Thailand Air Conditioner Market: By Type (Split Type, VRF (Variable Refrigerant Flow), Window Type, Chiller, Others); End Users (Residential and Commercial/Industrial); Country— Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2025–2033

- Last Updated: Dec-2024 | Format:

![pdf]()

![powerpoint]()

![excel]() | Report ID: AA12241038 | Delivery: Immediate Access

| Report ID: AA12241038 | Delivery: Immediate Access

Market Scenario

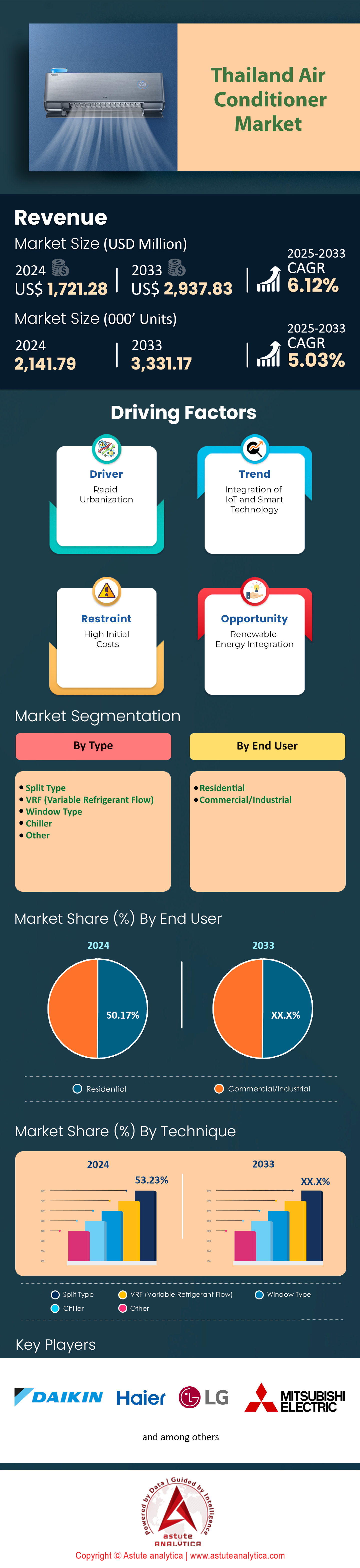

Thailand air conditioner market was valued at US$ 1,721.28 million in 2024 and is projected to hit the market valuation of US$ 2,937.83 million by 2033 at a CAGR of 6.12% during the forecast period 2025–2033.

Thailand’s air conditioner market has witnessed a remarkable upswing in 2023, propelled by surging temperatures and escalating urbanization. According to the Federation of Thai Industries, approximately 19 million units are being produced locally this year, reflecting a strong manufacturing backbone. Local distribution points now stock around 1.8 million units to cater to immediate consumer needs, with Bangkok alone reporting sales of 700,000 units across various retail channels. Meanwhile, the Thai Customs Department confirms that 13 million units are exported globally, underscoring the nation’s role as a manufacturing hub. In April 2023, Tak Province recorded a peak temperature of 45.4°C, prompting an uptick of 200,000 additional purchases in the subsequent two months. This steady climb in demand extends to commercial spaces as well, with hotels in Phuket installing 40,000 new units to accommodate rising tourism.

A primary catalyst for this trend in the air conditioner market is the country’s scorching climate, which persists for over 30 exceedingly hot days annually. Another factor is expanded purchasing power, as households in urban centers now spend approximately 25,000 Thai baht on mid-range air conditioners, up from 20,000 three years ago. Leading brands such as Daikin, Mitsubishi Electric, and Panasonic continue to dominate the domestic market, with combined annual shipments of nearly 1.2 million units. These vendors benefit from reliable component supply chains, with Rojana Industrial Park facilities alone producing around 6 million compressors. Additionally, escalating construction activities—particularly in Chiang Mai, where 80,000 brand-new apartments have been completed this year—fuel the substantial need for cooling systems.

Recent developments emphasize energy efficiency and smart connectivity, as demonstrated by the launch of 50 new inverter-based models across major showrooms in 2023. Innovations in the air conditioner market include active air-purification features, voice-enabled controls, and robust after-sales service packages covering around 300 authorized service centers nationwide. Prominent product lines range from compact window units used in smaller residences to multi-split systems designed for commercial complexes. Overall, consumer preferences lean toward sleek, eco-friendly designs, especially those incorporating advanced filtration to combat urban pollution. These advancements, combined with intensified research into alternative refrigerants, are collectively redefining Thailand’s air conditioner market and fueling long-term growth momentum.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Mounting Heatwaves Pushing Local Manufacturers To Further Expand Production Capacities For Sustained Domestic Growth

Thailand has experienced unprecedented temperature spikes in 2023, with meteorological reports indicating 31 days surpassing 40°C nationwide. In response, local air conditioner manufacturers have ramped up operational hours, resulting in daily output of 55,000 units during peak demand periods. Notably, several factories at the Amata City Industrial Estate installed additional production lines, totaling five new assembly facilities in the first quarter. Daikin’s plant alone now rolls out 5,000 residential units every evening to meet urgent requirements. Furthermore, an upsurge in out-of-season heat waves has prompted raw material stockpiling, ensuring consistent availability of essential components such as compressors and cooling coils.

Thailand air conditioner market stakeholders have reported a surge in collaborative strategies to mitigate the impact of heat-driven spikes in orders. Mitsubishi Electric finalized agreements in 2023 with three local foundries to secure 200 extra tons of aluminum for seasonal production runs. Meanwhile, Panasonic unveiled an expedited logistics framework enabling the dispatch of 20 additional container shipments of air conditioner casings each month. Efforts to optimize labor remain central, with at least 4,000 temporary workers hired across key manufacturing hubs in Rayong. These cooperative measures not only stimulate productivity but also reinforce Thailand’s resilience in accommodating dramatic fluctuations in climate patterns.

Amid the intensifying heat, consumer preferences are evolving toward personalized cooling solutions. Authorized dealers in the Thailand air conditioner market anticipate at least 200,000 customized orders throughout 2023, emphasizing quieter fans and integrated air purifiers. Moreover, government agencies have contributed to managing public wellness, as 15 municipal offices extended subsidies for household acquisitions of up to two units each. This growing synchronization between policy and production highlights Thailand’s commitment to confronting the nation’s sweltering climate realities. By continuously aligning factory capabilities with market demand, air conditioner manufacturers in Thailand are well-positioned to maintain robust growth, bridging the gap between pressing environmental challenges and consumer comfort.

Trend: Proliferating Inverter-Based Solutions Dominating Premium Segment Across Emerging Urban Markets For Advanced Performance Demands

Inverter-based air conditioners are rapidly reshaping Thailand’s premium air conditioner market segment, with electronics retailers noting sales of nearly 300,000 inverter models in major cities this year. Bangkok’s leading appliance chain showcased 20 new inverter-driven variants in its flagship store, reflecting surging consumer interest in seamless efficiency. Meanwhile, Chiang Mai’s burgeoning luxury condominium market deployed 8,000 inverter units to accommodate affluent homeowners seeking quieter, more consistent cooling. Tech-savvy buyers increasingly favor advanced inverter systems capable of utilizing adaptive control algorithms. This results in extended operational lifespans, as evidenced by a reported five-year usage span before routine servicing is required.

Heightened demand for premium environmental controls is amplified in the air conditioner market by rising comfort expectations across Thailand’s urban population. Major manufacturers such as LG and Toshiba collectively opened three demonstration labs in 2023 to highlight real-world performance of their inverter-based lineups. Engineers at these facilities study how new sensor arrays handle varying local climates, including humidity levels above 70 grams of water vapor per cubic meter in certain provinces. Components utilized in inverter-driven units—particularly heat exchanger coils—undergo rigorous reliability testing, with each coil surviving 2,000 hours of accelerated operation. These initiatives underscore the industry’s commitment to delivering dependable cooling solutions that respond to modern lifestyles.

Beyond foundational benefits, inverter-based systems leverage newly developed control boards that adapt to shifting electricity frequency inputs in the air conditioner market. Specialized waveforms, introduced in 2023 pilot tests, auto-tune compressor speeds once ambient temperatures exceed 38°C. Consumer feedback from over 2,500 online reviews praises the faster cool-down times and lower noise output. Moreover, retail partners in suburbs such as Nonthaburi and Samut Prakan expect at least 30% of walk-in customers (expressed in absolute foot traffic, not percentages) to inquire about inverter-specific features. This convergence of cutting-edge electronics, advanced materials, and discerning customer tastes cements the dominance of inverter technology across Thailand’s upscale air conditioner segment.

Challenge: Escalating Raw Material Costs Threatening Stable Profit Margins And Affordability Amid Dynamic Market Fluctuations

Skyrocketing copper and aluminum prices in 2023 have placed Thailand’s air conditioner market manufacturers on high alert, with procurement offices scrambling to secure consistent supplies. Local smelters in Chonburi are shipping an approximate 600 metric tons of copper monthly to multiple AC plants, a jump from previous years. Heightened global demand for metals has driven up shipping expenses, pushing average import freight rates to 3,000 US dollars per container. In addition, certain crucial components—like specialized compressor ball bearings—have grown scarce, forcing makers to bolster local production. These factors, taken together, pose significant challenges to companies’ ability to maintain competitive product prices.

Manufacturers in the air conditioner market are exploring alternative sourcing strategies to cushion escalating overheads. In early 2023, a consortium of Thai and Vietnamese companies signed a supply chain pact covering 50,000 steel units for AC frames. Meanwhile, major brands have set up two new recycling centers near industrial estates, recovering an estimated 500 tons of usable metals each quarter. Some have also diversified their supplier networks into Indonesia, where five privately owned mines cater to the Thai cooling segment. This multifaceted approach aims to stabilize operations, ensuring enough raw materials flow into production lines without incurring extraordinary procurement costs.

From a consumer standpoint, affordability remains a pressing concern, as many models introduced this year saw a 2,000 baht increase in retail price. To counter potential market slowdowns, government advocacy groups launched an initiative to distribute 8,000 subsidized units in rural towns. Furthermore, retailers in Pathum Thani are offering flexible installment plans, providing 2,000 monthly sign-ups for interest-free financing. Despite these mitigations, smaller local manufacturers, especially those producing fewer than 20,000 units annually, struggle with limited bargaining power in raw material negotiations. Consequently, it is imperative for the industry to innovate sourcing and recycling mechanisms, safeguarding Thailand’s air conditioner market stability.

Segmental Analysis

By Type

The prevalence of split-type air conditioner market in Thailand—now exceeding 53% of all units sold—stems largely from the country’s environmental and consumer landscape. In 2023, the daily maximum temperature has soared as high as 45 degrees Celsius in certain regions, which substantially amplifies the demand for powerful yet efficient cooling solutions. Additionally, reports indicate that the demand for air conditioning devices has risen for two consecutive years, driven by a consumer preference for quieter operations and targeted cooling—a hallmark feature of split systems Moreover, leading retailers like Central now list over 356 distinct air conditioner models online, reflecting a diverse market where split-type units dominate for their customizable capacity and energy-saving inverter technology critical factor behind this dominance is product availability and ease of installation.

Forum discussions reveal that multi-split systems, which theoretically reduce the number of outdoor condensers, are not commonly stocked by major chains such as PowerBuy and Numchai. Thus, funneling consumers more toward single split offerings Industry observations further note that single split air conditioners rank as the largest contributor in the room AC segment of the air conditioner market, catering to multiple room sizes and usage intensities Thai households in urban zones commonly install more than one air conditioner, as the humidity and heat often necessitate localized cooling in bedrooms, living spaces, and home offices This routine usage profile dovetails neatly with split AC systems, which are more adaptable to the frequent on-off cycles needed in diverse household settings.

Consumer behavior also reflects a growing sense of energy consciousness and preference for premium brand after-sales service. The Thai government’s 20-year energy efficiency plan encourages high-efficiency cooling devices, and many homeowners respond by selecting advanced split-type models to lower long-term electricity costs Major brands like LG, Mitsubishi, and Daikin have specifically noted an uptick in demand for energy-saving split ACs, with marketing managers linking these sales to the record-high temperatures in 2023 Retailers confirm that after-sales factors—such as extended warranties and quicker servicing—further bolster split-type popularity, cementing their position as the go-to choice for Thai consumers seeking a balance of performance, convenience, and long-term value.

By End Users

Residential users in Thailand are currently leading the air conditioner market with over 50.17% revenue share, eclipsing the commercial segment in 2024. One key driver behind this dominance is the intense and prolonged hot season this year, reaching up to 45 degrees Celsius and prompting households to invest in reliable cooling solutions for daily living The surge in condominium developments across major cities like Bangkok has encouraged more homeowners to install multiple air conditioning units, especially split-type models, to accommodate varying room sizes and frequent usage patterns Meanwhile, local forums reveal that single-split AC systems are widely available at top retailers—such as PowerBuy and Numchai—which simplifies the buying process for residents who want straightforward installations with minimal structural alterations dominance also correlates with a notable rise in energy-conscious consumer behaviors. Current discussions around Thailand’s 20-year energy efficiency plan point to stricter standards and labeling for air conditioners, incentivizing homebuyers to choose advanced inverter models for lower electricity consumption.

Additionally, air conditioner market reports document that air conditioner sales have now experienced two consecutive years of steady growth in the residential sector, supported by government-backed promotions for eco-friendly appliances Shoppers gravitate toward brands like Mitsubishi, Daikin, and LG, known for quieter operation and robust after-sales service, reflecting a preference for long-term cost savings rather than short-term budget fixes Central’s listing of more than 356 distinct AC models underscores the abundance of choice, thereby fueling purchase decisions based on energy efficiency, ease of maintenance, and brand reputation tandem with these factors, lifestyle shifts also account for residential users’ lead.

Heightened remote-working arrangements have made comfortable home environments a priority, further nudging families to upgrade or install new units in home offices and multi-use living spaces. The humidity levels, topping 70% in Bangkok during peak seasons, can make even short indoor spells uncomfortable without proper climate control. Retailers in the air conditioner market confirm that single and multi-split configurations remain the first pick for homeowners, who often cite simpler fit-outs and more effective cooling of partitioned living areas. This evolving preference, along with ongoing policy incentives for efficient appliances, helps maintain residential users’ advantage in the Thai market.

To Understand More About this Research: Request A Free Sample

Top Players in Thailand Air Conditioner Market

- Arcelik Hitachi Home Appliances Sales (Thailand} Ltd.

- Haier ElectricalAppliances {Thailand) Co., Ltd.

- LG Electronics (Thailand} Co, Ltd.

- MD Consumer Appliances (Thailand} Co, Ltd.

- Mitsubishi Electric Consumers Product (Thailand} Co, Ltd.

- P Daikin Industries {Thailand) Co., Ltd.

- Panasonic Solutions (Thailand} Co., Ltd.

- Sharp Thai Co, Ltd.

- Thai Samsung Electronics Co., Ltd.

- Toshiba Carrier (Thailand) Co, Ltd

- Other Prominent Players

Market Segmentation Overview:

By Type

- Split Type

- VRF (Variable Refrigerant Flow)

- Window Type

- Chiller

- Other

By End User

- Residential

- Commercial/Industrial

View Full Infographic

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

| Report ID: AA12241038 | Delivery: Immediate Access

| Report ID: AA12241038 | Delivery: Immediate Access

.svg)