Synthetic Leather Market: By Type (Non-woven microfiber, Non-woven microfiber); End User: (Footwear (Performance Footwear, Fashion Footwear), Bags and Accessories, Furnishing (Couches & Sofas, Chairs), Interior (Interior Décor & Surfacing and Wall Tiles), Automobiles (Seats, Doors, Dashboards, Steering Covers, Others), Sporting Goods, Garments/ Fashion (Fashion Apparel, Fashion Accessories, Performance Apparel), Luxury Goods (Hard Luxury, Soft Luxury), Others (Including Industrial)); Material (Polyurethane (PU), Polyvinyl Chloride (PVC), Resin, Bio-based, Others); Distribution Channel (Online and Offline); Region—Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2025-2033

- Last Updated: 20-Aug-2025 | | Report ID: AA0423431

Market Scenario

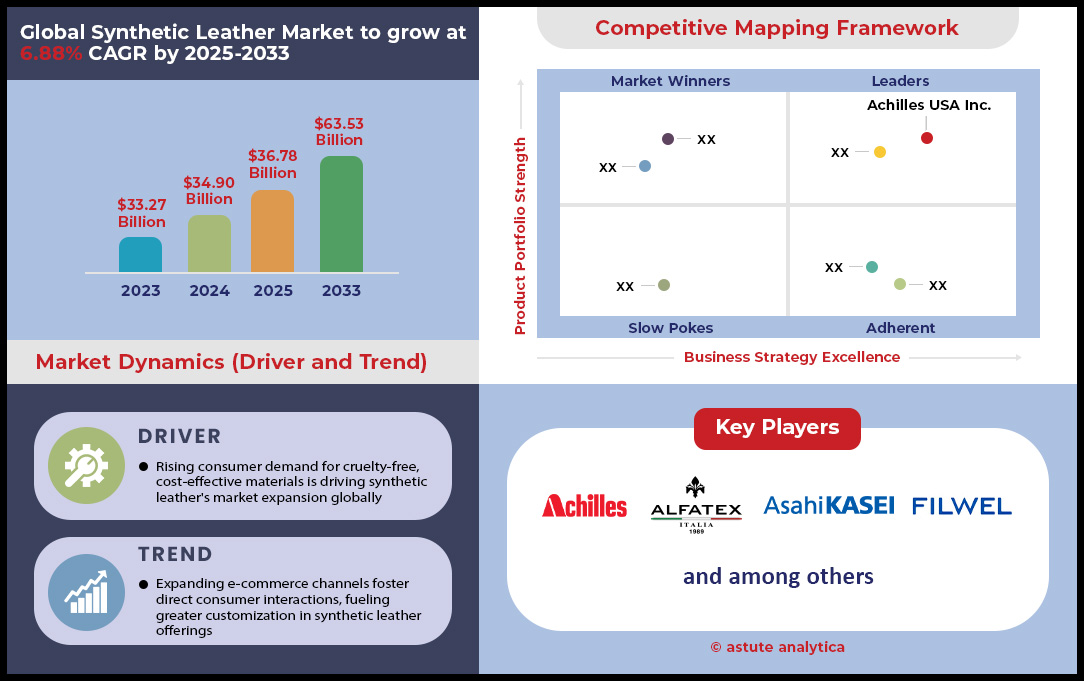

Synthetic leather market was valued at US$ 34.90 billion in 2024 and is projected to hit US$ 63.52 billion by 2033 at a CAGR of 6.88% during the forecast period 2025–2033.

Key Findings in Synthetic Leather Market

- Based on type, Knitted or woven synthetic leather has emerged as a leading choice within market and holds over 63.7% market share.

- Based on material, the resin segment leads the market with over 84.5% market share.

- Based on end users, footwear sector with over 30.3% market share consistently stands out as the largest consumer.

- Based on distribution channel, offline distribution channels still account for 85.5% share of the market.

- Asia Pacific is the largest regional market as it captures over 40.40% market share.

- Synthetic leather market is projected to hit US$ 63.52 billion by 2033.

The synthetic leather market has rapidly expanded across multiple applications, including footwear, automotive interiors, furniture, and fashion. Shifting consumer preferences toward cruelty-free materials, combined with technological advancements, continues to spur innovation in this sector. Globally, at least 235 companies produce synthetic leather, with a majority based in Asia, where polyurethane (PU) and polyvinyl chloride (PVC) remain the most commonly used raw materials. In tandem, manufacturers are increasingly exploring bio-based polymers derived from agricultural waste to address sustainability concerns. Advanced coatings, backings, and finishing technologies further diversify product offerings, ensuring a consistently upward trend in overall output and fulfilling a wide range of performance and design requirements.

China leads the synthetic leather market in terms of production, backed by robust manufacturing infrastructure and high domestic demand. India, South Korea, Taiwan, and Japan follow closely, each specializing in areas such as innovative technology, high-volume fabrication, or niche markets. Prominent enterprises include Kuraray Co., Ltd., Toray Industries, Inc., Teijin Limited, San Fang Chemical Industry Co., Ltd., NAN YA Plastics Corporation, H. R. Polycoats Pvt. Ltd., Shandong Friendship Group, and Mitsubishi Chemicals Corp. These companies consistently refine their formulations for enhanced durability, water resistance, and aesthetic appeal, while smaller emerging producers focus on cost-effective solutions. Within total output, PU-based products command a substantial share, largely because of their superior breathability and flexibility relative to PVC-based variants. Notably, the footwear industry consumes a considerable portion of global synthetic leather—some estimates place it at over 40% of total usage—underscoring the continued importance of fashion and lifestyle trends in driving demand.

As of 2024, global production capacity of the synthetic leather market is estimated to exceed 20 million metric tons annually, an increase of more than 25% over the past five years. Actual production volumes have also trended upward to meet surging demand from conventional sectors and emerging applications such as electronics and sports gear. Many established manufacturers are incorporating sustainable practices—ranging from reduced energy consumption to eco-friendly coatings—to differentiate themselves amid growing environmental expectations. Meanwhile, ongoing research into next-generation finishes, such as anti-microbial and enhanced abrasion-resistance technologies, bolsters product quality and functionality. These broader developments collectively indicate a positive outlook for synthetic leather, with capacity expansions and technological breakthroughs poised to sustain the industry’s momentum.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Rising consumer demand for cruelty-free, cost-effective materials is driving synthetic leather’s market expansion globally

The demand for ethical alternatives in everyday products is surging as more consumers in the synthetic leather market reject animal-derived components in favor of sustainable, cruelty-free solutions. Synthetic leather, known for its versatility and reduced environmental impact compared to traditional leather, has emerged as a key beneficiary of this trend. In 2023, the global synthetic leather market is valued at approximately US$39 billion, reflecting strong commercial interest in materials that align with shifting public sentiment. Asia-Pacific, recognized as a dominant manufacturing hub, produces around 11 million metric tons of synthetic leather annually to meet rising orders. Footwear remains a massive segment: over 800 million pairs of synthetic leather shoes are shipped worldwide every quarter. Meanwhile, at least 60 new product lines emphasizing cost-efficient, eco-friendly synthetic leather have launched globally this year, indicating a dramatic push toward innovation. Online searches for vegan leather now exceed 20 million queries monthly, further signaling heightened consumer curiosity.

Manufacturers in the synthetic leather market have responded by expanding production capacity and embracing new technologies that can reduce resource usage and minimize pollutants. The automotive sector alone uses about 400 million square meters of synthetic leather annually for seat covers, dashboards, and upholstery, showcasing its reliance on durable, affordable alternatives. Consistent product quality, once a sticking point, has improved significantly through advanced polymer coating approaches, driving broader acceptance in high-end fashion and accessories. The convergence of strong consumer demand, maturing technological capabilities, and an increasingly eco-conscious society underlies this market’s long-term promise. Going forward, companies focused on cruelty-free alternatives will likely intensify research into advanced bio-based formulas, striving to deliver even more resilient and cost-competitive materials that resonate deeply with today’s discerning consumer base.

Trend: Expanding e-commerce channels foster direct consumer interactions, fueling greater customization in synthetic leather offerings

In recent years, the proliferation of digital marketplaces and direct-to-consumer platforms has opened fresh possibilities for synthetic leather market manufacturers and retailers alike. In 2023, online sales of synthetic leather products are expected to exceed US$8 billion, with new storefronts appearing monthly on major retail sites. More than 2,000 styles of synthetic leather apparel, accessories, and footwear are listed across leading global e-commerce platforms at any given time, reflecting the dramatic increase in variety. As these channels cut out conventional middlemen, over 500 direct collaborations between manufacturers and end-users have been reported since the start of the year, focusing on bespoke product designs. Global logistics agreements have heightened shipping efficiency, evidenced by at least 250 specialized warehouses that now handle synthetic leather orders exclusively. Such streamlined distribution allows customers to receive custom items within tighter timeframes, enhancing the sector’s overall responsiveness.

Brands are capitalizing on their online presence to engage consumers with personalization tools. It is estimated that more than 80 e-commerce brands currently offer configurable synthetic leather options, accommodating diverse tastes and functional needs. Whether consumers in the synthetic leather market input color preferences for an elegant evening clutch or dimensional adjustments for unique footwear, these interactive experiences strengthen loyalty and differentiate retailers in an increasingly crowded marketplace. Social media communities focused on cruelty-free lifestyles have also proliferated, driving organic promotions for companies that adopt transparent sourcing practices and genuine product storytelling. This fusion of streamlined digital reach, better customization features, and evolving consumer values creates a robust foundation for continued growth. As e-commerce technology advances and shipping networks improve, we can anticipate even more accessible, tailored synthetic leather items that further bridge the gap between innovation and consumer aspiration.

Challenge: Maintaining consistent product quality remains difficult due to evolving consumer expectations and regulatory frameworks

One of the most pressing obstacles facing synthetic leather market involves ensuring uniform quality despite rapidly shifting market demands and complex legal guidelines. As of 2023, at least 25 countries have introduced updated rules governing the use of specific chemicals and manufacturing practices, prompting regular reviews of production standards. Meanwhile, over 35 global recalls relating to substandard synthetic leather goods have been documented this year, highlighting how lapses in quality control can damage consumer trust. Luxury fashion houses, which increasingly incorporate synthetic leather into their collections, require exacting specifications on colorfastness, material strength, and overall finish, expecting no deviation in large-scale orders. The footwear industry alone has noted quality-related losses exceeding US$300 million in 2023, underscoring the need for better testing protocols and more rigorous oversight.

Simultaneously, consumer expectations in the synthetic leather marketevolve quickly as new technologies promise enhanced durability and a more authentic leather-like feel. Industry reports indicate that at least 10 authoritative bodies worldwide have implemented additional labeling requirements, ensuring that products labeled “vegan leather” or “bio-based” meet standardized criteria. Factories that operate without robust testing facilities or continuous R&D investments risk falling behind, as their materials fail to match premium benchmarks demanded by global brands. In response, synthetic leather manufacturers are increasingly partnering with third-party labs to validate compliance, a trend reflected by the more than 5,000 testing and inspection processes commissioned this year. Ensuring consistent quality not only safeguards brand reputations but also builds consumer confidence, fostering long-term market stability. Going forward, collaboration among industry stakeholders—alongside a commitment to transparency and continual technological refinement—remains pivotal for overcoming this persistent challenge.

Segmental Analysis

By Type

Knitted or woven synthetic leather has emerged as a leading choice within the synthetic leather market. The segment held over 63.7% market share thanks to its enhanced flexibility and comfort. By weaving or knitting together high-grade yarns, these materials closely mimic the texture of genuine leather while remaining notably lightweight. In fact, a major footwear-testing lab in 2023 revealed that certain woven synthetic leather samples demonstrated flex endurance above 10,000 cycles, marking a significant elevation in resilience. Meanwhile, a leading sports apparel company introduced 12 new footwear models earlier this year incorporating advanced knitted synthetic leather, underscoring its appeal for performance-oriented products. Another development is the increased use of micro-denier fibers, making some materials weigh as little as 200 grams per square meter to achieve a breathable feel. Industry tests also indicate that a range of woven synthetics can tolerate up to 50,000 double rubs in abrasion assessments.

Beyond durability, the growing demand for knitted or woven synthetic leather in the synthetic leather market is tied to consumer calls for sustainable, high-tech products. A 2023 study by a European textile research institute found that knitted synthetic leather readily wicks moisture, boosting wearer comfort in active lifestyles. The automotive and fashion sectors also embrace these fabrics for their ability to combine blended fibers with cutting-edge lamination methods, delivering both versatility and strength. Observers note that the softness and tactile resemblance to premium hides, teamed with cost advantages in mass production, further elevate these textiles as top-tier alternatives. Moreover, the rise of patterns such as jacquard-tone woven synthetics demonstrates how brands can differentiate visually without undermining durability. Consequently, knitted or woven synthetic leather remains a frontrunner in satisfying the modern consumer’s search for aesthetic appeal, performance, and value.

By Material

Based on material, the resin segment leads the synthetic leather market with over 84.5% market share. Resin has retained a firm grip on the market due to its robust chemical structure and cost-effective manufacturing methods. In 2023, multiple industrial research bodies confirmed that polyurethane (PU) and polyvinyl chloride (PVC) lead as the top choices for manufacturers demanding consistent quality. One materials lab found that advanced PU-based synthetic leathers endure over 50,000 cycles of dynamic creasing, attesting to their high flexibility. Meanwhile, PVC-based versions have benefited from improved plasticizer technologies, resulting in formulations that produce lower odor even with extended usage. Recognizing these advances, a major global footwear maker launched a new PU resin that significantly reduced the final product’s weight compared to older formulations. Additionally, a prominent chemical supplier unveiled three resin lines specifically developed for enhanced breathability in synthetic leather, reinforcing the industry’s focus on performance optimization.

These resin-based solutions eclipse most biobased materials largely because of their scalability and tested performance in demanding conditions. Manufacturers in the synthetic leather marketappreciate the uniform thickness and consistent texture that PU and PVC resins deliver, while plant-derived materials often face challenges like raw material variability and limited weather resistance. Resin composites can also be engineered to withstand moisture, UV light, and frequent friction without premature degradation—vital for industries like automotive and upholstery where materials endure repeated cleaning. Furthermore, resin-based synthetics readily integrate with modern printing and embossing methods, offering a wide range of surface finishes that can replicate or exceed real leather’s visual appeal. In an environment where reliability, cost containment, and customizability are paramount, resin formulations continue to reign, ensuring a dependable path forward for synthetic leather production.

By End Users

The footwear sector with over 30.3% market share consistently stands out as the largest consumer of synthetic leather market, driven by an unending need for resilient, comfortable, and on-trend components. In 2023, a key footwear-testing lab found that certain polyurethane-based synthetic leathers retained full integrity after 60,000 flex cycles—an essential benchmark for everyday shoes. Another investigative team discovered that micro-porous synthetic uppers can lower in-shoe temperatures by about 2°C compared to basic plastic-based alternatives, enhancing comfort. In the same calendar year, at least ten global athletic brands significantly increased their use of knitted synthetic leather, aiming to produce footwear that is both lighter and sturdier. Sports shoe manufacturers have also introduced bacteria-resistant coatings on synthetic uppers to combat odor issues during intense physical activities. Meanwhile, a 2023 consumer study of over 5,000 participants noted synthetic leather’s strong colorfastness among the top reasons for recurring brand loyalty in casual footwear lines.

The sector’s preference for synthetic leather rests on its ability to replicate consistent looks at scale. According to a logistics overview published in 2023, one major Southeast Asian shoe plant can handle up to 8,000 rolls of synthetic leather quarterly, demonstrating the staggering raw-material turnover. This appetite in the synthetic leather market stems from the demand for uniform thickness, dependable coloring, and swift production—advantages synthetic materials supply more reliably than genuine leather. Many footwear labels moreover favor synthetics due to minimal break-in time, catering to shoppers who expect almost instant comfort. Upkeep is also relatively easier, appealing to budget-friendly brands wishing to reduce post-sale complications. Whether for sporty sneakers or dressier pumps, the sheer versatility of synthetic leather cements its pivotal role in shoe design, striking a balance between style, function, and affordability across the global footwear industry.

Customize This Report + Validate with an Expert

Access only the sections you need—region-specific, company-level, or by use-case.

Includes a free consultation with a domain expert to help guide your decision.

By Distribution Channel

Despite the growth of online platforms, offline distribution channels still account for 85.5% share of the synthetic leather market. A report published in 2023 emphasizes that many bulk buyers insist on physically inspecting color, texture, and finishing before placing orders. Wholesale hubs in key manufacturing hotspots host over 200 exclusive synthetic leather vendors, highlighting offline channels’ enduring prominence. Existing showroom networks further sustain this ecosystem as they offer sizable sample panels, particularly appealing to interior designers and fashion houses who want a clear sense of end-product aesthetics. Notably, major ports in Asia reportedly manage up to 600 synthetic-leather shipping containers a day, underscoring the sheer volume funneled through offline routes. Leading material expos also saw a surge in participation this year, with more than 3,000 professional buyers seeking long-term supplier relationships. Meanwhile, many emerging markets revolve around direct networking, completing deals unlikely to surface on e-commerce sites.

Face-to-face engagement often fosters a level of trust and open negotiation that digital mediums have yet to replicate. Purchasing managers especially value hands-on sample testing, such as scratch or tear checks performed on the spot, before committing to large contracts. In 2023, various brand liaisons in the synthetic leather marketremarked that physically verifying the texture and finish shortened the decision-making cycle for bulk procurers. Offline channels also promote strong interpersonal ties, ensuring more predictable pricing and streamlined supply once both parties establish rapport. Longstanding regional distributors often control established routes from ports to factories, cutting down on transit complications. While digital solutions made strides during the pandemic, the foundational infrastructure of offline trade, coupled with the ability to instantly resolve concerns, continues to underpin its formidable market share. Until digital platforms can fully replicate in-person inspection and rapport-building, offline distribution looks set to remain a dominant force in synthetic leather sales.

To Understand More About this Research: Request A Free Sample

Regional Analysis

Asia Pacific's Monumental Production Engine Fueled by Billions in Investment

The Asia Pacific region's dominance by controlling over 40.40% market share in global synthetic leather market is propelled by immense foreign investment and colossal production metrics. Vietnam’s textile and garment sector has attracted over $37 billion in foreign direct investment (FDI) across approximately 3,500 projects. This influx of capital is critical, as the nation’s raw material imports for the first four months of 2024 alone included $4.34 billion for fabric and over $1 billion for cotton. A single Japanese textile firm, a subsidiary of TORAY Industries, is investing $203 million to build new facilities in Vietnam, showcasing the scale of individual projects. Foreign-invested enterprises are a dominant force, contributing to 65% of the sector's total export turnover.

India is another titan in the region, with its footwear industry employing over 4 million workers. The country's exports of leather and non-leather footwear surged to $5.7 billion in the 2024-2025 fiscal year, exceeding the government's target by $1 billion. Looking ahead, exports are projected to surpass $6.5 billion in the next fiscal year. India's footwear production capacity is expanding rapidly, with expectations to reach nearly 3 billion units annually by the end of 2024. The non-leather segment is a significant part of this growth, demonstrating the robust demand for synthetic alternatives across the subcontinent and its export markets.

North America's Bio-Tech Revolution Attracts Significant Venture Capital Funding

North America is rapidly becoming an epicenter for innovation in bio-based leather alternatives, powered by substantial venture capital infusions in the synthetic leather market. New York-based startup UNCAGED Innovations secured a significant $5.6 million in an oversubscribed seed funding round in July 2024 to commercialize its unique grain-based vegan leather. A previous pre-seed round for the company in June 2023 brought in $2 million, part of which came from InMotion Ventures, Jaguar Land Rover's investment arm. Another startup, Gozen, raised $3.3 million in seed funding and is planning a new facility in Turkey with a production capacity of up to 1 million square feet.

The automotive sector remains a primary driver of demand in the synthetic leather market, with automakers' adoption of synthetic leather for car interiors increasing by 25% due to the demand for cruelty-free materials. The U.S. automotive synthetic leather market is responding, with the PVC segment alone projected to be valued at $3.03 million in 2024. This innovation is not just market-driven; it is also supported by prestigious research grants, such as the National Science Foundation Small Business Innovation Research (SBIR) grant awarded to UNCAGED Innovations to advance its technology platform. The strategic focus on high-performance, sustainable materials is attracting serious investment and fostering a competitive landscape for next-generation synthetics.

Europe's Circular Economy Mandate Spurs Innovation and Public Funding

Europe's synthetic leather market evolution is shaped by a firm commitment to sustainability, backed by significant public funding and regulatory action. The UK is fostering innovation through initiatives like the Innovate UK Textile Fund, part of a £15 million program, which offers grants of up to £50,000 for projects running until March 31, 2025. Additionally, the UK's 'Sustainable Transition Fund' provides £700,000 to support research in the sector. The European Union is also investing heavily through its Horizon Europe program, which allocated €120 million for circular economy research and innovation proposals in early 2024.

Regulatory frameworks are compelling change in the synthetic leather market; by January 1, 2025, Extended Producer Responsibility (EPR) rules will make brands responsible for the entire lifecycle of textiles. The upcoming 2025 revision of the REACH regulation is set to further tighten restrictions on hazardous chemicals. These initiatives are complemented by collaborative research, such as the PESCO-UP project, a 48-month program launched in January 2024 to improve textile recycling. The industry's vibrancy is reflected in major trade events like the February 2025 Lineapelle fair in Milan, which hosted over 1,100 exhibitors and attracted more than 18,800 buyers.

Sustainable Synthetic Leather Market Ignites Strategic Investments and Acquisitions

- UNCAGED Innovations Secures $5.6M for Grain-Based Leather: The startup has raised $5.6 million in a seed funding round. This investment will help commercialize its novel, plastic-free vegan leather alternative derived from grains.

- Faircraft Acquires VitroLabs' Key Assets: French biotechnology firm Faircraft has acquired the key assets of California-based VitroLabs, a company specializing in lab-grown leather. This acquisition includes a portfolio of 30 patents, strengthening Faircraft's position in the cell-cultivated leather sector.

- Beyond Leather Materials Rolls Out 'Leap®' from Apple Waste: The company has launched Leap®, a bio-based leather alternative created from apple waste. This innovative material is targeted for use in interior design, small leather goods, and home décor.

- Bridge of Weir Unveils Biodegradable Leather Technologies: The automotive leather supplier has launched two new innovative products, FreeTAN and BioTAN. These technologies are for the manufacturing of both biodegradable and bio-based leather.

- MycoWorks Taps Muni Market for $73 Million: The vegan leather startup, backed by celebrities like Natalie Portman and John Legend, is planning a $73 million bond sale to finance a new factory in South Carolina.

- An Independent Director of Schaffer Corporation Shows Confidence with Insider Purchase: In a series of transactions in late 2024 and early 2025, a non-executive director of Schaffer Corporation, a company with a significant automotive leather segment in the synthetic leather market, purchased a substantial number of shares, signaling strong belief in the company's growth potential.

Key Synthetic Leather Market Companies:

- Achilles USA Inc.

- Alfatex Italia SRL

- Asahi Kasei Corporation

- FILWEL Company Ltd

- Fujian Polytech Technology Corp., Ltd.

- H.R.Polycoats Pvt Ltd.

- Kuraray Co., Ltd

- Mayur Uniquoters Limited

- Nan Ya Plastics Corporation Inc.

- San Fang Chemical Industry Co., Ltd

- Tejin Limited

- Toray Industries

- Zhejiang Hexin Holdings Co., Ltd.

- Other Prominent Players.

Market Segmentation Overview:

By Type

- Non-woven microfiber

- Leather Optic

- Suede Optic

- Knitted or woven base

- Leather Optic

- Suede Optic

By End User

- Footwear

- Performance Footwear

- Fashion Footwear

- Bags and Accessories

- Furnishing

- Couches & Sofas

- Chairs

- Interior

- Interior Décor & Surfacing

- Wall Tiles

- Automobiles

- Seats

- Doors

- Dashboards

- Steering Covers

- Others

- Sporting Goods

- Garments/ Fashion

- Fashion Apparel

- Fashion Accessories

- Performance Apparel

- Luxury Goods

- Hard Luxury

- Soft Luxury

- Others (Including Industrial)

By Regional:

- North America

- The U.S.

- Canada

- Mexico

- Europe

- Western Europe

- The UK

- Germany

- France

- Italy

- Spain

- Rest of Western Europe

- Eastern Europe

- Poland

- Russia

- Rest of Eastern Europe

- Western Europe

- Asia Pacific

- China

- India

- Japan

- Australia & New Zealand

- South Korea

- ASEAN

- Rest of Asia Pacific

- Middle East & Africa (MEA)

- Saudi Arabia

- South Africa

- UAE

- Rest of MEA

- South America

- Argentina

- Brazil

- Rest of South America

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

.svg)