4.1. Industry Value Chain Analysis

4.1.1. Raw Material Supplier

4.1.2. Manufacturer

4.1.3. Distributors

4.1.4. End Users

4.2. PESTLE Analysis

4.3. Porter's Five Forces Analysis

4.3.1. Bargaining Power of Suppliers

4.3.2. Bargaining Power of Buyers

4.3.3. Threat of Substitutes

4.3.4. Threat of New Entrants

4.3.5. Degree of Competition

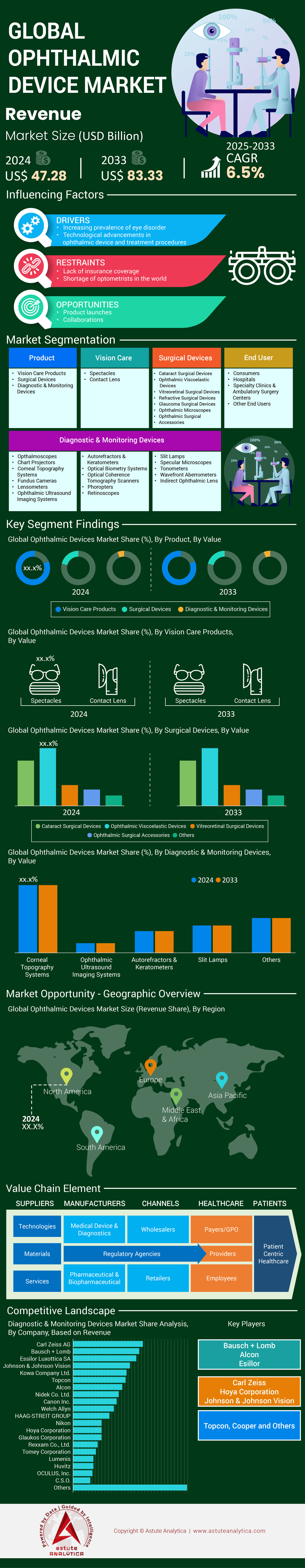

4.4. Market Dynamics and Trends

4.4.1. Growth Drivers

4.4.2. Restraints

4.4.3. Challenges

4.4.4. Key Trends

4.5. Covid-19 Impact Assessment on Market Growth Trend

4.6. Market Growth and Outlook

4.6.1. Market Revenue Estimates and Forecast (US$ Bn), 2017 – 2027

4.6.2. Market Volume Estimates and Forecast (Mn Units), 2017 – 2027

4.6.3. Pricing Analysis

4.7. Regulatory Landscape

4.7.1. FDA

4.7.2. CE Mark

4.7.3. Pharmaceuticals and Medical Devices Agency and Ministry of Health, Labor, and Welfare (MHLW)

4.7.4. Other Regulatory Bodies

4.8. Competition Dashboard

4.8.1. Market Concentration Rate

4.8.2. Company Market Share Analysis (Value %), 2022

4.8.3. Market Share Analysis (Revenue %), 2022 – Monitoring & Diagnostic Devices

4.8.3.1. Autorefractors & Keratometers

4.8.3.2. Chart Projectors

4.8.3.3. Corneal Topography Systems

4.8.3.4. Fundus Cameras

4.8.3.5. Lensometers

4.8.3.6. Ophthalmic Ultrasound Imaging Systems

4.8.3.7. Ophthalmoscopes

4.8.3.8. Optical Biometry Systems

4.8.3.9. Optical Coherence Tomography Scanners

4.8.3.10. Perimeters/Visual Field Analyzers

4.8.3.11. Phoropters

4.8.3.12. Retinoscopes

4.8.3.13. Slit Lamps

4.8.3.14. Specular Microscopes

4.8.3.15. Tonometers

4.8.3.16. Wavefront Aberrometers

4.8.3.17. Indirect Ophthalmic Lens

4.8.4. Competitor Mapping

4.8.5. Sales Composition Ratio – Diagnostic & Monitoring Devices

![pdf]()

![powerpoint]()

![excel]() | Report ID: AA0621081 | Delivery: 2 to 4 Hours

| Report ID: AA0621081 | Delivery: 2 to 4 Hours

| Report ID: AA0621081 | Delivery: 2 to 4 Hours

| Report ID: AA0621081 | Delivery: 2 to 4 Hours