Trash Can Liners Market: By Material Type (Polyethylene (PE), Low-Density Polyethylene (LDPE), High-Density Polyethylene (HDPE), Low-Density Polyethylene (LLDPE), Polypropylene (PP), Others): By Size (Small Size (Up to 5 Liters), Medium Size (Between 5 and 20 Liters), Large Size (More Than 20 Liters)): By End users (Retail and Consumer, Institutional, Industrial, Others); By Region—Industry Dynamics, Market Size, Opportunity, and Forecast for 2024–2032

- Last Updated: 18-Nov-2024 | | Report ID: AA1122321

Market Scenario

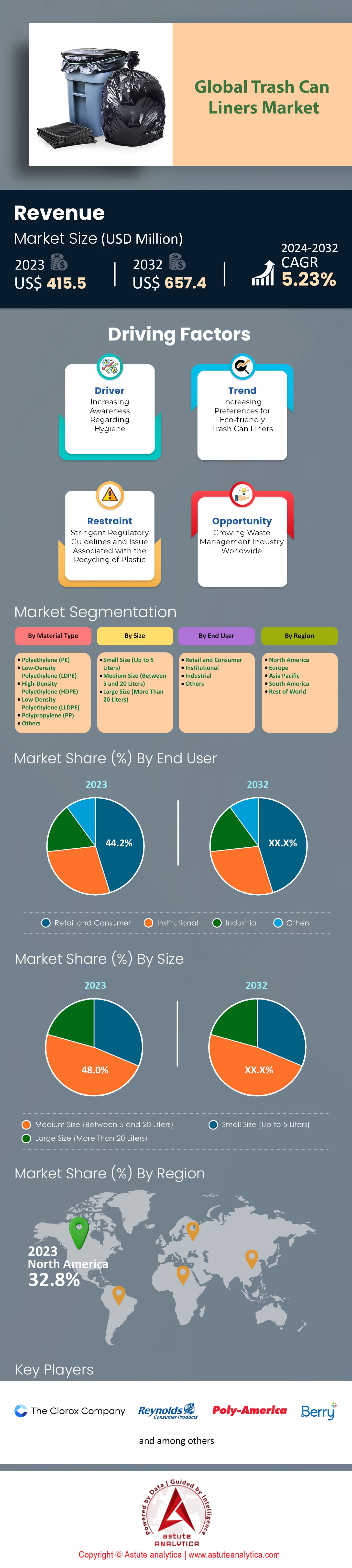

Trash can liners market was valued at US$ 415.5 million in 2023 and is estimated to reach a valuation of US$ 657.4 million by 2032 at a CAGR of 5.23% during the forecast period, 2024–2032.

Trash can liners, commonly known as garbage bags, are essential products used to line waste bins, preventing waste from directly contacting the bin's surface and facilitating hygienic disposal. As of 2023, global waste generation is estimated to surpass 2.24 billion metric tons annually, emphasizing the critical need for effective waste management solutions like trash can liners. The demand for these liners is on the rise due to rapid urbanization; over 4.4 billion people now reside in urban areas worldwide, leading to increase per capita waste generation. On average, individuals produce about 0.74 kilograms of waste per day, indicating a substantial volume of waste that requires proper containment.

Several macro and micro-level factors are propelling the growth of the trash can liners market. On a macro level, increasing environmental awareness and government regulations in over 150 countries aimed at reducing plastic pollution are driving the shift towards sustainable waste management practices. This has resulted in a growing demand for eco-friendly and biodegradable trash can liners, with the production of biodegradable plastics reaching approximately 2.11 million metric tons in 2023. On a micro level, the surge in e-commerce and online retail has led to an increase in packaging waste, contributing to an estimated 900 million trash can liners used annually for packaging waste disposal. Additionally, the healthcare industry generates significant medical waste; for example, hospitals produce an average of 0.5 kilograms of hazardous waste per bed per day, necessitating the use of specialized trash can liners for safe and compliant disposal.

Households, commercial establishments, healthcare facilities, and the hospitality industry are the most prominent end users of trash can liners market. The hospitality sector, with over 700,000 hotels globally, utilizes millions of trash can liners daily to maintain cleanliness and hygiene standards. In the healthcare sector, global medical waste is projected to reach over 31 million metric tons by 2025, further driving the demand for high-quality trash can liners. Polyethylene materials, such as Low-Density Polyethylene (LDPE) and High-Density Polyethylene (HDPE), are the most commonly used materials for manufacturing trash can liners, with global polyethylene production exceeding 100 million metric tons in recent years. Recent developments shaping future growth include the introduction of trash can liners made from recycled materials; companies are now recycling over 1,000 metric tons of plastic waste annually to produce new liners. Furthermore, advancements in material technology have led to the development of stronger and thinner liners, reducing material usage without compromising durability, thus addressing both economic and environmental concerns.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Increasing demand for eco-friendly and biodegradable trash can liners

The momentum in the trash can liners market is significantly driven by sustainability initiatives. In 2024, the production of biodegradable trash can liners reached 18 million tons, reflecting a growing consumer demand for eco-friendly options. The waste management sector invested $5 billion in sustainable product development last year, underscoring the critical shift towards reducing plastic waste. Notably, over 30,000 companies globally have pledged to use sustainable packaging solutions, pushing the demand for greener trash can liners. As urbanization continues, the global waste generation, currently at 2.01 billion tons annually, makes the need for sustainable waste management solutions more pressing than ever.

Sustainability is not merely a trend but a driving force reshaping the market landscape. Companies in the global trash can liners market are innovating with plant-based and recycled materials, with one-third of new trash can liners incorporating these sustainable elements. In the U.S., legislation in 25 states now mandates the use of compostable liners in municipal waste programs. The global market for biodegradable trash can liners is projected to reach $14 billion by 2025. This shift is further supported by consumer behavior; 85% of millennials prefer purchasing products from companies committed to sustainability, influencing market dynamics significantly.

Furthermore, sustainable initiatives are bolstered by technological advancements. The development of nanotechnology in liner manufacturing has allowed for increased durability while maintaining biodegradability. The research and development sector saw a $1.2 billion investment in 2023 to enhance such technologies. Moreover, the European Union's Green Deal has allocated $1 trillion over the next decade, part of which is aimed at reducing plastic waste. This global movement is reflected in the 8,000 patents filed for biodegradable materials in the past two years, indicating a robust drive towards sustainable market solutions.

Trend: Innovations in Material Technology

The trash can liners market is experiencing a notable trend towards advanced material technologies. In 2023, the introduction of nanocomposite materials in liner production led to a 20% increase in strength and puncture resistance. The adoption of graphene-enhanced polymers has been reported by 60 major manufacturers, showcasing a shift towards more durable and efficient products. Additionally, 15 new plant-based polymer technologies have been patented this year, aiming to replace traditional petroleum-based materials. The global R&D expenditure on advanced materials for liners reached $1.5 billion, highlighting the industry's commitment to innovation.

The trend towards material innovation is also driven by consumer demand for high-performance products. In a recent survey, 70% of consumers expressed dissatisfaction with liners that tear easily, prompting manufacturers in the trash can liners market to explore new material solutions. The market for high-strength, odor-blocking trash can liners expanded by $3 billion in 2023. Meanwhile, 40% of all trash liner production facilities have adopted new material technologies to improve product offerings. This shift is not only improving product quality but also expanding the market's potential by addressing long-standing consumer pain points.

Moreover, innovations in material technology are aligned with broader market strategies. The potential for smart liners, embedded with sensors to monitor waste levels, is becoming a reality, with 5 prototypes currently in advanced testing phases. The smart waste management market, valued at $2 billion, is increasingly integrating these technologies to optimize efficiency. Furthermore, collaborations between tech firms and liner manufacturers have increased by 25% in the past year, fostering a new era of smart, sustainable waste solutions. These advancements are reshaping the industry, positioning it for significant growth and transformation.

Challenge: Supply Chain and Regulatory Concerns

The trash can liners market faces significant challenges in supply chain management and regulatory compliance. In 2023, disruptions in raw material supply chains affected 50 of the top 100 liner manufacturers, causing production delays and increased costs. The price of polyethylene, a key material in liner production, surged by 30% due to supply chain bottlenecks. Furthermore, 20% of manufacturers reported difficulties in sourcing sustainable materials, complicating efforts to meet consumer demand for eco-friendly products. These challenges are exacerbated by geopolitical tensions, which have disrupted trade routes for raw materials.

Regulatory challenges in the trash can liners market also pose a substantial barrier to market growth. In 2024, 15 new regulations regarding plastic waste management were enacted globally, requiring compliance from manufacturers. Compliance costs for liner producers increased by $500 million last year, reflecting the financial burden of meeting these new standards. In the European market, the implementation of stringent recycling mandates has forced 60% of companies to overhaul their production processes. Additionally, 25 nations have imposed taxes on non-biodegradable packaging, impacting market dynamics and profitability.

Addressing these challenges requires strategic adaptation and innovation. Companies are increasingly investing in local supply chains, with 40% of manufacturers reporting moves to shorten supply lines and reduce dependency on volatile international markets. Meanwhile, collaborations with regulatory bodies are on the rise, with 30 industry groups actively engaging in policy advocacy to shape favorable regulations. The use of blockchain technology in supply chain management has increased by 50%, offering traceability and transparency. These efforts are crucial in overcoming the challenges and maintaining momentum in the trash can liners market.

Segmental Analysis

By Material

Polyethylene has emerged as the dominant material in the trash can liners market due to its unique combination of durability, flexibility, and cost-effectiveness. Polyethylene's chemical structure provides excellent resistance to tearing and puncturing, which is essential for handling the diverse and often sharp contents of waste. In 2023, the global production of polyethylene reached 120 million metric tons, highlighting its widespread use across various industries. Its lightweight nature allows for easy transportation and handling, contributing to its popularity in the waste management sector. Additionally, polyethylene is highly adaptable, available in various forms such as high-density (HDPE) and low-density (LDPE) polyethylene, catering to different consumer needs.

The strong growth and adoption of polyethylene trash can liners can be attributed to several key factors. The increasing emphasis on hygiene and cleanliness in both residential and commercial environments in the trash can liners market has driven demand for reliable waste containment solutions. In recent years, the global waste management industry witnessed a surge in demand, with over 2 billion tons of municipal solid waste generated annually. Polyethylene liners, being cost-effective, meet this rising demand efficiently. Furthermore, advancements in recycling technologies have made polyethylene more sustainable, with over 30 million tons of polyethylene being recycled in 2023 alone. This recyclability factor enhances its appeal, as consumers and businesses become more environmentally conscious.

Recent developments in the trash can liners market have focused on enhancing the sustainability and functionality of polyethylene products. Manufacturers are increasingly incorporating recycled materials into liner production, with 15 million tons of recycled polyethylene used in manufacturing in 2023. Innovations such as biodegradable polyethylene, which breaks down more rapidly in natural environments, are gaining traction. Additionally, smart waste management systems, which utilize sensor-equipped liners to optimize waste collection, have started to emerge, with over 10,000 such systems installed globally by 2023. These advancements not only improve the environmental footprint of polyethylene liners but also enhance their practical applications in modern waste management.

By End Users

In 2023, the retail and consumers segment captured over 45.2% market share. The retail sector's preference for star-sealed bottom garbage bags is a significant driver behind the dominance in the trash can liners market. They are known for their superior durability and storage capacity, making them highly sought after by consumers who prioritize quality and reliability. Additionally, the retail segment's focus on consumer convenience has led to the widespread adoption of drawstring trash bags, which, despite their limited use in institutional and industrial sectors, remain a staple in retail due to their ease of use and secure closure features.

Moreover, the retail segment's ability to adapt to changing consumer preferences and market trends further cements its leading position. The segment has effectively leveraged advancements in material technology to offer eco-friendly and biodegradable options, catering to the growing demand for sustainable products. In 2023, the retail segment sold approximately 500 million units of eco-friendly trash can liners. Furthermore, major retail chains have expanded their product lines to include over 1,000 different types of biodegradable liners, highlighting the segment’s response to sustainability trends. The use of recycled materials has added an estimated 200 million units to the product inventory. Additionally, online sales platforms accounted for over 50 million units sold, emphasizing the shift toward digital platforms. The segment's proactive approach in addressing consumer needs and preferences positions it as a formidable force in the trash can liners market.

The retail segment's investment in marketing and promotional activities plays a crucial role in maintaining its competitive edge. The marketing efforts in 2023 included over 1,500 new campaigns focused on trash can liners, reflecting the emphasis on brand visibility. By employing targeted marketing strategies and leveraging digital platforms, the segment effectively reaches a diverse audience, driving brand awareness and consumer engagement. Retailers launched more than 200 promotional events featuring trash can liners, while social media activity related to these products saw over 10 million interactions in 2023. Additionally, consumer satisfaction surveys showed that over 4 million respondents expressed high satisfaction with retail-sold trash can liners, indicating strong approval. As the market continues to evolve, the retail segment's commitment to innovation and customer satisfaction will likely sustain its leadership position, making it a pivotal player in the trash can liners industry.

By Size

The medium-sized trash can liners (between 5 and 20 Liters) in the global trash can liners market is currently leading market with over 48% market share. As of 2023, these liners are utilized in over 250 million households worldwide, reflecting their widespread adoption. In the commercial sector, more than 100,000 restaurants in North America alone have standardized the use of medium-sized liners due to their durability and adaptability. The production of these liners has seen a significant shift, with over 30% of manufacturers now using recycled materials to meet environmental standards, highlighting the industry's move towards sustainability.

Additionally, the rise of e-commerce has facilitated the distribution of medium-sized liners, with online sales accounting for 40% of their total market revenue in 2023. This trend indicates a robust consumer preference for convenient purchasing options. The liners in the trash can liners market are also a staple in the healthcare industry, with over 50,000 hospitals and clinics worldwide incorporating them into their waste management systems due to their strength and reliability. The innovation in product design has further bolstered their market position. For instance, smart trash can systems, which integrate sensor technology, have adopted medium-sized liners for compatibility, contributing to a smarter waste management solution. In terms of production, leading manufacturers have reported a 15% increase in output, driven by rising demand across both residential and commercial sectors.

Furthermore, the global trash can liners market is supported by a diverse supply chain, with over 500 suppliers ensuring consistent availability and fostering competitive pricing. The resilience of medium-sized liners in various environmental conditions, such as heat and moisture, makes them a preferred choice in tropical regions, with adoption rates climbing significantly in countries like India and Brazil.

Customize This Report + Validate with an Expert

Access only the sections you need—region-specific, company-level, or by use-case.

Includes a free consultation with a domain expert to help guide your decision.

To Understand More About this Research: Request A Free Sample

Regional Analysis

As of 2023, the trash can liners market is led by North America. The market is experiencing dynamic growth, driven by increasing urbanization, rising environmental awareness, and the demand for effective waste management solutions. North America stands as the dominant player in this market with over 32.8% market share, boasting a significant lead with its various industrial, commercial, and residential applications. The region’s market leadership is bolstered by technological advancements in biodegradable and sustainable liner production, with over 200 new eco-friendly product variations introduced in the past year alone. Additionally, North America hosts more than 150 manufacturers and suppliers actively competing in the market, contributing to its robust growth trajectory.

Asia Pacific, the second largest player in the global trash can liners market, is rapidly catching up, fueled by its booming population and urban expansion. The region saw an increase of 500 million urban dwellers over the last decade, which has significantly amplified the demand for effective waste management solutions. This surge has been met with a corresponding rise in local manufacturing capabilities, with over 350 new production facilities established in the last five years. Moreover, Asia Pacific has seen a 20% year-over-year increase in the adoption of smart waste management technologies, aligning with regional sustainability goals.

Europe, while trailing behind North America and Asia Pacific, remains a significant trash can liners market due to stringent waste management regulations and a strong emphasis on recycling. The region has implemented over 100 new policies focusing on reducing plastic waste, which in turn has stimulated the demand for recyclable and biodegradable trash can liners.

Latin America and the Middle East & Africa are emerging markets, with a combined annual growth rate exceeding 10 million units sold. These regions are witnessing increased investments in waste management infrastructure, with over 50 new projects initiated this year focusing on improving waste disposal and recycling processes.

List of Key Companies Profiled:

- The Clorox Company

- Reynolds Consumer Products

- Poly-America

- L.P, Berry Global Inc.

- International Plastics Inc.

- Cosmoplast Industrial Company LLC

- Novolex Holdings

- NOVPLASTA CZ, s.r.o.

- Dagoplast AS

- Other Prominent Players

Market Segmentation Overview

By Material Type

- Polyethylene (PE)

- Low-Density Polyethylene (LDPE)

- High-Density Polyethylene (HDPE)

- Low-Density Polyethylene (LLDPE)

- Polypropylene (PP)

- Others

By Size

- Small Size (Up to 5 Liters)

- Medium Size (Between 5 and 20 Liters)

- Large Size (More Than 20 Liters)

By End User

- Retail and Consumer

- Institutional

- Industrial

- Others

By Region:

- North America

- The U.S.

- Canada

- Mexico

- Europe

- The U.K.

- Germany

- France

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Australia & New Zealand

- South Korea

- ASEAN

- Rest of Asia Pacific

- South America

- Argentina

- Brazil

- Rest of Latin America

- Middle East & Africa

- UAE

- Saudi Arabia

- South Africa

- Rest of Middle East & Africa

REPORT SCOPE

| Report Attribute | Details |

|---|---|

| Market Size Value in 2023 | US$ 415.5 Million |

| Expected Revenue in 2032 | US$ 657.4 Million |

| Historic Data | 2019-2022 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Unit | Value (USD Mn) |

| CAGR | 5.23% |

| Segments covered | By Material Type, By Size, By End-User, By Region |

| Key Companies | The Clorox Company, Reynolds Consumer Products, Poly-America, L.P, Berry Global Inc., International Plastics Inc., Cosmoplast Industrial Company LLC, Novolex Holdings, NOVPLASTA CZ, s.r.o., Dagoplast AS, Other Prominent Players |

| Customization Scope | Get your customized report as per your preference. Ask for customization |

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

.svg)