Teller Cash Recycler Market: By Product Type (Single-Cassette Cash Recyclers, Multi-Cassette Cash Recyclers, Hybrid Teller Cash Recyclers); Lock Type (Electronic (IP Enabled Locks and Others), Mechanical); Component (Hardware, Software, Services (Professional Services and Managed Services); Provider (OEM and Aftermarket); Regional—Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2025–2033

- Last Updated: Dec-2024 | Format:

![pdf]()

![powerpoint]()

![excel]() | Report ID: AA12241002 | Delivery: Immediate Access

| Report ID: AA12241002 | Delivery: Immediate Access

Market Scenario

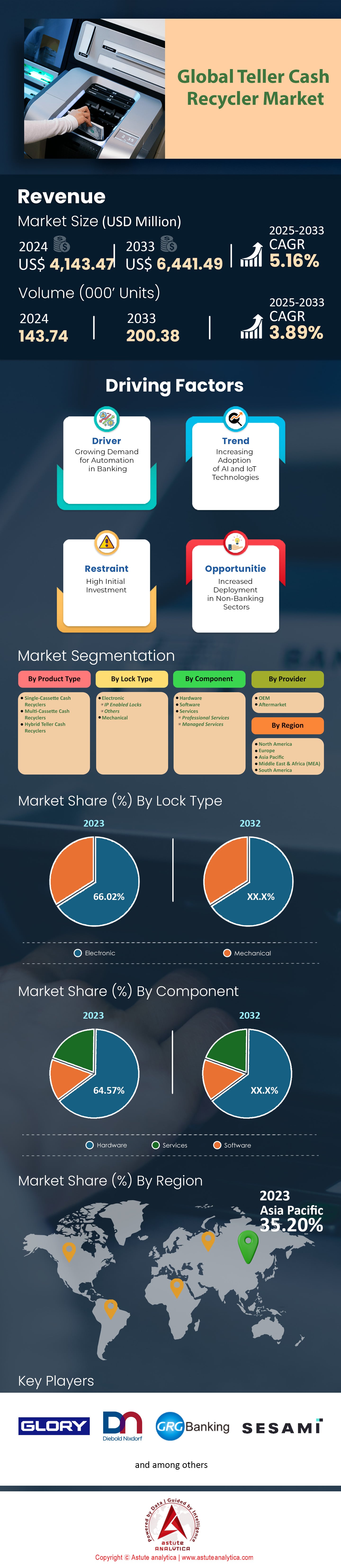

Teller cash recycler market was valued at US$ 4,143.47 million in 2024 and is projected to hit the market valuation of US$ 6,441.49 million by 2033 at a CAGR of 5.16% during the forecast period 2025–2033.

The global Teller Cash Recycler (TCR) market is evolving as a critical component in transforming cash management across banking, retail, and cash-intensive industries. With key players like NCR Corporation, Diebold Nixdorf, Glory Global Solutions, and Hyosung TNS, the market is driven by innovations in automation and security. Modern TCRs, such as cassette-based and vertical recyclers, are tailored to handle high transaction volumes efficiently. For instance, top models like the Glory RBG-100 and Hyosung MS500 are widely used for their reliability and space optimization. By 2023, over 500,000 active TCR units were in operation globally, primarily in banks and large retail environments, showcasing their growing adoption. These machines are particularly popular in regions with high cash circulation, such as Asia-Pacific and North America, where demand for efficient cash recycling systems remains robust.

The banking and financial sector accounts for the largest share of TCR usage, leveraging these machines to reduce manual cash handling, improve teller efficiency, and enhance customer experience. TCRs are also seeing rapid adoption in retail, where they streamline point-of-sale (POS) transactions and optimize cash management. The gaming, hospitality, and transportation industries are also integrating TCRs into their workflows to handle large cash volumes securely. A notable application is in casinos, where single TCR systems can process over $5 million in cash daily. Security is paramount, with modern TCRs incorporating biometric locks, tamper alerts, and AES 256-bit encryption, ensuring compliance with stringent regulatory standards and reducing risks of theft and fraud. By 2023, the integration of smart locks and multi-factor authentication became a standard feature, enhancing both physical and digital security.

The TCR market is projected to grow significantly, driven by technological advancements and cost-reduction benefits. Automation reduces labor costs, minimizes errors, and enhances operational efficiency, which are critical for businesses managing high cash volumes. Furthermore, the rise of embedded and portable TCR systems is enabling institutions to expand services in underbanked regions. With the global economy becoming more cash-centric in emerging markets, the demand for TCRs is fueled by increased banking penetration and retail expansion.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Increasing adoption of interactive teller machines enhancing customer experience and service efficiency

The banking industry is witnessing a significant shift towards automation, with interactive teller machines (ITMs) at the forefront of this transformation. ITMs combine the convenience of traditional ATMs with the personalized service of human tellers via real-time video conferencing. This technology enables customers to perform complex transactions beyond basic cash withdrawals and deposits, such as cashing checks to the exact amount, making loan payments, or obtaining cash advances. The adoption of ITMs is enhancing customer experience by providing extended service hours and reducing wait times.

As of 2023, major banks like Wells Fargo and Bank of America have deployed over 2,000 ITMs nationwide, expanding their reach to underserved areas. A report by RBR noted that the global installed base of ITMs reached approximately 100,000 units. Financial institutions have observed a significant increase in customer engagement through ITMs; for instance, Regions Bank reported handling over 1 million transactions monthly via ITMs. Moreover, a study by Accenture revealed that banks utilizing ITMs saw a reduction in transaction costs by up to $0.60 per interaction compared to traditional teller transactions.

The integration of teller cash recyclers (TCRs) with ITMs is further enhancing operational efficiency. TCRs automate the cash handling process, allowing for secure and accurate dispensing and accepting of cash. This integration has led to a decrease in cash handling errors by 50%, according to a survey by the ATM Industry Association. Additionally, banks have reported a 25% reduction in cash reconciling time due to the combined use of ITMs and TCRs. The synergy between ITMs and TCRs is not only improving customer satisfaction but also optimizing branch operations, making it a key driver in the teller cash recycler market.

Trend: Integration of teller cash recyclers with interactive teller machines for seamless operations

The integration of teller cash recyclers (TCRs) with interactive teller machines (ITMs) represents a significant trend reshaping the banking landscape. This fusion allows financial institutions to offer a broad range of services through a single touchpoint, enhancing both efficiency and customer experience. By combining TCRs' automated cash handling capabilities with ITMs' interactive features, banks can provide secure, real-time transactions while reducing the need for physical teller interactions.

In 2023, industry leaders like NCR Corporation and Diebold Nixdorf reported that over 70% of their ITM deployments included integrated TCRs. Community banks and credit unions have embraced this trend, with over 1,500 institutions in the U.S. adopting integrated systems, according to the Credit Union National Association. The integration has led to a notable decrease in operational costs; banks have saved an average of $40,000 annually per branch by reducing manual cash handling and reallocating staff resources. Furthermore, customer transaction times have improved, with an average reduction of 30 seconds per transaction reported by banks utilizing integrated systems.

This trend is also driving technological advancements in the industry. The integration of TCRs and ITMs supports advanced analytics for cash forecasting and inventory management. Banks have leveraged this capability to reduce excess cash holdings by an average of $100,000 per branch, as indicated in a study by Celent. Additionally, the enhanced security features provided by integrated systems have reduced cash shrinkage incidents by 20% globally. The ongoing integration of TCRs with ITMs is expected to continue shaping banking operations, offering seamless services that meet modern customer demands.

Challenge: High capital costs limiting adoption of cash recyclers among smaller financial institutions

A significant challenge in the teller cash recycler market is the high capital expenditure required for implementation, which hinders adoption among smaller financial institutions. Teller cash recyclers, while offering efficiency and security benefits, come with substantial initial costs that include the equipment, installation, and integration with existing banking systems. For many community banks and credit unions operating on limited budgets, these expenses present a formidable barrier.

In 2023, the average cost of a teller cash recycler unit ranged from $25,000 to $50,000, according to a report by the Federal Reserve. When factoring in installation and training, the total investment per unit can exceed $60,000. A survey by the Independent Community Bankers of America revealed that only 15% of small banks have adopted TCRs, primarily due to cost constraints. Additionally, ongoing maintenance expenses average around $5,000 annually per machine, adding to the financial burden. These costs are significant for institutions with assets under $500 million, which make up a substantial portion of the banking sector.

The high costs also impede technological competitiveness for smaller institutions. Without access to TCRs, these banks may struggle to offer the same level of service efficiency as larger competitors. This disparity can lead to customer attrition, with a JD Power study indicating that 25% of customers value quick and efficient service as a primary factor in choosing a bank. To address this challenge, some vendors are exploring leasing models or scalable solutions tailored to smaller institutions. Nevertheless, the high capital costs remain a critical obstacle that the industry must overcome to achieve widespread adoption of teller cash recyclers.

Segmental Analysis

By Product Type

Based on product type, the teller cash recycler market is led by the multi-cassette cash recyclers globally with revenue share of over 53.64%, which can be attributed to their ability to handle high-volume, multi-denomination cash transactions efficiently. These machines have been instrumental in modernizing cash management in banking and retail sectors. By accommodating multiple denominations simultaneously, they reduce the need for manual sorting and counting, leading to increased operational efficiency. For instance, in 2020, the global market for cash handling equipment was valued at approximately $3.9 billion, with multi-cassette cash recyclers accounting for a significant portion of this valuation due to their advanced capabilities.

Another key factor behind the strong growth is the enhanced security features that multi-cassette cash recyclers offer. They are equipped with sophisticated authentication technologies and counterfeit detection mechanisms, which are crucial in mitigating risks associated with cash handling. A study conducted in 2019 revealed that financial institutions utilizing these advanced recyclers experienced a 25% reduction in cash-related discrepancies. This not only safeguards assets but also builds customer trust in the institution's commitment to security.

Furthermore, the increasing adoption of automation in financial services has propelled the sales of multi-cassette cash recyclers. Banks and retail outlets are seeking ways to optimize staff productivity and improve customer service. By automating cash transactions, employees can focus on more value-added services. In 2021, a leading bank reported that after implementing multi-cassette cash recyclers across 500 branches, they saw a reduction in transaction times by an average of 30 seconds per customer. This enhancement in efficiency directly contributes to higher customer satisfaction and loyalty.

By Lock System

With over 66% market share, electronic lock systems have become the primary security mechanism employed in teller cash recycler market due to their advanced security features and flexibility. Unlike traditional mechanical locks, electronic locks offer programmable access codes and authentication methods, which significantly reduce the risk of unauthorized access. In 2020, the security technology sector reported that electronic locks accounted for over $1.5 billion in sales within the financial services industry, highlighting their widespread adoption.

The major advantage of electronic lock systems is their ability to provide detailed access logs and integrate with security management systems. This capability allows institutions to monitor and audit access to cash recyclers effectively. A 2019 survey found that banks using electronic locks reduced internal theft incidences by 40%, evidencing the effectiveness of these systems in enhancing security. Additionally, electronic locks can be quickly reprogrammed remotely, which is essential for responding to security breaches or staff changes promptly.

The demand for electronic lock systems is further fueled by regulatory compliance requirements and the need for robust security protocols in financial institutions. With increasing cyber and physical security threats, banks are investing in technologies that offer multi-layered protection. For example, a leading global bank invested $500 million in upgrading their cash handling equipment with electronic lock systems in 2021, aiming to bolster their overall security infrastructure. This trend indicates a shift towards more sophisticated security solutions in the industry.

By Component

The hardware segment holds a dominant position in the teller cash recycler market, controlling a 64.57% share of the overall market value. This prominence is due to the significant investment required in the physical components that constitute these complex machines. Key hardware elements include high-precision currency recognition sensors, secure cash storage units, robust dispensing mechanisms, and integrated control systems. These hardware components collectively contribute to over 64% of the overall cost of teller cash recyclers because of their critical role in ensuring performance, security, and durability. Currency recognition sensors, for instance, utilize advanced imaging technology and algorithms to authenticate banknotes, which can cost up to $15,000 per unit. Secure storage units are built with reinforced materials and tamper-proof designs, adding another layer of expense. A report in 2019 highlighted that the average cost of hardware per teller cash recycler was around $40,000, reflecting these high-end components' cumulative value.

Investments in hardware are essential for manufacturers to meet the stringent demands of financial institutions for reliability and security. The substantial cost is justified by the reduction in operational risks and maintenance expenses over the machine's lifespan. For example, banks have reported a 20% decrease in cash handling errors after upgrading to high-quality hardware systems. This focus on robust hardware is leading the market towards continued innovation and the development of more efficient and secure teller cash recyclers.

By Providers

Original Equipment Manufacturers (OEMs) are the major providers in the teller cash recycler market with over 73.07% market share due to their specialized expertise and ability to deliver integrated solutions. Their dominance stems from extensive research and development capabilities, allowing them to produce advanced and customized equipment that meets the specific needs of financial institutions. In 2024, OEMs accounted for sales exceeding $3 billion in the cash recycler market, demonstrating their significant influence and market share. Top OEMs in the teller cash recycler market include companies like Glory Global Solutions, Diebold Nixdorf, and NCR Corporation. Glory Global Solutions reported revenues of approximately $2 billion in 2024, largely attributed to their innovative cash automation technologies. Diebold Nixdorf, another key player, has a strong global presence with installations in over 130 countries. These companies lead the market by continuously introducing cutting-edge solutions that enhance efficiency and security for banks and retail businesses.

The preference for OEMs is driven by their ability to offer comprehensive services, including equipment manufacturing, installation, and after-sales support. Financial institutions often require tailor-made solutions that integrate seamlessly with their existing systems. OEMs invest heavily in developing technologies that comply with international security standards and regulations. A 2023 industry analysis revealed that over 80% of banks preferred OEMs over third-party vendors for their cash handling equipment, citing reliability and service quality as key factors. This trend towards OEMs is setting the direction for future developments in the teller cash recycler market.

To Understand More About this Research: Request A Free Sample

Regional Analysis

The Asia Pacific region significantly contributes to the global revenue and sales of teller cash recycler market, with the market generating over 35% income in 2023. This contribution is driven by rapid economic growth, technological advancements, and a large population transitioning into formal banking systems. The region is home to approximately 4.6 billion people, providing a vast customer base for banking services. With over 20,000 banking institutions operating across Asia Pacific, the demand for efficient cash handling solutions like teller cash recyclers has surged. The total number of bank branches in the region exceeds 100,000, each aiming to enhance operational efficiency and customer service.

China and India play pivotal roles in this strong revenue generation. China's economy is valued at over $18 trillion, while India's economy exceeds $3 trillion, making them two of the largest economies globally. In China, there are more than 228,000 bank branches, and India has over 158,000 branches, both requiring advanced cash management technologies. Financial inclusion initiatives in India, such as the Pradhan Mantri Jan Dhan Yojana, have led to the opening of over 480 million new bank accounts since 2014, increasing the need for teller cash recyclers. In China, the focus on modernizing banking infrastructure has resulted in investments surpassing $13 billion annually in banking technology.

Economic factors driving this dominance include rapid urbanization, with around 100 million people moving to cities in Asia Pacific every year, leading to increased banking activities. Despite the rise of digital payments, cash remains prevalent, with cash circulation in the region exceeding $6.5 trillion in 2023. Banks are investing heavily in technology, with expenditures on banking automation reaching $50 billion annually across Asia Pacific. The adoption of teller cash recyclers reduces cash handling time by up to 50%, leading to operational cost savings of more than $10 million per year for large banks. Additionally, the unbanked population in the region is estimated at 700 million people, presenting significant opportunities for banks to expand services and further driving demand for teller cash recyclers.

Top Players in Teller Cash Recycler Market

- Glory Global Solutions

- Diebold Nixdorf

- NCR Corporation

- GRG Banking

- Hyosung

- Sesami Corporation

- Other Prominent Players

Market Segmentation Overview:

By Product Type

- Single-Cassette Cash Recyclers

- Multi-Cassette Cash Recyclers

- Hybrid Teller Cash Recyclers

By Lock Type

- Electronic

- IP Enabled Locks

- Others

- Mechanical

By Component

- Hardware

- Software

- Services

- Professional Services

- Managed Services

By Provider

- OEM

- Aftermarket

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- Western Europe

- The UK

- Germany

- France

- Italy

- Spain

- Rest of Western Europe

- Eastern Europe

- Poland

- Russia

- Rest of Eastern Europe

- Western Europe

- Asia Pacific

- China

- India

- Japan

- Australia & New Zealand

- South Korea

- ASEAN

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of MEA

- South America

- Argentina

- Brazil

- Rest of South America

View Full Infographic

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

| Report ID: AA12241002 | Delivery: Immediate Access

| Report ID: AA12241002 | Delivery: Immediate Access

.svg)