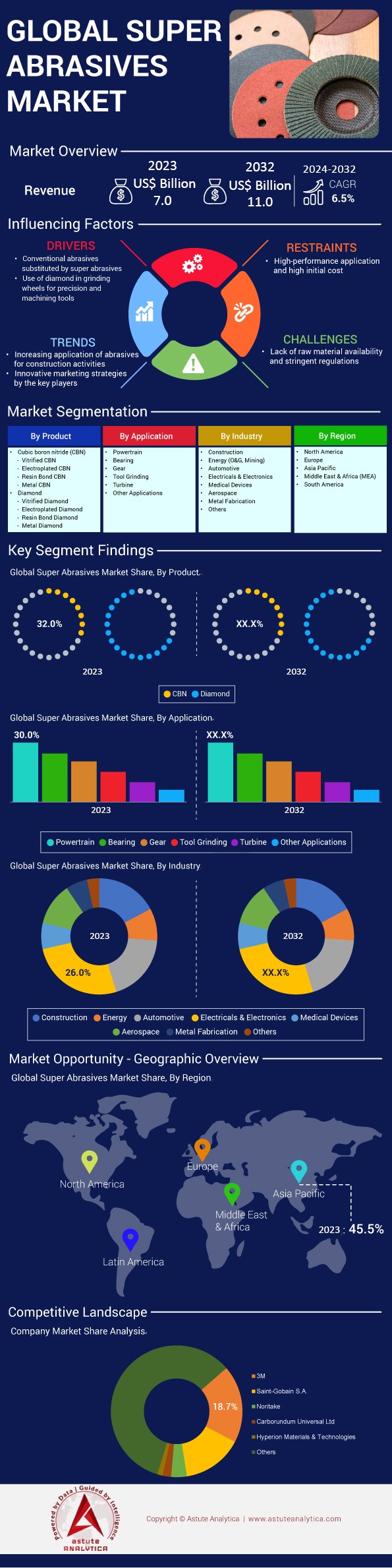

Global Super Abrasives Market, By Product (Cubic Boron Nitride (CBN) and Diamond); Application (Powertrain, Bearing, Gear, and Others); Industry (Construction, Energy, Automotive, and Others); Region—Industry Dynamics, Market Size and Opportunity Forecast, 2024-2032

- Last Updated: 18-Oct-2024 | | Report ID: AA0222141

Market Scenario

Global Super abrasives market is projected to reach valuation of US$ 11.0 billion by 2032 from US$ 7.0 billion, with an estimated CAGR of 6.5%, during the forecast period 2024–2032.

The super abrasives market is experiencing robust growth, propelled by advancements in manufacturing technologies and increasing demand across various sectors. Super abrasives, such as synthetic diamonds and cubic boron nitride (CBN), are essential for precision grinding, cutting, and polishing applications where conventional abrasives are insufficient. Wherein, China emerged as the leading producer, manufacturing about 90% of the world's synthetic diamonds, which are vital for cutting tools and abrasive applications.

The surge in demand for super abrasives is predominantly driven by industries requiring high-precision tools and components. The automotive sector, producing over 90 million vehicles annually in the super abrasives market, utilizes super abrasives in the manufacturing of engine parts and electric vehicle components. The aerospace industry, valued at over $838 billion globally, relies on these materials for producing turbine blades and other critical components that demand exceptional precision and durability. Additionally, the electronics industry, with global revenues exceeding $2 trillion, employs super abrasives in the fabrication of semiconductors and other intricate parts. The medical device market, valued at over $450 billion, also contributes to the demand, using super abrasives to create precision instruments and implants.

Key end users in the super abrasives market encompass the automotive, aerospace, electronics, medical devices, and construction industries. The current trajectory of demand is leading the industry toward innovative developments, such as the creation of nano-diamond coatings and advanced CBN materials to meet the evolving requirements of precision engineering. With global investment in smart manufacturing technologies projected to reach $400 billion by 2025, the future outlook for the super abrasives industry is optimistic. Continuous technological advancements and expanding applications are expected to fuel growth, solidifying the critical role of super abrasives in high-precision industrial processes.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Growing Need for Precision Tools in Advanced Manufacturing Industries

The escalating complexity of products in industries such as aerospace, automotive, and electronics has intensified the demand for precision tooling, with super abrasives market playing a pivotal role. Advanced manufacturing processes require materials that can withstand high levels of stress and temperature while maintaining exacting tolerances. Super abrasives meet these needs by offering superior hardness and thermal stability compared to traditional abrasives. For instance, the aerospace industry's focus on fuel-efficient engines has led to the use of heat-resistant superalloys, which necessitate super abrasive tools for machining. Companies like Rolls-Royce and GE Aviation reported billions of dollars in engine sales, highlighting the scale of demand.

In the automotive industry, which produced over 90 million vehicles annually prior to 2020, super abrasives market are essential in machining advanced materials for engine components, transmissions, and electric vehicle parts. The rise of electric vehicles, with over 2 million units sold in 2019, further increases the demand for super abrasives in manufacturing batteries and motor components. The electronics industry, producing billions of devices annually, requires super abrasives for the precise fabrication of semiconductors and microchips, critical for smartphones, computers, and other digital devices. The global electronics industry, with revenues exceeding $2 trillion, underscores the significant demand for super abrasive materials. Furthermore, the push towards Industry 4.0 and smart manufacturing amplifies this demand. Precision tools enable manufacturers to produce high-quality products efficiently, reducing waste and improving profitability. The investment in smart manufacturing technologies was projected to reach $400 billion by 2025, highlighting the emphasis on precision and efficiency in production processes. This growing need for precision tools continues to drive the super abrasives market forward.

Trend: Increasing Adoption of Super Abrasives in Medical Device Manufacturing

The medical device industry has increasingly embraced super abrasives due to their ability to produce instruments and implants with exceptional precision and surface finish. The global medical device market, valued at over $450 billion, has seen significant growth driven by an aging population and advancements in medical technology. Super abrasives enable manufacturers to meet stringent regulatory standards and enhance the performance of medical devices.

Advancements in medical technology, such as robotic surgery systems valued at $5.5 billion, have further escalated the need in the super abrasives market for highly precise components. The production of orthopedic implants, a market exceeding US$47 billion, dental instruments, and cardiovascular devices often involves materials like titanium and stainless steel alloys. These hard materials require super abrasives for effective machining, ensuring products meet the necessary health and safety standards. Additionally, the increased prevalence of minimally invasive surgeries, projected to reach over 20 million procedures, drives the demand for precisely engineered surgical instruments. Moreover, the emphasis on patient outcomes and the desire for longer-lasting medical devices contribute to this trend. Super abrasives facilitate the efficient manufacturing of these devices, ensuring they meet the necessary quality standards. This increasing adoption is a significant trend shaping the super abrasives market.

Challenge: High Production Costs Limiting Super Abrasives' Affordability Industry-Wide

As of 2023, high production costs in the super abrasives market pose a significant challenge to their wider adoption. Manufacturing super abrasives involves complex processes such as high-pressure, high-temperature synthesis, which require substantial energy and specialized equipment. The cost of super abrasive production equipment can exceed several hundred thousand dollars, representing a significant investment for manufacturers.

In sectors where tight margins prevail, such as small-scale manufacturing or in developing economies, the cost barrier can deter companies from investing in super abrasive tools. Small and medium-sized enterprises (SMEs), which represent over 90% of businesses globally in the super abrasives market, may find the initial investment prohibitive. Additionally, the advanced machinery required to effectively utilize super abrasives demands significant capital investment and skilled personnel to operate. The global shortage of skilled workers in manufacturing was estimated at 10 million in 2020, adding to the challenge. Energy costs also contribute significantly to production expenses, with fluctuations in global energy prices impacting manufacturing costs. For example, the average industrial electricity price in the US was around 7 cents per kilowatt-hour, but higher in other regions. These factors collectively limit the affordability and adoption rate of super abrasives across various industries, particularly where cost sensitivity is high.

Segmental Analysis

By Products

Diamond reigns supreme in the super abrasives market due to its unparalleled hardness and thermal conductivity. The segment held over 68.4% market share. These properties make it the ideal material for cutting, grinding, and polishing applications across various industries, including automotive, aerospace, electronics, and construction. Diamonds can effectively machine a wide range of materials, from metals to ceramics and composites, which contributes to their widespread use and dominance in the market. The global production of industrial diamonds, primarily synthetic, is substantial, with estimates suggesting annual outputs reaching billions of carats. China is the leading producer and exporter of synthetic diamonds, accounting for a significant majority of the world's supply. Companies like Element Six (a subsidiary of the De Beers Group) and ILJIN Diamond are key players in producing synthetic diamonds for super abrasive applications. Natural industrial diamond production is much smaller, with countries like Russia and the Democratic Republic of Congo contributing to the supply through mining activities in the super abrasives market.

Several factors drive the higher demand for diamond over other super abrasives such as Cubic Boron Nitride (CBN). Wherein, diamond's superior hardness (ranking 10 on the Mohs scale) allows it to cut or shape virtually any material with high precision. Moreover, technological advancements in synthetic diamond production have reduced costs, making diamond abrasives more accessible to various industries. At the end, diamond tools offer exceptional durability and efficiency, leading to longer tool life and reduced operational costs. This combination of unmatched performance and cost-effectiveness ensures that diamond remains the preferred choice in the super abrasives market.

By Industry

The electricals and electronics industry is currently leading the super abrasives market, driven by rapid technological advancements and high demand for precision in manufacturing. In 2023, the segment held over 26.1% market share thanks to the global production of semiconductor devices reached an all-time high, with over 1 trillion units produced, necessitating the use of super abrasives for wafer slicing and chip fabrication. Additionally, the push towards miniaturization in electronics has increased the need for finer, more precise abrasive tools. The industry also benefits from a robust supply chain, with over 2,000 manufacturers worldwide specializing in super abrasive tools for electronics, ensuring constant innovation and availability.

A significant factor contributing to the dominance of the electronics industry is the rise in consumer electronics, notably smartphones and tablets. Over 1.4 billion smartphones were shipped globally in 2023, each requiring intricate components that demand super abrasive materials for manufacturing. Furthermore, the global expansion of 5G networks has spurred investments in infrastructure and devices, with more than 200 million 5G devices shipped this year alone, further increasing the demand for precision tools in the electronics sector. Moreover, the move towards greener technologies, like electric vehicles and renewable energy solutions, is boosting the need for advanced electronic components, which in turn drives the super abrasives market. Apart from this, the electronics sector's commitment to innovation and quality assurance plays a critical role. The industry invests heavily in R&D, with leading companies dedicating up to $20 billion annually to develop next-generation devices. This investment fuels the demand for super abrasives, as manufacturers seek to produce high-performance, reliable products. Additionally, the industry's focus on sustainability and efficiency supports the use of durable and precise super abrasives, which enhance manufacturing processes and reduce waste. Thus, the electronics industry's leadership in the super abrasives market is a result of its dynamic growth, technological demands, and strategic investments.

By Application

The powertrain segment's dominance in the super abrasives market is attributed to the critical role these materials play in manufacturing high-precision components required for modern engines and transmissions. In 2023, it captured over 30.1% share. Super abrasives, such as industrial diamonds and cubic boron nitride (CBN), are essential for grinding and finishing processes that demand exceptional hardness and thermal stability. In 2023, the automotive industry witnessed the production of over 85 million vehicles globally, with a significant portion featuring complex powertrains that require precise machining. The surge in electric vehicle (EV) production, expected to reach 14 million units by the end of 2023, further amplifies the need for super abrasives in powertrain component manufacturing.

One of the key factors making super abrasives indispensable in powertrain applications is the stringent tolerance levels and surface finish requirements of engine parts like crankshafts, camshafts, and gear shafts. For instance, the production of high-performance engines demands surface finishes as fine as 0.2 micrometers, achievable only through the use of super abrasive tools. Additionally, the rise in adoption of advanced high-strength steels (AHSS) in powertrain components, accounting for over 70 million tons used in 2023, necessitates the use of super abrasives due to their ability to efficiently machine hard materials without significant tool wear. Technological advancements have also bolstered the super abrasives market within the powertrain segment. The integration of Industry 4.0 and automation in manufacturing facilities has led to increased utilization of high-precision grinding machines equipped with super abrasive wheels. Reports indicate that over 60% of automotive manufacturers have incorporated some form of automation in their production lines by 2023. Moreover, government regulations on emission standards have pushed manufacturers to produce more efficient engines, thereby increasing the demand for super abrasives to achieve the necessary precision and finish. The cumulative effect of these factors solidifies the powertrain segment's leading position in the market, accounting for a significant portion of the industry's value, which surpassed $5 billion in 2023.

Customize This Report + Validate with an Expert

Access only the sections you need—region-specific, company-level, or by use-case.

Includes a free consultation with a domain expert to help guide your decision.

To Understand More About this Research: Request A Free Sample

Regional Analysis

The Asia Pacific region stands as the largest super abrasives market with 45% revenue share, primarily due to its rapid industrialization and burgeoning manufacturing sectors. Countries like China, India, Japan, and South Korea are key contributors to this dominance. China's role is particularly significant; as one of the world's largest manufacturing hubs, it has a vast demand for super abrasives across industries such as automotive, aerospace, electronics, and construction. The country's substantial investments in infrastructure projects have resulted in the establishment of over 200 major super abrasive manufacturing facilities. The export market for Chinese super abrasives is valued at nearly US$ 4 billion, with over 500,000 tons of abrasives exported annually. Emerging economies like India and Vietnam are also favoring the Asia Pacific's dominance, with India alone seeing the establishment of 150 new manufacturing plants in the last five years. With continuous economic growth and technological advancements, the Asia Pacific market is poised for sustained growth, with an expected production capacity of 2 million tons of super abrasives by the end of 2025.

North America holds the second-largest share in the super abrasives market, driven by its advanced industrial base and technological innovation. The United States and Canada have well-established automotive, aerospace, and electronics industries that require high-quality super abrasive materials for precision manufacturing processes. The region has seen the establishment of 120 advanced research facilities focused on super abrasive technologies. Additionally, the United States exports super abrasives worth US$ 1.2 billion, contributing significantly to its market share. The region's focus on sustainable and energy-efficient manufacturing practices is increasing the adoption of super abrasives, which enhance productivity and product quality. This robust industrial base supports North America's significant share in the global super abrasives market, with projections indicating a steady growth trajectory in the coming years.

Top Companies in Global Super Abrasives Market

- 3M

- Action SuperAbrasive

- Asahi Diamond Industrial Co. Ltd

- Carborundum Universal Ltd

- Diametal AG

- Element Six (UK) Limited

- Finzler, Schrock & Kimmel GmbH

- Henan Huanghe Whirlwind Co., Ltd.

- Husqvarna AB

- Hyperion Materials & Technologies

- ILJIN DIAMOND CO., LTD

- Noritake

- Saint-Gobain S.A.

- SHOWA DENKO K.K.

- Super Abrasives Inc.

- Zhengzhou ZZDM Superabrasives Co., Ltd.

- Other Proiminent Players

Market Segmentation Overview:

By Product:

- Cubic boron nitride (CBN)

- Vitrified CBN

- Electroplated CBN

- Resin Bond CBN

- Metal CBN

- Diamond

- Vitrified Diamond

- Electroplated Diamond

- Resin Bond Diamond

- Metal Diamond

By Application:

- Powertrain

- Bearing

- Gear

- Tool Grinding

- Turbine

- Other Applications

By Industry:

- Construction

- Energy (O&G, Mining)

- Automotive

- Electricals & Electronics

- Medical Devices

- Aerospace

- Metal Fabrication

- Others

By Region:

- North America

- U.S.

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia & New Zealand

- Korea

- ASEAN

- Rest of Asia Pacific

- Middle East & Africa (MEA)

- UAE

- Saudi Arabia

- South Africa

- Rest of MEA

- South America

- Argentina

- Brazil

- Rest of South America

REPORT SCOPE

| Report Attribute | Details |

|---|---|

| Market Size Value in 2023 | US$ 7.0 Bn |

| Expected Revenue in 2032 | US$ 11.0 Bn |

| Historic Data | 2019-2022 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Unit | Value (USD Bn) |

| CAGR | 6.5% |

| Segments covered | By Product, By Application, By Industry, By Region |

| Key Companies | 3M, Action SuperAbrasive, Asahi Diamond Industrial Co. Ltd, Carborundum Universal Ltd, Diametal AG, Element Six (UK) Limited, Finzler, Schrock & Kimmel GmbH, Henan Huanghe Whirlwind Co., Ltd., Husqvarna AB, Hyperion Materials & Technologies, ILJIN DIAMOND CO., LTD, Noritake, Saint-Gobain S.A., SHOWA DENKO K.K., Super Abrasives Inc., Zhengzhou ZZDM Superabrasives Co., Ltd., Other Proiminent Players |

| Customization Scope | Get your customized report as per your preference. Ask for customization |

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

.svg)