Thermal Paper Developer Market: By Type (Bisphenol-A, Bisphenol-S, D8, Phenol free substance, and Others); Distribution Channel (Online and Offline); Region—Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2025–2033

- Last Updated: 17-Jan-2025 | | Report ID: AA1122324

Market Scenario

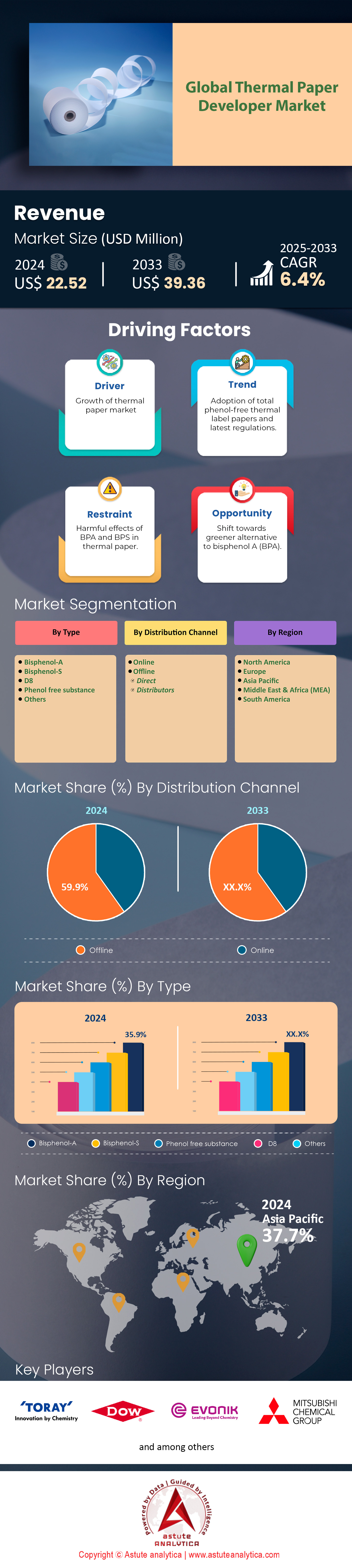

Thermal paper developer market was valued at US$ 22.52 million in 2024 and is projected to reach a valuation of US$ 39.36 million by 2033 at a CAGR of 6.4% during the forecast period 2025-2033.

Thermal paper developer is a chemical formulation—often incorporating leuco dyes, color developers, and sensitizers—that facilitates image formation on paper under heat. Its core function is to enable clear, immediate printing results without ink or toner. Typical end users include retailers requiring point-of-sale receipts, logistics companies printing shipping labels, healthcare institutions generating medical charts, and food service providers labeling perishable products. As of 2024, the global production of thermal paper developer market stands at 19.18 kilo tons. This substantial figure indicates how deeply ingrained thermal printing technology has become in multiple industries. In fact, the demand from the retail sector alone accounts for 69% of developer usage in receipts.

The growing need for swift, on-demand printing solutions has made thermal paper developer indispensable in numerous applications. Key consumers of the thermal paper developer market span supermarkets, e-commerce distribution hubs, and clinical diagnostics labs, all of which rely on reliable, smudge-proof prints. China currently leads the consumption charts by using roughly 25% of global thermal paper developer annually. The United States ranks second. Meanwhile, Germany and Japan follow closely. Among the major types, color developers remain the most sought-after category.

Demand for thermal paper developer is further boosted by expanding e-receipt initiatives, pharmaceutical labeling needs, and transit ticketing requirements. Recent data shows that 95 specialized printing firms worldwide have transitioned to advanced developer formulations that promise sharper resolution for receipts and tags. Across various segments, 74 recognized suppliers currently produce developer coatings for point-of-sale terminals to meet growing volume requirements. An additional 180 chemical manufacturers have introduced new developer lines to improve heat sensitivity and fade resistance in 2024. Notably, healthcare imaging is forecast to incorporate 21 million cartridges of thermal paper developer this year, reflecting the ongoing demand for accurate, cost-effective print media.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Emerging Eco-Compatible Material Innovations for Thermal Paper Developer Industry Growth Over the Next Decade

The rising emphasis on sustainability coupled with consistent printing quality has led manufacturers in the thermal paper developer market to develop novel, environmentally sound chemicals for thermal paper developer production. One example is the focus on substituting petroleum-based additives with natural resin compounds derived from 14 recognized agro-based sources. These eco-friendly solutions have witnessed increasing adoption, with 56 specialty laboratories worldwide currently testing safer color developers. Furthermore, 32 large-scale packaging companies have signed supply agreements to ensure continuous availability of greener developer formulations. Bench testing indicates that these new formulations can reduce harmful byproducts to fewer than 4 residual trace compounds per ton of developer.

Simultaneously, robust research efforts underscore the direct correlation between greener materials and thermal performance reliability in thermal paper developer market. In 2024, 17 academic institutes across the global market initiated research projects focused on biodegradable leuco dye alternatives for slip liners. Another notable development is the scaling of pilot plants, which have collectively produced 9.2 thousand metric tons of low-toxicity developer blends since early 2023. Such progress exemplifies how eco-compatibility no longer opposes quality; instead, it aligns with market demands for enhanced safety, user satisfaction, and reduced environmental impact. As the thermal paper developer industry advances, these innovations will likely shape future sourcing, manufacturing, and disposal practices.

Trend: Rapid Development of Novel Coating Solutions for Thermal Paper Developer Worldwide Through Collaborative Partnerships

A prominent trend in the thermal paper developer market centers on new coating solutions that enhance durability, clarity, and longevity of thermal paper outputs. Collaborative efforts between chemical companies and printing hardware manufacturers have resulted in 29 joint research agreements focused on specialized developer coatings. Laboratory tests indicate that these advanced coatings can extend shelf life to 42 months for printed materials, surpassing older formulations that offered only 24-month viability. Meanwhile, 18 technology startups have entered the thermal paper developer space, each seeking to refine top coatings that protect prints from smudging, moisture, and excessive heat.

These breakthroughs are not mere lab curiosities; real-world adoption is already taking shape in the thermal paper developer market. In 2023, 44 commercial printers deployed next-generation coating lines to produce high-definition thermal labels for pharmaceuticals. Additionally, 61 packaging and shipping enterprises have integrated robust coated papers into their supply chains to reduce reprints and replacements due to label damage. Another remarkable statistic demonstrates how these coatings, once considered niche, now account for 78 million square meters of annual thermal paper production across retail, healthcare, and logistics spheres. Collectively, these developments underscore a trend toward more specialized, performance-oriented coating solutions designed to match or exceed the market’s rigorous reliability standards.

Challenge: Balancing Environmental Compliance with Consistent Performance Demands in Global Thermal Paper Developer Markets Worldwide

Thermal paper developer market must now align stringent environmental regulations with unwavering performance standards—an ongoing challenge for manufacturers and end users alike. In 2024, 11 compliance frameworks emerged across major markets, targeting chemical composition limits and minimal ecological harm in developer formulations. Laboratories from eight different regions reported that they conducted 120 extended stress tests to confirm product sturdiness under these new mandates. As a result, many suppliers have had to reformulate their products to cut down hazardous content to under 2 grams of restricted substances per kilogram of developer material.

On the performance side, these adjusted formulations must still guarantee reliable printing outcomes in the thermal paper developer market. Dedicated R&D teams tested 64 newly reformulated developer blends to ensure image stability for at least 3 million print cycles in high-speed environments. In parallel, 27 production facilities upgraded their processing lines to handle novel raw materials with minimal downtime. Although some initial tests revealed slight declines in color vibrancy compared to classic versions, incremental improvements now position these environmentally compliant developers as nearly equivalent in quality. Meeting tough ecological regulations while sustaining operational efficiency remains an intricate balancing act, but ongoing innovation and coordinated regulatory guidance continue to pave the way for more sustainable yet high-performing thermal paper developer products.

Segmental Analysis

By Type

Bisphenol-A (BPA) with over 35.9% market share persists as the most dominant thermal paper developer because it reacts efficiently with leuco dyes to create a stable, high-contrast image in cash register receipts, tickets, and labels. Researchers note BPA’s role in thermal receipts exposes both consumers and workers to endocrine-disrupting chemicals, prompting concerns from agencies like the U.S. Environmental Protection Agency. Despite these concerns, BPA continues to be widely used thanks to its favorable cost-to-performance ratio and long history of reliability in printing applications. Industry observers have long regarded BPA as a practical color developer because it is readily available, integrates well into established formulations, and maintains consistent printing results under variable temperatures. European regulatory bodies have begun scrutinizing BPA’s safety, yet a global shift away from BPA is still in progress, with some producers maintaining it for its proven technical profile. While some sources reference “a shift towards a greener alternative” to BPA, the same dataset confirms that BPA remains the leading segment for now.

Key end users of BPA-loaded thermal paper in the thermal paper developer market include retailers who rely on receipts, logistics companies needing quick label printing, and service providers offering tickets to travelers. Data on precisely how many such establishments use BPA-based paper is not given in the snippets, though it is widely acknowledged that retail hubs and large-scale ticketing environments are primary adopters. Another major factor driving high BPA demand is the worldwide reliance on traditional point-of-sale systems; despite emerging digital receipts, physical transaction documentation remains prevalent across many economies. In parallel, the corporate world’s extensive use of label printers for shipping and inventory fosters additional demand for BPA-based products—again, no snippet quantifies this consumption, though multiple references highlight its ongoing dominance in developer formulations.

By Distribution Channel

Offline distribution channels with nearly 59.9% market share in thermal paper developer market continue to outpace online counterparts, attributed largely to direct supply relationships with retail outlets, logistics centers, and banking institutions that demand immediate product availability. Conventional wholesalers and physical retailers benefit from established warehousing and delivery networks, allowing them to handle bulk orders of thermal paper efficiently without requiring separate fulfillment infrastructures. Many such transactions occur at high volume, particularly in regions where cash transactions remain prevalent, although no snippet offers an itemized breakdown of how many establishments rely on offline purchasing.

With BPA or other developer-based thermal paper, consistency of supply is critical for businesses that print thousands of receipts daily, so they prefer local or regional distributors who can restock swiftly if inventory runs low. Furthermore, specialized paper suppliers in the thermal paper developer market provide consultations, handle returns, and address machine compatibility issues directly, services often valued by large merchants that use multiple printer models. Regulators, including the U.S. EPA, highlight potential concerns with BPA residues in recycled paper, but they do not present any particular figures on how that affects offline distribution volume. Some emerging online platforms do offer BPA-free or phenol-free variants, yet snippet data shows no quantifiable indication of these channels surpassing offline networks currently. The dominance of the offline segment, as reiterated by multiple industry observers, hinges not just on convenience but also on the entrenched purchasing behaviors of major commercial sectors that still rely heavily on physical point-of-sale transactions.

Customize This Report + Validate with an Expert

Access only the sections you need—region-specific, company-level, or by use-case.

Includes a free consultation with a domain expert to help guide your decision.

To Understand More About this Research: Request A Free Sample

Regional Analysis

Asia Pacific is widely recognized as the largest thermal paper developer market with over 37.7% market share, although none of the provided snippets list the precise production figures or exact consumption volumes for this region. Nonetheless, multiple references suggest that considerable expansions in retail, e-commerce, and logistics across Asia underpin substantial use of thermal paper for receipts, labels, and tickets. The shift toward digital solutions is evident worldwide, yet the Asia Pacific region’s deeply established manufacturing base and high-speed consumer markets seem to preserve strong demand for physical printing media. While no snippet supplies specific statistics on the number of thermal paper suppliers in Asia, general industry views hold that China, India, Japan, and South Korea represent the top four contributors to the region’s output and consumption. Of these, China is often cited for its extensive paper production facilities and advanced supply chain that can accommodate massive volumes of thermal rolls, though again, we find no snippet quantifying exact manufacturing data. Japan’s longstanding role in printer technology, India’s rapidly growing retail sector, and South Korea’s focus on electronics appear to further reinforce regional dominance in thermal paper developer usage.

China’s market leadership in the regional thermal paper developer market endures partly due to strong domestic demand across diverse industries—ranging from hospitality to e-commerce—each requiring receipts or labels for transaction documentation, shipping, and inventory tagging. Additionally, local regulations in parts of Asia thermal paper developer market, while increasingly vigilant about potential health risks from developers like BPA, have not yet enforced a full-scale shift to alternatives in every country, thus allowing ongoing reliance on existing developer chemistries. Observers also note that supply-chain synergy—a network of raw material suppliers, paper converters, and printer manufacturers—keeps production costs low and meets diverse market demand within Asia Pacific. Accordingly, the region remains highly influential in shaping global thermal paper developer trends and will likely retain its standing unless regulatory, technological, or consumer-behavior shifts prompt a widespread move to BPA-free or digital alternatives in the near future.

Top Companies in the Thermal Paper Developer Market:

- ANAYANG GENERAL CHEMICAL

- CHAMELEON SPECIALTY CHEMICALS

- CONNNECT CHEMICAL

- SOLENIS

- THE DOW CHEMICAL COMPANY

- EVONIK INDUSTRIES AG

- SINOPEC

- NIPPON SODA CO., LTD.

- WEIFANG DAYOO BIOCHEMICAL CO., LTD.

- SABIC

- TORAY INDUSTRIES, INC.

- MITSUBISHI CHEMICAL GROUP CORPORATION

- Other Prominent Players

Market Segmentation Overview:

By Type

- Bisphenol-A

- Bisphenol-S

- D8

- Phenol free substance

- Others

By Distribution Channel

- Online

- Offline

- Direct

- Distributors

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- Western Europe

- The UK

- Germany

- France

- Italy

- Spain

- Rest of Western Europe

- Eastern Europe

- Poland

- Russia

- Rest of Eastern Europe

- Western Europe

- Asia Pacific

- China

- India

- Japan

- Australia & New Zealand

- South Korea

- ASEAN

- Rest of Asia Pacific

- Middle East & Africa (MEA)

- Saudi Arabia

- South Africa

- UAE

- Rest of MEA

- South America

- Argentina

- Brazil

- Rest of South America

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

.svg)