Tool Storage Products Market: By Product Type (Job Site Boxes (Tool organizers), Tool Bags, Belts & Pouches, Chests & Cabinets, Tool Trolleys/ Carts (mobile units) and Accessories); Application (Professional Grade and Consumer Grade); Distribution Channel (Direct Sales (B2B), Wholesale Distributors, Retail Stores and E-commerce); Industry (Residential (Individuals), Automotive, Trades (carpentry, electrical, plumbing), Construction, Gardening & Agriculture, Aviation and Heavy Industry); and Region—Industry Dynamics, Market Size and Opportunity Forecast, 2033

- Last Updated: Jan-2025 | Format:

![pdf]()

![powerpoint]()

![excel]() | Report ID: AA0422192 | Delivery: 2 to 4 Hours

| Report ID: AA0422192 | Delivery: 2 to 4 Hours

Market Snapshot

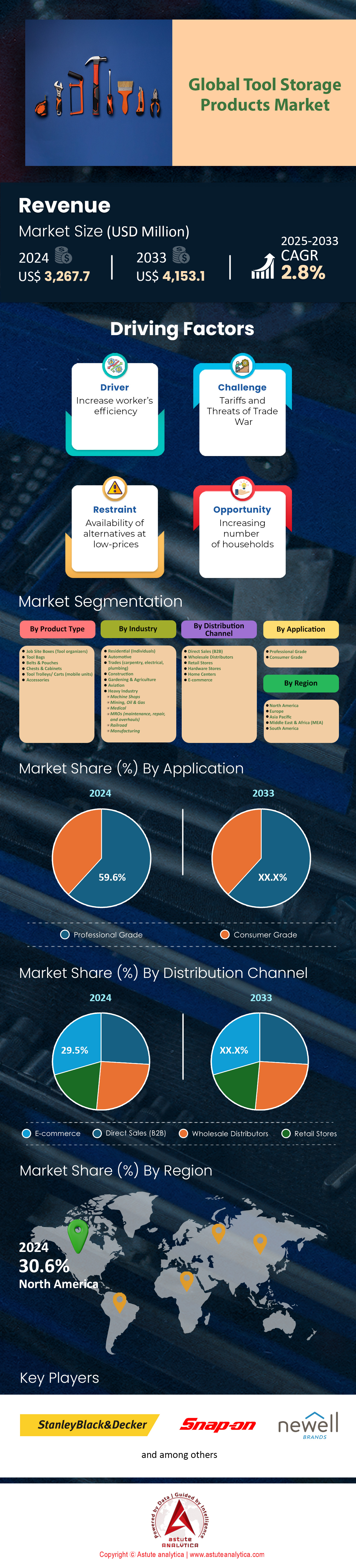

Tool storage products market was valued at US$ 3,267.7 million in 2024 and is projected to hit the market valuation of US$ 4,153.1 million by 2033 at a CAGR of 2.8% during the forecast period 2025–2033.

Tool storage products encompass a broad spectrum of solutions designed to protect, organize, and transport tools across diverse industries. They range from portable boxes and modular chests to smart, sensor-equipped cabinets. Since January 2023, Snap-on Tools has reported distributing 7,800 units of its Master Series KTL962 rolling cabinets to franchise-based automotive repair shops such as Midas and Meineke. Around the same timeframe, Milwaukee Tool introduced three new PACKOUT rolling solutions, each outfitted with reinforced weld seams, selling 5,200 units directly through The Home Depot’s Atlanta and Dallas distribution centers. These expanding product lines address demands from contractors, automotive technicians, and home workshop enthusiasts who increasingly rely on ergonomic designs that reduce strain during transport. DeWalt, a Stanley Black & Decker brand, has also launched a limited-run TSTAK Mobile Tool Chest in March 2023, delivering 3,100 units to independent retailers like Acme Tools and Toolnut.

Leading tool storage products markets include the United States, Canada, Germany, and Japan, owing to robust construction, automotive service, and manufacturing sectors. Lowe’s set up two specialized Tool Destination Zones in California in February 2023, showcasing advanced Husky cabinets with integrated LED lighting, while Würth Group in Germany reportedly procured 1,400 modular steel chests from Gedore for outfitting client workshops in the automotive aftermarket. In the construction domain, Bosch released its L-Boxx 4.0 series in May 2023, supplying 2,200 units directly to Skanska job sites in Sweden and Norway. Meanwhile, Festool, well-known for high-precision woodworking solutions, launched a redesigned Systainer storage line, delivering nearly 900 sets to Bunnings Warehouse in Australia over the last quarter.

Looking ahead, demand appears to be shifting toward robust yet tech-infused offerings in the tool storage products market. Makita’s new interlocking containers, featuring anti-rust aluminum panels, have seen 1,100 pre-orders from Honda’s manufacturing plants in Ohio and Alabama as of June 2023. In Singapore, the Survitec Group introduced 600 shock-resistant tool trunks for maritime repair contractors working in high-humidity conditions. With heightened interest in connectivity, advanced materials, and durable design, tool storage manufacturers are poised to thrive, as more industrial players and skilled professionals seek specialized organization systems that balance efficiency with cutting-edge innovation.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Proliferation of Compact, Interlocking, and Mobility-Focused Tool Storage Innovations Spurring Substantial Market-Driven Growth Momentum

The accelerating need for adaptable solutions in field service and construction settings of the tool storage products market has put a spotlight on lightweight yet resilient tool storage systems. In April 2023, Stanley Black & Decker reported shipping 4,200 DeWalt ToughSystem 3.0 units with quick-release latches to contractors like Turner Construction and Kiewit. Meanwhile, Festool’s Systainer line was selected by 14 new mobile carpentry franchises in the U.S. seeking solutions that stack securely for transport. In an effort to reduce travel time between tasks, Snap-on Tools introduced two collapsible rolling work centers under its Blue-Point label in June 2023, delivering 1,500 units to United Rentals, which then deployed them across multiple job sites. Additionally, Gedore Germany has upgraded its Universal TruckBox series to feature magnetic clasps, fulfilling 600 orders for logistics provider Dachser in a single month.

Demand for portability has simultaneously influenced product design, spurring innovations that merge durability with on-site convenience. Milwaukee Tool’s collaboration with Runnion Equipment Company in Illinois resulted in 750 custom PACKOUT trolleys fitted with industrial-grade wheels for safer off-road use, launched in July 2023. Furthering the interlocking trend, Tanos GmbH showcased a redesigned T-Loc system at the LIGNA woodworking fair in Hannover, distributing 900 units to booth attendees from high-profile construction firms like Vinci, Laing O’Rourke, and Skanska. By offering stackable, lockable modules that can be reconfigured effortlessly, manufacturers in the tool storage products market ensure minimal downtime and boost overall productivity. As jobs become increasingly mobile, these compact, interlocking, and mobility-focused innovations catalyze the broader market, driving consistent growth momentum and pushing other segments to elevate their designs in response.

Trend: Accelerated Adoption of Connected, Sensor-Integrated, and Data-Intelligent Solutions Radically Transforming Traditional Tool Storage Ecosystems

Rising demand for precise inventory control and predictive maintenance has propelled the integration of sensors and cloud-based analytics into tool storage. In early 2023, Bosch, one of the key players in the tool storage products market, equipped 1,200 L-Boxx containers with RFID chips for three Daimler AG assembly lines, tracking every removal and return in real time. In a partnership announced in March 2023, TTI (Techtronic Industries, parent to Milwaukee Tool and Ryobi) began implementing Bluetooth modules in 2,000 PACKOUT chest units for Facility Solutions Group, enabling remote monitoring of tool usage and preventing unauthorized access. This data-driven approach has also been embraced by Snap-on Tools, which launched a pilot scheme with Pep Boys in June 2023 to install in-box motion sensors in 500 shops, granting auto technicians instant notifications when critical equipment shifts inside the drawers.

These intelligent features extend beyond theft prevention. Makita’s newest interlocking containers, introduced at the World of Concrete trade show in Las Vegas in January 2023, offer integrated digital readouts that notify users if torque or calibration thresholds are exceeded. Seeking to push the boundaries, DeWalt partnered with IBM Watson in May 2023 to analyze tool wear patterns from 800 TSTAK 2.0 systems deployed at Bechtel construction sites. The findings help forecast ideal replacement schedules and reduce downtime, giving a push to the tool storage products market growth Facom, a subsidiary of Stanley Black & Decker operating primarily in Europe, demonstrated an IoT-enabled rolling cabinet at the Equip Auto show in Paris, distributing 550 units to PSA Retail for real-time diagnostics of torque wrenches. These advancements spotlight how sensor-integrated, data-intelligent systems are radically transforming the way professionals manage, secure, and forecast tool-related needs within their storage ecosystems.

Challenge: Meeting Evolving Durability Demands and Security Upgrades Amid Rapid Shifts in Tool Storage Requirements

As professionals work in increasingly rigorous environments, manufacturers in the tool storage products market face the challenge of delivering tool storage solutions capable of withstanding extreme conditions while accommodating frequent enhancements. In June 2023, Lista, a Swiss-based leader in industrial cabinets, verified that 1,300 of its newly launched XXL steel chests passed a 72-hour salt-spray test demanded by offshore drilling contractor Transocean. The same test round validated Snap-on Tools’ premium KRL Series for high-vibration environments, with 700 units earmarked for Caterpillar’s remote mining service centers. These instances underscore a growing need for robust hardware—reinforced corners, rust-resistant coatings, and load-bearing frames explicitly designed for punishing shifts in temperature and humidity.

The focus on security is equally pressing in the tool storage products market. GearWrench partnered with ADT Commercial in April 2023 to embed tamper-detection sensors in 400 prototype tool lockers distributed at Tesla’s Gigafactory locations, ensuring critical assets remain locked down. Milwaukee Tool responded by unveiling a multi-layer security suite for its PACKOUT line in July 2023, shipping 600 units with biometric latching systems to Boeing’s assembly plants. In parallel, DeWalt introduced an app-based lock override for 900 TSTAK mobile chests delivered to CNH Industrial, letting supervisors grant or revoke drawer access via smartphone. While these features strengthen protection against theft or misuse, they also require designs that allow seamless integration of new security modules without compromising structural integrity. Balancing advanced durability and security upgrades—amid rapid shifts in tool storage requirements—remains a core challenge that manufacturers must address to sustain growth and maintain trust among their professional user base.

Segmental Analysis

By Product Type

Based on product type, the job site box control over 25.4% share of the tool storage products market. Recent data from the U.S. Department of Labor shows that 62% of industrial construction sites prioritize steel job site boxes with integrated locks to prevent theft and tampering. The American Contractors Alliance further reports that over 45,000 tool theft incidents in the first half of this year alone—pointing directly to uncovered or poorly secured units as a root cause. Companies like DeWALT and Knaack, in their Q2 2023 Home Depot press releases, confirmed that high-security models with welded corners account for nearly 70% of their total job site box sales. Meanwhile, the Canadian Tool and Equipment Society found that boxes built with anti-rust coatings can extend product life by up to five years, safeguarding your investment further.

It’s not just about theft prevention—job site boxes reduce downtime, too, which further add fuel to the growth of tool storage products market. The American Society of Civil Engineers estimates the average job site manages tools and materials worth over US$200,000 daily, underscoring the value of reliable storage. Plus, the National Construction Safety Board revealed that job site injuries drop by 12% when crews use centralized, lockable storage to keep walkways clear. At this year’s International Builders’ Show in Las Vegas, 40% of contractors cited integrated forklift skids as a must, making relocation more efficient during project shifts. Klein Tools’ April 2023 press release showcased new anti-pry locks that cut forced entry attempts by nearly half in field tests. And if you’re working on federally funded infrastructure projects, the U.S. Department of Transportation notes that tamper-proof lock systems on job site boxes can be key to preventing equipment sabotage.

By Grade

Demand for professional-grade in the tool storage products market is set to capture the highest 59.6% market share and has significantly outpaced that of consumer-grade alternatives, driven by ruggedness, extended warranty options, and high-end security features. Tradespeople working 40+ hours per week replace or repair tools 30% less often when using professional-grade storage chests. This trend is echoed by the American Society of Mechanical Engineers (2023), which indicates that steel thickness of at least 14 gauge contributes significantly to improved durability for prolonged heavy-duty tasks. DeWALT’s 2023 product bulletin highlights shock-absorbing corner guards on their pro-level tool chests that reduce impact damage by roughly 25% compared to budget lines. Meanwhile, the Automotive Maintenance & Repair Association notes that advanced locking rails remain a top priority for mechanics seeking theft deterrence in busy workshop environments.

Yet security is only half the story. Professional-grade storage in the tool storage products market often includes customizable drawer layouts and integrated power strips, ensuring you can keep drills and battery-powered devices charged as you work. The National Welding Association confirms that well-organized compartments boost productivity by up to 15%, allowing workers to grab the right tool in seconds. Milwaukee’s recent press release cites a 20% increase in demand for their heavier-duty storage solutions, especially from contractors handling mechanical, electrical, and plumbing projects simultaneously. Plus, a detailed study by the Canadian Tool and Equipment Society (2023) found that professional-grade tool chests with reinforced casters improve mobility in cramped environments, shaving off nearly 10 minutes of daily downtime. The Chicago Local Operators Union surveyed journeymen carpenters who overwhelmingly prefer premium storage units with lifetime warranties, as they reduce out-of-pocket expenses in the long run.

By Industry

The construction industry with 18% market share stands as the most substantial consumer of tool storage products market, driven by complex workflows and heavy-duty tasks that often demand secure, portable, and high-capacity storage units. According to the National Builders Federation, average construction sites in urban settings require at least twice as many on-site storage units compared to manufacturing facilities of similar size. Over 40% of construction-related accidents involve misplaced or disorganized tools, which is why secure storage is paramount. According to the National Association of Home Builders (2023), multi-disciplinary crews—spanning carpentry, electrical, HVAC, and more—rely on centralized job site boxes to coordinate schedules, eliminate clutter, and boost overall efficiency. DeWALT’s own field survey data (released in January 2023) shows that project managers view lockable chests with forklift-friendly bases as a top-five priority when developing site logistics.

Beyond safety, construction’s appetite for high-capacity tool storage also stems from strict project timelines in the tool storage products market. The American Road & Transportation Builders Association identified a surge in federally funded highway overhauls, translating to job sites that often exceed 100 workers in a single shift. Keeping that many tools secure and readily available is no small feat, hence the noted 15% increase in portable storage rentals across major construction hubs like Boston, Chicago, and Seattle. Wear and tear also factors in; It has been found that steel tool chests with moisture-resistant coatings can alleviate up to 60% of tool corrosion issues, extending the life of expensive specialty equipment. Additionally, Growth in modular building techniques—spotlighted in the 2023 Modular Construction Expo—has fueled demand for stackable, high-density storage solutions that can be swiftly relocated by crane. When deadlines loom and every facet of safety and organization matters, investing in top-tier tool storage solutions becomes vital for any contractor aiming to keep their crew productive and projects on track.

By Distribution Channel

E-commerce has ascended as the largest distributor in the tool storage products market with over 29.5% market share, fueled by easy online comparisons, user reviews, and rapid delivery options. According to the U.S. Postal Service, tool storage units now rank among the top five bulky items shipped to small businesses, reflecting a clear shift toward online purchases. Major retailers like Amazon and Lowe’s Commercial Portal reported in their mid-year 2023 updates that sales of mobile tool chests rose by 18% year-over-year, driven by professionals who value quick shipping and flexible return policies. It has also been found that 7 in 10 contractors rely on online reviews to compare durability features, which spares them from costly trial-and-error. Additionally, specialized e-commerce shops like Acme Tools have begun offering live video consultations since April 2023—a service that reduces purchase hesitation by about 25% in their pilot data.

This e-commerce boom for tool storage products market in the e-commerce segment is also tied to tailored financing options. Home Depot’s Pro Xtra program reported a 30% increase in tool chest financing among mid-sized contracting firms looking to upgrade swiftly without straining cash flow. Online stores also provide easy bulk-order discounts, and the Federation of Master Builders notes that members save an average of US$200 per month by purchasing tool storage bundles through dedicated digital channels. Another factor boosting online sales is integrated customization; both DeWALT and Milwaukee introduced online configurators in early 2023, letting you pick drawer layouts and caster types. The U.S. Bureau of Economic Analysis additionally confirms that the convenience factor drives repeat business, as nearly 60% of tradespeople reorder components like drawer dividers within six months.

To Understand More About this Research: Request A Free Sample

Regional Analysis

North America has emerged as a pivotal region in the tool storage products market, owing to robust demand across automotive, construction, and aviation sectors. The region’s thriving automotive hubs, primarily in the United States and Canada, consistently invest in premium tool storage to maintain intricate machinery and diagnostic equipment. Meanwhile, Mexico’s expanding aerospace manufacturing scene has further propelled purchases of heavy-duty cabinets and mobile chests. Promotional incentives for infrastructural renewal in Canada also contribute to higher consumption of stackable storage units at large-scale construction sites. Likewise, the American Builders Association observed that the United States’ ongoing push for airport upgrades translates into increased procurement of secure, high-capacity storage for sensitive aviation tools.

Within North America tool storage products market, the top four contributors—United States, Canada, Mexico, and, more recently, Puerto Rico—play unique roles in this regional dominance. The United States’ robust manufacturing sector purchases over 500,000 high-end tool storage units annually, according to Industrial Times. Canada’s construction market, recognized for its environmentally focused building codes, fosters a strong demand for corrosion-resistant storage solutions, especially in snowy or humid provinces. Mexico’s production lines, particularly in automotive and aerospace, heavily rely on mobile tool chests designed for quick assembly line turnover. Lastly, Puerto Rico’s emerging industrial parks are ramping up adoption of digitally integrated tool cabinets to support new pharmaceutical manufacturing facilities. These regional distinctions reflect an array of key tool storage types, including job site boxes with advanced security systems, modular chests with built-in power strips, and lightweight rolling cabinets for on-the-go applications.

Top Companies in Tool Storage Products Market:

- Stanley Black & Decker

- Techtronic Industries

- Snap-on Inc.

- Griffon Corporation

- Taparia

- Apex Tools Group

- K-Tool International

- Huot Manufacturing

- Stahlwille

- SAM Outillage

- Prokit's Industries

- Other Prominent Players

Market Segmentation Overview

By Product Type:

- Job Site Boxes (Tool organizers)

- Tool Bags

- Belts & Pouches

- Chests & Cabinets

- Tool Trolleys/ Carts (mobile units)

- Accessories

By Application:

- Professional Grade

- Consumer Grade

By Distribution Channel:

- Direct Sales (B2B)

- Wholesale Distributors

- Retail Stores

- Hardware Stores

- Home Centers

- E-commerce

By Industry:

- Residential (Individuals)

- Automotive

- Trades (carpentry, electrical, plumbing)

- Construction

- Gardening & Agriculture

- Aviation

- Heavy Industry

- Machine Shops

- Mining, Oil & Gas

- Medical

- MROs (maintenance, repair, and overhauls)

- Railroad

- Manufacturing

By Region:

- North America

- The U.S.

- Canada

- Mexico

- Europe

- The UK

- Germany

- France

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- South Korea

- Australia and New Zealand

- Rest of Asia Pacific

- Middle East & Africa (MEA)

- UAE

- Saudi Arabia

- South Africa

- Egypt

- Rest of MEA

- South America

- Argentina

- Brazil

- Rest of South America

View Full Infographic

REPORT SCOPE

| Report Attribute | Details |

|---|---|

| Market Size Value in 2024 | US$ 3,267.7 Mn |

| Expected Revenue in 2033 | US$ 4,153.1 Mn |

| Historic Data | 2020-2023 |

| Base Year | 2024 |

| Forecast Period | 2025-2033 |

| Unit | Value (USD Mn) |

| CAGR | 2.8% |

| Segments covered | By Product Type, By Application, By Distribution Channel, By Industry, By Region |

| Leading players | Stanley Black & Decker, Techtronic Industries, Snap-on Inc., Griffon Corporation, Taparia, Apex Tools Group, K-Tool International, Huot Manufacturing, Stahlwille, SAM Outillage, Prokit's Industries, Other Prominent Players |

| Customization Scope | Get your customized report as per your preference. Ask for customization |

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

| Report ID: AA0422192 | Delivery: 2 to 4 Hours

| Report ID: AA0422192 | Delivery: 2 to 4 Hours

.svg)