Global Stretchable Devices Market: By Type (Stretchable Battery, Stretchable Displays (OLED, LCD, Others), Stretchable Transistors, Stretchable Photovoltaics, Stretchable Sensors (Photo Detectors, Bio Sensors, Others) and Others); Material (Polydimethylsiloxane, Eco flex, Polyurethane, and Others); Application (Consumer Electronics, Automotives, Medical & Healthcare, Energy and Power, Sports and Fitness, Aerospace and Défense, and Others); Distribution Channel (Online and Offline (Direct and Distributor); Region—Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2024–2032

- Last Updated: 13-May-2024 | | Report ID: AA0524828

Market Scenario

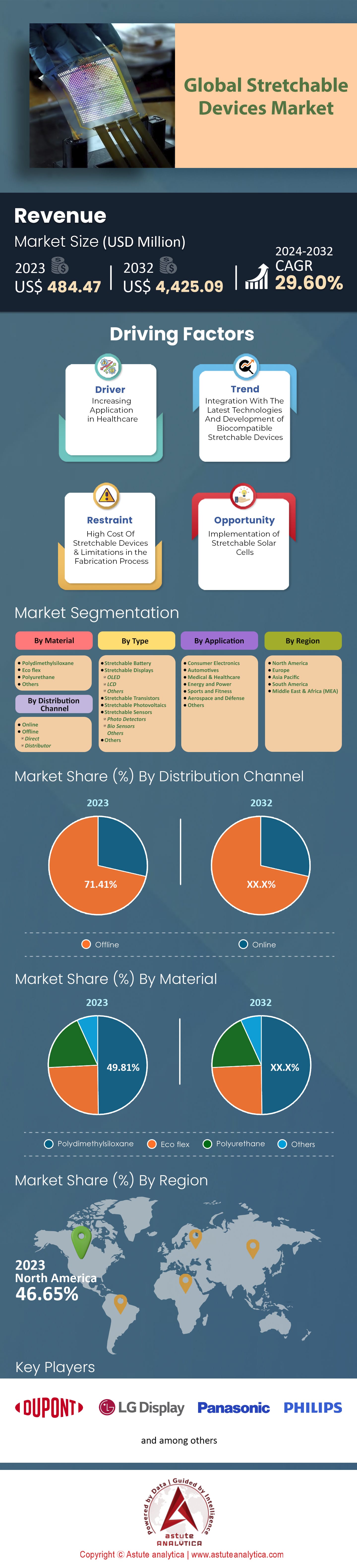

The Global Stretchable Devices Market was valued at US$ 484.47 million in 2023 and is projected to hit the market valuation of US$ 4,425.09 million by 2032 at a CAGR of 29.60% during the forecast period 2024–2032.

In the last few years, the market has witnessed a significant growth in the demand for various consumer electronics and medical devices having stretchable displays, batteries and sensors among others. For instance, in 2023, more than 15.8 million units of foldable smartphones were sold around the world by all the present companies active in the smartphones market. Astute Analytica’s recent study found that the year 2023 experienced 23% growth in the overall sales of these foldables compared to previous year. In addition to this, over 520 million units of fitness trackers were shipped worldwide in 2023, a 5.6% growth as compared to 2022. Moreover, it has been found that over 13.7 million units of blood glucose monitoring devices were sold by private labels.

Flexible and stretchable electronics production in the global stretchable devices market are possible due to advances made in materials science and manufacturing processes. As a result, demand for flexible/stretchable electronic products is expected to increase significantly; thereby driving growth of such type of industry altogether. The increasing acceptance for wearable devices is one of key drivers spurring this expansionary trend. Smart watches, fitness bands and health monitors require wearable components that can move alongside body motion (Gomez-Plaza et al., n.d.). In particular Apple and Fitbit use elastic fabric substrates with embedded sensors into their wearables (Mosley & Rodriguez-Villegas). However, beyond wearables sector lies great potential for growth of stretchable electronics in many other sectors including healthcare industry where they may find application.

Stretchable electronics hold tremendous promise within wearable technology fields too where it can be used to create advanced medical wearables like biosensors that keep track on vital signs or wound healing (Dasgupta et al., p1). MC10 has created BioStamp system which uses soft sensors glued to medical bandages so as to monitor health-based conditions.

There are other opportunities that exist through Internet of things (IoTs) and the smart devices in the stretchable devices market. This means that conventional objects can be turned into intelligent and interactive environments through the integration of stretchable sensors such as those worn within clothes or placed on furniture. Similarly, smart clothing is also being developed with stretchable sensors by companies like Xenoma, which monitor body movements (Dasgupta et al., p1). Stretchable devices make great strides in consumer electronics and entertainment sectors. An example of this includes flexible displays utilized in gaming controllers, VR/AR devices among many others (Dasgupta et al., p1). Also, in a bid to come up with a number of consumer electronics such as television sets that will have foldable screens; Samsung and LG are investing hugely in flexible OLED displays.

The automotive and aerospace industries are not exempt from the use of stretchable electronics in the stretchable devices market. They need these electronic components because they enhance safety measures, efficiency levels, and user experience during operations in vehicles or planes. The emergence of companies like Canatu designing conductive films that are both transparent and stretchable has brought about this recent development especially for aerospace industry.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Rapid Growth in Wearables and Medical Devices

The key driver of stretchable devices market is a rapid growth in wearable and medical devices. A return to normalcy could help fuel this surge as well, with the global wearable medical device market estimated to expand to $38.7 billion by 2030. The study found that one out of every five Americans now wears a smartwatch or fitness tracker, and more than three-quarters are comfortable wearing technology that monitors health. This leads to robust sales figures, with more than 109 million units of smartwatches shipped globally in 2021 alone. Moreover, healthcare industry itself is experiencing an upsurge in investment levels. The investments in digital health start-ups through venture capitalist surpassed $10.7 billion by 2023 thus signifying great interest.

An aging population also plays a role. It is expected that by 2050, there will be over 1.5 billion people aged above 65 years old necessitating the increased need for wearable devices for chronic diseases (that affect over forty percent of the US population). Even within one country like America where fitness trackers had 75 million users only last year alone, it shows how popular wearables have become for health purposes in the stretchable devices market. With volumes data generated from such contraptions being projected at around 2,000 exabytes within four years from now clearly shows them as important tools in healthcare provision among other fields as well.

In addition to this some insurers offer lower premiums on those who monitor their health via wearables, thereby bolstering uptake of these gadgets among general publics while supporting regulatory approvals by the FDA which increase each year and COVID-19 causing quickened remote monitoring build deeper bonds between wearables and healthcare delivery systems. During all those nights when we have changed our sleeping patterns due to stress or just because we’ve been too lazy; moreover, many adults use those mobile applications for tracking sleep (over ten percent); moreover, this demonstrates how diverse the sphere could be if applied to healthcare.

Trend: Growing Demand for Stretchable Sensors in Electronic Skin and Robotics

The emerging field of e-skin offers immense opportunities for the stretchable devices market. The e-skin is a growing market that is projected to hit $17.3 billion by 2029.The growth is being driven by recent advances in e-skin technology which have made it more sensitive, stretchable and durable. In its modern form, some types of e-skin can tell how much a butterfly weighs and stretch up to 60% before snapping. Researchers have even been working on self-healing e-skins and biocompatible materials that can be worn over long periods of time such as those found in shoes with holes. This jump in technology has several promising applications across various sectors. For instance, the prosthetics market that will grow to $2.8 billion by 2032 could benefit from e-skin offering sensory feedback in artificial limbs. Touch-sensitive epidermis might also be used on any one among the total number of industrial robots which accounts for about 2.7 million worldwide, thus making them nimbler and increasing their ability to experience touch. Furthermore, there are increased funding into research projects such as EU ROBOSKIN initiative brightening the prospects of using e-skin in robotics.

The link between wearables and e-skin is another crucial driver of the global stretchable devices market. Accordingly, the market size for wearable skin patches alone could soar up to $12 billion by 2028. E-Skin’s ability to detect pressure or temperature among other vital signs creates room for advanced health monitoring systems hence possibly doing away with traditional diagnostic devices. A good example of this would be virtual reality where highly sophisticated haptic feedback is needed. This number includes soft robotics market expected to register $6.83 billion sales by the year 2029 where e-dermis has remained a center stage. It imitates human movement like walking or dancing and interaction with surroundings. The future of elastic technology looks exciting since progressions in this area such as the stretchable devices, particularly e-skin and other sectors are merging with wearables, robotics and others.

Challenge: High Production Costs is Likely to Hinder Growth of Stretchable Devices Market

Undoubtedly, high production costs form a big hindrance to the development of stretchable devices market. There are several contributing factors to this obstacle. Among them, material costs is a main culprit with silver nanowire inks; which are common ingredients for stretchable circuits costing above $200 per gram. Furthermore, research and development (R&D) also adds to the expenses. Electronics companies usually set aside significant portions of their earnings (7-15%) to R&D and this ratio can go even higher for those seeking new technologies such as stretchable devices. Moreover, manufacturing complexity makes them expensive. In most cases, initial production runs of stretchable electronics have yield rates which are as low as 30-50%. This implies that a lot of material gets wasted or needs rework; thereby, increasing the overall cost. However, economies of scale –a great cost reduction factor in mature industries—do not work well for these devices yet because large scale efficiency that reduces cost by between 25% and 30% is not there.

Another challenge is customization. Unlike standard products, customized solutions for stretchable devices can be 50-100% more expensive due to unique designs and small-scale manufacturing methods. Quality control which is necessary for every electronic device becomes more important and costly when it comes to advanced products like stretchable devices. These stringent measures in the stretchable devices market could add up to 10-15% on the total manufacturing cost. This problem goes beyond the line of production itself since there is supply chain volatility characterized by fluctuating raw material prices ranging from 10% to 20%, leading to pricing uncertainties. On top of this technical workers attract higher salaries with technicians in electronics earning between 20-30% more compared to other regular employees involved in manufacturing.

Segmental Analysis

By Type

Based on type, the global stretchable devices market is primarily dominated by stretchable sensor segment. In 2023, the segment generated more than 76.15% revenue of the market. On the other hand, the stretchable display segment is projected to keep growing at the highest CAGR of 31.98% during the forecast period 2024–2032. The dominance of the stretchable sensor is majorly attributed to rapid growth in technological developments like biocompatibility, flexibility, light weight, bio-integrated circuits. These properties are heavily employed across a range of application such as smart lenses, e-textiles, smart manufacturing, healthcare technologies, consumer electronics, and smart wearable devices, among others.

It has been observed that the demand for smart garments, especially in the healthcare domain is on the rise, which in turn, drives the growth of the smart stretchable sensors for remote patient monitoring. These sensors in the stretchable devices market mainly include for glucose, lactate, and pH levels monitoring in bodily fluids like sweat, tears, and saliva. All these sensors equipped with noninvasive monitoring of biomarkers. On the other hand, stretchable sensors provide real-time biomechanical data that help optimize training regimes and minimize injury risks in in sports and fitness activities. The increasing adoption of stretchable sensors across different sectors is fueled by their unique properties such as extreme sensitivity, resistance to wearing out and capability for fitting on complex surfaces. These sensors can be invisibly woven into garments, wearable electronics or simply applied directly on human skin. They enable continuous and accurate monitoring of vital signs, physical activities and environmental conditions. Notably, significant progress has been made in the application of stretchable sensors for remote patient monitoring, personalized medicine and early disease detection in healthcare.

Moreover, the growing trend toward wearable technology as well as Internet of Things (IoT) has further driven the demand for stretchable sensors, giving an impetus to the growth of the stretchable devices market. People are increasingly looking for smart gadgets that can constantly update them about their health, fitness level thereby helping them stay healthy always. With this regard stretchable sensors incorporated in smart watches and fitness trackers among other wearables provide valuable information about individual’s everyday routine including activities done during day time or at night while sleeping hence informing him about his lifestyle so that he can make right choices about his body care especially regarding health matters.

By Material

Polydimethylsiloxane (PDMS) stands out as a dominant material in the stretchable devices market due to its unique blend of properties. In 2023, it held over 49.81% revenue share of the market thanks to its flexibility and stretchability. It is shown by low moduli of Young. However, the blend usually fluctuates between 0.57 – 3.7 MPa depending upon the composition. Consequently, it possesses great bending or stretching characteristics thereby being applicable in tools requiring bending without breaking or having to stretch to conform curved surfaces. PDMS also portrays superior thermal resistance levels and withstands temperature degradation at about 350°C hence convenient when exposed to higher temperatures.

In addition, this polymer is transparent optically with a refractive index approximately equal to 1.4, thus allowing it to be integrated into optical devices as well as sensors without any observable discontinuity on their surfaces. It also provides good gas permeability especially for carbon dioxide and oxygen where PDMS stands out again. Its oxygen permeability ranges from approximately 3.4 ×10−14 m2/sto 8 ×10−14 m2/s. This attribute of the material in the stretchable devices market is highly advantageous in biology such as cell culture and tissue engineering since these processes rely heavily on diffusing gasses through the membrane that surrounds cells which should be kept alive for growth purposes: most importantly, the property helps maintain cellular viability while ensuring they exist within an environment where carbon dioxide (CO2) passes through so freely.

PDMS goes above and beyond its flexibleness and compatibility. PDMS can be tailored to suit any particular requirements. Moreover, PDMS has a high dielectric strength (14 V/μm), which makes it an outstanding insulator in flexible electronics. It is also compatible with many rapid prototyping techniques, which is a major advantage in its use.

By Application

The consumer electronics industry is a driving force behind the growth of stretchable devices market, fueled by the increasing popularity of wearable technology and smart devices. The segment accounted for over 33.73% market share in 2023 and is expected to grow at the highest CAGR of 31% in the years ahead. Worldwide wearable technology market is estimated to be around $57 billion by 2028 with smartwatches leading others. This fact is not surprising, because almost all Americans (97.6%) own smartphones, and a substantial part of them (96.6%) use it to access the internet. Furthermore, there is a growing interest in smart clothing whose market size is set to exceed $5 billion by 2032 as this is consistent with trend of younger generation’s adoption of new technologies.

A recent survey results have shown that generative AI had been tested by 31% Gen Z respondents compared with only 9% from other generations which indicates wider acceptance of AI-driven devices among younger consumers than their elder counterparts do. The consumer electronics industry in the stretchable devices market has also experienced another major driving factor such as Internet of Things (IoT). It is projected that by year end 2022 alone IoT devices will reach an incredible number of up to twenty billion where North America currently leads while Asia-Pacific region leads North America in terms of fastest growth rates. Samsung dominates other companies since it has more IoT patents in the consumer electronics space.

Consumer electronics are embracing innovation through 5G networks supported by other products including VR glasses and gaming consoles. Majority or rather about half of individuals using fifth-generation network want fresh applications whose rise can be seen from demands on remote work and healthcare (42% participated in virtual visits). Alongside these new technologies like IoT, AI, edge computing and most importantly 5G are fueling an upswing in job postings seeking candidates with these skills sets across the global stretchable devices market. China, North America and Western Europe are poised to dominate IoT markets owing to young people’s extensive mobile communications and high-end consumer sales via online platforms respectively hence indicating future prospects for growth.

By Distribution Channel

The stretchable devices market leans heavily on traditional offline distribution channels. In line with this, the offline segment accounted for over 71.41% market share in 2023. There are advantages of offline channels over their online counterparts. The US, for example, is dominated by the top ten electronics distributors who possess more than 42% of the market share with companies like Arrow Electronics generating sales worth $32 billion in 2022. This makes for a smooth flow of goods in the supply chain and also builds trust between manufacturers and their intermediaries. Therefore, offline channels are best suited to addressing issues such as product complexity and customer support. On the other hand, 67% customers’ preferences are demanding that they see and feel the items first before making any purchase. Thus, physical stores with hands-on experiences still have some value left in them. Major players such as Best Buy with its thousands of Geek Squad agents (over 20,000) clearly demonstrate how extensive customer support can be provided through offline channels.

It is easier to comply with regulations when offline distribution is involved too. The US Federal Communications Commission (FCC) and EU’s Restriction of Hazardous Substances (RoHS) directive controls sale of electronics. Offline channel intermediaries in the stretchable devices market can help make sure that every step in a supply chain complies with these specifications since they understand them better than an ordinary retailer does. Furthermore, consumer preference plays a part as well as trust. Research shows that consumers consider product quality (73%) and warranties (64%) as significant factors during electronic purchases; a matter very much associated with old ways of retailing those products physically. Trust can also be fostered because Astute Analytica has found out that 56%of buyers worry about security aspects related to buying online thus; physical locations that have been serving people over time seem trustworthy.

Customize This Report + Validate with an Expert

Access only the sections you need—region-specific, company-level, or by use-case.

Includes a free consultation with a domain expert to help guide your decision.

To Understand More About this Research: Request A Free Sample

Regional Analysis

North America is leading the global stretchable devices market with over 46.65% revenue share. Wherein, the US is market leader due to a number of important factors. In 2023, it has the biggest consumer market in the world, with household final consumption expenditure accelerated at $15 trillion. This means that there are higher levels of disposable income among American consumers who are likely to invest in creative products such as stretchable devices. The U.S. boasts an environment for innovation in this field. The presence of major players like Apple, Google and Microsoft drives North America’s control of 46.65% global share in the Stretchable Devices Market by 2023. These tech giants are putting money into wearable and stretchable technology, with Apple ‘s wearables, home and accessories segment generating more than $41.1 billion revenue alone by 2023.

Moreover, the U.S increases its position because they have advanced technological infrastructure. Country which spends highest on research and development is the US (estimated at $612.7 billion in 2023). This commitment to R&D, with significant portions targeting emerging technologies like stretchable electronics ensures constant innovation and growth across industry. The high adoption rates of stretchable devices across key application areas also contributes towards strengthening the American market. American healthcare sector is worth around $4.3 trillion (in terms of spending) and is therefore a huge opportunity for medical applications using stretchable devices. Conversely, the US automotive industry had a production output of 15.6 million vehicles making it second largest globally while incorporating stretchable electronics for better functionalities. Consumer Electronics market within USA shows promise as indicated by forecasts reaching $460 billion by year 2025 with considerable contribution from elasticity enabled systems.

Europe stretchable devices market has a substantial customer base for mobile technology as close to 130 million smartphones were delivered during 2023.Apple dominated through its premium gadgets taking nearly one third share (27%) equivalent to about34.6 million iphones shipped. Most importantly Apple’s high-end iPhone 15 Pro models showed a marginal increase in YoY sales despite a 3% drop in overall market during the fourth quarter of 2023, indicating strong demand for them.

On the other hand, Samsung with shipments of 43.7 million units became Europe’s number one smartphone maker in 2023. Nevertheless, they had their Q4 shipment figures decline by 12%. Other players that have relatively larger shares are Xiaomi (22.2 million) Motorola (6.4 million) and Honor who is just rising to fame (1.1million). In contrast, Motorola and Honor experienced impressive growth of 73% and 116%, which propelled them into first five for the first time ever during Q4-2023 respectively.

With a focus on the future of stretchable devices market, some analysts anticipate going back to single-digit growth in 2024 probably because consumers are likely to be changing their devices that they bought during the COVID-19 pandemic. This is a significant development for European market prospects with respect to AI integration and smartphones’ adaptation. Moreover, Oppo, Vivo or Realme and other established vendors will have to compete hard, as well as newcomers like Nothing and Transmission looking for their place in mobile industry. The economic resilience of this sector coupled with innovation efforts is expected to be beneficial for companies into stretchable devices. High-end smartphones selling well in Europe indicate a market that is ready for advanced technology. Also, the entry of new players introduces dynamism where innovation is valued hence stretching the possibility of complimenting stretch devices within wider consumer electronic family.

Top Players in Global Stretchable Devices Market

- 3M Company

- Apple Inc.

- AVERY DENNISON CORPORATION

- Bainisha cvba

- Blue Spark Technologies

- BodyMedia

- Canatu Oy

- DuPont

- Forciot Ltd

- Gcell

- IMEC

- Leap Technology ApS

- LG Display

- NextFlex.

- PowerFilm Solar Inc.

- Panasonic Corporation

- Philips N.V.

- Samsung Electronics

- StretchSense

- Other Prominent Players

Market Segmentation Overview:

By Type

- Stretchable Battery

- Stretchable Displays

- OLED

- LCD

- Others

- Stretchable Transistors

- Stretchable Photovoltaics

- Stretchable Sensors

- Photo Detectors

- Bio Sensors

- Others

- Others

By Material

- Polydimethylsiloxane

- Eco flex

- Polyurethane

- Others

By Application

- Consumer Electronics

- Automotives

- Medical & Healthcare

- Energy and Power

- Sports and Fitness

- Aerospace and Défense

- Others

By Distribution Channel

- Online

- Offline

- Direct

- Distributor

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- Western Europe

- The UK

- Germany

- France

- Italy

- Spain

- Rest of Western Europe

- Eastern Europe

- Poland

- Russia

- Rest of Eastern Europe

- Western Europe

- Asia Pacific

- China

- India

- Japan

- Australia & New Zealand

- South Korea

- ASEAN

- Rest of Asia Pacific

- Middle East & Africa (MEA)

- UAE

- Saudi Arabia

- South Africa

- Rest of MEA

- South America

- Argentina

- Brazil

- Rest of South America

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

.svg)