CAGR in the global Truck and Bus Tires Market over the forecast period, driven by the increasing demand for heavy-duty vehicles and the growing adoption of radial tires in this segment. The 80-100 Kg tires are designed to carry heavy loads and provide better traction and durability on the road surface.

Customize This Report + Validate with an Expert

Access only the sections you need—region-specific, company-level, or by use-case.

Includes a free consultation with a domain expert to help guide your decision.

To Understand More About this Research: Request A Free Sample

Regional Analysis

Asia Pacific is the dominating region in the global Truck and Bus Tires Market in 2022, with a significant share of the market. This can be attributed to the high demand for commercial vehicles in the region, driven by the growth of the logistics and transportation industry, as well as the rise of e-commerce.

The sales volume of medium and heavy commercial vehicles in Asia Pacific reached over 3.9 million units in 2019, with China and India accounting for a significant portion of the sales. In addition, the region is also witnessing significant investments in infrastructure, including highways, bridges, and ports, which is driving demand for commercial vehicles and Truck and Bus Tires.

China is the largest market for Truck and Bus Tires in the region, with a significant share of the market. The country is witnessing significant growth in the logistics and transportation industry, driven by the rapid pace of e-commerce and the increasing demand for commercial vehicles. According to a report by China Briefing, the sales volume of heavy-duty trucks in China reached over 1.15 million units in 2019, representing a growth of 4.4% compared to the previous year.

India is also a significant market for Truck and Bus Tires in the region, driven by the growth of the logistics and transportation industry and the increasing demand for commercial vehicles. According to a report by the Society of Indian Automobile Manufacturers (SIAM), the sales volume of commercial vehicles in India reached over 0.71 million units in 2020, representing a growth of 20.8% compared to the previous year.

Other countries in the region, such as Japan, South Korea, and Indonesia, are also witnessing significant growth in the demand for Truck and Bus Tires, driven by factors such as government investments in infrastructure and the growth of the logistics and transportation industry.

List of Key Companies Profiled:

- Aeolus Tyre

- Bridgestone

- Cheng Shin Rubber

- Continental

- Cooper tire

- Double Coin

- Giti Tire

- Goodyear

- Hankook

- KUMHO TIRE

- Linglong Tire

- Michelin

- Pirelli

- Sumitomo Rubber

- Toyo Tires

- Triangle Tire Group

- Xingyuan group

- YOKOHAMA

- ZC Rubber

- Other Prominent Players

Recent Developments

- Goodyear Acquires Cooper Tire & Rubber Company: In February 2021, Goodyear Tire & Rubber Company announced its acquisition of Cooper Tire & Rubber Company. This acquisition will enable Goodyear to expand its product portfolio and increase its global presence in the tire market.

- Michelin Launches New X Works Tire Range: In January 2021, Michelin launched its new X Works tire range, designed specifically for construction and mining applications. This range of tires offers increased durability and improved resistance to cuts and impacts.

- Bridgestone and Lightyear Partner for Solar-Powered Vehicle: In June 2021, Bridgestone announced its partnership with Lightyear, a Dutch manufacturer of solar-powered vehicles. As part of the partnership, Bridgestone will provide its fuel-efficient tires for Lightyear's solar-powered vehicle, which is expected to launch in 2022.

- Continental Launches Conti Hybrid HT3 Trailer Tire: In April 2021, Continental launched its new Conti Hybrid HT3 trailer tire, designed for long-haul operations. This tire offers improved fuel efficiency and reduced rolling resistance, making it an ideal choice for commercial vehicles.

- Yokohama Launches Geolandar CV G058 Tire: In January 2021, Yokohama launched its new Geolandar CV G058 tire, designed for crossover and SUV applications. This tire offers improved handling and traction, as well as reduced rolling resistance for increased fuel efficiency.

Segmentation Overview

By Tire Type:

- Radial

- Bias

By Operation Type:

- Steer

- Drive

- Trailer

By Applications:

- Truck

- Bus

By Weight:

- < 50 Kg

- 50 - 80 Kg

- 80 - 100 Kg

- 100 - 150 Kg

- > 150Kg

By Distribution Channel:

- OEM

- Aftermarket

- Brand Stores

- Independent Tire dealers

- Retail Tire Chains

By Region:

- North America

- The U.S.

- Canada

- Mexico

- Europe

- The UK

- Germany

- France

- Italy

- Spain

- Russia

- Poland

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Australia & New Zealand

- ASEAN

- Rest of Asia Pacific

- Middle East & Africa (MEA)

- UAE

- Saudi Arabia

- South Africa

- Rest of MEA

- South America

- Argentina

- Brazil

- Rest of South America

FREQUENTLY ASKED QUESTIONS

Most tires, such as those for automobiles and bicycles are pneumatically inflated structures, which also provide a flexible cushion that absorbs shock as the tire rolls over rough features on the surface.

Raw materials such as natural rubber, synthetic rubber, steel and fillers are used in making of a truck tire.

The global truck-bus tires market is studied from 2018-2031.

The segmentations considered to analyze the global truck-bus tires market are based on tire type, operation type, applications, weight, distribution channel and region.

The rising e-commerce sector and supportive functioning of trucks and buses in e-commerce sector are presenting a lucrative opportunity for market expansion.

Asia Pacific region held the major share in terms of revenue, in the global truck-bus tires market in 2022.

A tire is a ring-shaped component that surrounds a wheel's rim to transfer a vehicle's load from the axle through the wheel to the ground and to provide traction on the surface over which the wheel travels.

The growth rate of the global truck-bus tires market is 5.5%, with an estimated value of US$ 64,729 Million by 2031.

Factors such as government investments in logistics & transportation and favorable trade agreements and entry of commercial vehicle manufacturers drives the growth in the global truck-bus tires market.

Fluctuations in raw material prices is a restraining factor which inhibits the growth of the market during the forecast period.

India is expected to project the highest CAGR during the forecast period in the Asia Pacific truck-bus tires market.

The radial segment is estimated to have the largest market share and highest CAGR in the global truck-bus tires market during forecast period owing to the rise in demand for medium-sized trucks.

The key players operating in the market include Aeolus Tyres, Bridgestone Corporation, Cheng Shin Rubber, Continental AG, Cooper Tire, Double Coin, Giti Tire, Goodyear Tire & Rubber Company, Hankook Tire & Technology Co., Ltd., Xingyuan Tire Group, Yokohama Tire Corporation and ZC Rubber among others.

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

.svg)