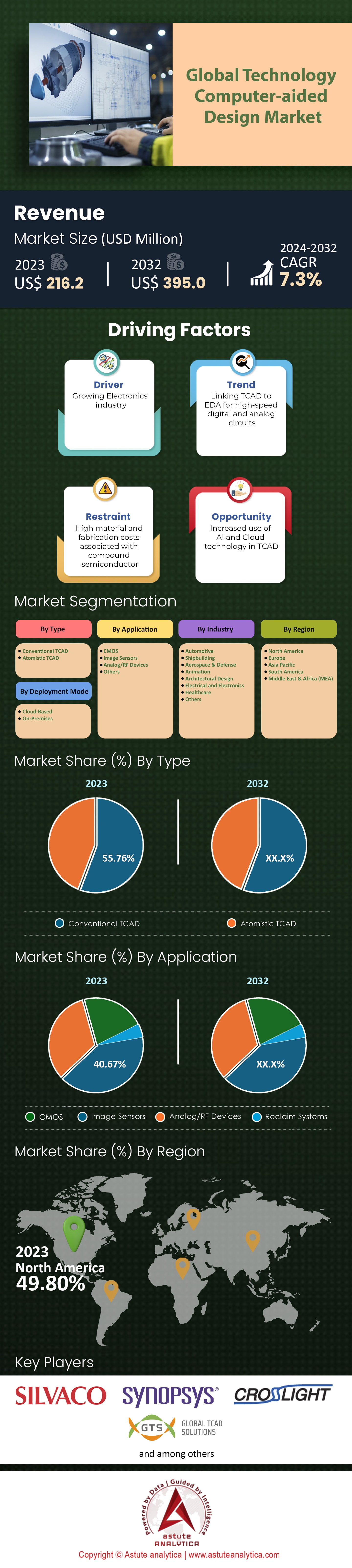

Global Technology Computer-aided Design Market: By Type (Conventional TCAD and Atomistic TCAD); Application (CMOS, Image Sensors, Analog/RF Devices, and Others); Deployment Mode (Cloud-Based and On-Premises); Industry (Automotive, Shipbuilding, Aerospace & Defense, Animation, Architectural Design, Electrical and Electronics, Healthcare, and Others); Region—Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2024–2032

- Last Updated: 01-Apr-2024 | | Report ID: AA0923624

Market Scenario

Global Technology Computer-aided Design (TCAD) Market was valued at US$ 216.2 million in 2023 and is projected to generate a revenue of US$ 395.0 million by 2032 at a CAGR of 7.3% during the forecast period 2024–2032.

The Technology Computer-Aided Design (TCAD) market, an integral segment of the electronic design automation (EDA) landscape, has evolved into a pivotal player in the broader electronics industry. Wherein, the entry barrier is notably high, attributed predominantly to the capital-intensive nature of advanced TCAD solutions. This has been a notable deterrent for smaller enterprises, with initial setup costs often breaching the $2 million mark for state-of-the-art systems. Yet, the industry is responding. The recent surge in cloud-based TCAD solutions, which reduce upfront costs by 40-50%, offers a more economically palatable avenue for businesses eager to harness the benefits of TCAD without the exorbitant initial expenditure.

What fuels this technology computer-aided design (TCAD) market propulsion? A granular look identifies the prodigious demand for semiconductor devices as a catalyst. With the production of these devices exceeding 1 trillion units annually, and an average year-on-year demand increase of 7%, the requirement for meticulous and efficient design tools like TCAD is accentuated. One often overlooked metric is the research and development (R&D) expenditure associated with TCAD tools. Leading corporations within the TCAD sphere have, in the recent fiscal year, allocated on average 15% of their revenue towards R&D activities. This heightened investment indicates a proactive approach to refining existing tools and pioneering next-generation solutions, ensuring the market remains on the cutting edge of innovation.

Moreover, the integration of artificial intelligence (AI) and machine learning (ML) in TCAD tools is on the rise. Current estimations posit that businesses incorporating AI-powered TCAD tools have realized efficiency gains of up to 25% in design and prototyping phases. The financial implications are profound, with potential cost savings, when extrapolated across the semiconductor industry, nearing $50 million annually. The enterprise adoption rate also provides valuable insights. While large multinational corporations in the global technology computer-aided design (TCAD) market have been the traditional heavy users of TCAD tools (with an adoption rate of 85%), the last two years have witnessed a 10% increase in adoption among medium-sized businesses. This change is largely credited to the more accessible cloud-based TCAD solutions and the clear ROI these tools promise. Apart from this, the educational sector’s involvement cannot be understated. Universities globally have increased their investment in TCAD tools by 12% in the past year alone. This surge is not merely for academic pursuits; it's a concerted effort to ensure a steady pipeline of skilled professionals familiar with contemporary TCAD solutions, addressing the industry's lament about a skills gap.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: The Exponential Demand for Advanced Semiconductors

In recent times, the electronics industry has experienced unprecedented growth. At the core of this momentum is the escalating demand for advanced semiconductors. Semiconductors serve as the backbone for a myriad of electronic devices, from smartphones and computers to the more intricate Internet of Things (IoT) devices and artificial intelligence (AI) modules. A recent market study has shown that the global semiconductor industry's sales reached a staggering $600 billion in 2022, marking a significant 6.5% increase from the previous year. This growth of the technology computer-aided design (TCAD) market isn't isolated to just one sector. For instance, the smartphone industry, which accounted for nearly 40% of all semiconductor sales, witnessed the shipment of approximately 1.2 billion units globally in 2022. Likewise, the AI sector, albeit a smaller market slice, has seen a 50% year-on-year increase in semiconductor demand due to the upsurge in AI-enabled devices and solutions.

This exponential demand is fueled by rapid technological advancements and a consumer market that is increasingly reliant on high-speed, efficient, and miniaturized electronic devices. As the tech industry strives to produce smaller, faster, and more efficient chips, the pressure mounts on semiconductor manufacturers to innovate and deliver. With each innovation cycle, the chip design complexity escalates, directly leading to the amplified need for advanced Technology Computer-Aided Design (TCAD) tools. Hence, the surging demand for sophisticated semiconductors acts as a primary driver for the TCAD market.

Trend: The Shift Towards Cloud-Based TCAD Solutions

The digital transformation wave, complemented by the increasing acceptance of cloud computing, has made significant inroads in the Technology computer-aided design (TCAD) marketas well. The past three years have marked a noticeable trend: the gravitation towards cloud-based TCAD solutions. Recent data indicates that nearly 55% of new TCAD installations in businesses were cloud-based, a leap from the mere 30% just five years ago. One can't ignore the financial dynamics underpinning this trend. Traditional TCAD setups, with their on-premises installations, demand significant capital expenditure, often reaching upwards of $2 million for comprehensive solutions. On the other hand, cloud-based models, with their Software-as-a-Service (SaaS) offerings, cut down the initial setup costs by a remarkable 60%, making them increasingly attractive for both large enterprises and SMEs.

This shift isn't solely cost-driven. The cloud model offers unparalleled scalability, allowing businesses to adjust their TCAD capabilities in line with their fluctuating requirements. Furthermore, cloud solutions ensure that businesses are always working with the latest software versions in the technology computer-aided design (TCAD) market, thanks to regular updates and patches. This, in turn, translates to a 20% efficiency increase in design workflows, as reported by early adopters. Apart from this, 99.9% uptime guaranteed by most cloud service providers, ensuring that design teams can work uninterrupted, leading to faster time-to-market for electronic products. Moreover, with the global cloud infrastructure expanding, businesses across different geographies, even those in regions previously underserved by advanced tech infrastructures, can now harness the full power of TCAD tools.

Restraint: The Steep Learning Curve and Skilled Workforce Deficit

A significant restraint impeding the unbridled growth of the global Technology Computer-Aided Design (TCAD) market is the steep learning curve associated with mastering these sophisticated tools, coupled with a glaring deficit in skilled professionals. As the complexity of electronic designs escalates, the TCAD tools used to model, simulate, and validate these designs have evolved into intricate software ecosystems, demanding both foundational and advanced knowledge for efficient operation.

The numbers elucidate the depth of this challenge. Recent surveys indicate that approximately 40% of businesses cite the lack of skilled personnel as a primary barrier to the adoption of state-of-the-art TCAD tools. This isn't merely about familiarity with the software's interface; it encompasses a deep understanding of semiconductor physics, device fabrication processes, and complex modeling techniques. Furthermore, training existing staff is not a straightforward solution. A comprehensive training cycle for TCAD tools can extend up to 6 months, translating to a substantial loss in productivity during the interim. This duration can be financially burdensome, with training costs for a single professional averaging around $10,000. Simultaneously, the global educational landscape has been slow to catch up. A mere 20% of engineering institutions have integrated advanced TCAD tool training in their curricula. This educational lag further exacerbates the skills gap, with companies often engaged in fierce competition to recruit the few available experts.

Segmental Analysis

By Type

By type, the Conventional TCAD segment has firmly established its stronghold in the global technology computer-aided design (TCAD) market, accounting for a commendable 55.7% of the market share. The reasons for its dominance are multifold. First, Conventional TCAD tools have been in the industry for a longer duration, leading to widespread acceptance, familiarity, and integration in numerous semiconductor design processes. These tools offer a balanced blend of accuracy and computational efficiency, making them ideal for a variety of standard semiconductor design applications. This broad-spectrum applicability and proven track record further bolster its high market share. Given its entrenched position, this segment is anticipated to maintain its leadership stance in the upcoming years.

On the other side, the Atomistic TCAD is making waves in the technology computer-aided design (TCAD) market. Even though it currently holds a smaller slice of the market pie, its growth trajectory is remarkably robust, with projections of a 6.3% CAGR in the coming years. The promise of Atomistic TCAD lies in its ability to model and simulate semiconductor devices at an atomic level, offering unparalleled precision. As the semiconductor industry pushes towards nanoscale devices and novel materials, the need for atomistic simulations escalates, thus driving the demand for Atomistic TCAD tools. Consequently, while it may not outpace the Conventional TCAD segment soon, its accelerated growth rate indicates its burgeoning importance.

By Application

By application, the CMOS segment of the technology computer-aided design (TCAD) market emerges as a clear frontrunner. Claiming a substantial 40.6% market share, the dominance of the CMOS segment is a testament to the pervasive use of CMOS technology in a plethora of electronic devices. The ubiquity of CMOS, stemming from its low power consumption and high noise immunity, translates to a massive demand for TCAD tools that can efficiently design and optimize CMOS-based devices. Furthermore, as we inch towards more advanced nodes in CMOS technology, the intricacies of design and the challenges of device variability necessitate sophisticated TCAD simulations. The segment's projected CAGR of 6.6% further emphasizes its continued importance in the Technology computer-aided design (TCAD) market landscape.

By Deployment

By deployment, the on-premise deployment mode continues to command the Technology computer-aided design (TCAD) market with a substantial share of 65.7%. Historically, companies have shown a preference for on-premise solutions due to concerns about data security, the need for customization, and the direct control it offers over software assets. Large enterprises, in particular, have the necessary infrastructure and IT capabilities to maintain and manage these solutions efficiently. They often prioritize the customization and robustness that on-premise solutions offer, especially when handling complex semiconductor designs that require substantial computational resources.

Even though cloud-based deployment for TCAD tools currently occupies a smaller segment in technology computer-aided design (TCAD) market, its significance can't be understated. With the increasing acceptance of cloud computing and the promise of scalability, cost-effectiveness, and accessibility, many businesses, especially SMEs, are exploring cloud-based TCAD solutions. As global cloud infrastructure becomes more robust and concerns about data security are assuaged, it's reasonable to anticipate an upward trajectory for this segment, albeit at a measured pace.

Customize This Report + Validate with an Expert

Access only the sections you need—region-specific, company-level, or by use-case.

Includes a free consultation with a domain expert to help guide your decision.

To Understand More About this Research: Request A Free Sample

By Industry

The electrical and electronics sector is the cornerstone of the technology computer-aided design (TCAD) market. With a dominant share of 27.6%, its supremacy is a direct reflection of the ever-growing demand for advanced electronic products and systems. The reach of electrical and electronics is vast, encompassing everything from consumer electronics like smartphones and laptops to more specialized equipment used in sectors such as healthcare, automotive, and aerospace. As these products continue to advance, becoming more energy-efficient, compact, and feature-rich, the reliance on sophisticated TCAD tools for their design and validation grows correspondingly. The forecasted CAGR of 7.3% for this segment underlines its continued growth and the unceasing innovations expected in the electronics domain.

Regional Analysis

North America, spearheaded by the technological powerhouse – the United States, currently sits atop the global Technology computer-aided design (TCAD) market hierarchy, claiming an impressive 49.8% of the market share. The region's dominance is underpinned by a combination of factors. Central to this is the U. S’s pioneering role in technological advancements. Even amidst the backdrop of strict political and national security concerns relating to chip manufacturing, American firms have consistently pushed the envelope, driving the market forward. Additionally, North America's Technology computer-aided design (TCAD) market strength is bolstered by the presence of an array of influential software providers and semiconductor manufacturing entities. Their collective contributions have effectively established the region as the global TCAD market's epicenter.

Followed by North America, Asia Pacific region is exhibiting a significant upswing in the TCAD market. Propelling this ascent is the region's robust embrace of technological software, brisk economic developments, and an expanding cohort of electronic manufacturing firms. Within the Asia-Pacific domain, China emerges as the undisputed leader, accounting for a noteworthy 30% of the region's market share. The twin factors of cost-effective labor and abundant availability of essential raw materials position China as an attractive hub for TCAD-centric activities.

Europe trails in the Technology computer-aided design (TCAD) market race, but its presence is steadily felt, marked by a CAGR of 4.6%. The European market is characterized by a blend of mature economies with advanced technological infrastructures and emerging economies keen on integrating cutting-edge design methodologies. The synergy of these dynamics makes Europe an intriguing player in the global TCAD market.

The regions of the Middle East & Africa and South America, while currently occupying a smaller market share, showcase promising growth prospects. With CAGRs of 3.8% and 3% respectively, these regions represent emerging markets where TCAD adoption is on the rise, driven by growing technological aspirations and increasing investments in semiconductor research and manufacturing.

Top Players in Technology Computer-Aided Design (TCAD) Market

- Cogenda Software

- Crosslight

- Global TCAD Solutions GmbH

- Graebert GmbH

- NTT Data Mathematical Systems, Inc.

- Silvaco

- Synopsys

- Tiberlab

- Other Prominent Players

Market Segmentation Overview:

By Type

- Conventional TCAD

- Atomistic TCAD

By Application

- CMOS

- Image Sensors

- Analog/RF Devices

- Others

By Deployment Mode

- Cloud-Based

- On-Premises

By Industry

- Automotive

- Shipbuilding

- Aerospace & Defense

- Animation

- Architectural Design

- Electrical and Electronics

- Healthcare

- Others

By Region

- North America

- The US

- Canada

- Mexico

- Europe

- The U.K.

- Germany

- France

- Spain

- Poland

- Belgium

- Finland

- Netherlands

- Portugal

- Sweden

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Australia & New Zealand

- ASEAN

- South Korea

- Rest of Asia Pacific

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Morocco

- Rest of MEA

- South America

- Brazil

- Argentina

- Colombia

- Chile

- Peru

- Rest of South America

REPORT SCOPE

| Report Attribute | Details |

|---|---|

| Market Size Value in 2023 | US$ 216.2 Mn |

| Expected Revenue in 2032 | US$ 395.0 Mn |

| Historic Data | 2019-2022 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Unit | Value (USD Mn) |

| CAGR | 7.3% |

| Segments covered | By Type , By Application, By Deployment Mode, By Industry, By Region |

| Key Companies | Cogenda Software, Crosslight, Global TCAD Solutions GmbH, Graebert GmbH, NTT Data Mathematical Systems, Inc., Silvaco, Synopsys., Tiberlab, Other Prominent Players |

| Customization Scope | Get your customized report as per your preference. Ask for customization |

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

.svg)