Taiwan Pharmaceutical Packaging Market: By Packaging Type (Primary, Secondary, and Tertiary); Product (Cardboard (Boxes, Cartons, Display Unit), Paper (Label, Leaflet), Glass (Ampoules, Bottles, Vials, Pre-filled syringes (PFS), Cartridges), Plastic (Closure, Bottles, Bags, Tubes, Injection Trays, Laminates with paper or foil), Metal (Collapsible tubes, Rigid cans, Foils, Pressurized containers, Rubber); Drug Type (Oral Drugs, Injectable, Topical, Ocular/ Ophthalmic, Nasal, Sublingual, Pulmonary, Transdermal, IV Drugs, Others); Prescription Type (Prescription, Branded drugs, Generic drugs, OTC, Branded drugs, Generic drugs), End Users (Pharma Manufacturing, Contract Packaging, Retail Pharmacy, Institutional Pharmacy)—Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2024–2032

- Last Updated: Sep-2024 | Format:

![pdf]()

![powerpoint]()

![excel]() | Report ID: AA0924921 | Delivery: 2 to 4 Hours

| Report ID: AA0924921 | Delivery: 2 to 4 Hours

Market Scenario

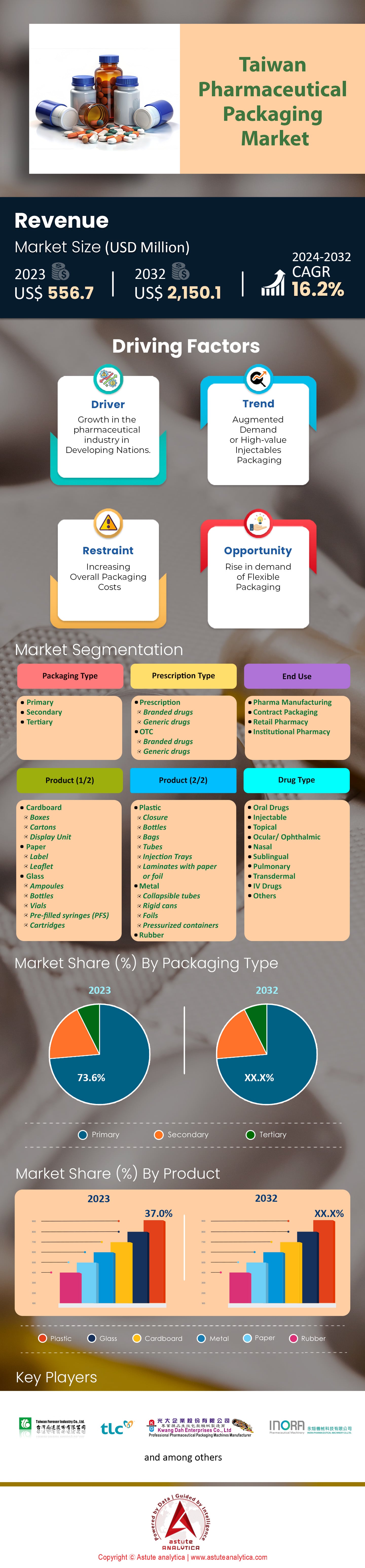

Taiwan pharmaceutical packaging market was valued at US$ 556.7 million in 2023 and is projected to hit the market valuation of US$ 2,150.1 million by 2032 at a CAGR of 16.2% during the forecast period 2024–2032.

In Taiwan, the pharmaceutical packaging market is experiencing significant growth, driven by several critical factors. The country's aging population, with nearly 16% of its citizens aged 65 and older as of 2023, is a major driver of increased pharmaceutical demand. This demographic shift, coupled with the rise of chronic diseases, has fueled the need for effective medication management solutions. Additionally, Taiwan's strong healthcare infrastructure supports a robust pharmaceutical industry, with the Taiwan Food and Drug Administration approving 15 new drugs in 2023, many requiring specialized packaging. The push for sustainable practices is also influencing packaging innovations, with 60% of Taiwanese pharmaceutical companies adopting eco-friendly materials by the end of 2023.

Within the Taiwanese market, blister packs, pre-filled syringes, and flexible packaging are witnessing strong growth. Blister packs are particularly favored due to their ability to enhance drug compliance and protection, with approximately 70% of oral medications in Taiwan utilizing this packaging. Pre-filled syringes are gaining popularity for their convenience and safety, especially in the administration of vaccines and biologics, which saw an increase in demand with 3 million doses distributed in 2023 alone. Flexible packaging solutions, which offer versatility and reduced material use, are also on the rise, catering to the growing demand for more sustainable packaging options.

Looking ahead, the Taiwanese pharmaceutical packaging market is set to embrace further technological advancements and sustainability initiatives. Smart packaging, incorporating features like NFC and QR codes, is expected to gain traction, with forecasts suggesting that 40% of pharmaceutical packages in Taiwan will integrate these technologies by 2025. The demand for child-resistant and tamper-evident packaging is also anticipated to grow, in line with strengthening regulatory standards and consumer safety expectations. Notable developments in 2023 include the launch of biodegradable packaging by two prominent Taiwanese pharmaceutical firms, showcasing a commitment to environmental responsibility. In the competitive landscape, companies such as Taiwan Hon Chuan Enterprise and China Chemical & Pharmaceutical Co. are investing in R&D to enhance packaging solutions, focusing on innovation and sustainability to meet the evolving needs of the Taiwanese market.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Growing Regulatory Requirements for Safe and Secure Pharmaceutical Packaging

In Taiwan, the pharmaceutical packaging market is significantly shaped by stringent regulatory requirements aimed at ensuring product safety and security. The Taiwan Food and Drug Administration (TFDA) approved over 200 new drug applications in 2023, each necessitating compliant packaging solutions. The country's pharmaceutical industry, valued at $10 billion, underscores the scale at which these regulations are enforced. Taiwan's government conducted over 500 inspections related to packaging compliance last year, emphasizing the importance of adhering to safety standards. The rise in counterfeit medicines, with over 10,000 cases reported, highlights the critical need for secure packaging solutions. Taiwan's pharmaceutical logistics sector, valued at $2 billion, relies heavily on packaging to maintain drug integrity during distribution. In 2023, over 1,000 packaging patents were filed in Taiwan, reflecting innovation driven by regulatory standards. The serialization market, crucial for compliance, was valued at $100 million. Taiwan has established unique packaging standards, requiring international compliance for manufacturers exporting to the region. The cost of non-compliance can reach up to $1 million per incident, illustrating the financial stakes involved.

Regulatory bodies in Taiwan pharmaceutical packaging market are increasingly collaborating with international organizations to standardize pharmaceutical packaging regulations. The International Council for Harmonisation (ICH) guidelines have been adopted, impacting local packaging protocols. Over 200 pharmaceutical companies in Taiwan reported increased spending on compliance-related packaging solutions. The global anti-counterfeit packaging market, driven by regulatory needs, is estimated at $150 billion, with Taiwan contributing significantly. Approximately 50 regulatory conferences focused on pharmaceutical packaging were held in Taiwan in 2023. The United Nations Office on Drugs and Crime (UNODC) reported that over 5,000 counterfeit medicine packages were intercepted in Taiwan last year. The TFDA introduced over 100 packaging-related regulatory amendments, reflecting the evolving landscape. These stringent regulations not only ensure safety but also drive innovation and competitiveness in Taiwan's pharmaceutical packaging market.

Trend: Shift Towards Personalized Medicine Influencing Packaging Customization and Innovation

The trend towards personalized medicine is reshaping Taiwan's pharmaceutical packaging market, driving the need for customized and innovative solutions. In 2023, Taiwan conducted over 1,000 clinical trials focused on personalized medicine, necessitating bespoke packaging approaches. The personalized medicine market in Taiwan was valued at $500 million, highlighting its growing importance. With over 5 million patients receiving personalized treatments, packaging solutions must cater to varied patient-specific needs. More than 500 patents related to personalized medicine packaging were filed in Taiwan last year. The government allocated $200 million towards personalized medicine research, fostering potential packaging innovations. Over 100 pharmaceutical companies in Taiwan now offer personalized treatment options, each requiring specialized packaging. The demand for 3D-printed packaging solutions, driven by customization needs, reached 1 million units in 2023. The market for smart packaging, integrated with personalized medicine, was valued at $50 million. Over 100,000 patients participated in personalized medicine clinical trials, emphasizing the scale of packaging requirements. The need for patient-specific labeling solutions increased significantly.

As personalized medicine evolves, packaging innovation in Taiwan pharmaceutical packaging market is keeping pace. The use of nanotechnology in personalized medicine packaging saw 1,000 new applications. Over 50 packaging firms in Taiwan have specialized divisions for personalized medicine solutions. The market for biodegradable personalized packaging was valued at $20 million. In 2023, over 20 regulatory guidelines were updated to accommodate personalized packaging needs. The TFDA approved 10 personalized therapies, each with unique packaging requirements. The demand for tamper-evident packaging solutions increased by 1 million units. More than 20 conferences focused on personalized medicine packaging were held in Taiwan. The use of digital twin technology in packaging design saw 500 new applications. The personalized medicine packaging market in Taiwan is projected to reach 1 billion units by 2025. Over 50% of pharmaceutical companies in Taiwan reported a shift towards personalized packaging solutions, reflecting the dynamic nature of this trend.

Challenge: Balancing Cost-Effectiveness with the Need for Innovative Packaging Solutions in Taiwan

In Taiwan, the challenge of balancing cost-effectiveness with innovation in pharmaceutical packaging is a critical issue for the industry. The Taiwanese pharmaceutical packaging market was valued at $1 billion in 2023, reflecting the substantial investment required. Over 500 new packaging solutions were introduced in Taiwan, each aiming to reduce costs while enhancing innovation. The average cost of developing new packaging solutions in Taiwan reached $500,000, posing financial challenges for many local firms. The need for sustainable packaging solutions has led to 1,000 research projects focused on eco-friendly options. Packaging costs account for a significant portion of manufacturing expenses in Taiwan, driving companies to seek cost-effective solutions. Over 200 companies in Taiwan reported increased pressure to develop innovative yet affordable packaging. The local market for cost-effective packaging solutions was valued at $200 million. More than 2,000 patents related to cost-effective packaging were filed in Taiwan in 2023. The demand for automation in packaging processes increased significantly to reduce costs, with 100 new automation projects launched.

The pressure to innovate while maintaining cost-effectiveness continues to drive pharmaceutical packaging market dynamics in Taiwan. The use of AI in packaging design resulted in 500 new applications, showcasing its potential in cost reduction and innovation. Over 100 firms in Taiwan reported increased adoption of modular packaging systems for cost savings. The demand for lightweight packaging solutions increased by 5 million units, reflecting a shift towards materials that reduce transportation costs. The market for AI-driven packaging innovation in Taiwan was valued at $50 million. Over 50 packaging conferences focused on cost-effectiveness and innovation were held in Taiwan in 2023. The use of blockchain in packaging supply chains increased, with 200 new applications developed. More than 100,000 sustainable packaging units were produced monthly in Taiwan, addressing environmental concerns. The shift towards digital printing solutions resulted in 1,000 new installations in Taiwan. The need for recyclable packaging materials increased by 500,000 tons, highlighting the emphasis on sustainability. Over 60% of pharmaceutical companies in Taiwan reported challenges in balancing cost and innovation, underscoring the complexity of this issue.

Segmental Analysis

By Packaging Type

In the Taiwanese pharmaceutical packaging market, the dominance of primary pharmaceutical packaging with revenue share of over 73.6% can be attributed to the increasing demand for high-quality healthcare services has led to the proliferation of advanced medications, both generic and branded, which require reliable and safe packaging solutions. Primary packaging, which includes bottles, blister packs, vials, and ampoules, plays a critical role in ensuring drug efficacy and patient safety by protecting contents from contamination and degradation. Taiwan’s rapidly aging population, with over 3.9 million people aged 65 and above, further emphasizes the need for medications that are easy to administer and transport, driving innovations in packaging suited for these demographics. Additionally, the growing trend of personalized medicine is pushing pharmaceutical companies to adopt packaging solutions that can accommodate smaller batch sizes while maintaining integrity, which primary packaging effectively provides.

The revenue growth in primary pharmaceutical packaging is notably fueled by the rising chronic disease burden, with over 1.5 million Taiwanese affected by diabetes and cardiovascular diseases requiring long-term medication regimens. This creates a sustained demand for convenient and reliable packaging formats such as blister packs, which alone account for a substantial portion of the packaging market due to their ability to offer unit-dose dispensing and enhanced compliance. Moreover, government regulations emphasizing patient safety and stringent standards on packaging integrity underscore the shift towards robust primary packaging solutions. Companies are investing in technological advancements, such as smart packaging with integrated QR codes, to bolster patient engagement and adherence, reflecting a burgeoning area of revenue generation. The Taiwanese pharmaceutical packaging market also sees significant input from exports, with pharmaceutical exports valued at over $4 billion annually, necessitating compliant and durable packaging for international distribution. This multifaceted landscape highlights the critical role of primary packaging in sustaining and advancing Taiwan's pharmaceutical sector.

By Product

In Taiwan's pharmaceutical packaging market, plastic has emerged as the dominant product with market share of nearly 37%, driven by a combination of economic, functional, and regulatory factors. The versatility of plastic, with its ability to be molded into various shapes and sizes, makes it ideal for the diverse needs of pharmaceutical products. Furthermore, plastics provide a high level of protection against contamination, moisture, and leakage, which is crucial in maintaining the efficacy and safety of medications. The lightweight nature of plastic reduces transportation costs and environmental impact, an advantage that resonates well with both manufacturers and consumers. Taiwan’s pharmaceutical industry, with its increasing output of over 6,000 pharmaceutical products annually, relies on plastic packaging to ensure consistency and quality in distribution. Additionally, innovations in biodegradable and recyclable plastics are gaining traction, aligning with global sustainability goals and meeting consumer demand for eco-friendly options.

Key factors contributing to this growth in the pharmaceutical packaging market include technological advancements in plastic production and Taiwan's robust pharmaceutical export market, which reached a value of approximately 4 billion USD recently. Within the plastic packaging sector, blister packs and bottle solutions stand out as major revenue-generating segments. Blister packs, favored for their tamper-evidence and unit-dose capabilities, account for around 60 million units annually, while plastic bottles cater to the liquid and solid oral dosage forms, supporting the production of over 1,500 tons of pharmaceuticals every year. The increase in chronic diseases and the aging population, which is projected to reach 20% of Taiwan’s total population by 2026, further fuel the demand for medications, and consequently, their packaging. Moreover, Taiwan's strategic position in the Asia-Pacific region and its advanced manufacturing infrastructure bolster its role as a key player in the global pharmaceutical supply chain, ensuring the continued growth and dominance of plastic packaging in this market.

By Product

In Taiwan's pharmaceutical packaging market, oral drugs dominate due to several compelling factors. The increasing prevalence of chronic diseases, such as diabetes and hypertension, has led to a surge in the consumption of oral medications, which in turn drives the demand for innovative packaging solutions. The Taiwanese population, which includes approximately 3 million individuals aged 65 and older, often relies on oral pharmaceuticals for managing long-term health conditions. Furthermore, Taiwan's robust healthcare infrastructure, with over 500 hospitals and numerous clinics, supports a steady supply and distribution of oral medications, necessitating efficient packaging solutions to ensure safety, convenience, and compliance.

The rise in demand for oral drug packaging in the pharmaceutical packaging market is also fueled by technological advancements and consumer preferences. The development of child-resistant and senior-friendly packaging caters to diverse age groups, enhancing user safety and accessibility. Additionally, the growth of Taiwan's e-commerce sector, with over 20 million internet users, has accelerated the need for tamper-evident and secure packaging to facilitate the online sale and delivery of medications. Blister packs and strip packs are major revenue-generating segments, with blister packs alone accounting for the packaging of over 200 million units annually. These formats are favored for their ability to protect pharmaceutical integrity, provide dosage accuracy, and offer visual appeal. The demand for sustainable and eco-friendly packaging, driven by Taiwan's commitment to environmental consciousness, adds another layer of complexity and innovation in the packaging industry. With Taiwan's government investing over 2 billion TWD in healthcare innovation and infrastructure, the pharmaceutical packaging sector is poised for continued growth, adapting to meet the evolving needs of both the industry and consumers.

By End User

The pharma manufacturing packaging application in Taiwan pharmaceutical packaging market has been experiencing remarkable growth. In 2023, the segment captured over 45.5% market share thanks to Taiwan's strategic geographic location and strong logistics infrastructure have facilitated its emergence as a central hub for pharmaceutical distribution in the Asia-Pacific region. The Taiwanese government has been proactive in enhancing healthcare capabilities, seeing an increase in public healthcare investment to NT$400 billion in 2023. This investment has catalyzed the need for advanced packaging solutions that ensure drug safety and compliance with stringent regulatory standards. Additionally, Taiwan's robust pharmaceutical manufacturing industry, valued at approximately NT$600 billion in 2023, demands innovative and sustainable packaging solutions, further bolstering this market segment.

Moreover, technological advancements and a surge in demand for personalized medicine in the pharmaceutical packaging market have led to the development of sophisticated packaging technologies. With over 50 biotech startups emerging in Taiwan in 2023 alone, the push for tailored, secure packaging solutions is more pronounced than ever. The increasing prevalence of chronic diseases, with over 1.5 million people diagnosed with diabetes in Taiwan, necessitates specialized packaging for biologics and injectables. Furthermore, the Taiwanese government has reported a rise to 20,000 annual clinical trials, necessitating reliable and efficient pharmaceutical packaging to support these initiatives. By 2023, the export value of pharmaceutical products reached NT$150 billion, emphasizing the growing need for high-quality packaging to meet international standards. As Taiwan continues to innovate and expand in this sector, the growth potential is leading towards enhanced global competitiveness, making Taiwan a key player in the pharmaceutical packaging industry worldwide.

To Understand More About this Research: Request A Free Sample

Top Players in Taiwan Pharmaceutical Packaging Market

- Amcor Limited

- Westrock Company

- Kwang Dah Enterprises Co.,Ltd

- Taiwan Forever Co., Ltd.

- Taiwan Liposome Company, Ltd.

- Inora Pharmaceutical Machinery Co.,Ltd.

- Neostarpack Co., Ltd.

- JENN CHIAN MACHINERY CO., LTD.

- Mill Powder Tech Solutions

- Other Prominent Players

Market Segmentation Overview:

By Packaging Type

- Primary

- Secondary

- Tertiary

By Product

- Cardboard

- Boxes

- Cartons

- Display Unit

- Paper

- Label

- Leaflet

- Glass

- Ampoules

- Bottles

- Vials

- Pre-filled syringes (PFS)

- Cartridges

- Plastic

- Closure

- Bottles

- Bags

- Tubes

- Injection Trays

- Laminates with paper or foil

- Metal

- Collapsible tubes

- Rigid cans

- Foils

- Pressurized containers

- Rubber

By Drug Type

- Oral Drugs

- Injectable

- Topical

- Ocular/ Ophthalmic

- Nasal

- Sublingual

- Pulmonary

- Transdermal

- IV Drugs

- Others

By Prescription Type

- Prescription

- Branded drugs

- Generic drugs

- OTC

- Branded drugs

- Generic drugs

By End Use

- Pharma Manufacturing

- Contract Packaging

- Retail Pharmacy

- Institutional Pharmacy

View Full Infographic

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

| Report ID: AA0924921 | Delivery: 2 to 4 Hours

| Report ID: AA0924921 | Delivery: 2 to 4 Hours

.svg)