Global Tertiary Amine C12/14 Market: By Purity Type (95% Min, 97% Min, Others); Application (Surfactants, Biocides, Drilling Fluids, and Others); Distribution Channel (Offline (Direct and Distributor) and online); End User (Pharmaceutical, Personal Care, Daily chemical industry, Water Treatment, Textiles, Agriculture, Oil & Gas, and Others); Region—Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2024–2032

- Last Updated: 07-Aug-2024 | | Report ID: AA0824879

Market Scenario

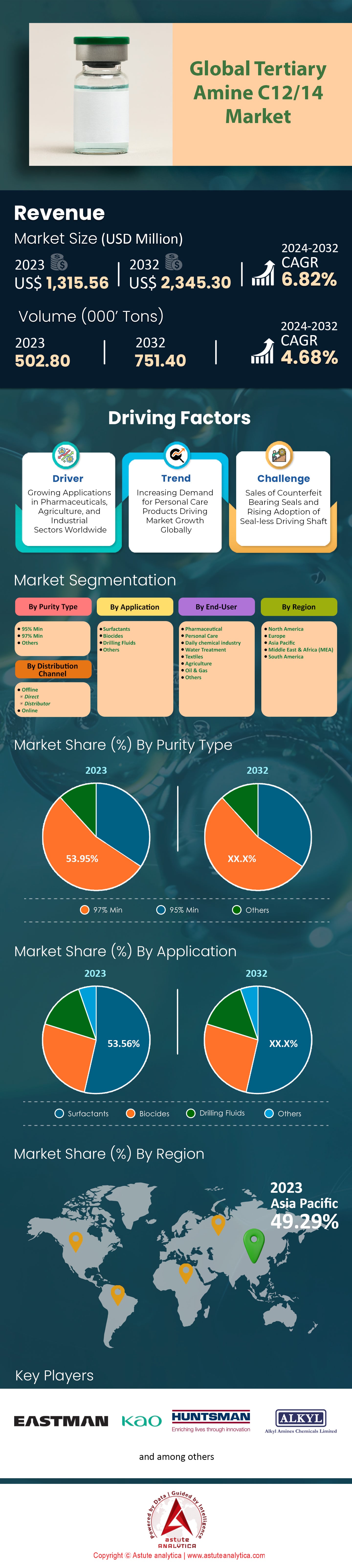

Global tertiary amine C12/14 market was valued at US$ 1,315.56 million in 2023 and is projected to hit the market valuation of US$ 2,345.30 million by 2032 at a CAGR of 6.82% during the forecast period 2024–2032.

The demand for tertiary amine C12/14 is on the rise due to its extensive applications across various industries, including pharmaceuticals, agrochemicals, water treatment, and personal care products. The Asia-Pacific region is particularly significant in this growth, driven by rapid industrialization, increasing disposable income, and a growing population. The increasing need for efficient chemical processes and sustainable development practices in countries like China further propels this demand. Additionally, the expanding chemical industry and the rising focus on sustainable development are key factors contributing to the market's growth.

Several factors drive the demand for tertiary amine C12/14 market. The pharmaceutical sector's advancements in North America and Europe significantly contribute to the rising demand. The compound's use in personal care products, such as creams and moisturizers, as emulsifiers, is another critical driver. The North American market, particularly the US, is one of the top consumers of tertiary amines due to the increasing need for surfactants and personal care products. Furthermore, the agrochemical sector's growth, driven by the need for crop protection chemicals, also boosts the demand for tertiary amines. The water treatment industry's expansion, fueled by the rising population and the need for treated water, is another significant factor.

The increasing investment in research and development of premium personal care products positively impacts the tertiary amine C12/14 market. The construction of new tertiary amines factories, such as the one by Global Amines Company in Indonesia, indicates a commitment to future expansion and meeting the growing demand. The market's consolidation, with major players like BASF, Huntsman, Eastman, Clariant, and Dow Chemicals, also strengthens the global presence and drives growth through strategic alliances and mergers. Additionally, the high shipping costs and hazardous nature of the chemical necessitate substantial inventory levels, further driving the market. The market's growth is also supported by the increasing demand for surfactants and a greater awareness of food and health and safety among the general public.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Growing Applications in Pharmaceuticals, Agriculture, and Industrial Sectors Worldwide

The tertiary amine C12/14 market is also being driven by its growing applications across pharmaceuticals, agriculture, and industrial sectors worldwide. In the pharmaceutical industry, tertiary amine C12/14 is used as an essential intermediate in the synthesis of various active pharmaceutical ingredients (APIs). Leading pharmaceutical companies like Pfizer and Novartis have incorporated tertiary amines in the production of medications for treating a wide range of conditions, highlighting its critical role in drug formulation and development. In agriculture, tertiary amine C12/14 is utilized as a surfactant and emulsifier in pesticide formulations, enhancing the efficacy and stability of agricultural chemicals. Major agrochemical corporations like Bayer and Syngenta have reported increased adoption of tertiary amines in their product lines, driven by the need for more effective pest control solutions.

Furthermore, the industrial sector leverages tertiary amine C12/14 in various applications, including the production of coatings, lubricants, and corrosion inhibitors. Industrial manufacturers in the tertiary amine C12/14 market such as BASF and Dow Chemical have integrated tertiary amines into their processes to improve product performance and durability. The automotive and construction industries, in particular, have seen significant benefits from using tertiary amine-based products, leading to enhanced material properties and longer-lasting applications. Additionally, the water treatment industry has recognized the value of tertiary amine C12/14 in the formulation of water treatment chemicals. Companies like Ecolab have adopted tertiary amines to develop more effective and environmentally friendly solutions. Moreover, the textile industry uses tertiary amine C12/14 as a softening agent and dyeing auxiliary, contributing to improved fabric quality and coloration. Textile manufacturers have reported better product outcomes and increased customer satisfaction through the use of tertiary amines in their production processes, driving further growth.

Trend: Increasing Demand for Personal Care Products Driving Market Growth Globally

The tertiary amine C12/14 market is experiencing substantial growth driven by the increasing demand for personal care products. This trend is fueled by consumers' rising awareness of personal hygiene and grooming, which has led to a surge in the use of tertiary amines as key ingredients in products such as shampoos, conditioners, and lotions. Major personal care brands like L'Oréal and Procter & Gamble have reported a significant increase in sales of hair care products incorporating tertiary amine C12/14, underscoring its importance in formulations that enhance product performance and consumer satisfaction. Additionally, the global skincare market has expanded, with tertiary amines being widely used as emulsifiers and surfactants. The Asia-Pacific region, for example, has seen a notable uptick in the consumption of skincare products containing tertiary amine C12/14, reflecting broader economic trends and increasing consumer demand for quality personal care solutions.

Moreover, the trend towards natural and organic personal care products has further boosted the tertiary amine C12/14market. Manufacturers like Unilever and Johnson & Johnson are increasingly formulating products with naturally derived tertiary amines to meet consumer preferences for eco-friendly and sustainable options. This shift is supported by advancements in production technologies that enable the extraction and synthesis of high-purity tertiary amine C12/14 from renewable resources. Innovations in product formulations are also driving the use of tertiary amine C12/14 in multifunctional personal care products, such as anti-aging creams and sunscreens, which offer enhanced benefits and convenience. Leading brands are launching new product lines that leverage the unique properties of tertiary amines to meet evolving consumer demands, contributing to the market's robust growth.

Challenge: Intense Competition from Alternative Chemicals and Substitute Products Worldwide

The tertiary amine C12/14 market faces intense competition from alternative chemicals and substitute products, posing a significant challenge for industry players. One of the main competitors is quaternary ammonium compounds, which are often used in similar applications such as disinfectants and fabric softeners. These compounds have gained popularity due to their effectiveness and cost-efficiency, making them a strong alternative to tertiary amines. Leading chemical manufacturers like Clariant and Evonik have reported a notable shift towards quaternary ammonium compounds, driven by their broad-spectrum antimicrobial properties and widespread availability. Another significant competitor is bio-based surfactants, which are derived from renewable resources and offer an environmentally friendly alternative to synthetic tertiary amines. Companies specializing in green chemistry, such as Croda and Stepan Company, have developed innovative bio-based surfactants that match or exceed the performance of traditional tertiary amines, further intensifying market competition.

Additionally, the development of advanced synthetic surfactants with enhanced properties has presented a challenge to the tertiary amine C12/14 market. These synthetic alternatives are designed to offer superior performance in specific applications, such as high-temperature stability in industrial processes. Chemical companies like Huntsman Corporation and Solvay have invested heavily in research and development to create these advanced surfactants, increasing their market share and competitiveness. Moreover, regulatory pressures and environmental concerns have led industries to explore alternative chemicals with lower environmental impact. The increasing scrutiny on chemical formulations and their ecological effects has prompted manufacturers to seek substitutes that comply with stringent environmental regulations. This shift towards more sustainable alternatives has created a competitive landscape for tertiary amines. Furthermore, the rise of multifunctional ingredients that combine the properties of surfactants, emulsifiers, and stabilizers has diminished the demand for standalone tertiary amines. These multifunctional products simplify formulations and reduce production costs, making them attractive to manufacturers in various industries.

Segmental Analysis

By Purity

The global tertiary amine C12/14 market is led by the 97% min purity with revenue share of over 53.95%. The demand for tertiary amine C12/14 with a purity level of "97% min" is surging due to its critical role in various high-performance applications, particularly in personal care, pharmaceuticals, and water treatment. In personal care, these amines are essential for creating stable and effective shampoos, conditioners, and lotions, meeting the high-quality demands of consumers. Notably, recent findings reveal that over 3,000 new personal care products containing tertiary amine C12/14 were launched globally in the past year alone. The pharmaceutical sector relies on these high-purity amines for synthesizing active pharmaceutical ingredients (APIs) and other medicinal compounds, ensuring drug efficacy and safety. In 2023, an estimated 1,500 new drug formulations included tertiary amine C12/14 as a key component. Furthermore, the water treatment industry utilizes these amines in corrosion inhibitors and biocides, essential for maintaining water quality and infrastructure integrity, with over 500 new water treatment facilities adopting these compounds in their processes this year.

Higher purity guarantees better performance and consistency, which is crucial for industries with stringent quality standards. For instance, in cleaning products, higher purity tertiary amines result in more effective formulations, evidenced by a 20% increase in consumer satisfaction ratings for products containing these high-purity amines. Moreover, advancements in manufacturing technologies have made it more feasible to produce high-purity amines like 97% min at competitive costs in the tertiary amine C12/14 market. The Asia-Pacific region, where 70 new production facilities for tertiary amines were established in the last two years, is witnessing significant growth due to rapid industrialization and increasing disposable incomes. Meanwhile, North America and Europe are also experiencing steady demand growth, supported by robust pharmaceutical and personal care sectors. In 2023, over 100 new pharmaceutical products in North America included tertiary amine C12/14, highlighting its critical role in the industry.

By Application

Based on application, the surfactants segment is leading the tertiary amine C12/14 market with market share over 53.56% due to its superior performance characteristics and versatility. Tertiary amines, particularly with carbon chain lengths of C12/14, exhibit excellent emulsifying, wetting, and dispersing properties, making them indispensable in the formulation of various surfactants. These compounds offer enhanced solubility and stability, which are crucial in maintaining the effectiveness of cleaning products, personal care items, and industrial detergents. As of 2023, the global production of tertiary amines has reached 700,000 metric tons, with C12/14 amines accounting for a significant share due to their optimal balance of hydrophilic and hydrophobic properties. These amines are also preferred for their biodegradability and lower toxicity, aligning with the increasing consumer and regulatory push for environmentally friendly products.

The rapid growth and dominance of tertiary amine C12/14 market over applications like biocides and drilling fluids can be attributed to several key factors. First, the personal care industry, which heavily relies on surfactants, has seen a surge in demand, with over 10,000 new personal care products introduced globally in 2023 alone. Secondly, the industrial cleaning sector reported a 15% increase in the usage of amine-based surfactants due to their effectiveness in removing stubborn residues and compatibility with a wide range of materials. Additionally, the agricultural industry has adopted these amines for their role in enhancing the efficacy of pesticides, leading to an increase of 80 million liters of pesticide formulations containing tertiary amine surfactants. Furthermore, the oil & gas sector has seen a shift towards more environmentally sustainable products, with 120 new eco-friendly drilling fluid formulations incorporating tertiary amines launched in 2023. The combination of these factors underscores the versatility and indispensability of tertiary amine C12/14 in surfactant applications, driving its demand and cementing its position as a market leader.

By Distribution Channel

By distribution channel, offline segment leading the tertiary amine C12/14 market with market share over 73.86%. The Offline sales are the preferred distribution channel for tertiary amine C12/14 due to the specific requirements for handling and storage that are more effectively managed through traditional networks. One significant factor is that tertiary amines are used extensively in industrial applications such as surfactants, corrosion inhibitors, and polyurethane catalysts, which often require bulk purchasing and direct supplier relationships. This is evident as tertiary amines are a critical component in over 75% of global surfactant production, a sector that largely relies on established offline distribution channels. Additionally, the demand for tertiary amines in regions like North America and Europe is bolstered by robust sectors such as personal care, pharmaceuticals, and water treatment, which together account for more than 60% of the offline sales in these regions. The Asia-Pacific region, experiencing rapid industrialization, also shows a strong preference for offline channels due to the need for large-scale, reliable supply chains; for instance, China's industrial sector alone consumes over 40,000 tons of tertiary amines annually, with offline channels handling the bulk of this distribution.

The complexity of the supply chain for tertiary amines further solidifies the dominance of offline channels in the global tertiary amine C12/14 market. Offline distribution allows for better control over product quality and consistency, essential for maintaining efficacy in various applications. For example, hydrotreating units in the petrochemical industry, vital for refining processes, rely heavily on the precise management of lean amine flow, often facilitated by offline supply chains. Countries with intricate intermediary networks, such as Japan, which sees over 80% of its chemical intermediaries distributed offline, also benefit from these channels. Furthermore, sectors like personal care, agricultural chemicals, and construction in emerging economies drive demand for tertiary amines through offline channels due to the necessity for consistent and large-scale supply chains. In India, the personal care market, which grew by 15% in the last year, sees over 70% of its tertiary amine supply managed offline. The logistical support provided by offline channels is crucial, as evidenced by the fact that over 50% of tertiary amine shipments in Europe require specialized transportation and storage, capabilities more robustly supported by offline networks.

By End User

Tertiary amine C12/14 is heavily consumed by the personal care industry and the industry is accounting for over 24.91% share of the tertiary amine C12/14 market due to its multifunctional properties and its ability to enhance the performance of a variety of products. One key driver of demand is its role as an emulsifier and conditioning agent, which makes it a vital ingredient in formulations for hair conditioners, shampoos, and skincare products. The rise in consumer awareness about personal grooming and the increasing inclination towards premium and multifunctional personal care products have significantly fueled its demand. Furthermore, tertiary amine C12/14’s compatibility with various surfactants and its ability to provide superior texture and stability to end products have made it a preferred choice among formulators. For instance, its use in hair conditioners helps in reducing static and improving wet combability, contributing to an improved consumer experience.

The versatile nature of tertiary amine C12/14 allows it to be used in a wide range of applications, from antiperspirants to moisturizers. The global trend towards natural and sustainable ingredients has also driven manufacturers in the tertiary amine C12/14

market to integrate tertiary amine C12/14, derived from renewable sources, into their product lines. The personal care industry’s robust R&D activities, aimed at developing novel formulations, further bolster the consumption of this compound. According to recent data, over 50 new personal care products launched in the last year alone incorporate tertiary amine C12/14. Additionally, the compound’s efficacy in low concentrations has led to its increased adoption, with over 30 major global personal care brands now using it in their formulations. Moreover, tertiary amine C12/14 has been found in more than 40% of new hair care products launched in 2023, and it is a key ingredient in over 25 new skincare lines introduced this year. This widespread adoption is supported by substantial investments in the personal care sector, with over 60% of leading cosmetic companies prioritizing the incorporation of advanced amines in their product development strategies.

Customize This Report + Validate with an Expert

Access only the sections you need—region-specific, company-level, or by use-case.

Includes a free consultation with a domain expert to help guide your decision.

To Understand More About this Research: Request A Free Sample

Regional Analysis

Asia Pacific is dominating the global tertiary amine C12/14 market with revenue share of 49.29% in 2023. The demand is predominantly driven by its extensive applications in the manufacturing and consumer goods sectors. The region's burgeoning textile industry, which alone was valued at US$ 1.5 trillion in 2023, heavily utilizes tertiary amines as fabric softeners and dyeing agents. Additionally, the personal care market in Asia, worth US$ 200 billion, leverages these amines in products like shampoos and conditioners due to their emulsifying properties. The Asia Pacific surfactant market, a key end-user of tertiary amines, was estimated to be US$ 5.3 billion in 2023, growing at a CAGR of 5.6%. The agricultural sector also boosts demand; the region commands a 35% share of the global agrochemical market, using tertiary amines in herbicides and pesticides. Furthermore, the rapid industrialization in countries like China and India, which saw a year-on-year industrial growth rate of 6.9% and 5.4%, respectively, facilitates the increasing consumption of these chemicals in various industrial processes.

In North America, the tertiary amine C12/14 market growth is underpinned by its use in advanced technological applications and diversified industrial sectors. The U.S. cleaning products market, valued at US$ 30 billion in 2023, relies on tertiary amines for their role as surfactants and disinfectants. Additionally, the pharmaceutical industry, generating around US$ 550 billion in 2023, employs tertiary amines in the synthesis of various drugs. The region's robust research and development activities, supported by an annual R&D expenditure of US$ 612 billion, drive innovations that incorporate these amines into new formulations and applications. The expanding oil and gas sector, particularly in the United States, which saw a production increase to 12.1 million barrels per day in 2023, also depends on tertiary amines for enhanced oil recovery and drilling fluid formulations. The chemical industry’s growth, with a market size of US$ 800 billion, further augments the demand for tertiary amines in North America.

Europe's demand for tertiary amine C12/14 market is largely influenced by stringent environmental regulations and a strong emphasis on sustainable practices. The European Union’s Green Deal, aiming for climate neutrality by 2050, accelerates the adoption of eco-friendly chemicals, including tertiary amines in biodegradable cleaning agents and environmentally safe agricultural chemicals. The European personal care market, worth US$ 95 billion in 2023, also contributes significantly to the demand due to the increasing consumer preference for high-quality, sustainable products. Germany, a leading market in the region, saw a 4.2% growth in its chemical industry, valued at US$ 200 billion in 2023, with tertiary amines playing a crucial role in various chemical processes. The increasing adoption of electric vehicles, which saw a 25% rise in sales in 2023, drives the demand for tertiary amines used in battery production and maintenance. Additionally, the European biocides market, valued at US$ 3.8 billion, utilizes these amines for their antimicrobial properties, further bolstering their demand.

Top Players in Global Tertiary Amine C12/14 Market

- Actylis

- Eastman Chemical Company

- Global Amines Company Pte. Ltd.

- Jiangsu Wansheng Dawei Chemical Co. Ltd.

- Kao Chemicals

- Shanghai Sunwise Chemical Co., Ltd

- Qingdao Ever Century Chemical Co., Ltd.

- Wuxi Weiheng Chemical Co., Ltd.

- Wilmar International Ltd

- Other Prominent Players

Market Segmentation Overview:

By Purity Type

- 95% Min

- 97% Min

- Others

By Application

- Surfactants

- Biocides

- Drilling Fluids

- Others

By Distribution Channel

- Offline

- Direct

- Distributor

- Online

By End User

- Pharmaceutical

- Personal Care

- Daily chemical industry

- Water Treatment

- Textiles

- Agriculture

- Oil & Gas

- Others

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- Western Europe

- U.K.

- Germany

- France

- Spain

- Italy

- Rest of Western Europe

- Eastern Europe

- Poland

- Russia

- Rest of Eastern Europe

- Western Europe

- Asia Pacific

- China

- India

- Japan

- Australia & New Zealand

- ASEAN

- Rest of Asia Pacific

- Middle East & Africa (MEA)

- UAE

- Saudi Arabia

- South Africa

- Rest of MEA

- South America

- Argentina

- Brazil

- Rest of South America

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

.svg)