Global Tour Operator Software Market: By Offering (Software and Services); Module (Booking/Reservation Management, Inventory Management, Payment Processing, CRM (Customer Relationship Management), Back-office Management; and Accounting Management); Deployment mode (SaaS and Web Based); Enterprise Size (SMEs and Large Enterprises); End Users (International Tour Operators, and Domestic Tour Operators); Region —Market Forecast and Analysis for 2024–2032

- Last Updated: 13-May-2024 | | Report ID: AA0723539

Market Scenario

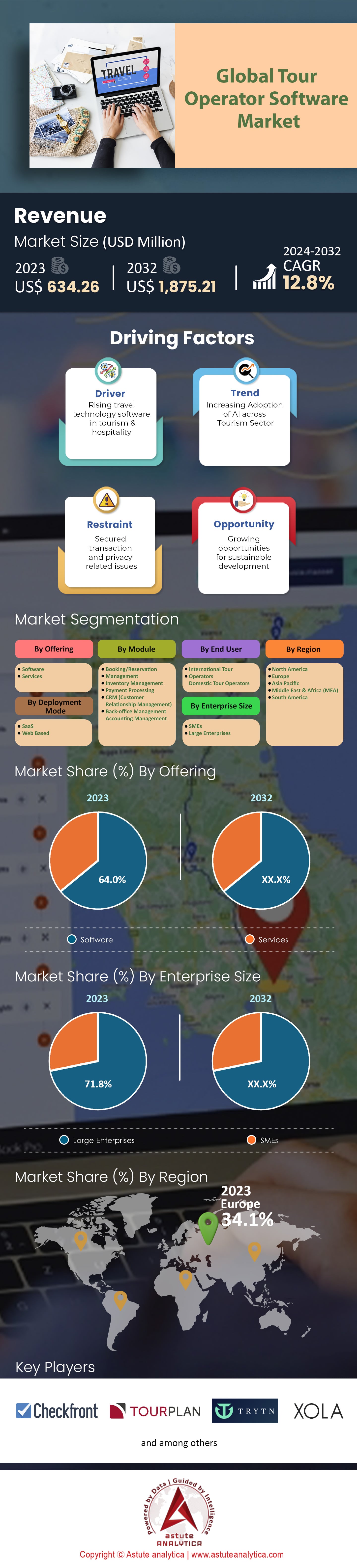

The global tour operator software market was valued at US$ 634.26 million in 2023 and is projected surpass the market size of US$ 1,875.21 million by 2032 at a CAGR of 12.8% during the forecast period 2024–2032.

The tour operator software market has undergone significant evolution in the recent years, driven by increasing digitalization and changing consumer behaviors. As the travel and tourism industry gravitates towards personalized experiences, tour operator software solutions have emerged as a bridge between consumers and memorable travel experiences. The growth landscape of this market has been marked by growing demand for integrated solutions that can manage reservations, customer relationships, and back-office operations seamlessly. With the proliferation of online platforms such as AirBNB, MakeMyTrip, and Booking.com, the role of traditional travel agents has been diminishing, creating a fertile ground for software solutions that bring efficiency and agility to travel planning and execution processes. From solo travelers to large travel groups, the reliance on digital tools for researching and booking holidays has increased manifold, making it imperative for tour operators to adopt these platforms.

The global tour operator software market is witnessing a rapid integration of artificial intelligence and machine learning for personalized trip recommendations and predictive analytics. This personalization trend is gaining momentum as more consumers seek unique travel experiences tailored to their preferences. Additionally, the growing emphasis on sustainable tourism is influencing software providers to incorporate features that promote eco-friendly travel choices.

Today’s consumers, especially millennials and Gen Z, prefer a DIY approach to travel planning, heavily relying on reviews, ratings, and online resources. They seek transparency, customization, and instant gratification, all of which can be addressed by robust tour operator software. Moreover, data privacy regulations, for instance, necessitate software solutions that prioritize user data security. Also, countries promoting tourism might offer incentives for software developers to create solutions that enhance tourist experiences and elevate their country's global standing as a preferred destination.

In the years to come, the tour operator software market likely to offer promising growth. As virtual and augmented reality technologies mature, there's potential for their integration, offering users immersive travel previews. Additionally, with global connectivity improving, even remote destinations are now accessible, further broadening the market for software solutions catering to niche travel experiences.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Rise of Mobile Commerce in the Travel Industry

The rise of mobile commerce, also known as m-commerce, has had a profound impact on the global tour operator software market. With smartphones becoming nearly ubiquitous, travelers have increasingly embraced the convenience and flexibility of planning, booking, and managing their trips through mobile devices. As a result, the demand for tour operator software that offers seamless mobile experiences has surged.

Recognizing this paradigm shift, software developers in the travel industry have prioritized creating mobile-responsive designs and dedicated apps. These mobile platforms offer numerous advantages to travelers, including real-time updates on travel-related information, push notifications for exclusive deals or last-minute changes, and integrated features like interactive maps and access to local activities. The integration of digital wallets and simplified payment methods within mobile apps has further streamlined the booking process, elevating the overall user experience.

The growing preference for mobile solutions among consumers has put immense pressure on tour operators to adapt and offer robust mobile platforms. This adaptation has led to a significant expansion in the tour operator software market. By catering to the needs of modern travelers who seek quick, accessible, and user-friendly options, the mobile commerce trend has become a driving force behind the industry's growth and evolution.

Trend: Incorporation of Augmented and Virtual Reality (AR/VR)

One of the most exciting and innovative trends in the tour operator software market is the incorporation of augmented and virtual reality technologies (AR/VR). These cutting-edge technologies have opened up new possibilities for prospective travelers, providing them with immersive experiences and a unique "try before you buy" approach.

With AR/VR integration, users can virtually "walk through" their chosen accommodations or get a 360-degree view of popular tourist destinations before making a booking decision. This level of interactivity empowers travelers to make more informed choices and eliminates any uncertainty about their travel arrangements. As a result, the incorporation of AR/VR technologies has become a distinguishing factor for tour operator software providers in a competitive landscape.

The appeal of AR/VR technology is particularly strong among tech-savvy travelers who are eager to embrace novel and futuristic experience in the global tour operator software market. As these technologies continue to advance and become more affordable, their prevalence within tour operator platforms is expected to rise significantly. This, in turn, will give market players a competitive edge and attract a broader audience of travelers seeking enhanced and personalized travel experiences.

Restraint: Data Security and Privacy Concerns

While the digitalization of the travel industry has brought remarkable convenience, it has also given rise to data security and privacy concerns. In the tour operator software market, travelers share a wealth of personal information during the booking process, ranging from contact details to sensitive payment information. Any compromise in data security could have severe repercussions, both in terms of financial losses and damage to a software provider's reputation.

The implementation of data protection regulations, such as the General Data Protection Regulation (GDPR) in the European Union, has further heightened the need for tour operator software providers to prioritize data security in the global tour operator software market. Compliance with such regulations demands robust security infrastructure and stringent measures to safeguard user data. However, implementing these measures can be resource-intensive, particularly for emerging players in the market with limited capital and resources.

As data breaches continue to pose a significant threat, tour operator software providers must invest in state-of-the-art security solutions to maintain their customers' trust. Balancing the demand for seamless user experiences with the need for data protection remains a critical challenge for the industry, and how companies address this restraint will play a crucial role in shaping the market's future trajectory.

Segmental Analysis

By Module:

The global tour operator software market is highly diverse and can be segmented based on different modules that cater to various aspects of tour management and customer experience. One of the most significant modules in this market is booking/reservation management. In 2023, the segment contributed over 35.1% share of the market. This module plays a crucial role in the day-to-day operations of tour operators as it enables them to efficiently manage bookings and reservations from customers. By leveraging booking/reservation management software, tour operators can ensure a smooth and seamless experience for travelers, reducing the chances of overbooking or scheduling conflicts. This not only enhances customer satisfaction but also improves the overall efficiency of the tour operator's business.

Another critical module in the tour operator software market is payment processing. While it currently holds a smaller market share, it is expected to witness rapid growth in the forecast period. As digital payment methods continue to gain popularity, tour operators are increasingly recognizing the importance of efficient and secure payment processing systems. Offering a seamless payment experience to customers is essential as it not only instills trust but also positively impacts the overall success and reputation of a tour operator business. By integrating secure and diverse payment options, tour operators can cater to the preferences of their customers, resulting in improved customer loyalty and repeat bookings.

By Deployment Mode:

The deployment mode of tour operator software is a crucial consideration for businesses in the industry. Software-as-a-Service (SaaS) is dominating the global tour operator software market and holds a substantial share of 57.2% in 2023. The popularity of SaaS can be attributed to its flexibility, affordability, and ease of implementation. SaaS solutions allow tour operators to access the software from any location with an internet connection, eliminating the need for complex on-premise infrastructure. Moreover, SaaS providers often offer seamless updates and maintenance, reducing the burden on tour operators' IT teams and allowing them to focus on core business operations. This accessibility and convenience make SaaS a preferred choice for many tour operators, enabling them to adapt quickly to changing market demands and offer enhanced services to their customers.

By End User:

The end-user segment of the tour operator software market is divided into international tour operators and domestic tour operators. Domestic tour operators held the largest market share of 70% in 2023, reflecting the significance of the local tourism industry. These operators specialize in offering travel experiences within their own country or region and play a crucial role in promoting local tourism. The strong market presence of domestic tour operators is often driven by their in-depth knowledge of the local destinations and their ability to provide unique and culturally immersive experiences to travelers.

On the other hand, international tour operators in the global tour operator software market are projected to experience substantial growth during the forecast period, indicating an increasing global interest in travel and tourism. With travelers seeking to explore new destinations and cultures around the world, international tour operators have the opportunity to capitalize on the expanding market by providing diverse and comprehensive travel packages.

While international tour operators are set to grow, domestic tour operators are also expected to witness steady growth, driven by a rising demand for both local and international travel experiences. As the preferences of consumers diversify, tour operators catering to different segments of the market stand to benefit from this trend.

By Enterprise Size:

Enterprise size plays a pivotal role in shaping the dynamics of the tour operator software market. Small and medium-sized enterprises (SMEs) are witnessing the highest CAGR during the forecast period. SMEs have distinct advantages, including agility, adaptability, and the ability to cater to niche markets. Their smaller size allows them to be more responsive to market changes and emerging trends, enabling them to offer personalized and unique travel experiences to their customers. Additionally, the cost-effective operations of SMEs make them an attractive choice for travelers seeking tailor-made and more intimate travel experiences.

However, large enterprises have historically dominated the market, capturing over 71.8% of the market share in 2023. These established players often have the financial resources and infrastructure to invest in advanced tour operator software solutions, allowing them to offer a wide range of services and expand their market presence. Large enterprises usually have well-established brand recognition, customer bases, and global networks, giving them a competitive advantage in attracting a broader audience across the global tour operator software market. Nevertheless, they face challenges in being as agile and innovative as SMEs, making it essential for them to continuously adapt to the changing demands and preferences of modern travelers.

Customize This Report + Validate with an Expert

Access only the sections you need—region-specific, company-level, or by use-case.

Includes a free consultation with a domain expert to help guide your decision.

To Understand More About this Research: Request A Free Sample

Regional Analysis

The Asia Pacific region is poised to experience remarkable growth in the tour operator software market, with an estimated CAGR of 13.4%, the highest among all other regions. This surge in growth indicates a robust and dynamic market with significant potential for software providers and tour operators alike. During the period between 2024 and 2032, the Asia Pacific region presents an opportunity of more than US$ 315 million, making it a highly opportunistic market.

Europe closely follows as another region with substantial growth potential, with an opportunity of US$ 311 million during the same period. Both Asia Pacific and Europe boast the highest number of travelers from around the world, making them key players in the global tourism landscape. The popularity of these regions as travel destinations contributes significantly to the traction experienced in the tour operator software market.

The Asia Pacific region's rapid growth can be attributed to several factors. Firstly, the region is home to a diverse range of countries, each offering unique cultural experiences and breathtaking landscapes, attracting travelers from all corners of the globe. The rising disposable income and expanding middle-class population in many Asia Pacific countries have also contributed to an increase in domestic and international travel, boosting the demand for efficient and reliable tour operator software.

Furthermore, advancements in technology and internet penetration have revolutionized the travel and tourism industry in the Asia Pacific region. With the increasing adoption of smartphones and access to online platforms, travelers seek seamless and personalized travel experiences, which tour operator software can deliver. These software solutions enable tour operators to manage bookings, reservations, itineraries, and payments efficiently, enhancing customer satisfaction and driving customer loyalty.

In Europe tour operator software market, the region's rich cultural heritage, historical landmarks, and scenic beauty attract millions of tourists annually. Europe's well-established travel industry and sophisticated infrastructure make it an ideal destination for both leisure and business travelers. To keep up with the demands of modern travelers, European tour operators are increasingly turning to advanced software solutions to streamline their operations and deliver top-notch services. The European market's competitiveness and high standards of service create a conducive environment for the growth of the tour operator software market.

As the Asia Pacific and European regions continue to draw tourists from across the world, the demand for innovative and feature-rich tour operator software is expected to soar. Software providers and tour operators in these regions are likely to invest significantly in research and development to stay ahead of the competition and meet the evolving customer expectations. Additionally, with the rise of sustainable and eco-friendly tourism practices, tour operator software that caters to responsible travel trends is expected to gain traction in these regions.

Key Players in the Global Tour Operator Software Market

- Adventure Bucket List

- Centaur Systems

- Checkfront Inc

- Dolphin Dynamics

- eMinds

- GP Solutions GmbH

- IT Web Services,

- Qtech Software

- Retreat Guru

- Rezdy

- Tourplan

- TechnoHeaven Consultancy

- Travefy, Inc

- TraveloPro

- Trawex Technologies Pvt Ltd

- TrekkSoft (TrekkSoft Group)

- TRYTN, Inc

- Xola, Inc.

- Other Prominent Players

Market Segmentation Overview:

By Offering

- Software

- Services

By Module

- Booking/Reservation Management

- Inventory Management

- Payment Processing

- CRM (Customer Relationship Management)

- Back-office Management

- Accounting Management

By Deployment Mode

- SaaS

- Web Based

By Enterprise Size

- SMEs

- Large Enterprises

By End User

- International Tour Operators

- Domestic Tour Operators

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- Western Europe

- The UK

- Germany

- France

- Italy

- Spain

- Rest of Western Europe

- Eastern Europe

- Poland

- Russia

- Rest of Eastern Europe

- Western Europe

- Asia Pacific

- China

- India

- Japan

- Australia & New Zealand

- ASEAN

- Rest of Asia Pacific

- Middle East & Africa (MEA)

- UAE

- Saudi Arabia

- South Africa

- Rest of MEA

- South Africa

- Argentina

- Brazil

- Rest of South America

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

.svg)